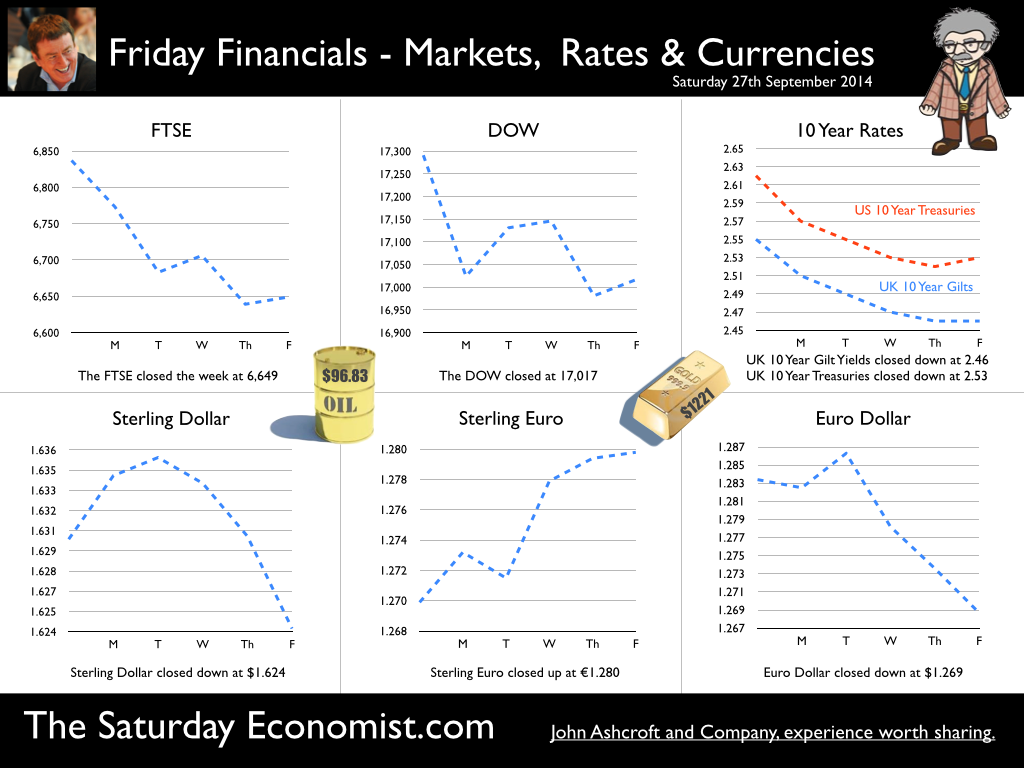

Brigitte Bardot, the "impossible dream of married men", will be 80 years of age tomorrow. Now a great grandmother, in a birthday interview for Paris Match, Ms Bardot claimed “I have loved a lot, passionately madly and not at all. Yet, I only keep one man in mind : the next one”. I feel much the same way about economic forecasts. I love a lot, passionately and madly, some not at all. I only keep one forecast in mind - the next one. Especially the next forecasts resulting from the GDP revisions out next Tuesday. The inclusion of drug dealing and prostitution for the first time, will no doubt, boost output and productivity in the UK economy. UK growth forecasts for the year will be revised as a result. The productivity dilemma resolved, understanding economic agents, burn a spliff, lie back and think of England as they contribute to economic growth. Forecast Revisions … Good news from Spain this week, as forecasts of growth have been revised up. The Finance Minister, Luis de Guindos has suggested growth this year will be 1.3% and 2% next. Still some way to go to full employment, the government now expects the unemployment rate to be 22.9% in 2015, down from prior forecasts of 23.3%. In the USA, growth in the second quarter has also been revised up! The annualised rate of growth revised higher to 4.6% from the previous 4.2%. The underlying growth rate (year on year) revised to 2.6% in the quarter. We now expect US growth of 2.5% for the year as a whole, following the slow start in the first quarter. The Manchester Index™, In the UK, the economy is on track for growth of 3.1% this year slowing to 2.8% next according to the latest data from GM Chamber of Commerce Quarterly Economic Survey and the influential Manchester Index™. The Manchester Index™ index moderated from 33.6 in Q2 to 32.0 in the third quarter largely as a result of the change in outlook for exports. The index remains above the pre recession average for the period 2005 - 2007. The outlook for home orders and deliveries improved slightly in both the service sector and the manufacturing sector. Exports, on the other demonstrated a significant fall in deliveries in both manufacturing and services. Service sector orders fell but the drop in export manufacturing orders was particularly marked. Overall confidence in turnover and profits was maintained and the prospects for employment and investment was particularly marked. Borrowing figures … Government borrowing figures were released this week. Public sector net borrowing was £11.6 billion in August, an increase of £0.7 billion compared with August 2013. For the year to date, total borrowing was £45.4 billion, an increase of £2.6 billion compared with the same period in 2013/14. Receipts in the month were boosted by Stamp duty up 24% and VAT receipts with a recovery in income tax payments, up by 2.4%. The cautionary note, expenditure £54 billion increased by 3.3%. The government is off track to meet the deficit targets this year. The good news, borrowing was revised down for 2013/14 to £99.3 billion. The reduction to £95 billion this year, less of a challenge as a result but there is still much to do with seven months to go before the end of the financial year if the targets are to be hit. So what of base rates … The Governor delivered a speech in Wales this week. “With many of the conditions for the economy to normalise now met, the point at which interest rates also begin to normalise is getting closer. In recent months the judgement about precisely when to raise Bank Rate has become more balanced. While there is always uncertainty about the future, you can expect interest rates to begin to increase. We have no pre-set course, however; the timing will depend on the data.” So what does this mean for UK rates? As we said last week, weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. The timing will depend on the data. The inflation and pay data says “don’t move yet but February is the best bet”. So what happened to sterling this week? Sterling slipped against the dollar to $1.624 from $1.630 but up against the Euro at 1.280 from 1.270. The Euro closed against the dollar at 1.269 (1.270). Oil Price Brent Crude closed down at $96.83 from $98.08. The average price in September last year was $111.60. Markets, moved down. The Dow closed at 17,017 from 17,291 and the FTSE closed down at 6,649 from 6,837. UK Ten year gilt yields move up to 2.46 from 2.55 and US Treasury yields closed at 2.53 from 2.62. Gold moved sideways at $1,221 from $1,218. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

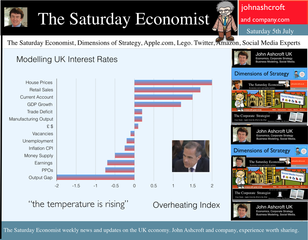

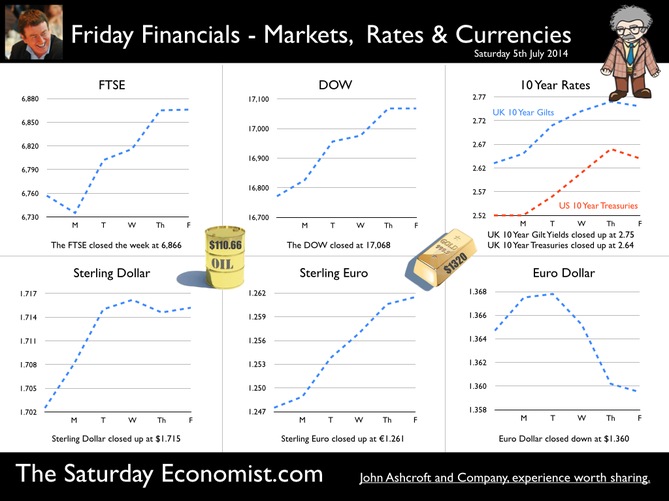

I made a trip to Liverpool this week. It was the Battle of the Economists, part of the International Festival of Business programme. Eight top economists were “in the ring” swapping punches. I “refereed” the morning event and hosted the Question Time session. It was a great event in the IFB calendar with lots of interesting perspectives on the world and UK economy. No blood spilled, nor egos bruised the outcome! To close the session, I asked the panel for views on when UK interest rates would begin to rise. Some argued for an immediate rate rise, most expected rates to rise in February next year and a few expected rates to rise in the November this year. As we said last week, “It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the low inflation figures for May and the strength of sterling ”. “Don’t watch my lips - watch the data!” the new forward guidance from the Governor. This week, the data continued to suggest the rate rise would be sooner rather than later. House prices up almost 12% … House prices increased by almost 12% in the year to June according to Nationwide. In London prices increased by 26%. The price of a typical property in London, reached the £400,000 level with prices 30% above the 2007 highs. Should we be concerned? Of course but the rate of increase in house prices of itself, will not lead to an increase in interest rates necessarily. Sir Jon Cunliffe, Deputy Governor for Financial Stability at the Bank of England was in Liverpool this week. “The main risk we see arising from the housing market is the risk that house prices continue to grow strongly and faster than earnings. The concern is the increase in prices leads to higher and more concentrated household indebtedness.” The Bank is not worried about the rise in house prices per se. The FPC (Financial Policy Committee) is concerned about the risk to the banking sector from high household indebtedness exposed to the inevitable rate rise and potential collapse in asset prices. The introduction of measures on interest rate multiples and leverage, the confines of policy intervention for the moment. Car Sales up 10.6% year to date … The strength of the housing market demonstrates the strength of consumer confidence and spending. The economy is growing at 3% this year, retail sales were up by almost 4.5% in the first five months of the year, car sales were up by 6% in June and by 11% in the first six months. We are forecasting registrations will be over 2.4 million in 2014, higher than the pre recession levels recorded in 2007, placing additional pressure on the balance of payments in the process. Yet rates remain pegged at 0.5%! Does this continue to make sense? PMI Markit Purchasing Managers’ Index® Survey Data The influential PMI Markit surveys continue to demonstrate strong growth in the economy into June. In manufacturing, strong growth of output, new orders and jobs completed a robust second quarter. In construction, output growth continued at a four-month high and job creation continued at a record pace. In the service sector, the Business Activity Index, recorded 57.7 in June. The survey produced a record increase in employment with reports of higher wages pushing up operating costs. The Manchester Index™- nowcasting the UK economy The Manchester Index™, developed from the GM Chamber of Commerce Quarterly Economic Survey, slowed slightly from 35.1 in the first quarter to 33.6 in the second quarter, still well above pre recession levels. The data within the survey, confirms our projections for growth in the UK economy this year of 3%, moderating slightly to 2.8% in 2015. So when will rates rise ? The Saturday Economist Overheating Index revealed ... At the GM Chamber of Commerce Quarterly Economics Survey yesterday, we revealed the “overheating Index”. This is a summary of fourteen key indicators which form the basis of any decision to increase rates by the Monetary Policy Committee (MPC). The strength of consumer spending, reflected in house prices, retail sales and car sales would argue in favour of a rate rise earlier rather than later, as would the growth in the UK economy at 3% above trend rate. On the other hand, inflation, reflected in retail prices and manufacturing prices remain subdued. Despite the strength of the jobs market, earnings remain below trend levels. The decision, on when to increase rates, remains finely balanced for MPC members at this time. Our overheating index is broadly neutral but tipped slightly in favour of a rate rise now. By the final quarter of the year, assuming earnings and inflation rally from current levels, the decision will be much more clear cut. Based on data from the Overheating Index, we expect rates to rise before the end of the year. Clearly markets think so too ... So what happened to sterling this week? Sterling closed up again against the dollar at $1.715 from $1.702 and up against the Euro to 1.261 from (1.247). The Euro moved down against the dollar at 1.360 from 1.365. Oil Price Brent Crude closed down at $110.66 from $111.35. The average price in June last year was $102.92. Markets, US closed up on the strong jobs data. The Dow closed above the 17,000 level at 17,068 from 16,771 and the FTSE was also up at 6,866 from 6,757, the move above 7,000, too much for the moment. UK Ten year gilt yields were up at 2.75 from 2.63 and US Treasury yields closed at 2.64 from 2.63. Gold was up slightly at $1,320 from $1,316. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Manchester Index™ The influential Manchester Index™, is developed from the GM Chamber of Commerce Quarterly Economic Survey. It is a big survey which is comprehensive, authoritative and timely. Now we also have the Manchester Index™. The Manchester Index™ is an early indicator of trends in both the Manchester and the UK economy. Using the Manchester Index we are in a great position to “nowcast” the UK economy and get a pretty good steer on employment and investment in the process. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed