Central bankers were in Jackson Hole this week discussing “Resilient Monetary Policy Frameworks for the Future”. Janet Yellen grabbed the headlines with the opening speech on Friday: “The case for an interest rate hike in 2016 has strengthened”. It is a pleasant fiction! Strong U.S payroll data in June and July, supported the argument to increase rates. Payroll, increases of 292,000 in June and 255,000 in July were above the five year month average of 210,000. Core inflation PCE at 1.6% is moving towards the Fed target. Growth in the second quarter was just 1.2% following revised growth of 1.6% in the first quarter. U.S. growth is likely to be around 1.5% this year down from 2.4% in 2015. Disappointing GDP figures will inhibit the push to increase rates. Markets expects the Fed to hike rates in December with a less than 25% probability attached to an earlier September rates rise. The Fed is unlikely to hike rates any time soon. Fed concerns continue … The Fed remains concerned any further move would damage growth, hit the bond markets, damage stock markets, inflict currency turmoil and undermine the recovery in emerging markets. Financial markets crashed in 2013 when the Fed hinted that it would begin to tighten monetary policy. The “taper tantrum” revealed that several major economies, including Brazil, were still addicted to cheap debt after borrowing heavily in the US currency. Since then the crisis in Brazil has deepened, Abenomics is struggling yet again in Japan, EU rates are negative and the Bank of England has announced further rate cuts and another round of QE. Janet Yellen may continue to “hint” at a rate rise but the Fed chair is quick to point out “Decisions depend on incoming data”. There is a lot of data. The Fed forward funds rate forecast ranges for 0% - 5% by the end of 2018. So much for incoming data and forward guidance. Stuck on Planet ZIRP ...? Central bankers are stuck in a hole not just in Wyoming. Hotel California is on Planet ZIRP. “You can check out anytime you like but you can never leave”. There is a serious problem with monetary policy. Interest rates pushed to the lower bound together with QE are unproven facets of policy with no empirical exposure to effect. “Ill considered new dogmas pushed into the mainstream of monetary policy” the verdict of Kevin Warsh a former member of the Federal Reserve Board and now at Stanford, writing in the Wall Street Journal this month. The Fed wants to restore some semblance of order to monetary policy without damaging equity and bond markets into the future. The problem is that interest rates at the lower bound together with QE have distorted capital markets. Ten year bond yields at 0.6% in the UK are a representation of the problem, not the success. In the UK £450 billion is the target for QE spending, US $3.7 trillion the budget in the USA. In the UK, USA and Europe central bank assets are over 20% of GDP. In Japan with the 80 trillion yen ($796 bn) annual bond-buying programme, central bank holdings are heading for 80% of GDP. BOJ's Kuroda recently said he would not rule out a “deepening cut” to the country’s negative interest rates. ECB's Draghi has followed the Japanese into negative territory, dragging the Swedish, Danish and Swiss national banks into the NIRP crevasse. For some strange reason the Bank of England panicked into rate cuts and further QE this month. UK data this week suggests the Governor jumped the gun in fears over Brexit. At least Carney and Yellen are ruling out negative rates. Bernanke and Shifting Perspectives … Former Fed Chair Ben Bernanke recently penned another of his Brookings Institute blog entries, called “The Fed’s shifting perspective on the economy and its implications for policy”. His summary: “It has not been lost on Fed policymakers that the world looks significantly different in some ways than they thought just a few years ago. The degree of uncertainty about how the economy and policy will evolve may now be unusually high.” What does that mean? Bernanke admitted that we had no idea what we were doing when we introduced QE. Since then, Fed projections have been wrong, and the central bank doesn’t know how to make them any better in the future. Worse still you begin to believe the Fed has no idea how to get out of this mess. QE has unintentionally created the biggest bond bubble in history boosting equity markets in the process. The role of the central bank is not to maintain bonus structures on Wall Street. How to explain the withdrawal to the addicted few? Don’t be baffled by new think concepts of Larry Summers, “secular stagnation” brought about by ageing Population, Low Productivity, Spending and Investment. What if low spending and investment are a function of interest rates at the lower bound and QE, inhibiting savings and productivity growth? Neither should we be baffled by the concept of the floating equilibrium real interest rate, a justification for low rates in a low growth environment. It is said that In a slowly growing economy, the equilibrium real rate is likely to be low, since investment opportunities are limited and relatively unprofitable. Yet investment opportunities and the search for yield are inhibited by central bank intervention driving down yields on government and corporate bonds. Extraordinary Popular Delusions and the Madness of Crowds : Charles Mackay 1841 The adventures on Planet ZIRP, with profligate QE spending, drifting into the NIRP crevasse will one day make a chapter update in the future edition of Extraordinary Popular Delusions and the Madness of Crowds. Tulip bulbs trading higher than gold? Ten year gilts yields lower than inflation. “Why do otherwise intelligent individuals form seething masses of idiocy when they engage in collective action? Why do financially sensible people jump lemming-like into hare-brained speculative frenzies--only to jump broker-like out of windows when their fantasies dissolve?" Mackay's classic--first published in 1841--shows that the madness and confusion of crowds knows no limits, and has no temporal bounds. What if there is a recession … More worrying still in a recent paper by Fed staff economist David Reifschneider, Reifschneider asks the question “What if there is a U.S. recession before the Federal Reserve has the chance to “normalise rates”. Janet Yellen’s response suggests the current monetary framework is up to the task. Rate cuts, $2 trillion of QE and forward guidance, should be enough to solve any growth problem claimed the Fed Chair in the speech yesterday! $2 trillion, how so exact? More of the same does not appear to be the solution to creating “Resilient Monetary Policy Frameworks for the Future”. The call should be made to end QE and produce a co-ordinated central bank response to “normalise” short rates and term bond rates in Europe, Japan and the USA. The locomotive theory of monetary policy should be enacted. In which all pull together to escape the gravitational pull of Planet ZIRP. So why Jackson Hole …? If central bankers are so smart, why are they in Jackson hole anyway? The Jackson Hole economic symposium is an annual gathering of the world’s leading central bankers in the Grand Teton mountain region of Wyoming. The meeting has been hosted since 1978 by the Federal Reserve Bank of Kansas City, which chooses a topic for the event. Initially concerned with farming and agriculture, in 1982, the theme for the symposium changed to broader economics and monetary policy. Fed Chairman Paul Volcker was the “catch”, fly fishing at Jackson hole the “lure”. Why Jackson Hole? They are there because of the fly fishing! Not initially the best place for communications, delegates would be informed “to obtain today’s copy of the Wall Street Journal, you would have to come back tomorrow”. One suspects to “Create Resilient Monetary Policy Frameworks for the Future” we may best get the answer, not today tomorrow but ... next year may yet be too soon. So what happened to Markets? Markets, were down - The Dow closed at 18,541 from 18,598. The FTSE closed down at 6,845 from 6,854. Sterling moved up against the Dollar to $1.3201 from $1.3125 and moved up against the Euro at €1.170 from €1.159. The Euro moved down against the Dollar to 1.128 from 1.132. Oil Price Brent Crude closed at $48.56 from $50.89. The average price in August last year was $46.52. Gilts - yields moved up. UK Ten year gilt yields closed at 0.55 from 0.56. US Treasury yields moved to 1.56 from 1.55. Gold closed at $1,347 from $1,350. John That's all for this week ... if you enjoy The Saturday Economist .. JOIN THE SATURDAY ECONOMIST CLUB as an INDIVIDUAL or CORPORATE member. Check out the link for lots of options to get involved. Special reports, Survey Results and the Quarterly Economic Outlook are made available to members and sponsors. Join The Saturday Economist Club as an Individual or Corporate Member ... © 2016 John Ashcroft and Company, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment..

0 Comments

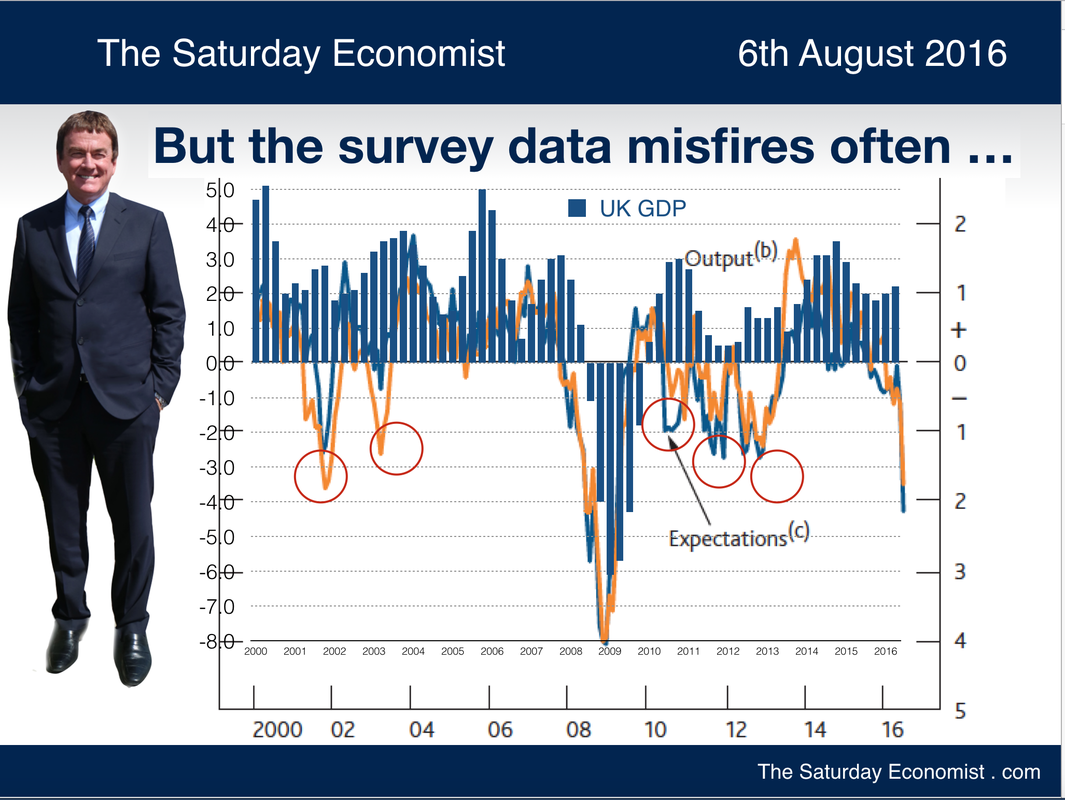

This week the ONS announced a raft of “hard data” about the economy. Inflation is rising, unemployment is falling, government borrowing is down, consumers are continuing to spend. Confidence has bounced back! Has the Bank of England moved too soon to cut rates? Has the Governor jumped the gun? There has been no immediate impact on the economy as a result of the referendum vote. The maxim for business - business as usual. Better for corporates, to wait until something really happens before reacting to Brexit. It could take years yet before we enact Article 50! It looks as if the MPC has moved too soon to cut rates. There really is no justification to increase QE and certainly no need to meddle with the corporate bond market. For institutions and investors, the search for yield is tough enough. The current account deficit is increasing, the kindness of strangers is under threat. The Fed is debating a further rate rise before the end of the year placing greater pressure on Sterling. Better for the Bank, to have waited rather than blowing the ammunition dump too soon. One day we will realise, low rates are the problem. If savings equal investment, and low rates inhibit savings, low levels of investment will ensue, damaging productivity growth. The Bernanke experiment leaves us trapped on Planet ZIRP, drifting closer into the NIRP crevasse with no hope of escape. Has the power of central banks reached the limit? If it has, it is a limit, a result of the abuse of power. Mis priced capital, distorting markets, is the legacy of monetary policy on Planet ZIRP. Ten year gilt rates at 0.6% are the manifestation of the problem. No provision for real return, Fisher must be turning in his grave. Impact of Brexit .. It is true tough negotiations are already taking place as a result of the referendum vote. For the moment they are confined to Inter departmental turf wars between the Brexit trio, Johnson, Davies and Fox. Staff poaching, office filching, difficult days are head in Whitehall, as mandarins get to grips with the enigmatic truth of Brexit means Brexit. When elephants fight, the grass (and policy) gets trampled. Article 50 may be shredded or simply set aside in the process. The Saturday Economist Club … Don’t forget you can now join the Saturday Economist Club as an individual or Corporate Member. Help us to expand and improve the coverage of our FREE weekly updates. Special Deals, Snap Surveys, Free Reports and Priority Bookings will be part of the package. Our members list is growing, don’t miss out … Sign up now! Dimensions of Strategy … In September, we will be in New York, filming for the IIIL strategy conference to be released in November. The line up includes Tom Peters and Dave Rogerson. Thought leaders in Strategy, it’s a great line up. The Dimensions of Strategy series and case studies, Apple, LEGO, Twitter and Yahoo, are in use around the world. The series on digital disruption attracted a high degree of interest in the UK and internationally. Our work on the Empires of the Cloud lays down the battle map of the clash of the internet titans. Don’t miss out on our regular updates on strategy … Back in the UK … Inflation CPI … Inflation CPI basis increased to 0.6% from 0.5%. A modest attribution to the weakness of Sterling perhaps as fuel and travel costs increased slightly. Service sector inflation eased back to 2.7% as the rate of goods deflation moderated to -1.4% from -1.6%. More inflation is on the way as oil prices continue to increase year on year. Producer input costs increased by 4.4% in the month. A clear portend of price increases to follow. In the final quarter of the year, Sterling denominated oil prices will be up by 35% year on year and up by 50% in the first quarter of 2017. Employment … Unemployment is falling … the claimant count figures fell in July to 763,000 a fall of over 8,000 than prior month. The number of vacancies was slightly lower at 741,000. There were 1.6 million unemployed according to the wider LFS data in June. The rate of unemployment was 4.9%, lower than the pre recession record levels. Average earnings were 2.4%, real earnings adjusted for inflation were just under 2%. Consumer Confidence … Confidence among British households has bounced back according to the Markit household finance index. The August reading showed a strong rally following the July lows. Consumers anticipate a broadly stable financial outlook in the year ahead according to Tom Knowles writing in The Times mid week. Retail Sales Retail Sales increased by 5.9% in volume and by 3.6% in value in July. On line sales increased by 16.7% now accounting for 14.2% of all retail sales volumes. Conventional retail is under pressure as Amazon expands the distribution network in the UK and Asda sales come under pressure. Government Borrowing Public Sector Net Borrowing fell by £3.0 billion in the four months to July. Overall borrowing was £23.7 billion compared to £26.7 billon prior year. In the current year we expect borrowing to be around £65 billion based on the first four months data. This compares with the £75.3 billion outturn in the last financial year. Lower growth may put pressure on forecast revenues. The Autumn statement will reveal any relaxation in spending plans. Next month we will update our quarterly economic forecast for 2016 and 2017. We remain optimistic in comparison with the consensus views. The full forecast is available to members and sponsors of The Saturday Economist Club. Join us and help us to improve the coverage of the UK and World Economy. What happened to markets … Markets, were mixed - The Dow closed up at 18,598 from 18,548. The FTSE closed down at 6,854 from 6,916. Sterling moved up against the Dollar to $1.3125 from $1.2910 and moved up against the Euro at €1.159 from €1.156. The Euro moved up against the Dollar to 1.132 from 1.117. Oil Price Brent Crude closed at $50.89 from $46.85. The average price in August last year was $46.52. Gilts - yields moved up. UK Ten year gilt yields closed at 0.56 from 0.52. US Treasury yields moved to 1.55 from 1.49. Gold closed at $1,347 from $1,350. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment in financial markets. Copyright © 2016 The Saturday Economist, All rights reserved.  The Treasury has announced a commitment to ring fence EU funding projects up to 2020 and beyond. Further education, science, research and infrastructure projects will benefit, along with a commitment to agriculture and regional funding. The Treasury guarantees will ensure cash from EU structural funds will continue to be funded up to 2020 and beyond. The commitment is expected to cost around £4 billion per year. The Chancellor has made a bold move to clarify uncertainty in the post referendum era. Fears for the loss of funding for key projects have been allayed. We expect further commitments on the status of EU nationals to be made in due course, removing a further level of uncertainty for business. We would further expect those seeking education in the UK to be removed from the immigration statistics. The move would radically reduce the inflow numbers significantly. The challenge to reduce immigration to the tens of thousands would receive an immediate boost. The apparent penalty to the further education sector would be removed. Bank of England and QE … The Bank of England began the QE buying programme this week, not without some difficulty. Institutions were reluctant to part with long dated gilts despite the dismal yields on offer. 30 year gilts slumped to 1.24% and 10 year gilts closed at 0.52%. The way is prepared for the Hammond Bond, a huge chunk of infrastructure bonds to be released in the Autumn Statement. A willing buyer in Threadneedle Street lies in wait. NIESR Monthly GDP estimate ... The NIESR monthly estimate of GDP for July was released this week. Growth year on year was 2%. Growth post referendum is in line with the average growth rate over the first six months. Has the Bank of England made the move too soon? We shall have to wait and see. The ONS managed to produce a raft of data this week which predates the referendum vote. Manufacturing growth was on trend, construction fell and the trade deficit continues to alarm! Manufacturing Output up … Production in total increased by 1.6% in June, a strong performance in utilities boosting output. Manufacturing output increased by 0.9% in the month. Growth in capital goods was offset by weakness in consumer goods. The average growth rate in manufacturing since the lows of 2009 has been just 1%. The prolonged weakness in manufacturing and the contribution to the UK economy continues to languish. We shall see what secrets will be revealed to rectify the problems, in the new Industrial Strategy … Construction Output Down… Construction output fell in the second quarter of the year by 1.7%, despite strong growth in private sector housing and commercial construction. Public sector contraction in housing (-22%) and infrastructure spending (-10%) were largely responsible for the downturn. Roll out the Hammond bonds, the old lady is waiting with an open purse. Growth Prospects … We expect little growth in manufacturing and construction in the current year. Growth of 1% in manufacturing is offset in part by a 0.2% fall in construction in our outlook. We expect overall growth of 2% in 2016 slowing to 1.4% next year. NIESR forecasts have 1.7% and 1% respectively in their latest August outlook. Our full forecast will be released next month. Trade in June … The trade figures in June revealed the deficit trade in goods and services increased to £5.1 billion up by £0.9 billion on prior month. The deficit on good was £12.4 billion. For the second quarter as a whole, the deficit trade in goods was over £34 billion offset by a £22 billion surplus in services. For the year as a whole we now expect the deficit (goods) to increase to £135 billion up from £126 billion last year. The service sector surplus of £88 billion will be largely unchanged on prior year. The combined deficit will increase to £46.5 billion increasing to almost 2.5% of GDP. Herein lies the huge problem for the UK economy. The trade deficit is likely to deteriorate if valuable service sector exports are lost following a post Brexit disruption. A relaxation of trade barriers with the rest of the world will exacerbate the trade in goods deficit. The trade deficit with China was £25 billion last year up from £10 billion ten years ago. A relaxation of tariffs will increase not diminish the deficit. The current account deficit at 7% of GDP is a post war record. The UK is dependent on the kindness of strangers to fund the internal and external deficit. Appetite for UK gilts will be challenged by the ongoing deterioration in the trade deficit. The weakness of Sterling will have little or no impact on net trade performance as we have long explained. Price elasticities are too weak to offset the impact of a weaker currency. The Marshall-Lerner conditions are not satisfied. There is no substitution effect. Problems for the UK economy … The problems for the UK economy lie not over the next six months. Business as usual should be the mantra. Article 50 is not yet triggered. The divorce still some five years away. The real challenges for the UK lie ahead. What then of monetary policy with rates on the floor and no escape plan from Planet ZIRP. Time yet to put in place the industrial strategy which will solve the twin deficit dilemma? Of course but unlikely. Should be an interesting Autumn statement! So what happened to Markets? Sterling fell against the Dollar to $1.291 from $1.308 and moved down against the Euro at €1.156 from €1.179. The Euro moved up against the Dollar to 1.117 from 1.109. Oil Price Brent Crude closed at $46.85 from $43.93. The average price in August last year was $46.52. Markets, were up - The Dow closed up at 18,548 from 18,509. The FTSE closed at 6,916 from 6,7916. Gilts - yields moved down. UK Ten year gilt yields closed at 0.52 from 0.67. US Treasury yields moved to 1.49 from 1.57. Gold closed at $1,350 from $1,337. John That's all for this week ... if you enjoy The Saturday Economist .. JOIN THE SATURDAY ECONOMIST CLUB as an INDIVIDUAL or CORPORATE member. Check out the link for lots of options to get involved. Special reports, Survey Results and the Quarterly Economic Outlook are made available to members and sponsors.  The Bank of England moved into action this week. The Governor introduced a “timely coherent and competitive package of measures” to avoid recession. Base rate was cut to 0.25%, an additional £60 billion was allocated to QE and £10 billion was allocated to a Corporate Bond Purchase Scheme. TLS, the Term Lending Scheme was introduced to improve liquidity in the banking system and ensure rate cuts are passed through to borrowers. Simultaneously the Financial Policy Committee announced a relaxation of leverage ratios and counter cyclical capital buffers to ease liquidity in the banking system. Ruling out negative rates and helicopter money, “a flight of fancy”, the governor suggested rates cut be cut by a further 15 basis points before the end of the year. Base rate could rest at 0.1% by Christmas. More QE and corporate bond buying remains a further option. Last month, Andy Haldane, Chief Economist at the Bank called for a sledgehammer to crack a nut in view of the “heady cocktail” of uncertainty about the economy, policy and politics. The Governor and the MPC heeded the call. Base rate was slashed, the MPC was unanimous. Not so in the case of QE and corporate Bond buys, three members of the committee voted no! Is the Bank moving too soon ...? “Changes in the economy are structural” said the Governor. Crikey, it was just a referendum vote! We haven even told the EU we are leaving yet! Article 50 may not be invoked until 2017, then will follow five years of negotiation on exit arrangements and a trade deal. The changes will be structural eventually but we will have up to ten years to adjust to the new environment. “Uncertainty may impact on investment, household spending and housing activity”, warned the Governor, “A fall in Sterling will push prices higher”. So it may prove, the transmission mechanism is well documented. Not long to wait though? The rate cut pushed Sterling lower. The August Inflation Report forecast lower growth, rising inflation, job losses and a fall in house prices. Excellent. Not so much a boost to confidence as a self fulfilling prophesy. Consumer confidence may take a hit if people churn through 68 pages of the latest Bank update. The pressure is now on the Chancellor to act in response. In his letter to the Governor, the Chancellor made it clear “I am prepared to take any necessary steps to support the economy and create confidence”. Wait for the Autumn statement was written between the lines. Better to wait and see, acting with HMT … Herein lies the problem, better for the MPC to hold fire for the moment. Weakness in domestic demand as a result of lower household spending or a fall in investment activity, is best met by fiscal action from HM Treasury. Better to wait and see. Business as usual with a Bank prepared to move in a co-ordinated move with Treasury would have been a stronger message. Far from cracking the sledgehammer, the Old Lady of Threadneedle Street is flapping a parasol in premature response to a problem which has not arisen as yet. Far from presenting “A timely and package of measures” the Governor is indulging in a premature, over reaction to sentiment surveys without hard data. The unreliable boyfriend is reliant on an unreliable data set. The PMI Markit Composite series on which the Bank is relying, has signaled seven recessions over the past sixteen years. Only one has come to pass as yet. The survey data has misfired often since 2000. “Recent survey data may have overstated a downturn. Over reaction based on limited data will make the situation worse. So what is really going on? More QE, may be a preparation for Infrastructure bonds to be announced by Treasury as part of the money for nothing - gilts for free plan. Or maybe the Governor is worried about the "Kindness of Strangers” and the diminishing appetite of overseas buyers for UK gilts. Last year, foreign holdings accounted for 25% of UK gilts down from 31% three years ago. The Debt Management Office has been slow to release the figures for 2016, maybe the Governor has had a peek! If the Governor is worried about the “kindness of strangers”, a policy which pushes 10 year gilts yields below 0.7% and undermines Sterling is no way to support the “Biggest Bond Bubble in History”, £1.6 trillion of debt with “inky blots and rotten bonds sustained". And what of corporate debt? The market has no need for Bank intervention in the corporate bond market. The market is worth some £400 billion of which £150 billion would be eligible within the Bank purchase scheme. £10 billion will be allocated to those firms “making a material contribution to the UK economy”. What is the point? Officially, the objective of the Corporate Bond Purchase Scheme is to “impart monetary stimulus by lowering yields on corporate bonds, reducing the cost of borrowing for companies.” Why so? There is no funding challenge for large corporates with bond market access. More than adequate liquidity is already squeezing rates available. So much for the search for yield. QE has undermined gilts yields, it will now attempt the same thing for the corporate bond market. The pressure on savers, investors and pensions funds will intensify. The 25 basis point reduction will have little impact on spending on confidence and investment. We drift nearer and nearer to the NIRP crevasse, trapped on Planet ZIRP. Bold moves this week heading in one direction but where is the exit plan? The time may come when we will have to confront the “structural” impacts of Brexit but not for years yet. What tools will then be left in the policy tool box. The sledgehammers and JCBs will be working overseas. The Old lady will have nothing but toothpicks and dental floss left in the handbag. So what happened to Markets? Sterling fell against the Dollar to $1.308 from $1.323 and moved down against the Euro at €1.179 from €1.185. The Euro moved up against the Dollar to 1.109 from 1.116. Oil Price Brent Crude closed at $43.93 from $42.36. The average price in August last year was $46.52. Markets, were up - The Dow closed up at 18,509 from 18,441. The FTSE closed at 6,793 from 6,724. Gilts - yields moved down. UK Ten year gilt yields closed at 0.67 from 0.69. US Treasury yields moved to 1.57 from 1.48. Gold closed at $1,337 from $1,350. John That's all for this week ... if you enjoy The Saturday Economist .. why not JOIN THE SATURDAY ECONOMIST CLUB as an INDIVIDUAL or CORPORATE member. Help us to make our coverage even better as we extend our research capacity. Your help is much appreciated The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed