|

Retail sales bounced back in January following a disappointing quarter at the end of 2023. Sales volumes were up by almost 1% in the month, year on year. Sales values increased by 4%.

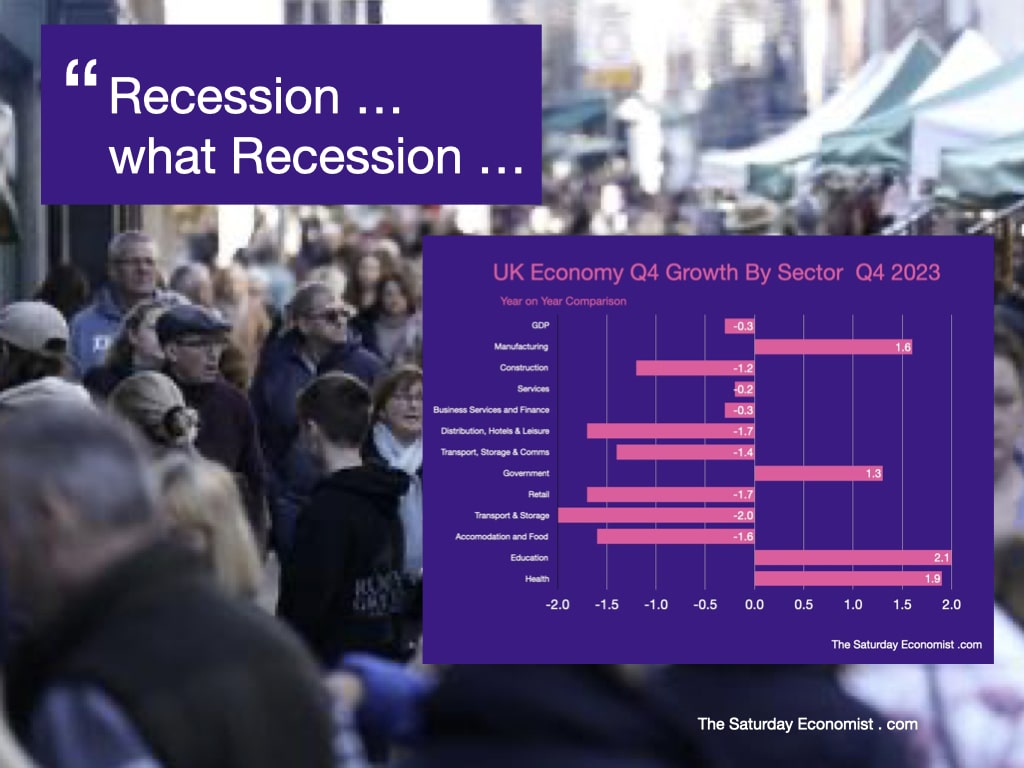

Consumers were spending big on alcohol (27%), music (34)%, computers (27%) and cosmetics (9%). Flowers, plant and seed sales were up by 18%, second hand goods sales increased by 29%. Biggest losers were chemists (-18%) and clothing retailers (-8%) . There is a pattern in there somewhere. Remember "Any explanation is better than none". Nietzsche. So what of the recession? Did you miss it? Markets, journalists and analysis were disturbed by the latest GDP date released on Thursday. The GDP monthly estimate for December 2023 revealed Real Gross Domestic Product (GDP) is estimated to have fallen by 0.3% in the three months to December 2023, compared with the three months to September 2023. According to the ONS, "On a quarterly basis, this gives two consecutive falls in GDP, with a fall of 0.3% in Quarter 4, following a fall of 0.1% in Quarter 3." For some, this constitutes a technical recession, defined as two consecutive falls in quarterly GDP. For purists (and those with pedantic disposition) this is not the case. The definition of recession requires two consecutive falls in quarterly GDP year on year, not quarter on quarter. This did not happen. The so called "technical recession" is in fact a "phantom recession." For the year as a whole, the UK economy is expected to have increased by 0.5% in 2023, compared to prior year. In the first half of the year, GDP increased by 0.6% in Q1 and Q2. Growth then slowed to 0.5% in the third quarter, then fell in the final quarter of the year by -0.3%. It was a strange quarter and a strange slow down. According to the latest employment data, the unemployment rate actually fell to 3.8% in December, the number unemployed fell to 1.3 million from 1.5 million in June. Data hardly consistent with a lurch into recession. Analyze the GDP fall by sector and the pattern becomes even more confusing. Strong growth was experienced in manufacturing and government spending, especially on health and education. Construction output slipped in the quarter, down by 1.2%. We still expect growth of 2.5% in the year as a whole, following a strong performance in the first half of the year and Q3. It is within the service sector down by -0.2% the damage occurred in the final quarter. Retail sales were down by 1.5%, this impacted on transport storage and communications, down by 1.4% overall (1.7% in retail and 2.0% in transport and storage.) In the leisure sector, distribution, hotels and leisure output fell by 1.7%, accommodation and food sales specifically fell by 1.6%. Maybe there is something of a structural change occurring in the sector as consumer spending is redirected. This month, Pryzm night club owner Rekom announced the closure of seventeen venues with the loss of 500 jobs. Students pre-drinking and not going out mid-week is to blame for nightclubs closing, the boss of the UK's biggest club chain has said. New data suggests close to 400 clubs permanently shut down between March 2020 and December 2023, according to the Night Time Industries Association (NTIA). Overall, the UK restaurant industry demonstrated resilience in the face of challenges including inflation, rising energy costs, food costs, staff turnover, recruitment difficulties and transport strike action. Yet ... According to the BDO Restaurant and Bars Report for 2023, over half of consumers cut back on discretionary spending to put the money towards energy bills. Of these people, 6 in 10 intended to achieve this by reducing how often they eat out (Barclaycard); 77% of UK hospitality firms reported a decrease in diners and drinkers at the end of last year. Outlets are responding by reducing opening hours and days to reduce energy costs. The British Beer and Pub Association reported over 500 pubs closed for good in 2023. In the Hotel sector, according to "Visit Britain" Hotel Occupancy rates were actually up in the final quarter from 76.3% to 77.0% thanks to a slight increase in the December performance. Overall, a disappointing performance in the leisure sector in the final quarter. The trade will be looking for a budget boost in the March statement on business rates, lower VAT and reform of the apprenticeship levy. The step up in the National Living Wage in April is unlikely to improve sentiment. The easing of price pressures on food and energy will help. The anticipated fall in base rates will undoubtedly assist. For the year as a whole, we still expect modest GDP growth of 0.7% in 2024 and over 1.3% in 2025. Inflation is expected to slow further, our base rate outlook is unchanged.

0 Comments

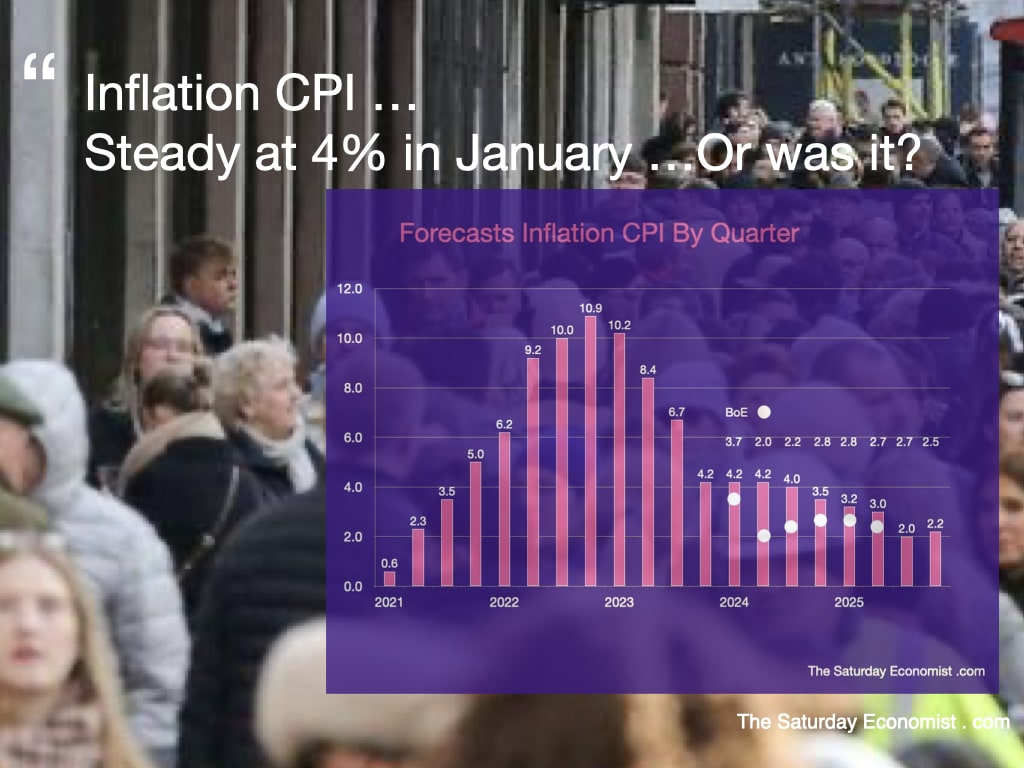

Expectations of a midsummer rate cut increased sharply this week in response to the release of cooler than expected inflation data for January. The Bank of England will make the first cut to interest rates since 2020 at its June meeting, if not before, according to money market bets.

Financial markets are now forecasting, with a probability of 70 per cent, the Monetary Policy Committee will lower the base rate from 5.25 per cent either at, or before, the June 20 meeting. Markets had expected inflation to ease up to 4.1% in the month. As it was, goods inflation eased to 1.8% from 1.9% prior month. Service sector inflation edged up to 6.5% from 6.4%. Food inflation eased to 7%, energy costs were down by just over 18%. Core inflation was steady at 5.1%. The headline CPI rate was unchanged at 4.0%. The arithmetic of goods and service sector inflation, a model in which both are equally weighted, suggests 4.1% would have been nearer the mark for January CPI but that would also apply to November and December for that matter. The inflation numbers followed updates on earnings and wages in the latest employment data. Earnings increased by 5.8% in the three months to December from 8% in the previous quarter ending September. We expect the rise in earnings to ease to 4.5% by the end of the year Q4. Inflation CPI to end at 3.5% in the final quarter. Not quite as optimistic as the Bank of England perhaps but even so ... Our base rate scenario is unchanged, we expect base rates to end the year at 4.5% with the first cut in May or June ... 1 No charges for Biden in classified documents probe but ...

Joe Biden carelessly kept classified documents and notebooks at his home, according to a special counsel report released Thursday. The report said the evidence wasn't strong enough to charge the president with crimes. The report's description of Biden as "an elderly man with a poor memory" prompted a furious response from the president at a hastily called news conference hours later. The 345-page special counsel report portrayed Biden, 81, as someone who haphazardly kept notebooks and documents with classified information at his home, and struggled to recall key dates in his life. In concluding Biden should not be prosecuted, Special Counsel Robert Hur, a former Trump-appointed US Attorney in Maryland, offered a political indictment of the president's fitness. Hur described the leader of the free world as a "sympathetic, well-meaning, elderly man with a poor memory". This would make him impossible to prosecute (and difficult to elect). Republicans quickly seized on that stinging characterization to attack the Democratic incumbent as unfit for office, well no surprise in that! 2 Trump is on a glide path to the Republican nomination ... Trump is on a glide path to the Republican nomination, or should we say "coronation". Trump romped home in the Nevada and US Virgin Island caucuses Thursday night, continuing his unbeaten streak and making Nikki Haley's campaign appear futile. After wins Thursday in Nevada and the US Virgin Islands, Trump remains undefeated and in total command of the primary race. Trump's win in Nevada was never in doubt in a state where party leaders molded the delegate-awarding contest to benefit him. Trump's chief rival, Haley, was not even an option for caucus goers Thursday. Haley, the former South Carolina governor chose instead to take part in the state-run primary conducted earlier this week, where Trump was not on the ballot. Haley finished second to"none of these candidates". A "Non Of The Above" embarrassment confirming her fading relevance in the race. "Nota Bene", It's a landmark. 3 Good signs for Trump in the Supreme Court case ... Trump appears poised for a win at the Supreme Court. Justices expressed deep skepticism that Colorado could declare him an insurrectionist and bar him from their election ballots. Even liberal justices were skeptical that Colorado should be able to declare the former president an insurrectionist and disqualify him from the state's ballot. The question of whether Trump actually engaged in insurrection was barely mentioned in the arguments. This was a clear indication the justices could sidestep Trump's behaviour on January 6, 2021, in a decision that seems likely to affirm his eligibility to appear on presidential ballots. Trump is not in the clear yet. Trump related questions loom for the Supreme Court, such as whether Trump enjoys absolute immunity from prosecution. His lawyers have until Monday to ask SCOTUS to review a DC appeals court ruling last week that Trump does not have super immunity and that he can be prosecuted for trying to overturn the 2020 presidential election. So what can we expect? It's all set for a November run off between a "sympathetic, well-meaning, elderly man with a poor memory" and a 'vicious, vindictive, unfeeling, self serving, malicious, old man with a revenge agenda and a blatant disdain for the American democratic process." Memory not that great either. It's Uncle Joe up against a relative you wouldn't leave alone with the kids ... and certainly not the U.S constitution, for four more years (At least). Fighting Over The Deck Chairs On The Titanic ...

Twenty five points behind Labour, in the polls, over 50 MPs about to jump ship, the Tories continue to fight over the deck chairs on the Titanic, as disaster looms.. Not content with the Balkanization of the Conservative party with five, or is it six families, Liz Truss, who did for Pork exports to China what Rishi Sunak appears to be doing for EV sales in the U.K., is to launch another faction. The Pop Con, faction. The reaction to the launch of "Popular Conservatism" has been mixed, with significant criticism from various quarters, including within her own party, the media, and the public. The initiative, aimed at galvanizing Britain's "secret Conservatives" and pushing back against left-wing ideologies, has been met with skepticism and irony, particularly given Truss's own unpopularity following her brief tenure as Prime Minister. Critics within the Conservative Party have expressed doubts about the necessity and positioning of this new faction. Some Tory MPs have questioned the space "Popular Conservatism" intends to fill, given the existence of other groups advocating for similar libertarian economic policies. The absence of several key MPs from the launch event, including Ranil Jayawardena and Simon Clarke, who were initially billed to speak but later withdrew, indicates a lack of unified support for Truss's movement. The media's response has been both satirical and critical. The Guardian's commentary likened the "Popular Conservatives" to a "Tory tribute act sounding a death knell for irony," highlighting the perceived absurdity of Truss leading a movement for popularity, despite her own unpopularity. This onslaught of satire and criticism reflects a broader skepticism about the movement's impact and Truss's leadership particularly. Public opinion, remains largely unfavorable towards Liz Truss, with recent polls suggesting she is one of the least popular politicians in the country. Ranked 152nd with a 10% approval rating according to YouGov. Widespread unpopularity underscores the challenges Truss faces in rallying support for her "Popular Conservatism" movement. The movement's success in influencing Conservative Party policies and public opinion remains to be seen, but initial responses suggest it faces significant hurdles. Like "do we really need another Tory variant?". The great thing about the Tories, they never stop fighting, the unfortunate facet of action, it always appears to be amongst themselves ... Good news for the Chancellor last week. The government borrowed £35 billion less than expected in the first nine months of the financial year. The chancellor, it was said, is estimated to have, between £15 billion and £20 billion to spend on his budget in March. What a stroke of luck!

Or was it? This week, in a note to self Jeremy Hunt has admitted there is no more money after all. The chancellor, has said there will be less room for tax cuts in the spring budget next month. This, just days after the International Monetary Fund warned that the UK needed to focus on repairing public finances and a week after the OBR dismissed the Treasury spending forecasts as a work of fiction. (The week in which we also warned of the Bond Market Vigilantes). Hunt, who in November announced he was cutting the main rate of national insurance contributions, was widely believed to be gearing up for another tax giveaway after dropping a series of hints about what could be the Conservatives' last budget before a general election. However, the chancellor said he needed to manage expectations. "It doesn't look to me like we will have the same scope for cutting taxes in the spring budget that we had in the autumn statement," Hunt told the BBC's Political Thinking with Nick Robinson podcast. "I need to set people's expectations about the scale of what I'm doing, because people need to know that when a Conservative government cuts taxes, we will do so in a responsible and sensible way." His comments come days after the IMF issued a strong warning to the chancellor against cutting taxes in his March budget, noting that any tax giveaways would probably require extra borrowing or post-election spending cuts. The International Monetary Fund warned against pre-election tax cuts as it downgraded Britain's growth prospects. It said the country should instead curb borrowing and prioritize public spending in areas such as health and education "Preserving high quality public services will imply higher spending needs over the medium term than are currently reflected in the government's budget plans. Accommodating these needs while assuredly stabilizing the Debt to GDP ratio will already require generating additional high quality fiscal savings, including on the tax side". It is this context, that IMF staff advises against additional tax cuts. This follows the statements last week from Richard Hughes, Chairman of the OBR in front of the Treasury Select Committee. The Chairman of the Office for Budget Responsibility (OBR) essentially called the government's post 2025 plans, or the conspicuous lack thereof, a flight of fiscal fantasy. In a striking attack on the government Hughes, said ministers were not being honest with voters about the probable scale of public sector cuts because they had failed to publish detailed spending plans for the period after April 2025. "Beyond 2025 we know virtually nothing," Hughes told the Lords economic affairs committee. "It is just two numbers one for total current spending and one for total capital spending. I think some people have referred to that as a work of fiction. I think that's probably generous, given that someone has bothered to write a work of fiction whereas the government hasn't even bothered to write down what its spending plans are." So we say again, it is all a bit rum. In the space of a few weeks in the autumn, the Treasury, moved from a position in which the Chancellor had no money to play with, to one where he could announce some crowd pleasers because of the effect of higher inflation on tax revenues. Last week, it seems the Treasury moved from a position in which the Chancellor had spent all the goodies in the Autumn statement, to one where he could provide more vote winners in the Spring budget. Now it seems in a note to self, there is no more money for vote winners after all, pressure from the IMF and the OBR not withstanding. It's another episode of "Soap, Life In Downing Street". The intro to Soap, the U.S. Sitcom in the seventies,always began with an intro to the stories of the week and the summary "Confused you won't be after this week's episode". Or will you? At the MPC meeting this week, the committee voted by 6 votes to three, to hold base rate at 5.25%. So much for group think, of which the Bank is oft criticized, two members voted for a rate hike and one voted for a rate cut.

Swati Dhingra, voted in favour of a 0.25-percentage-point reduction to the base rate, marking the first vote for monetary easing in almost three years. Dhingra thinks the Bank is at risk of over-tightening if it waits for data showing sharp declines in wage growth. Jonathan Haskel and Catherine Mann, on the other hand, voted for another rate rise to 5.5 per cent. They think that wages (rising by 6.5%) are still dangerously high. A majority of six MPC members, including Andrew Bailey, the governor, and Huw Pill, the chief economist, voted for another month of no change. Andrew Bailey delivered a mixed message to the markets, pointing out that the MPC was "not at the point where we can lower rates'. Nevertheless, he said, the main question facing rate setters at future meetings was 'how long we need to maintain this position". This is a significant change in stance. The MPC has removed its previous guidance relating to the need for more rate rises, suggesting that the Bank's next move would be a reduction in borrowing costs. In the US, this week, the Fed also shifted its guidance to financial markets to remove its previous language on the need for more monetary tightening. Chairman Jerome Powell opened the door to rate cuts, without specifying when they were likely to happen. A cut as early as May remains a possibility. Markets were previously exciting about a possible March cut. Governor Bailey hinted at a potential rate cut, markets assume in June. This would mark the first easing of monetary policy since 2020. Andrew Bailey said, "The economy is "moving in the right direction", possibly towards a position that could cause the Bank of England to consider cutting interest rates. The obsession with the "Suite of Models" continues. The "models" suggest inflation may hit the 2% target in the second quarter of the year. Thereafter, the headline CPI rate is expected to rise in the latter half of 2024 closing at just under 3%. (The "models" are also pretty optimistic about earnings and wage settlements). The Governor called for caution, suggesting that while rate cuts are on the horizon, they may not be as substantial as financial markets anticipate. In a later statement, Chief Economist How Pill decided to cloud the market view further. The day after the statements from the Governor, Hugh Pill indicated the Bank may have to raise interest rates, as a next step, instead of cutting them. Pill highlighted potential risks, such as developments in the Middle East, that could necessitate a response from the Bank. He also pointed to sustained inflationary pressures from wages, the job market, and service industry prices as reasons to be cautious about rate cuts. Despite market expectations for a rate cut to 5% by May or June, Pill emphasized that the Bank does not have sufficient evidence yet to support a reduction in rates. "There are dangers from developments in the Middle East for example, that if they were to become manifest we would need to respond to, and that would certainly alter my assessment of the speed or even the direction of future movements in rates". So what can we make of it all? Our overall forward guidance outlook remains unchanged. We expect a series of three base rate cuts in the current year possibly beginning, in May or June. We model base rates at 4.5% in the final quarter. Don't be too surprised if inflation fails to perform as the Bank's ""suite of models" suggest. Models are like that ... |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed