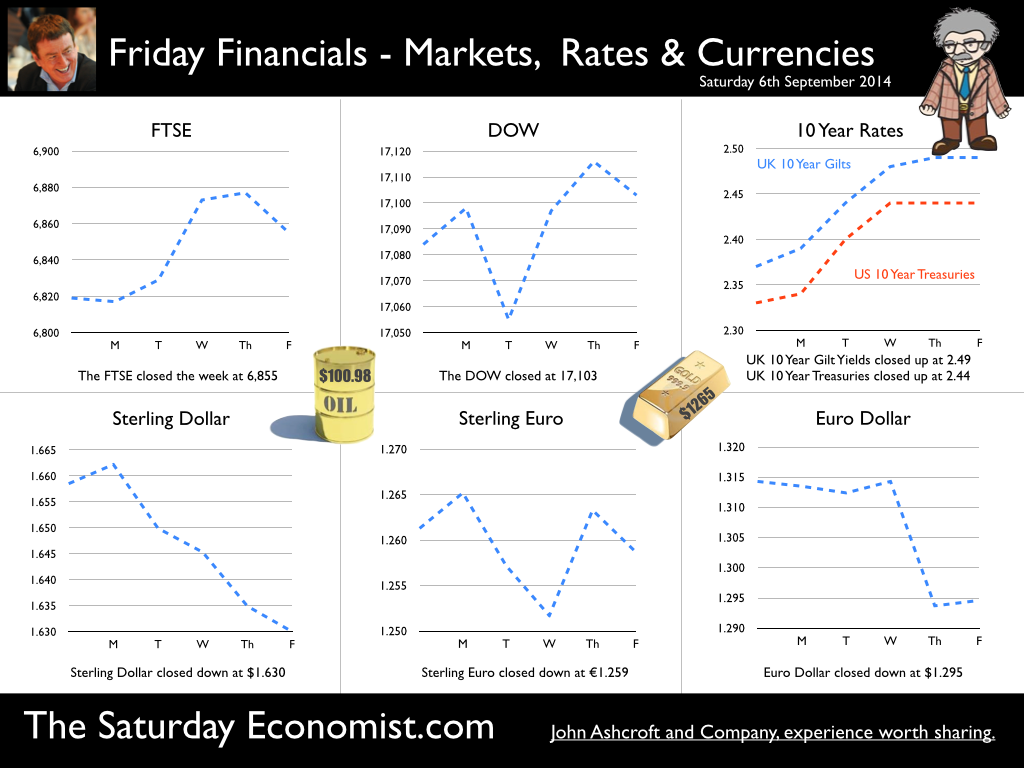

No surprise this week as MPC votes to hold rates … It’s that time of month again …The Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The minutes of the meeting will be published on the 17 September. Can’t wait! The hawks views may have been subdued by the latest data on retail sales and earnings data but the economics news this week remains bullish about growth this year. Car Sales … Car sales in August were up by 9% in the month and just over 10% in the year to date. The UK is on track to sell 2.45 million cars this year. That’s higher than the pre crash levels recorded in 2007. Commercial vehicle sales were up almost 12% in August, increasing by 13% for the year to date. The car market remains a powerful indicator of consumer confidence and spending trends. August, with registrations of just 72,000, is no longer a big month for sales. September is the one to watch with over 400,000 new car sales recorded last year, 425,000 a hurdle number! UK Survey Data … The Markit/CIPS UK PMI® surveys for August were released this week. Chris Williamson, Chief Economist at Markit, claimed “An acceleration of growth in the services sector and an on-going construction boom offset a weakened performance in manufacturing in August. The three PMI surveys indicate that the economy grew at the fastest rate since last November, providing further ammunition for policymakers arguing for higher interest rates.” In the service sector, activity growth was the strongest for ten months. The headline Business Activity Index recorded 60.5 up from 59.1 in July, representing the sharpest monthly improvement in activity since October 2013. In the construction sector, output appears to have risen at the fastest pace for seven months. The key index recorded a level of 64.0 in the month, up from 62.4 in July. Residential construction posted the fastest growth in activity. News from the manufacturing sector disappointed slightly. The Manufacturing PMI index posted 52.5 in August, down from 54.8 in July. Albeit a 14 month low, the index is still in growth (above 50) territory. Domestic sales dominate, export demand is strong in North America, the Middle East and China but obvious problems in European order books persist. So what of the rest of the world? US jobs disappoint but Fed still on track to tighten … The US labour market added 142,000 new jobs in August, significantly below consensus expectations and well below the 225,000 average over the prior six months. The unemployment rate fell to 6.1%. Positive news on car sales and manufacturing output also hit the headlines … “The data doesn’t say the economy is slowing down but it does not suggest it is accelerating much either” according to Steven Blitz chief economist at ITG Investment Research. Nor we would add, is there much in the data to suggest the Fed will stray from the path of gently monetary tightening in the first half of 2015. In Europe … The ECB adopted further measures in an attempt to stimulate the slow recovery and low inflation in the Eurozone. Growth in Q2 increased by 0.7% compared with Q2 last year with some evidence of a slow down in Germany. Inflation fell to 0.3% and unemployment remained stubbornly high at 11.5%. The ECB lowered policy rates by 10 basis points, the refinancing rate moved down to 0.05%, the marginal lending facility fell to 0.3% and the deposit rate was pushed further into negative territory, dropping to -0.2%. No escape from Planet ZIRP in prospect! Despite the concerns about deflation, GDP is forecast to increase by 0.9% in 2014 and 1.6% in 2015. Low prices are an international phenomenon, not confined to Europe. Negative rates and QE are unlikely to provide the solution to low commodity prices. A slow for recovery for Europe is in prospect. Marooned on Planet ZIRP, digging up the runway will not improve the timetable for takeoff and escape. There is an old Iberian imprecation, “May the builders be in your home”. Far worse - the curse “May the academics be in your central bank”. So what of base rates … In the UK base rates were held at 50 basis points with no additions to the asset purchase programme. The chances of a rate rise before the end of the year are receding. Hot money is moving to February for the first rate hike but if the bad news from Europe continues, the hike may be post hustings after all. Is this at odds with the latest data? Of course. Demand conditions are strong, the labour market is tightening, recruitment challenges are increasing and skill shortages are ubiquitous. Pay and earnings remain subdued and international energy and commodity prices remain low. For the moment the inflation target remains within reach, easing the grip of the hawks on monetary policy. So what happened to sterling this week? Sterling fell against the dollar to $1.630 from $1.658 and down against the Euro at 1.259 from 1.261. The Euro was down against the dollar at 1.295 (1.314). Oil Price Brent Crude closed down at $100.98 from 102.19. The average price in September last year was $111.60. Markets, move up slightly. The Dow closed up at 17,103 from 17,084 and the FTSE closed up at 6,855 from 6,819. UK Ten year gilt yields move up to 2.49 from 2.37 and US Treasury yields closed at 2.44 from 2.33. Gold was slightly tarnished at $1,265 from $1,286. That’s all for this week but we would like to introduce the Bracken Bower Prize to our readers! John Introducing the Bracken Bower Prize The Financial Times and McKinsey & Company, organisers of the Business Book of the Year Award, want to encourage young authors to tackle emerging business themes. They hope to unearth new talent and encourage writers to research ideas that could fill future business books of the year. A prize of £15,000 will be given for the best book proposal. The Bracken Bower Prize is named after Brendan Bracken who was chairman of the FT from 1945 to 1958 and Marvin Bower, managing director of McKinsey from 1950 to 1967, who were instrumental in laying the foundations for the present day success of the two institutions. This prize honours their legacy but also opens a new chapter by encouraging young writers and researchers to identify and analyse the business trends of the future. The inaugural prize will be awarded to the best proposal for a book about the challenges and opportunities of growth. The main theme of the proposed work should be forward-looking. In the spirit of the Business Book of the Year, the proposed book should aim to provide a compelling and enjoyable insight into future trends in business, economics, finance or management. The judges will favour authors who write with knowledge, creativity, originality and style and whose proposed books promise to break new ground, or examine pressing business challenges in original ways. Only writers who are under 35 on November 11 2014 (the day the prize will be awarded) are eligible. They can be a published author, but the proposal itself must be original and must not have been previously submitted to a publisher. The proposal should be no longer than 5,000 words – an essay or an article that conveys the argument, scope and style of the proposed book – and must include a description of how the finished work would be structured, for example, a list of chapter headings and a short bullet-point description of each chapter. In addition entrants should submit a biography, emphasising why they are qualified to write a book on this topic. The best proposals will be published on FT.com. Full rules for The Bracken Bower prize are available here or here http://membership.ft.com/PR/brackenbower/ © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed