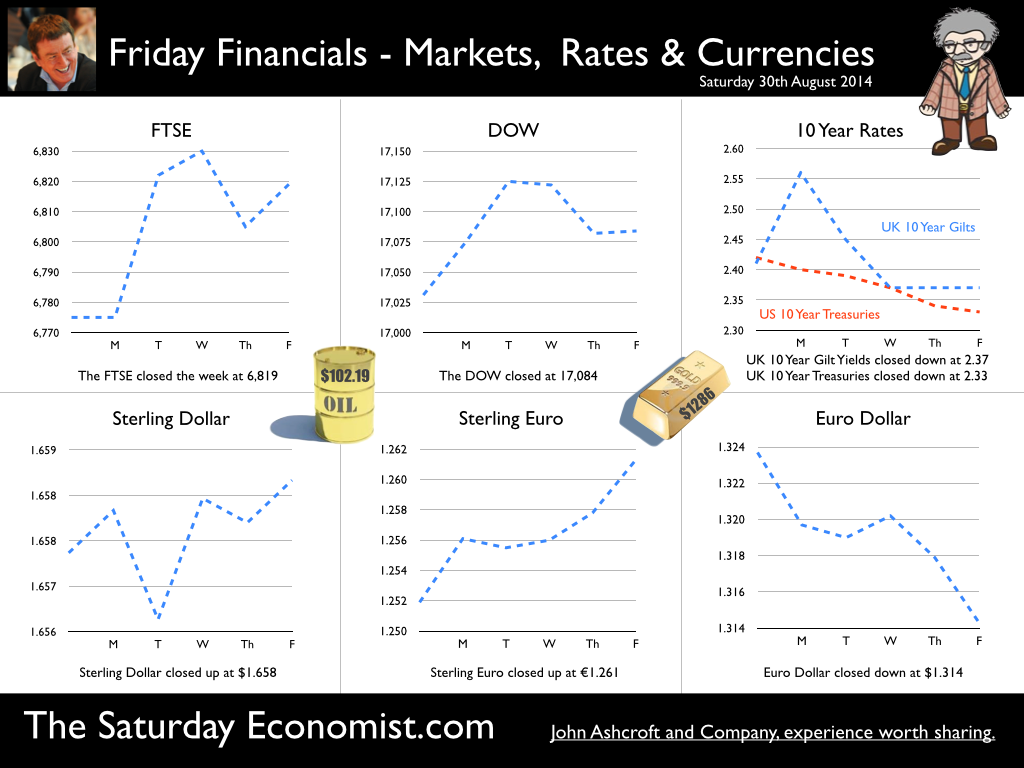

Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*

0 Comments

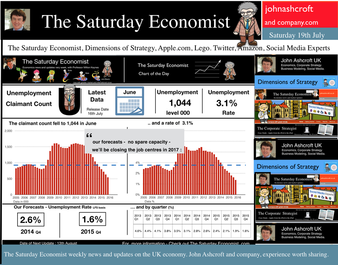

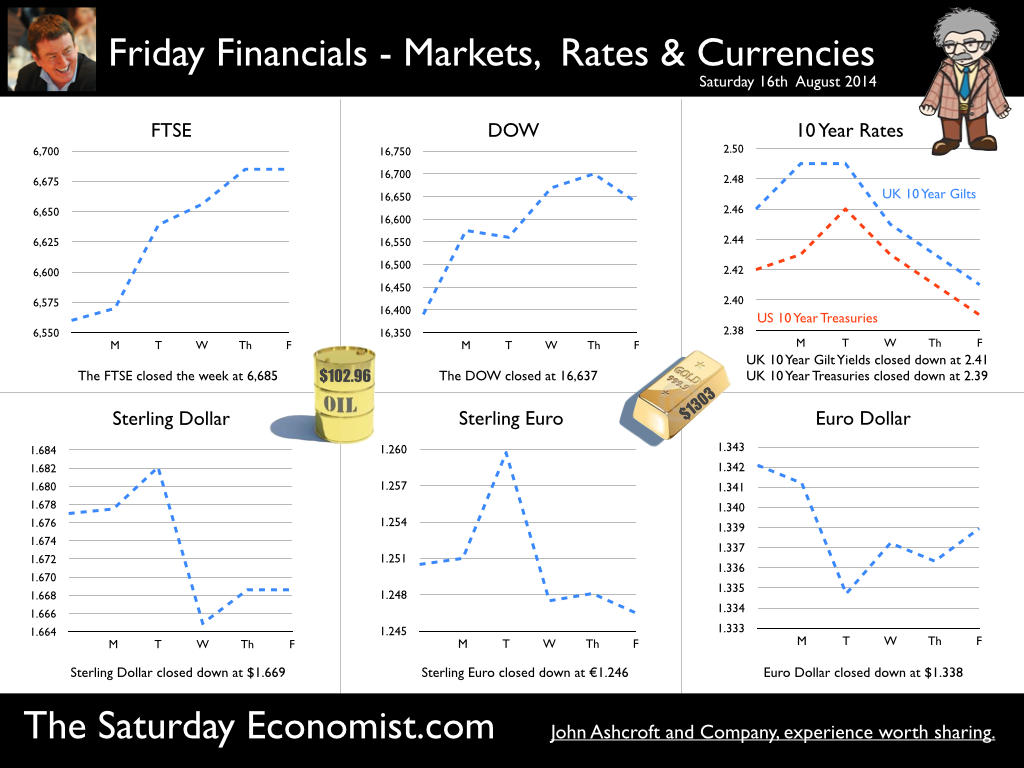

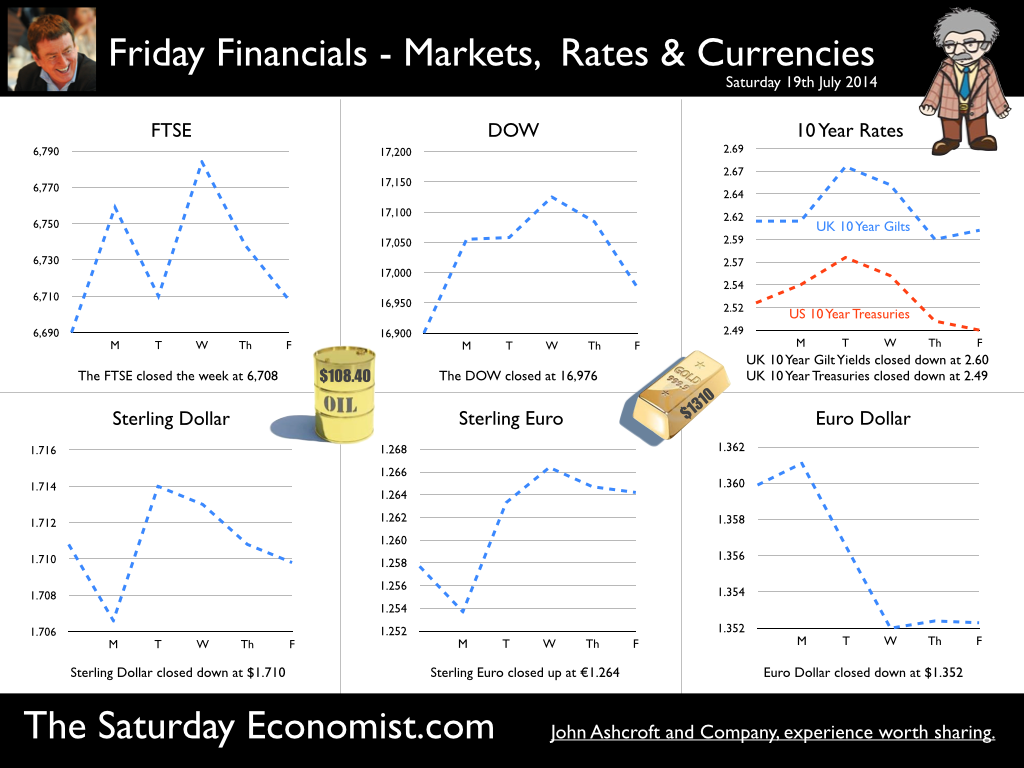

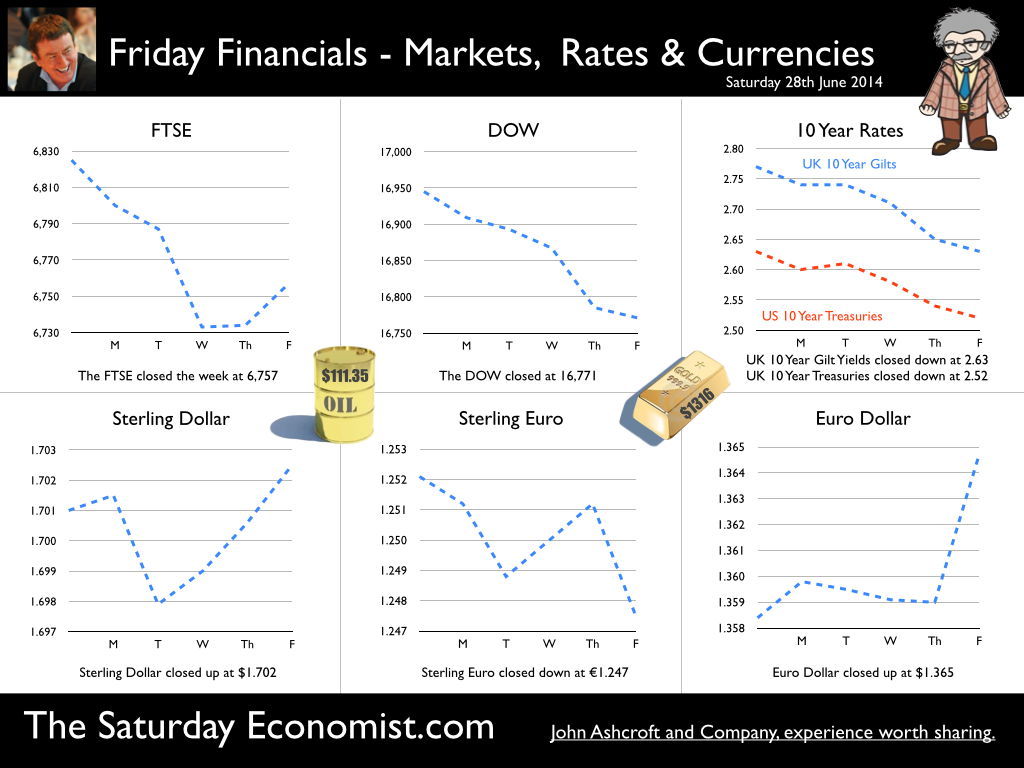

The Inflation Report Press Conference … Reassurance from the Inflation Report Press Conference this week. The Bank of England may be uncertain about what is happening in the economy but it is certainly not clueless. Excellent. £3.5 million spent on the economics model and 200 PhDs in the pot to stir up the data, not all is for nought. James Macintosh of the FT put the difficult question “It would appear you've been moving over the past five years from a fair degree of certainty towards a fair degree of cluelessness and currently - you are at the more clueless end of the spectrum.” Is this a fair point? Well perhaps. Larry Elliott of the Guardian had begun the challenge suggesting there's a wide range of views on the Committee about the likely degree of slack in the economy. There is uncertainty about the housing market, wages may go up, they may not go up. Guidance on the pace and extent of interest rate rises is an expectation not a promise … “I mean once you cut through all this doesn't it lead you to three conclusions - one, that the Bank hasn't really got a clue what's going on out there; two, that the MPC is divided about what's going on out there; and thirdly, any person thinking about taking out a mortgage on the basis of the Bank's forward guidance would be ill-advised to do so, because anything you say, has to be taken with a very large pinch of salt?” Oh dear ... The Carney honeymoon is over … Well one thing we can be certain about, this is not the questioning we would have expected under Governor King. For Governor Carney the honeymoon is over. So much for the open routine. The Emperor’s economics models are proving to be as insubstantial as the clothing. Perhaps it is time to return to the enigmatic, grumpy old professor emeritus routine, dismissive of those of a lower intellectual order including undergraduates and the press core particularly. Ed Conway now with Sky News, would occasionally rattle Governor King teasing about the accuracy of the inflation forecasts, (not actually forecasts of course) but Governor Carney,cast in the role as the unreliable boyfriend, is taking more and more hits. All a bit of a muddle … Clearly Asa Bennett From the Huffington Post rattled the Governor, sensitive to criticism of forward guidance, “I just wanted to ask Governor about the evolution of your forward guidance plan, particularly when it started with the sort of clear to understand unemployment threshold, and then the sort of output gap, and then this bolt on about pay growth. Do you wish you started with this at the beginning? Hasn’t it all been a bit of a muddle or is it a learning process? “Well you’re muddled I'm afraid”. The playground retort from the Governor of the Bank of England. So is that the best we can get? The Old Lady of Threadneedle Street - the Aunt Sally of Fleet Street … The Old Lady of Threadneedle Street is becoming the Aunt Sally of Fleet Street. It would help if Jenny Scott, Executive Director of Communications, chairing the press conference, appeared to know some of the names of the press corp, instead of jabbing a pencil in this or that direction, when it came to question time. Perhaps Jenny was trying to ward off evil spirits, waving the magic wand of oblivion, which Governor King carried so successfully in his cloak. For debutante MPC member Minouche Shafik, it was all too much. Shifting uneasily, apparently bored, struggling under the weight, not of office but of a voluminous hair style, the governor allowed Minouche one question response on Europe … Minouche : “It would be good for us if Europe grew faster since it’s our key trading market, but for the near term that doesn’t look very likely”. “That’s all we have time for”, said the Director of Communications and that was that. Well, we must hope there is much more to come. So what happened this week? GDP Estimate … The ONS second estimate of GDP was released this week. Growth in the UK Q2 increased by 3.2% compared to the prior estimate of 3.1%. Actually the numbers hadn’t changed, the statisticians were using a more accurate calculator this time round for the rounding. Our estimates of growth for the year are unchanged at 3% which makes the Bank of England estimates of growth (3.5%) all the more difficult to understand. Either the economy will grow at an eye watering 4% in the second half of the year or the Bank expects big revisions to the data in September as a result of the inclusion of drugs and prostitution in the national accounts. Who would have thought hookers had that much clout. We shall have to wait until the end of September for the update. Labour Market Stats … The jobs outlook just gets better. The claimant count rate fell to 3% in July at just over 1 million unemployed. 400,000 have found work in the past year. At the current rate of growth we will be closing the job centres at the end of 2016, there will be no on left on the register looking for work. The wider LFS data confirmed the trend with the unemployment rate falling to 6.4%. More people in work, unemployment rates falling, recruitment increasing, skills shortages heightening, which makes the pay data even more inexplicable. Earnings increased by less than one per cent in June. We would expect increases in line with inflation or more at 3% plus at this stage in the recovery. For this we have much sympathy with the models at the Bank of England, something strange is happening on Planet ZIRP. Maybe low rates are the problem and no the solution? So what of base rates … Growth and jobs data would push the argument for a rates rise before the end of the year. Inflation and pay data would suggest the rates could be kept on hold until 2015. The latest data from Europe confirms a rate rise is off the agenda for months if not years to come. The MPC will be loathe to act ahead of the Fed and not too eager to move in advance of the ECB. Markets assumed rates will be kept on hold as a result of the Inflation Report… So what happened to sterling this week? Sterling closed down against the dollar at $1.669 from $1.6774 and down against the Euro at 1.246 from 1.252. The Euro was down against the dollar at 1.246 (1.341). Oil Price Brent Crude closed down at $102.96 from 105.02. The average price in August last year was $111.28. Markets, rallied on the rates news. The Dow closed up at 16,637 from 16,554 and the FTSE closed up at 6,685 from 6,567. UK Ten year gilt yields were down at 2.41 from 2.55 and US Treasury yields closed at 2.39 from 2.49. Gold was largely unchanged at $1,303 from $1,305. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Of inflation and unemployment? Job centers will be closing in 2017 … This week the ONS released latest data on inflation and unemployment. The rate of employment growth is such, job centers will be closing in 2017, if current trends hold. Unemployment falls … Unemployment fell to 3.1% in June, (claimant count basis) and to 6.5% in the three months to May (LFS basis). The number of unemployed in June was 1.04 million. The rate of job creation has surprised not just our models but those of the Bank of England. Spare capacity will be eliminated within the next three months. Claimant count levels will be back at pre recession levels within six months and job centres will be closing by 2017 - no-one will be looking for work. Is this realistic? Probably not! Earnings remain at unrealistic levels if we accept the official data (sub 1%). The level of recorded earnings does not correlate with job levels. Neither does it sit well with evidence of household spending on car sales, retail sales and trends in the housing market. Our evidence on recruitment and skills shortages also infers that earnings should be on the increase. It is a strange world on Planet ZIRP! As for the so-called Productivity Paradox, do we really believe our businesses are taking on more and more people to do less and less work - of course not. The economy is in danger of overheating based on job trends. Productivity absorption will improve as output increases but this will not really ameliorate the inflation impact! So what of inflation in June? Inflation rises … Inflation CPI basis increased to 1.9% in June from 1.5% in May. Service sector inflation increased to 2.5% and goods inflation also increased to 0.9%. The largest contributions to rising prices came from clothing, food, drinks and transport. We expect inflation to hover above the 2% level for the rest of the year assuming sterling tracks $1.75. Manufacturing prices, increased by just 0.2% in the twelve months to June, slightly down from the prior month. Low world prices and higher sterling dollar values are easing the pressure on input costs. Metals, materials, parts and chemicals are all down in price, import cost basis. Housing Market … So what of the housing market this week? The Council of Mortgage Lenders released the latest gross lending figures for June. “The pace of lending slowed” according to the headlines. Commenting on market conditions in this month’s Market Commentary, CML chief economist Bob Pannell observes: "The macro-prudential interventions announced by the Financial Policy Committee in late June are finely calibrated and precautionary, but could nevertheless reinforce April’s Mortgage Market Review in tipping the UK towards a more conservative lending environment.” Yeah, thanks Bob. Lending was up by 20% in the first quarter, that’s an increase of almost 30% for the first six months of the year. Despite the interventions of the FPC we expect the volume of activity to increase by 25% this year and by a further 15% in 2015. Even then, activity will still be some 20% below pre recession levels. A great recovery but no real threat to the economic outlook over the medium term either. So what of interest rates … The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the inflation and jobs update. Our overall growth outlook is unchanged but the chances of a rate rise before the end of the year ticked higher in line with the index. So what happened to sterling this week? Sterling closed down against the dollar at $1.709 from $1.711 but up against the Euro to 1.263 from (1.258). The Euro moved down against the dollar at 1.352 from 1.360. Oil Price Brent Crude closed up at $108.40 from 106.90 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed above the 17,000 level at 17,100 from 16,900 and the FTSE was up at 6,749 from 6,690. UK Ten year gilt yields were down at 2.60 from 2.61 and US Treasury yields closed at 2.49 from 2.52. Gold was down at $1,310 from $1,336. That’s all for this week. Join the mailing list for The Saturday Economist™ or forward to a friend. John © 2014 The Saturday Economist™ by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Governor was in front of the Treasury Select Committee this week. Pat McFadden raised a laugh about forward Guidance - “The bank is behaving like an unreliable boyfriend, one day hot, one day cold, - people on the other side of the message not really knowing where they stand”. But is that really fair? It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the strength of sterling and the low inflation figures for May. The Governor is advising markets, “forward guidance is state contingent”. As the state of the economy changes, the timing of future rate increases will also change. No need to wait for the Quarterly Inflation Report to mark the move. The situation is fluid and dynamic. As the data changes, so will future rate rise probabilities. “Don’t watch my lips - watch the data!” the new guidance. Revisions to GDP data … And so it was, the UK data changed, slightly, this week with the revisions to growth in the first quarter. The ONS revised down growth in Q1 from 3.1% to 3%! This is hardly likely to impact on monetary policy in any way shape or form. The adjustments reflect minor statistical adjustments rather than major structural moves. Our forecast of growth for 3% in 2014 is unaffected by the change. Investment grabbed the headlines, increasing by almost 10% in the quarter. The year on year comparison was against a particularly weak quarter last year. We expect investment growth of over 7% for the year as a whole, using research data derived from the Manchester Index™. [GM Chamber of Commerce research data - capacity and investment intentions]. In the USA, the revisions to GDP growth in the first quarter were much more significant. The headlines confirm growth fell by 2.9% quarter on quarter. Yet, the underlying growth year on year was up by 1.5%. The FOMC expect US growth of 2.2% this year rising to over 3% next. So what of Medium Term Rates … In the UK, the governor would have markets believe rates will rise slowly and thereafter are unlikely to rise above 2.5% in the medium term. In the USA, the Fed present no such illusion. Medium term rates, according to members of the FOMC, are expected to rise to 4% plus and some members expect this to occur by 2016. For now, US Bond traders believe the FOMC is too optimistic about the economy. Interest rates will remain low well into this decade. But if it does happen “over there”, is the UK - US spread manageable? Hardly likely. The medium term path of UK base rates is set to return to the 4.0% plus norm in due course, narrowing the divide. As for the timing - well that is another "guidance" issue altogether! So what happened to sterling ... The pound closed up against the dollar closing above the highly significant $1.70 level. Sterling closed at $1.702 from $1.70, slipping against the Euro to 1.247 (1.252). The Euro moved up against the dollar at 1.365 from 1.358. Oil Price Brent Crude closed down at $111.35 from $114.70 as Middle East concerns cleared slightly. The average price in June last year was $102.92. Markets, closed down. The Dow closed down at 16,771 from 16,945 and the FTSE was also down at 6,757 from 6,825. UK Ten year gilt yields were down at 2.63 from 2.77 and US Treasury yields closed unchanged at 2.63. Gold was steady at $1,316 from $1,314. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed