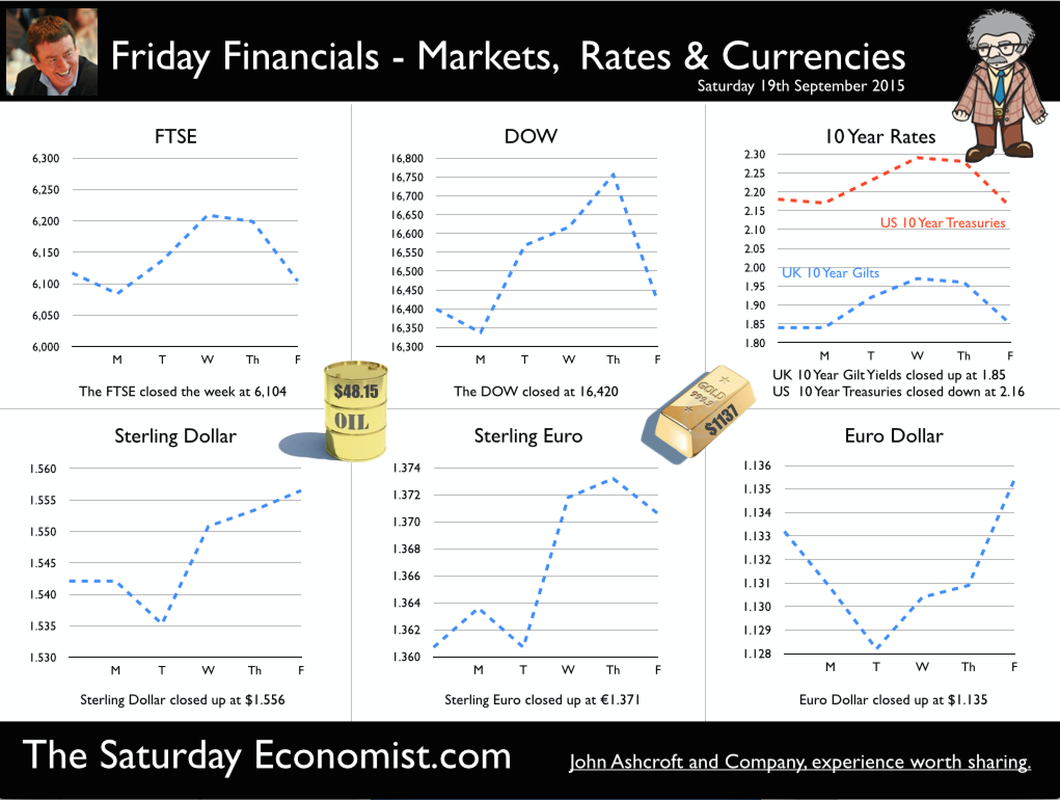

“Markets end week at a gallop” the headline in the Times today. Global markets rallied at the end of a tough week. Revisions to US growth data boosted confidence and offset fears about the slowing economy in China. “Stock markets across Europe and the United States rallied following the Bureau of Economics Analysis upward revision to US Q2 growth from 3.7 per cent to 3.9 per cent. Economists claimed the GDP upgrade would calm anxiety about the economy in the wake of the recent financial market turmoil. Much ado about nothing - really. The 3.9% growth rate is one of those US quarter on quarter annualised numbers which can flatter to deceive. The underlying year on year growth rate, (our preferred measure) in the second quarter was actually unchanged at 2.7%. Not bad though … with US growth averaging 2.8% in the first half of the year, we expect the out turn for 2015 to continue. Growth of 2.8% in 2015 and 2.9% next is our outlook. Given the strength of US consumer spending, investment and the jobs markets, the Fed will move soon to hike rates. Janet Yellen Speech … Janet Yellen struggled this week to conclude a speech on inflation and monetary policy at the University of Massachusetts on Thursday. The head of the Fed appeared to suffer from a slight dizzy spell towards the end of her address. Later receiving medical attention, a Fed spokeswoman confirmed Yellen “felt fine and was able to resume her schedule for the evening”. With Fed policy moving in ever tightening circles, a bout of presenter and market nausea is inevitable. Last week the Fed confirmed no change in monetary policy in September. In the speech this week, Janet Yellen confirmed a rate rise before the end of the year was still on the agenda. “Most FOMC participants, including myself, currently anticipate that achieving these conditions [inflation target and growth] will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter.” So expect a rate rise in December? China Data … Misery in the Middle Kingdom continued this week, with news the Caixin Flash China General ManufacturingPMI™ declined further to 47.0 in September from 47.3 prior month. The index slumped to a six year low as total new orders fall at faster pace. Commenting on the data, Dr. He Fan, Chief Economist at Caixin Insight Group said: “The decline indicates the nation’s manufacturing industry has reached a crucial stage in the structural transformation process. Overall, the fundamentals are good.” Particularly in view of government fiscal measures to boost growth and stimulate expansion. Markets still expect growth of 6.5% to 7% in the current year. UK Borrowing ... Bad news for the Chancellor this week as borrowing figures in August appeared to drift off track. The Government borrowed more in August 2015 than prior year. Public sector net borrowing increased by £1.4 billion to £12.1 billion in August 2015 compared with August last year. For the year as a whole, public sector net borrowing fell by £4.4 billion to £38.4 billion compared with the same period in 2014. The OBR has set a target forecast reduction on £20 billion in the financial year, from the £90.2 recorded last year. A reduction of just £4 billion in the first five months, suggests there is much to do, to hit target. With revenues up almost 4% in the year to date and spending held below 1%, the reduction remains a possibility. The vagaries of local government spending and August anomalies may be offset by the underlying strength of the economy in the months ahead. With total debt of £1.5 trillion (80% of GDP) the odd £10 billion shortfall in the year wouldn't present a funding challenge. It would however challenge the credibility of Treasury and the OBR for that matter. The Great Manchester Economics Conference … Just ONE weeks to go to the Great Manchester Economics Conference on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in Manchester in our fast paced “News Style” show. Chris Williamson from PMI Markit will comment on the Caixin index and much more. If you enjoy the Saturday Economist - Book Your Tickets NOW! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.522 from $1.556 and moved down against the Euro to €1.363 from €1.371 The Euro moved down against the Dollar to €1.1175 from 1.135. Oil Price Brent Crude closed at $48.34 from $48.15. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. This appears unrealistic against the EIA STEO backdrop and OPEC stance on output. Markets, mixed this week! The Dow closed at 16,315 from 16,420. The FTSE closed up at 6,113 from 6,104 Gilts - UK yields steadied. UK Ten year gilt yields were at 1.835 from 1.85. US Treasury yields were unchanged at 2.16. Gold moved up to $1,149 ($1,137). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

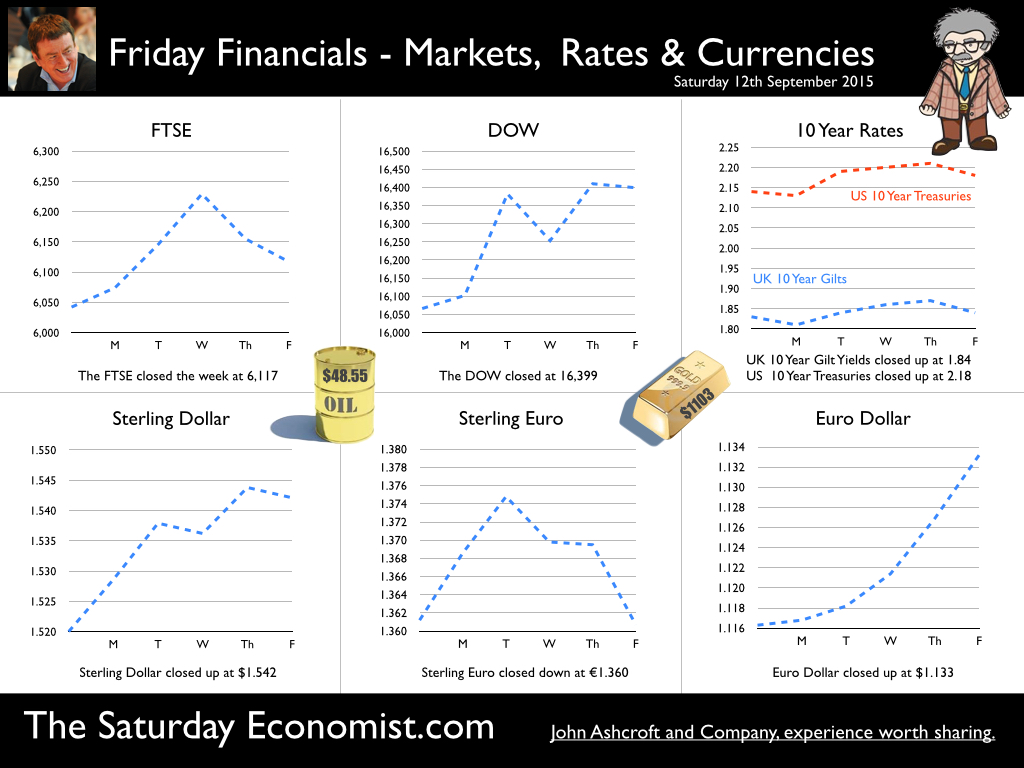

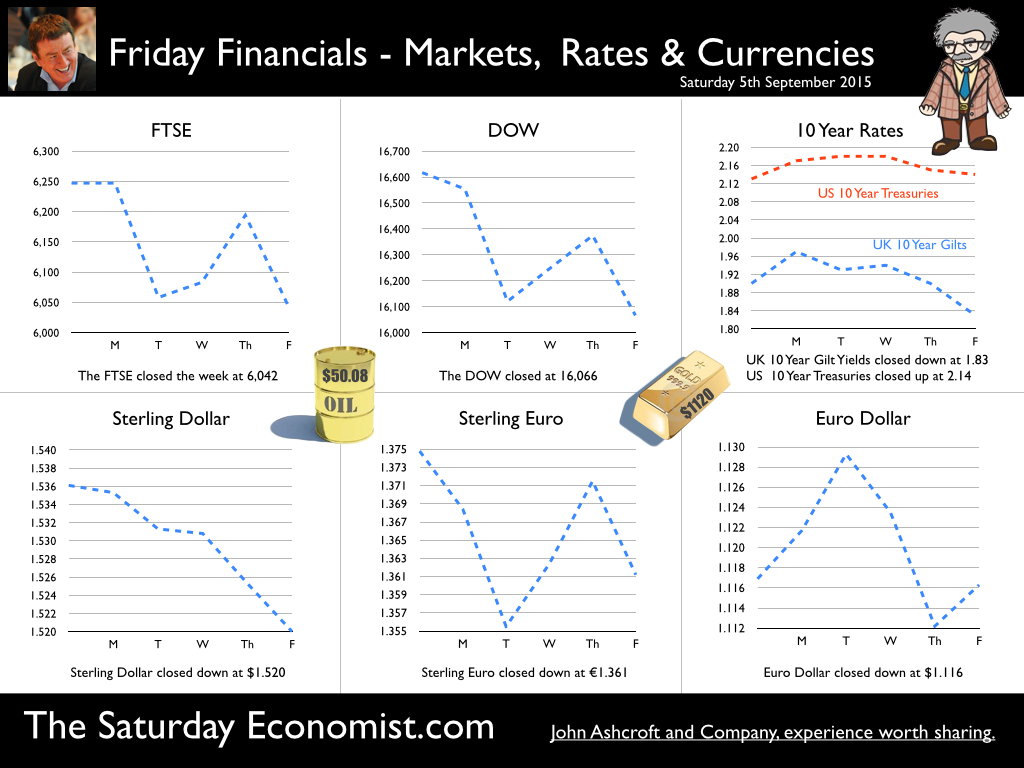

The Fed Funds rate remained unchanged this week. A low inflation outlook together with heightened concerns over international developments in China and emerging markets featured. Of the ten members of the FOMC, only one was in favour of a rate hike at the Thursday meeting. Current policy rate projections indicate a 25 basis point rate hike before year-end, followed by a total of 100 basis point increase until the end of 2016. The long-run projection of the Federal Funds rate was lowered to 3.5%. Forecasts for inflation, unemployment and GDP growth in 2016 and 2017 were reduced slightly. Our base case is now for a rate increase at the December 2015 meeting, as the US economy and labour market continue to improve. The outlook for oil and commodity prices remains subdued with concerns about growth in China manifest. A postponement of the rate rise into 2016 remains a strong possibility, with obvious implications for any UK rate rise in the short term. Inflation UK … In the UK, inflation in August fell to zero with goods inflation falling by -2% and service sector inflation slowing to 2.3%. Manufacturing prices continued to fall with output prices dropping by 1.8% in the period to August as input costs fell by 13.8%. Oil prices down by 48% the main story on costs, with a significant contribution from imported metals (-17.1%) and chemicals (-5.6%) also featuring. Oil Prices … The outlook for oil prices is so important but remains unclear. Goldman's $20 dollar call looks as well timed as the $200 front desk call in 2008. The OPEC outlook projects a $60 dollar price into the future, a statement designed to put further pressure on US oil production, perhaps. A good time to recall Herbert Stein’s Law. Herbert Stein (1916 – 1999) was a senior fellow at the American Enterprise Institute and was on the board of contributors to the The Wall Street Journal. He was chairman of the Council of Economic Advisers under Richard Nixon and Gerald Ford. "Herbert Stein's Law," states "If something cannot go on forever, it will stop”. So it must be with oil sub $50 and OPEC pumping away future revenues below the optimal revenue curve. Retail Sales August … Retail sales in August slowed slightly to 3.7% compared to 4.1% in July. The value of retail sales increased by just 0.2%. Household goods enjoyed a near 5% increase buoyed by the strength of the housing market. Online sales increased by 7.2% in the month, the lowest increase in almost three years. The proportion of sales on line in the month was just over 12%. Average Earnings … Clearly average earnings are assisting the retail boom. In July, earnings increased by 3.7% with private sector earnings growth of 4.4%. Finance and Business services increased by 5% with retail and leisure earnings increasing by almost 6%. In the construction sector, earnings increased by 4% in the three month period to July. Real earnings adjusted for CPI inflation, are now higher than pre recession levels. This really is the year of the LILIES with Low Inflation, Low Interest and an Earnings Surge. For the consumer - 2015 is as good as it gets in this recovery cycle. Unemployment … The jobs data revealed this month confirmed an unemployment rate of 5.5%. The number of people in work increased by over 400,000 compared to a year earlier. The claimant count fell slightly, with a rate of unemployment steady at 2.3%. The rate of pick up in jobs is slowing. This is consistent with an acceleration in wage rates, earnings (and productivity). At 2.3% the claimant count rate is lower than at any time in 2008 before the crash. The LFS rate compares to a cyclical low of 5.2% in 2007 and 2008. The rate of LFS structural unemployment may have increased over the past seven years, suggesting the margin of spare capacity has already evaporated. It really is time for base rates to rise in the UK and the US for that matter. The current weakness of oil and commodity prices may be maintained but the deflation impact will shortly unwind on a year on year basis. The average price in January was $48 per barrel Brent Crude basis. Petroleum inflation is set to rise modestly in 2016, even if low prices persist. On the other hand, prices may react to the upside with dramatic increase. An OPEC “volte face” would push prices back to $80 - $100. The UK trade balance would deteriorate. Sterling may come under pressure. Imported inflation would rise as domestic wage costs accelerate. Soon we would learn, the disappearance of inflation is more akin to the receding of the tide from the beach ahead of the Tsunami waves shortly to hit. The Great Manchester Economics Conference … Just TWO weeks to go to the Great Manchester Economics Conference on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in Manchester in our fast paced “News Style” show. If you enjoy the Saturday Economist - Book Your Tickets NOW! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.556 from $1.5542 and moved up against the Euro to €1.371 from €1.360. The Euro moved up against the Dollar to €1.135 from 1.133. Oil Price Brent Crude closed at $48.15 from $48.558. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. This appears unrealistic against the EIA STEO backdrop and OPEC stance on output. Markets, mixed this week! The Dow closed at 16,420 from 16,399. The FTSE closed up at 6,104 from 6,117. Gilts - UK yields steadied. UK Ten year gilt yields were at 1.85 from 1.84. US Treasury yields moved to 2.16 from 2.14. Gold moved down to $1,137 ($1,133). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  No surprises from Threadneedle Street this week - the MPC voted to keep rates on hold. The Bank will not move ahead of the FED. Ian McCafferty - the only member of the MPC to vote for a rate rise this month. In the US, with just a week to go, doubts remain about the timing of the FED rate rise. In yesterday’s Wall Street Journal poll, most private economists think the Fed will keep interest rates near zero at the next meeting but it’s a close call. 46% expect rates to rise. Not long to wait, to find out. Kristin Forbes caused some confusion in Cardiff later this week, suggesting UK rates may have to rise sooner than expected in order to fend off inflation. The comment by the MPC member taken slightly out of context. More a technical reference to the inadequacy of the exchange rate - inflation reaction function in the Bank of England model rather than “forward guidance” on the future path of monetary policy. Elsewhere in the world … Good news from Europe as the recovery gathers momentum. Euro Area GDP expanded by 1.5% in the second quarter following growth of 1.2% in Q1. Heading in the right direction, German GDP increased by 1.6% with growth in Spain up 3.1% and the Celtic Tiger, Ireland, growing by 6%. In China, growth in 2014 was downgraded slightly to 7.3% from 7.4%. A modest shift designed to demonstrate the accuracy of the economic data set, rather than a warning of slowdown. The authorities committed to a growth rate of 7% in the current year. Guidance was issued to domestic economics journalists and commentators locally to “promote the discourse on China’s bright economic future and the superiority of the China’s system” at every occasion. Chinese journalists who do not follow the party instructions can face sever punishment and arrest. Which makes you wonder what would have happened to Robert Peston during the banking crisis in 2008, had an alternative regime held sway at the time! Back in the UK … Latest data on construction, manufacturing and trade were released this week. Construction output fell in July by 0.7% year on year according to ONS data, following disappointing growth in Q2. The data is confusing. Walk around Manchester, the cranes are back evidence of strong growth in commercial and residential expansion. Strong appetite for investment from foreign funds is easing the funding process. The UK construction data is subject to revision. We expect construction output to increase by 4.5% this year slowing to 3.9% next. Manufacturing output fell in July by 0.5% compared to prior year. Consumer durables the only bright spot up by 3.6% as capital goods output fell by -0.7%. The march of the makers rebuilding the workshop of the world now a distant memory. We expect manufacturing growth of just 1.5% in the current year following 3% growth last year. The re balancing agenda takes a further hit in July. The trade deficit in goods increased to £11.1 billion in the month compared to £8.5 billion in June and £11.2 billion in July last year. For the year as a whole we expect the deficit to fall to around £117 billion compared to £121.2 billion last year. The slight improvement, a result of the oil price fall rather than any underlying improvement in trade conditions or the vagaries of sterling. Oil Prices … As for oil prices, the EIA project an average oil price Brent Crude Basis of $54.07 in 2014 and $58.57 in 2015 in the latest short term economic outlook. Crude oil production is forecast to fall through mid-2016 before growth resumes late in the year. Projected U.S. crude oil production will average 9.2 million b/d in 2015 and 8.8 million b/d in 2016. US shale taking the hit, delivering a small triumph of sorts for OPEC. The Great Manchester Economics Conference … Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about Chinese growth into full context. David Smith will talk about his new book “Something will turn up”, Ian King Will be with us from Sky News. Andrew Sentance will update on his perspectives about “The New Normal”. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in Manchester in our fast paced “News Style” show. With just three weeks to go - Book Your Tickets NOW! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.542 from $1.5360 and moved down against the Euro to €1.360 from €1.375. The Euro moved up against the Dollar to €1.133 from 1.117. Oil Price Brent Crude closed at $48.558 from $50.08. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast but this appears unrealistic against the latest EIA short term forecasts. Markets, rallied this week! The Dow closed at 16,399 from 16,066. The FTSE closed up at 6,117 from 6,042. Gilts - UK yields steadied. UK Ten year gilt yields were at 1.84 from 1.83. US Treasury yields moved to 2.148 from 2.14. Gold moved down to $1,133 ($1,116). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  All eyes on the Fed this month as the decision on a US rate rise looms. September or December? Markets are undecided. The US jobs data released this week appeared at first sight inconclusive. The unemployment rate fell to 5.1% in August, the lowest since April 2008. The U rate is in line with the average between 2000 and 2007. A powerful argument to push rates higher. On the other hand the rate of job gain was just 173,000 in the month, slightly below market expectations. Upward revisions to data in June and July ensure the average over the past three months was 221,000. The data represents “a healthy employment growth rate, as the US economy steams ahead”. We expect the US economy to grow by over 2.7% this year. An economy steaming ahead with base rates on hold presents an unacceptable anomaly. At the G20 summit, leaders expressed concern about the proximity of a hike in US rates. adding to the warnings from the IMF. The final statement may accept the inevitable, a sort of “Get on with it, and be on your way” mentality. It is time to pull the trigger and leave Planet ZIRP. In contrast Mario Draghi reduced the forecasts for Euro growth this week and expressed a commitment to easy monetary policy and more QE - much to the delight of markets. Fears about China overdone … Fears about China still abound but for how long? At the G20 summit China assured leaders the Renminbi was not in pursuit of further competitive devaluation. Beijing would implement key reforms expressing absolute determination to sustain economic growth in the future. Nouriel Roubini, (Dr Doom) dismissed market panic over China as “excessive, unreasonable and irrational”. “China is not in free fall” he told world leaders in Lake Como this week. Growth may be around 6.5% this year at worst according to Dr Doom. Hardly a hard or soft landing as we have explained with our Chinese Whispers series. UK Car Sales … No soft landing was evident in the UK this week. The SMMT reported a near 10% increase in car sales in August. New car registrations increased 9.6% to 79,060, taking year-to-date growth to a healthy 6.7%. The new car market recorded its 42nd consecutive month of growth. For the year as whole we expect registrations of over 2.6 million. Output on the other hand will be just over 1.5 million. The deficit (trade in cars) compounding the structural balance of payments problem. Markit/CIPS UK Series PMI® A confused picture emerged from the Markit/CIPS series this week. UK construction sector picked up slightly in August, led by fastest rise in commercial work for five months. Manufacturing expansion remained subdued despite a strong performing consumer goods sector. The service sector increased at the weakest rate in over two years in August. The index slowed to just 55.6 from 57.4 in July, still well into growth territory. So what can we make of it all … We have just updated our GDP(O) forecast model for the UK economy. We still expect growth on 2.8% for the year, led by strong growth in the (private) service sector. The leisure sector, (distribution, hotels, restaurants) is expected to grow by over 4%. Business and Professional Services will increase by 3.5%. Service sector growth will be 3% in line with prior year levels. Construction is expected to rise by over 4.5% in the year. We expect further upward revision to the published Q2 data. Manufacturing is expected to increase by just 1.5% compared to growth of over 3% last year. The march of the makers disappointing. The upturn in consumer products, offset by the slow down in capital goods exports. The extent of the slow down, difficult to understand in view of the strength of domestic demand and the gradual recovery in Europe. Still worried about China? Don’t forget Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. David Smith will talk about his new book “Something will turn up”, Ian King Will be with us from Sky News. Andrew Sentance will update on his perspectives about “The New Normal”. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Book Now! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.536 from $1.570 and moved down against the Euro to €1.375 from €1.381. The Euro moved down against the Dollar to €1.117 from 1.137. Oil Price Brent Crude closed at $50.08 from $50.43.19. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, slipped this week! The Dow closed at 16,066 from 16,617. The FTSE closed down 6,042 from 6,247. Gilts - UK yields fell. UK Ten year gilt yields fell to 1.83 from 1.90. US Treasury yields moved to 2.14 from 2.13. Gold moved down to $1,116 ($1,117). The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed