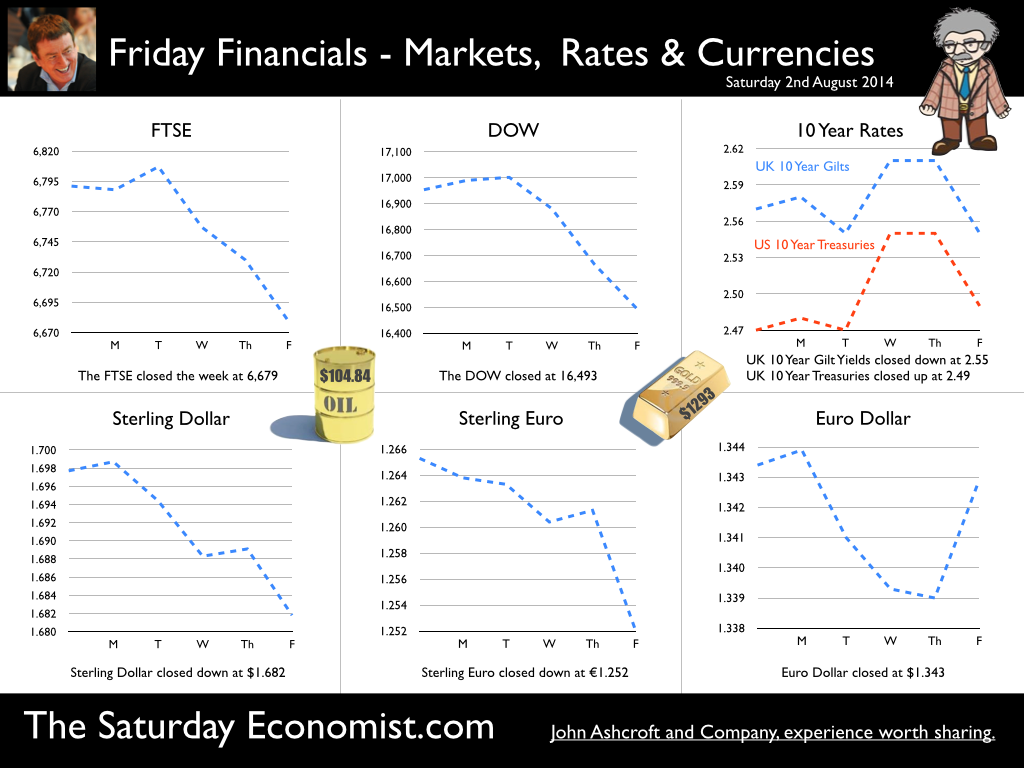

A letter from America … This week the Professor is in America, reviewing the prospects for the US economy. Despite the pressure on the Bank of England to increase rates before the end of the year, the MPC will be reluctant to move ahead of the Fed and be the first to leave Planet ZIRP. So what are the prospects of a US rate rise any time soon? Two Fed policy hawks, Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed, made comments this week, suggesting they have seen enough evidence to support an interest rate rise earlier than expected. Currently, tapering is expected to continue, extinguishing the asset purchase programme in October. US rates are not expected to rise until Q1 or even Q2 next year. The Prof thinks the latest crop of economics data will take the pressure off the doves to move earlier. Growth in the USA … In the USA, real gross domestic product increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. 4% sounds quite exhilarating but …. According to our year on year comparison, US GDP Q2 increased by 2.4% in the second quarter compared to Q2 2013. This followed growth of 1.9% in the first quarter - both below trend rate. Our forecast of growth at 2.4% in 2014 is unchanged based on the latest data. The latest GDP estimates ensure there is no pressure on the Fed to accelerate the change in monetary policy. We expect tapering to continue into the Autumn, with a rate rise postponed into 2015. Jobs in the USA … Friday's employment and income reports pointed to steady U.S. job growth with the number of non farm payroll jobs increasing by 209,000. The unemployment rate ticked higher to 6.2% but this a refection of a widening labour pool rather than a slow down in the economy. Moderate expansion in payroll numbers, slightly below expectations, will ensure there is no short term pressure to increase rates anytime soon. Inflation in the USA … The US Consumer Price Index increased by 2.1 percent in the twelve months to June. The PCE (personal consumption expenditure) price index, the Fed's favoured measure of inflation, was up 1.6%. Average hourly earnings of private-sector workers were up 2.0% from a year earlier, unchanged from the range of the past few years. Growth, jobs, earnings and inflation are all demonstrating trends that are likely to keep the Federal Reserve on course to conclude the bond-purchase program in October but remain cautious about raising short-term interest rates before the end of the year. We would expect US rates to rise in the Spring of 2015. Despite any further increase in The Saturday Economist™ Overheating Index™, the MPC will be reluctant to increase rates this year and open the “Spread with the Fed”. So what of the UK? The latest manufacturing data from Markit/CIPS UK PMI® confirmed the strong output growth continued into July. Production and new orders both continued to rise at robust, above long-run average rates in the month. At 55.4, down from 57.2 in June, the headline index posted the lowest reading in one year but remained well above the survey average of 51.5. No need to worry about manufacturing output! Something to worry about … Ben Broadbent, Deputy Governor for monetary policy, Bank of England, made a speech in London this week. His theme - “The UK Current Account Deficit”. Last year the UK current account deficit was 4.5% of GDP. That’s the second-highest annual figure since the Second World War. So is the near record deficit a threat to growth? The Deputy Governor concludes the “significance [of the deficit] depends on the health of a country’s net foreign asset position and more fundamentally, on the trust in its institutions”. “…having a balanced net asset position seems to reduce the threat from a large current account deficit, as does a floating currency.” Now that is concerning. In the 80’s Chancellor Lawson argued the Balance of Payments “doesn’t matter”. It does and in the end it did! Interest rates had to rise dramatically to curtail domestic demand. In the current cycle, the deficit, trade in goods, is offset in part by the service sector surplus. At around 2% to 2.5% of GDP, the deficit is not a threat to growth. The collapse in overseas earnings on the other hand is a more serious concern. A current account deficit of 4.5% is unsustainable. A dismissive speech at Chatham House will not disguise the extent of the problem, rule or no rule. So what happened to sterling this week? Sterling closed down against the dollar at $1.682 from $1.698 and down against the Euro to 1.252 from (1.2653). The Euro was unchanged against the dollar at 1.343. Oil Price Brent Crude closed down at $104.84 from 108.30. The average price in August last year was $111.28. Markets, closed down. The Dow closed down 460 points at 16,493 from 16,953 and the FTSE was down 12 points at 6,679 from 6,791. UK Ten year gilt yields were down at 2.55 from 2.57 and US Treasury yields closed at 2.49 from 2.47. Gold was unchanged at $1,293 from $1,294. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

1 Comment

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed