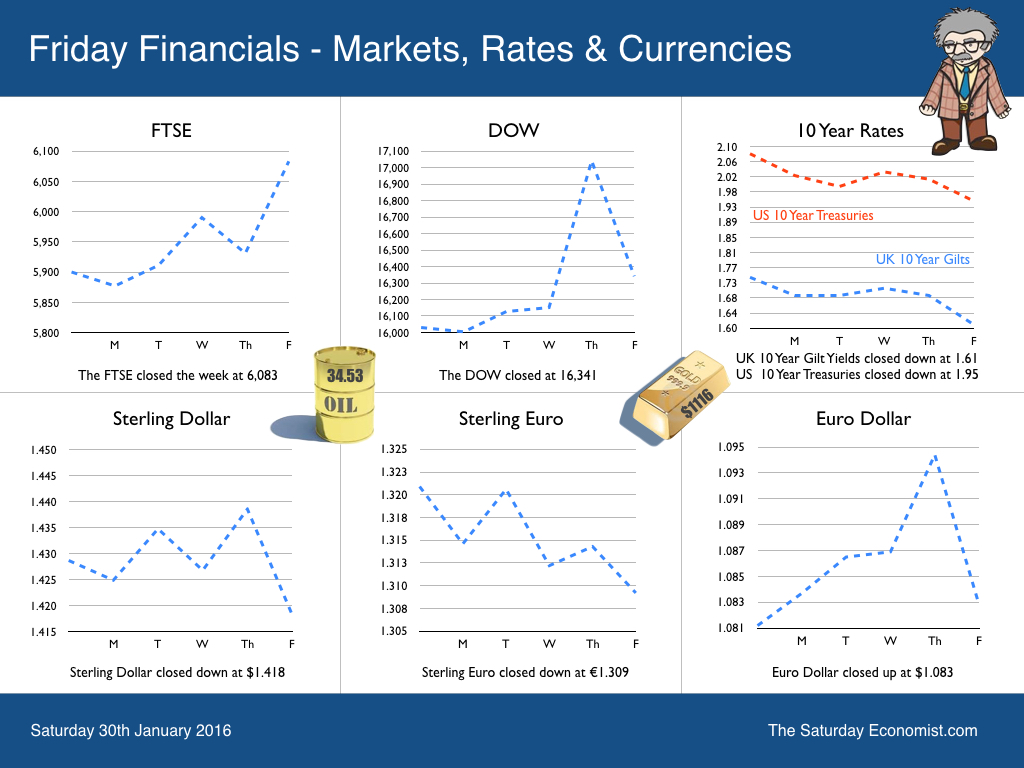

UK Growth slowed in the final quarter of the year according to the first estimate of GDP released this week. Output growth was just 1.9% in the quarter compared to a heady 2.8% in the final quarter last year. For the year as a whole growth was just 2.2% compared to 2.9% in 2014. Manufacturing output fell by 1% and construction growth slowed to 3.2% from 7.5%. The service sector remained the driver of growth, down from 2.5% from 3.5%. So what of 2016? 2.5% remains a plausible target for the moment. With growth in construction and service sector the major sectors of strength. Our full forecast update will be released next week … so watch out for that! What happened in the USA … Over in the US it was much the same story. Growth slowed in the final quarter to just 1.8% year on year compared to 2.4% for the year as a whole. Slowing consumption blamed by many but a fall in exports (goods) was largely to blame. The recovery is steady. Growth for the year is comparable to prior year levels at 2.4%. The doves accuse the Fed of jumping the gun with the December rate rise but don’t panic just yet. The kindness of strangers … This week the governor was in front of the Treasury Select Committee warning of the dangers of Brexit to the UK economy. Sterling weakness, the risk, with vulnerability and volatility the problem. Trade and capital account deficits leave the UK dependent on “foreign capital flows” - the “kindness of strangers" as he put it. Together the “Old Lady of Threadneedle Street” and the “Kindness of Strangers” account for over half of the £1.6 trillion gilts in issue. The Chancellor is set to miss his borrowing target for the current financial year, as slow growth, weak earnings and low inflation impact on the tax take. Gilt issues may have to be increased. The Old lady will be forced to cling to her handbag stuffed with bonds for the long term. This week the head of the Debt Management Office warned of the risk of a gilt strike as difficulties emerge in clearing the book on early issues this year. Foreign holdings at 25% are down from 30% six years ago. Should foreign investors loose their appetite for UK risk, pressure on Sterling will be compounded, forcing the Bank to make a move to defend the currency. In 1931, Sir Warren Fisher Permanent Secretary to the Treasury warned of deficits .. “with inky blots and rotten parchment bonds sustained”. Strange how history repeats itself … So what of markets … Last week we talked of the “GOBI desert on Planet ZIRP”. Was it the last Great Opportunity to Buy In to Western markets? Perhaps. Markets experienced a good rally last week allegedly on news of Japan experimentation with negative rates and an increase in Euroland inflation. It is a strange world on this Lonely Planet, the kindness of strangers and the madness of fools! So what do we expect of UK rates … Where do we go from here? We still expect the MPC to move within the first four months of the year, despite the weakness of growth in the final quarter. Markets are reversing, oil and commodity prices are set to rise. Fears for China are overblown, the sky is not falling down … it really is time to leave Planet ZIRP. So what happened to Sterling? Sterling moved down against the Dollar to $1.418 from $1.427 and moved down against the Euro to €1.309 from €1.321. The Euro moved up slightly against the Dollar to €1.083 from €1.080. Oil Price Brent Crude closed at $34.53 from $31.50. The average price in January last year was $47.76. The deflationary impact continues for the moment. Markets, rallied further - The Dow closed at 16,341 from 16,030. The FTSE closed at 6,083 from 5,900. Gilts - yields moved down. UK Ten year gilt yields were at 1.61 from 1.74. US Treasury yields moved to 1.95 from 2.08. Gold closed at $1,116 ($1,089). John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

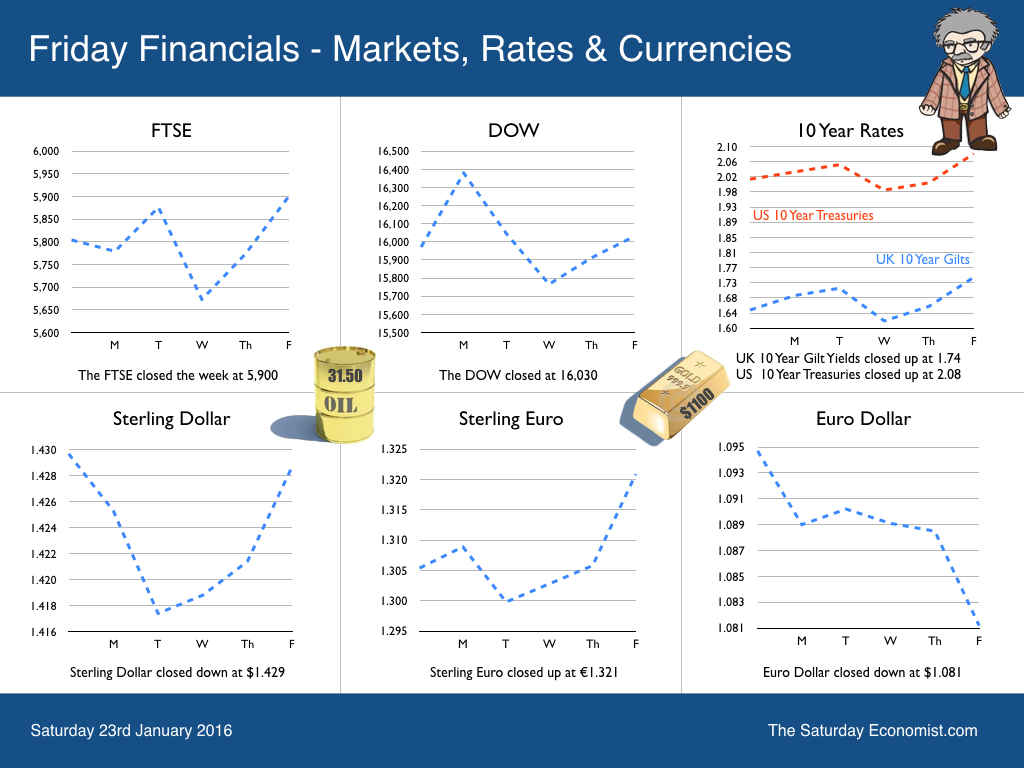

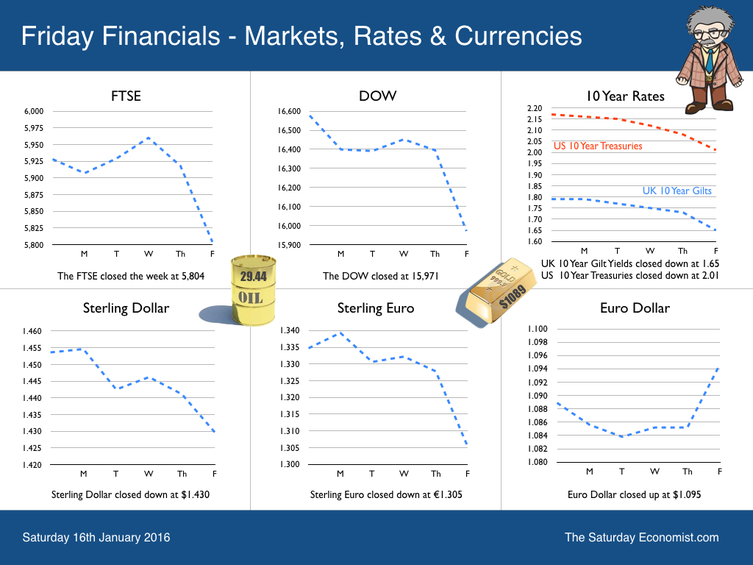

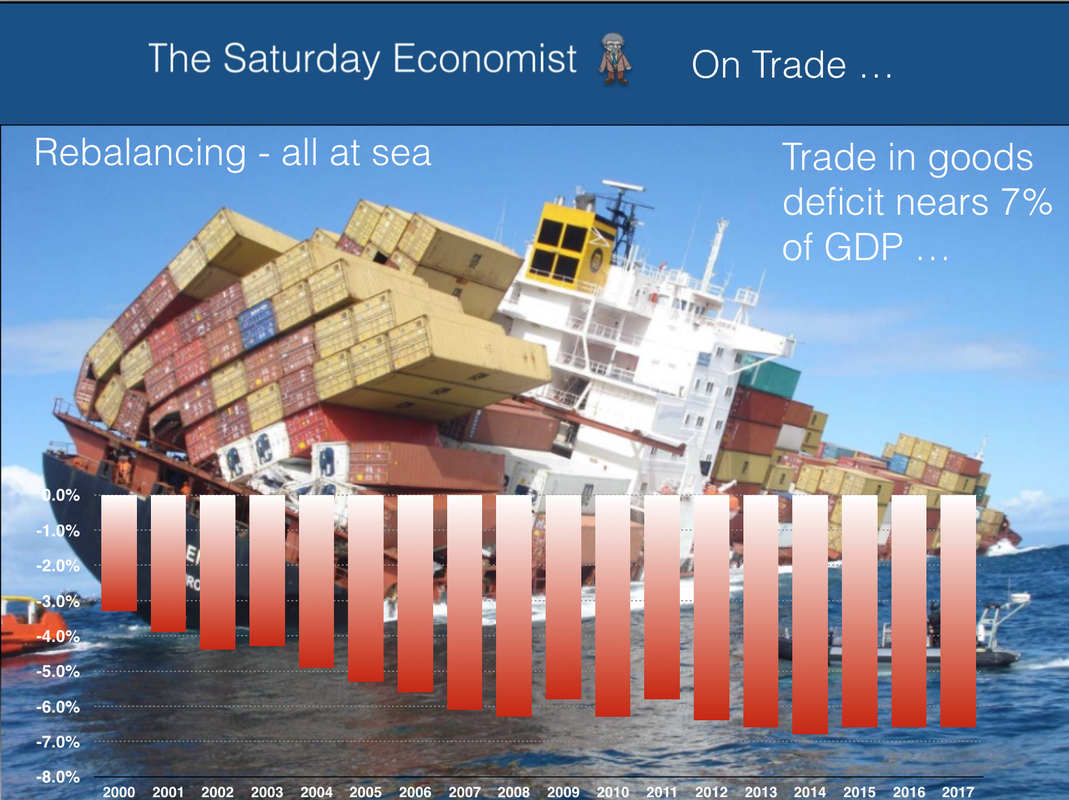

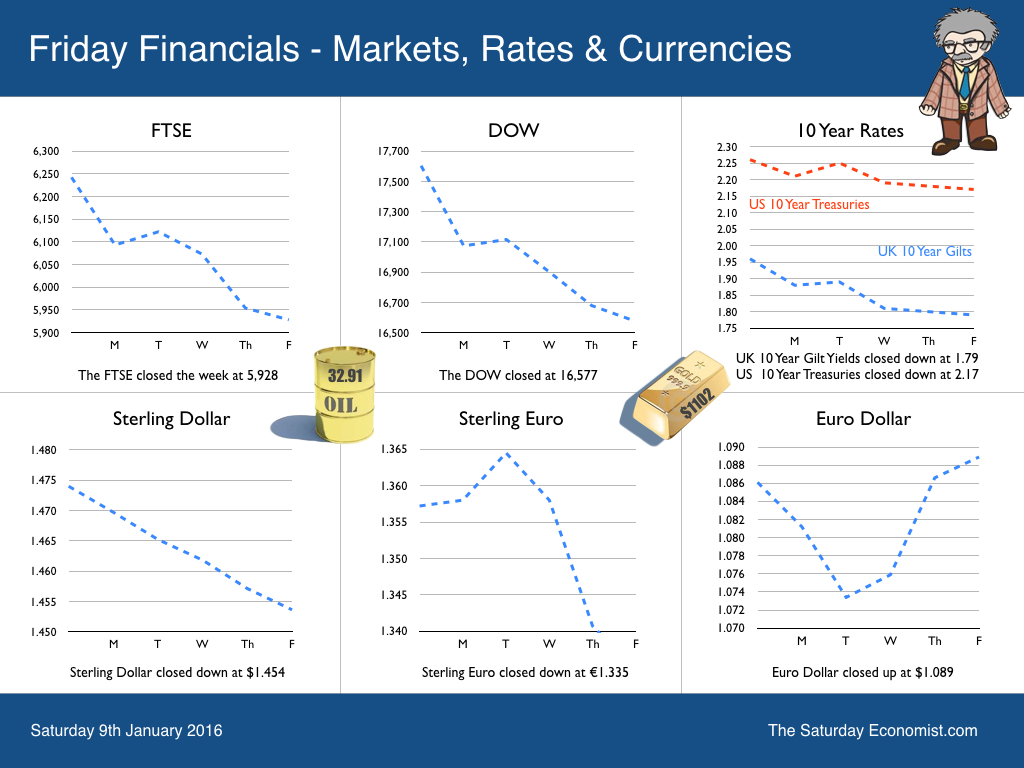

It was the week of #Davos2016. As the leaders met in the snow, the bears had their fun with the markets. Oil touched $27, the FTSE and the Dow closed below critical levels. Fears about China abundant, bulls wandered in and out of the “GOBI desert on Plant ZIRP”. Yep we think this was the last Great Opportunity to Buy In to Western markets. We are not so confident about the Eastern Shanghai Composite as we explain below. Should we worry about China? Not really. To understand what is happening in the East is to differentiate between the three issues of markets, currency and economy. Chinese growth increased by 6.9% in 2015 according to official data. The Shanghai Composite improved by 3.2% on the news. Good news on the economy bit for the markets, it’s a suckers rally. By the end of the week, the SCI closed below 3,000. Best avoided. The index is set to fall further, to clear the market around 2,000. It looks like a classic Speculative Bubble Map. [Google : Speculative Bubble Map to understand more] As for the economy, China is set to grow by over 6.5% in 2016 importing more oil and primary metals along the way. As for the Yuan, the currency is decoupling from the Dollar. The short technical position suggests dollar strength. The fundamentals of current account capital flows suggest inherent strength of the Renminbi along the way. The currency adjustment is not about trade, it’s about realignment in advance of the enhanced reserve currency status, particularly amongst the Asean trading block. For the geeks out there, the Triffin Paradox awaits as a further challenge to the Chinese authorities. Next week we will focus on “The importance of being Asean” in our weekly update. Just how important are the Asean economies to the world economy. We will explain all. Back in the UK … CPI Retail Inflation … The headline inflation rate CPI basis increased to 0.2% in December. No one seemed to notice that service sector inflation jumped to 2.9%. 2.9% is way ahead of the Bank of England target. The service sector rise was offset by weakness in goods inflation, predominantly food and oil falling by 2.1%. Producer Prices … Manufacturing prices fell by 1.2% in December. Is this significant? Yes. It is the slowest rate in the year. In August prices fell by 1.9%. The major contributions continue to be from food and oil. Inflation trends are turning as world commodity prices change tack Manufacturing costs fell by 10.8% in the month. Imported metals, commodities, oil and food the explanation. In August prices were falling by almost 15%. Prices are turning, inflation is returning. The MPC is looking the other way still operating in the misguided belief that interest rate rises take two years to impact on domestic inflation. No thought of the impact of Sterling and international commodity prices on the CPI index. Retail Sales … Retail Sales growth slowed in December to 2.6% as the value of sales fell by 1% in the month. It has been a good year for volume sales, in 2015, the volume of retail sales increased by 4.5%. Retailers were kept busy but margins were under pressure as the value of sales in the year increased by just 1.2%. On line pressures continued as internet sales increased by 8.2% accounting for almost 13% of all retail sales. Unemployment Figures … Strong growth in the jobs market continued into the close of year. The employment rate was 74.0%, the highest since comparable records began in 1971. There were 1.68 million unemployed 239,000 fewer than for a year earlier. The unemployment rate was 5.1%. We haven't seen such figures since before the great recession. Vacancies are increasing to record highs, the claimant count rate is falling to record lows. The data suggests a labour market which is overheating. Earnings fell to 2% from 2.4% in November. It’s just one month. We should not pay too much attention to what could well be an anomaly. So what of markets … The bears have had their fun as the shorts made their last play. The oil price closed above $30, the Dow and the FTSE closes above significant technical levels. The Shanghai composite closed below 3,000 despite the attempts of the PBOC and others to hold ground. The SCI is set to clear at 2,000, the donkey from Guizhou is easy meat for the bears. So what do we expect of UK rates … The Governor delivered a speech this week suggesting rates will stay on hold for some time to come. Martin Weale mandated this was not the time to raise rates based on the weakness of December earnings data. New dove in the MPC coop Dr (Gert) Gertjan Vlieghe made a speech at the LSE “I would like to see evidence that growth is not slowing further, and that a broad range of inflation indicators are on an upward trajectory from their current low levels” before voting for a rate rise! Where do we go from here? We still expect the MPC to move within the first four months of the year, despite the weakness of retail sales and earnings in December. Markets are reversing, oil and commodity prices are set to rise. Fears for China are overblown, the sky is not falling down … it really is time to leave Planet ZIRP. So what happened to Sterling? Sterling moved down against the Dollar to $1.427 from $1.429 but moved up against the Euro to €1.321 from €1.305. The Euro moved down against the Dollar to €1.080 from €1.095. Oil Price Brent Crude closed at $31.50 from $29.44. The average price in January last year was $47.76. The deflationary impact continues. Markets, rallied after mid week crisis - The Dow closed at 16,030 from 15,971. The FTSE closed at 5,900 from 5,804. Gilts - yields moved up. UK Ten year gilt yields were at 1.74 from 1.65. US Treasury yields moved to 2.08 from 2.01. Gold closed at $1,081 ($1,089). John That's all for this week. Off to see The Big Short later. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  In ancient times, there were no donkeys in Guizhou, a province in southwest China. One day, a local man brought home a donkey. Since he did not know what to do with the animal, he decided to let it roam and graze in some nearby woods. The donkey, with long legs, large ears, black hair and big eyes, terrified the local tiger. Never having seen one before, the tiger thought the donkey to be a strange divine animal sent by a god. The tiger hid in thick bushes and dared to look only occasionally at the new arrival. Out of curiosity, the tiger decided after a few days, to move a bit closer to get a better look at the donkey. The donkey let out a terrifying bray, which made the tiger flee to safety. Eventually, the tiger became used to the donkey's loud noise and began to take move closer and closer. After some time, the tiger decided the donkey did not look as fearsome as first thought. Strange how we adapt to new things. The tiger became bolder and bolder with each passing day. One day, the tiger moved really close, just a few yards away. He made a careful study of the donkey but still did not dare make a move. To find out what the donkey might do if attacked, the tiger decided to test the donkey. As the tiger grew nearer, the donkey kicked out with his rear legs but missed the agile attacker. “So that is all you’ve got”, thought the tiger. “I have nothing to fear”. He then leapt onto the donkey, killed the strange beast and devoured the most delicious dinner the big cat had ever had. The moral of this fable is that although the donkey is big, has a scary hee-haw and looks formidable if you haven’t seen one before, it can trick and mislead even a tiger but just for a short time. So what can we learn from this tale ... Donkeys like markets should be allowed to run … The Shanghai Composite Index … The Shanghai Composite Index fell 107 points (3.6%) to 2,900 on Friday from 3,008 the previous day. The index has lost over 436 points (13%) over the last 12 months.. So what does this really tell us about the prospects for the Chinese economy? Not much really. The SCI reached an all time high over 6,000 in October 2007. The collapse to below 1,700 soon followed in 2008. The bull market rally to over 5,000 in June last year looks more and more like a speculative bubble map. The current close to below 3,000 will not be enough. Technically, the market may fall to 2,000 with a prospect for overshoot. Like it or not, markets must clear in the end. Just as with the tiger and the Donkey from Guizhou, bears will realise for the authorities, circuit breakers and “national teams” are all they have got. It is not enough. Rolls Royce and the unacceptable face of communism … Rolls Royce sales in China, fell by over 50% last year. The Big Roller became the unacceptable face of communism. Slowing Chinese economic growth, stock market falls, a crackdown on corruption and investigations into wealth accumulation led to a cut back on conspicuous consumption ... back in the UK ... UK Manufacturing … In the UK, Manufacturing output fell by -1.2% in November compared to prior year. Consumer durables fell by 3%, capital goods fell by 2.7%. Basic Metals, computer and electrical output fell by over 4%. Machinery and equipment output fell by 14%. Chemicals (3.4%) and big pharmaceuticals showed growth, along with transport up over 6%. It was not enough. UK Construction … Further bad news followed on Friday as the ONS released the latest dodgy data on construction. Compared with November 2014, output in the construction industry fell by 1.1%. All new work increased by 1.3% but there was a fall of 5.1% in repair and maintenance. The main upwards contribution to new work came from infrastructure which increased by 11.7%. There is considerable doubt about the quality of the construction data. Nevertheless most forecasters have down graded their forecasts for UK growth last year to 2.3% with a similar performance expected this year and next. We await the first estimate for Q4 before revising our forecasts for the current year currently at 2.5%. So what of markets … The bears have it as the Dow and FTSE closed lower this week on the oil price close below $30 and fears from China. The man from Qi is still worried about the falling sky. Further correction is possible in the short term but the markets will look much healthier by Easter surely. As for the oil price? Well all bets are off … So what do we expect of UK rates … The MPC voted this week to keep rates on hold and to reinvest the £8.4 billion of cash flows associated with the redemption of the January 2016 gilts. Ian McCafferty was the sole hawk voting for a 25 bps rate rise. Where do we go from here? Despite the short term market turmoil, e still expect the MPC to move within the first four months of the year, … So what happened to Sterling? Sterling moved down against the Dollar to $1.430 from $1.454 and moved down against the Euro to €1.305 from €1.335. The Euro moved up against the Dollar to €1.095 from €1.095. Oil Price Brent Crude closed at $29.44. The average price in January last year was $47.76. The deflationary impact will continue. Markets, closed below critical levels on China market fears - The Dow closed at 15,971 from 16,577. The FTSE closed at 5,804 from 5,928. Gilts - yields moved down. UK Ten year gilt yields were at 1.65 from 1.80. US Treasury yields moved to 2.01 from 2.17. Gold closed at $1,089 ($1,102). That's all for this week. Don't miss Our What the Papers Say, morning review every day! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here .  A Man in Qi Worrying about the Falling Sky … 3,000 years in a small kingdom called Qi, there was a man who always worried about everything around him. He was ridiculed in his village, because he always made a fuss about everything. He was restless day and night, fearing that someday the sky would fall and the earth would sink. He constantly worried about where to hide. He could neither eat nor sleep. Then a kind hearted man came to explain to him, the sky had its own track to go around, like the Moon and stars. It would never fall down. Even if it fell, it was so huge that no one could stop it. So there was no use worrying about it and doing harm to his health. Hearing that, the man finally felt relieved and went away. He built up his savings over may years and invested everything in the Chinese Stock Market. Hence the expression "杞人忧天 Qi Ren You Tian” "A man in Qi worrying about the falling sky should never invest time and money day trading”. China Market wobbles … Warren Buffett was a strategic long term investor. “I never attempt to make money on the stock market, he would say. I buy on the assumption they could close the market the next day.” And so it was … in China this week, they did. The Shanghai Stock Exchange's circuit breakers were triggered twice on Thursday. The day ended after just 29 minutes. Calling time on trading and the circuit breakers in the process. Slowly the Chinese authorities are coming to terms with capitalism and free market capital flows. Let the markets run should be the mantra within appropriate guidelines of course. Technically the Shanghai Composite is hung with downside potential evident. The authorities are endeavoring to manufacture a floor around the 3,200 level. Too many private investors were encouraged to enter in and have yet to pay the price. The reverberations of the New Year crash, swept around the world with the Dow and the FTSE closing below strategic 17,000 and 6,000 levels. So what hope for 2016? Better hope for the Yuan …. The People's Bank of China published rate guidance for the yuan for the first time in nine trading days having allowed the currency's biggest fall in five months. Don’t worry about the Renminbi. Rate manipulation is not about a weak economy securing export growth. With a trade surplus of $600 billion and a current account balance new $350 billion, there is no need to panic just yet. A larger game is in process. The daily midpoint rate for the yuan was set at 6.5636 per dollar. Slowly the PBOC is decoupling the Yuan from the Dollar and reducing dollar denominated reserves in the process. Admission into the IMF SDR basket at the end of the year and the creation of the Asian Infrastructure Investment Bank are steps in the strengthening of Yuan world reserve currency status. With international trade flows dominated by the dollar, The PBOC is developing an alternative trade and asset denomination currency for emerging markets and the Asian trading block. Current dollar strength is a result of short rate changes. Strength, slightly at odds with the $450 billion annual current account deficit for Uncle Sam. The Chinese don’t want to be caught out, as was the Bank of France in the 1920s, with huge holdings on end of empire currency. The French were left with overvalued holdings of Sterling which couldn’t be moved at book values. The Chinese authorities will not make the same mistake with the Greenback in the 2020s. So what of US rates … US rates seem set to move higher in the New Year as jobs increased by 292,000 in December. Markets expect a further rate rise in the Spring which will put greater pressure on the MPC to follow suite. UK trade data won’t help … The latest trade figures for November were released this week. Not much in one month’s data. For the year as a whole, we expect the deficit trade in goods to be £124.3 billion in 2015 flattered by a £3 billion oil price swing. At just under 7% of GDP, the service sector surplus of £90 billion will be a welcome offset to reduce the overall goods and services shortfall to around 2%. The vagaries of sterling have little impact on the trade balance as we have long explained. Now the IMF is slowly coming to terms with the reality. Almost half of UK imports and exports are in areas of food, materials, oil and semi manufactures. Areas which are basic to growth and inelastic with respect to price. Imported components form a significant part of exports. UK exports of manufactures and semi manufactures increased by 3% in 2015. The weakness of exports to the EU largely explained by low oil prices. Into 2016, the trade in goods deficit will continue to deteriorate as our disaggregated model explains. So what do we expect of UK rates … We still expect the MPC to move within the first four months of the year. The strength of domestic demand and the continuing current account deficit will provoke a cautionary move, despite inflation weakness in the first half of the year. So what happened to Sterling this week ...? Sterling moved down against the Dollar to $1.454 from $1.475 and moved down against the Euro to €1.335 from €1.3573. The Euro moved up against the Dollar to €1.089 from €1.086. Oil Price Brent Crude closed at $32.91. The average price in January last year was $47.76. Markets, closed below critical levels on China market fears - The Dow closed at 16,577 from 17,650. The FTSE closed at 5,928 from 6,250. Gilts - yields moved down. UK Ten year gilt yields were at 1.796 from 1.961. US Treasury yields moved to 2.17 from 2.226. Gold moved to $1,102 ($1,089). John That's all for this week. Don't miss Our What the Papers Say, morning review every day! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Growth … We expect the UK economy to grow by around 2.5% in 2016 following a similar level of growth in the prior year. Output growth will be determined by service sector activity with a slightly better contribution from construction and manufacturing. Household consumption with continue to drive the recovery with a more significant contribution from investment. 2016 will continue the years of the LILIES with low inflation, low interest rates and an earnings surge pushing household spending, retail sales, car sales and housing transactions. Investment will also improve in 2016. Bear in mind almost two thirds of investment is property related (housing and commercial real estate). There should be no real fears for output growth as a result of the post recession, investment slow down. The fixed asset capital stock (plant and machinery) has returned to pre recession levels, with no limits to expansion as the result. Government expenditure will remain subdued. Export growth may increase as world markets recover. Our models continue to reflect a significant level of import dependency for any export expansion. Hence, there will be no re balancing of domestic demand or total final expenditure as a result. We expect the trade in goods deficit in 2015 to be £124.2 billion flattered by a £3 billion oil price effect. In 2016, The trade in goods deficit will rise to over £127 billion off set in part by a £93 billion plus surplus on services. The overall trade in goods and services deficit at less than 2% of GDP will not be a cause for concern. The current account deficit is set to moderate as overseas investment returns improve. This should allay fears of a balance of payments constraint to growth over the medium term. Inflation … Service sector inflation will close the year end 2015 at around 2.5%. Goods inflation has been flattered by low oil, energy, commodity and food prices prices with an average rate of -2% in the final quarter of the year. By the end of 2016 most analysts now expect inflation to be around 1% to 1.5%. A fair assumption, assuming no radical reversal of Saudi Policy on oil prices. Were that to happen, the inflation outlook could change quite dramatically as prices firm in commodities and food. Employment and Earnings … Employment growth will continue with current levels for vacancies and claimant count now at pre recession levels. Earnings growth will continue as recruitment difficulties in construction and the service sector increase. Borrowing Figures … Government borrowing figures will improve as the economy continues to grow. Low inflation is creating a fiscal drag on VAT receipts despite strong retail sales volumes. The OBR targets over the next two years may be a challenge as a result but the official targets are broadly within reach. Interest Rates … The Fed has made the first move in the escape from Planet ZIRP. We expect the MPC to follow in less than six months with March or April favourite. By the end of the year rates will be around 1% assuming no radical change in the inflation outlook. [Planet ZIRP was always assumed to be an emergency stop over and not a permanent settlement. Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts, bonds and property prices. Low cost of capital can lead to over investment in oil and commodity prices, resultant lower prices exacerbating the deflationary environment. Lower rates do not help and negative rates will impair not improve the banking system. Deposits are withdrawn to avoid punitive charges and the bank asset base and lending capacity shrinks as a result.] Brexit … Uncertainty in the run up to the Brexit vote will create a level of investment uncertainty particularly in areas of international syndicated manufacturing i.e. motor, marine and aerospace. Areas in Eastern Europe enjoying strong growth including the Czech Republic, Romania and Poland create attractive alternative investment opportunities for access to broader European markets. We expect the UK to remain "in" post the referendum. The block votes from Germany, China, USA and Japan to have significance in the final count. World Growth … World growth is expected to be around 3.5% in the year ahead. Strong growth in India, China, USA and the UK with a developing recovery in Europe will fuel growth. Oil and commodity based economies have been badly hit. Problems in Venezuela, Brazil, Russia, the Ukraine particularly marked. The slow down is also impacting on the fortunes of Saudi Arabia and Nigeria as oil revenue dependency is significantly hampered. We expect oil prices to bounce back to $60 Brent Crude basis through 2016 as OPEC begins to react to the reality of US production and domestic self sufficiency. Should we worry about China … China is the second largest economy in the world, with a population on 1.3 billion struggling to get into the world top eighty in terms of GDP per capita. Per capita wealth equality with the USA would deliver a Chinese economy valued at $40 trillion, that’s four times the current level, probably doubling world GDP values in the process to around $150 trillion. Chinese growth may slow to 6.5% as the economy moves to service sector, household consumption based growth. The continued demand for energy and commodity resources will be maintained. With international capital reserves of $3.5 trillion dollars, we should not worry too much about China over the short to medium term. Things not to worry About … What colour are the eyes of a Yeti, Equilibrium Real Interest Rates, The Meandering NAIRU, The Output gap, The Capacity Gap, Productivity, Household Mortgage Debt, The Vagaries of Sterling, the elusive J curve, the departure from Planet ZIRP and the timely death of QE. Things to worry about … The ease with which the government introduced the Apprenticeship Levy, the Living Wage and the Buy to Let Clamp Down without adequate consultation and deliberation. The challenge to asset prices, particularly bond prices as interest rates are set to rise. Possibly … the developing trade deficit and the evident current account deficit. Labour Market over heating Missing out on regular updates from The Saturday Economist. For a full set of forecasts, check out our latest economic Outlook for January 2016 and join the mailing list for the Saturday Economist Weekly Updates. TheSaturday Economist, We always keep you in the picture! Our What the Papers Say, Twitter morning review will continue in 2016! Follow @jkaonline We wish you all a Happy New Year. Have a great 2016. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed