|

From hospitality to healthcare, companies are complaining they can't get staff. Recruitment difficulties are increasing, pay rates are rising. More perks and promises are on offer to secure sign ups. The pingdemic isn't helping.

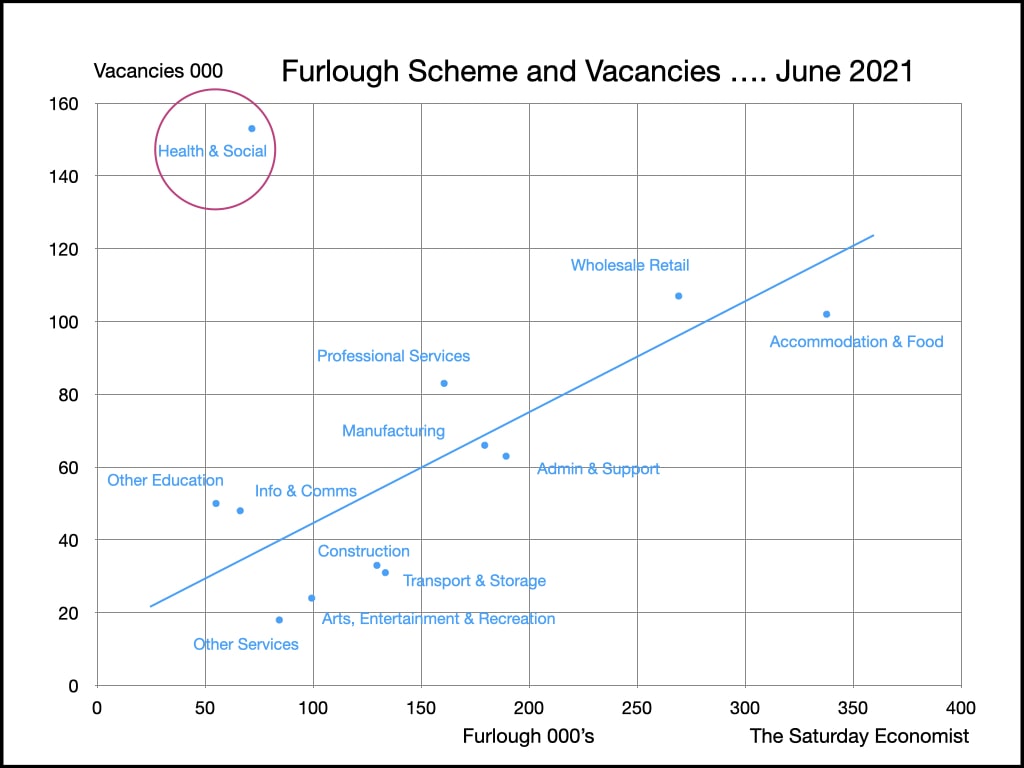

This week, the SMMT reported production shortfalls as a result of the global chip shortage, caused by the pandemic and staff shortages caused by the pingdemic. By the end of July, almost 700,000 workers had received isolation alerts from the NHS "Stay at Home" App. The motor trade is just one of many, hit by the pings. The list of "reserved" occupations is expected to rise. Isolation conditions will ease, for all in August. For the wider economy, the problem of labor shortages will persist compounded by the furlough scheme. At the start of the year, 4.7 million were on furlough. The total number had fallen to 1.9 million by the end of June, according to HMRC data. More than a third of the working population have been supported by government schemes, since the pandemic began. Latest figures show the UK Government supported over 14.5 million jobs during the crisis, at a cost of £325 billion pounds. So where have all the workers gone? Not far really. In June the number of vacancies in the economy had increased to 860,000. 1.9 million were furloughed. 1.6 million were out of work. The largest number of vacancies were in accommodation and food (102,000) and retail distribution (107,000). The largest sectors for furlough retention were accommodation and food (338,000) and retail distribution (270,000). There were almost three workers furloughed for every vacancy in hospitality and retail. On average there were 2.2 furloughed workers for every vacancy in the economy as a whole. The furlough scheme is due to end in September. The anomalies within the jobs market may begin to unwind in the final quarter of the year. The expected rise in unemployment may not be quite as bad as many are forecasting ...

0 Comments

Our Chart of The Week, examines the relationship between vacancies in the economy and the number of people on furlough. The sectors to which most attention is drawn are accommodation and food and the retail sector.

The retail sector has been subject to structural disruption as more business moved on line. Jobs have been protected on furlough as more vacancies have been created in "new distribution" opportunities. The accommodation and food sector has been impacted by the repatriation of EU workers, the staycation boom and the geographical switch to holiday hot spots including the South West, Devon, Cornwall and the Lake District. The correlation between furlough and vacancies is high across most sectors. The anomaly is with the health and social care sector. 153,000 vacancies are reported in June, with just over 70,000 on furlough. There are over two vacancies for every worker still on furlough. It is the inverse of the overall picture. The recruitment crisis will continue in healthcare and social care long after the pangdemic and pingdemic impacts have faded ... Good news for the Chancellor this week. In the first three months of the financial year, borrowing fell to £69.5 billion compared to almost £120 billion last year.

The out turn was £19 billion below the OBR forecast. The fiscal watchdog had penciled in borrowing of £234 billion in the current financial year. If the current trends were to be maintained, the outcome could be a drop in borrowing levels to around £175 billion. The fall reflects stronger than expected tax receipts and lower than expected spending. The OBR had forecast growth of just 4% in the current year. Market expectations are for growth of between 7% and 8% this year, a significant adjustment worth between £30 and £40 billion in receipts alone. Corporation Tax, Income Tax, and National Insurance Receipts were all much higher. Stamp duty receipts spiked in June, as transactions were brought forward to beat the deadline. The downside surprise in the data, was the reduction in government spending due to lower subsidies including CJRS and SEIS. Social spending was lower, as was the expected debt interest costs, despite the rise in total debt to £2.2 trillion. The recovery is on track despite the Pingdemic shock. Borrowing is set to fall to less than 5% of GDP in the net financial year. Even so policy seems "All At Sea" as the Treasury seeks control. No money for police pay, no money for doctors as applicants for training places are told to come back next year. No money for overseas aid, no money for leveling up. No money to complete the extreme Northern loops of HS2. The Chancellor is set to announce his three year spending plans in the Autumn. Budget action is set to be delayed until the Spring. It is not clear if the Chancellor and the Prime Minister are swimming in synch ... evidence of formation remains "all at sea" ... Christine Lagarde, President of the European Central Bank, is used to holding the line. As a former member of the France National Synchronised Swimming Team, she knows a thing or two about maintaining formation.

In the US, the Fed remains committed to maintaining interest rates at the zero bound and continuing the $120 billion per month asset purchase programme. In the UK, despite noises of debate on the MPC, there really is no real prospect of an increase in rates as yet. The NHS isolation App is making sure of that. Rishi Sunak's £1 trillion pound bank note, may yet be filled before the end of the financial year. Borrowing may be falling but not yet to levels within the purchase capacity of the private sector. Trapped on Planet ZIRP, the process of Gross Asset Inflation continues. Bond yields were unchanged during the week. Markets moved higher in The US and Europe, the DOW, NASDAQ and S&P closed at new highs, following the early week flutter. Markets are playing "What time is it Mr Wolf". Each step closer to the time to run but pushed ever nearer by peer group pressure and the fear of missing out. Expect more volatility as experienced at the start of the week. The Dow dropped 4% before recovering at close. At its latest meeting, the ECB governing council said it would allow inflation to rise above target without corrective action. European Central Bank pledged to maintain monetary stimulus for even longer. As Phil Aldrick, writing in the Times explained. "The change in emphasis was likely to mean no rate rises until 2023 at the earliest. It reflected the ECB’s new “symmetrical” inflation target. The previous target, circa 2003, had been to keep inflation below but close to 2 per cent." The ECB governing council stated the plan to get inflation back to 2 per cent “may also imply a transitory period in which inflation is moderately above target”. Christine Lagarde, the ECB president, said the comment “underlined our commitment to maintain a persistently accommodative monetary policy”. Sound familiar? Yes even in Europe, inflation is always and everywhere a transitory phenomenon. Fortunately for the Europeans, CPI inflation is just 1.9% for the moment ... The Pandemic Emergency Purchase Programme continues, Pepping the markets in the process ... Central Bankers came under increased pressure this week as inflation levels continue to rise. Jerome Powell, Chair of the Federal Reserve admits to being "uncomfortable" about the level of price increases.

“This is a shock going through the system associated with reopening of the economy, and it has driven inflation well above 2%. We’re not comfortable with that,” Mr. Powell told the Senate Banking Committee on Thursday. CPI Inflation hit 5.4% in June. Fed officials are set to continue discussions at the July 27-28 meeting over how and when to gradually pare their purchases of $120 billion a month in Treasury and mortgage securities. The Prospects of tapering and rate rises, failed to impress markets. US Ten Year Bond yields closed down at 1.31. Some suggest Larry Summers, former US Secretary of State, could be right. He predicted there would be a one in three chance of the high inflation the U.S. saw in the 1970s. He also said there would be a one in three chance the Fed would have to quickly hike interest rates in response to inflation, stifling price increases and causing a recession. He assigned the final one in three probability that everything would work out just fine — fast growth without problematic levels of inflation. Could he be right? Or rather how could he be wrong. The Summers play, is an each way bet on every runner in the race. The smart money is on the third option. Steady growth with inflation returning towards peg into 2022. Trapped on Planet ZIRP, the Fed can but do otherwise. UK Inflation Hits 2.5% in June In the U.K. inflation CPI basis increased to 2.5% in June, the Bank expects levels to rise to 3% before returning towards the 2% target later this year. Not all members of the MPC are in agreement. Dave Ramsden thinks inflation could hit 4% before falling back to target. He thinks conditions are such, a tightening in policy may be required somewhat sooner than he had previously expected. Michael Saunders, in his "Inflation Outlook Speech" this week, explained, "In my view, if inflation indicators remain in line with recent trends, it may become appropriate fairly soon, to withdraw some of the current monetary stimulus. In this case, options might include curtailing the current asset purchase program – ending it in the next month or two, before the full £150 billion has been purchased – and/or further monetary policy action next year." Markets were unimpressed. Ten year gilt yields closed lower at just 63 basis points. The Pound closed lower at $1.3785. On the duck ponds of Planet ZIRP, the ducks are quacking but have yet to realize they are long since pinioned and incapable of flight. The Chancellor still has need of the £1 trillion bank note. For lovers of detail, inflation CPI basis jumped to 2.5% in June. CPI(g) goods inflation increased to 2.8% from 2.3% prior month. CPI(s) Service Sector inflation closed at 2.1% from 1.9%. Manufacturing output prices slowed to 4.3% from 4.4%. Manufacturing input costs eased to 9.1% from 10.4%. Oil prices and metal prices featured in the underlying cost pressures. Input costs may have peaked In May. The pass through rates are roughly 50% from input prices to output prices. The pass through rates are roughly 70% from output prices to CPI goods. The process offers a three month lag. CPI(g) accounts for roughly 50% of the total CPI index. That's why we expect inflation to hit the 3% level in the next few months, peaking in August, easing to 2.5% perhaps by the end of the year. What Next For Oil ... Oil prices have peaked according to CNBC's Jim Cramer. Calling the top "right here" for oil, "the hottest trade of the year is over". Time for fundamentals to come into play. He believes U.S. companies will begin to bring production back online. This jump in supply comes on the heels of OPEC and its oil-producing allies reportedly nearing a deal that would also boost production. In the July Short-Term Energy Outlook, the EIA forecast Brent crude oil price will average $73/b in the third quarter of 2021 and will fall to average $71/b in the fourth quarter. Brent crude oil price is expected to average $67/b in 2022. Brent Crude closed the week down $2 this week at $73.65. For inflation fears to abate, we look for the drop below $70 dollars to provide significant reassurance. In the meantime in the Fed we trust, inflation will subside and the age of the magic money tree will continue to flourish in the rich forests of Planet ZIRP ... Our Inflation Models and Chart Book and our updated Labour Market Charts are available to Premium Subscribers. My thanks to all of our new subscribers in July, your support is invaluable to us ... Finals weekend at Wimbledon and Wembley, a great couple of sporting days ahead. Is it really coming home on Sunday! Let's hope so. We wish the England team well, as they put an end to all those years of hurt!

Markets wobbled mid week. The ebb and flow of fortune on court, always evident in the markets. The Dow closed down below 34,200 on Thursday, before closing at a new record high at almost 35,000 by the end of the week. American markets moved higher, European markets followed. Turmoil in the East, Asian stocks moved down. Beijing keen to pressure tech stocks with a US listing. The tech favorites like Alibaba, Baidu and Tencent moved lower, creating a new buying opportunity in the process. The FTSE tested the 7,000 level before closing slightly down at 7,122. Markets were troubled by so-called slowing growth in the UK economy. The ONS released the GDP Monthly estimate for May. Growth increased by just 0.8% month on month, compared to 2% in April. Is the economy slowing? Not really. Year on year, we expect growth of over 22% in the second quarter. The UK economy is on track to hit our central scenario of 7.5% growth this year and 5.5% next. The full slide deck with our scenario forecasts is available to view and down load to TSE Club Members and Premium Subscribers. In the US, the Federal Reserve is reporting material shortages. Recruitment difficulties are slowing the pace of the recovery. Car output is hampered by the global chip shortage, supply side challenges in the housing market are pushing up prices. As with all things, the market will resolve the anomalies. Fears of oil price hikes abound, yet world demand will not return to pre-pandemic levels until Q3 next year. OPEC failed to reach an agreement on output levels this week. Oil Prices moved lower at close. Halifax reported house prices dipping for the first time since January. The annual rate of price growth was just 8.8% in June compared to 9.6% in May. For the second quarter, we model house price increases at 10%. We expect the rate of growth to slow to 6.5% by the end of the year. The inflation story is abating. Ten year bond and gilts yields closed lower at 1.35 and 0.66. So what next for bond yields? It takes two sides to make a market. UBS Wealth Management said this week that it still expects yields to reach 2 per cent this year. BlackRock Investment Institute is shying away from government bonds on the basis that skinny yields offer little cushion to compensate. Making sense of economics, strategy and financial markets in strange turbulent times is our mantra. We always keep you in the picture our objective ... It really is time to get serious about The Saturday Economist Club ... become a Premium Subscriber ... you get access to all the great research and publications ... including our forecast updates ... Phil Aldrick reports of a mugging in Downing Street this week. The Chancellor received help from Treasury and the OBR to convince the Prime Minister it was time to dig up the magic money tree in the rose garden.

Within days, Sunak was warning of a possible end to the triple lock, an end to furlough scheme and an end to the universal credit coupon. No money for the Biden's Global Belt and Braces initiative, money had to be found for building batteries in the UK. Does the state have any “fiscal space” left? Yes, the OBR said, because the Bank of England can buy the debt issued by the government! No talk of QE, a clear admission of the process of monetary financing of the fiscal deficit. We call it Dire Straits Economics, money for nothing, gilts for free. Plus we don't even have to worry about repaying the debt. Here's why ... In 2008 we warned of the dangers of monetary policy. Rates at the zero bound could leave us 'trapped on Planet ZIRP'. Rate hikes on the Planet have led to more than one flight cancellation in the past. In 2021, central banks are still struggling to raise rates. The process of tapering will have to be delayed. In 2012 we asked and explained what's wrong with QE. Central banks were buying gilts and bonds. Purchases were pushing up prices and lowering yields. Central Bankers were creating the biggest bond bubble in history according to Andy Haldane Chief Economist at the Bank. By 2020, the language of "QE" was abandoned. Andrew Bailey, Governor of the Bank of England admitted the Bank was acting as the "Buyer of Last Resort", acquiring monetary assets from the Debt Management Office. Without central Bank intervention, 'the government would have struggled to fund itself', said Andrew Bailey in an interview with Sky News in April last year. In June this year, the Governor explained, The Bank of England Monetary Policy Committee voted this week to keep rates on hold and to maintain the existing target of UK government bond purchases at £875 billion. No mention of QE. QE is dead. Central banks cannot as yet raise rates. A reduction in the rate of asset purchases, the process of tapering, cannot begin, until the level of government annual borrowing falls within the capacity of independent financial institutions and the appetite of overseas holdings. UK Insurance companies and Pension Funds picked up just over 5% of new gilts issued in 2020. Their share of total holdings fell to 28% from 58% at peak before central bank intervention began in 2009. In 2020, the Bank acquired almost 70% of new debt issued by the DMO. By the end of the year, the Bank of England stock of government gilts increased to almost £800 billion according to the Debt Management Office. The Bank had become the largest owner of UK debt accounting for 32% of total issue. The promise of the Chancellor's £1 trillion pound bank note will soon be filled. The Treasury creates the borrowing need, the Debt Management Office issues the debt. The Treasury, underwrites the Bank of England purchases. The coupons paid on the Gilts held by The Bank of England are remitted, paid back to the Treasury. We call this Dire Straits Economics" "Money for Nothing Gilts for Free". Better still, the debt, the liability owned by the Treasury, is an asset owned by the Bank of England. Both are owned by Her Majesty's Government. Inter-group consolidation at some date in the future would imply that £1 trillion of government liability could just fade away. No need to worry about the debt burden for your children, grandchildren and great grandchildren and generations beyond. Like old soldiers, the gilts will lose their shine and just fade away. That's the real beauty of Dire Straits Economics. Want to know more? You can access and download the slidedeck with video clips on the Saturday Economist Club Web Site. Become a Premium Subscriber, you will have access to the pack ... The Governor of the Bank of England Andrew Bailey warned this week of "Inflation Alarmism".

Prices are on the rise. House prices increased by over 11%. Haribo deliveries are failing, for a lack of lorry drivers. Construction costs are rising at the "drop of a hat". Quoted prices are good for just 24 hours. A shortage of materials is compounding pricing dilemmas in the building industry. Andy Haldane the outgoing and departing Chief Economist at tthe Bank of England warned this week, inflation could hit 4% before the end of the year. He believes the Bank of England is not doing enough to control inflation. A "higher inflation narrative could become the dominant theme." Left too late, monetary policy would have to play catch up with larger and faster interest rate increases than would otherwise be the case. "Everyone would lose" if the Bank has to execute a "handbrake turn" he said. Haldane was delivering his Swan Song Speech to the Institute for Government this week. He always delivers great speeches. The "Dog and The Frisbee" a particular favourite. Given at the Federal Reserve Bank of Kansas City's 36th Economic Policy Symposium at Jackson Hole Wyoming in 2012. The theme was "The Changing Policy Landscape". The Chief Economist explained, to the assembled gathering, "catching a frisbee is difficult", yet a dog can master the technique. Indeed some dogs like border collies are better at frisbee catching than humans. Consider frisbee catching as an optimal control problem, the important thing is to keep your eye on the frisbee. So it is with policy making, the important thing is to keep your eye on the frisbee and the policy objective. Haldane had called for a reduction in the planned rate of asset purchases at the last two MPC meetings. The Governor hit back by the end of the week. Warning of alarmism, he said, "It is important not to overreact to rising prices and risk killing off the recovery. The rise in prices is likely to be temporary. Inflation is everywhere and always a temporary phenomenon, he might have added. Lumber prices in the US have fallen back from over 50% at peak. Copper prices are some 10% off the year high. The economy is bouncing back but the "Output Gap", (who can remember the output gap), the output gap remains some 10% off trend growth. At the end of May some 2.4 million in the UK were still on furlough. Trapped on Planet ZIRP, the Bank cannot reduce the level of gilt purchases until the demands of the DMO can be met by the capacity of independent financial institutions. Rate hikes on the Planet have led to more than one flight cancellation in the past. For now the Bank must keep eyes on the frisbee. It is right not to take a bite. We expect inflation CPI basis to rise to over 3% and soon before easing towards a 2.5% by the end of the year. What happens next for oil prices remains key ... we expect oil prices Brent Crude to fall below $70 dollars in the Summer months. Rising Oil Prices could kill off recovery ... executing a process of demand destruction and raising fears of rising inflation ... In our "What next for oil prices", published in May we expected oil prices Bent Crude basis to average $66 dollars in the third quarter of the year.

Prices closed last week at $76 dollars. The OPEC delay to any decision on output increases didn't help. The US administration is voicing concerns as the market tests the $75 dollar level. OPEC concerns rise as fears of "Demand Destruction" loom. Analysts on Wall Street believe oil prices are on track to climb significantly beyond $80 a barrel in the coming months, potentially even surpassing triple digits as soon as next summer. Goldman Sachs sees international benchmark Brent crude averaging above $80 in the third quarter, with potential spikes “well above” that level as demand comes roaring back. JP Morgan expects crude oil prices to “decisively” break into the $80s during the final three months of the year. Morgan Stanley believes Brent will trade between $75 to $80 through to the middle of 2022. Analysts at Bank of America, however, are even more bullish. They argue Brent prices could see $100 in the summer of next year. All three of the world’s main forecasting agencies, OPEC, the International Energy Agency and the U.S. Energy Information Administration, expect a demand-led recovery to pick up speed in the second half of 2021. Crude markets are searching for the price that would start to destroy demand growth. The US administration fears we may be already there. OPEC is anxious to avoid that fate. The cartel may look to hold prices above $70 dollars but sooner or later the US oil rigs must respond to the call. For inflation fears to abate, the drop below $70 dollars would provide significant reassurance ... As for policy ... as Sebastian Wallaby [Foreign Relations] reported this week, In the Fed we trust, inflation will likely subside and the age of the magic money tree will continue to flourish in the rich forests of Planet ZIRP ... (OK I added the bit about the forests). Sebastian Mallaby is Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed