Steve Hilton was back in the UK this week. Hilton is a Cameron close friend and one time Blue Sky free thinker to the Prime Minister. Steve Hilton revealed “Cameron would vote leave, were it not for his job.” Yes that’s what close friends are for … so much for the constraints and sacrifice of high office. Beware of ex advisers wearing clogs and hippy wrist bands living in California. They just can’t keep their mouths shut. The Eurosceptic explained the leave campaign. “It’s about taking back power from an arrogant unaccountable, hubristic elite in Brussels” and handing it over to “an arrogant, unaccountable, hubristic elite in the eurosceptic right wing of the Tory party.” So now we know, why we are having a referendum. Many business people I talk to aren’t really sure. Posh Boys Bun Fight … The posh boys bun fight is turning into a post Brexit leadership campaign. Ian Duncan Smith the “quiet man” of the Conservative party attacked Cameron this week for failing to clamp down on immigration. He then turned on the Chancellor for failing to clamp down on government borrowing. [Oh yes, the latest borrowing figures from the ONS suggest government borrowing in 2015/16 was £2 billion higher than first thought. The figure of £76 billion is some £4 billion higher than the OBR target.] Well IDS, it’s still down year on year by £16 billion and heading in the right direction. What more do you want, you kept spending money on welfare after all. Boris Johnson’s quest to emerge as the darling of the right wing gathered pace this week as the focus of debate moved to immigration. BJ was on the case. The latest figures from the ONS showed immigration to be at a record high with a significant contribution from Bulgaria and Romania. If only more from the east, were “bricklayers by day and computer coders by night” then no one could have any complaints. The digital society could expand in new homes built to target. Everyone a winner. The bun fight gets political … Right wing Tories are getting moody. The Tory Leave campaigners were promised a free referendum only to be shanghaied by the Prime Minister and his mates. It’s a big list of mates (excluding Steve Hilton) including the Treasury, The Bank of England, The OBR, NIESR, the IFS, the IMF, The White House, EU leaders and the G7 states. Now the WTO have taken the Queen’s shilling and explained of a problematic world post Brexit assuming the UK leaves the EU. We have argued the arguments should be divided into the business case, the economics case, the political case and the social case. Of course, there is no business case to leave the EU, clearly there is no economics case either. The political argument is largely about who governs Britain. Hilton explained the options this week. You may make your choice. The argument about immigration … The social argument revolves around immigration. Does immigration place a burden on society, with pressures on housing, education, the health service and welfare? Or is immigration a key factor in GDP growth? Only through growth will we achieve the expansion in government revenues to meet the requirements of the indigenous population with or without additional immigration. The list is large and demanding. Health, housing, education, welfare, defence, domestic security, roads, rail, energy, telecommunications … Cameron made a mistake this week, suggesting immigration is a price worth paying to secure access to the EU. It is more than that. Labour and Capital, the drivers of growth. Immigration is providing jobs for the health service, the leisure industry, farming and much more. It is a demographic offset to an ageing population. A stimulus to growth. “Poles pay for pensions” the new campaign mantra perhaps. The head boy moves in … Andrew Tyrie is chairman of the Treasury Select Committee. The head boy moved in, on the posh boys debate this week. The TSC produced “The economics and financial costs and benefits of the UK’s EU membership”. It’s a great read running to almost 90 pages. It is an objective cross party report. Including Tory eurosceptic Jacob Rees-Mogg. Rees-Mogg talks in the language of yore. Of pugilistic politicians riding charabancs across the UK. The report is a balanced, objective analysis of the major economic risks to leaving the EU. The Leave campaign were heavily criticised for the ridiculous claim of the (£350 million per week) £18 billion cost of EU membership. The Chancellor was chastised for the claim that leaving the EU could cost every household the equivalent of £4,300. Yes in terms of GDP per capita, no in terms of loss of household income! A small complaint perhaps. Back in the UK … The ONS released the second estimate of GDP this week. The overall figure was largely unchanged with 2% growth year on year. Household consumption is driving recovery with spending up 2.6%. Investment was up by 1.1%. The trade figures continue to disappoint. No real surprise there. Most analysts expect growth of just 2% for the year (2016) as a whole. The trade deficit and the current account deficit are the major problems facing the UK. This is no time to take risks with capital flows, international confidence and foreign direct investment. So what of rates? Over in the USA, the growth figures for Q1 were revised up slightly. Janet Yellen has made it clear a rate rise is coming, in coming months. June is not ruled out. In the UK, we still expect rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Growth of over 2% plus the backdrop, assuming we vote to remain on the 23rd June. If only the G7 had resolved to share the flight costs and vow to leave Planet ZIRP together, confining the NIRP experiment to history. So what happened to Sterling? Sterling closed up against the Dollar at $1.464 from $1.451 and up against the Euro at €1.314 from €1.294. The Euro moved down against the Dollar to 1.114 from €1.121. Oil Price Brent Crude closed at $49.22 from $48.47 The average price in May last year was $64.08. Markets, moved up - The Dow closed at 17,867 from 17,527. The FTSE closed at 6,270 from 6,156. Gilts - yields moved down. UK Ten year gilt yields closed at 1.43 from 1.47. US Treasury yields moved to 1.83 from 1.86. Gold closed at $1,213 from $1,255. John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here.

0 Comments

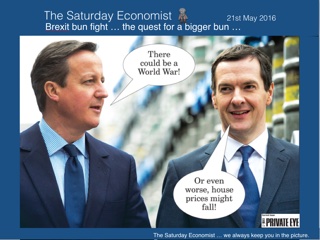

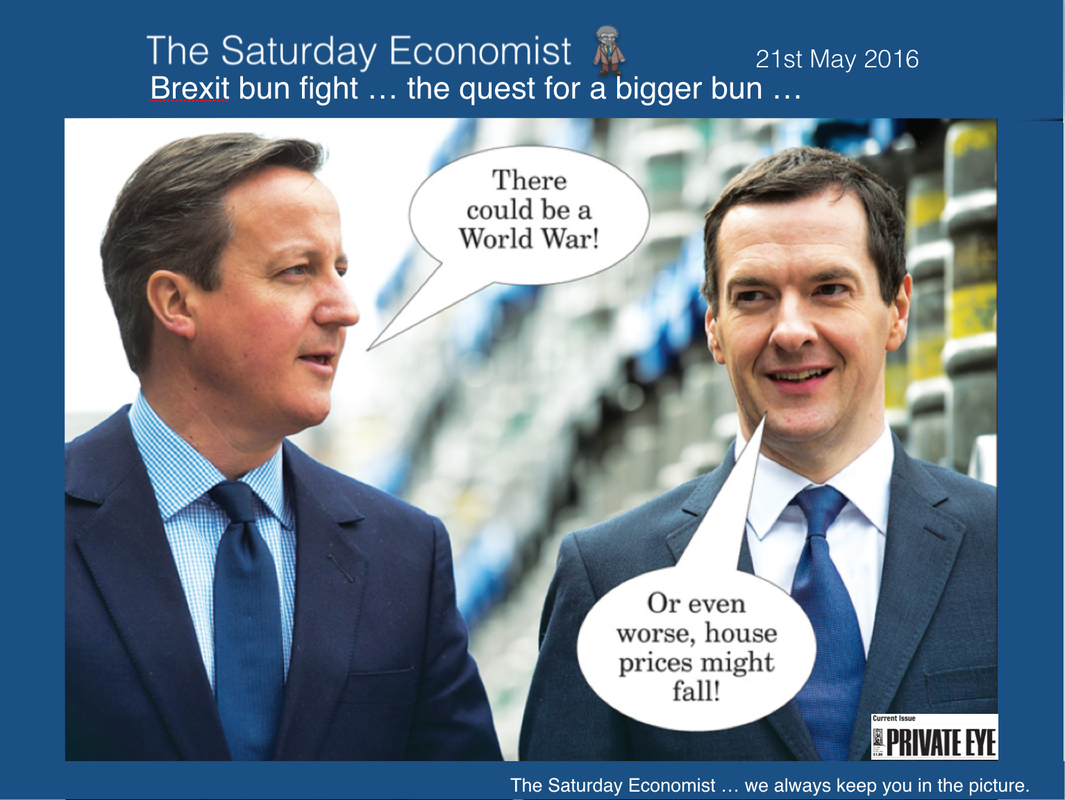

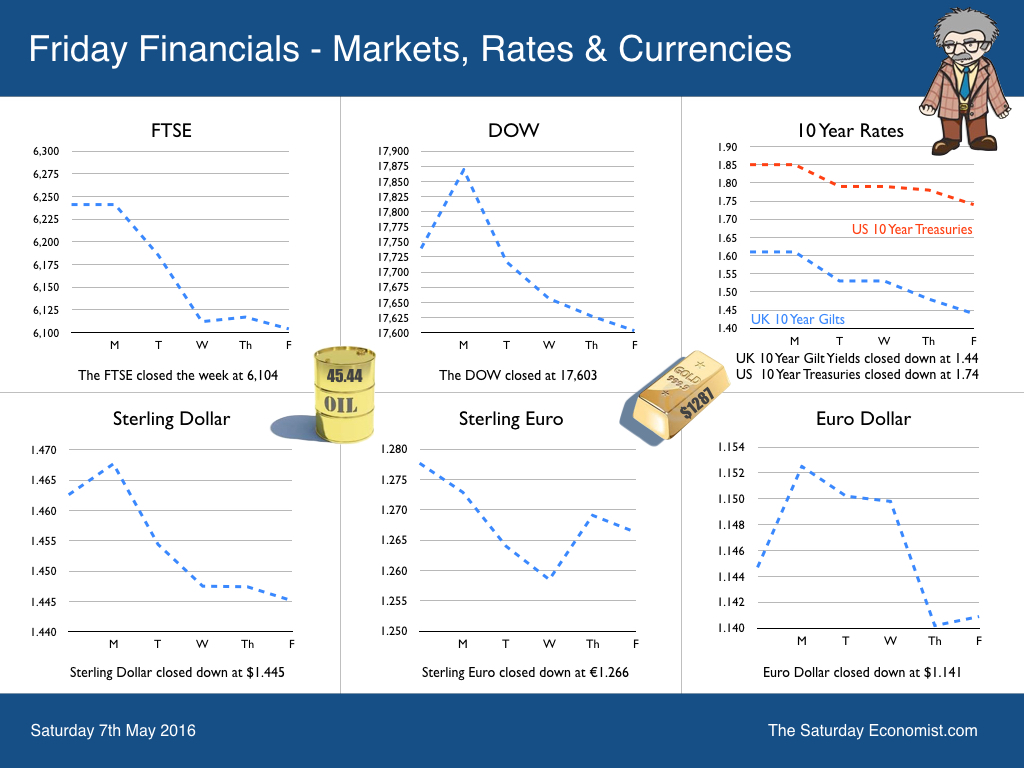

The Brexit debate is fast becoming a bunfight. The problem with bunfights it just leads to the quest for a bigger bun. Voters need facts, they are offered sound bites with high transmission potential. Michael Gove suggested this week 5.2 million people could come to the UK over the next ten years if we vote to “remain". George Osborne has suggested house prices will fall by 18%, if we vote to leave. Exit and the Prime Minister has warned the threat to peace could lead to nuclear war. Exit and Boris Johnson advises we will be able to buy bananas in bunches of more than three. Excellent. Leave and we will “renegotiate" say the leave camp. Leave and “we will make your lives a misery” warns Jean-Claude Juncker, President of the EU commission. Leave and we shed the yoke of Brussels bureaucracy. We will no longer subsidize Spanish bullfighting, hairdressers will be able to wear high heels and children of any age would be able to blow up balloons. Now that’s something worth fighting for, if only any it were true, Which way will the vote go? We can’t be sure. Just over four weeks to go to the referendum. Polls are confusing, suggesting voters are confused. “Brexit” The social .. political .. economic .. business arguments We have had 5,000 hits on our lengthy and objective Slideshare analysis. We advocate the debate is divided into the social, political, economic and business arguments. The social argument about immigration. The political argument who governs Britain. It’s about borders and sovereignty. Social and political, largely a political choice. The economics case places the Treasury, The OBR, NIESR, The Bank of England and The IMF in the remain camp. In the leave camp sit Patrick Minford, Roger Bootle, Gerard Lyons and Tim Congdon and others. Models abound. In fashion we say, there is a model for every cat walk, in economics we say, there is a model for every catfight. Voters have to make a choice based on dubious econometrics offering spurious accuracy. It’s a judgment call but many think “Leave” have already lost the economics argument. Oh yes, and I am one of them. As for the business case? There is no business case to leave. We know lower business confidence will lead to lower investment and lower foreign direct investment. Key contracts already have Brexit break clauses in place. Distribution sites in the UK will be subject to relocation in the Netherlands and elsewhere. Motors, aerospace and financial services will be particularly at risk. The Mini may well move to Munich! When meeting with business groups to discuss Brexit, the overwhelming consensus is to remain and get on with it. Businesses accept, we will have to trade with the EU subject to the same rules, regulations, product and packaging standards as everyone else. Better to remain, have a say and hold sway. There is no alternative to the “Blue Sky nearby”. Back in the UK … growth continues … Retail Sales … Retail sales volumes were up by over 4% in April and values increased by 1.2%. On line sales increased by 9.3%, now accounting for 13.4% of all retail sales. The high street “perfect storm” continues. Higher volume, lower margins with increased online penetration and the complication of multi channel retail with high delivery and return costs. Amazon announced a move into own label food this week! Only at Amazon could own label food margins be attractive. Jobs … A strong set of jobs figures were released from the ONS this week. There were 31.6 million people in work up by over 400,000 on prior year. The claimant count fell. the unemployment rate was 5.1%. Data is confirming labour market conditions are higher than pre recession in 2008. The unemployment rate is 2% lower than the first forward guidance offered by the Governor, on when rates would begin to rise. So what's missing? Earnings growth at 2% remains subdued overall but earnings increased by 8% in the construction sector. Earnings the missing link, for the moment, in the rate rise chain. Inflation … Inflation CPI basis slowed to 0.3% in April from 0.5% prior month. Goods inflation was unchanged at -1.6%. The major change is service sector inflation. Easter timing and travel costs were major factors in the move. The month on month change isn’t really significant. Manufacturing costs both input and output are signalling a major basing action with prices set to rise. Oil prices rallied to $50. Commodity prices are basing. Mining stocks are rallying. The inflation outlook will look very different in the second half of the year. So what of rates? Minutes from the Federal Reserve meeting suggest a June rate rise could still be on the agenda. Either way, markets expect at least two rate U.S rate rises this year. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. UK GDP growth of over 2% (2.2% - 2.4%) the backdrop. So what happened to Sterling? Sterling closed up against the Dollar at $1.451 from $1.437 and up against the Euro at €1.294 from €1.271. The Euro moved down against the Dollar to 1.121 from €1.1301. Oil Price Brent Crude closed at $48.47 from $47.76 The average price in May last year was $64.08. Markets, were transfixed - The Dow closed at 17,527 from 17,604. The FTSE closed at 6,156 from 6,138. Gilts - yields moved up. UK Ten year gilt yields closed at 1.47 from 1.44. US Treasury yields moved to 1.86 from 1.73. Gold closed at $1,255 from $1,273. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here.  The IMF team were in London this week. Christine Lagarde warned of the dangers of leaving the EU. “A vote for exit would precipitate a protracted period of heightened uncertainty, leading to financial market volatility and a hit to output.” For sure, consumer and business confidence would be hit, damaging spending prospects and investment spending, if the decision is made to leave in June. Foreign direct investment could take a big hit, exacerbating the current account deficit and ongoing funding challenge. No time to risk a “Johnny Foreigner” gilt strike with a £1.5 trillion government debt to finance. The IMF were enjoined in the negative outlook by the Bank of England. For Mark Carney and the MPC “A vote to leave the EU could have material economic effects on the exchange rate, on demand and on the economy’s supply potential ”. NIESR produced a series of articles this week, the overall conclusion was clear “the potential downside risks of a decision to leave, while not susceptible to precise quantification, appear large”. A powerful line up for the “Remain” campaign, the IMF, the Bank of England and NIESR. So what of the “Leave” camp? … No need to worry about Brexit? … Boris Johnson and the campaign bus were in Cornwall, focusing on the export potential of asparagus and ice cream. Did you know the UK sends £350 million of asparagus each week to Brussels? I didn’t know that! Did you know the EU won’t allow bullfighters to wear high heels on work days! Shocking. And did you know the EU subsidises bull fighting? Well not really. But it’s a great headline. For sure we know the Vote Leave campaign subsidises “bull shitting”. It really is time to damp down the rhetoric if the campaign bus is to establish credibility to the debate and make any inroads into the “don’t know” camp. The voters need facts, not headlines and photo ops. This is no time for soundbites, I feel the hand of history should be held across the mouth of the ex mayor of London in the run up to the referendum. Both sides of the debate would surely benefit. The IMF argument in detail … Christine Lagarde explained that a decision to "leave" would exacerbate uncertainty and financial stability. Sterling would come under pressure, consumer and business confidence would be damaged. This could lead to a drop in household spending, business hiring, and business investment. Exports could be hit, output would fall and job lay offs would ensue. The trade deficit would deteriorate, exacerbating the current account deficit. Funding the external deficit may become a challenge, as foreign direct investment flows would diminish and hot money flows would avoid the UK. Funding the internal deficit (government borrowing) would also become more of a challenge. Borrowing would rise as a result of lower growth and national income flows. Inflation would increase. Interest rates would rise. London would no longer be the centre of finance in Europe. Frankfurt and Paris would benefit as “passporting” rules were denied to foreign banks based in London. There would be a real risk of a gilt strike, equities would fall along with house prices especially in London! It’s a gloomy outlook and it could get worse. “The Germans would take the Mini back to Munich. The Bentley would be made in Brussels and the UK would be denied access to the next round of Airbus investment.” On the other hand … it could all be alright .. We can leave the EU, shedding the yoke of EU oppression. Put an end to red tape and regulation. Reclaim our sovereignty, protect our borders. Create our own laws. Invigorate our industry. Protect our farmers, invest in the NHS the money squandered on EU contributions to grow olives in Greece and rear bulls in Spain. Protect our fishermen, build nets to stop fish swimming out of the English Channel and the North Sea. Deal with the rest of the world on the old “trade follows the flag” basis. It served us well in the past. Gunboats down the Rhine, Tall Ships Down the Seine. Civis Brittanicus Sum, that sort of thing. Realise the export target of £1 trillion within five years. Who says it could take ten years to get a trade deal with Azerbaijan? Make the message clear. The thin red line is out to do business with the rest of the world. Let the clarion call ring out … “May the sun never set on a UKTI trade mission”. Yes "Vote Leave" on June 23rd. Blue Skies await, forget the factual debate. You know it makes sense, We think you’re all dense. Together We can Make Britain Great again. So what of rates? The Bank of England reduced the central forecast for growth to just 2% this week with inflation set to return to target within a two year period. The MPC were unanimous in holding rates this month. There was no clear indication of the rate rise timing. In the US, the Fed is still expected to increase rates this year, with one or two rate hikes remaining a possibility but not in June. In the UK, wage growth and headline inflation will provide the triggers to action with no rate rise expected ahead of the referendum in June. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Oil Brent Crude closed at $48 this week. The outlook for inflation will look remarkably different by the end of Q3 this year. So what happened to Sterling? Sterling closed down against the Dollar at $1.437 from $1.445 but up against the Euro at €1.271 from €1.266. The Euro moved down against the Dollar to 1.130 from €1.141. Oil Price Brent Crude closed at $47.76 from $45.44 The average price in May last year was $64.08. Markets, were transfixed - The Dow closed at 17,604 from 17,603. The FTSE closed at 6,138 from 6,104. Gilts - yields moved slightly. UK Ten year gilt yields closed at 1.44 from 1.44. US Treasury yields moved to 1.73 from 1.74. Gold closed at $1,273 from $1,287. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  US jobs growth disappoints in April but wages edge higher … U.S. jobs growth in April was 160,000 compared to analysts expectations some 40,000 higher. Job gains in February and March were revised down. The unemployment rate held at 5%. For some, the news was disappointing, killing off any prospect or a rate rise in June. More, now expect the next hike to be in 2017. But is this really the case? The Fed will note with interest the earnings rise to 2.5% in the month. They will also note the 170,000 rise in private sector jobs and the increase in private sector wages to 3.2%. We still expect strong growth this year. US rates will rise at some stage. June may be a little juste! but “Fall remains the Call” for the next hike in rates. Back in the UK … Back in the UK it is the week of the Markit/CIPS PMI series. Prepare for setbacks. They are sentiment surveys after all. Construction output eased to the lowest level in almost three years, according to the survey data, as new business volumes slowed in April. The key index was down to 52.0 from 54.2 in March and a peak of 60 last year. Should we be too worried? Perhaps not. The index remains above the critical “no growth” level. Commercial building remained the strongest sector with a slight upturn in residential spending. Anecdotal evidence suggests projects may be on hold pending the out turn of the referendum in June. In manufacturing, the index fell to the lowest level since February 2013. At 49.2, the index was below the critical no growth level of 50, falling from 50.7 last month. Consumer and investment sectors were hit. The slow down in oil and gas investment impacted on output along with some hesitation ahead of the vote in June. In the service sector, growth appeared to be the lowest for three years. The Business Activity Index fell from from 53.7 in March to 52.3 in April. New business activity increased in the month. Here again, anecdotal evidence suggested the forthcoming EU referendum may have led to the delay in contract placement ahead of the critical June date. Talking with bankers, investors and project managers, there is little doubt some activities are on hold pending the referendum decision. This is not a widespread phenomenon. Either way, post vote, we should experience an upswing in the second half of the year, especially in business services and construction. The structural malaise in manufacturing may not benefit from the post “referendum” bounce. We still expect UK growth of 2.4% in the year, as the outlook in the second half will improve significantly. The Saturday Economist on Brexit … This week John Longworth ex Director General of the British Chambers of Commerce and Chairman of the Vote Leave campaign was our guest at a pro-manchester event on Wednesday. John is a powerful and fervent advocate of exit, wishing to free the UK from the yoke of European rules and regulation. Presenting over lunch, John then left for an evening presentation at Keeble College Oxford, before flying on to the Brookings Institute in Washington. A busy schedule to spread the message about the myths perpetrated by the “Remain” conspirators. According to John, June 24th will be declared “Independence Day” as the votes are counted and we set off on the great adventure. So what to make of it all? We remain on the fence as a neutral observer for now! To date, we have had almost 4,500 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. Over the next few weeks we have a great series of events with debate from either side. Sir Richard Leese will be speaking at a pro-manchester event on the 26th May. AGMA has come out clearly in favour of “Remain”. So what will be the outcome on the day? The out turn on the 23rd June, still too early to call. Results of the Manchester poll will be released by the Chairman Tim Grogan at our Annual Dinner on Thursday. So what of rates? The Fed is still expected to increase rates this year, with one or two rate hikes remaining a possibility but not in June. In the UK, wage growth and headline inflation will provide the triggers to action with no rate rise expected ahead of the referendum in June. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Oil Brent Crude closed at $45 this week. The outlook for inflation will look remarkably different by the end of Q3 this year. So what happened to Sterling? Sterling closed down against the Dollar at $1.445 from $1.463 and down against the Euro at €1.266 from €1.278. The Euro moved down against the Dollar to 1.141 from €1.145. Oil Price Brent Crude closed at $45.44 from $47.94 The average price in May last year was $64.08. Markets, were mixed - The Dow closed up 17,603 from 17,739. The FTSE closed at 6,104 from 6,241. Gilts - yields moved down. UK Ten year gilt yields closed at 1.44 from 1.61. US Treasury yields moved to 1.74 from 1.85. Gold closed at $1,287 from $1,291. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed