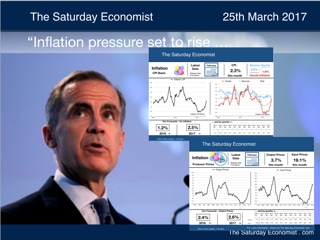

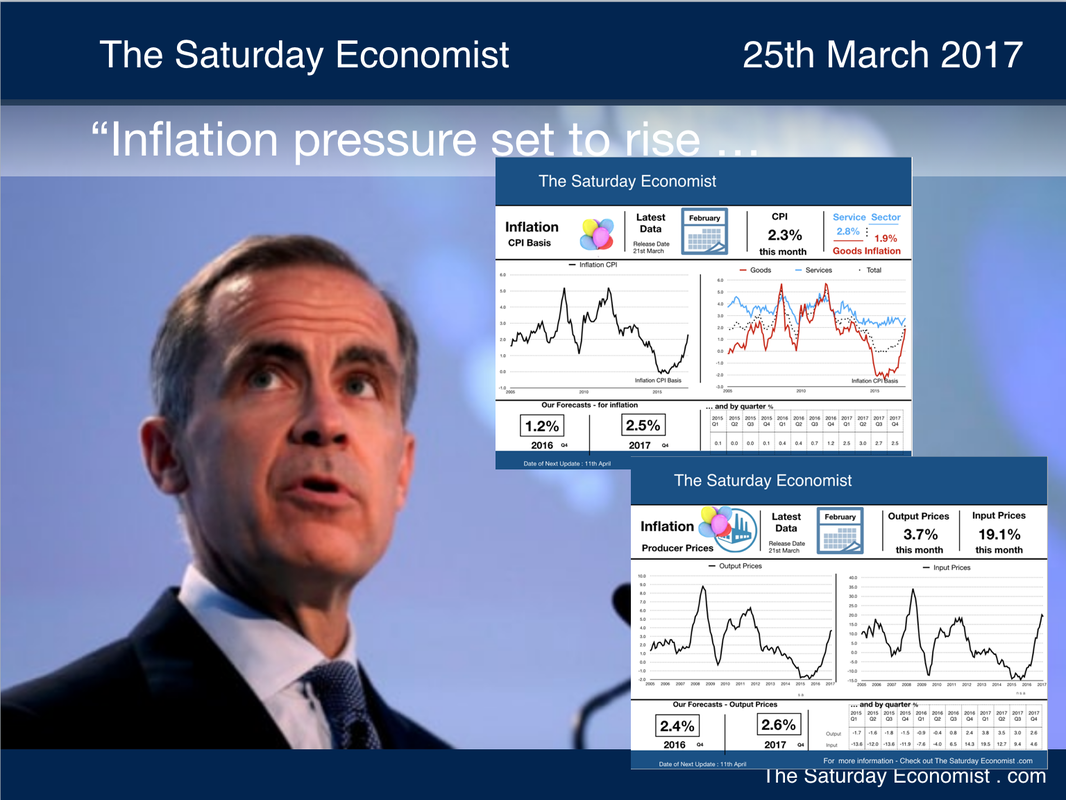

Inflation on the rise this week! Inflation CPI basis increased to 2.3% in February compared to 1.8% prior month. Service sector inflation increased to 2.8%. Goods inflation jumped to 1.9% from just 1.1% in January. So what happens next? We expect a further rise in headline inflation to 3% over the next few months. Price increases should then ease back towards the second half of the year to around 2.5%. Transport, education and the leisure spend bore the brunt of the increases in February. Service sector inflation evident and well above target, the big jump in goods inflation is attributed to oil prices and the weakness of Sterling. The recovery in the world economy, world trade and commodity prices will ensure the underlying pressure on import prices will continue. Manufacturing output prices increased to 3.7%. Input costs increased by over 19%. The big story is oil and imported metal prices. In February last year the average price of Brent Crude was $32 per barrel. Sterling traded at just under $1.45. Compare that with a rise in oil to $55 dollars in February 2017 and a fall in Sterling to $1.25, this explains the near 90% increase in petroleum costs. The good news, all things being equal, the oil price impact slows to 64% in March and to 35% in the second quarter. This is why we expect the inflation pressures to ease through the year. It is also the reason the MPC choose to "see through" the transient trend and keep rates on hold. It is a mistake. Of retail sales and borrowing ... The 2.3% rise in earnings in January has been wiped out by the 2.3% increase in prices in February according to the latest ONS data. Fears the income squeeze would damage household incomes and spending were assuaged by the February retail sales figures. The income squeeze hypothesis is driving fears for growth this year and conditioning monetary policy. Hard to explain the 6.4% increase in retail sales values in the month and the 3.7% increase in sales volumes. Internet sales increased by 20% accounting for over 15% of all transactions. Household goods stores increased by almost 4% in the month. We expect the growth in household spending to continue, a result of a strong jobs market and growth in the economy of between 2.0% to 2.4%. Time to normalise base rates and hike rates from the August low. Good news for the Chancellor this week. Borrowing in February was just £1.8 billion down from £4.6 billion prior year. For the year as a whole, borrowing was down by almost £20 billion to £47.8 billion. The OBR forecast for the financial year of £52 billion is well on track compared to £72 billion prior year. At 2.7% of GDP, the task of deficit reduction is still work in progress. The £1.7 trillion public sector debt - a measure of the job yet to be done. West Wing ... Whisky Tango Foxtrot ... It has been another tough week for the President. The travel been blocked in the courts, the health care act pulled from Congress at the last moment. "We just don't have the votes", explained Paul Ryan, speaker of the house. Trump will blame the Democrats but his own party couldn't find consensus. The Bill was hastily and badly drafted. Even Trump wouldn't put his name to it. Just as well, he appeared to have little or no idea what was in it. Abolishing the Obama legacy the primary focus, all was on the table to secure assent. There is no art to this deal. Broken campaign promises on Medicaid and coverage were implicit in the GOP draft. For the moment Obamacare remains in place. What fun will be head on the Trump budget in the months ahead! Dead on arrival the view of many in the house. Trump's approval ratings have dropped into the 30's according to the latest fake news from Gallup. "I can't be doing so badly" explained the leader of the free world in an interview for Time magazine, "I am President and you're not". Yep we all know that. The good news - "Repeal and Replace" for healthcare, was never part of the plan anyway according to Trump. Now who knew that! As Ryan struggled to garner votes, the President pretended to drive a truck on the White House lawn, honking the horn and clenching his fists. Jared Kushner, senior advisor was in Aspen, taking the powder. As Sean Spicer explained the President was "all in" on this one. Stuck in a truck, honking the horn, going nowhere. Trump's credibility is becoming a real problem, The Wall Street Journal asserted, "Trump's falsehoods are eroding trust at home and abroad." The claim "Just found out Obama had my wires tapped" was blown away by FBI and NSA testimony before Congress this week. "No evidence, Trump clings to the claim like a drunk to an empty gin bottle" claimed the WSJ. "If President Trump doesn't show more respect for the truth, most Americans may conclude he is a fake President". Time magazine's Nancy Gibbs was equally critical. During the 2016 campaign, 70% of Trump statements were untrue, according to a review by Politifact, just 4% were true. Check out the interview with Trump in Time on truth and falsehoods. The President is rambling and incoherent. Rex Tillerson explained this week, he didn't really want the job at state. Looking forward to retirement at the ranch, his wife told him he had to do it! God hasn't finished with you yet and neither has Donald J Trump. A flair for diplomacy, Tillerson bumped a NATO meeting in favor of a flight to Moscow. Excellent. What is it about this administration and the Russians. The smoking gun is about to burst into flames ... watch this space Paul Manafort is to give evidence. Once the Trump campaign manager, Sean Spicer explained "he was just a man who worked for somebody for five months ..." Ouch! That's all for this week from the West Wing Whisky Tango Foxtrot ... So what happened to Markets? The Trump bump skipped a beat this week as markets reassessed trends in the White House. The Dow closed at 20,634 from 20,948. The FTSE closed at 7,336 from 7,424. Sterling was up against the Dollar to $1.249 from $1.239 and was up against the Euro to €1.156 from €1.153. The Euro moved up against the Dollar at 1.080 from 1.075. Oil Price Brent Crude closed at $50.81 from $51.75 The average price in March last year was $38.21. UK Gilts - yields moved down. UK Ten year gilt yields closed at 1.21 from 1.23. US Treasury yields softened to 2.41 from 2.50. Gold closed at $1,247 from $1,230. John That's all for this week. Don't miss our next economics update in Manchester on the 18th May. © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment.. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom.

0 Comments

Good news for the Chancellor? Botched budgets lead on to fortune. Chancellor Phil has a hole in his spreadsheet. The planned National Insurance rise has been scrapped. The Prime Minister made it clear, the lady may not be for turning but the Treasury certainly is. Enough trouble on the back benches without a manifesto pledge own goal. Spreadsheet Phil was obliged to deliver a despatch box spin. A humiliating climb down, damaged the image of a steady pair of hands. Fortunately Jeremy Corbyn couldn't deliver a knock out blow. The Chancellor will survive the set back, for the moment at least. No need to worry about the hole in the budget, just a modest revision from the OBR will plug the gap. The good news? Botched budgets lead on to fortune, as George Osborne demonstrated this week. Author of the Omnishambles budget, the pasty tax and the caravan tax, the former Chancellor has taken on the job of editor of the Evening Standard. Editor in the morning, parliamentarian in the afternoon, in just four days a week, the MP for Tatton will pick up over £300,000 a year. Day five, a chance to earn the £650,000 from Blackrock Investments for his one day a week deal. Weekends - free to work on the book and the lecture circuit, helping to balance the Osborne household budget. Nice work if you can get it. Let's hope the Northern Powerhouse will get a column in the London free sheet. Other news this week, Charlotte Hogg resigned from the Bank of England. The Deputy Governor failed the stress test in front of the Treasury Select Committee. Failing to inform or fill in the form about a brother working for Barclays, it was enough to force the Harvard Scholar out. A confused response to a question about QE didn't help. Interest rates were on hold this week. The MPC voted 8:1 to keep rates on hold. Kristin Forbes the hawk voting for a rate rise is scheduled to leave the Bank of England in June. The Governor's quest for gender balance took a further hit this week. Unemployment fell in January to 4.7%. It hasn't been lower than this for forty years. (It was actually 4.7% as recently as 2005). The earnings puzzle continues. Wage growth slowed to 2.2% in January. The decision to avoid any rates action made easier by the slow down. But what if low rates are contributing to low earnings growth? How strange the twists on Planet ZIRP. The Fed moved to normalise rates with a further hike this week. The yanks are pulling out, over there! Article 50 ... shouldn't take too long says Davis ... David Davis, Secretary of State for Exiting the EU, was in front of the EU select committee this week. Sorting out Article 50 shouldn't take too long, said the confident Davis. "It can be done in two years!" Michel Barnier the EU's chief negotiator had warned any deal would be subject to agreement from thirty seven regional and national parliaments. This alone could take six of the twenty four months allocated to the process. No problem. "It can be done in eighteen months if need be", claimed the assured Davis. Excellent. Tariffs of 30% - 40% on dairy and meat. 10% bills on cars would follow from a bad Brexit deal. The UK government would have to introduce the Great Repeal Bill, a repeal of the European Communities Act of 1972, translation of the "Acquis Communitaire", plus bills dealing with immigration, environment, financial services and more. "Is it true", asked the Chairman of the committee, "the UK will fall out of the open skies agreement between the EU and the USA!" Who had realized, the Atlantic will become a no fly zone for the British, unless a further deal was put in place! No problem. Davis will probably deal with that too. "Attitudes have softened in Europe since the referendum" explained the Secretary of State. "Our friends are disappointed we are leaving". Access to free trade, outside of the customs union, with controls on migration plus the great escape from the clutches of the European Court of Justice, the hoped for outcome. "Has any modelling been done about the economic impact of a no deal outcome" asked the chair of committee. "No" replied the Secretary of State. You get the feeling they think it won't be needed! Let's hope so! West Wing ... Whisky Tango Foxtrot ... The phone tapping saga continued to run all week in the White House. Despite the lack of any evidence the story runs and runs. The White House issued a denial of any apology to the UK for suggestions GCHQ was involved in Trump Tower espionage. The President explained he didn't actually have any "evidence" just an article on wire tapping generally and a short piece on Fox News. Kellyanne Conway explained "wire tapping" can take many forms. "Even the microwave can be turned into a camera" claimed the Advisor to the President. Who would have thought that! David Tennant was in trouble this week. Doctor Who was seen brewing tea in a time machine. Actually he was heating up an earlier brew in a particle process accelerator. Yep he used a microwave. Who would have realized, he could have also taken a picture. "I am no Inspector Gadget" said Conway and "I am not in the job of having evidence" she said. Yep we know that! Back in the White House, the latest immigration ban was subject to court challenge from Hawaii and Maryland, the health care bill is rattling around Congress and the administration submitted the first draft of the budget. A big increase in defence spending, a huge cut for everything else especially the Department of State, the EPA and "meals on wheels". Badly drafted and ill prepared, there's a long haul ahead before any approval is forthcoming from the Democrats and the Republicans for that matter. Rex Tillerson was in Asia this week. Trump has placed North Korea on notice. "North Korea is behaving very badly" tweeted the President, adding "China has done little to help". So much for diplomacy. Every option is on the table warned the White House administration, including the threat of military action. Chancellor Merkel was in Washington yesterday. The President had hosted the Irish Prime Minister earlier in the day. It was St Patrick's day after all. "Did you know Saint Patrick was an immigrant!" Enda Kenny delivered a lecture on the merits of migration. It didn't go down well. Worse was to follow. The meeting with Merkel, an episode of Blind Date from Hell. A dialogue of the death. Body language bad, the President couldn't even shake hands before the cameras. Trump just can't get a grip on the whole EU thing! Fair trade not free trade the mantra for those manipulating currencies. At least the commitment to NATO survived, along with and agreement on joint action in Ukraine. The Germans will commit to spend more on defence as part of the deal. That's all for this week from the West Wing Whisky Tango Foxtrot ... So what happened to Markets? The Fed moved to hike rates, markets rallied, Dollar softened! The Dow closed at 20,948 from 20,855. The FTSE closed at 7,424 from 7,343. Sterling was up against the Dollar to $1.239 from $1.216 and was up against the Euro to €1.153 from €1.139. The Euro moved up against the Dollar at 1.075 from 1.067. Oil Price Brent Crude closed at $51.75 from $51.44 The average price in March last year was $38.21 UK Gilts - yields moved down. UK Ten year gilt yields closed at 1.23 from 1.38. US Treasury yields softened to 2.50 from 2.60. Gold closed at $1,230 from $1,199. John That's all for this week. Don't miss the pro-manchester Business Conference in March. We focus on Digital Disruption and the Smart City Challenge. Sponsors Samsung will be demonstrating the latest in virtual rally, plus we have the latest on robotics, AI and autonomous vehicles. © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment.. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom.  All started well for the Chancellor. The OBR revised up the forecast for growth in the current year to 2%. Borrowing in the financial year was revised down to £52 billion. Thereafter Robert Chote and the OBR team lost any real enthusiasm for further significant revision. Growth is expected to be 1.6% in 2018 and 1.7% in the following year. Borrowing is more or less unchanged in 2017/18 and in all years other than a £6 billion saving in 2018/19. Nevertheless some £25 billion of borrowing short fall was available to the Chancellor. Spreadsheet Phil was intent on building a "stronger, fairer, more global Britain". No need to splash the cash. Better to build a war chest for the potential Brexit problems ahead. Cynics might suggest a national debt of £1.7 trillion rising to £1.9 trillion within two years does not a war chest make. The Chancellor was listening to complaints about business rates. A review of the system was to follow. In the meantime there would be some small business rate relief and a special deal for pubs. £1,000 for pubs with a rateable value of less than £100,000. Small beer, the total value of provisions was just £435 million. There was some money for infrastructure, training and skills. Provision for PhDs in STEM subjects plus provision for AI, robotics and autonomous vehicles. The introduction of T Levels and technical skills was welcomed. The overall spend was parsimonious and parcelled with an element of regional competition for limited funds. In many ways the budget ticked all the boxes. The problem there was not enough cash to fill the vacuous boxes. Most of the money was to be spent on a £2 billion boost to welfare spending. Determined to be fiscally neutral, the Chancellor decided to raise the money by closing the NIC gap between the self employed and regular workers. 9% at present, the rate is set to rise to 11% over the next two years. How much nicer it would have been to level out a 10% band for all. It's just a stage 2 income tax after all. Therein was the downfall of the Chancellor's day. Tory back benchers are now the champions of free enterprise and the self employed. Cameron and Osborne had made a manifesto pledge - no tax rises and no increases in NIC. The Prime Minister's support was nervously ambivalent. The increases will go ahead subject to a wider review in the Autumn. No need for another parliamentary fuss this month, in view of the imminent Article 50 invocation. Spreadsheet Phil appeared at the despatch box in full command of his brief and briefcase. Time for jokes at the expense of the opposition. "They don't call it the last Labour Government for nothing" and "A party with experience of driverless vehicles" were some of the best. The opposition squirmed. The Chancellor was to squirm later. Why the back bench fuss? All of the items in the budget had been leaked to the press days before the event. No need for the red box, just a press release and an active Twitter handle would easily done the job ... As for the budget it was NICe work if you can get it ... Economic news this week ... Some weeks you wait in vain for an ONS release. This is the week when they come in threes. Manufacturing, construction and trade all on a Friday. Manufacturing growth was up by 2.7% in January. It had risen by over 4% in December. Growth for the year as a whole was less than 1% for the year. Will the momentum continue into the year? We expect growth of 1.8% in 2017 a significant upward revision on earlier estimates. Construction output increased by 2.4% in 2016 compared to previous estimates of 1.5%. In January, growth increased by 2%. The strong increase in housing and commercial real estate is driving growth despite the set back in infrastructure and public sector spending. Growth for the current year could be up by 2% - 2.5% as the private sector commitment continues. The trade figures for January offered additional hope to the re balancing agenda. The deficit trade in goods and services was just £2 billion. Don't get too excited, it was £1.5 billion in the prior year. The deficit trade in goods was £11 billion compared to £9 billion in January 2016. Exports are benefiting from growth in world trade and stronger GDP growth in the EU and USA. The Sterling fall offers some translation impact. The price elasticity effect is much less significant. So what of the year as a whole. Forecasts of 2% GDP growth in the current year may well be conservative. The out turn could be as high as 2.5%. The Fed has indicated rates are set to rise next week, with at least two more rates planned for the current year. Sterling drifted lower on the news closing at $1.216 against the dollar. Strong growth rising, inflation spiking, full employment looming and EU workers leaving. All this with base rates at just 0.25%. And the winner is La La Land ... West Wing ... Whisky Tango Foxtrot ... In last week's edition we were just able to catch the morning twitter tirade against Obama. The Presidential mask worn at the address to Congress had been cast aside. "Terrible, just found out Obama had my phones tapped" "Bad (or sick guy)!" Of course there is no evidence to support the accusation. Trump had read something in Breitbart triggering the tweet. Republicans distanced themselves from the accusation. White House staffers took a step back. Sean Spicer claimed the information available to the President was above his pay grade. KellyAnne Conway confirmed the President of the United States has "access to information no one else has". The list includes the CIA and the FBI apparently. Arnold Schwarzenegger took a hit' "He was fired by his bad (pathetic) ratings, not by me." tweeted the President and leader of the free world, "Sad end to great show". Not to worry the best show in the USA has moved to Washington. The Mexican Foreign minister was in town this week. No one told the State Department or Rex Tillerson for that matter. Louis Videgaray went straight to the White House. Jared Kushner, McMaster and Gary Cohn met with the Mexican mission. Scott Pruitt was appointed to the EPA. Pruitt doesn't believe in Global warming, the problems of Carbon Emissions and the Paris Agreement on climate change. Interesting. Pruitt at the EPA has doubts about the EPA; Tillerson at State has doubts about the UN; Peter Navarro at trade has doubts about the WTO. Coming next the Attorney General with doubts about the Rule of Law. It's only a matter of time. Forty seven Obama attorneys were summarily fired this week. The GOP has a pop at health care, the White House has another go at the immigration ban. Meanwhile the missiles pop out of North Korean bunkers like rockets on bonfire night. Won't happen? Really. The good news, Trump may have inherited a mess but it hasn't taken long to sort out. The White House saluted the latest data on jobs growth this week. 235,000 jobs added to the non farm payroll in February. The unemployment rate fell to 4.7%. But wait! Isn't the BLS party to the Obama Fake News BS. No longer Sean Spicer assured the White House press room. The data may have been phony in the past but no longer! Of course, making America great again didn't take that long That's all for this week from the West Wing, Whisky, Tango, Foxtrot ... So what happened to Markets? Markets, were down, the Dow closed at 20,855 from 20,986. The FTSE closed at 7,343 from 7,374. Imminent Fed rate hike subdued markets. Sterling was down against the Dollar to $1.216 from $1.225 and was down against the Euro to €1.139 from €1.160. The Euro moved up against the Dollar at 1.067 from 1.055. Oil Price Brent Crude closed at $51.44 from $55.58 The average price in February last year was $32.18. US shale output growth spooked markets. UK Gilts - yields moved up. UK Ten year gilt yields closed at 1.38 from 1.19. US Treasury yields rallied to 2.60 from 2.49. Gold closed at $1,199 from $1,222. John That's all for this week. Don't miss the pro-manchester Business Conference in March. We focus on Digital Disruption and the Smart City Challenge. Sponsors Samsung will be demonstrating the latest in virtual rally, plus we have the latest on robotics, AI and autonomous vehicles. © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment.. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom.  The budget is just days away. What will the Chancellor have to say? The OBR will present a strong platform for spreadsheet Phil. Growth estimates will be revised up towards the Bank of England norms of around 2% growth this year. Borrowing forecasts will be revised down. The Chancellor may have as much as a £12 billion saving in the current financial year. Extrapolated over the years ahead, the zero borrowing target could be within reach within three to four years. So will the Chancellor splash the cash? Unlikely! This will be the last Spring Budget before the "New Style" Autumn Budget is introduced. Ahead in the polls, Labour in disarray, mid term in the election cycle, there is no real need to appease the back benches or the electorate for that matter. Some spending on business rate relief, more money for health and welfare, the Chancellor will maintain a steady stance on spending and on taxation. Some tinkering with pension fund provision is expected. Expect legislation on subscription traps according to the Guardian. The budget will outline plans to better protect consumers who sign up for free trials. Free trials, later converting automatically into paid membership will be outlawed. An attack on small print is expected. Terms and conditions may be shortened and simplified to avoid excess length and jargon. Has the Chancellor had a problem with his Amazon Prime Account? Possibly! Will the Treasury lead the way with simplification of the Red Book Financial Statement? Unlikely. Just days away to find out what's in the red box ... Economic news this week ... PMI Markit Data ... This is the week of the PMI Markit survey updates for February. Good news for the manufacturing sector. UK manufacturing recorded further solid growth of output and new orders in the month according to the headline. The index fell to 54.6 from 55.7 in January. Output and new orders increased, albeit at a slower rate. Price pressures remain elevated ... costs pressures were at the highest level in survey history, the feed through to output prices a clear and present danger! In the construction sector, there was a modest rise in construction output as cost pressures increased at the highest rate for eight years. The index closed at 52.5 up from 52.2 in January. Service sector growth eased to a five month low in February. At 53.3, the index was down from 54.5 prior month but still in growth territory. Overall the data suggests strong growth in the economy continues into the first quarter of the year. Inflation pressures are increasing, job prospects are improving, no fears for Brexit evident ... In the U.S.A. the Fed has given strong signals interest rates will rise this month based on growth and employment trends particularly. The Bank of England is falling behind the curve. There is no basis to maintain rates at 0.25% ... West Wing ... Whisky Tango Foxtrot ... The President gave his address to Congress this week. More Presidential with a softening in tone, did this really mark a sea change in the White House attitude? Hardly. The wonders of auto cue and a strong incentive to stick to the script the more likely interpretation. The President elect had indicated on the campaign trail, he could become more Presidential at the drop of a baseball cap. Nothing changes. No baseball caps in Congress. Trump slipped on the mask of office ... The President reiterated campaign themes to clamp down on immigration, re work trade deals and increase spending on the military. Health care, infrastructure, lower taxes and lower regulation also featured. Flash rhetoric flowed in a bonfire of the inanities. "We must rebuild the bridges of trust not drive the wedge of disunity and division. The time for small thinking is over. The time for trivial fights is behind us. We just need the courage to share the dreams that fill our hearts. The bravery to express the hopes that stir our souls and the confidence to the hopes and dreams into action." Touching but it was not to last ... The President ended the week defending KellyAnne Conway for putting her feet on the couch in the Oval office and defending Jeff Sessions for talking with the Russians during the election campaign. What is it about this administration and the Russians? The time for small thinking may well be over but Trump still found time, to accuse Obama of bugging Trump Towers. "Bad guy". "This is Nixon/ Watergate" tweeted the President this morning! No it isn't. During the speech, Trump said "Think of the marvels that could be achieved if we simply set free the dreams of the American people" Yep especially the Democrats and the majority who didn't vote for Trump. The President plans to boost military spending at the expense of the EPA and the State Department. "Each American generation passes the torch of truth, liberty and justice" said Trump "That torch is now in our hands (along with the nuclear codes:Ed) and we will use it to light up the world". Worrying! That's all for this week from the West Wing Whisky Tango Foxtrot ... So what happened to Markets? Markets, were up, the Dow closed at 20,986 from 20,775. The FTSE closed at 7,374 from 7,243. Sterling was down against the Dollar to $1.225 from $1.249 and was down against the Euro to €1.160 from €1.179. The Euro moved down against the Dollar at 1.055 from 1.059. Oil Price Brent Crude closed at $55.58 from $56.21 The average price in February last year was $32.18. UK Gilts - yields moved up. UK Ten year gilt yields closed at 1.19 from 1.09. US Treasury yields rallied to 2.49 from 2.39. Gold closed at $1,222 from $1,256. John That's all for this week. Don't miss the pro-manchester Business Conference in March. We focus on Digital Disruption and the Smart City Challenge. Sponsors Samsung will be demonstrating the latest in virtual rally, plus we have the latest on robotics, AI and autonomous vehicles. © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment.. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed