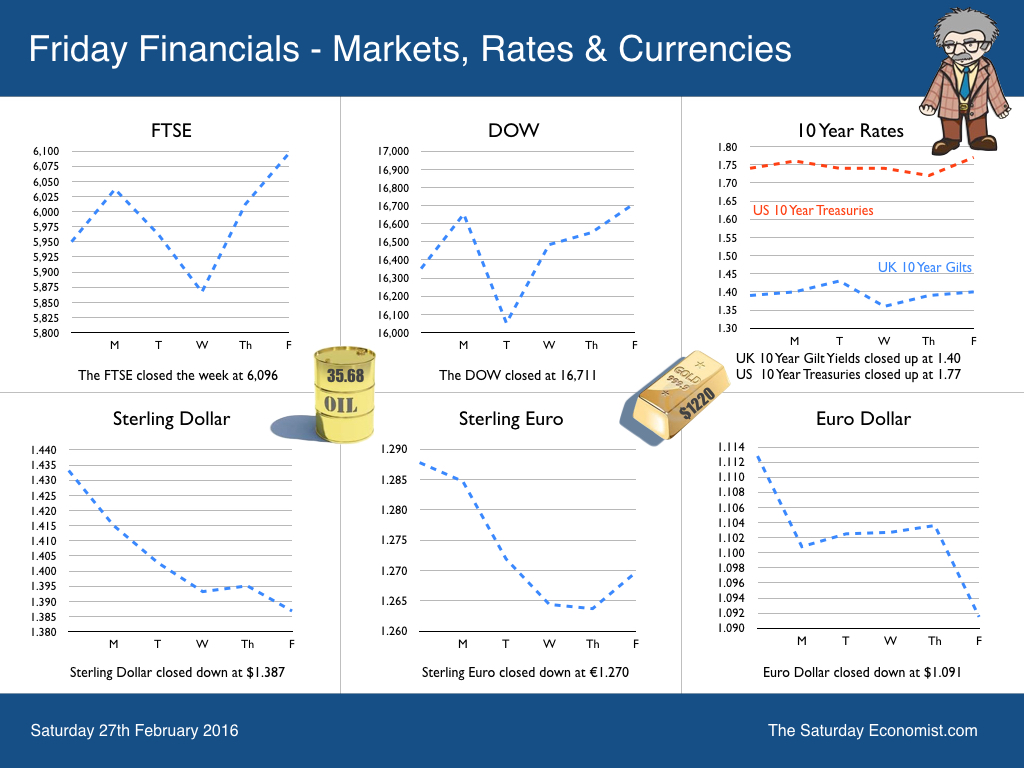

Sterling closed down against the dollar this week at $1.387 compared to a 2015 average of over $1.52. It’s a big move. Boris Johnson's call for Brexit allegedly to blame as The Mayor of London became Enemy of the State despite naming Crossrail, the Elizabeth line. The Brexit debate is warming up. Writing in the Telegraph Dr Gerald Lyons suggested the EU is like the Titanic. We need to jump off before it sinks. Gerard is economic adviser and now swim coach presumably to the Mayor of London. The Economist, on the other hand, headlined - leaving the EU would hurt Britain, and deal a terrible blow to the West. The G20 Finance Ministers meeting in Shanghai this week concluded Brexit would pose a risk to the world economy. It’s set to be a great four months of debate and sound bites. Can’t wait for the cant and rant to hot up. So what happened in the USA … So was Boris really to blame for the Sterling demise? Not really. The short term fundamentals are in favour of the dollar with the UK currency under pressure. The latest data from the Bureau of Economic Analysis confirmed US growth in the final quarter was slightly stronger than first thought. Growth for the full year of 2.4% in 2015 was unchanged but data suggest the US will get off to a stronger start in the first quarter 2016, than expected. Last week the Bureau of Labor Statistics reported, the US all items CPI index increased 1.4% in January before seasonal adjustment. This was up from 0.7% in December. US inflation is on the move, despite the strength of the Dollar, and the weakness of commodity and energy prices. The US Labor market is tightening. The Fed will be forced to act accordingly. Nothing has changed in the US to suggest the “Blue Dot” projections of steady rate rises through this year will not continue. Hence the strength of the Dollar and the high probability the Bank of England will be forced to make a move early in the current year in response. For the moment, Sterling looks over sold. We expect a near term rally to $1.42 in response ... Back in the UK … The ONS released the second estimate of GDP for the final quarter of last year and 2015. Growth was marginally better than expected in the last three months but not enough to warrant a revision for the year as a whole. UK growth in 2015 was 2.2% down from 2.8% prior year. The service sector continued to drive the recovery with growth in distribution, hotels and leisure up by 4.8% followed by transport, storage and comms up by 4.2%. Construction growth slowed to 3.4% compared to 7.5% prior year. Manufacturing output was down by -0.2% compared to almost 3% growth in 2014. So much for the march of the makers and on shoring for that matter. Is the economy rebalancing? Not really! Household spending and investment increased by 3% and 4.2% respectively in the year. The net trade position deteriorated further as export growth of 5% was offset by over 6% growth in imports. It’s a familiar story of service sector driving the recovery but with strong contributions from construction, investment and household spending. The trade deficit and current account deficit will continue to present a challenge to policy. The risk of negative capital flows, will put pressure on the Bank of England to hike rates. The kindness of strangers will have a price to pay in the end. So what of 2016 … The consensus for the UK economy is for growth of 2.2% in the current year. We are more optimistic and still expect growth of 2.5% based on our GDP output model. The full forecast will be released next week. Growth in the service sector will continue supported by strong household spending. Manufacturing output will recover slightly but construction growth will slow when compared the strong performance in the first half last year. So what of rates … US rate rises will continue into 2016. Negative rates will be reversed in Europe and Japan. The Bank of England will be forced to act this year, as growth continues, the labour market tightens, earnings increase and inflation trends return. So what happened to Sterling? Sterling closed down against the Dollar at $1.387 from $1.433 and down against the Euro at €1.270 from €1.288. The Euro moved down against the Dollar to €1.091 from €1.113. Oil Price Brent Crude closed at $35.68 from $32.99 The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, rallied - The Dow closed at 16,711 from 16,352. The FTSE closed at 6,096 from 5,950. Gilts - yields moved up but not much. UK Ten year gilt yields were at 1.40 from 1.39. US Treasury yields moved to 1.77 from 1.74. Gold closed at $1,220 ($1,231). Not much excitement for the old relic. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

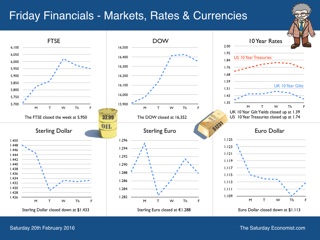

Worried about deflation, then consider a move to Caracas. The rate of inflation in Venezuela increased to 180% in 2015. Prices could double again and more by the end of this year as the currency is devalued and petrol prices hiked. Food prices are such, a cabbie in the capital, can allocate one day’s earnings to buy three chicken thighs according to the Wall Street Journal. A taxi tip won’t even buy a chicken toe In Caracas these days. Be careful what you wish for … UK Inflation … In the UK we don’t have to worry about deflation or inflation for that matter, at least for the moment. Inflation CPI basis increased to 0.3% in January. Goods inflation fell by 1.5% but service sector inflation remained above target at 2.3%. According to the Governor, we will have to wait the statutory two years for inflation to return to target. Ah yes, the mañana mantra of monetary policy. UK jobs data released this week suggest we may not have to wait that long … UK Jobs data … The claimant count fell to 760,000 in January as vacancies increased to 776,000. There are now more vacancies than claimants available for the job slots! Levels are lower (claimant count) and higher (vacancies) than pre recession. There were 31.4 million people in work, that’s 521,000 more than a year earlier. The employment rate is the highest since records began. The unemployment rate fell to 5.1% that’s lower than last year (5.7%) and lower than the highs of 2007 and 2008. (5.2%). The jobs market data is screaming for rates to rise as the labour market is flashing clear signals of overheating. Remember forward guidance and the 7% hurdle rate? Earnings ... Earnings remain something of an anomaly. Apparently, average weekly earnings in the final quarter of the year increased by 2% down from 3% in the third quarter. Why are earnings falling as the job market tightens and recruitment difficulties increase? It doesn’t make sense. Remember earlier in the year when vacancies where falling? That didn’t make sense either. Data revisions eliminated the slow down. Vacancy levels had actually increased. So it may well be with the earnings, expect some revision to the numbers. Then the MPC stance will have to change. Consumers are confident and continuing to spend … Retail Sales January … Retail sales in January increased by 5.2% in volume terms up by 2.3% in value. Internet sales increased by over 10% in the month accounting for 13% or all retail sales. Online sales for department stores increased by over 25%, such is the value of a strong multichannel proposition. The latest GfK consumer confidence data suggests households remain confident about the economy and consider it remains a good time to spend. So don’t worry too much about the prospects for the UK economy this year. Some of the spending filtered in to the Chancellor’s coffers in January … Public Sector Borrowing … Public sector borrowing was in surplus £11.2 billion, last month, that’s £1 billion more than last year. Year to date, borrowing fell by $10.6 billion compared to prior year, to a level of £66.5 billion. Latest projections suggest borrowing will be around £79.5 billion compared to £91.9 billion last year. The Chancellor will struggle to hit target but so what! Total debt fell to just under £1.6 trillion, approximately 80% of GDP. Half the debt held by the Old Lady of the Threadneedle Street and the “Kindness of Strangers” but for how much longer at yields sub 2%? So What of Rates … Sir Jon Cunliffe, Deputy Governor of the Bank of England, warned this week, the economic data did not suggest rates would remain on hold into 2017. The next move in UK rates will be up and sooner than markets expect. Mario Draghi has suggested the ECB may cut rates further into negative territory despite the steady recovery in growth. It would be a dangerous mistake. There is a growing backlash against negative rates amongst the public in Japan and bankers like Morgan Stanley, across the world. Journalists including Ambrose Evans Pritchard at the Telegraph, Oliver Kamm at the Guardian and Simon French in The Times today are openly critical of negative rates. This is no time to be experimenting with the world economy. It is time to call for a treaty of the Non Proliferation of Negative Interest Rates before too much damage is done. There were tentative moves towards a cap on OPEC production this week, the Iran intransigent for now. Sooner or later OPEC will make the move and oil prices (and inflation) will rally. Say No to NIRP on Planet ZIRP. It really is time to leave Planet ZIRP avoiding the lure of the NIRP Crevasse. If Yellen continues to tighten policy, the UK will surely follow, despite the market myopia. So what happened to Sterling? Sterling closed down against the Dollar at $1.433 from $1.448 but was unchanged against the Euro at €1.288. The Euro moved down against the Dollar to €1.113 from €1.124. Oil Price Brent Crude closed at $32.99 from $33.08 The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, rallied - The Dow closed at 16,352 from 15,910. The FTSE closed at 5,950 from 5,707. Gilts - yields moved up but not much. UK Ten year gilt yields were at 1.39 from 1.38. US Treasury yields moved to 1.74 from 1.71. Gold closed at $1,231 ($1,236). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Markets were in turmoil this week as concerns about China, OPEC, Oil, Commodities, Miners, and Bankers came to the fore. Gold rallied as the Dow and FTSE closed below critical levels of 16,000 and 6,000 respectively. UK Gilt yields fell to 1.38 and US yields fell to 1.71. In Japan ten year bond yields fell to zero, marginally trading in negative territory as markets settled. The Yen rallied, despite the cut in rates, undermining the little credibility remaining for Abenomics. Life on Planet ZIRP … There is a problem with life on Planet ZIRP. It is the lure of the NIRP crevasse. Central banks adoption of negative interest rates in Sweden, Switzerland, Europe and Japan is a step into the unknown. The crevasse may well be a deeper black hole, sucking central bankers into the depths of experimentation with the soft lure of a Sirens call. The Sirens were called the Muses of the lower world. "Their song, though irresistibly sweet, was more desolate than dulcet, lapping both body and soul in fatal lethargy, it was the forerunner of death and corruption.” Walter Copland Perry So too with the soft call of academic monetarists, the lure of negative interest rises is seducing central bankers, confounding common sense. We were bemused by QE and baffled by extended near zero rates. The stopover on Planet ZIRP has developed in to a prolonged stay from which now there appears to be no escape. Janet Yellen far from making the bold move to leave Planet ZIRP, now appears stuck in the departure lounge. We have warned of the dangers of low rates in the economy but what of negative interest rates? The damage to savers, the threat to bank deposits is a threat to the banking system in entirety. No wonder shareholders were concerned about bank stocks. The Deutsche Bank rumours partially settled by the share buy back at the end of the week. This is no time to be experimenting with the world economy. It is time to call for a treaty of the Non Proliferation of Negative Interest Rates before too much damage is done. Back in the UK … The trade figures continue to disappoint. The deficit trade in goods was £125 billion in 2015 compared to £123.1 billion prior year. The oil dividend offered a mere £2 billion respite despite our expectations of a much larger contribution. In 2016 we expect the deficit to increase to £128 billion as the economy continues to expand at around 2.5%. The trade in services surplus was just over £90 billion in the year compared to £88 billion prior year. The overall trade deficit (goods and services) of £35 billion at around 2% of GDP is not of itself a constraint to growth. The wider current account deficit is expected to fall to around 3.5% of GDP this year. Heading in the right direction assisted by the “kindness of strangers” and the “madness of crowds” perhaps … Manufacturing .. Manufacturing output fell in the final quarter of the year by -1% falling by -0.2% in the year as a whole. Transport and chemicals the outliers of growth as output of capital equipment and consumer goods were hit through the year. In 2016, we expect a similar pattern of output with modest growth of just over 1% achievable. Transport (water, wheels and wings) will continue to be the strongest areas of growth. Construction … In the final quarter of the year, construction output increased by 0.4%. For the year as a whole, output increased by 3.4% with a near 7% increase from new work. All new work increased by 6.8% while repair and maintenance decreased by 2.2%. Much better result that appeared possible through the year. So much for data revisions … In 2014, construction output increased by 7.5% slowing to 3.4% in 2015. We expect growth of around 3.5% in 2016. This together with continued strength in the service sector will underpin growth in the UK economy through the year. So what of rates …? Markets are pricing in a UK rate move some time in 2017 with little or no expectations of a rate rise this year. In the US, the FED is giving mixed signals about the extent of further rate rises and the timing of the next move. Despite turmoil in the markets, the volatility is more “much ado about nothing” rather than the “Tempest” some anticipate. China growth continues, the ASEAN block will grow at around 4.5% this year. The US and UK will continue on track and modest growth continues in Euroland according to the latest Eurostat data. Sooner or later OPEC will turn the tap down and oil prices (and inflation) will rally. It really is time to leave Planet ZIRP avoiding the lure of the NIRP Crevasse. If Yellen continues to tighten policy, the UK will surely follow, despite the market myopia. So what happened to Sterling? Sterling closed unchanged against the Dollar at $1.448 but moved down against the Euro to €1.288 from €1.299. The Euro moved down against the Dollar to €1.124 from €1.400. Oil Price Brent Crude closed at $33.08 from $34.29. The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, crashed then rallied - The Dow closed at 15,910 from 16,242. The FTSE closed at 5,707 from 5,863. Gilts - yields moved down. UK Ten year gilt yields were at 1.38 from 1.57. US Treasury yields moved to 1.71 from 1.87. Gold closed at $1,236 ($1,154). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  All eyes on the Bank of England this week as the Governor delivered the February Inflation report. Expectations of growth in 2016 have been lowered to 2.2% from 2.5% and forecasts for 2017 and 2018 have fallen to 2.3% and 2.4% respectively. Unemployment is expected to fall gradually and inflation is expected to return to target within two years! Sounds familiar? As for interest rates, the February MPC meeting voted 9-0 to keep rates on hold. Ian McCafferty the hawk returned to the dove perch. The Bank is taking a dismal view on a UK economy slow down and softer earnings data, despite the strength of the jobs market. As for rates, there is some speculation the Governor may extend his term in office from six to eight years, if only to ensure he can implement a rate rise at least once during tenure. The markets are ruling out a rate rise in 2016 with some speculation there will be no rate rise until late 2017. For the moment, Governor Carney is happy for this market conditioning to sustain the projections. Our expectations of a rate rise in the first four months of the year look to be way off track. As for the direction of rates, at least the Governor made it clear, the next move in rates will be up. Any though of negative rates off the table. Yep, it is bad enough to be stuck on Planet ZIRP, without being dragged in to the NIRP crevasse. What happened in the USA … Over in the US, the FED is teased by markets about a perceived premature rise in rates. The jobs data for January showed an increase in jobs growth of just 151,000 as the unemployment rate fell to 4.9%. Few now expect a further US March rate rise but Yellen has a vision which may see through any short term data noise. We still expect further US rate rises in the first four months of the year. The oil market will not lubricate at sub $50 oil. Once the oil price turns, as it surely will, or maybe already has, the growth and inflation outlook change swift and favour the hawks. Western eyes … looking in the wrong direction … Fears of the slow down in China abound despite projections of near 7% growth in 2016. Indian growth is expected to be over 7% in 2015. Why do we worry about a $10 trillion economy (China) growing at 7%, compared to a $7 trillion economy (China) growing at 10% some years ago. The dollar growth impact on the world is just the same. Last year China imported more oil and copper year than 2014. Filling the tanks and hoppers as world prices collapse. The Return of the Middle Kingdom … Western eyes are looking in the wrong direction as the “Return of the Middle Kingdom” transpires and the importance of being ASEAN is revealed. Last week ChemChina unveiled a $45 billion bid for Syngenta. Syngenta formed in 2000 by the merger of Novartis Agribusiness and Zeneca Agrochemicals is the world’s largest crop chemical producer. Feed the domestic population the China priority with more from less the plan. The deal follows the ChemChina acquisition of Pirelli tyres earlier this year for $7 billion. (That's more about cars than crops!) Overseas deals to date for Chinese companies have hit the $68 billion mark just five weeks into the year. The FDI programme is dominated by second and third phase action in [ATT] access to technology and [ATR] access to resource. The process is a relentless continuum. As for domestic infrastructure, China announced plans to build forty nuclear power stations over the next five years, whilst continuing to expand a high speed rail network that would stretch from Battersea to Beijing as the rail lies. Why do we talk of the “Return of the Middle Kingdom?” In the 10th and 12th century, China accounted tor over 20% of world population and wealth. It had the largest mercantile fleet in the world patrolling the South China Seas and beyond, with strong industrial capacity producing more steel than would be seen in the West until the UK Industrial revolution six hundred years later. Under the Ming dynasty, the economy accounted for almost 30% of world population and GDP. By 1820, China was the largest economy in the world accounting for 37% of world population and 33% of world wealth. Foreign invasion and the preposterous British Opium wars in the mid 19th century provided the set back to growth from which China is only now returning to a rightful place as the world’s leading economy in Middle Earth. The importance of being ASEAN … So what of growth prospects? China is the second largest economy in the world, yet struggles to get into the top 80 economies in the world in terms of GDP per capita. Were China to achieve Western levels of per capital growth, the economy would more than quadruple in size from current levels. China is not dependent on the West. Natural trading partners in an extended ASEAN group, from India to Australia, account for over 50% of world population yet just 30% of world GDP. The average growth rate of this trade group has been 5% over the last five years, expected to slow to over 4.5% over the next three years. The GDP per capita average is just 60% of the world norm, with lots of capacity for catch up growth to come. More significantly the current account surplus of the extended trading block is almost $700 billion per annum compared to a North American current account deficit of over $500 billion. The Renminbi is set to become the reserve currency in the ASEAN trading block, allowing nominal status for the dollar for now in the Asian Infrastructure Investment Bank. Why should we be too surprised if a decision has been made to dump the dollar and reduce exposure to the greenback in the foreign reserve coffers in the process. The arrogance of the West … There is an arrogance of empire in attitudes to the East which under estimates the extent of long term planning in China. It is important to distinguish between matters with the economy, capital reserves and currency and of course the stock market. There is evidence of bubble in the Shanghai composite of course. Too easily in the West we forget we paid the equivalent of $10,000 for a tulip bulb from Holland, or thousands of pounds for mis sold shares in the South Sea Bubble. Hopes for the “Japanese Wall of Money arriving in London, led to “Black Monday” and the stock market crash of 1987. Further US follies include the Dot com boom in 2000 and the derivatives crash in 2008. Too easily are were ready to lecture the “financial apprentices” of the East demanding clarity on policy in the process. So what happened to Sterling? Is the dollar rally over? Sterling moved up against the Dollar to $1.448 from $1.418 and moved down against the Euro to €1.299 from €1.309. The Euro moved up against the Dollar to €1.14 from €1.083. Oil Price Brent Crude closed at $34.29 from $34.33. The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, slipped - The Dow closed at 16,242 from 16,341. The FTSE closed at 5,863 from 6,083. We wtill think this is the GOBI desert on Planet ZIRP. A great opportunity to buy into Western stocks. Gilts - yields moved down. UK Ten year gilt yields were at 1.57 from 1.61. US Treasury yields moved to 1.87 from 1.95. You know it doesn't make sense. Gold closed at $1,154 ($1,116). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed