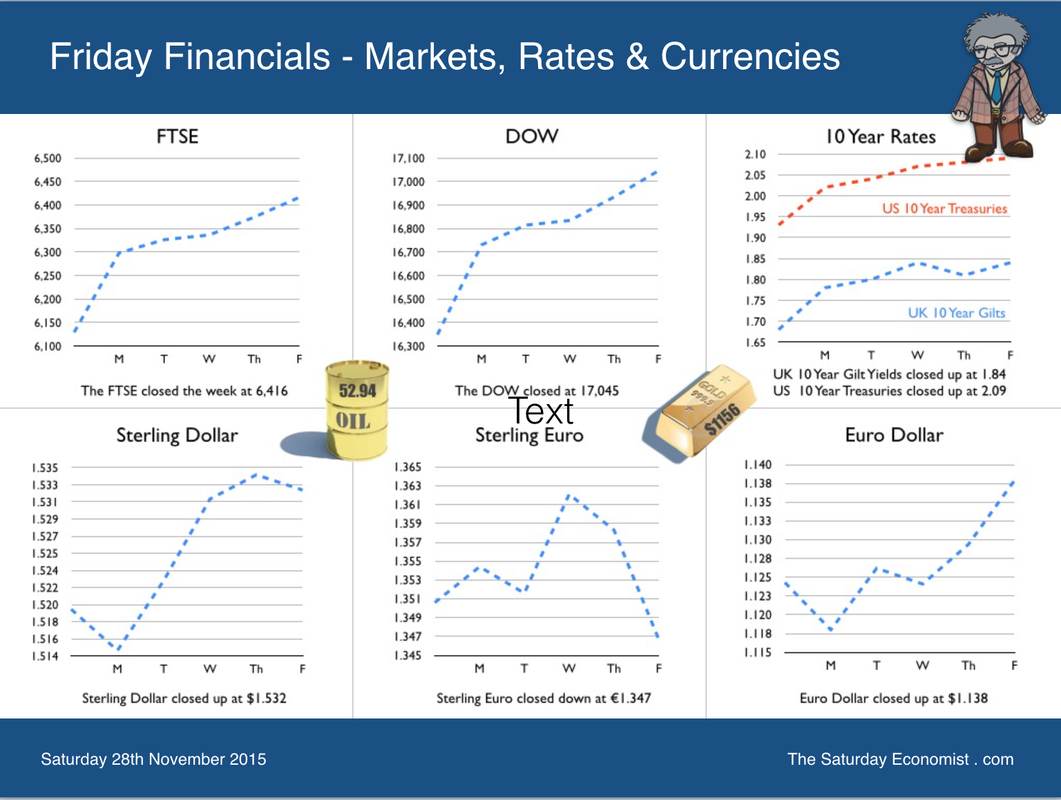

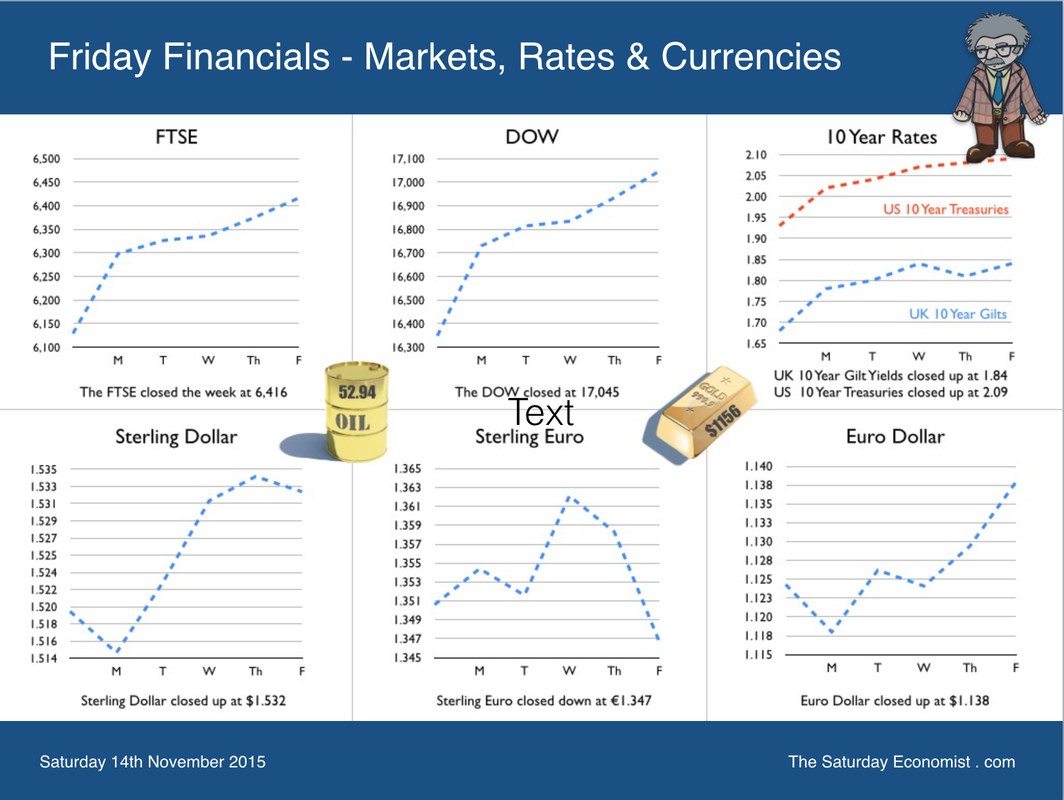

The Autumn statement promised to be a difficult time for the Chancellor. Latest borrowing figures for October, suggested an overshoot of £11 billion in the current year, against the July target. The ONS had reclassified housing association debt into the Government figures adding £4 billion to the borrowing total year on year. The abolition of tax credits, at a gain of £4.5 billion, was under pressure politically. The decision to cut police spending appeared impractical in view of the Paris terrorist attacks. On the face of it, the chances of securing the £10 billion surplus by 2019/20 appeared remote. By the end of the day on Wednesday, the Chancellor had produced not just one rabbit but a veritable warren of rabbits from within the pages of the Spending Review and Autumn statement. This is how he did it … The OBR Revisions … Osborne was assisted by a series of revisions to the revenue forecasts from the Office of Budget Responsibility. The OBR produced an estimated £27 billion of additional revenues over the forecast period to ease embarrassment. Not bad … Higher receipts from income taxes, corporation tax and VAT were unveiled– some of which result from modelling changes to the NICs and VAT deductions forecasts. Spending on debt interest was also lower in all years, reflecting a further fall in market interest rates plus the decision by the Bank of England to maintain the stock of gilts over the lifetime of the forecast. Not only would the Bank repurchase gilts on expiry but the dividend coupons would be returned to the Treasury under the QE ‘money for nothing, gilts for free” scheme. Hence some 25% of the gilts in issue would be coupon free. For the public finances, the measures ensured that public sector net debt continued to fall in every year of the forecast as a share of GDP. The budget reaches a surplus of £10.1 billion in 2019-20. The Chancellor was able to meet the legislated fiscal targets … in line with the estimates in the July statement. The adjustments to tax credits .. “I’ve had representations that these changes to tax credits should be phased in. I’ve listened to the concerns. I hear and understand them. And because I’ve been able to announce today an improvement in the public finances, the simplest thing to do is not to phase these changes in, but to avoid them altogether.” Reversing tax credit cuts produced a £5.0 billion increase in welfare spending over the period. In the first year, the effect was a loss of £3.5 billion and not the £4.5 billion as first estimated. Over the medium term the loss is mitigated by the implications of the Universal Credit adjustments phasing in from 2017 onwards. The Chancellor will have his welfare cut before the end of the decade, so best to avoid trouble in the house in the short term. New Revenue Options … New taxes from the apprenticeship levy (£11.6 billion), higher council tax (£6.2 billion) and higher stamp duty on second homes and buy to let (£3.8 billion) assisted the achievement of the tax reduction plans. The additional payroll tax for larger firms has largely gone unchallenged. It is not quite clear as yet how the apprenticeship levy will produce a full net income gain to the exchequer. The magic of the changes in spending and income mean, net borrowing in 2015/16 becomes £73.5 billion, falling to £49.9 billion in 2015/17, £24.8 billion in 2017/18, £4.6 billion on the following year, producing a surplus of £10 billion in 2019/20. All this including the additional housing association burden. So what of the economy … Growth helps, the OBR assume an average growth rate of 2.4% over the forecast horizon, with moderate assumptions on employment, trade and inflation. Is the projection realistic? It looks like it! The OBR states “On our central forecast, we judge that the Government has a greater than 50 per cent chance of meeting the fiscal mandate and supplementary target. “We expect the budget to be in surplus by 0.5 per cent of GDP £10.1 billion in 2019-20 and public sector net debt to fall by 0.6 per cent of GDP in 2015-16 and by bigger margins in subsequent years.” Projected total debt £1.7 trillion falls to 74% of GDP by 2019/20, still a massive burden on the economy attracting interest charges of £34.6 billion in this financial year rising to almost £50 billion by 2019/20. Fully interested the annual interest burden would be £75 billion assuming gilt yields move back to pre recession norms and the Bank of England withdraws from the gilt market! So is this the end of Austerity ? Paul Johnson of the IFS sums up the Spending Review … “There is no question that the cuts will be less severe than implied in July but this spending review is still one of the tightest in post war history. Total managed expenditure is due to fall from 40.9% of national income in 2014-15 to 36.5% in 2019-20. A swathe of departments will see real terms cuts. This is not the end of austerity" ... but growth will help ease the burden of the Master of the House. So what happened to Sterling over the last two weeks? Sterling fell slightly against the Dollar at $1.503 from $1.520 and moved down against the Euro to €1.419 from €1.427 The Euro moved down against the Dollar at €1.059 from€1.065. Oil Price Brent Crude closed at $46.25 from $45.10. The average price in December last year was $62.24. Markets, steadied! The Dow closed at 17,8068 from 17,818. The FTSE closed up at 6,393 from 6,334. Gilts - yields moved down. UK Ten year gilt yields were at 1.83 from 1.87. US Treasury yields moved to 2.23 from 2.24. Gold moved to $1,059 ($1,065), going nowhere slowly. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

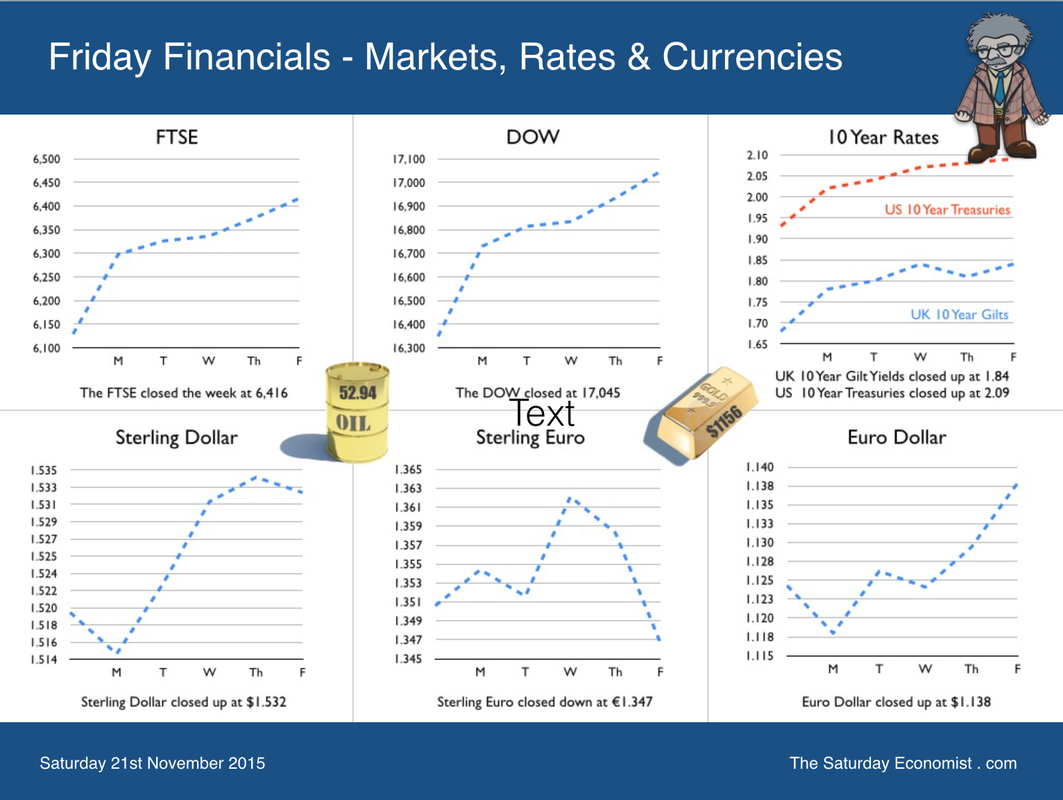

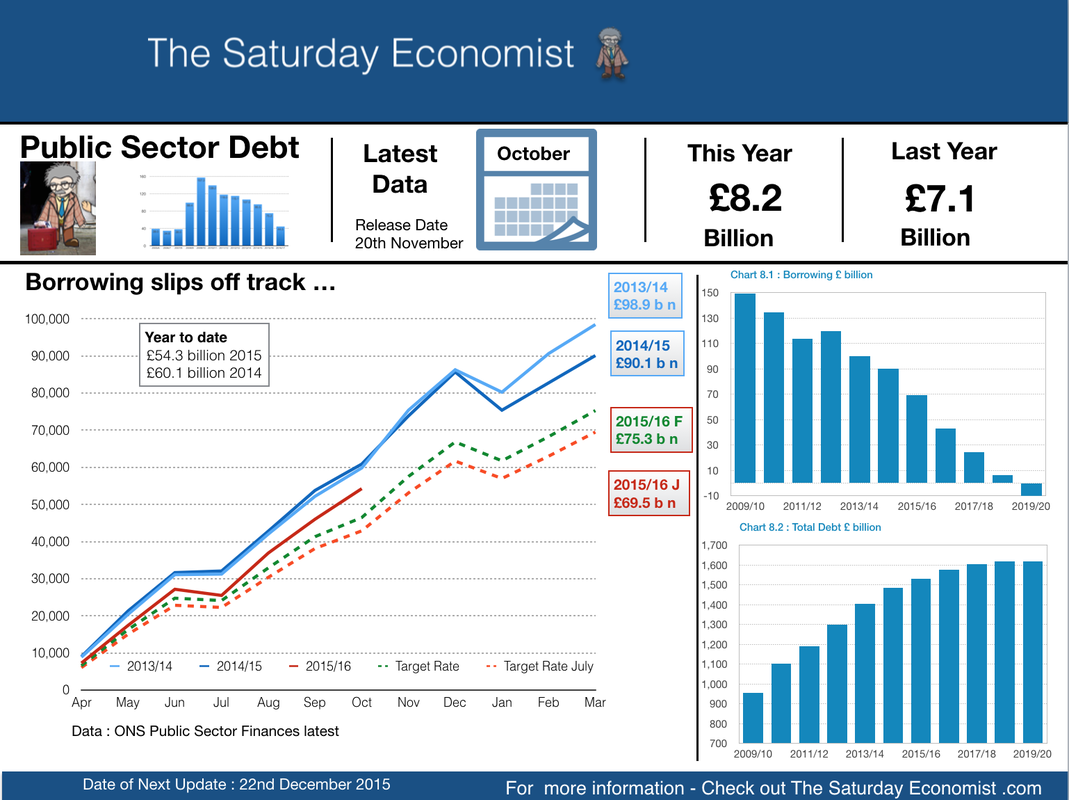

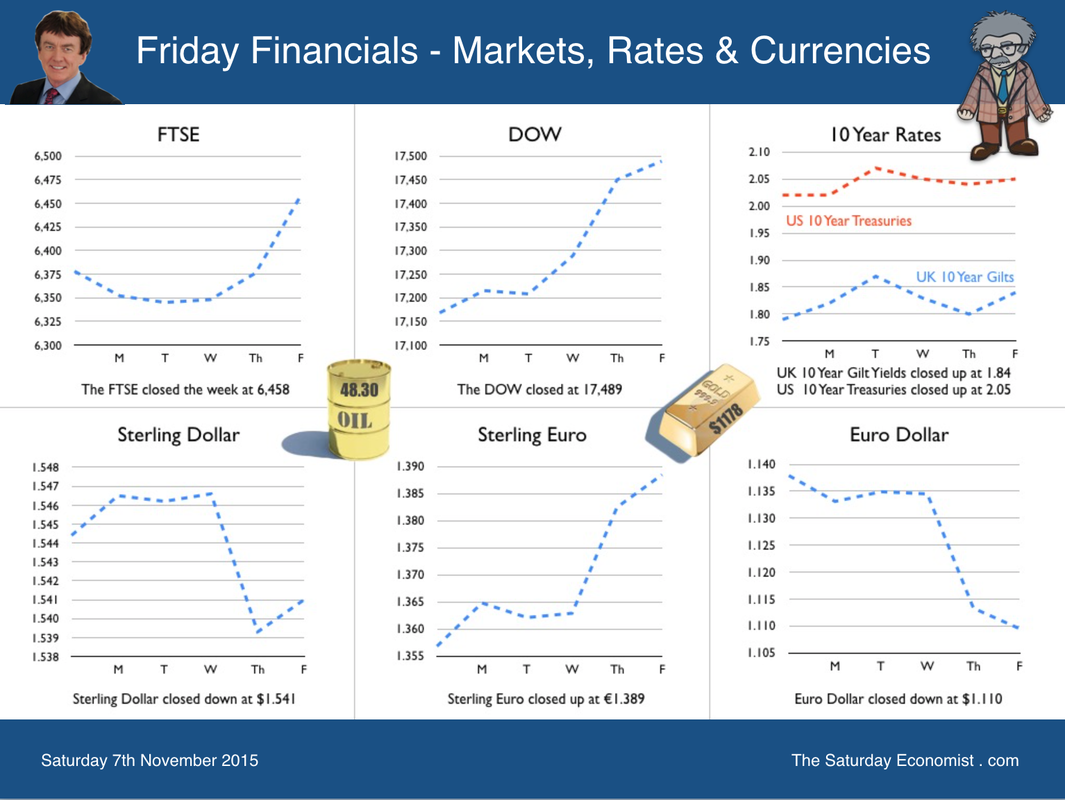

One day we will realise that low rates are part of the problem and not the solution. Planet ZIRP was always supposed to be a stopover not a permanent settlement. Low rates, and QE effectively mis price capital leading to a misallocation of resources. Misallocation of resources leads to asset price inflation in housing, commercial real estate bonds and gilts. Asset price inflation leads to yields and dividends collapsing, putting pressure on annuity yields, savers, pensioners, pension funds and insurance companies. Pension funds are forced to over invest in bond volumes to secure yield mass despite the risk of price collapse in the medium term. The lack of realistic yields and bond collapse can lead to capital flight. Overseas investors will reduce holdings of domestic gilts to offset the low yields and risk of bond price collapse in the medium term. Currently overseas holdings of UK gilts are down to 25% compared to a 30% plus average. Over the medium term, we expect bond yields (after Fisher) to reflect a hedge against inflation plus a real risk return. Hence we consider the normalised yield on ten year gilts to be between 4% to 4.5% if the plausible inflation target is 2%. There is a real risk of capital collapse as bond yields rise and capital prices fall as yields return to normalised values. The mis pricing of capital leads to unrealistic gilt yields (currently around 2%) which then leads to the mis pricing of risk in the search for yield. In 2012 Zambia was able to issue a dollar denominated government bond twenty times oversubscribed yielding 5.4%. Current Zambian 2 year yields are 22%. Low interest rates and the low cost of capital have led to an over investment in commodities and energy supplies. In turn over investment, despite strong demand conditions leads to over supply and pressure on prices. Low prices introduce a disinflationary spiral on planet ZIRP which reduces the pressure to increase rates, compounding the misallocation of resources and delaying the departure date. The Fed, is considering a rate rise in December, the MPC must surely follow in March or April next year. Draghi should avoid further talk of easing monetary policy and follow the counsel of the council of Wise Men. Warning from the Wise men of Europe … In Europe, Berlin's Council of Economic Experts - known as the country's five "wise men" - said the ECB must consider tapering its bond-buying measures early to avoid dangerous imbalances from building up in the bloc. The European Central Bank must end its unprecedented stimulus measures to prevent a new financial crisis from erupting in the eurozone. "Monetary policy is leading to a build-up of risks to financial stability which could pave the way for a new financial crisis,”. "Persistently low interest rates erode the earnings of banks and life insurance companies, and raise the appetite for taking risks. It is important to avoid delaying an exit from the low interest rate environment for too long.” Instead, they called for the ECB to announce "a timely end to monetary policy accommodation which could effectively prevent the further build-up of risks in the financial system.” Asset Price Inflation … In June 2013 Andy Haldane warned : “Let’s be clear, we have intentionally blown the biggest government bond bubble in history” speaking before the Treasury Select Committee. Andy Haldane was then the director of financial responsibility at the Bank of England. Not to worry, the markets will get the message in the end. High bond prices and absurdly low yields are a by product of life on Planet ZIRP. With short rates at or near the zero interest rate bound, undermining long term rates was considered to be the next great step. Who could possibly think that creating a financial climate with negative long term real rates, would encourage lending, in an uncertain business world. There is no “Lonely Planet” Guide to life on Planet ZIRP as we pointed out in December 2008. Commenting on a paper by Bernanke - we said then - “OK it’s official, the effects of QE remain quantitively quite uncertain. Welcome to Planet ZIRP. We don’t have a hand book or fully understand the terrain. We cannot be sure QE is going to work at all. The process of quantitative easing, the plan to helicopter money may work but as a fire fighting option, it may be like dropping water into a desert, such are the fissures in the financial system” We also said, “This is your captain speaking, Welcome on board flight QE 2009. I hope you have a nice flight, I am relatively new at this, haven’t actually flown before, we shall be flying by the seat of our pants but have every confidence, we will get somewhere, but not sure where, in the end.” QE was an experiment which is still five years late unproven. We warned then, Planet ZIRP, would be a desiccated sterile planet where a liquidity crisis is exacerbated and prolonged. Now, eight years on, the US markets are beginning to welcome the end of the Bernanke experiment and the departure from Planet ZIRP. Soon too UK and Euro markets will follow suit. We need to ensure an orderly exit, avoiding the mad rush should an asset collapse and sterling crisis precipitate a more rapid response. JKA  BBC Breakfast - I am the Spin Doctor … Tuesday this week - BBC breakfast with Stephanie McGovern, talking about inflation. I am the spin doctor. Yep the stool was rotating in the middle of the show emitting a loud creaking noise in the process. We were talking about inflation, deflation and the Year of the Lilies, in surround sound. If you missed the clip, it was at 6:50am after all, here’s the Youtube link, highly amusing! Inflation latest … The latest inflation figures for October were released this week. The headline CPI number was -0.1%, a mild deflation. As always we stress the difference between goods inflation, down -2.1% and service sector inflation up by +2.2%. Food and Transport costs are pushing the index lower. Leisure costs, restaurants and hotels push the index higher. The general expectation is for prices to begin to rise through 2016 as the impact of lower oil, food and commodity prices unwind and service sector wage pressures increase. The Bank of England expects prices to rise to around 1% by the end of 2016 returning to the 2% target within two years. A fair forecast assuming no dramatic change in oil and commodity prices ensues. Producer prices … Manufacturing output prices fell by -1.3% in October a much slower rate than the -1.8% prior month. Oil costs dominate the price outlook with petroleum costs down by over 17% in the month. Input costs fell by 12.1% compared to -13.4% in September. Crude oil prices, together with imported metals and chemicals dominate the downward effect on prices. So what’s the outlook? As we eruditely explained to national viewers on Tuesday … in farming it is said the best cure for low prices … is low prices. So too with energy and commodities. Oil closed at $45 dollars per barrel this week but prices are set to rally. In the US, the squeeze on US shale has seen a series of bankruptcies, 250,000 job losses and a collapse in the oil rig count. So far output has been resilient but for how long? In any case, at around $50 dollars per barrel, the deflationary impact of oil will subside from December onwards. A reversal in OPEC policy could see a bounce back in prices with inflationary implications evident. In commodity prices, Lonmin, Glencore, Antofagasta and others are adjusting the over supply condition. There is no fundamental demand shortage. Even in China, oil and copper imports are up almost 10% year to date. Over supply, a function of the low cost of capital on Planet ZIRP has created a deflationary spiral from which we must escape soon. Retail sales … Retail sales volumes were up by almost 4% in October but revenues increased by just 0.5% as store prices fell by 3.3%. A big problem for retail, more work in store at reduced margins with greater pressure from the internet. Online sales were up by 11.2% in October now accounting for 12.8% of all retail sales. Bad news for retailers, but great news for households, in this the year of the LILIES. Household goods sales were up by 5.5%, clothing and footwear sales were up by 2.4%. Government Borrowing … The government borrowing figures released on Friday were at first glance a disappointment for the Chancellor. Borrowing in the month was up by £1 billion compared to last year. For the year to date the total borrowing was down by just £6 billion, a total of £54 billion compared to £60 billion prior year. The Chancellor will overshoot the OBR target by over £10 billion if the trend is maintained. Revenues in the month were up by just 2% compared to 3% year to date. Spending increased by 3% in October compared to less than 1% year to date. Strange that. The Chancellor wouldn’t want to finalise the spending round and Autumn statement with an overly optimistic fiscal position year to date. “Grim month will limit Osborne’s giveaways” says Phil Aldrick in The Times today. Exactly … grim month, great timing. We still expect the Chancellor to hit the borrowing target in the current year with a better performance in the second half. We await the OBR update next week for a more comprehensive review. So what of Rates … The Fed gave a clear signal in the minutes of the October FOMC meeting rates may well rise in December by around 25 basis points. Ben Broadbent in a speech to Reuters this week, explained observers should not place great reliance of the market indicators of the future path of interest rates. UK Rates may rise sooner than expected. Sterling rallied against the Euro as Mario Draghi continued to suggest a further monetary easing in Euroland was possible in December. If the Fed moves in December, the MPC will surely follow in March or April next year. Draghi would be well advised to drag his feet, then follow the rest of the West in the escape from Planet ZIRP. So what happened to Sterling over the last two weeks? Sterling was largely unchanged against the Dollar at $1.520 from $1.521 and moved up against the Euro to €1.427 from €1.418 The Euro moved down against the Dollar at €1.065 from €1.073. Oil Price Brent Crude closed at $45.10 from $43.84. The average price in November last year was $79.44. World stock levels and gloomy EIA outlook weighed down on prices last week. News of US shut downs buoyed prices this week. Markets, bounced back! The Dow closed at 17,818 from 17,322. The FTSE closed up at 6,334 from 6,118. Gilts - yields moved down. UK Ten year gilt yields were at 1.87 from 1.99. US Treasury yields moved to 2.24 from 2.29. Incomprehensible. Gold moved to $1,065 ($1,081), going nowhere slowly. That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  As the futurist at a dinosaur convention might explain, the good news - in the medium term, you will have have nothing to worry about, the bad news - not so good. Andy Haldane Chief Economist at the Bank of England was at the Trades Union Congress this week dismissing concerns about UK productivity in the years ahead. The good news, in the future we won’t have to worry about productivity. The bad news, fifteen million human jobs could be replaced by robots. That must have been a shock to the TUC with almost 6 million members and not so good for the UK economy with 34 million people currently in work. Accountants will be most at risk, [androids don’t file tax returns] but hairdressers, nannies and care workers will be spared. Economists will also avoid the cull, which is good news for some including the Chief Economist of the Bank of England … “When it comes to forecasting the economy, I can’t believe an Andy robot will be giving this lecture to the TUC a decade from now" he said ... Andy Haldane has already talked of the demise of capitalism and the end of money earlier this year. The termination of the TUC and the destruction of public sector finances presumably - the latest prognostication. In 2014 he was described by Times Magazine as the world’s 100 most influential people … ah yes, fear for the world if they send in the clones … Job Stats Latest … The latest employment data for October were released this week. More people are in work, unemployment rate down to 5.3%, the claimant count rate down to 2.1%. Vacancies are steady and earnings are increasing. The employment rate (the proportion of people aged in work) was 73.7%, the highest since comparable records began in 1971. On almost every employment measure key indicators are back to pre recession levels. The domestic pressure to increase base rates is becoming more evident. For households, this continues to be the year of the LILIES. Low Inflation, Low Interest rates with an Earnings Surge. Overall earnings in the three months to September were 3%. Earnings in the leisure sector were up by 4.4% and in construction earnings increased by 6%. Perhaps the high level of earnings explains the slow down in construction … you just can’t find a bricklayer or builder when you need them. Construction … According to the latest ONS data, output in the construction industry decreased by 1.6% in September 2015 compared with September prior year. For the quarter as a whole, output fell by just 0.1% compared to 2014. New work was up by 3% but repairs and maintenance fall by 5% apparently. [1A.Q volume seasonal adjusted index]. The construction data may yet be subject to revision, as has been the case over the last few years. Based on the latest data our forecast for GDP as a whole would fall to 2.5% this year and 2.7% next. The Bank of England are projecting 2.7% this year having adopted a “see through” basis on the latest data, accepting upward revisions are likely. We shall see … OECD on world trade … The OECD produced downward revisions to world trade and to world GDP this week. World growth is expected to slow to 2.9% this year and world trade to slow to just 2%, the gloomy outlook outlined by Angel Gurría, Secretary-General. The OECD is just too gloomy on trade. For example, imports into China are expected to fall by 15% this year, value basis. The OECD may well be missing the point. Chinese import volumes of oil and copper are up by almost 10% this year as the economy remains resilient and strategic reserve stocks are rising. The collapse in prices means the China trade surplus is set to almost double this year as the value of exports is maintained compared to last year and import values fall. Latest Euroland data … The latest data on Europe confirms the economy grew by 1.6% in the Eurozone and 1.9% amongst the wider EU 28. A modest but steady increase with a strong performance from Spain up by 3.4%. Despite Mario Draghi concerns, QE should be off the agenda given the growth data and the warning from the German Council of Wise Men against further extension of QE and the call for the next move in rates to be up. It is time for the West to provide a co-ordinated response to life on Plant ZIRP. Rates are set to rise in the US. The UK and Europe should follow to provide symmetrical response. The locomotive theory of fiscal stimulus and growth in the West also works for monetary policy. Soon we will realise, low rates are now the problem. Mis priced capital leads to misallocation of resources. Bond prices are inflated, forward yields offer negative returns. Over investment in risky assets ensues, including energy and commodity supplies particularly. In this scenario international deflationary pressures from commodity and energy prices are exacerbated by a prolonged stay on Planet ZIRP. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.521 from $1.506 and moved up against the Euro to €1.418 from €1.403 The Euro moved down against the Dollar at €1.073 from€1.074. Oil Price Brent Crude closed at $43.84 from $47.35. The average price in November last year was $79.44. World stock levels and gloomy EIA outlook weighed down on prices. Markets, crashed! The Dow closed at 17,322 from 17814. The FTSE closed down at 6,118 from 6,353. Gilts - yields moved down. UK Ten year gilt yields were at 1.99 from 2.03. US Treasury yields moved to 2.29 from 2.33. Gold moved to $1,081 ($1,088). That's all for this week. Enjoy the rest of the week-end. Off to play tennis and hope for a win! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  Remember, Remember the 5th of November, began the Governor in his opening remarks on Thursday. "What is memorable about today’s Inflation Report", he continued … well not much really. Assured in August, the interest rate rise would come into closer focus at the end of the year, by the end of the meeting analysts, were less clear about which year was in question. The indication - rates would be on hold until late into 2016 or early the following year. Bags packed, ready to leave, now we are told all flights are suspended until 2017 perhaps. We are trapped on Planet ZIRP with no chance of escape. The Inflation Report headlines familiar. Inflation close to zero. Another letter written to the Chancellor. The MPC has voted by a majority of 8-1 to maintain Bank Rate at 0.5%. Asset purchases will be maintained at £375 billion until inflation hits the 2% level ... More fundamentally, monetary policy must continue to balance two forces, domestic strength and foreign weakness, if we are to return inflation to target in a sustainable manner. Sterling fell on the news of a weaker rate outlook, [assisting inflationary acceleration in the process.] The weakness of growth in emerging markets and Chinese whispers caused a complete change in the Bank stance on interest rates apparently. In reality not much has changed. Chinese stocks rallied this week, marking a new bull market. Growth of 6.5% is set to become the new Mandated Mandarin target. Not much of a slow down in reality. Despite the poor UK growth outlook in Q3, The Bank of England is still expecting growth of 2.7% this year with inflation set to return to target over the medium term. Before the Governor’s end of term in office - perhaps. Late in the presentation the Governor explained, “There is no major central bank, the Bank of England included, that knows what it is going to do at its next meeting” - yep we were certainly getting that feeling. Bring back forward guidance the mantra and some semblance of oversight and see through in the process. US Jobs in October … No such quandary in the USA. Despite the poor GDP figure in Q3, (2% year on year) the Fed remains on track to hike rates in December. Chatter from the FOMC is turning to the rate and timing of the subsequent round of increases in 2016. The October employment data proved the strength of the US recovery continues. Total non farm payroll employment increased by 271,000 in October. The unemployment rate essentially unchanged at 5.0 percent. So what of the UK … Despite the dovish remarks during the Inflation Report presentation, the MPC will be obliged to follow the Fed with a rate rise in early 2106. We still expect a UK rate rise on March. Growth will be around 2.7% this year, with little slow down next year. The jobs market is tightening and earnings are increasing. Domestic demand will remain strong. The international outlook may change significantly for the better early in the New Year. UK Manufacturing September … The GDP figures in Q3 released last week were hampered by a poor performance in manufacturing and construction. We expect substantial revision to the construction data on the next ONS update but the manufacturing figures continue to disappoint. Data released this week confirms manufacturing output fell in September by 0.6% and by almost 1% in the quarter. A further disappointing performance from consumer durables and capital goods, continue recent trends. The PMI Markit data suggests a modest manufacturing rally in October. The average growth over the last fifty years has been less than 0.5%. We now expect zero growth this year following last year’s near 3% surge. Trade Data in September … The trade deficit narrowed in September following an implausible fall in imports in the month. The UK’s deficit on trade in goods and services was estimated to have been £1.4 billion in September 2015, a narrowing of £1.6 billion from August 2015. The narrowing is attributed to trade in goods, where the deficit fell from £10.8 billion in August 2015 to £9.4 billion in September 2015. The fall was attributed to a decrease in unspecified goods of £1.0 billion. It must have included the fall in Volkswagen vehicles. Last month, VW sales fell by 10% year on year as the emissions scandal clouds the new registrations outlook. For the year as a whole, we still expect a trade in goods deficit of £125 billion largely offset by a service sector surplus of £95 billion. The overall deficit (trade in goods and services) less than 2% of GDP will not provide a hindrance to growth. So what happened to Sterling over the last two weeks? Sterling moved down against the Dollar to $1.506 from $1.541 but moved up against the Euro to €1.403 from €1.389 The Euro moved down against the Dollar at €1.074 from €1.110. Oil Price Brent Crude closed at $47.35 from $48.30. The average price in November last year was $79.44. The deflationary push continues. Markets, up? The Dow closed at 17,814 from 17,489. The FTSE closed down at 6,353 from 6,458. Gilts - UK yields moved up. UK Ten year gilt yields were at 2.03 from 1.84. US Treasury yields moved to 2.33 from 2.05. Gold moved to $1,088 ($1,178). That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed