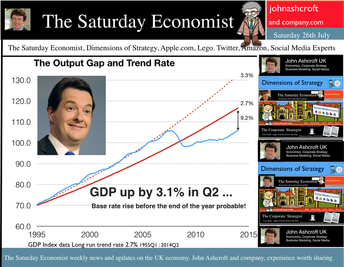

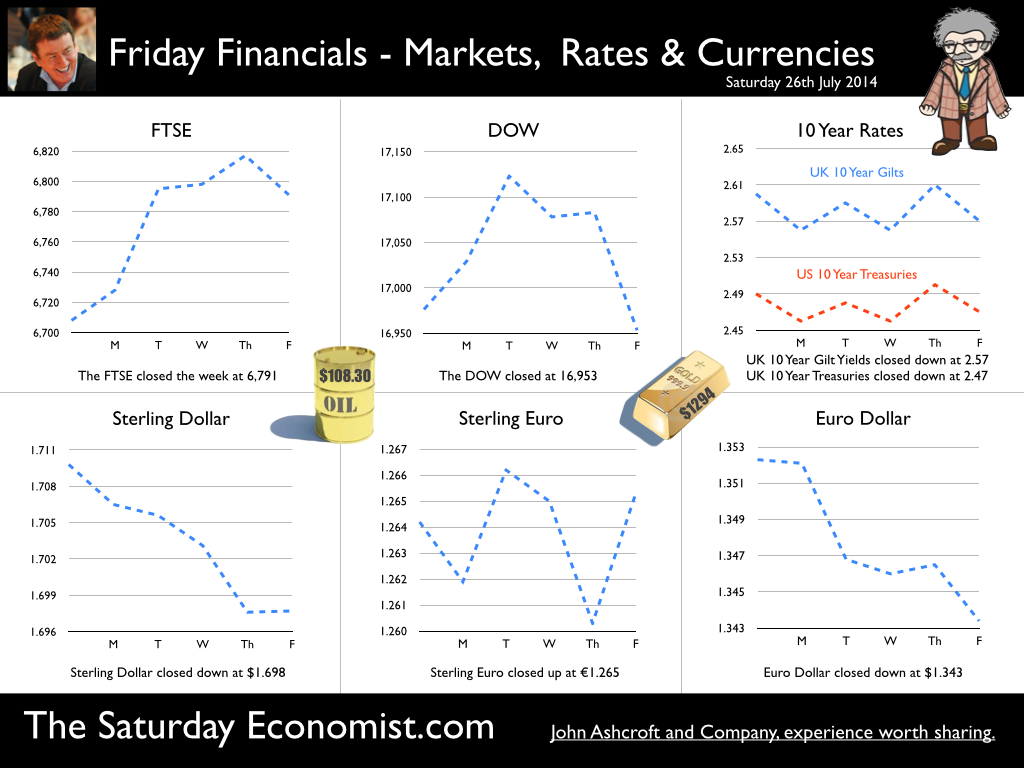

GDP up by 3.1% in Q2 ... a rate rise before the end of the year seems probable! The UK economy grew by 3.1% in the second quarter of the year according to the latest figures from the ONS. The economy is on track for growth of just over 3.0% this year and 2.8% next. The output gap closed to 9.2% based on our estimated long term trend growth rate of 2.7%. Service sector continued to support the expansion (up by 3.3%) with particularly good performances in the leisure sector (4.9%) and business services sector (4.2%). Manufacturing and construction also made strong contributions with growth of 3.2% and 4.2% respectively. This is the first estimate of growth based on partial information. The next update is due on the 16th August. The initial estimate may well be revised up (3.2%) based on revisions to the manufacturing data. This week the IMF revised their forecasts of the UK economy to 3.2% for 2014 and 2.7% next. The UK will be the fastest growing economy in the western world with deleterious implications for the trade balance. If the IMF forecasts are correct, UK growth will accelerate in the second half of the year to 3.4%. It‘s simple arithmetic not complex economics! If that is the case, The Saturday Economist™ Overheating Index™ will move higher, bringing the prospect of a rate rise before the end of the year into clear focus. Retail Sales … Retail sales volumes increased by 3.6% in June 2014 compared with June last year. This is lower than the average over the first six months of the year, a period within which the volume of sales averaged 4.1%. (March and April were particularly strong months for retail activity.) Retail sales growth averaged 3.9% in our benchmark period [200Q1 - 2008Q1]. The performance in June of 3.6% suggests MPC members will rest easy on the news, with no pressure on a rate rise evident in the data. The amount spent online increased by 13.4% year on year, accounting for 11.3% of all retail spending. The pressure on conventional retail is continuing to increase significantly. UK Government Borrowing : No fiscal fizzle, the deficit is increasing! Writing in the New York Times this week, Paul Krugman talked of the imaginary US budget and debt crisis. Despite all the fears of deficit doomsters, the US federal deficit will be just 2.8% of GDP this year, down from 9.8% in 2009. The economy is growing and the deficit is falling. It's a fiscal fizzle. “We don’t have a debt crisis, and we never did”, says Krugman. Excellent news for them over there! But is it so good over here? According to the figures released by the ONS this week, in the first three months of the year, total borrowing was higher than first quarter last year by some £3 billion. Total borrowing was £36.1 billion compared to £33.6 billion last year. Despite economic growth in the quarter of over 3%, the deficit is increasing rather than falling. The government is off track to hit the deficit target of £95.5 billion in 2014/15. The deficit to GDP ratio was 6.5% in 2013/14 set to fall to around 5.5% this year. On current trends this is not about to happen. Total debt of £1.3 trillion has risen to over 77% of GDP. Analysts are beginning to call for more cuts in spending to resolve the problem. Yet spending over the first three months of the year was up by less than 1% [ANLP basis] assisted by a fall in interest costs of almost 3%. The problem for the Chancellor - Exchequer revenues actually fell. Despite an increase in the VAT take of just over 4%, Income and CG taxes were down by 3.5%, which is bizarre in an economy growing by 3% in real terms and over 5% in nominal values. The US economy invariably demonstrates an ability to rebound, evaporating the internal deficit in the process in quite dramatic fashion. Fiscal drag, generates a fiscal fizzle, vaporising the deficit and improving the outlook for the Fed. In the UK, the process is more protracted. The current trend is troubling. No need to panic just yet. We still expect a significant rebound in the tax take through the year as the economy continues to grow at over 5% in nominal terms. The deficit was revised down last year to £105.8 billion. The target of £95.5 billion appears to be a stretch for the moment. No fiscal fizzle for the Chancellor more like a slow burn - the OBR targets could still be hit! So what of interest rates … At the last meeting of the MPC, the Committee agreed that no increase in base rates was warranted. For some members the decision had become “more balanced in the past few months compared to earlier in the year”. The latest figures on retail spending and GDP would suggest the decision remains finely balanced but the hawks will be flapping their wings. The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the GDP data. The chances of a rate rise before the end of the year edged higher in line with the index. So what happened to sterling this week? Sterling closed down against the Dollar at $1.698 from $1.709 but up against the Euro to 1.265 from (1.263). The Euro moved down against the dollar at 1.343 from 1.352. Oil Price Brent Crude closed down at $108.30 from 108.40 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed below the 17,000 level at 16,953 from 17,100 and the FTSE was up at 6,791 from 6,749. UK Ten year gilt yields were down at 2.57 from 2.60 and US Treasury yields closed at 2.47 from 2.49. Gold was down at $1,294 from $1,310. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed