|

The January IMF Update ...

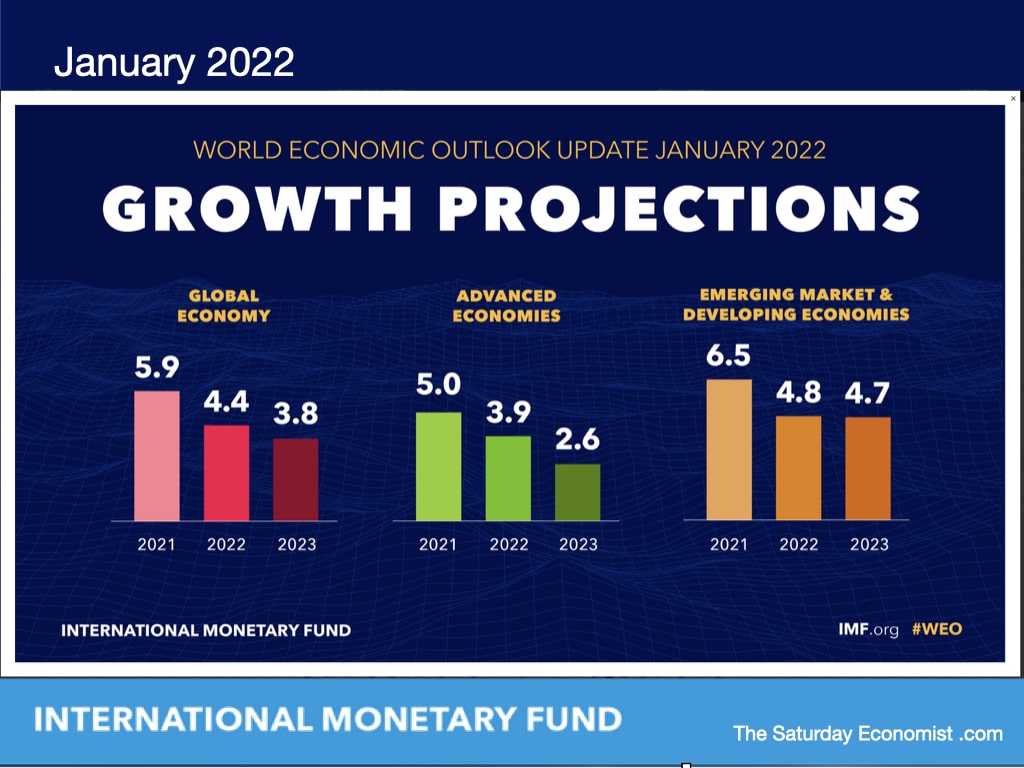

The IMF released the latest World Economic Outlook this week. Growth is expected to moderate this year to 4.4% from 5.9% last year. The revision is a downward adjustment of 0.5%. In the earlier October forecast, growth of 4.9% was expected. Weaker growth is expected. The shadow of the Omicron virus overhangs activity. Countries have reimposed mobility and work restrictions. Supply disruptions have continued into the new year. Rising shipping charges, energy prices and metal costs have resulted in higher and more broadly based inflation than anticipated. Interest rates are set to rise in the U.S. and the West to offset the inflation surge. China seeks to alleviate monetary policy in the East. Next year, world growth is expected to slow further to 3.8%. This is slightly better than the 3.6% forecast in October. The IMF cautions, the forecast is conditional on an alleviation of health conditions and restrictions. Faster and wider vaccination would be of assistance. Better health therapies would also help. World Trade and Inflation ... World trade is forecast to increase by 6% in 2022 and by 5% in 2023. A strong background for international activity set to continue. World shipping rates are set to fall back to trend average towards the end of the year. Inflation pressures are set to ease. The IMF expects inflation to average 3.9% amongst the advance economies in the year slowing to just over 2% next year. In emerging markets, inflation will rise to 5.9% this year up from 5.7% last year. Headline inflation will moderate (but not by much) to 4.7% next. Oil and gas prices are key to the inflation outlook. The IMF assumes an oil price of around $80 dollars per barrel Brent Crude basis. Oil traded at $90 dollars at the end of last week. Geo political tensions pushing prices higher. $75 - $80 dollars remains our benchmark call for the year. Risks to the global baseline are tilted to the downside, the IMF warns. The pandemic, supply chain disruptions, energy prices, rising wage costs may impact on growth. Risks to currencies, capital flows and asset prices may result from tighter monetary policies to combat inflation. Geopolitical tensions remain high. Russia on the borders of the Ukraine. China on the edge of the South China sea. China US decoupling. We monitor fifteen world hot spots with ten conflicts to watch. Rising tensions between the UK and France should not really have to figure in our International Relations Review. Growth Projections by Region ... The outlook for the two largest economies in the world largely explains the change in forecast outlook. In the U.S. Biden's build back better deal has been removed from the stimulus package. Tighter monetary policy and continued supply side shortages has resulted in a downgrade of 1.2% in US forecasts. In China, retrenchment in the real estate market and a sluggish recovery in personal consumption has led to lower growth forecast of almost 1%. Growth of 4% in America and 4.8% in China the revisions. In Europe, growth is expected to slow to 3.9% in 2023 then 2.5% next. In Germany, France and Italy growth of 3.7% is expected. In the U.K. the IMF forecasts growth of 4.7% this year and 2.3% next following a recovery of over 7% growth last year. We think the estimates are a tad pessimistic over the forecast period. For the moment our Forecast Update Remains Unchanged. You can access the UK chart set on our Flipsnack channel by clicking on the link. Don't forget, every day we undertake our "What The Papers Say Review". We check economics and business news from over twenty titles around the world. This feeds into our social media channels on Twitter, Facebook and LinkedIn. One of the many ways, we always keep you in the picture. For our "International Relations Review", we follow "Foreign Policy" "Foreign Affairs" and "Geopolitical Futures". International relations featured in our LSE training. The Cuban Missile Crisis became featured in my third year at Grammar School. Mutually Assured Destruction was the MAD option for foreign policy then as now ... That's all for this week really looking forward to Our Monday Morning Market Update next week. Markets down, Bond Yields Up, Crypto Crashes, Tech Stocks Tormented, Sterling Lower, Don't Miss that! Have a great weekend, John To understand the markets, you have to understand the economics ... Friday Forward Guidance, The Saturday Economist, Monday Morning Markets ... Forward to a Friend of Colleague, the can register for our FREE updates here. It's Only Fair To Share !

0 Comments

Goods Inflation Rises to 6.9% ...

Headline CPI hit 5.4% in December, up from 5.1% prior month. Goods inflation increased to 6.9% from 6.5%. Service sector inflation was up just 0.1% to 3.4%. Fears are increasing for the hike in energy bills to be expected in April. The reality of rising energy costs is already with us. Fuel prices were up 23% in the month. Electricity bills were up 19%. Gas prices were up by 28%. Petrol prices were up 27%. Flight costs were up 29%. Thinking of buying a second hand car? You will be paying 29% more than December 2020. Inflation pressures are increasing. Oil prices moved higher last week. The Houthi attack on Abu Dhabi spooked oil prices. The prospect of a Russian invasion of Ukraine rattled gas prices. Even so, gas prices fell 10% in the week, down by almost 50% from peak last year. The Bank of England expects inflation to peak around 6% in April. The more pessimistic think the high could be around 7%. We still expect prices to peak in the first quarter of the year, easing to around 3.5% by the end of the year. The Governor of the Bank of England, Andrew Bailey now expects prices to remain above the 2% target into 2023. Really? Producer Prices Easing ... Manufacturing output prices (PPOs) eased to 9.3% from 9.4%. Input costs (PPIs) eased to 13.5% from 14.2%. Oil prices and metal prices featured in the cost mix along with chemicals. Oil prices Brent Crude averaged $50 dollars on December prior year, compared to $74 dollars in 2021. The inflation impact eases by the second quarter this year and is eliminated into the second half, assuming oil trades between $75 - $80 dollars over the period. OK, Oil traded higher last week closing at $87.63 but this was down from the mid week freak. International shipping costs are easing. The Baltic Dry Index fell to 1,415 last week. The index peak hit 5,500 in October last year. Shipping costs from China to the East Coast USA are also easing, down 20% from peak last year according to Freightos. The big fear for the UK central bank is wage costs will respond to the cost of living squeeze in a tight labour market. The latest jobs data will have done little to alleviate concerns. Want to know more about our forecasts for inflation and our models used in the process? You can access our twenty page TSE Inflation Chart Book on our Flipsnack Channel. It's a bit geeky but worth a look. Unemployment Rate Falls to 4.1% ... The latest jobs data made for incredible reading. The unemployment rate fell to 4.1%. The number unemployed fell to 1,382,000. The number of vacancies in the economy increased to 1,247,000. There were 32.5 million in employment, compared to 32.2 in November 2020. Whole economy earnings eased to 4.2% from 4.9% prior months. Real earnings adjusted for inflation CPI were negative -0.9%. We expect earnings to slow further to 3.5% towards the end of year. Assuming our projections for inflation are correct, the cost of living pressures will ease into the second half of the year. Over half of the vacancies in the economy are in health and social, retail, accommodation and food. The correlation between vacancies and unemployment by sector is significant. The anomaly is in health and social. There are over 200,000 vacancies in the sector with a relatively smaller number out of work compared to the overall sector average. Will our wage forecasts hold in a tight labour market? This week, MPC member Catherine Mann warned of a "self perpetuating cycle of pay and price rises". We must "lean against stronger for longer inflation." The 25 point base rate rise could happen when the MPC meets again in February. Want to know more about our forecasts for jobs and wages used in the process? You can access our ten page TSE Labour Market Charts on our Flipsnack Channel. It's a not quite so geeky but worth a look. That's all for this week really looking forward to Our Monday Morning Market Update next week. Markets down, Bond Yields Up, Crypto Crashes, Tech Stocks Tormented, Sterling Back in Place, Don't Miss that! Have a great weekend, John John Ashcroft : Much More Than Economics ... Friday Forward Guidance, The Saturday Economist, Monday Morning Markets ... Economic output exceeded pre-pandemic levels for the first time in November. GDP increased by 0.9% compared to prior month. Compared to prior year output increased by 8.1%. Despite an assumed setback in December, we now think the economy will have grown by 8% for the year as a whole.

In our forecasts for 2021 we model growth at 7.5% with an upside of 8%. We attached greater uncertainty at that time to the outlook for manufacturing and construction. Construction output was up by almost 7% in the month. Manufacturing growth slowed to just 0.4% year on year. Service sector growth was up by 9.5% in November. We expect growth of 8% in the final quarter and 8.3% for the year. To some extent more clarity is provided on the direction of travel. Our low growth scenario for construction and our high growth scenario for manufacturing, have been eliminated. We expect growth of around 5.5% in 2022, slowing to the trend rate of growth of 2.1% thereafter. This means the economy will enjoy a period of nominal growth of the three year period of almost 25%. A great opportunity for debt absorption in relation to GDP or revenues on a national or corporate level. You can access our updated 30 page chart book on our Flipsnack Channel The Saturday Economist Forecasts for 2022 by clicking on the link. We model GDP(O) output as we would with our conventional business models. No theory, just pragmatic, empirical analysis. Rates Set To Rise ... Markets are bracing for the escape from Planet ZIRP. Our Friday Forward Guidance outlines the pattern of rate hikes. Base rates in the U.S. and the U.K. will end the year around 1%. Bond yields are set to rise to 2.5% in the U.S. and 1.5% plus in the U.K. The outlook for pension fund deficits will look much better this time next year. Market volatility is expected in the current year. Equity markets took a hit last week. Our Monday Morning Markets update will assess the damage and try to explain the Sterling rally! Our Labor Market and Inflation outlook will be updated next week. The Fed is reacting to the 7% rise in December's headline rate in the U.S.. The Bank of England may not have to wait until April for the 6% CPI spike in the U.K. Trade Deficit Set To Increase ... The latest data suggests the deficit trade in goods will increase to £155 billion this year from £129 billion last year. Exports increased by 4.6%. Imports increased by just over 9%. The pattern of trade is moving away from the EU, more in terms of imports rather than exports. The EU share of imports fell to 47% in 2021 compared to 53% in 2020. Truly global Britain is becoming an open market to container shipments from around the globel as the workshop of the world continues to lose share of trade, The trade deficit in goods was offset by the service sector surplus of some £135 billion last year. Combined exports (goods and services) of just over £600 billion, still leave us some way short of that £1 trillion Pound export target. Forecasts for 2022 ... That's all for this week. Have a great weekend and a great week ahead. You can access the chart book The Saturday Economist Forecasts for 2022 by clicking on the link. Forward to a friend or colleague, encourage them to sign up for our FREE updates. My thanks to every one for their support during the past year. We continue to work with a number of private clients including Protiviti and Robert Half this year. If you would like to join our Private Client Group just drop me a line. "Great Research dies in darkness." The reaction to our Monday Morning Markets and Friday Forward Guidance has been great. We look forward to a great year ahead as we extend the coverage of economics, strategy and financial markets. The Saturday Economist, we always keep you in the picture ... John John Ashcroft : Friday Forward Guidance, The Saturday Economist, Monday Morning Markets ... Forecasts for 2022 ...

This is our first Saturday Economist publication for 2022. Yesterday we released our Friday Forward Guidance. On Monday we published our Monday Morning Markets Review of past year. Today we update our forecasts for the UK economy for the year ahead. You can access the full chart set on our Flipsnack channel using the link or clicking on the photo. We use the word "forecast" cautiously. It is a best guess scenario. A benchmark at best. Lot of caution and uncertainty surround the outlook for growth, inflation and monetary policy. So what's new about that. World Growth ... In October, the IMF released their forecasts for the world economy. Growth of 4.5% was then expected for the year ahead. Our good friends at CEBR have adjusted their outlook for the year down to 4.0%. Economies are currently hampered by supply side shortages and the impact of the omicron variant. Growth of 4% - 4.5% would remain a fair call for the twelve months ahead. We outline in detail our expectations for major markets in our Saturday Economist Live updates. World trade expanded by around 12% last year, leading to supply side shortages and delivery issues especially in container freight. Growth in the second quarter was up by 22% slowing to 8% in the third quarter. We expect growth to slow to around 4.5% this year. It may take some time for container congestion to unwind. UK Growth ... Economists have penciled in growth of 7% in 2021, slowing to 4.7% in 2022 according to HMT Forecasts for the UK Economy published in December. Our outlook is a slightly more optimistic scenario. We expect growth of 7.5% in 2021, slowing to just over 5% in 2022. We attach greater uncertainty to the outlook for manufacturing and construction. We assume a short term setback in the first quarter for leisure, hospitality and travel. Inflation ... CPI inflation is expected to average 5% in the final quarter for 2021. The Bank of England expects the level to peak at around 6% in April. 7% could be the level attained, without some intervention to moderate the energy price cap. Thereafter inflation is expected to slow towards 3.5% by the end of the year. The inflationary impact of the rise in oil prices last year fades into the second quarter of the year and is eliminated into the second half. Greggs are warning of price increases to come in the year ahead. Sainsburys have announced an increase in minimum wage. The big fear is price transmission into earnings as domestic household costs rise. We expect earnings to slow to a trend rate 3.5% by the end of the year. The cost of living squeeze, acute at the start of year, eases by close. Labour Market ... In October, the unemployment rate fell to 4.2%. There were 1.4 million unemployed. The number of vacancies in the economy was 1.2 million. Earnings growth had slowed to 4.9%. There were 32.5 million in work. The numbers on furlough had been largely absorbed into work or so it would appear. In the US, the unemployment rate fell to 3.9%. So what to make of our projections into 2022? We model out with an unemployment rate of 4.5% through 2022. The number of vacancies expected to fall to 750,000 by the end of the year but then again? Twin Deficits Borrowing and Trade ... In the chart set we forecast the outlook for the twin deficits of Public Sector Borrowing and Trade. We also provide a first look at the impact of Brexit on trade. No discernible impact on the volume and pattern of exports, share of imports increasing from the rest of the world. Markets and Interest Rates ... Our Monday Morning Markets and Friday Forward Guidance provide weeky updates on trends in financial markets. Last week, bond yields moved higher, the Nasdaq slipped 4%. The S&P closed down in the first week of trading. This is a bad omen for performance in the year ahead as we will explain on Monday. That's all for this week. Have a great weekend and a great week and year ahead. This is the first in our series for 2022. The Forecasts will provide a benchmark during the year. My thanks to every one for their support during the past year. My special thanks to everyone with whom we have been able to work this year. Thanks also to our Premium Subscribers. Your support is invaluable to be able to develop the product offer. The reaction to our Monday Morning Markets and Friday Forward Guidance has been great. We look forward to a great year ahead as we extend the coverage of economics, strategy and financial markets. The Saturday Economist, we always keep you in the picture ... John John Ashcroft : Friday Forward Guidance, The Saturday Economist, Monday Morning Markets ... |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed