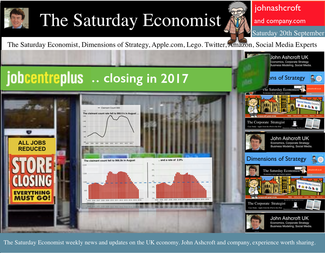

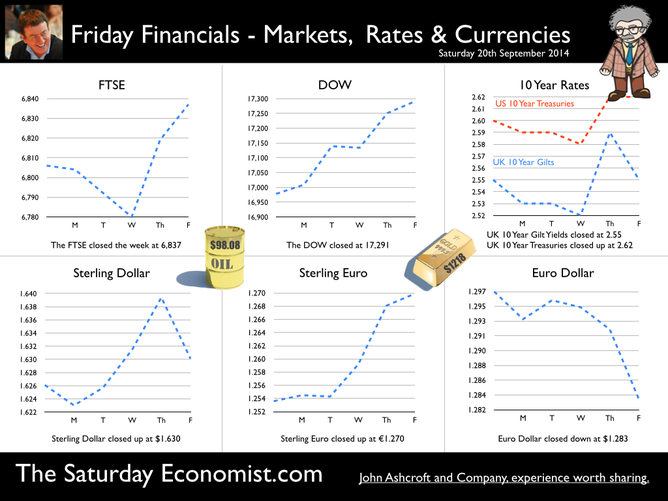

The prospect of a UK base rate rise before the end of the year receded this week with the release of latest data on inflation and earnings … Retail Prices … Retail price inflation CPI basis slowed to 1.5% in August from 1.6% prior month. Falls in the prices of motor fuels and food provided the largest downward contributions to the change in the rate. Markets expect CPI inflation to average 1.7% over the final quarter of the year, significantly below the MPC benchmark 2% target. Don’t worry about deflation too much, service sector inflation actually increased to a rate 2.7%, as goods inflation fell to 0.6%. Manufacturing Prices … Manufacturing output prices actually fell in August, down by -0.3% compared to a fall of -0.1% in July. Input costs, price of materials and fuels bought by UK manufacturers, fell -7.2% in the year to August, compared with a fall of -7.5% in the year to July. Crude oil costs were down by 14% as price of energy and import costs generally benefited from the weakness of world commodity and trade prices. The appreciation of Sterling helped, up by 8% against the dollar in the month. Home food material costs were down by -10%. Evidence that weak food prices at retail level are not really attributable to supermarket food wars after all. For the moment, inflation, or lack of it, is always and everywhere an international phenomenon. World trade prices are weak. Oil price Brent Crude is trading below $100 per barrel compared to $112 last year. Sterling closed at $1.63 this week up by just 3% compared to September last year. A warning perhaps, the currency contribution may be eroding and the dramatic fall in manufacturing costs may soon be reversed. Unemployment data … The number of people unemployed, claimant count basis fell below 1 million in August, the actual figure was 966,500 and a rate of 2.9%. Over the last six months over 200,000 have left the register. At this rate, job centres will be closing by the end of 2017, there will be no one looking for work. Despite the surging jobs market, pay data remains remarkably weak. Average earnings increased by 0.7% in July. Surprising given the rate of jobs growth. Some evidence of compression is more evident in manufacturing pay, up almost 2% and construction, up by 4%. Retail Sales ... Retail sales rallied in August as volumes increased by 3.9% year on year and values increased by 2.7%. Online sales volumes were up by 8.3% accounting for 11% of all retail transactions. Households are spending and will continue to do so. The August ©GfK Consumer Confidence Barometer confirms households are more optimistic, feel better off and believe it is a good time to spend. So what of base rates …? Janet Yellen, head of the Fed, gave additional guidance on the direction of US rates this week. “The Committee currently anticipates that economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run”. “A highly accommodative stance remains appropriate”. There was no real change in the police stance. Markets rallied and the Dow closed above 17,000. Analysts do not expect a rate rise in the USA before June next year. So what does this mean for UK rates? Weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. No escape from Planet ZIRP just yet, we may regret the delayed take off in the years ahead. So what happened to sterling this week? Sterling rallied against the dollar to $1.630 from $1.626 and well up against the Euro at 1.270 from 1.254. The Euro was down against the dollar at 1.270 (1.297). Oil Price Brent Crude closed down at $98.08 from $97.62. The average price in September last year was $111.60. Markets, move up. The Dow closed at 17,291 from 16,978 and the FTSE closed down at 6,837 from 6,806. UK Ten year gilt yields moved 2.55 from 2.49 and US Treasury yields closed at 2.62 from 2.60. Gold drifted lower at $1,218 from $1,227. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

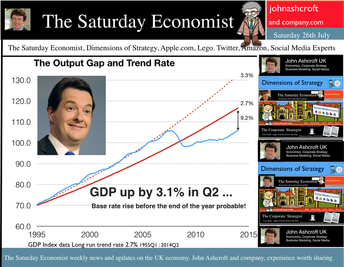

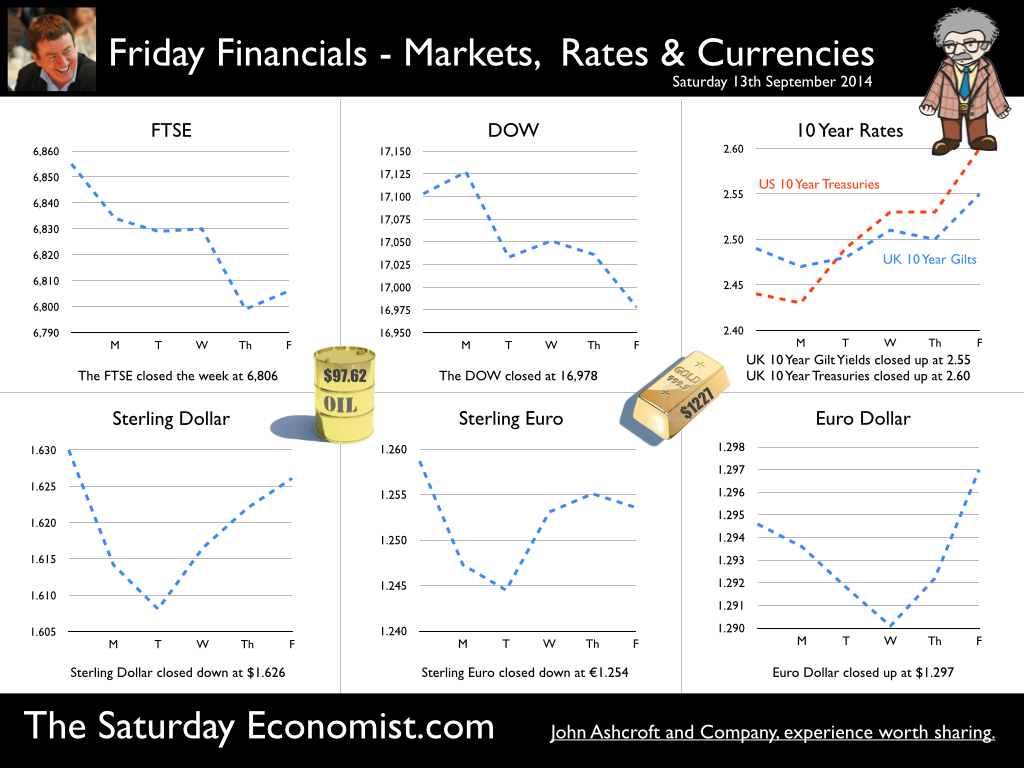

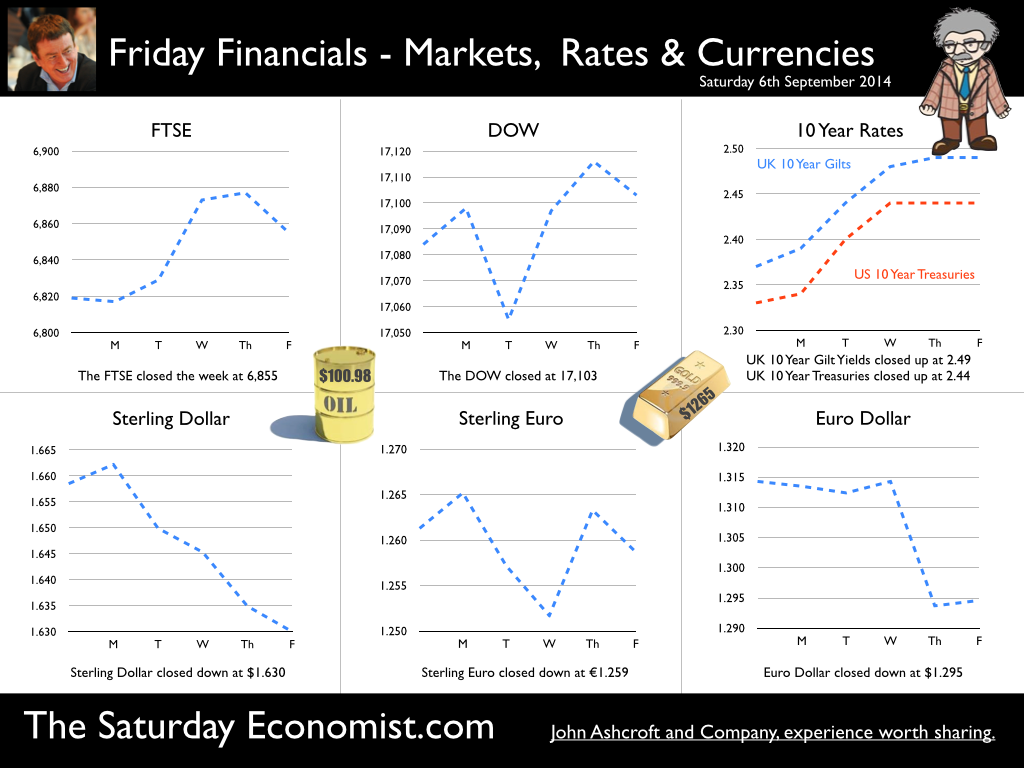

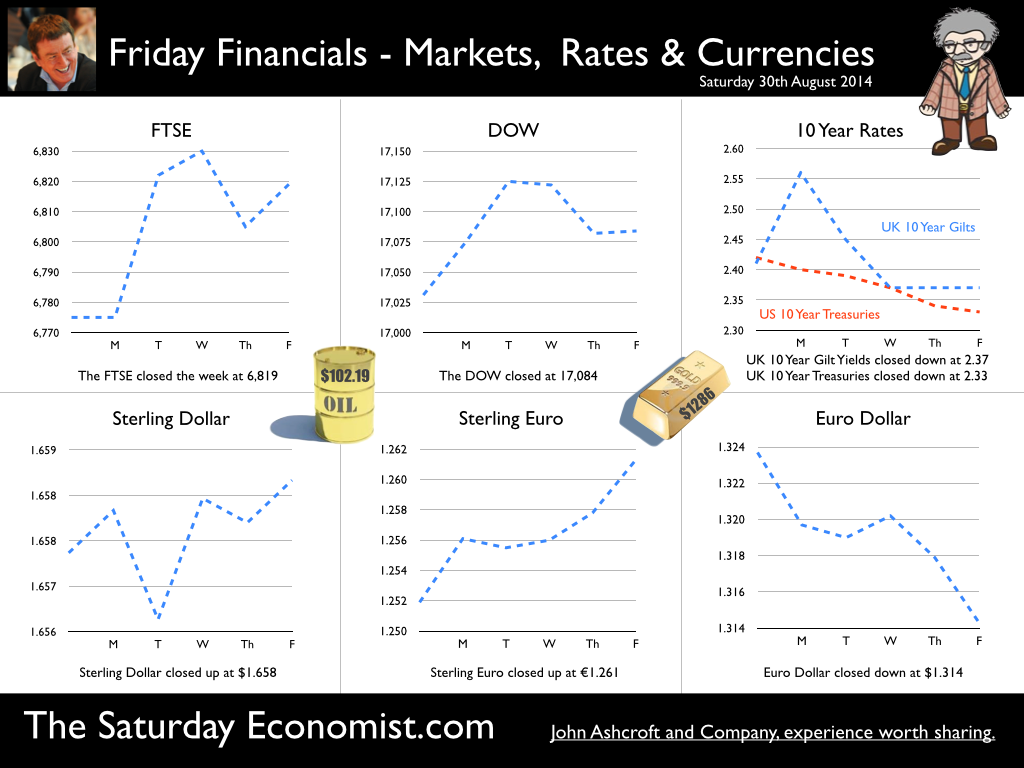

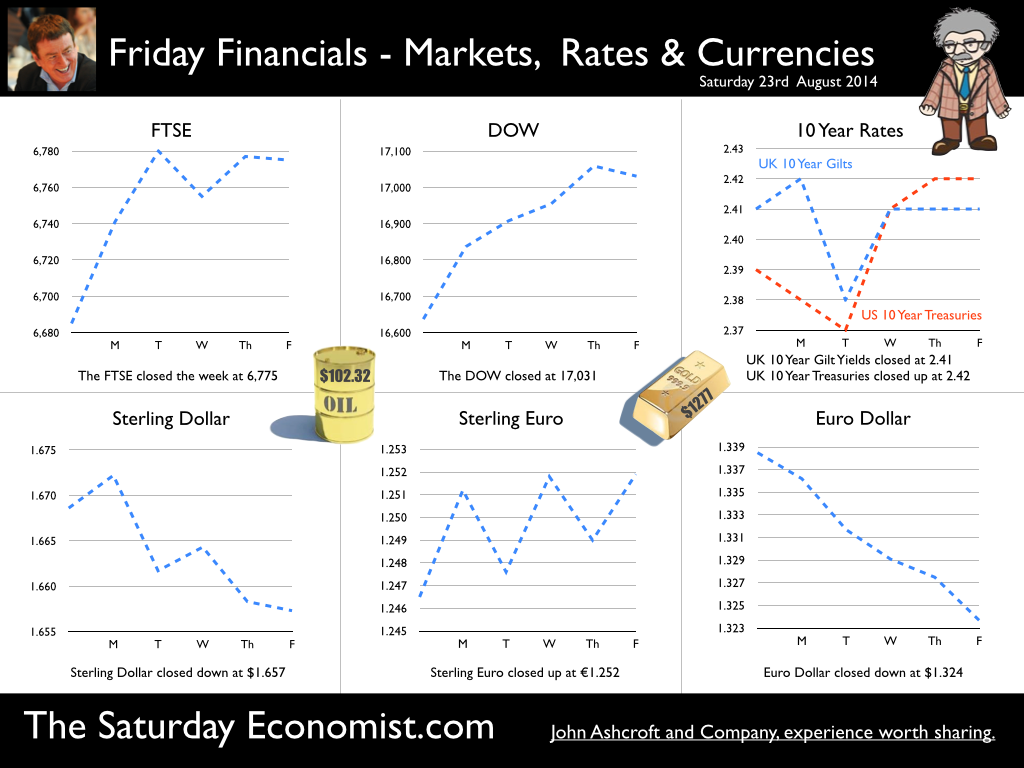

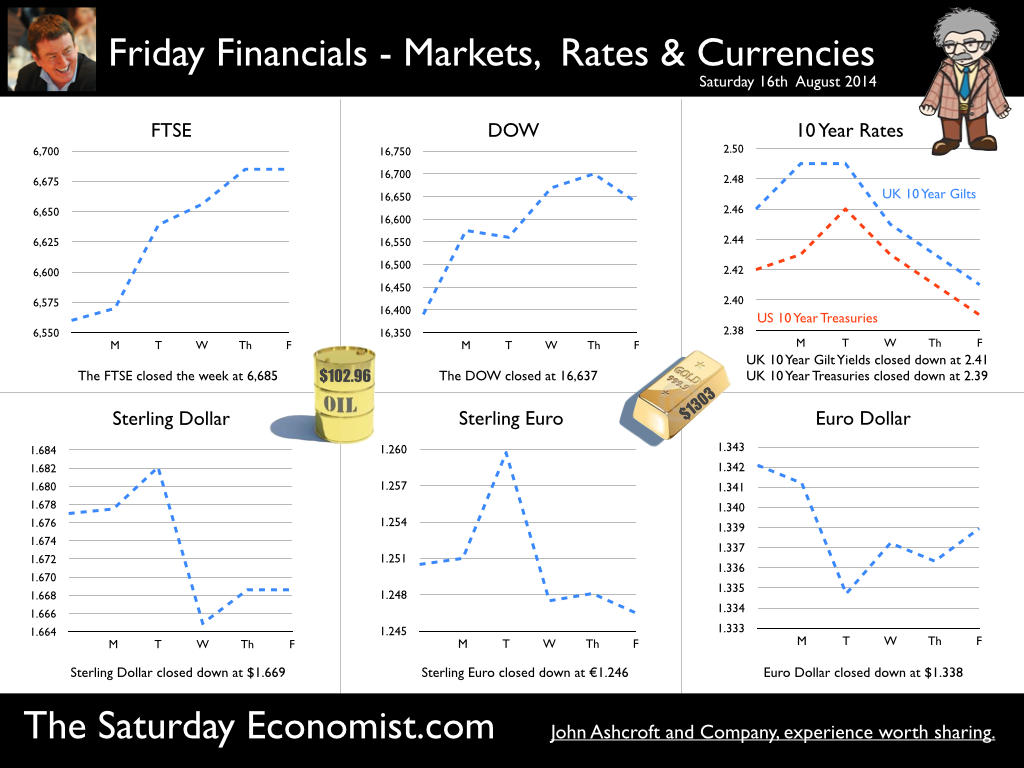

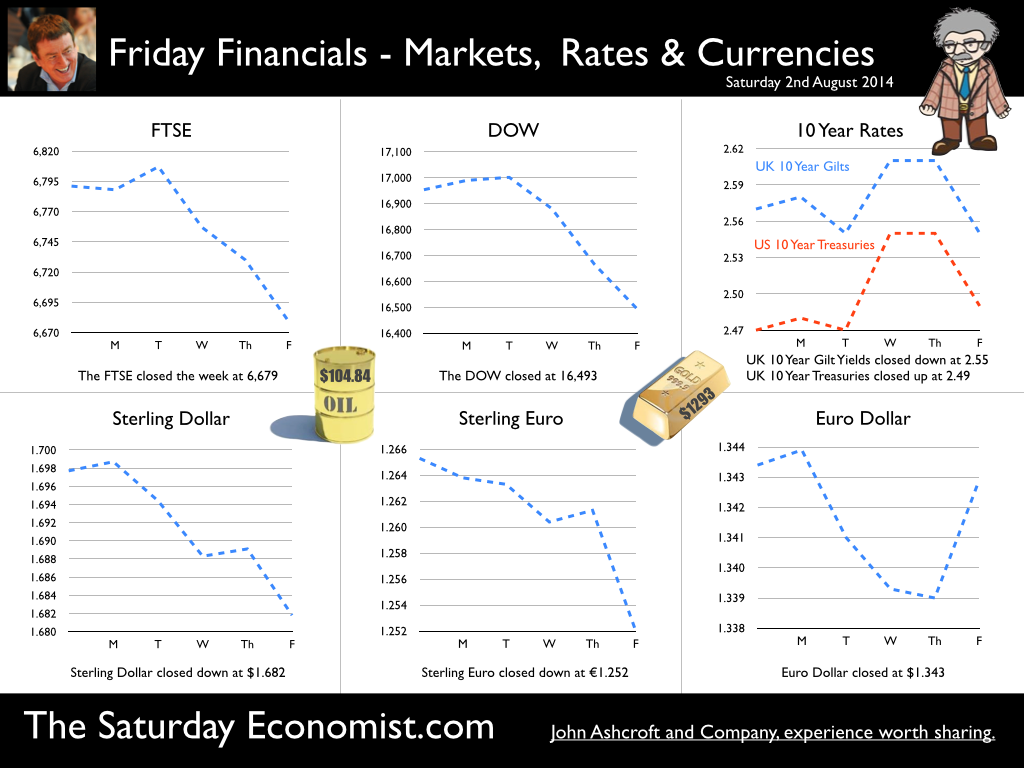

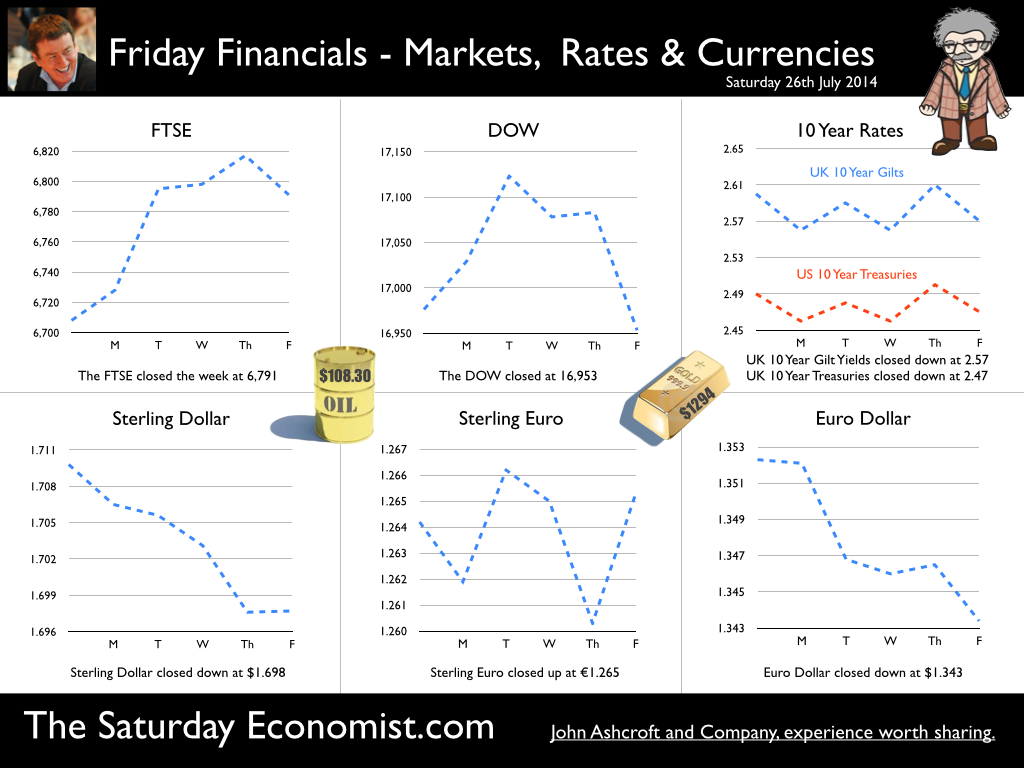

USA ... When will US rates rise? According to the latest survey in the Wall Street Journal, most economists expect the Fed to raise rates in June next year. 40% expect rates to rise in the second quarter and almost half expect the rise to be delayed until the second half of the year. Positive about the prospects for growth in the US, economists believe concerns about Europe and challenges in the Ukraine suggest the Fed will be anxious to hold the rate rise for as long as possible and well into the year ahead. Mark Carney in Liverpool … The Governor was in Liverpool this week speaking to the TUC Annual Congress. Reassuring union members he and 3,600 staff in the Bank of England were paid a living wage, the governor went on to explain the “judgement about precisely when to raise Bank Rate has become more balanced”. “With no pre set course, the timing would depend on the data.” This week, the data suggests there will be no pressure to increase rates anytime soon and probably not before the end of the year. Oil Price … Fears of inflation abate, as the oil price fell below the $100 dollar mark. Despite turmoil in Iraq and Syria, Oil Price Brent Crude closed at $97.62. The average price in September last year was $112. UK manufacturing prices and headline inflation rates will soften as a result. For the moment, the Saudi swing producers are relaxed. The seasonal low will impact and prices will take the hit. Restoration to the $100 - $110 band will follow in the Autumn, demand and supply will adjust to ensure this is the case. Manufacturing … UK Manufacturing output increased by just 2.2% in July after growth of 3.5% in the first half of the year. Output of capital goods and consumer goods was surprisingly week in the month. We have downgraded our forecasts for the third quarter and the year as a whole (3.4%) as a result. Construction output ... UK Construction output growth slowed to 2.6% in July after growth of 6% in the first half of the year. Strong growth in new housing (both public and private) up by 27% and in private industrial (up by 20%) was offset by weakness in infrastructure and related public sector projects. For the year as a whole we expect growth of 4.6% slightly down on the June forecast of 5.1%. UK Trade Figures … The trade deficit (goods) increased to £10.2 billion in July offset by a £6.8 surplus in services. Our forecasts for the year as whole - unchanged as a result. We expect the deficit (trade in goods) to be £30.8 billion in the quarter and £112.5 billion for the year as a whole. Is this a threat to recovery? Not really. The trade in services surplus will reduce the combined deficit in the year, to around £30 billion. Less than 2% of GDP, the deficit is easily funded. No pressure on policy makers to increase rates, assuming overseas dividends recover to finance the shortfall. Growth in the UK … Despite the soft figures in manufacturing and construction in July, our forecast for growth in the UK in the Q3 and for the year as a whole remains unchanged around 3.1% So what of base rates … Last week, base rates were held at 50 basis points. The chances of a rate rise before the end of the year are receding. Next week’s inflation and retail figures will be soft but the labour stats will suggest further tightening in the claimant count and vacancy rates. There will be nothing in next week’s data to precipitate a rate rise this year. So what happened to sterling this week? Sterling fell against the dollar to $1.626 from $1.630 and down against the Euro at 1.254 from 1.259. The Euro was up against the dollar at 1.297 (1.295). Oil Price Brent Crude closed down at $97.62 from 100.98. The average price in September last year was $111.60. Markets, move down slightly. The Dow closed down at 16,978 from 17,103 and the FTSE closed down at 6,806 from 6,855. UK Ten year gilt yields move up to 2.55 from 2.49 and US Treasury yields closed at 2.60 from 2.44. Gold was further tarnished at $1,227 from $1,265. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  No surprise this week as MPC votes to hold rates … It’s that time of month again …The Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The minutes of the meeting will be published on the 17 September. Can’t wait! The hawks views may have been subdued by the latest data on retail sales and earnings data but the economics news this week remains bullish about growth this year. Car Sales … Car sales in August were up by 9% in the month and just over 10% in the year to date. The UK is on track to sell 2.45 million cars this year. That’s higher than the pre crash levels recorded in 2007. Commercial vehicle sales were up almost 12% in August, increasing by 13% for the year to date. The car market remains a powerful indicator of consumer confidence and spending trends. August, with registrations of just 72,000, is no longer a big month for sales. September is the one to watch with over 400,000 new car sales recorded last year, 425,000 a hurdle number! UK Survey Data … The Markit/CIPS UK PMI® surveys for August were released this week. Chris Williamson, Chief Economist at Markit, claimed “An acceleration of growth in the services sector and an on-going construction boom offset a weakened performance in manufacturing in August. The three PMI surveys indicate that the economy grew at the fastest rate since last November, providing further ammunition for policymakers arguing for higher interest rates.” In the service sector, activity growth was the strongest for ten months. The headline Business Activity Index recorded 60.5 up from 59.1 in July, representing the sharpest monthly improvement in activity since October 2013. In the construction sector, output appears to have risen at the fastest pace for seven months. The key index recorded a level of 64.0 in the month, up from 62.4 in July. Residential construction posted the fastest growth in activity. News from the manufacturing sector disappointed slightly. The Manufacturing PMI index posted 52.5 in August, down from 54.8 in July. Albeit a 14 month low, the index is still in growth (above 50) territory. Domestic sales dominate, export demand is strong in North America, the Middle East and China but obvious problems in European order books persist. So what of the rest of the world? US jobs disappoint but Fed still on track to tighten … The US labour market added 142,000 new jobs in August, significantly below consensus expectations and well below the 225,000 average over the prior six months. The unemployment rate fell to 6.1%. Positive news on car sales and manufacturing output also hit the headlines … “The data doesn’t say the economy is slowing down but it does not suggest it is accelerating much either” according to Steven Blitz chief economist at ITG Investment Research. Nor we would add, is there much in the data to suggest the Fed will stray from the path of gently monetary tightening in the first half of 2015. In Europe … The ECB adopted further measures in an attempt to stimulate the slow recovery and low inflation in the Eurozone. Growth in Q2 increased by 0.7% compared with Q2 last year with some evidence of a slow down in Germany. Inflation fell to 0.3% and unemployment remained stubbornly high at 11.5%. The ECB lowered policy rates by 10 basis points, the refinancing rate moved down to 0.05%, the marginal lending facility fell to 0.3% and the deposit rate was pushed further into negative territory, dropping to -0.2%. No escape from Planet ZIRP in prospect! Despite the concerns about deflation, GDP is forecast to increase by 0.9% in 2014 and 1.6% in 2015. Low prices are an international phenomenon, not confined to Europe. Negative rates and QE are unlikely to provide the solution to low commodity prices. A slow for recovery for Europe is in prospect. Marooned on Planet ZIRP, digging up the runway will not improve the timetable for takeoff and escape. There is an old Iberian imprecation, “May the builders be in your home”. Far worse - the curse “May the academics be in your central bank”. So what of base rates … In the UK base rates were held at 50 basis points with no additions to the asset purchase programme. The chances of a rate rise before the end of the year are receding. Hot money is moving to February for the first rate hike but if the bad news from Europe continues, the hike may be post hustings after all. Is this at odds with the latest data? Of course. Demand conditions are strong, the labour market is tightening, recruitment challenges are increasing and skill shortages are ubiquitous. Pay and earnings remain subdued and international energy and commodity prices remain low. For the moment the inflation target remains within reach, easing the grip of the hawks on monetary policy. So what happened to sterling this week? Sterling fell against the dollar to $1.630 from $1.658 and down against the Euro at 1.259 from 1.261. The Euro was down against the dollar at 1.295 (1.314). Oil Price Brent Crude closed down at $100.98 from 102.19. The average price in September last year was $111.60. Markets, move up slightly. The Dow closed up at 17,103 from 17,084 and the FTSE closed up at 6,855 from 6,819. UK Ten year gilt yields move up to 2.49 from 2.37 and US Treasury yields closed at 2.44 from 2.33. Gold was slightly tarnished at $1,265 from $1,286. That’s all for this week but we would like to introduce the Bracken Bower Prize to our readers! John Introducing the Bracken Bower Prize The Financial Times and McKinsey & Company, organisers of the Business Book of the Year Award, want to encourage young authors to tackle emerging business themes. They hope to unearth new talent and encourage writers to research ideas that could fill future business books of the year. A prize of £15,000 will be given for the best book proposal. The Bracken Bower Prize is named after Brendan Bracken who was chairman of the FT from 1945 to 1958 and Marvin Bower, managing director of McKinsey from 1950 to 1967, who were instrumental in laying the foundations for the present day success of the two institutions. This prize honours their legacy but also opens a new chapter by encouraging young writers and researchers to identify and analyse the business trends of the future. The inaugural prize will be awarded to the best proposal for a book about the challenges and opportunities of growth. The main theme of the proposed work should be forward-looking. In the spirit of the Business Book of the Year, the proposed book should aim to provide a compelling and enjoyable insight into future trends in business, economics, finance or management. The judges will favour authors who write with knowledge, creativity, originality and style and whose proposed books promise to break new ground, or examine pressing business challenges in original ways. Only writers who are under 35 on November 11 2014 (the day the prize will be awarded) are eligible. They can be a published author, but the proposal itself must be original and must not have been previously submitted to a publisher. The proposal should be no longer than 5,000 words – an essay or an article that conveys the argument, scope and style of the proposed book – and must include a description of how the finished work would be structured, for example, a list of chapter headings and a short bullet-point description of each chapter. In addition entrants should submit a biography, emphasising why they are qualified to write a book on this topic. The best proposals will be published on FT.com. Full rules for The Bracken Bower prize are available here or here http://membership.ft.com/PR/brackenbower/ © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*  Jackson Hole, Wyoming. Skiing in Winter and Fly Fishing in Summer, there are several perks to the role of central banker. This week the bankers were in Jackson Hole, Wyoming, fishing for answers to the employment - inflation conundrum. The occasion - the Federal Reserve, Kansas City, Economic Symposium, Jackson Hole, Wyoming. Why Wyoming? You may well ask? In 1982 the conference moved to Jackson Hole (Kansas City district) to persuade Paul Volcker, then chairman of the Fed and an avid fly-fisherman, to attend. Flies and fish were the big lure for the head of the Fed - and so it began. The location, based some 2,000 miles from New York and 5,000 miles from London is not ideal. Communication - in the early days - not always ideal either. Want a copy of the New York Times? The local store stocked today’s and yesterday’s but if you wanted today’s copy, you had to come back tomorrow - delivery lagged a day behind. Monetary Policy and the Muddler Minnow* … This year the theme was Labor Market Dynamics and Monetary Policy. Mario Draghi reassured markets there would be no early rise in rates in Europe! Quelle Surprise! Janet Yellen delivered a lecture on structural, cyclical, secular and frictional unemployment before claiming the mantle of Truman’s two handed economist to explain the Fed’s stance on future monetary policy. On the one hand … “If progress in the labor market continues to be more rapid than anticipated or if inflation moves up more rapidly than anticipated, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target could come sooner than the Committee currently expects and could be more rapid thereafter.” On the other hand … “If economic performance turns out to be disappointing and progress toward our goals proceeds more slowly than we expect, then the future path of interest rates likely would be more accommodative than we currently anticipate.” Excellent. Yellen then left the room, thrust on a pair of waders, tied on a muddler minnow before making an excellent double spey cast into the River Snake. [*The muddler minnow is currently one of the most favoured trout flies amongst central bankers.] The MPC Minutes … muddying the waters … Back in the UK, the Bank of England released the minutes of the August MPC meeting. Two members of the committee, Martin Weale and Ian McCafferty voted for an increase in base rates by 25 basis points. The Carney consensus has cracked. Charm school is out for the Summer. Markets fell, Sterling rallied, on the prospect of an early rate rise. Inflation Update ... The day before, the ONS released the inflation figures for July. CPI fell to 1.6% from 1.9% prior month. Markets had rallied, Sterling fell, prospects of an imminent rate rise postponed. No one seemed to notice that service sector inflation was unchanged at 2.5%. The overall drop in the headline rate - attributable to goods inflation down to 0.8% from 1.4% in June. So why the drop in goods inflation? Manufacturing output prices were flat but input costs fell by over 7% in the month. Effects of sluggish world trade, weak commodity and energy prices were exacerbated by the translation impact of a stronger Sterling. Government Borrowing … Thursday and the ONS released figures on government borrowing for the month of July. Four months into the year and borrowing remains off track compared to last year and to plan. In the first four months, total borrowing was £37.0 billion compared to £35.2 billion in 2013. In July borrowing was down to £0.7 billion from £1.6 billion last year. An improvement but with an economy expanding by over 3% in the first half of the year, we would expect a big improvement in borrowing given the strength of the recovery. Government spending is not the problem, nor VAT receipts up by 5%. The problem is revenues from income and capital gains tax are actually down on prior year over the first four months of the fiscal year. In part this is a result of strong receipts in the first quarter last year which may level out in due course. Compared to two years ago, revenues are up 5%. Even so, for the year as a whole the Chancellor will still have some work to do if the OBR target is to be met. Retail Sales … Retail sales in July were up by 2.6% after growth of 4% in the first half of the year. A disappointment, perhaps. Internet sales were up by 11% accounting for 11% of all retail activity. It will take more than a few digital mannequins to reverse fortunes on the high street but it is a tad to soon to make the call about a slow down in overall activity. The house market remains strong in terms of prices and the Council of Mortgage Lenders reported a 15% increase in gross mortgage leading last month. So what of base rates … The MPC minutes suggested the rate rise could come earlier than expected but news on inflation and retail sales suggest the rates will be kept on hold until 2015. No rate rise in prospect in Europe but Janet Yellen has “nowcast” a muddler minnow into the thought stream. A rate rise in the USA on the cards for Q2 next year or even earlier? Possibly. In the UK - February or June would appear to be the call. So what happened to sterling this week? Sterling closed down against the dollar at $1.657 from $1.669 but up against the Euro at 1.252 from 1.246. The Euro was down against the dollar at 1.324 (1.246). Oil Price Brent Crude closed down at $102.32 from 102.96. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,031 from 16,637 and the FTSE closed up at 6,775 from 6,685. UK Ten year gilt yields were unchanged at 2.41 and US Treasury yields closed at 2.342 from 2.39. Gold was largely unchanged at $1,302. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Inflation Report Press Conference … Reassurance from the Inflation Report Press Conference this week. The Bank of England may be uncertain about what is happening in the economy but it is certainly not clueless. Excellent. £3.5 million spent on the economics model and 200 PhDs in the pot to stir up the data, not all is for nought. James Macintosh of the FT put the difficult question “It would appear you've been moving over the past five years from a fair degree of certainty towards a fair degree of cluelessness and currently - you are at the more clueless end of the spectrum.” Is this a fair point? Well perhaps. Larry Elliott of the Guardian had begun the challenge suggesting there's a wide range of views on the Committee about the likely degree of slack in the economy. There is uncertainty about the housing market, wages may go up, they may not go up. Guidance on the pace and extent of interest rate rises is an expectation not a promise … “I mean once you cut through all this doesn't it lead you to three conclusions - one, that the Bank hasn't really got a clue what's going on out there; two, that the MPC is divided about what's going on out there; and thirdly, any person thinking about taking out a mortgage on the basis of the Bank's forward guidance would be ill-advised to do so, because anything you say, has to be taken with a very large pinch of salt?” Oh dear ... The Carney honeymoon is over … Well one thing we can be certain about, this is not the questioning we would have expected under Governor King. For Governor Carney the honeymoon is over. So much for the open routine. The Emperor’s economics models are proving to be as insubstantial as the clothing. Perhaps it is time to return to the enigmatic, grumpy old professor emeritus routine, dismissive of those of a lower intellectual order including undergraduates and the press core particularly. Ed Conway now with Sky News, would occasionally rattle Governor King teasing about the accuracy of the inflation forecasts, (not actually forecasts of course) but Governor Carney,cast in the role as the unreliable boyfriend, is taking more and more hits. All a bit of a muddle … Clearly Asa Bennett From the Huffington Post rattled the Governor, sensitive to criticism of forward guidance, “I just wanted to ask Governor about the evolution of your forward guidance plan, particularly when it started with the sort of clear to understand unemployment threshold, and then the sort of output gap, and then this bolt on about pay growth. Do you wish you started with this at the beginning? Hasn’t it all been a bit of a muddle or is it a learning process? “Well you’re muddled I'm afraid”. The playground retort from the Governor of the Bank of England. So is that the best we can get? The Old Lady of Threadneedle Street - the Aunt Sally of Fleet Street … The Old Lady of Threadneedle Street is becoming the Aunt Sally of Fleet Street. It would help if Jenny Scott, Executive Director of Communications, chairing the press conference, appeared to know some of the names of the press corp, instead of jabbing a pencil in this or that direction, when it came to question time. Perhaps Jenny was trying to ward off evil spirits, waving the magic wand of oblivion, which Governor King carried so successfully in his cloak. For debutante MPC member Minouche Shafik, it was all too much. Shifting uneasily, apparently bored, struggling under the weight, not of office but of a voluminous hair style, the governor allowed Minouche one question response on Europe … Minouche : “It would be good for us if Europe grew faster since it’s our key trading market, but for the near term that doesn’t look very likely”. “That’s all we have time for”, said the Director of Communications and that was that. Well, we must hope there is much more to come. So what happened this week? GDP Estimate … The ONS second estimate of GDP was released this week. Growth in the UK Q2 increased by 3.2% compared to the prior estimate of 3.1%. Actually the numbers hadn’t changed, the statisticians were using a more accurate calculator this time round for the rounding. Our estimates of growth for the year are unchanged at 3% which makes the Bank of England estimates of growth (3.5%) all the more difficult to understand. Either the economy will grow at an eye watering 4% in the second half of the year or the Bank expects big revisions to the data in September as a result of the inclusion of drugs and prostitution in the national accounts. Who would have thought hookers had that much clout. We shall have to wait until the end of September for the update. Labour Market Stats … The jobs outlook just gets better. The claimant count rate fell to 3% in July at just over 1 million unemployed. 400,000 have found work in the past year. At the current rate of growth we will be closing the job centres at the end of 2016, there will be no on left on the register looking for work. The wider LFS data confirmed the trend with the unemployment rate falling to 6.4%. More people in work, unemployment rates falling, recruitment increasing, skills shortages heightening, which makes the pay data even more inexplicable. Earnings increased by less than one per cent in June. We would expect increases in line with inflation or more at 3% plus at this stage in the recovery. For this we have much sympathy with the models at the Bank of England, something strange is happening on Planet ZIRP. Maybe low rates are the problem and no the solution? So what of base rates … Growth and jobs data would push the argument for a rates rise before the end of the year. Inflation and pay data would suggest the rates could be kept on hold until 2015. The latest data from Europe confirms a rate rise is off the agenda for months if not years to come. The MPC will be loathe to act ahead of the Fed and not too eager to move in advance of the ECB. Markets assumed rates will be kept on hold as a result of the Inflation Report… So what happened to sterling this week? Sterling closed down against the dollar at $1.669 from $1.6774 and down against the Euro at 1.246 from 1.252. The Euro was down against the dollar at 1.246 (1.341). Oil Price Brent Crude closed down at $102.96 from 105.02. The average price in August last year was $111.28. Markets, rallied on the rates news. The Dow closed up at 16,637 from 16,554 and the FTSE closed up at 6,685 from 6,567. UK Ten year gilt yields were down at 2.41 from 2.55 and US Treasury yields closed at 2.39 from 2.49. Gold was largely unchanged at $1,303 from $1,305. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK Interest Rates on hold ... No surprise this week as the MPC voted to keep rates on hold and to maintain the asset purchase facility at £375 billion. The decision to increase rates may becoming more finely balanced for some but the news from around the world, will disturb the hawks and give succour to the doves. The rate rise may well be held over into the new year, despite the continued strong performance of the domestic economy. The minutes of the MPC meeting, due later this month, may provide some insight into the overall views of the individual committee members. ECB and Rates ... problems in the East In Europe, rates were kept on hold as Draghi continues to consider QE. Action is needed but the futile process of debt monetisation will do little to offset the economies beset by weak levels of domestic demand. Complaints against the need for labour reform and excessive regulation will largely miss the point. Italy is slipping back into recession with forecasts for the current year downgraded once again to growth of just 0.2%. France will struggle to hit the 1% growth target this year and German export performance is slowing as economies are transfixed by the crisis in Ukraine. Trade sanctions and threat of war are damaging exports from Euro land to Eastern Europe and to Russia. The Euro trading block is now imperilled by it’s very “raison d’être” at inception. Growth in the Euro economies is expected to be just 1% this year with no prospect of a rate rise on the horizon until late 2015 / 2016 at the earliest. Production and Manufacturing ... In the UK, manufacturing data was surprisingly weak in the latest data for June but Euroland is not to blame. Output increased in the month by just 1.9% after strong growth of 3.6% in the first quarter and 4% in April and May. In the second quarter overall growth was up by 3.2%. The underlying data from the Markit/CIPS Manufacturing PMI® suggests strong growth continued into June and July which suggests the latest ONS data may be something of an aberration. [We are adjusting our forecast for the year to growth in manufacturing of 3.4% based on the latest data. Expectations for UK GDP growth are unchanged at 3% following revisions to our service sector forecast.] The Car Market … The SMMT reported strong car sales in July, with new registrations up by 6% in the month and 10% in the year to date. Output increased by 3.5% over the year. The car market is on track to sell 2.45 million units this year. That’s actually higher than the levels achieved in 2007. Assuming output hits the 1.55 million mark, the deficit (trade in cars) will increase to almost 900,000 units. Car manufacturing is benefitting from the recovery in consumer confidence and household spending but the trade deficit will increase as a result of the strength of domestic demand and limitations to domestic capacity. The UK cannot enjoy a period as the strongest growth economy in the Western world without a significant deterioration in the trade balance. Deficit trade in goods and services … And so it continued to prove with the latest trade data. The deficit trade in goods increased slightly in the month of June to £9.5 billion offset by a £7 billion surplus in services. For the second quarter, the deficit was £27.4 billion (trade in goods) and just under £7 billion overall, goods and services. The service sector surplus was £20.5 billion. For the year as a whole, we expect the goods deficit to be £112.3 billion offset by an £80 billion plus serve sector surplus. No threat to the recovery but we still have concerns about the current account deterioration and the drop in overseas investment income. In the first six months of the year, exports of goods have fallen by almost 8% in value and imports have fallen by 4.6%. World trade growth has been subdued in the first six months of the year yet UK domestic demand increased by 3%. Sterling appreciation against the dollar has lead to a translation impact on the trade balance rather than an elasticity effect. Construction and housing ... The latest adjustment for construction data confirms the recovery continues driven by a huge increase in new housing. Total output increased by 5.3% in June, up by 4.8% in Q2 2014 compared to Q2 last year. The total value of new work in the month increased by 5.8% with the volume of new housing increasing by 18% compared to June last year. House Prices ... The increase in housing supply is doing little to assuage the demand for house moves and house prices. Halifax and Nationwide reported prices up by 10% in July. Our transaction model is simple. Activity is a function of house prices and the real cost of borrowing. With mortgages fixed at 4%, the double digit capital appreciation is irresistible to the basic mechanics of a free market. The real cost of borrowing is negative 6%. Demand for housing will continue to out strip supply, despite the regulatory adjustments to the mortgage market. So what happened to sterling this week? Sterling closed down against the dollar at $1.6774 from $1.682 and unchanged against the Euro at 1.252. The Euro was largely unchanged against the dollar at 1.341. Oil Price Brent Crude closed up slightly at $105.02 from 104.84. The average price in August last year was $111.28. Markets, closed mixed. The Dow closed up 61 points at 16,554 from 16,493 and the FTSE closed down 112 points at 6,567 from 6,679. UK Ten year gilt yields were down at 2.46 from 2.557and US Treasury yields closed at 2.42 from 2.49. Gold was up at $1,305 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  A letter from America … This week the Professor is in America, reviewing the prospects for the US economy. Despite the pressure on the Bank of England to increase rates before the end of the year, the MPC will be reluctant to move ahead of the Fed and be the first to leave Planet ZIRP. So what are the prospects of a US rate rise any time soon? Two Fed policy hawks, Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed, made comments this week, suggesting they have seen enough evidence to support an interest rate rise earlier than expected. Currently, tapering is expected to continue, extinguishing the asset purchase programme in October. US rates are not expected to rise until Q1 or even Q2 next year. The Prof thinks the latest crop of economics data will take the pressure off the doves to move earlier. Growth in the USA … In the USA, real gross domestic product increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. 4% sounds quite exhilarating but …. According to our year on year comparison, US GDP Q2 increased by 2.4% in the second quarter compared to Q2 2013. This followed growth of 1.9% in the first quarter - both below trend rate. Our forecast of growth at 2.4% in 2014 is unchanged based on the latest data. The latest GDP estimates ensure there is no pressure on the Fed to accelerate the change in monetary policy. We expect tapering to continue into the Autumn, with a rate rise postponed into 2015. Jobs in the USA … Friday's employment and income reports pointed to steady U.S. job growth with the number of non farm payroll jobs increasing by 209,000. The unemployment rate ticked higher to 6.2% but this a refection of a widening labour pool rather than a slow down in the economy. Moderate expansion in payroll numbers, slightly below expectations, will ensure there is no short term pressure to increase rates anytime soon. Inflation in the USA … The US Consumer Price Index increased by 2.1 percent in the twelve months to June. The PCE (personal consumption expenditure) price index, the Fed's favoured measure of inflation, was up 1.6%. Average hourly earnings of private-sector workers were up 2.0% from a year earlier, unchanged from the range of the past few years. Growth, jobs, earnings and inflation are all demonstrating trends that are likely to keep the Federal Reserve on course to conclude the bond-purchase program in October but remain cautious about raising short-term interest rates before the end of the year. We would expect US rates to rise in the Spring of 2015. Despite any further increase in The Saturday Economist™ Overheating Index™, the MPC will be reluctant to increase rates this year and open the “Spread with the Fed”. So what of the UK? The latest manufacturing data from Markit/CIPS UK PMI® confirmed the strong output growth continued into July. Production and new orders both continued to rise at robust, above long-run average rates in the month. At 55.4, down from 57.2 in June, the headline index posted the lowest reading in one year but remained well above the survey average of 51.5. No need to worry about manufacturing output! Something to worry about … Ben Broadbent, Deputy Governor for monetary policy, Bank of England, made a speech in London this week. His theme - “The UK Current Account Deficit”. Last year the UK current account deficit was 4.5% of GDP. That’s the second-highest annual figure since the Second World War. So is the near record deficit a threat to growth? The Deputy Governor concludes the “significance [of the deficit] depends on the health of a country’s net foreign asset position and more fundamentally, on the trust in its institutions”. “…having a balanced net asset position seems to reduce the threat from a large current account deficit, as does a floating currency.” Now that is concerning. In the 80’s Chancellor Lawson argued the Balance of Payments “doesn’t matter”. It does and in the end it did! Interest rates had to rise dramatically to curtail domestic demand. In the current cycle, the deficit, trade in goods, is offset in part by the service sector surplus. At around 2% to 2.5% of GDP, the deficit is not a threat to growth. The collapse in overseas earnings on the other hand is a more serious concern. A current account deficit of 4.5% is unsustainable. A dismissive speech at Chatham House will not disguise the extent of the problem, rule or no rule. So what happened to sterling this week? Sterling closed down against the dollar at $1.682 from $1.698 and down against the Euro to 1.252 from (1.2653). The Euro was unchanged against the dollar at 1.343. Oil Price Brent Crude closed down at $104.84 from 108.30. The average price in August last year was $111.28. Markets, closed down. The Dow closed down 460 points at 16,493 from 16,953 and the FTSE was down 12 points at 6,679 from 6,791. UK Ten year gilt yields were down at 2.55 from 2.57 and US Treasury yields closed at 2.49 from 2.47. Gold was unchanged at $1,293 from $1,294. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  GDP up by 3.1% in Q2 ... a rate rise before the end of the year seems probable! The UK economy grew by 3.1% in the second quarter of the year according to the latest figures from the ONS. The economy is on track for growth of just over 3.0% this year and 2.8% next. The output gap closed to 9.2% based on our estimated long term trend growth rate of 2.7%. Service sector continued to support the expansion (up by 3.3%) with particularly good performances in the leisure sector (4.9%) and business services sector (4.2%). Manufacturing and construction also made strong contributions with growth of 3.2% and 4.2% respectively. This is the first estimate of growth based on partial information. The next update is due on the 16th August. The initial estimate may well be revised up (3.2%) based on revisions to the manufacturing data. This week the IMF revised their forecasts of the UK economy to 3.2% for 2014 and 2.7% next. The UK will be the fastest growing economy in the western world with deleterious implications for the trade balance. If the IMF forecasts are correct, UK growth will accelerate in the second half of the year to 3.4%. It‘s simple arithmetic not complex economics! If that is the case, The Saturday Economist™ Overheating Index™ will move higher, bringing the prospect of a rate rise before the end of the year into clear focus. Retail Sales … Retail sales volumes increased by 3.6% in June 2014 compared with June last year. This is lower than the average over the first six months of the year, a period within which the volume of sales averaged 4.1%. (March and April were particularly strong months for retail activity.) Retail sales growth averaged 3.9% in our benchmark period [200Q1 - 2008Q1]. The performance in June of 3.6% suggests MPC members will rest easy on the news, with no pressure on a rate rise evident in the data. The amount spent online increased by 13.4% year on year, accounting for 11.3% of all retail spending. The pressure on conventional retail is continuing to increase significantly. UK Government Borrowing : No fiscal fizzle, the deficit is increasing! Writing in the New York Times this week, Paul Krugman talked of the imaginary US budget and debt crisis. Despite all the fears of deficit doomsters, the US federal deficit will be just 2.8% of GDP this year, down from 9.8% in 2009. The economy is growing and the deficit is falling. It's a fiscal fizzle. “We don’t have a debt crisis, and we never did”, says Krugman. Excellent news for them over there! But is it so good over here? According to the figures released by the ONS this week, in the first three months of the year, total borrowing was higher than first quarter last year by some £3 billion. Total borrowing was £36.1 billion compared to £33.6 billion last year. Despite economic growth in the quarter of over 3%, the deficit is increasing rather than falling. The government is off track to hit the deficit target of £95.5 billion in 2014/15. The deficit to GDP ratio was 6.5% in 2013/14 set to fall to around 5.5% this year. On current trends this is not about to happen. Total debt of £1.3 trillion has risen to over 77% of GDP. Analysts are beginning to call for more cuts in spending to resolve the problem. Yet spending over the first three months of the year was up by less than 1% [ANLP basis] assisted by a fall in interest costs of almost 3%. The problem for the Chancellor - Exchequer revenues actually fell. Despite an increase in the VAT take of just over 4%, Income and CG taxes were down by 3.5%, which is bizarre in an economy growing by 3% in real terms and over 5% in nominal values. The US economy invariably demonstrates an ability to rebound, evaporating the internal deficit in the process in quite dramatic fashion. Fiscal drag, generates a fiscal fizzle, vaporising the deficit and improving the outlook for the Fed. In the UK, the process is more protracted. The current trend is troubling. No need to panic just yet. We still expect a significant rebound in the tax take through the year as the economy continues to grow at over 5% in nominal terms. The deficit was revised down last year to £105.8 billion. The target of £95.5 billion appears to be a stretch for the moment. No fiscal fizzle for the Chancellor more like a slow burn - the OBR targets could still be hit! So what of interest rates … At the last meeting of the MPC, the Committee agreed that no increase in base rates was warranted. For some members the decision had become “more balanced in the past few months compared to earlier in the year”. The latest figures on retail spending and GDP would suggest the decision remains finely balanced but the hawks will be flapping their wings. The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the GDP data. The chances of a rate rise before the end of the year edged higher in line with the index. So what happened to sterling this week? Sterling closed down against the Dollar at $1.698 from $1.709 but up against the Euro to 1.265 from (1.263). The Euro moved down against the dollar at 1.343 from 1.352. Oil Price Brent Crude closed down at $108.30 from 108.40 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed below the 17,000 level at 16,953 from 17,100 and the FTSE was up at 6,791 from 6,749. UK Ten year gilt yields were down at 2.57 from 2.60 and US Treasury yields closed at 2.47 from 2.49. Gold was down at $1,294 from $1,310. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Deficits with inky blots and rotten parchment bonds sustained - of Balance of Payments and Public Sector Finances. Earlier this month is his speech at the Mansion House, Mark Carney, Governor of the Bank of England, referenced the Sterling Crisis of 1931 and imbalances within the economy. “We need balance. One has only to look back to 1931 when Britain’s economic prospects were strained by a large budget deficit and a deteriorating balance of payments. In the ensuing crisis, the government of the day resigned, sterling was forced off the gold standard" [and the Governor of the day went back to Canada.] In 2014, despite significant internal and external deficits, neither the resignation of the government, nor the repatriation of the Governor of the Bank of England appears imminent. It is however, worth revisiting 1931 and recalling the worlds of Sir Warren Fisher, permanent secretary to the Treasury. In September of that year, Sir Warren Fisher, warned Cabinet, of the Balance of Payments Crisis and the National Budget problem - "Deficits with inky blots and rotten parchment bonds sustained". He could easily have been talking of the present day, QE and debt monetisation. Trade Deficit ... Fisher 1931: The seriousness of the financial difficulties which are engaging public attention is perhaps not fully realised. The root cause of the "run on Sterling" on the part of the foreign depositor is the fact of our living beyond our means as evidenced by our ordering from abroad more goods than we could pay for and therefore our owing to other countries more in dollars and francs than they owe to us in sterling.” Public Sector Finances … Fisher 1931: Closely associated with this fact in the foreign mind is the question of our national Budget. After the war a certain number of countries continued to have difficulties in balancing their budgets and instead of pulling in their belts, resorted to the expedient of meeting deficits by printing innumerable bank or currency notes. Whenever this was done, the national currency lost much or all of its value i.e. purchasing power, and with the corresponding rise in prices, hardship, even hunger, was widespread. Consequently, when any of these countries subsequently desired financial assistance from other countries before the citizens of the latter could be induced to lend, they insisted on the borrowing country balancing its budget. And no one was more emphatic than ourselves in preaching this doctrine. National Budget … Fisher 1931: A national Budget has thus come to be regarded as a touchstone of a country's financial stability second only in importance to its international balance of trade; and if, as the case at present with us, we are "down" on our balance of trade with other countries, foreigners to whom we owe money automatically turn a microscope on to our Budget. And if the Budget is not really balanced, but is merely dressed up to look as though it were, the distrust abroad of our soundness would be intensified. Any expectation that we might continue on a "rake's progress" would complete the destruction of international confidence and thus result in the final collapse of our greatest asset, i.e. our credit. Living beyond our means … Fisher 1931: The remedy is to reverse the process which has been responsible for the trouble, and this means that instead of living at a level which has entailed ordering abroad more goods than we can pay for, we must relate our orders to our capacity to pay. And unless we can produce and sell abroad more goods (including "services") than we have been doing, we shall be forced to cut down our orders abroad, and our and our standard of living must be reduced accordingly. Consequences ... If not the epitaph of us English of to-day will be written by historians to come in Shakespeare' words (Richard II , Act 2, Scene l ) "England, bound in with the triumphant sea, Whose rocky shore beats back the envious siege of watery Neptune, Is now bound in with shame, with inky blots and rotten parchment bonds. That England, that was won’t to conquer others, hath made a shameful conquest of itself". Lessons from History And so history is revisited. With inky blots and rotten bonds sustained. The latest data on the Public Sector Finances is hardly reassuring and the trade deficit will continue to present a problem for an economy growing faster than major trading partners. Note "By the Secretary, The attached memorandum by Sir Warren Fisher is circulated to the Cabinet by instructions from the Prime Minister. (Signed) M. P. A. HANKEY Secretary, Cabinet, Whitehall Gardens, SW1. September 14th, 1931. Footnote : Up to this time the pound sterling, has for international purposes been valued and accepted as the equivalent of a gold pound or of 4.00 dollars or 124 Francs. The Financial and Economic Position of the United Kingdom 1931. Memo to Cabinet from Sir Warren Fisher, Permanent Secretary to the Treasury September 1931. Deficits with Inky Blots and Rotten Parchment Bonds sustained. This article was originally published John Ashcroft.co.uk in July 2009. References : Fun with the National Archives : Cabinet Papers |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed