|

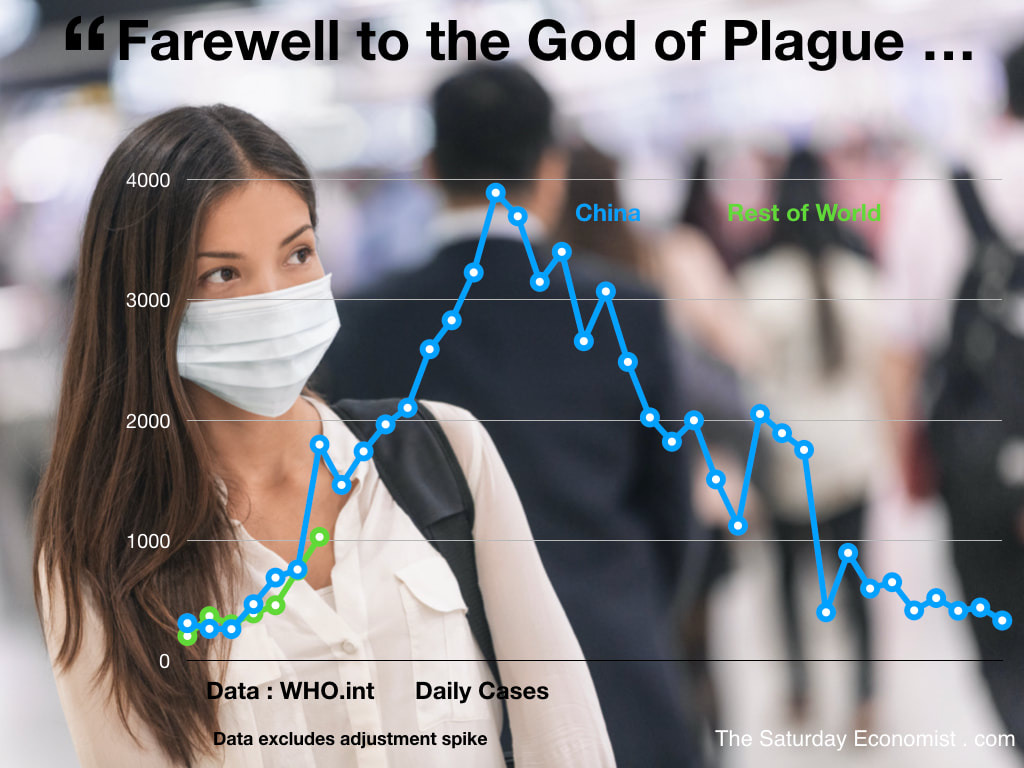

The number of cases of Corona virus increased to 83,652 yesterday. The increase day on day was 1,352. The China case load increased by just 331. The number of cases in the rest of the world increased by 1,027.

Barring a herald wave, China appears to be saying goodbye to the "God of Plague". As in Mao Zedong's poem in 1958 ... "The Spring wind blows amid profuse willow wands, we ask the God of Plague, where are you bound?" Japan, Korea and Northern Italy appears to be the answer. The greatest case acceleration is in Korea and Italy. In the UK plans are under preparation to allow schools to increase class sizes and to use Hyde Park as a morgue. With just 16 cases reported to date, the preparations may appear to be just a little premature. The mortality rate, using the data within China, appears to be around 3.5%. Mass burials in London are unlikely any time soon. Markets experienced a greater slaughter this week. The Dow was down by 3,500 points, almost 12%. The NASDAQ and S&P fell by 10% and 11% respectively. It was a similar story in Europe. Leading indices in the UK, France and Germany were off by almost 12% in total. In the East markets were more sanguine. Chinese equities, were up slightly in the month and Hong Kong stocks held firm. Commodity prices including Gold, Copper and Oil came under pressure. Sterling closed lower against the Dollar and the Euro. So what happens next? My reading this week, included a revisit to Galbraith's "Great Crash of 1929" and Laura Spinneys "The Pale Rider: The Spanish Flu of 1918 and How it Changed the World". The Spanish Flu claimed over 50 million lives. The Great Crash led to the Great Depression of the 1930s. We ask of the markets "Where are you bound"? Some consolidation was expected following the bull run last year. NASDAQ appears to be still a little over extended. This is no great crash, and Covid-19 is not the Spanish Flu. The outbreak will bring tragedy to some families and this is to be regretted. Containment of 60 million people in China confined the infection to just 0.125% of the population. Fears of a mass outbreak in the UK with a population of 67 million would appear to be wide of the mark. Data from the World Health Organization Daily Situation Reports. My thanks to Laura Spinney and The New Statesman for the reference to the God of Plague. Cummings and Goings ... Sajid Javid delivered his resignation speech from the back benches this week. The plan to merge the advisory teams within Number Ten and Number Eleven were not in the national interest he claimed. The requirement for the Treasury teams to speak truth unto power would be undermined by the move. Ministers should have the right to appoint their own team of special advisors he stated. "It has always been the case, that advisers advise, ministers decide and ministers decide on their advisers." Javid found the terms of continuance unacceptable. In his resignation letter he had told the Prime Minister, "it is important as leaders, to have trusted teams that reflect character and integrity". This was a veiled hint at the perceived shortcomings of Dominic Cummings. Javid will forever be known as the CHINO chancellor who never had the chance to deliver a budget. This week, he made some headway, challenging his successor to stick within the fiscal rules but also to cut taxes. His own plan would have been to cut income tax by 2p in the Pound, reduce stamp duty and to introduce generous reliefs for capital investment. In a clear message, "A huge signal for working people that government was on their side" Javid explained, he intended to reduce the basic rate of income tax from 20% to 18% and to set an ambition to cut it to 15% by the end of parliament. The cuts costing some £10 billion a year, rising to £25 billion within five years would be added to the additional £100 billion of current spending already announced by the Prime Minister and the further plans for an additional £100 billion of fixed capital investment on infrastructure. "I very much hope the new Chancellor will be given space to do his job without fear or favour and I know my right honourable friend for Richmond (Rishi Sunak) is more than capable of rising to the challenge". He obviously felt the new Chancellor of the Exchequer needed a little help along the way. This year borrowing is set to increase to around £44 billion. The IFS has warned the increase in the next financial year will be almost £60 billion. The revision to tax and spending plans will call for greater creativity in defining as set of fiscal rules to accommodate profligacy and prudence. It remains to be seen if Rishi Sunak is truly capable of rising to the challenge ... That's all for this week, have a great weekend. We will be back with more news and updates next week.

0 Comments

The Home Secretary outlined the new Tory immigration policy this week. In the biggest change to immigration since William stepped off the boat in Hastings, Priti Patel was in no mood to pull punches.

"Today is a historic moment for the whole of the country. We are ending free movement, taking back control of our borders and delivering on the people's priorities by introducing a new UK points-based system which will bring immigration numbers down." EU and non EU citizens will be treated equally. High skilled workers like scientists, academics and engineers will be prioritized. Skilled workers will be allowed in under a points system with points awarded for language, education and a job offer above a salary floor of £25,600. Fruit pickers and other seasonal farm workers will be accommodated. Farmers will be allowed to recruit 10,000 low skilled workers from outside the EU to harvest, flowers, fruit and vegetables. Farm workers from Eastern Europe will have to pick their own fruit from now on. Not everyone was convinced by the change in policy. Fears of recruitment problems in construction and care came to the fore. Carolyn Fairbairn, Director General of the CBI, warned against the ending of low skilled immigration. "In some sectors, firms will be left wondering how they will recruit the people needed to run their business". Health and health care were immediate cause for concern. "The proposals would negatively impact the sector and will not meet the health and care needs of the population" said Dame Donna Kinnair, the Chief Executive of the Royal College of Nursing. This week, the ONS announced a further fall in unemployment and a rise in vacancies. With 1.3 million out of work, a rate of 3.8%, unemployment is at a 45 year low. The employment rate has never been higher. The number of vacancies in the economy increased to over 800,000. 8.5 million are inactive and could be put to work given the right encouragement and training by business according to Patel. That sounds an awful lot of resource. Unfortunately for the Home Secretary, 2.3 million are students, 1.9 million are looking after family or home, over 1.1 million are retired and 2.1 million have long term illness. "Rise, take up thy sick bed and work" is the Patel Patois. The good news, 1.9 million of the economically active want a job allegedly. The just don't like the look of the 800,000 vacancies currently on offer apparently ... Budget Nears ... Deficits Increase ... Rushi Sunak is on the case. The budget will take place on the 11th March. An end to austerity and a boost to infrastructure problems will create both a financial challenge and an intellectual challenge. More doctors, nurses and police on the streets will boost current spending. Big commitments to infrastructure will place greater demands on longer term capital spending. The intellectual challenge will be to cobble together a set of "fiscal rules" which will present some semblance of order. The financial challenge, there really is not much money to play with and not much appetite for tax hikes at this stage of government. The latest data on government borrowing was somewhat disappointing. In the ten months to January 2020, borrowing was almost £45 billion compared to £39 billion last year. For the year as a whole, borrowing is expected to increase to £44 billion compared to £38.4 billion last year. Total debt increased to £2.1 trillion if the Bank of England obligations are taken into account. It would appear the Chancellor is not well placed to meet the £150 billion bill for infrastructure spending. On the other hand, life on Planet ZIRP is incredibly accommodating for profligate spenders. Ten year gilt yields fell to 0.56% this week. A thirty year Sterling Infrastructure Bond could hit the streets with a 1% coupon. The market has appetite for debt, the Chancellor must have the ambition to exploit. £150 billion should be the ambition, more than enough to finance the refurbishment in the open plan accommodation between Number Ten and Eleven ... China ... Inflation on the rise ... Inflation CPI basis increased to a six month high this week. Despite the strength of Sterling and the weakness of oil prices, CPI inflation increased to 1.8% from 1.3% last month. Service sector inflation increased to 2.3%. Goods inflation increased to 1.3% from 0.6%, providing the major boost to prices. Producer prices remained subdued. We expect inflation to move to the target rate of 2% through the year. Relatively low inflation and a strong jobs market suggests the new Governor of the Bank of England will not face any tough decisions on rates this year. The latest retail figures for January were pretty dismal, despite the headlines to the contrary. On the other hand, the latest PMI Markit Composite index suggested a significant boost to manufacturing and service sector activity in January. With a positive budget outcome next month, we expect growth to average 1.3% to 1.5% compared to 1.4% last year. Many difficult challenges remain to resolve the trade deal with Europe and to determine the strategy for many sectors including fishing and agriculture. It continues to appear as if Cabinet members are trying to earn their lines in a script that has yet to be written. Let's hope not too many continue the process of ad libbing ... That's all for this week, have a great weekend. We will be back with more news and updates next week. Boris Johnson confirmed this week, the High Speed Rail network would be built in full. The 330 mile Y shaped network will connect London, Birmingham, Manchester, Leeds and Wigan.

Plans were also outlined plans for "High Speed North". The East West link across the Pennines will connect Liverpool, Manchester, Leeds and Hull. The Northern network would be extended to Carlise and Newcastle. The HS2 costs would be closely monitored by cabinet. Grant Shapps, transport secretary, promised the whole of government would be involved in ensuring the project ran on budget. "Just like the Olympics" A bridge across the Irish Sea is to be evaluated. Cycle tracks in the air are under review across London. 4,000 carbon neutral buses are to be added to the transport fleet. The project costs could total £150 billion in total. For Sajid Javid it was all too much. The Chancellor resigned just four weeks before his maiden budget. "Boris Johnson had attached conditions to the role which "no self respecting minister would accept" he explained in his resignation letter. All Treasury SPADs will be sacked. Partition walls between Number Ten and Eleven were to be knocked down. The Treasury was to be brought more directly under Prime Ministerial control. Rishi Sunak was appointed to the job. Dubbed as the "Maharajah of the Yorkshire Dales" the fast rising Tory star is ex Goldman Sachs and is married to the daughter of the Infosys Tech billionaire, Narayana Murthy. A more flexible approach to "spending rules" from Treasury is now expected. Fed warns on debt and spending ... Spending was very much on the mind of Jerome Powell this week. The Chairman of the Federal Reserve warned Congress on Tuesday, of the dangers presented by rising U.S. debt and deficit. Now would be a good time to begin to reduce the level of deficit the Chairman explained, putting the economy on a sustainable path for the future. The deficit is set to exceed the $ one trillion dollar level this year. The Congressional Budget Office has warned deficits will average over $1.3 trillion in the years ahead. The deficit has already increased by $3 trillion dollars since Trump has been in office. A further $5 trillion will be added based on current plans and budgets. There are no plans to eliminate the deficit over the next ten years according to briefing documents. It was a week of set backs and challenges for the President. The Senate voted to limit Trump's authority to wage war with Iran. A judge ordered all work on the Jedi project should be halted, pending a review of the Amazon claim of Presidential prejudice. The Department of Defense contract had been awarded to Microsoft. Trump hates Jeff Bezos and the Washington Post. The President was accused of another quid pro quo in his dealings with New York. Attorney General William Barr complained "His tweets make it impossible to do my job". Trump attacked former Chief Of Staff John Kelly. John Bolton, former national security adviser, sprang to Kelly's defense. Trump's nominee to the Federal Reserve Judy Shelton faces rejection by the senate. Trump admitted sending Giuliani to Ukraine, a claim he denied through the impeachment process. A glimmer of hope for the President? U.S. troops will be leaving Afghanistan. A deal with the Taliban has been outlined. If the Taliban can stop killing people for a few weeks, the U.S. will begin to pull out military personnel from the country. This will "Open the way for the Afghan government and the Taliban to negotiate the future of the nation" ... Ah yes, peace in our time ... sort of ... China ... Inflation on the rise ... Chinese Inflation increased to the highest level in eight years in January. The consumer price index increased by 5.4% in the month. It was the highest level since October 2011. Food prices increased by over 20%. Pork prices jumped by 114%. Pig stocks have halved over the last two years as the country has grappled with an outbreak of African swine fever. The Coronavirus continues to weigh on the economy. It is thought that economic growth could slow to 4.5% in the first half of the year, as the country grapples with the viral outbreak. Evidence continues to suggest the outbreak may have peaked. The number of new cases reported has fallen to around 2,000 per day by the end of last week. The World Health Organization reports some 49,000 cases to date. The mortality rate is approximately 2.8%. A return to work is now encouraged. The impact of the outbreak is extensive. This week JCB warned of production cutbacks as a result of part shortages. Economists will be scouring the data releases over the next few weeks for further information on the extent of the economic slowdown. "Boris Bounce Helps the High Street" the headlines in the Times this week. The BDO Retail Tracker reported like for like sales up by almost 6% in January. It was the biggest increase in six years. Consumers are feeling more confident about the future of the economy, under the Johnson administration, apparently.

The housing market is showing signs of life. House prices were up by 4% in January, according to the latest Halifax data. December mortgage approvals increased by 4.6% year on year. Housing transactions were up by 7% in the month. The BDO data revealed sales of sofas and furniture increased by 9% in January. Feet up and watch the TV for further news on Brexit the guideline. On the look out for policy gaffes, the comedy option, as new ministers move into office. The service sector enjoyed a solid recovery in January according to the latest PMI data. New orders, more employment and continued business activity pushed the index up almost four points to 53.9 from 50.0 last month. A combination of greater consumer confidence and business confidence had translated into rising client demand. It was the first indication of growth in five months. Positive expectations for the year ahead, continued to improve. Respondents noted the "headwind" from delayed decision making had lifted since the general election. No fears of a Labour government with a radical agenda. No hung parliament and further legislative indecision. No concerns about Boris Johnson, dead in a ditch. A clear deadline for Brexit declared. The surge in activity will settle in the months ahead. Growth for the year is expected to be around 1.3% with continued growth in jobs and earnings. Much is awaited in the March budget. Policy clarification is required on the ask for trade deals with the EU and U.S. An understanding of immigration policy would help. Bold statements on the greening of the economy would be better made in co-operation with the manufacturing sector, especially in the car industry. New ministers appear to be learning their lines in a script which has yet to be written. The Home Secretary has vowed to clamp down on counter terrorism. The Chancellor has promised no alignment with the EU or any other country for that matter. Truly global Great Britain will not be bound by instructions from others. The Tory government has a great opportunity to capitalize on the strong platform in Parliament. A series of sensible policy proposals developed in conjunction with, not isolation of, all stakeholders would help. Putting cabinet on tour will achieve nothing but road noise. A show boat on the Thames would be just as effective and greener ... Trump Acquitted ... Pelosi lets Rip ... The President was acquitted this week, retribution was swift to follow. Never one to hold a grudge when you can throw it, Gordon Sondland, the U.S. Ambassador to the E.U. was recalled from Brussels. Colonel Alexander Vindman and his brother were removed from the White House. Trump is punishing witnesses who testified against him in the impeachment process. More firings are probable. The President will exact retribution on perceived enemies. It is a long list. For Gordon Sondland it has been an expensive departure. The U.S. ambassador donated $1 million to Trump's inaugural committee. A hasty recall to Washington seems indecent. At least he wasn't routed via the Saudi Consulate in Istanbul. The President delivered the State of the Union address this week. Nancy Pelosi let rip. Listening to Trump was all too much. The Speaker of the House ripped up a copy of Trump's speech in a premeditated action. He had refused to shake hands after all. Trump's delivery had the fact checkers working over time as usual. The President claimed the U.S. economy is "roaring" and moving forward at an unimaginable pace. "Jobs are booming, incomes are soaring, poverty is plummeting, our economy is the best it has ever been". It is the "Great American Comeback" and it is all down to me, the claim. A fiscal stimulus worth some 10% of GDP fueled the expansion. Accelerating and deficit the price to pay. In January the expansion continued as 225,000 jobs were added to the payroll. Earnings increased by 3.1% . Yet Trump's tariff and trade policy is damaging growth. The U.S. is now experiencing "cascading protection", as tariffs are extended on steel and aluminum products including nails, car bumpers and beer kegs to protect domestic manufacturing. This week, Steve Mnuchin, Secretary of the Treasury, was forced to admit the U.S. economy would fail to meet his 3% growth target this year. In an interview with Fox Business Network, Mnuchin explained officials are reducing forecasts for the year by 50 basis points or more. Boeing was to blame. "Boeing has had a big impact on our exports", Mnuchin said. Boeing bad, Tesla good, the President claimed. More tax cuts are planned to ensure the President is returned in November. Fears Grow of Global Slowdown ... The World Health organization confirmed yesterday the number of cases of coronavirus had increased to almost 32,000. The number of deaths had increased to 638. For the moment the mortality rate appears to the around 2%, significantly lower than the SARS rate of 10%. Fears are mounting of a global slow down as a result of the epidemic. Commodity prices including oil, gas, iron ore and copper have fallen sharply since the outbreak began. China is the dominant consumer of commodities accounting for 50% of copper consumption. Oil consumption in China has dropped by 20%. China's factories and transport networks have been shut down to contain the outbreak. Fears are growing of product and component shortages around the world. Chrysler warned of a shut down in Europe. Sony and Nintendo warned of unavoidable delays. Burberry scrapped it's profit forecast for the year. Sales in China have slumped. The company has shuttered 24 of 64 stores. Those remaining open have experienced a 70% to 80% drop in revenue. Tourism will take a hit. Cathay Pacific urged staff to take a three week unpaid holiday to cut costs. Chinese officials have suggested growth could be hit by one percentage point in the first quarter. Oxford Economics believe China's GDP could fall from 6% to 4%, with a possible impact on global growth of 0.25%. The forecasts assume the outbreak will be contained within a three month period with a six month duration in total. Thereafter the bounce back will be swift and significant with any losses to output recovered in the year as a whole. As with all crises, this too will pass ... we can but hope so ... That's all for this week, have a great weekend. We will be back with more news and updates next week. And so it came to pass, the U.K. has finally left the EU. We should have parted ways at midnight last night, but with a final twist of Brussels irony, we were forced to leave an hour earlier due to European regulations. Just a taste of things to come perhaps.

According to the Telegraph today, Boris Johnson is ramping up the pressure on the EU. The Prime Minister is preparing to impose full customs and border checks on all European goods entering the UK. Comprehensive checks on EU imports will be imposed by the new administration. Excellent. No thought of the delays on deliveries, nor the threats to just in time manufacturing. Empty shelves in supermarkets, a result of empty thinking in cabinet. No thought of retaliatory measures from our friends across the channel. The French will play catch all in Calais and the Spanish will hold all traffic moving across the border into Gibraltar. If this is setting the tone for negotiations with Brussels, there is little or no chance of a trade agreement before the end of the year. The Bank of England held rates at the MPC meeting this week. It was Mark Carney's last call. The unreliable boyfriend is off, to be replaced by Andrew Bailey, a bank stalwart. Despite market sentiment, foreseeing a cut in rates, this was never really an option. The Bank is worried about the implications of Brexit on growth and trade. Forecasts for the UK have been slashed this year to just 0.8%, with a more promising 1.4% growth in prospect for next year. No Boris bounce envisaged by Threadneedle Street. No widespread evidence of a pick-up in growth. A renewal of trade tensions could damage growth. The challenge of Brexit will persist. The Governor hinted the next move for rates would be up, if growth developed in line with forecasts. "Things are gradual if they are multiple, things are modest if they are not" Carney explained. So much for forward guidance, with one bound he was off ... "When the seagulls follow the trawler, it is because fiscal prudence will be thrown into the sea" would have been my more favoured parting shot ... Fed Holds Rates ... U.S. growth slows ... The Fed also held rates this week providing no real shock to markets. The President would like rates slashed to negative and beyond. The "Boneheads At The Bank" are unlikely to oblige. Officials are monitoring a number of risks including a renewal of trade tensions and the threat of the coronavirus outbreak in China. Any mention of a "very stable genius" in the White House with "unstable economic policies" was omitted. "We expect moderate economic growth to continue" Fed Chair Jerome Powell told reporters Wednesday "but uncertainties about the outlook remain, including those posed by the new coronavirus". The Fed funds rate remains in a range between 1.5% and 1.75% following three cuts last year, from a high of 2.5%. Further changes in rates are not expected this year as the Fed assesses the implications of a soaring fiscal deficit, with further tax cuts on the cards from the Trump administration. The latest data confirms the U.S. economy expanded by 2.3% in 2019 with a slowdown in the final quarter from 2.7% at start of year. Household spending is supporting growth (up by 2.6%) but business investment came under pressure in the second half of the year. Private sector investment, up by 5% in the first quarter actually fell in the final quarter by almost 2% year on year. Business investment is under pressure. The manufacturing sector was in recession last year. Capital spending actually fell in 2019. Trade and tariff policies clashed with tax cuts, as Gary Cohn, former director of the National Economic Council and Chief Economic Advisor to President Trump explained last week. Growth in the U.S. is expected to slow to around 2% this year. The fiscal deficit will rise beyond $1 trillion dollars, with no relief for the trade deficit, as consumer spending continues. The Senate will vote to acquit Trump this week. No need for witnesses, the breaches of protocol are evident. Abuse of power and obstruction of Congress admitted. Senators condemned to drink nothing but water or milk during the impeachment process are eager to provide a swift response. "Let the people decide" Trump's White House counsel said this week. They will get their chance in November, a Trump dynasty awaits the verdict ... High Speed Rail Goes Ahead ... China announced ten new infrastructure projects this week. The schedule includes four new high speed rail projects, covering some 2,000 kilometers. The rail links will be completed in the next four years, at a cost of $50 billion dollars. The extensions will be added to the 35,000 kilometer network already in existence. Next year, China will trial the MagDev rail project with speeds of up to 500 kilometers per hour possible. That's fast!. The emergency hospital in Wuhan, to treat coronavirus patients will be completed in four weeks. That's also fast. Next week we will assess the economic implications of the viral outbreak. The World Health Organization has defined the outbreak as a "Global Health Emergency". 10,000 cases have now been identified in China. More hospitals may well be needed in due course. In due course they will be built at speed. For the moment we return to the pressures on the Johnson administration to make a decision on HS2. The government made the right call on Huawei last week. The U.S. is falling behind in the 5G race. It has long abandoned any move to High Speed Rail. The Prime Minister is in favor of HS2 allegedly, a decision is expected soon. The issue is one of capacity rather than speed. The decision more pressing now the "Smart Motorway" Aporia has been revealed. Road congestion will place freight traffic under greater pressure if not. It is time to make the call if real productivity gains are to be secured ... That's all for this week, have a great weekend. We will be back with more news and updates next week. John |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed