Economics news – Don't worry about the double dip ... Good news - no need to worry about a triple dip, the double dip has been eliminated from history according to the latest release of the National Accounts data from the ONS this week. The hint of a double dip has been smoothed away. The good news continued as the increase in activity was up held at 0.3% growth into the first quarter of 2013. The economy is "healing"! Slightly concerning, the recession in 2008/9 was now worse than we had believed. The economy fell by 5.5% in 2009 compared to the 4% last feared. Despite the rally into the year, the economy remains some 4% below peak in the first quarter of 2008. Worse still the comparison of year on year growth is much lower than first thought. In the first quarter of the year growth was up by just 0.3%. We have to be less bullish about the year as a whole as a result but 1% growth still remains a possibility. Relying on data from the ONS is like planning a mountain trek with a dodgy GPS device. Every so often you tap the tracker and find out you are not exactly where you were led to believe, having arrived by a different route from that last chosen. Who would have thought for example, between 2000 and 2008, the economy grew by almost 3% a year. Had only we known, we had it so good, the Governor could have taken away the punchbowl much earlier. In the USA, the feral hogs could have been put out to grass and the heavy drinkers could have been weaned from Wild Turkey to cold turkey much earlier in the process. For lovers of nominal GDP targeting the revisions should be a clear warning. Nominal GDP grew by an average 5.5% over the period 2000 - 2008. The problem for policy makers, the GPS device was on the blink, with only a sporadic reading available. For lovers of forward guidance, the reaction of bond markets to Bernanke’s comments on QE and tapering, should also be a warning. The statement led to a 100 basis point jump in Treasury yields. The market “over reaction” led to criticism of by the Dallas Fed chief, “Traders are behaving like feral hogs”. “Investors shouldn't overreact to the central bank's plan to reduce the pace of asset purchases”, the Dallas Fed chief Richard Fisher said in an interview with the Financial Times this week. Investors behaved like "feral hogs" after the comments by Bernanke. "What we're talking about here is dialling back," said Fisher, president of the Federal Reserve Bank of Dallas. “I don’t want to go from Wild Turkey to Cold Turkey”. For the more technically inclined. Wild Turkey Bourbon is super-premium American bourbon, made in Lawrenceburg, Kentucky by Master Distiller Jimmy Russell. Forward guidance is a market feed programme by which feral hogs can increase market volatility and trading volumes. Dialling back, is a wish that Bernanke would make a few telephone calls before making a few market calls. After all, we all love to hedge, even Fed chiefs. Back to the ONS stats, by the end of 2012, the economy was some 11% below trend rate at a cost to the economy of some £200 billion in lost output and a cost to Treasury of over £80 billion in lost revenue. Hence the challenge of the spending review this week. The Chancellor obliged to cut a further £15 billion from spending in 2015/16. Radical changes to the level and composition of public spending will continue but spending cuts will achieve little without significant economic growth. For a more detailed analysis check out the IFS web site. In the absence of growth, the IFS warn that further consolidation may require tax rises and spending cuts to hit the targets in the future. Furthermore there appears to be little boost to infrastructure spending, according to Paul Johnson Director of the IFS, “What the Chancellor, did not announce was an increase in public sector net investment. Despite the hype net capital spending is not set to rise”. Jonathan Portes and the Krugmanites will just love that. What happened to sterling? Sterling fell further on dollar strength to 1.5220 from 1.5425 and slipped against the euro to 1.1687 from 1.1757. The Euro dollar closed at 1.302 from 1.3115 and against the Yen, the dollar closed up 99.12 from 97.8. Oil Price Brent Crude closed at $102.16 from $101. Average prices in June were some 9% higher than June 2012. Markets, The Dow closed up 14,910 from 14,799. The FTSE closed at 6,215 from 6,116. Markets have rallied from lows, could be time to average in. UK Ten year gilt yields closed at 2.46 from 2.42, US Treasury yields closed down at 2.49 from 2.54. The feral hogs will have their say. Yields are set to move higher. Gold closed down at $1, 232 from $1293. Worshippers of the old relic at a loss, as we begin the exodus from Planet ZIRP. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

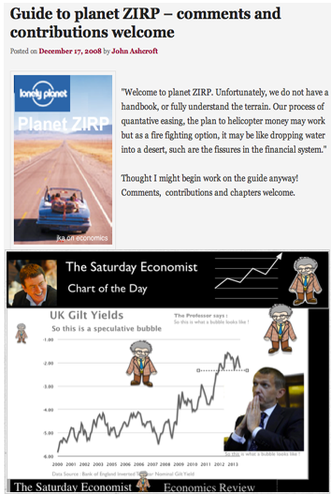

This week Bernanke signaled the end of QE, just as Obama signaled the end of the Bernanke regime at the Fed. “Well, I think Ben’s done an outstanding job... he’s already stayed a lot longer than he wanted or he was supposed to”, said the president this week. Ouch. Some of us feel the same way about the great QE experiment. It may soon, all be over. On the basis the unemployment rate falls to a target rate of 6.5% in the US, the $85 billion monthly asset purchase programme will drift to a close within the next twelve months. As Truman may have said, The Big Bucks stop here! Bernanke explains this is not a tightening of policy. The Fed is lifting its foot off the gas, (reducing QE) not hitting the brakes (increasing base rates). Fascinating. Monetarists believe controlling the economy is like driving a chevy. Foot on the gas, toe on the brakes, steering the economy in the right direction. Total control. Keynesians on the other hand, believe the economy is like some great Keynesian slot machine, insert the coins, adjust the Okun ratio, pull the lever - jobs flow as the money tumbles into the bottom of the gaming well. If only it was all so easy! The markets were a little confused. US Treasury yields jumped higher to 2.54% up by over 40 basis points, as the Dow closed down 200 points on the week. So what happened back home? In the UK, Sir Mervyn King’s time at the Bank of England draws to a close. At the Mansion House this week, The Chancellor announced a peerage for the Governor, marking the passage of Lord King to the upper house and the passage of QE as a policy option in the UK. In other news, inflation CPI basis ticked back to 2.7% from the 2.4% relief in April. Manufacturing prices show little evidence of pressure as input prices remain subdued and the uptick in output prices to 2.2% in the month should be easily contained. Inflation CPI should end the year around the 2.4%, no threat to policy at that level. Retail sales in May were up by 1.9% in volume terms, marking a modest recovery but no great surge forward. The borrowing figures were released for May. Public sector net borrowing excluding temporary effects of financial interventions was £8.8 billion. This is £6.9 billion lower than in May 2012 when it was £15.6 billion. At first sight this is great news from the Chancellor but ... Closer inspection reveals borrowing has been reduced by £3.9 billion from transfers from the Bank of England Asset Purchase Facility Fund and by £3.2 billion from retrospective tax payments by Swiss banks. The Old Lady has been mugged again by the Treasury and time is up for the Swiss deposit accounts flattering the performance in the month. Nevertheless, the borrowing figures will improve this year as the economy continues to recover and spending plans bite. Check out the IFS release for details. What happened to sterling? Sterling fell on dollar strength to 1.5425 from 1.5703 and held at 1.1757 (1.1763) against the Euro. The Euro dollar closed at 1.3115 from 1.3345 and against the Yen, the dollar closed up at 97.8 from 94.06. Oil Price Brent Crude closed at $101 from $105.93. Markets, The Dow closed down 14,799 from 15,070. The FTSE closed at 6,116 from 6,308. Time to stand aside whilst markets consolidate. It will soon be time to average in. UK Ten year gilt yields closed at 2.42 from 2.08, US gilt yields closed up at 2.54 from 2.13. The great rotation is gathering momentum. Gold closed down at $1293 from $1,390. Worshippers of the old relic do not know what to make of it all, as we begin the exodus from Planet ZIRP. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. JKA The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Andy Haldane warned this week : “Let’s be clear, we have intentionally blown the biggest government bond bubble in history” speaking before the Treasury Select Committee. Andy Haldane is the director of financial responsibility at the Bank of England. His views were quickly distanced by Old Lady of Threadneedle Street, as very much a “personal view”. OK bond markets may be the main risk to financial stability but best not to speak of it in public. Not to worry, the markets will get the message in the end. High bond prices and absurdly low yields are a by product of life on Planet ZIRP. With short rates at or near the zero interest rate policy level, undermining long term rates was considered to be the next great step. Who could possibly think that creating a financial climate with negative long term real rates, would encourage lending, in an uncertain business world. Well Ben Bernanke for one. There is no “Lonely Planet” Guide to life on Planet ZIRP as we pointed out in December 2008. Commenting on a paper by Bernanke - we said then - “OK it’s official, the effects of QE remain quantitively quite uncertain. Welcome to Planet ZIRP. We don’t have a hand book or fully understand the terrain. We cannot be sure QE is going to work at all. The process of quantative easing, the plan to helicopter money may work but as a fire fighting option, it may be like dropping water into a desert, such are the fissures in the financial system” We also said, “This is your captain speaking, Welcome on board flight QE 2009. I hope you have a nice flight, I am relatively new at this, haven’t actually flown before, we shall be flying by the seat of our pants but have every confidence, we will get somewhere, but not sure where, in the end.” QE was an experiment which is still five years late unproven. We warned then, Planet ZIRP, would be a desiccated sterile planet where a liquidity crisis is exacerbated and prolonged. Now, five years on, the US markets are beginning to fret about the end of the Bernanke flight, with fears of a crash landing in prospect. As Sam Fleming, warns in The Times today, “the Governor of the Bank of England, in 2009, described the process of reversing QE as completely straightforward. It is proving to be a nightmare. “ In the Saturday Economist we pointed out last week, The Bank of England has mopped up almost 75% of UK gilt purchases since QE began. There can be no reversal of QE in the UK. The gilts will be held to redemption. The real challenge - who will buy the gilts at negative real rates, now the Old Lady has to stay off the street. For earlier posts Google “Planet ZIRP - John Ashcroft” , or check out this post you had been warned! What happened to sterling? Further dollar weakness the story, this week as fears over QE3 increase. Sterling rallied to 1.5703 from 1.552 dollar basis and held at 1.1763 against the Euro. The Euro dollar closed at 1.3345 from 1.3216. Against the Yen, the dollar closed once again below the critical 100 level at 94.06 from 97.60. Oil Price Brent Crude closed at $105.93 from $104.56. In June last year Brent Crude averaged $95! The best for inflation may be over, oil prices will be up 10% this month compared to last year. Markets, The Dow closed at 15,070 from 15,248. The FTSE closed at 6,308 from 6,411. The easy calls have been made, time to stand aside whilst the markets consolidate and fret about QE. UK Ten year gilt yields held at 2.08 from 2.09 - US gilt yields closed down at 2.13 from 2.18. The great rotation - in a bit of a spin. As for gold, closed at $1,390 from $1,384. The excitement is over for now, this is a hung chart. Really pleased this week to be appointed as the Chief Economist at the Greater Manchester Chamber of Commerce. Looking forward to working with Clive Memmott, and the team in Manchester. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft.  From whom has the Bank of England been buying all the gilts? 1 Since QE began in the first quarter of 2009, the total value of gilts in issue has increased from £616 billion to £1.354 trillion [Data to 2012 Q4 The latest figures available from the Debt Management Office.] 2 The Debt management office has issued £738 billion of new gilts over the period to fund the government deficits, over half of which have been purchased by the Bank of England under the QE policy. 3 At the end of 2012, the Bank of England held gilts to the value of £397 billion. That’s almost £400 billion. The Bank of England has purchased almost £400 billion or 54% of the new gilts issued, according to the data. 4 Overseas holdings of gilts have doubled in the period, increasing from £203 billion to £420 billion, an increase of £217 billion. 5 UK holdings of gilts have increased from £400 billion to £937 billion, that is to say, UK holdings have increased in value by £523 billion. 6 The Bank of England has accounted for 76% of the UK purchases of gilts issued since the first quarter of 2009. 7 Insurance companies and pension funds have increased holdings of gilts from £228 billion to £348 billion. 8 Households have increased their holdings of gilts over the period from £13 billion to £31 billion. 9 In fact most, if not all, holders on gilts at the end of 2008, have increased the value of gilt holdings over the last four years. 10 There is some evidence of front running by some financial institutions as holdings increased ahead of the QE announcement in early 2009 but other than that holdings have increased across the board. Which poses the question, from whom has the Bank of England been purchasing all the gilts? It would appear to some the QE policy is more concerned with mopping up the gilts issued by the DMO, at beneficial rates, than it is with stimulating growth or avoiding deflation. If that is the case, then the Governor of the Bank of England has done a great job but hence the need to continue with QE despite the recovery in growth and inflation. Download the DMO Data Set Here.  Base rates on hold this week as the MPC voted to hold rates at 0.5% and withstand any further pressure to increase QE above the £375 billion level. Speculation continues that rates will remain on hold into 2016 but can we really be so sure that UK base rates will remain at such low levels for a further three year period? In the USA Bernanke has opted for a QE infinite policy, injecting $85 billion monthly into the US economy until unemployment falls below 6.5% or inflation ticks higher above the 2.5% level. So much for forward guidance, it just gives the markets more things to fret about. In Europe the ECB held rates this week, forecasting negative GDP growth this year of -0.6%. Croatia with slowing growth and rising unemployment meets the convergence criteria apparently and will join the ranks of the soaring unemployed in Europe. It really is a difficult international back drop, against which to set rates in the domestic economy. The latest signals are that rates will rise sooner rather than later in the UK as a raft of data suggests the recovery in the second quarter could continue at trend rate of over 2%. Car sales in April and May have increased by almost 10% compared to 2012 and latest data from the British Retail Consortium suggests retail sales in May increased by almost 2% like for like. More convincingly, the latest survey data from Markit/CIPS PMI® surveys suggest the worst may be over in the construction sector. The short lived fillip to output from the outgoing labour administration has now worked it’s way in and out of the system. The latest boost to new home construction from the Treasury Homes for Heroes campaign may be having some effect. The construction index moved into positive territory led by residential building activity. The UK manufacturing sector continued its positive start to the second quarter of 2013. After returning to growth in April, May saw operating conditions improve at the fastest pace in over a year, with growth of production and new orders both improving. At 51.3 in May, up from 50.2 in April, the seasonally adjusted Markit/CIPS Purchasing Manager’s Index® (PMI®) posted its highest reading since March 2012 and remained above the neutral 50.0 mark for the second straight month. But it was in the service sector, the most positive signals to growth were found. The headline seasonally adjusted Business Activity Index hit 54.9, up from April’s 52.9, the index signaled a strong rate of growth, the largest since March 2012. New business activity increased at the fastest rate for three years. It has been a great couple of weeks for the Chancellor, with inflation falling, the deficit dropping and growth confirmed in the first quarter. Even the trade figures improved in April according to latest data this week. Alas, the improvement in trade for the wrong reasons, imports fell as exports remained flat. No signs of a booming economy in the second quarter but survey data suggests the recovery is continuing at a respectable pace. The UK economy should experience growth well above 1.0% this year, despite the problems in Europe. No pressure for rate rises in the short term. What happened to sterling? It’s all about dollar weakness this week. Sterling rallied to 1.552 from 1.5198 against the dollar and to 1.1763 from 1.1687 against the Euro. The Euro dollar closed at 1.3216 from 1.2996 and against the Yen, the dollar closed below the critical 100 level at 97.6. Why? US jobs data suggests more QE is guaranteed in the short term. Oil Price Brent Crude closed at $104.56 from $100.39. In June last year Brent Crude averaged $95! The best for inflation may be over, oil prices will be up 10% this month compared to last year. Markets, settlement week. The Dow closed at 15,248 from 15,115. The FTSE closed at 6,411 from 6,583. The easy calls have been made for the moment. Nervous money should move to the sidelines before the Autumn moves. UK Ten year gilt yields increased to 2.09 from 2.03 - US gilt yields closed up at 2.18 from 2.13. The great rotation continues albeit at a subdued rate. As for gold, closed at $1,384 from $1,387. The excitement is over for now, this is a hung chart. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – Feeling good but not about lending ... Latest government research shows, if people are in health, in work and in love, preferably living with someone (the loved one even better), the national well being scores soar. If you are educated, that's tough, - higher levels of education create greater levels of anxiety - ah yes - ignorance is bliss. And what of kids? Children of any age, have no impact on anxiety levels apparently. Hard to believe, so much for research bias! Is this really survey money well spent? It doesn’t make me happy thinking about it. Great set back to national well being, in the Bank of England, lending stats this week. “Lending to business plummets” according to The Times mid week. Lending to business fell by £3 billion in April, to a level of £470 billion. Actually, it was more of a plop than a plummet, a fall of around 0.5%, as lending to small businesses fell by £700 million. Banks blamed a lack of demand amongst borrowers, business leaders were a little more circumspect. Does this mean FLS is failing? The funding for lending scheme is an ambitious sales promotion tool in a moribund market. Credit supply does not a recovery make. Money supply M4 increased by 4.8% in April, no dramatic change but a continued demonstration that liquidity is not a problem within the economy, domestic demand is the real challenge. Banks are using FLS each in their own special way, some to tighten spreads, some to ease arrangement fees, and some as a simple cash back model for capital investment. Buy a fork lift truck and get 10% cash back, that sort of thing. Try fitting that into the Bank of England, monetary transmission mechanism, it would make a PhD’s eyes pop. As for eyes popping, is the answer to Britain’s economic problems another round of sterling depreciation? asks Sam Fleming in The Times today. Mike Amey, Managing director of Pimco, suggests the incoming governor of the Bank of England, may seek to weaken sterling against the dollar in an attempt to stimulate exports. Calling $1.37 as a reasonable target, Amey suggests another round of QE could effect the currency shift. Let’s hope not. Even Charlie Bean the deputy governor of the Bank of England, is becoming sceptical about the depreciation solution. “The disappointing performance of net trade is another puzzling aspect of this downturn”, says the DG, speaking at the Official Monetary and Financial Institutions Forum in London this week. “there is a possibility the demand for, and supply of, exports have become less responsive to relative price signals, perhaps reflecting the nature of the goods and services in which we have a comparative advantage”. Crikey Charlie, we stopped talking about comparative advantage once Ricardo had persuaded the good burghers of Lisbon to part with fortified wine in exchange for dodgy textiles from Lancashire. At least you didn’t mention the J curve. The Bank is beginning to get the message about which we have been writing for years. Depreciation does little to improve net trade. Imports and export elasticities are demand dominant, with relative price, relatively inelastic, in the case of exports and almost inelastic with regard to imports, there is no substitution effect. The Old Lady is a slow learner. In the 80s the Bank models claimed interest rates had little impact on consumer spending, five years ago the model claimed low base rates would lead to a surge in investment. The Bank of England has a slow adaptive model, it may be DSGE but it is hardly dynamic and appears to be oblivious to shocks. What happened to sterling? Sterling rallied to 1.5198 from 1.5123 against the dollar but steadied against the euro at 1.1687 (1.1691). The Euro dollar closed at 1.2996 from 1.2932. On fundamentals the pound is fair value at 1.50 - 1.55 dollar but remains undervalued below 1.25 euro basis, the technicals are all for the present. Oil Price Brent Crude closed at $100.39 from $102.64. The average price in May around $103 compared to $107 last year. June 2012 $95 is the number to beat! The best for inflation may be over. Markets, it is pay the piper week. The Dow closed at 15,115 from 15,303. The FTSE closed at 6,583 from 6,654. Time to sell in May and go away we said mid May, we are off to Crete next week. UK Ten year gilt yields increased to 2.03 from 1.91 - US gilt yields closed up 2.13 from 2.01. The great rotation has now begun. Markets are beginning to fret about QE cessation and exit. The financially repressed, obliged to buy gilts for now, will slow the return to market equilibrium in the medium term. As for gold, closed at $1,387 from $1,392. The excitement is over for now, this is a hung chart. Confused about economics? Check out The Saturday Economist web site, probably the best economics site in the UK. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed