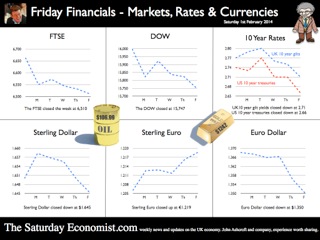

GDP growth up in the UK .. The ONS delivered the preliminary estimate of growth in the final quarter of the year this week. The UK economy grew by 2.8% year on year and 1.9% for the year as a whole. Who would believe this time last year markets were still fretting about a triple dip recession. The service sector, accounting for almost 80% of activity increased by 2.6%, construction increased by 4.5% and even the beleaguered manufacturing sector managed to push output up by 2.6%. Within the service sector, the leisure pound was once again to the fore, with strong growth in distribution, hotels and restaurants up by 4.5%. Business services increased by over 3%. We expect growth to be revised up to 2% for 2013 at some stage. For the moment we stick with our forecast of growth in 2014 and 2015 of 2.5% and 2.7% respectively. Our GDP(O) model is still performing well. The dataset has been updated and is available on the Publications page, along with our latest review of world trade. For economists, it doesn’t get more exciting. The release of the preliminary estimate is comparable to the release of a first draft of a Harry Potter chapter. What happened to the Weasleys, Gilderoy and Malfoy? Has Hagrid shaved off his beard as an end of year bet? Has Dumbledore lost weight. Has Voldemort renounced the devil and all his works? So what happened to Hermione and Harry? Can water supply and sewage really have grown by 8% in the final three months of the year? All is revealed to muggles and analysts alike by Joe Grice Chief Economist of the Office for National Statistics. In a high profile press conference, analagous to the lottery or some talent show, Joe reveals all... and the number is 1.9%. Excellent, thanks Joe. Data revisions are always interesting. But imagine if the next chapter of Rowling release revealed, the philosopher’s stone has been lost, the Chamber of Secrets has been opened to the public, the prisoner of Azkaban has been recaptured and the goblet of fire turns out to be a flaming glass of sambuca. It really can be so dramatic. After all the double dip disappeared. One day we may discover there was no recession in 2008 after all. Can’t wait for the next chapter in the GDP chronicles on the 26th February. So what happened to consumer spending and what of investment? Still stuck in the deathly hallows no doubt. US GDP also increased by 2.7% in the final quarter ... Over in the US, the Bureau of Economic Analysis announced growth of 2.7% in the final quarter and 1.9% for the year as a whole. The UK and the USA are neck an neck in the race to be the fastest growing economies in the Western World. Makes you wonder why the Fed were spending $85 million each month on treasuries and mortgage debt. No wonder the decision was made to taper further and reduce the spend to $65 billion with immediate effect. It is said that if a butterfly flaps its wings in Nicaragua, it can cause a hurricane in New York. I always found that difficult to be believe. But then who would have thought gay marriage could cause such flooding in Somerset according to UKIP. Even so, Bernanke flapping his tapering wings in Washington caused chaos in capital markets across the world. The tapering announcement led to falls in international stock markets, capital flight from developing economies and exchange rates rattling in India, Turkey and Argentina. Turkey hiked rates to over 10% to persuade the dollars to stick around. In Buenos Aires, they have long since departed. So what happened to sterling? Markets were disturbed by the decision on tapering, once again undermining stock market strength in the USA and destabilizing international capital flows across developing economies. Nevertheless, the CBOE Vix volatility index closed relatively unchanged over the week at 18.4. The pound closed at $1.6433 from $1.6481 against the dollar and 1.2184 from 1.2041 against the Euro. The dollar closing at 1.3487 from 1.3681 against the euro and 101.96 from 102.34 against the Yen. Oil Price Brent Crude closed at $106.40 from $107.88. The average price in January last year was almost $113, no real threat to inflation from crude oil prices Markets, moved down - The Dow closed at 15,698 from 15,879 and the FTSE closed at 6,5210 from 6,663. 7,000 on the FTSE no longer such a soft call for the near term. UK Ten year gilt yields closed at 2.72 from 2.78 and US Treasury yields closed at 2.65 from 2.72. Yields will test the 3% level as tapering accelerates into 2014 but for this week, once again, the flight to quality led the market. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

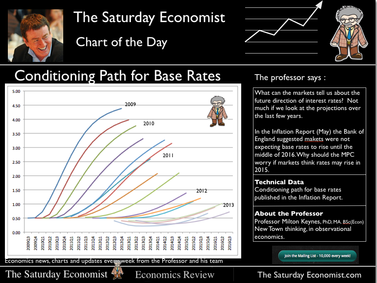

No tapering, more tampering leads to more questions than answers at the FED. So much for forward guidance. Despite clear indications “Tapering” may begin in the Fall, the Fed decided to continue the process of QE, purchasing mortgage backed securities at a pace of $40 billion per month and longer term Treasury securities at the rate of $45 billion per month, this week. The objective - to maintain downward pressure on longer term interest rates to support mortgage markets, a fragile housing recovery and to make broader financial conditions more accommodative in the short term, In that way, growth plans for the US economy are not derailed in the recovery phase. The Federal Open Market Committee had been concerned by the rapid rise in ten year Treasury rates by 120 basis points and evidence of low inflation and slightly weaker jobs market. Furthermore, fiscal consolidation and a higher tax burden were likely to damage growth this year. The FOMC reduced their own forecasts for 2013 to around 2.1% from 2.4% in the July review, as a result of recent developments. Should we be surprised by the decision? Should we be surprised by the decision? Well yes and no. In July the mood was more optimistic about the economy. The US economy was expected to growth by almost 2.4% in 2013 and by 3.3% next year. Unemployment was expected to fall towards 7% this year, then down to 6.5% next. Inflation was expected to average around 1.5% next year, with no obvious inflation threat on the horizon. The surprising thing is the revised forecasts haven’t changed the medium term outlook over much. The US recovery is still on track. The growth forecasts have been reduced to a more realistic level for the current year. We still think the USA will struggle to hit the 2% mark but nothing has changed of late to alter that view. So what’s changed? So what’s changed. The FOMC committee has been disturbed by the rally in long rates and the rise in ten year Treasury yields towards 3%. The labour market has seen moderate growth but no reason of itself to step back from tapering. Bernanke’s phone line must have been ringing off the hook by calls from central bankers in emerging markets. Faced with the repatriation of hot monies to the USA, capital outflows and plummeting exchange rates, Brazil, India, South Africa, Indonesia, Turkey and more have confronted the realignment of the US yield curve to some semblance of normality but not without some considerable cost to their own domestic economies. The BISTO kids would have welcomed the continuation of the QE gravy train for now. For the Fed and Bernanke, there is no fall back. They have to get the timing right to begin to tighten policy. “Monetary shocks played a major role in the Great Depression” said Bernanke in Essays on the Great Depression :Princeton 2000 and “Much of Japan’s [lost decade] can be attributed to exceptionally poor monetary policy making” writing in "Japanese monetary policy, A Case of Self Induced Paralysis Princeton in 1999. The Fed cannot be seen to move too soon and damage the recovery. Bernanke would rather hold the patient a little longer on life support, than allow the economy and the markets, to leave intensive care too soon. Will a few months or so make much difference? Not really, sooner or later, and better sooner, QE must be drawn to a close in the USA. What about Base Rates? Despite the delay on tapering, the FOMC believe base rates will be on the rise in 2015 towards 1%. The labour market is likely to hit the 6.5% hurdle rate at some stage next year. The tapering process may begin by the end of the current year or may await the cosmic flip from Planet ZIRP to Planet Janet in January. (Assuming Janet Yellen takes over as lead astronaut at the Fed early in the New Year.) By 2016, US rates are expected to rise to 2% on their way back to a 4% norm over the medium term. Indeed 20% of the fed votes would expect rates to be back at 4% by 2016. So what does this mean for the UK. Our guideline is watch the US and add six months. Fed rates are expected to remain on hold until the end of 2014, rising in 2015 to 1%. By 2016, they may be at 2% or above. In the UK, the MPC’s forward guidance suggests rates may be on hold for three years until 2016. That’s a long way off. For the moment, the decision not to taper but to continue to tamper, will please the markets but only in the short term. The traders will find a reason to test the Fed towards the end of the year. Tapering is coming and so are the rate rises in the USA and the UK. Posted by John Ashcroft. Keywords, Forward Guidance, Tapering, QE, FOMC, Bernanke. © 2013 John Ashcroft, The Saturday Economist, John Ashcroft and Company. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets.  The decision to hold rates was widely expected. The economy is showing signs of recovery, confirmed by recent data including our own QES survey and the important GM composite indicator. It is too early to begin the programme of base rates rises but it is time to say goodbye to QE as a policy option. Commenting on today's Monetary Policy Committee (MPC) interest rate decision, as Chief Economist at the Greater Manchester Chamber of Commerce. The sooner long term gilt rates return to some semblance of normality the better. The August meeting should be more interesting to rate watchers. Markets are looking for a statement on forward guidance and the future path of interest rates. Mark Carney must be careful not to make the same mistakes as Bernanke. Forward guidance increases market volatility with an unhealthy focus on the US non farm payroll data. The markets can no more ignore a speech delivered by Bernanke, than Chinese banks can ignore a directive from the People’s Bank of China. The new Governor must avoid becoming hostage to a monthly data set. What can the markets tell us about the future direction of interest rates? Not much if we look at the projections over the last few years. In the Inflation Report (May) the Bank of England suggested markets were not expecting base rates to rise until the middle of 2016. Why should the MPC worry if markets think rates may rise in 2015? The analysis of expectations over the last four year has not proven to be much of a guide as the Chart of the Day indicates.  Economics news – Don't worry about the double dip ... Good news - no need to worry about a triple dip, the double dip has been eliminated from history according to the latest release of the National Accounts data from the ONS this week. The hint of a double dip has been smoothed away. The good news continued as the increase in activity was up held at 0.3% growth into the first quarter of 2013. The economy is "healing"! Slightly concerning, the recession in 2008/9 was now worse than we had believed. The economy fell by 5.5% in 2009 compared to the 4% last feared. Despite the rally into the year, the economy remains some 4% below peak in the first quarter of 2008. Worse still the comparison of year on year growth is much lower than first thought. In the first quarter of the year growth was up by just 0.3%. We have to be less bullish about the year as a whole as a result but 1% growth still remains a possibility. Relying on data from the ONS is like planning a mountain trek with a dodgy GPS device. Every so often you tap the tracker and find out you are not exactly where you were led to believe, having arrived by a different route from that last chosen. Who would have thought for example, between 2000 and 2008, the economy grew by almost 3% a year. Had only we known, we had it so good, the Governor could have taken away the punchbowl much earlier. In the USA, the feral hogs could have been put out to grass and the heavy drinkers could have been weaned from Wild Turkey to cold turkey much earlier in the process. For lovers of nominal GDP targeting the revisions should be a clear warning. Nominal GDP grew by an average 5.5% over the period 2000 - 2008. The problem for policy makers, the GPS device was on the blink, with only a sporadic reading available. For lovers of forward guidance, the reaction of bond markets to Bernanke’s comments on QE and tapering, should also be a warning. The statement led to a 100 basis point jump in Treasury yields. The market “over reaction” led to criticism of by the Dallas Fed chief, “Traders are behaving like feral hogs”. “Investors shouldn't overreact to the central bank's plan to reduce the pace of asset purchases”, the Dallas Fed chief Richard Fisher said in an interview with the Financial Times this week. Investors behaved like "feral hogs" after the comments by Bernanke. "What we're talking about here is dialling back," said Fisher, president of the Federal Reserve Bank of Dallas. “I don’t want to go from Wild Turkey to Cold Turkey”. For the more technically inclined. Wild Turkey Bourbon is super-premium American bourbon, made in Lawrenceburg, Kentucky by Master Distiller Jimmy Russell. Forward guidance is a market feed programme by which feral hogs can increase market volatility and trading volumes. Dialling back, is a wish that Bernanke would make a few telephone calls before making a few market calls. After all, we all love to hedge, even Fed chiefs. Back to the ONS stats, by the end of 2012, the economy was some 11% below trend rate at a cost to the economy of some £200 billion in lost output and a cost to Treasury of over £80 billion in lost revenue. Hence the challenge of the spending review this week. The Chancellor obliged to cut a further £15 billion from spending in 2015/16. Radical changes to the level and composition of public spending will continue but spending cuts will achieve little without significant economic growth. For a more detailed analysis check out the IFS web site. In the absence of growth, the IFS warn that further consolidation may require tax rises and spending cuts to hit the targets in the future. Furthermore there appears to be little boost to infrastructure spending, according to Paul Johnson Director of the IFS, “What the Chancellor, did not announce was an increase in public sector net investment. Despite the hype net capital spending is not set to rise”. Jonathan Portes and the Krugmanites will just love that. What happened to sterling? Sterling fell further on dollar strength to 1.5220 from 1.5425 and slipped against the euro to 1.1687 from 1.1757. The Euro dollar closed at 1.302 from 1.3115 and against the Yen, the dollar closed up 99.12 from 97.8. Oil Price Brent Crude closed at $102.16 from $101. Average prices in June were some 9% higher than June 2012. Markets, The Dow closed up 14,910 from 14,799. The FTSE closed at 6,215 from 6,116. Markets have rallied from lows, could be time to average in. UK Ten year gilt yields closed at 2.46 from 2.42, US Treasury yields closed down at 2.49 from 2.54. The feral hogs will have their say. Yields are set to move higher. Gold closed down at $1, 232 from $1293. Worshippers of the old relic at a loss, as we begin the exodus from Planet ZIRP. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  This week Bernanke signaled the end of QE, just as Obama signaled the end of the Bernanke regime at the Fed. “Well, I think Ben’s done an outstanding job... he’s already stayed a lot longer than he wanted or he was supposed to”, said the president this week. Ouch. Some of us feel the same way about the great QE experiment. It may soon, all be over. On the basis the unemployment rate falls to a target rate of 6.5% in the US, the $85 billion monthly asset purchase programme will drift to a close within the next twelve months. As Truman may have said, The Big Bucks stop here! Bernanke explains this is not a tightening of policy. The Fed is lifting its foot off the gas, (reducing QE) not hitting the brakes (increasing base rates). Fascinating. Monetarists believe controlling the economy is like driving a chevy. Foot on the gas, toe on the brakes, steering the economy in the right direction. Total control. Keynesians on the other hand, believe the economy is like some great Keynesian slot machine, insert the coins, adjust the Okun ratio, pull the lever - jobs flow as the money tumbles into the bottom of the gaming well. If only it was all so easy! The markets were a little confused. US Treasury yields jumped higher to 2.54% up by over 40 basis points, as the Dow closed down 200 points on the week. So what happened back home? In the UK, Sir Mervyn King’s time at the Bank of England draws to a close. At the Mansion House this week, The Chancellor announced a peerage for the Governor, marking the passage of Lord King to the upper house and the passage of QE as a policy option in the UK. In other news, inflation CPI basis ticked back to 2.7% from the 2.4% relief in April. Manufacturing prices show little evidence of pressure as input prices remain subdued and the uptick in output prices to 2.2% in the month should be easily contained. Inflation CPI should end the year around the 2.4%, no threat to policy at that level. Retail sales in May were up by 1.9% in volume terms, marking a modest recovery but no great surge forward. The borrowing figures were released for May. Public sector net borrowing excluding temporary effects of financial interventions was £8.8 billion. This is £6.9 billion lower than in May 2012 when it was £15.6 billion. At first sight this is great news from the Chancellor but ... Closer inspection reveals borrowing has been reduced by £3.9 billion from transfers from the Bank of England Asset Purchase Facility Fund and by £3.2 billion from retrospective tax payments by Swiss banks. The Old Lady has been mugged again by the Treasury and time is up for the Swiss deposit accounts flattering the performance in the month. Nevertheless, the borrowing figures will improve this year as the economy continues to recover and spending plans bite. Check out the IFS release for details. What happened to sterling? Sterling fell on dollar strength to 1.5425 from 1.5703 and held at 1.1757 (1.1763) against the Euro. The Euro dollar closed at 1.3115 from 1.3345 and against the Yen, the dollar closed up at 97.8 from 94.06. Oil Price Brent Crude closed at $101 from $105.93. Markets, The Dow closed down 14,799 from 15,070. The FTSE closed at 6,116 from 6,308. Time to stand aside whilst markets consolidate. It will soon be time to average in. UK Ten year gilt yields closed at 2.42 from 2.08, US gilt yields closed up at 2.54 from 2.13. The great rotation is gathering momentum. Gold closed down at $1293 from $1,390. Worshippers of the old relic do not know what to make of it all, as we begin the exodus from Planet ZIRP. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. JKA The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed