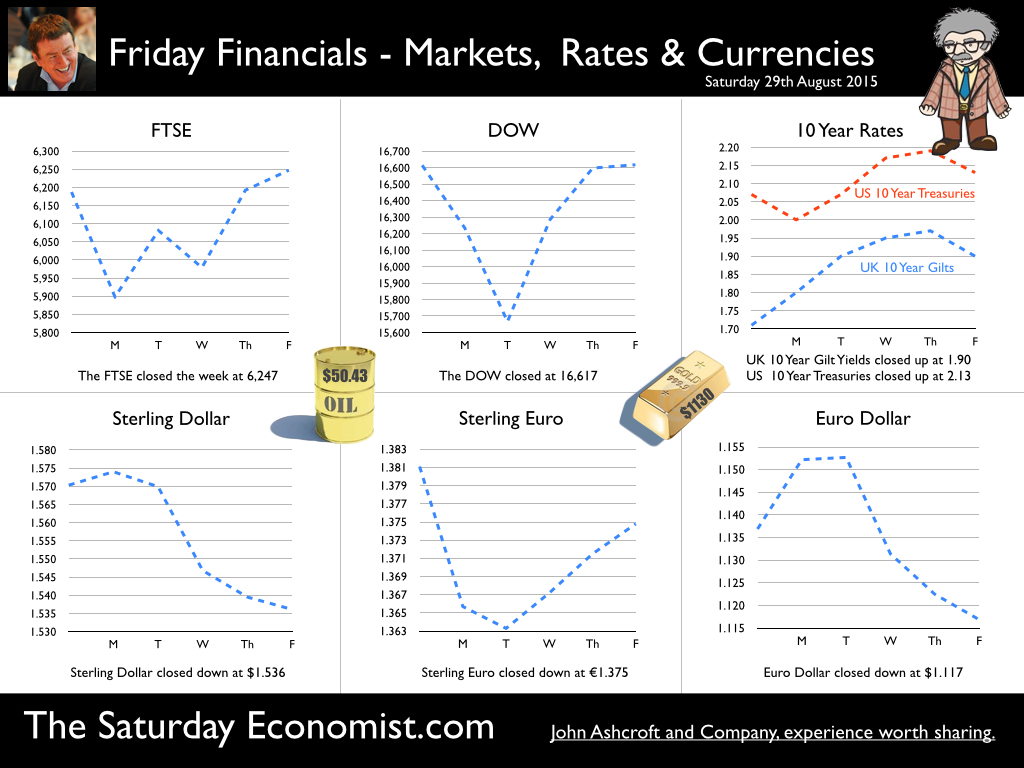

The Shanghai index fell further this week … 2,900 in the week before rallying to 3,232 at close. A recovery of sorts. Shanghai stocks are down from the 5,166 peak in the middle of June. A near 40% collapse from peak. The price drop leaves the index back in line with the 3,200 level at the start of the year. Does this signal real problems in the Chinese economy? Not really. The “Great Fall of China” is just another great example of the Speculative Bubble Map. A dramatic rise in price followed by an equally dramatic collapse. The professional traders, suck in the punters in a professional bull race followed by a bear short move. The innocent are caught unawares. Governments caught off guard. A command economy unable to command stock markets. Lessons rarely learned. It has happened before and it will happen again, ere too long. For Chinese investors, they only have to go back seven years to 2008 to have experienced the same thing on an even larger scale. Movements in markets of such dimension, do not reflect the underlying strength or weakness in the wider economy. So what of international markets …? In the US and UK shares shrugged off concerns with the FTSE and the Dow closing largely unchanged on the week. We would expect some recovery in levels over the final quarter as the underlying strength of the recovery in the US and UK continues. So what of growth? In the US the Bureau of Economic Analysis produced a revision to growth estimates in the US economy in the second quarter. US growth year on year increased by 2.7% largely driven by household spending up 3.1% and an investment surge up by almost 6%. For the year as a whole we expect US growth of 2.8% following growth of 2.4% last year. In the UK, the ONS released the second estimate of growth in the second quarter. Growth year on year was unchanged at 2.6% compared to 2.8% in the first quarter. We expect this to be revised up at some stage to deliver 2.8% for the year as a whole. Growth in the (private) service sector continues to drive output, up by 3.7%. Construction, up by 2.5% and manufacturing, up by 0.5% continue to disappoint. Data (especially construction data) will be subject to upward revision in due course. From a demand perspective, household spending (up 3.3%) and investment (up 4.9%) were the key drivers of domestic demand. Inventories fell, shipped abroad presumably. Exports increased by 8% and imports increased by just 6%. The trade deficit fell £9 billion compared to £11.2 billion last year. [Chained Value Basis]. Another trade miracle? Not really! A blip rather than a trend! So what of Rates? Market expectation have eased with regard to the Fed rate rise in September but mixed signals from the Fed emerged this week. William Dudley, the head of the New York branch of the Fed, said this week, it was “important not to overreact to short-term market developments”. “The argument for tightening monetary policy as early as September seemed “less compelling to me now than it was a few weeks ago” Stanley Fischer, the vice-chair of the Fed’s Board of Governors, made it clear a rate rise next month is still a possibility, despite volatility in the markets and uncertainty about China. So what will happen? We can't be sure. We will have to wait for the Fed meeting in just two weeks. It is time to leave Planet ZIRP. The engines on the runway are causing turbulence enough. US growth and strong labour markets will push for take off. Fasten your seat belts. The rate rise rumble will rattle markets over the next few months. Still worried about China? Don’t forget Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Imagine “Bloomberg meets Beyonce” that sort of thing! Book Now! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.536 from $1.570 and moved down against the Euro to €1.375 from €1.381. The Euro moved down against the Dollar to €1.117 from 1.137. Oil Price Brent Crude closed at $50.43 from $45.19. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. A forecast, clearly tested by latest US oil stocks data and OPEC inaction. Markets, held after some markdowns intra week! The Dow closed at 16,617 from 16,614. The FTSE closed up 6,247 from 6,187 up 60 points. Gilts - yields rallied. UK Ten year gilt yields increased to 1.90 from 1.71. US Treasury yields moved to 2.13 from 2.17. Gold moved down to $1,117 ($1,158). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

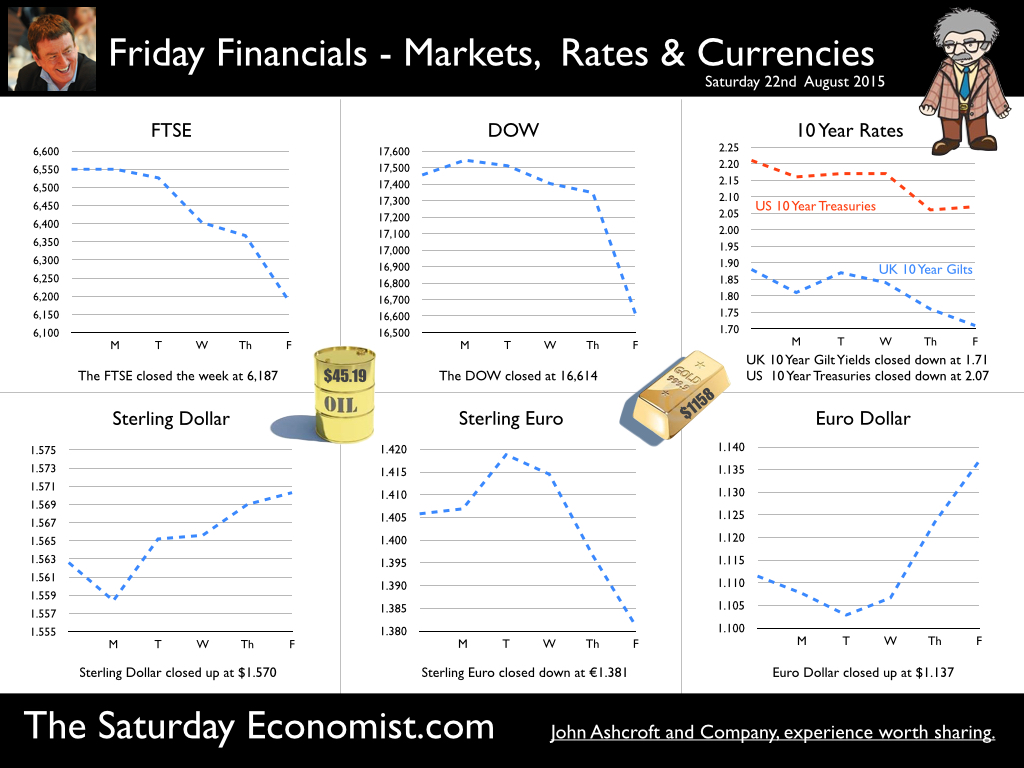

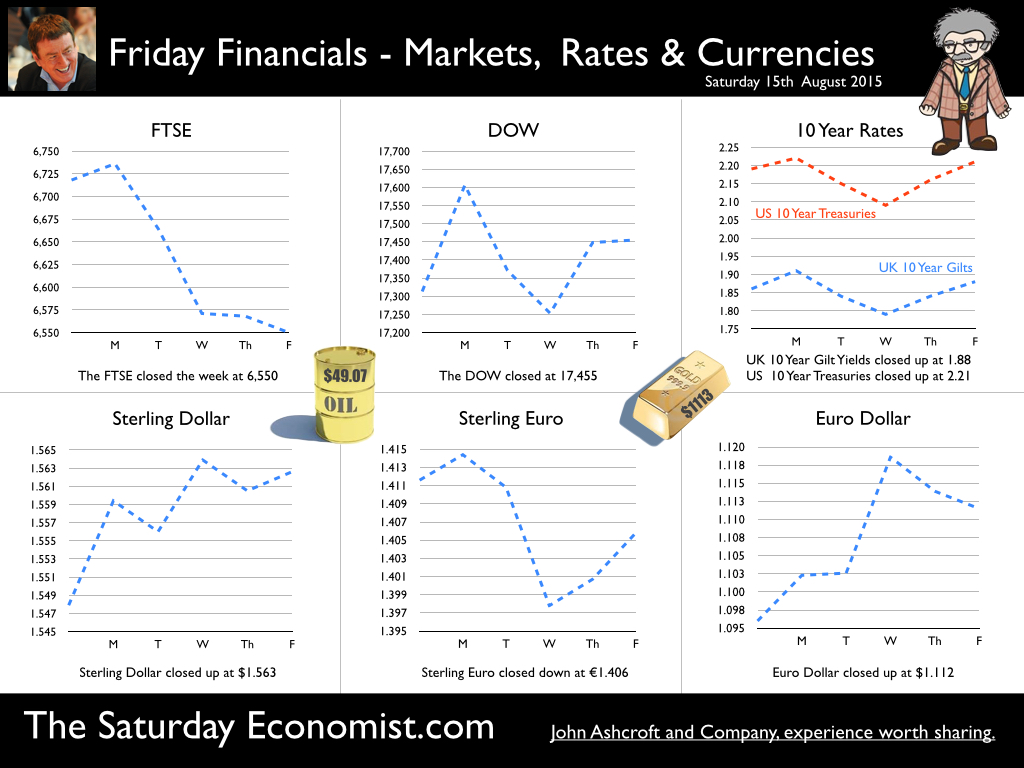

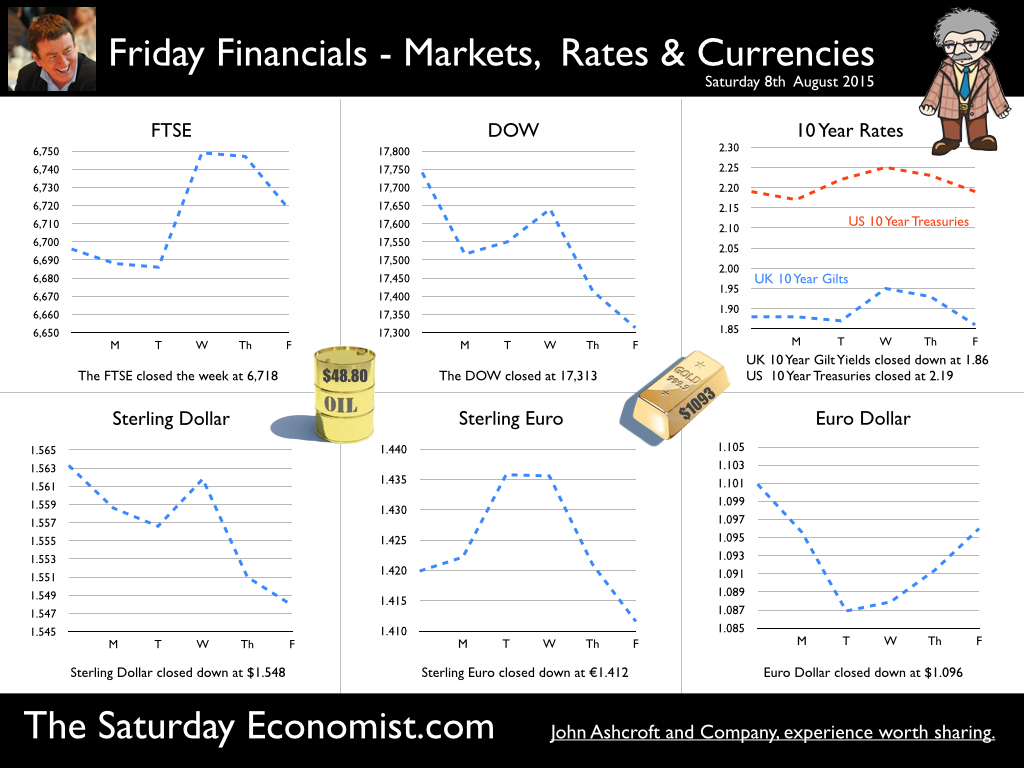

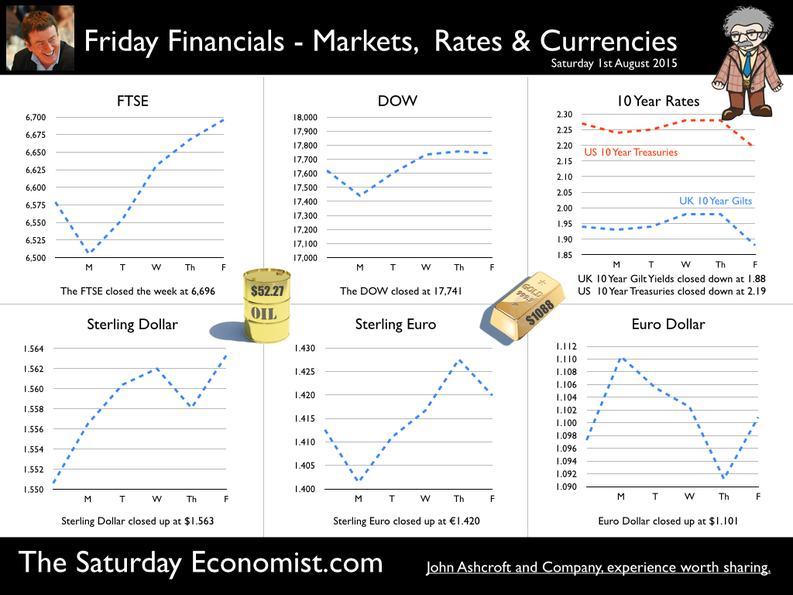

It should have been a great week for UK markets. Inflation edged higher, the retail sales boom continued and government borrowing fell over the first four months of the year. The good news on the UK recovery continued. So what happened? The FTSE fell by over 5%. Bond prices moved higher, gilt yields fell. Markets around the world slumped as fears about China and commodity prices continued. Last week the markets were trying to adjust to a currency devaluation for the Renminbi. This week, China’s Caixin Manufacturing PMI™ index fell to 47.1 in August from 47.8 in July. A 77 month low confirmed worst fears. Growth in China is slowing and may be below the official 7% estimate for GDO growth in 2015. China’s voracious appetite for primary commodities is slowing, putting pressure on metals and energy prices worldwide. In China, the Shanghai index fell by 11.5% last week, bringing the fall from the highs this year to over 30%. Churlish to point out out the index is still above the levels in February. Maybe the Chinese authorities know just how and when to prick a market bubble. Should we be so worried? Not really. World demand for energy and commodities continues to grow. The supply side is yet to adjust from over supply and surplus stocks in oil and copper specifically, energy and metals generally. Turmoil set to continue … We are leaving Planet ZIRP. Fasten your seat belts, there will be some turbulence on take off. With an anticipated rise in US rates and a strengthening of the dollar, the shock wave will extend to currencies and bond prices across the world. Despite fears to the contrary the “Sky is not falling down”. Chicken Licken and friends were devoured by the fox. In markets, chickens are devoured by bears. The shorts are out, in thin trading volumes in a holiday month. Prices are receding, just as the seas retreat from the beach before the Tsunami. It’s August, the commodity price outlook could look materially different by the end of the year. Inflation moved higher in July … UK inflation moved higher in July with the headline CPI increasing to 0.1% from 0.0% in June. Service sector inflation increased to 2.4%. Core inflation increased to 1.2%. Prices are moving higher. No need to worry about deflation, despite the strength of Sterling and the weakness in world commodity prices. The strength of domestic demand is gradually pushing prices higher. Retail Sales … In July retail sales volumes increased by 4.2%. The retail boom continues with a strong performance in housing related items particularly. For retailers, the news is mixed. Values increased by just 1%. Online sales increased by 13%, accounting for 12.6% of all sales. Multi Channel or die the mantra. For the consumer, growth in jobs and wages is improving confidence. This is the year of the LILIES after all. Real earnings adjusted for inflation are back to pre recession levels. With inflation and interest rates set to rise … this may be as good as it gets for households. Government Borrowing … The Chancellor recorded a surplus in July of £1.3 billion. Borrowing in the first four month of the financial year was just £24 billion, down by £7.4 billion from the same period last year. Income and corporation tax receipts were up by over 5%. VAT receipts were up by over 3%. Central government current receipts in July were 3.9% higher than in July 2014. Growth leads to higher revenues - True! Spending over the first four months of the year increased by just 0.1%. A great combination. For the year as a whole, the Government is on track to hit the OBR target of around £70 billion, down from £88 billion last year. With total debt of £1.5 trillion, it’s probably just as well. Worried about China? Linda Yueh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Imagine “Bloomberg meets Beyonce” "Ian King Live" that sort of thing! Book Now - Click Here! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.570 from $1.5633 and moved down against the Euro to €1.381 from €1.406. The Euro moved up against the Dollar to €1.137 from €1.112. Oil Price Brent Crude closed at $45.19 from $49.07. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. A forecast clearly tested by latest US stocks data. Markets, moved lower! The Dow closed at 16,614 from 17,455, down 5% in the week. The FTSE closed at 6,187 from 6,550 down 5.5%. Gilts - yields slumped. UK Ten year gilt yields fell to 1.71 from 1.88. US Treasury yields moved to 2.07 from 2.21. Gold moved up to $1,158 ($1,1193). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. Check out the web site - Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  European growth continued at a steady pace into Q2 … European growth continued at a steady pace into the second quarter according to the latest flash estimates from Eurostat. Euro area growth increased by 1.2% compared to 1.0% in the first quarter, year on year. We expect growth of around 1.3% this year with little impact from the QE stimulus. Clearly, the PIGS are leaving the trough with growth in Portugal, Italy, Greece and Spain up by 1.5%, 0.5%, 1.4% and 3.1%. German growth of 1.6% was significant amongst the big four with France up by just 1.0%. No data as yet for Ireland in Q2. Celebrations continue following the heady growth of 6% in the first quarter. With the Greek crisis resolved in the current round, the Euro area is set for growth to continue into 2016, assuming no deterioration in Ukraine and Eastern Europe more generally. In the USA … U.S. industrial output moved into higher gear in July on the strength of auto production up by just over 10%. Manufacturing output increased by 1.5% year on year with strong demand for cars and consumer goods particularly. Since 2000, US manufacturing growth has averaged 1.7% [excluding the 14% fall in 2009]. The data will provide a further teaser for the Fed. Evidence of growth but hardly a threat to inflation. Will this lead to a later decision on a rate rise? Perhaps. For the moment, the money is on a rate rise next month - but the decision is data dependent after all! UK Jobs … The latest data on jobs and employment was released this week. The claimant count fell to 792.4 thousand down by 5,000 on prior month and by 220,000 prior year. The unemployment rate was 2.3%. Vacancies increased to 735.000 delivering a UV ratio of 1.08. Total earnings increased by 2.4% in the three months to June. Private sector services earnings increased by 2.8%, construction earnings increased by 3.5% and leisure sector earnings increased by 3.8%. The number of people in work increased by 350,000 over the past year with all of the growth explained by full time employees. The rate of job creation may be slowing but the levels are above the highs pre recession, placing pressure on recruitment and earnings. With inflation at zero overall in June, real earnings are boosting confidence and retail sales. This is the year of the LILIES with low inflation, low interest rates and an earnings surge. Real earnings (adjusted for inflation) are back to pre recession levels. We may look back and realise this may be as good as it gets for the consumer in this recovery cycle. So what about the Renminbi … Lots of excitement about the Chinese devaluation this week. A competitive structural adjustment in a deteriorating economy? Not really. The eye on the prize is acceptance into the IMF SDR basket of currencies. No need to rush in pegged to an overvalued dollar. The IMF accept the Yuan is fair value at current levels. The Chinese authorities have made it clear further devaluation is not required or desired. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.563 from $1.5483 and moved down against the Euro to €1.406 from €1.412. The Euro moved up against the Dollar to €1.112 from 1.096. Oil Price Brent Crude closed at $49.07 from $48.80. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, rallied. The Dow closed up at 17,455 from 17,313 but the FTSE closed down at 6,550 from 6,718. Gilts - yields moved higher. UK Ten year gilt yields rallied to 1.88 from 1.86. US Treasury yields moved to 2.21 from 2.19. Gold moved up to $1,113 ($1,093). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The August deal is now open. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Super Thursday and the Inflation Report … It was Super Thursday this week. The Bank of England released the decision on interest rates and the minutes of the meeting at the same time. A new approach to communications at the Bank of England … an end to the drip feed of information around monetary policy decisions. Decisions and minutes of the meeting together at the same time! Excellent! No longer would commentators have to speculate on the line up of hawks and doves over the next few weeks. The minutes revealed just one hawk on the MPC this month. Ian McCafferty alone believed risks to the medium-term inflation outlook justified an immediate increase in Bank Rate. McCafferty voted for a 25 point increase. It didn’t happen. David Miles retires from the MPC after six years service, never having seen an increase in base rates at all. A job well done? So what can we learn about the future direction of interest rates … In the madness of King George, Dr. Pepys, analyses the King's stools and urine believing that body wastes may contain some clue to the Royal malady. So too economists analyse the comments and statements on the Governor’s output, to garner some clue about when base rates are set to rise. The speech in Lincoln, the MPC minutes, the Inflation Report, opening remarks and Q&A. So when will rates rise? It isn’t clear yet but the timing is getting closer. In his Lincoln speech, the Governor warned the decision as to when to increase rates will likely “come into sharper relief around the turn of this year”. In the opening remarks for the Inflation Report the Governor said “the likely timing of the first Bank Rate increase is drawing closer. However, the exact timing of the first move cannot be predicted in advance; it will be the product of economic developments and prospects. In short, it will be data dependent …” And what of the data ? So what of the data? It’s confusing. The slowdown in Russia, Brazil and China. The weakness of world trade volumes. The strength of Sterling, the collapse of oil, energy and commodity prices. The continued low inflation levels, the rise in wages, the strength of consumer confidence and spending, the slow down in the jobs market, the somnolent productivity trends. In the US the GDP figures for Q2 were disappointing but the July jobs data continues to point to stronger growth. The Fed may still move in September, clearing the path for the MPC to follow within four to six months. A decision which is data dependent is a decision confused by signals from a UK economy clearly on the turn. The Bank has revised the forecast for UK growth this year to 2.8% with an inflation outlook of 1.5% in 2016 based on a $57 oil price. Base rates set to average 1% in 2016. Yes the timing of the first Bank Rate increase is getting closer! Meanwhile … In the minutes, the MPC agreed to buy a further £17 billion of gilts. “The Committee agreed to re-invest the £16.9 billion of cash flows associated with the redemption of the September 2015 gilt held by the Asset Purchase Facility.” The DMO has a lot of gilts to sell this year - £120 billion to be precise. The Old lady is splashing the cash to assist the funding process. So what of manufacturing … Manufacturing output increased by just 0.5% in June and by just 0.6% in the second quarter. Strong growth in consumer durables was offset by a fall in non durable output and a weak performance in capital goods. The data is consistent with the preliminary estimate of GDP in the second quarter. The march of the makers slows to a crawl ... so much for re balancing. And what of trade … The UK’s deficit on trade in goods and services was estimated to have been £1.6 billion in June 2015, compared with £0.9 billion in May. This reflects a deficit of £9.2 billion on goods, partially offset by an estimated surplus of £7.6 billion on services. Patrick Hosking writing in The Times today talks of the “false dawn” in the re balancing agenda based on the June data! Alas it was ever thus. Strong growth in the UK will lead to an increasing deficit - trade in goods. Domestic demand growth is import dependent. As for exports, policy makers fail to take into account the heavy dependence on imports to achieve an export target. Exports are import dependent, for raw materials, components, parts and semi manufactured goods. International manufacturing syndication within the car, marine and aerospace industries - a clear demonstration of the problem. Wings, wheels and water may be the champions of export growth but they suck in an awful lot of foreign product in the process. Higher export growth in manufacturing? Be careful what you wish for! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.5483 from $1.563 and moved down against the Euro to €1.412 from €1.420. The Euro moved down against the Dollar to €1.096 from 1.101. Oil Price Brent Crude closed at $48.80 from $52.27. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, cooled. The Dow closed down at 17,313 from 17,741 but the FTSE closed up at 6,718 from 6,696. Gilts - yields softened. UK Ten year gilt yields fell to 1.86 from 1.88. US Treasury yields were unchanged at 2.19. Gold moved up to $1,093 ($1,088). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal now closed. You can still save money if you buy your tickets in August. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  We feature in the UK Top Ten Economists this week … This week we featured at number six in the CityAM Top 100 economists in the UK & Ireland. A great privilege to be in the “most influential top ten list! Based largely on social media profiles, Jonathan Portes, Diane Coyle, Andrew Sentance, Chris Williamson, Kate Barker, Bridget Rosewell and Mark Gregory are also listed. These great names will also feature in The Saturday Economist Economics Conference in October. It’s a great line up. Robert Chote (OBR) and Carl Emmerson (IFS) will also be with us, along with top journalists and commentators. You can check out the full CityAM list here and get details of the economics conference here. Buy your tickets soon, it promises to be a sell out at the Radisson in Manchester on the 2nd October. GDP Preliminary GDP Q2… This week the ONS released the preliminary estimate of GDP in the second quarter of the year. Growth year on year was up by 2.6% following growth of 2.9% in the first quarter and 3% last year. Service sector growth was up by 2.7% held back by a sluggish public sector performance, up by just 0.6%. Private sector services surged ahead at 3.6% lead by leisure sector growth (distribution, hotels and restaurants) of 4.5%. Napoleon may have claimed we are a nation of shopkeepers, (“Une nation de Carrefour et Conforama” [unverified]) but we are rapidly becoming a nation of party animals. The march of the makers rebuilding the workshop of the world in the quest for £1 trillion exports by 2020 long forgotten. Manufacturing output increased by just 0.5% and construction output increased by just 2.2%. The construction data is at odds with survey data and empirical observation. Our Manchester Index suggests growth will be revised up to 2.8% in the second revision of GDP, based on a revision to construction data. Our forecast of 2.8% - 2.9% growth for the year as a whole unaffected by the latest GDP estimate. US GDP Growth … In the US, the BEA (Bureau of Economic Analysis) released the second quarter estimate of US GDP. Growth was up by 2.3% compared to 2.9% in the first quarter and 2.4% last year. Personal consumption increased by just over 3% and gross private sector investment was up by 4.5%. Weak government spending (0.3%) and a surge in imports (4.9%) impacted on the overall growth figure. Will this change the Fed view on rates? Into August and the view is the Fed will make the move before the end of the year. September may be a little premature. The FOMC statement this week was as enigmatic and phlegmatic as usual … “The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.” So when will rates rise …? The FOMC looks set to move on rates over the next few months and we expect the UK to follow before the end of the year or early next. Oil prices and commodity prices continue to push world price levels lower. Interesting that Antofagasta has just taken a $billion dollar bet on copper prices, despite the six year price low. According to The Times, The FTSE 100 miner is set to outbid BHP Billiton for a 50% stake in the Chilean Zaldivar mine. Perhaps they know something we don’t but then Barrack Gold are the sellers! That’s the beauty of the market. Buyers and sellers, bulls and bears. We are bulls and expect a significant change in oil and copper prices into the final quarter of the year. Don’t get too carried away by the strength of Sterling either. UK growth will come at the expense of the trade imbalance despite the fortunes of Sterling. A number of analysts are now beginning to reference the current account deficit in their analysis. At 6% of GDP, we have been here before in 1974 and 1979. It did not end well. For the moment households will continue to enjoy the year of the LILIES with low inflation, interest rates and the earnings surge. Sooner or later the balance of payments will once again become a constraint to growth but not just yet! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.563 from $1.551 and moved up against the Euro to €1.420 from €1.413. The Euro moved up against the Dollar to €1.101 from 1.097. Oil Price Brent Crude closed at $52.27 from $54.41. The average price in August last year was $101.16. The deflationary push continues but is set to unwind. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, rallied. The Dow closed up at 17,741 from 17,620 and the FTSE closed up at 6,696 from 6,579. Gilts - yields softened. UK Ten year gilt yields fell to 1.88 from1.94. US Treasury yields moved to 2.19 from 2.27. Gold moved up to $1,088 ($1,079). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal has now closed. You can still save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed