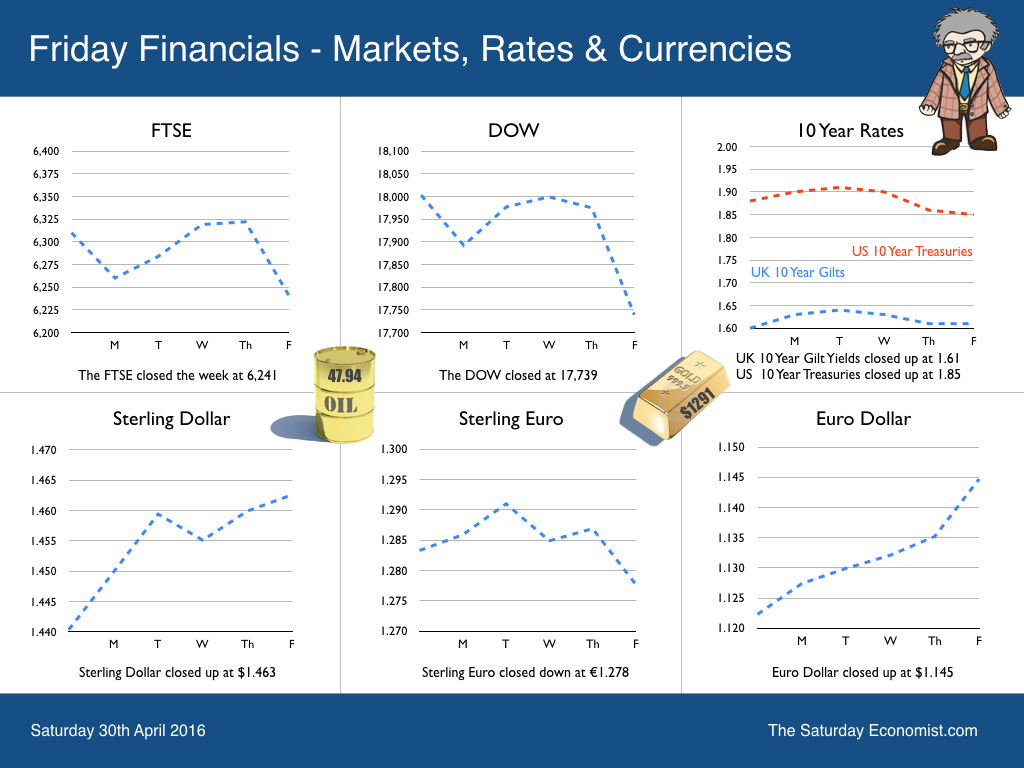

UK growth in the first quarter of the year was 2.1% following growth of 2.1% in the final quarter of last year. The service sector continues to drive growth in the economy with leisure and distribution the main drivers of growth, up by over 4% year on year. Business service activity increased by just 2.1% and government activity increased by just 1.6%. Service sector growth of 2.7% contrasted with the disappointing performance of manufacturing (down by 1.3%) and construction (down by 1.7%). For the year as a whole we now expect growth of 2.4% compared to growth of 2.3% last year and our earlier forecast of 2.6% in our March update. The May economics update will reflect the second estimate of GDP from the ONS due next month. Strong jobs growth and household income expansion would confirm a positive outlook for the UK economy. The key question remains ... who is making the cocktails to sustain consumption over the medium term! For the moment, world growth is steady and growth in Europe continues the path of recovery … Growth in Europe … The latest data from the European Union suggests growth was 1.7% in the first quarter of the year compared to growth of 1.9% in 2015. We expect EU growth to continue into the year with growth of around 1.9% for the year as a whole. EU unemployment was down to 10.2% in March and inflation fell to -0.3% in the month, the latter driven lower by falling energy costs. We expect inflation to bounce back in the second half of the year as energy costs unwind and the economic recovery continues. Across the EU area, performance is varied. In Germany, unemployment at 4.2% is lower than the UK and less than half the rate in France (10%). Spain (20.4%) and Greece (24.4%) remain the troubled regions despite the 3% plus growth in Spain in 2015. Growth in the USA … In the US, the Fed held rates in April. Job gains averaged 230,000 per month in the first three months of the year. The unemployment rate has fallen to 4.9%. The labor force participation rate is rising but wage growth is yet to show a sustained pickup according to Janet Yellen this week. Household spending is increasing but investment is falling as a result primarily of oil exploration cut backs. Net exports are weaker attributed to weak world growth and the sluggish pattern of world trade. Inflation increased to 1.25% in March with oil prices and the vagaries of the dollar pertinent to the increase in headline and core inflation. The latest data for The Bureau of Economic Analysis confirms GDP growth was 1.9% in the first quarter of 2016 compared to 2.0% in the final quarter of 2015 and 2.4% for the year 2015 as a whole. We expect US growth of 2.4% in the year compared to the consensus forecasts of just 2%. Why so gloomy? Even the Fed expects growth of 2.2% in 2016, with unemployment falling to 4.7% by the end of the year. The Saturday Economist on Brexit … This week we had a surprise visit into the office from Lord Hill, EU Commissioner for Financial Stability, Financial Services and Capital Markets. Charged with the responsibility for financial regulation and capital markets union, Lord Hill was keen to listen to any concerns about the EU's role in regulation but also to explain the most valuable aspects of the Single Market. We didn’t take about Brexit over much but Lord Hill cautioned on the potential difficulties and protracted negotiations that would follow from a decision to leave the EU. It won't be easy or axiomatic to secure a free trade deal in goods or services. To date, we have had over 4,000 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. It is difficult to identify the business case to leave the EU. In fashion it is said, there is a model for every catwalk. In economics we say, there is a model for every cat fight. So it proved with the release of new forecasts from the group of eight economists for the leave campaign this week. Over the next few weeks we have a great series of events with debate from either side. John Longworth is with us next week and Sir Richard Leese will be speaking later in the month. So what of rates? In the US, the Fed is still expected to increase rates this year, with one or two rate hikes remaining a possibility. In the UK, wage growth and headline inflation will provide the triggers to action in the second half of the year, with no rate rise expected ahead of the referendum in June. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Oil Brent Crude closed just below the $50 dollar mark this month. The outlook for inflation will look remarkably different by the end of Q3 this year. So what happened to Sterling? Sterling closed up against the Dollar at $1.463 from $1.440 and steady against the Euro at €1.278 from €1.280. The Euro moved up against the Dollar to 1.145 from €1.125. Oil Price Brent Crude closed up at $47.94 from $41.64 The average price in April last year was $59.52. Markets, were down - The Dow closed at 17,739 from 18,000. The FTSE closed at 6,241 from 6,294. Gilts - yields moved up. UK Ten year gilt yields closed at 1.61 from 1.60. US Treasury yields moved up to 1.85 from 1.87. Gold closed at $1,291 ($1,243). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

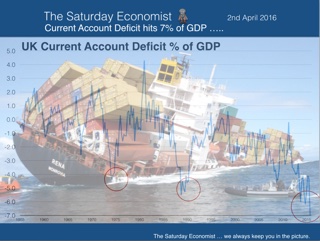

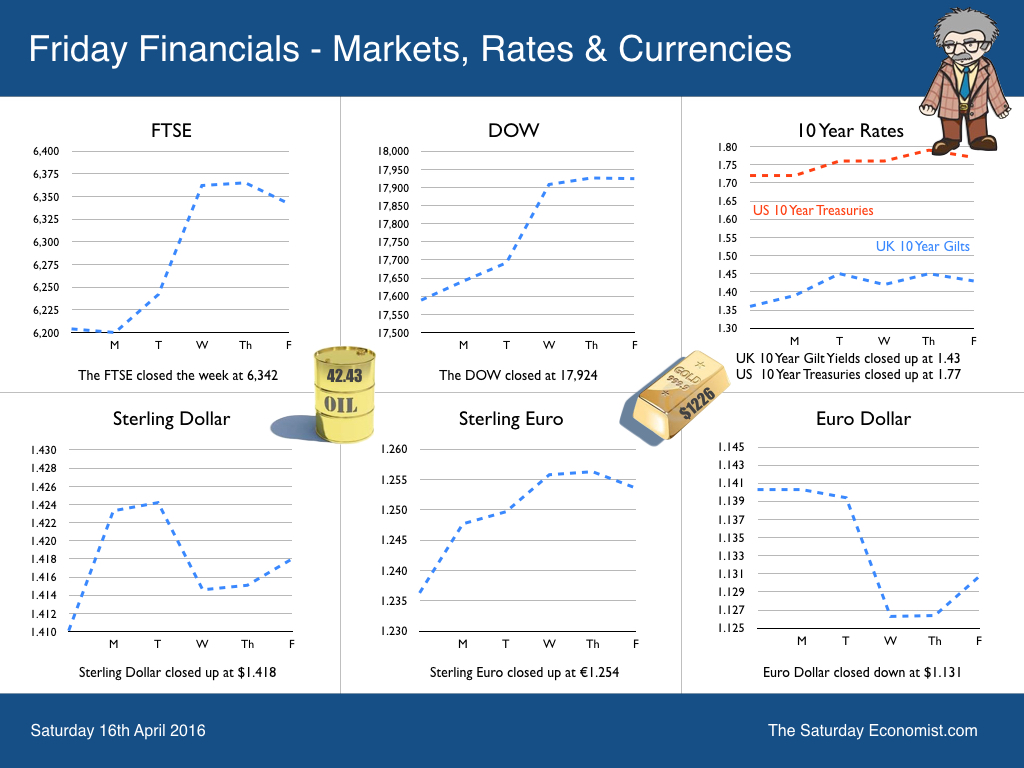

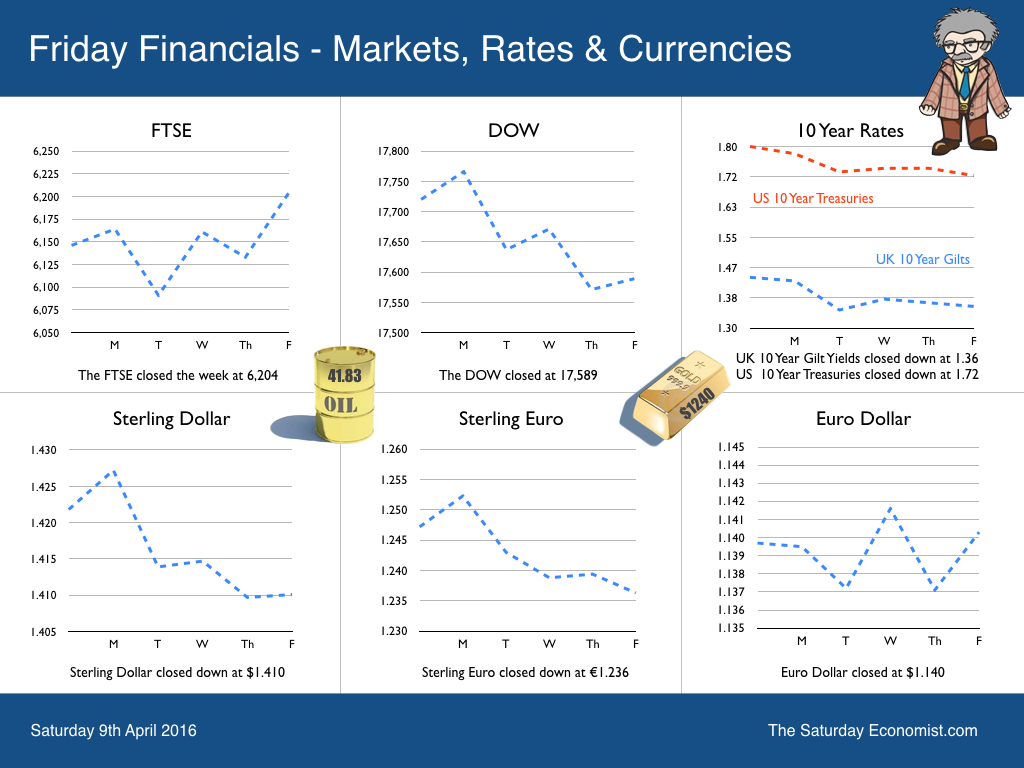

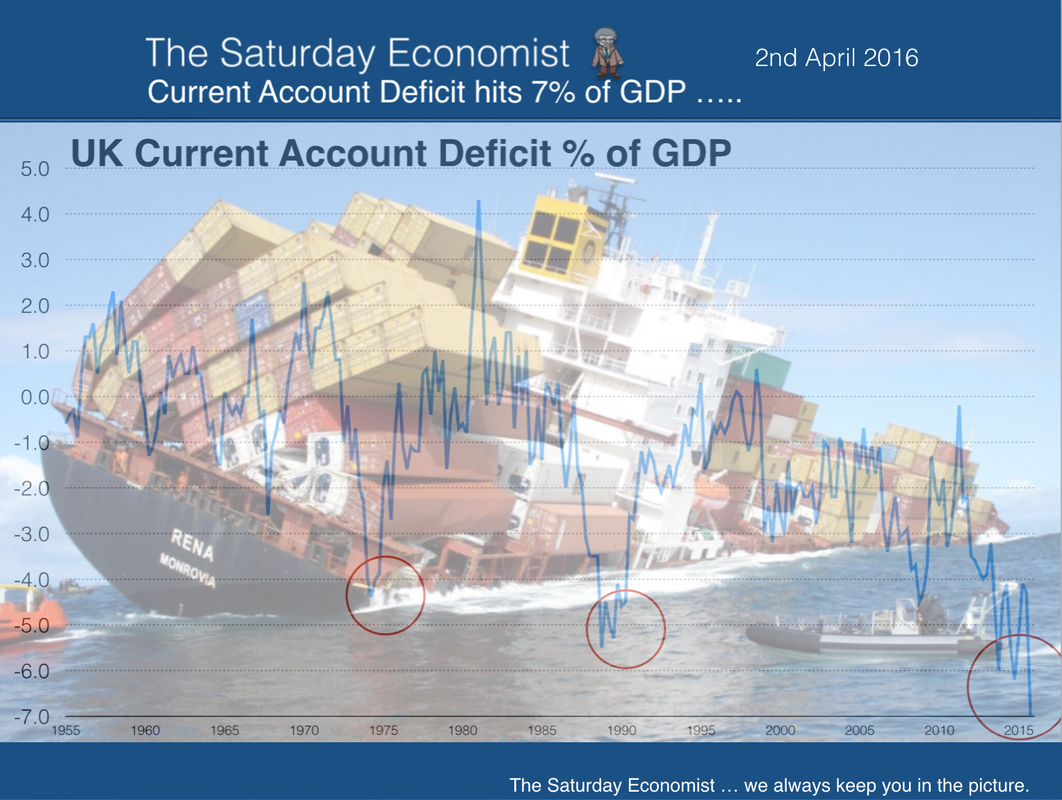

"It will cost you money" says the Chancellor’s Brexit Review. Based on Treasury estimates, GDP could be 6% lower and families would be worse off by £4,300 if the UK leaves the EU, according to the Chancellor’s and Treasury review published this week. Michael Gove suggested the Chancellor is treating UK voters like children. They must be children with a fair grasp of economics and a basic grounding in econometrics. The Treasury is using a Gravity Density Model to identify the risk to international trade of a decision to leave the EU. The results are then compiled with NIESR’s global macroeconomic model NIGEM, to produce estimates of the impact on GDP over the next fifteen years. The report explains why the Gravity Density Model is preferred to a Computable General Equilibrium Model (CGE) or a Dynamic Stochastic General Equilibrium Model (DSGE). The Treasury report runs to over 200 pages and identifies the risk to the pocket and the threat to Pharmaceuticals, Aerospace, Motor and Financial Services specifically. Aligning the IMF, HM Treasury and the Bank of England against Michael Gove and the “Leave” campaign group may seem like overkill. Flying in President Obama to deliver the “Remain” message may seem a little over the top. As for the 200 page Treasury Report, most will be happy to accept the summary and skip the economic theory and modelling process. Confused by Brexit? … The Saturday Economist on Brexit … We have had over 3,000 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. Over the next few weeks we have a great series of events with debate from either side. Don’t miss the John Longworth event on the 4th May and Sir Richard Leese later in the month. Tensions will rise in the run up to the campaign. So what happened in the UK this week? … Retail Sales … Retail sales volumes increased by 2.7% year on year in March as sales values dipped slightly by -0.1%. Online sales increased by 9% accounting for just over 13% of all retail activity. Textiles, clothing and footwear sales fell in the month by 6% offset by a similar increase in department store activity. In 2014, the volume of retail sales increased by 4.5%. We expect a volume increase of 4% in 2016 with a near 1.5% increase in retail sales values. Government Borrowing … Government Borrowing fell in March to £4.8 billion compared to £7.1 billion. For the year as a whole government borrowing was £74 billion compared to £91.7 billion prior year. In theory, the Chancellor failed to meet the OBR forecast by £1.8 billion. To be fair, Robert Chote had suggested the first estimates may be ahead of the final figure, forecast to be near £72 billion. Is the shortfall significant? Not really. The near £20 billion reduction is a fair achievement with low nominal GDP growth, sluggish earnings and low retail sales value expansion in the year. The Chancellor seems set to achieve a further target reduction of almost £20 billion in the current financial year 2016/17. No need to panic just yet! “Brexit” could impact on government revenues by as much as £45 billion per year according to the Treasury update. In 2015/16 total revenues increased by 3.6%. A 4.4% increase in VAT, income tax and capital gains tax assisted the process, as revenues from the asset purchase facility fell by £2 billion year on year. Expenditure was held at prior year levels more or less. Total current expenditure was £652 billion compared to £650 billion prior year. Interest payments were £45.1 billion, down on the prior year £45.2 billion. Life on Planet ZIRP is making it easier for the Treasury to control the spend on debt interest. The Job Figures were released this week … The claimant count rate was unchanged at 2.1%. The overall unemployment rate held at 5.1%. The number of people unemployed held at 1.7 million in the three months to March. The vacancies data has been subject to significant revision and appeared to fall in the three months to March to 751,000 compared to 754,000 prior month. Average weekly earnings for employees in Great Britain increased by 1.8% including bonuses and by 2.2% excluding bonuses compared with a year earlier according to the latest ONS data. For the first three months of the year, nominal earnings increased by 2.3%. Earnings in the construction sector increased by almost 8%! So what of rates? The ECB held rates this month with no expansion of QE. Latest data from China suggests the threat to the world growth is dissipating. US jobs data confirms the recovery. The Fed is now more likely to continue with the rate hikes later this year. The UK will surely follow. Ian McCafferty admitted in a speech this week, his about turn on a rate rise had been forced by the sluggish earnings growth in the UK economy. The jobs data continues to suggest an economy which is at levels above the pre recession period in 2008. Service sector inflation is 2.8%. Business and Financial earnings are increasing by 3%. Construction earnings are increasing by 8%. We expect earnings to increase above 2.5% in the second half of the year. McCafferty has indicated the path of rates will rise, should earnings start to move as is now widely anticipated. So what happened to Sterling? Sterling closed up against the Dollar at $1.440 from $1.418 and up against the Euro at €1.280 from €1.254. The Euro moved down against the Dollar to 1.125 €1.143. Oil Price Brent Crude closed up at $41.64 from $42.43 The average price in April last year was $59.52. Markets, were mixed - The Dow closed at 10,352 from 17,924. The FTSE closed at 6,294 from 6,342. Gilts - yields moved up. UK Ten year gilt yields closed at 1.60 from 1.43. US Treasury yields moved up to 1.88 from 1.77. Gold closed at $1,243 ($1,226). John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England MPC held rates at 0.5% this week. No real surprise but the warnings of the referendum impact on UK growth this year were clear “There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity. Some decisions on capital expenditure and commercial property transactions are being postponed pending the outcome of the vote. This might lead to some softening in growth during the first half of 2016.” Softer growth? Perhaps but this is just a short term problem, assuming the “Remain” campaign wins the day in June. The official campaign has begun. The battle is on to win hearts and minds ahead of the EU referendum on 23 June.The tension will build in the weeks ahead … Inflation … This week, the ONS released the latest inflation figures. CPI inflation increased to 0.5% up from 0.3% last month. Service sector inflation increased to 2.8% offset by a 1.6% fall in goods inflation. Is this significant? Yes. We expect a big rise in service sector earnings this year, pushing service sector inflation still higher. As for goods inflation, commodity prices are turning in oil, hard metals and food. The evidence in the Producer Price Inflation charts is clear. Inflation is on the move. We expect inflation (CPI) to be rising towards the 2% target by the end of the year. There may yet be an escape from Planet ZIRP in 2016 … Negative rates … the lethal monetary policy injection … Trapped on Planet ZIRP, we are in danger of being dragged into the NIRP crevasse as central bankers continue to experiment with the world economy. Mis pricing capital in a capitalist system will create havoc in financial systems and so it is proving with negative rates. Japan’s negative interest rate experiment is floundering. Interest rate levels are having little effect on credit demand, the market function is declining. The policy is having no impact on household spending or investment activity according to the Wall Street Journal this week. Trading has withered in money markets, bond yields have fallen and the Yen has surged to 18 month highs against the dollar. “Every day is like being Alice in Wonderland”, said Tomohisa Fujiki head of interest rate strategy at BNP Paribas Securities. Deeper and deeper into the hole, negative rates and a rising Yen? It isn’t supposed to be like that. "Sometimes I have believed in as many as six impossible things before breakfast" said Alice. Carroll's character could have been talking about central bank monetary policy. In Germany, negative rates are fast becoming a lethal injection. In life insurance, the sector has historically offered high levels of guaranteed returns over very long periods to investors. To fund the outlay commitments of policies in place, insurers need investment returns of 5% plus. The search for Alpha difficult to achieve with EU bond yields sub 1%, as The Wall Street Journal explained this week. To meet the capital gap, high yielding assets are being sold to secure capital gains from older investments. In the short term this will boost liquidity and capital reserves. The search for yield then becomes a bigger problem have to be reinvested in an era of negative rates. With negative rates, the ECB is trying to stimulate inflation with an experimental unproven monetary policy which is damaging the financial system, failing to stimulate domestic demand and leading to unpredictable impacts on currency trading. It is a lethal cocktail. It is the wrong policy at the wrong time. The monetarist mantra “Inflation always and everywhere a monetary phenomenon” is out of time. For the moment, inflation is always and everywhere an international phenomenon, exacerbated by a commodity cycle driven lower by would be supply side adjustments in the energy sector. The commodity cycle is turning and will accelerate in due course. It is time to climb out of the NIRP crevasse and leave Planet ZIRP before more harm is done. The Saturday Economist on Brexit … We have had over 2,500 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. Over the next few weeks we have a great series of events with debate from either side. Don’t miss the John Longworth event on the 4th May. So what of UK rates? The inflation data data will increase the odds for a rate rise this year. The IMF has been pessimistic about the outlook for UK, writing down the forecasts for GDP growth in the current year to just 1.9%. Why so gloomy when nothing much has changed? We still expect growth of 2.5% this year despite the latest disappointing data on manufacturing and construction. So what happened to Sterling? Sterling closed up against the Dollar at $1.418 from $1.410 and up against the Euro at €1.254 from €1.236. The Euro moved up against the Dollar at €1.143. Oil Price Brent Crude closed up at $42.43 from $41.83 The average price in April last year was $59.52. Markets, were positive - The Dow closed at 17,924 from 17,589. The FTSE closed at 6,342 from 6,204. Gilts - yields moved up. UK Ten year gilt yields closed at 1.43 from 1.36. US Treasury yields moved up to 1.77 from 1.72. Gold closed at $1,226 ($1,240). The old relic rebuffed this week. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  New figures spark alarm over UK recovery, the headline in the Times today. It is the week of ONS updates on trade and manufacturing output. Like a fire alarm test undertaken once a month, a regular ring, can first alarm, then insensitive the mind to the fundamental problems behind the noise on each and every subsequent occasion. So with the trade data and now manufacturing output, the new figures spark old alarms about the UK economy. Clearly there is no march of the makers rebuilding the workshop of the world. Soon there may be no steel, nor the anvils on which to forge a trade recovery. So what is going on ... Deficit Trade in Goods … There is a problem with the UK external deficit, made manifest by the record 7% current account deficit in the final quarter of 2015. To make matters worse, the trade deficit is set to deteriorate further this year. The trade deficit with the EU increased to £8.4 billion in February. We expect a trade deficit with the EU (trade in goods) of almost £100 billion this year. The overall UK trade deficit around the world will increase to over £133 billion this year from £125.4 billion in 2015. Free trade with the rest of the world? Be careful what you wish for. The trade deficit with China was £25 billion last year. It has doubled over the last ten years. Surplus Trade in Services … The deficit trade in goods will be offset by a potential £90 billion surplus trade in services. The problem is the service sector export performance is slowing, up by a mere billion in the year in comparison. The UK has a “revealed comparative advantage” in the service sector, particularly financial services. This "advantage" can improve the international trade performance. The service sector performance can be improved by a strategy which guarantees the role of London in Europe, challenges further regulation and resists the lure of a punitive tax and penalties regime providing easy revenue to the Exchequer. No time to kill the Golden Goose ... the UK is no longer laying billets of iron and steel. Manufacturing output slumps in February … Manufacturing output fell in February by 1.8% compared to prior year. We were not expecting much growth this year, just 1%. Nevertheless, the figures are disappointing. Capital goods output fell by over 3%, consumer goods fell by 1% approximately. Textiles, chemicals and metals were badly hit in the month. Big Pharma offered the strongest area of growth up by 5% in February. Car sales hit record in March … As if to add insult to injury, car sales hit a record 519,000 in March up by 5% in the month and year to date. We expect registrations on 2.6 million this year. Manufacturing will be around 1.6 million, generating a clear import “deficit” of one million units. The strength of household spending and domestic demand will exacerbate the trade deficit. Relative demand conditions dominate the balance of payments performance. So what of Sterling … Can fluctuations in currency assist the outlook? Not really. A fall in Sterling merely compounds the problem. It is no solution. We are import dependent for food, drink raw materials, semi manufactures and finished consumer goods. Imports are relatively inelastic with respect to price. A depreciation merely generates domestic inflation or damages margins in manufacturing, wholesale and retail. For those who would look to Sterling to solve the problems of the UK steel industry, consider the basic components of iron ore and high grade coke, are totally import dependent. The biggest set back to steel output since peak in 1971 was not the vagaries of sterling, nor the evils of the EU and Chinese imports. The coal strike in the early seventies, caused an immediate loss of output and market share for The British Steel Corporation. Another self inflicted wound from which there was no recovery. The Saturday Economist on Brexit … We have over 2000 hits on our Brexit presentation last week. It’s long I know. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides are available on line with all the information needed to understand the key issues in this important vote. You can download the presentation here. Over the next few weeks we have a great series of events with debate from either side. Don’t miss the John Longworth event on the 4th May, nor The Saturday Economist Quarterly Economics Presentation on the 18th of May we will present the Brexit data then ... So what of rates … The Fed are cautious about the outlook for the world economy but still consider the UK. recovery to be sound. The decision on rates is unlikely to change this month. We still expect a further two increases in the US this year. The Bank of England will be relieved to follow in the third or fourth quarter this year. A current account deficit of 7% of GDP is incompatible with base rates at 0.5%. The alarm is ringing but no one is rushing for the exit as yet … So what happened to Sterling? Sterling closed down against the Dollar at $1.410 from $1.422 and down against the Euro at €1.236 from €1.247. The Euro held against the Dollar at €1.140. Oil Price Brent Crude closed up at $41.83 from $38.71 The average price in April last year was $59.52. Markets, were mixed - The Dow closed at 17,589 from 17,720. The FTSE closed at 6,204 from 6,146. Gilts - yields moved down. UK Ten year gilt yields were down at 1.36 from 1.44. US Treasury yields moved down to 1.72 from 1.80. Gold closed at $1,240 ($1,217). The old relic slightly buffed. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Great news from the ONS this week, the UK economy grew at a slightly faster rate than first thought. GDP growth was 2.3% for the year as a whole compared to the previous estimate of 2.2%. Not much of a change and rather inexplicable. Output growth was revised down to 2.2% from 2.3%. The mysteries of Welsh valley publications continue. We have revised our forecast growth for the current year to 2.5% using the latest published data. The Balance of Payments … So far so good. Then came news of the UK Balance of Payments and the Current Account Deficit. The current account deficit increased to 7% of GDP in the final quarter of last year. Always good to see the UK economy breaking records. This is the highest deficit on record in post war history. That’s not so good. At the end of the day, the balance of payments must balance. We are reliant on the “kindness of strangers” to fund the current account deficit - the message from the Governor in January. Deficits “with inky blots and rotten bonds sustained” - the message from Cabinet Office in the 1930s … The Current Account Deficit … The current account deficit includes the deficit, trade and goods … a deficit (goods) of £125.4 billion was offset by a surplus (services) of £88.7 billion. The net trade deficit in goods and services was £36.7 billion. The imbalance at around -2% of GDP is not really a cause for concern and is easily funded, or should be. The deterioration on the “primary income account" is more serious. Net investment income fell to minus £33.7 billion for the year as a whole and almost minus £13 billion in the final quarter. Earnings remitted from the UK are in excess of receipts from investments in foreign lands. Is this a real problem? That rather depends on whether this a cyclical challenge - a result of the strong growth in the UK compared to lower growth in Europe and elsewhere. In which case, there is no real cause for concern. The trend will reverse as foreign economies improve and overseas earnings increase accordingly. On the other hand we must consider if this a structural problem? A result of the long term reduction in UK overseas investment and the acquisition of UK domestic assets by international corporates? In which case there will be no cyclical relief as growth in Europe and the rest of the world accelerates. The current account deficit may continue to deteriorate. This may then lead to a serious credibility and funding problem. The “kindness of strangers" may not extend to the “madness of crowds”. The Twin Deficit Dilemma … The Current Account Deficit was £96 billion in 2015 (-5.2% of GDP). Government borrowing (the internal balance) was -£82 billion (-4.4% of GDP). The twin deficit dilemma represents a structural problem within the UK economy. The deficits should be as opposite sides on a see saw, one rising as the other falls. When both are down, the see saw is broken. We then spend more time on the slide … The strength of domestic demand is generating a trade deficit but earnings are not strong enough to generate the government revenues needed to offset public sector borrowing. The solution? Higher tax and higher interest rates the classic and inevitable solution to the Twin Deficit Dilemma but not just yet ... The Saturday Economist on Brexit … For the moment, the focus is on the referendum in June. We have now completed our presentation on the Brexit issue. We analyse the issues into the Business, Economic, Political and Social arguments. The latter largely confined to immigration, the political a matter of choice. Almost 100 slides are available on line with all the information needed to understand the key issues in this important vote. You can download the presentation here … Steel Crisis … So what of Port Talbot … last year China produced more steel than the UK produced over the last 45 years. Over the past two years, China produced more steel than the UK has produced since the introduction of the Bessemer converter in the late 19th Century. China has over 50% of the world steel market. The UK less than 1%. The game of Chinese Chequers, almost over. It’s Check Mate for UK steel … In the USA … In March the economy created 215,000 new jobs. Earnings increased by 2.3%. Household confidence and spending continues. New car sales were up by 3% in the month. Car registrations set for 18 million this year. We expect growth in the US of 2.4% in 2016, interest rates will continue to rise … So what of rates … Janet Yellen suggests rates may rise under caution, with a further two rises in interest rates before the end of the year. We expect UK rates to rise in the third quarter this year as inflation accelerates and commodity prices rally. The MPC will be obliged to follow the Fed at some stage … So what happened to Sterling? Sterling closed down against the Dollar at $1.422 from $1.480 and down against the Euro at €1.247 from €1.265. The Euro moved up against the Dollar to €1.140 from €1.116. Oil Price Brent Crude closed at $38.71 from $40.45 The average price in April last year was $59.52. Markets, held - The Dow closed at 17,720 from 17,515. The FTSE closed at 6,146 from 6,106. Gilts - yields moved down. UK Ten year gilt yields were down at 1.44 from 1.48. US Treasury yields moved down to 1.80 from 1.90. Gold closed at $1,217 ($1,265). The old relic is losing it’s shine. John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed