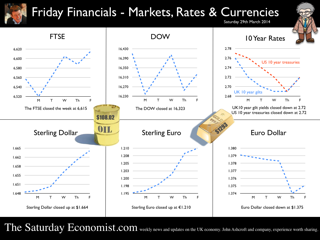

Inflation, deflation and retail sales … Inflation CPI basis fell to 1.7% in February from 1.9% at the start of the year. Good news for households as net earnings improve. Good news for the Bank of England as inflation hits the lowest level for almost five years. Interest rates are more likely to stay on hold into 2015. We never thought otherwise. Should we be worried about deflation? Not really. The fall was marked by a reduction in goods inflation. Service sector inflation, accounting for half the index, was unchanged at 2.4%. The other half, “goods stuff” slowed to 1.2% from 1.4%. Despite higher growth, lower unemployment and expansive monetary policy, inflation is drifting lower but it isn’t all one way. Fish and sewage prices increased by 6%, tobacco prices by 7%, utilities, gas and electricity up by over 6% and insurance costs up by 5%. If you plan to send a post card from your hospital bed to the kids in private school about a book you have just read. Don’t do it! Hospital services, postal services and book costs were up 6%. Education costs increased by over 10%. Stay healthy, watch TV and Skype the better solution. Strong growth in the UK suggests prices should be rising. So why the drop? The fall in inflation, particularly goods inflation is assisted by trends in world trade and prices, assisted by the appreciation of sterling. Manufacturing Prices … Sterling has appreciated by 10% over the year. World prices, oil and basic materials are relatively flat. In February, manufacturing input costs fell by 5.7% overall. Crude oil prices fell by 11% and imported metals and materials fell by 15% and 5% respectively. Imports of parts and equipment assisted the fall, down by 7%. Manufacturing output prices slowed to 0.5% from 0.9%. This will improve the retail inflation outlook over the short term. We haven't seen input costs fall like this since September 2009 as the UK and the world grappled with recession. So can it really last? World growth is increasing, world trade is growing, we still await the full recovery in Europe but it will come. Oil prices are becalmed, as the market tries to understand the implications of fracking in the USA. Commodity prices, particularly metals, copper, lead, zinc and iron ore are experiencing a market work out which reflects stock adjustment rather than supply and demand derterminants.. Sooner or later, commodity prices will turn, perhaps in the second half of the year. Fears of deflation are over played, as are the suggestions the inflation genie is back in the bottle in the UK. Retail Sales … UK domestic demand conditions are improving demonstrated by the strength of retail sales in the UK. Retail sales in February increased by 3.7%. Sales growth over the last three months has averaged 4.3%. Values in February increased by just 3.8%. On line sales increased by 12% in value accounting for almost 11% of all retail sales. Food sales increased by 14% with a 4% penetration. Clothing and footwear sales were up by 15% with an 11% share. National Accounts Data The latest revisions to UK gross domestic product (GDP) were released on Friday. GDP is estimated to have increased by 1.7% in 2013 revised down 0.1percentage points from the previously estimated 1.8% increase. Does this affect out outlook for the year? Not really. We have just released the GM Chamber of Commerce Quarterly Economic Outlook, in which we think growth will be around 2.9% this year. The forecast upgrade is as a result of the latest survey data and the strength of the Manchester Index®, a powerful indicator of trends in the UK economy. The late revisions will lower or forecasts for construction a little. Check out the full forecast on the GM Chamber Economics Web site. Manchester News Good news for Lynder Myers with a restructuring effected by Jepson Holt, Assure Law, EY and Duff & Phelps. Paul Smith from Duff & Phelps summed it up “the primary objective to find a solvent and consensual solution to a complex problem”. Excellent. So what happened to sterling? The pound closed at $1.664 from $1.649 and at 1.21 from 1.1956 against the Euro. The dollar closed at 1.375 from 1.3790 against the euro and 102.82 from 102.27 against the Yen. Oil Price Brent Crude closed at $108.01 from $107.37. The average price in March last year was $108. Markets, the Dow closed down at 16,323 from 16,410 and the FTSE closed at 6,615 from 6,557. UK Ten year gilt yields closed at 2.72 from 2.76 and US Treasury yields closed at 2.72 from 2.77. Gold loves a crisis, the crisis is over as the metal moved lower to $1,293 from $1,358. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

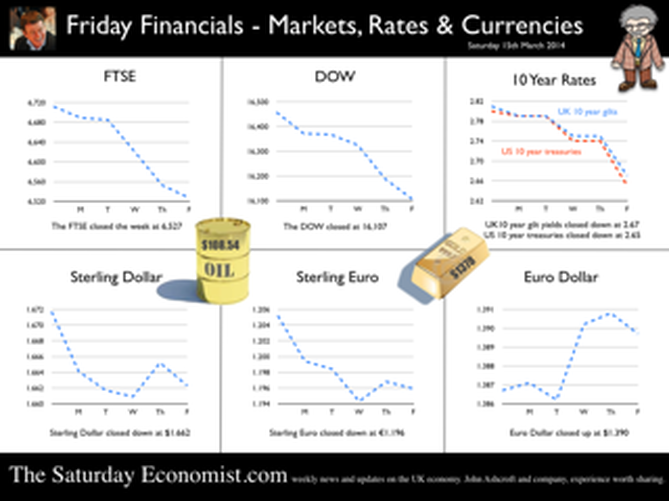

The week of the budget … “I have never shied away from presenting difficult truths to the British people. And one difficult truth the British people must confront, is that by this time next year, I may well appear to be the most successful Chancellor in UK history.” Well it would have been a great start to the budget speech - and yes it could well be true! Growth up, inflation down. Employment up, borrowing down, just the trade figures will continue to disappoint. Construction will be much higher. Investment and real earnings will be rising by the second half of the year. The Tories could not hope for a better economic platform to pitch at the hustings next year. The Budget 2014 simply enhanced economic prospects for the year ahead. Proclaimed as a budget for makers, doers and savers. The savers did particularly well but above all else, it was a budget for voters. The Chancellor offered a prudent budget with fiscal constraint and an obvious eye on the electorate. “Fixing the roof whilst the sun is shining” the mantra. It is clear the Bullingdon boys are fixing the roof in Downing Street, intent on a prolonged stay beyond May 2015. For a more comprehensive note on the budget itself, check out the full post here. It was a budget which 24 hours later was considered (by the IFS and others) to be more expansionary than at first thought. It was a clever budget. Hard to think it came from the same stable as the "omni shambles" just two years ago. The polls have Labour just 3 to 4 points ahead of the Conservatives. Tory analysts will have an eye on the 1986 rally. A fifteen point swing in just twelve months, to enable the Thatcher administration to stay in power. The Lib Dem vote has collapsed, the UKIP vote will evaporate. The Chancellor has created a winning platform. It will be difficult, but not impossible, for Prime Minister Cameron to slip from the podium. Borrowing … The borrowing figures for February were released on Friday. At first sight the figures appear disappointing. Borrowing in the month was £9.3 billion, slightly up from £9.2 billion in the prior year. Heading in the wrong direction? Not really. The prior year figures were enhanced by the £2.3 billion sale of 4G licences. For the year as a whole the OBR projections assume borrowing of around £108 billion in the year down from £115 billion last year. Over the next four years, assuming the budget forecasts for spending are achieved, borrowing could be eliminated within four years. Entirely plausible. Then the real task of reducing the £1.5 trillion debt can begin. Unemployment … The good news on employment continued with further news this week. The claimant count fell by almost 35,000 in February to a rate of 3.5%. Over the last twelve months the count has fallen by 360,000 to a level of 1.175 million. Over the last three months, the count has fallen by 100,000. On current trends, assuming growth of around 2.7% in the year, the unemployment level could fall below 1 million by the end of the year, hitting the critical 2.5% rate by the middle of next year. Why so critical? This would be the best performance since the beginning of 2008. A 2.5% claimant count rate is consistent with earnings of 4% - 5%. Far more than current achievements of 1.5%. “Spare capacity” could become a scarce resource, sooner than we think. Base rates are set to rise in the first half of next year. The rate rise could be sooner and thereafter faster than we are currently led to believe. Rate rise USA … Janet Yellen as the new head of the Fed gave a clear indication, US tapering will continue with a possible elimination of the whole QE programme by the Fall. Thereafter Yellen made clear, US rate rises are likely to follow within six months. Watch the UK and add six months, our mantra modified to perhaps three months, the guideline last week. On current job trends, we caution, watch the US and don’t blink. The UK rate rise - much sooner than you think. So what happened to sterling? The pound closed at $1.649 from $1.662 and at 1.1956 from 1.196 against the Euro. The dollar closed at 1.379 from 1.390 against the euro and 102.27 from 101.31 against the Yen. Oil Price Brent Crude closed at $107.37 from $108.34. The average price in March last year was $108. Markets, the Dow closed at 16,410 from 16,107 and the FTSE closed at 6,557 from 6,527. UK Ten year gilt yields closed at 2.76 from 2.67 and US Treasury yields closed at 277 from 2.65. Gold loves a crisis, the crisis is over as the metal moved lower to $1,3358 from $1,378. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results - recorded - then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experts in strategy. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  This was a budget for the makers, the doers and the savers but above all it was a budget for the voters, in a country which does not invest enough, export enough or save enough apparently. With just over twelve months to go to the election, the Chancellor could not have hoped for a better economic backdrop with which to revisit the polling stations in May next year. Growth is up, inflation down, employment up, borrowing down, investment up, so all is well. Just the trade figures will continue to disappoint, as the structural deficit trade in goods will continue to provide a drain on net trade. Despite the clear evidence of a strong recovery, the Chancellor will continue with the austerity programme. More departmental cuts planned, along with a cap on welfare spending. The chancellor is determined to “fix the roof” whilst the sun is shining. The deficit will fall over the next four years, the plan to eliminate government borrowing by 2018. Attacks on tax dodgers, will ensure the complex tax avoidance schemes and “Corporate wraps for property” are placed under pressure. Fines for LIBOR abusers will be redirected to good causes including military charities, scouts, guides, cadets and St John’s Ambulance. Exporters will receive a modest boost with and increase to £3 billion in the amount available to finance export growth. Alas £ 3 billion - a small drop in the world’s five oceans, if the £1 trillion export target is to be met. In housing, the help to buy scheme is to be extended to 2020, assisting the purchase of 120,000 new homes, with an additional 15,000 new homes planned for Ebbsfleet. Where is that? In infrastructure, £270 million is planned for the Mersey Gateway Bridge, with a further £200 million available to fill “potholes” around the country. A modest contribution if HS2 is to proceed. Investment also receives a boost, with a doubling of the investment allowance to £500,000. Almost every business in Britain, will pay no upfront tax as they invest to expand capacity in the future. Energy costs will be clipped, with caps on carbon price support and additional measures providing savings to every manufacturer in the country. Bingo tax is set to halve, fuel duty prices will not be implemented in September, the lost revenue, partly financed by increase duties on betting terminals and offshore bookies. Personal allowances will increase to £10,500 producing tax savings for millions of voters. Tax cuts for those on low incomes and those on middle incomes too. But the biggest giveaway was for savers. A new composite ISA for cash and shares, new higher yielding pensioner bond, yielding 4% on a three year investment. An end to the iniquity of the forced purchase annuity. An end to caps and drawdown limits on pensions. People will have the right to access their own savings at a time of their own choosing and best of all, the abolition of the 10 pence tax rate for savers altogether. It is a vote winner for hitherto disillusioned pensioners. The Chancellor claims this is a budget for the makers, the doers and the savers. Above all the savers appear to have done remarkably well, the makers and the doers, less so. Above all it is a clever budget for the electorate. The Labour lead in the polls is narrowing to around five points. Tory analysts will have an eye on the 1986 pre election swing. A swing yielding over 15 points to the Conservatives in the twelve month run up to the election of 1987. The Lib Dem vote has collapsed, the UKIP vote will evaporate. This is a budget which will do little harm to the economy but a great deal for Tory spirits and voters in this critical pre election phase. It is a budget which should be commended to the House but above all to the Tory back benchers, particularly MPs and prospective candidates in marginal seats. © John Ashcroft 2014 Word Count 650 words  UK march of the makers … Good news for the march of the makers this week, - manufacturing output increased by 3.3% in January compared to disappointing growth of just 1.9% in the final quarter of 2013. Still some way to go to restore the sector to positive growth. Output remains some 9% below the peak registered in the first quarter of 2008. Output of Investment and capital goods increased by 3.8%, continuing the strong trend since the setback in 2008. We expect manufacturing output to increase by 2.9% for the year as whole and around 2.7% in the following year. Consumer goods output remained weak with further declines in the month. For some sectors of manufacturing, the march of the makers is more like a retreat from Moscow, than a move across the Rhineland. The makers will fail to make a real contribution to the rebalancing agenda. So what of net trade … The trade figures for January were released this week. After the December aberration, a month in which the ONS appears to have lost some £2 billion of imports, the total trade balance returned to normality. A deficit of £2.6 billion compared to £0.7 billion last month. There was a trade shortfall of £9.8 billion on goods, partly offset by an estimated surplus of £7.2 billion on services. For the year as a whole, we expect the trade deficit in goods to increase to £114 billion, offset by a trade in service surplus of £85 billion. The overall trade in goods and services shortfall will be £29 billion. At less than 2% of GDP, the deficit will not pose a threat to the outlook for sterling, assuming investment capital flows recover. The trade deficit will fail to make a real contribution to the rebalancing agenda. And what of Construction … Good news in construction. Output increased by 5.4% in January compared to the same month last year. New work increased by almost 6% in the month, as repair and maintenance budgets also increased by 4.5%. For the year as a whole we expect construction growth of around 6%, with strong growth in housing and commercial property expansion fuelling growth. Prospects for the year … The OECD suggests the UK economy will grow by over 3% in the first half of the year, in line with the strong expectations from the Bank of England “Nowcasting” model, news of which was also released this week. The NIESR GDP tracker for February suggests growth may have slowed to 2.6% in February after strong growth of 3.2% in the prior month. For the year as a whole most forecasters are moving to a 2.7% growth figure. Seems reasonable for now. The recovery appears secure and sustainable. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint as we have long pointed out. Charlie Bean on the North East Scene … Charlie Bean was in the North East this week, delivering a speech to the Chamber of Commerce. Further reassurance the MPC will be doing its utmost to ensure that recovery is not nipped in the bud. “When the time does come for us to start raising Bank Rate, we should celebrate that as a welcome sign that the economy is finally well on the road back to normality”. Excellent. Much of the rest of the speech was devoted to investment, productivity and net trade. As the deputy governor points out, the United Kingdom has run a persistent trade deficit of the order of 2-3% of GDP since the beginning of the century. So much for “rebalancing”. On investment, productivity, depreciation and “on shoring”, the speech demonstrates the lack of fundamental understanding of the real economy amongst policy makers at a senior level. We had hoped for better from the new regime. Charlie represents the old guard due to retire in June this year. Of The Treasury Select Committee … The Governor and members of the MPC were in front of the Treasury Select Committee this week. The protocol still eludes the new man. Governor Carney actually winked at Chairman Tyrie at one stage. It is difficult to imagine Governor King, managing a nod let alone a wink. It appears the meetings of the MPC are minuted and recorded. Then for good measure the tapes are destroyed. Lack of good recording equipment formed part of the explanation by the old guard. The solution to invest in better equipment seemed a little too obvious for the Chairman and the new Governor. Expect a rethink! Wink Wink. So what happened to sterling? The pound closed at $1.662 from $1.672 and at 1.196 from 1.205 from against the Euro. The dollar closed at 1.390 from 1.387 against the euro and 101.31 from 103.3 against the Yen. Oil Price Brent Crude closed at $108.34 from $108.86. The average price in March last year was $108. Markets, moved down concerned about China and the Ukraine - The Dow closed at 16,107 from 16,458 and the FTSE closed at 6,527 from 6,712. UK Ten year gilt yields closed at 2.67 from 2.81and US Treasury yields closed at 2.65 from 2.80. Gold loves a crisis, closing up at $1,378 from $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results will be recorded then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK rates on hold … No surprise this week - the MPC voted to keep rates on hold and maintain the size of the asset purchase programme at £375 billion. It will be some months yet before rates begin to rise. Our current assumption is that rates will begin to rise in the second quarter of 2015. 40% of respondents in the latest Bank of England/GfK Inflation survey expect rates to rise over the next twelve months. No worries for the future apparently. Once on the rise, over 70% expect rates to be less than 3% in five years time. So much for the madness of crowds. Clearly the general public have a much better grasp of the latest simulations of the “equilibrium real interest rate associated with a neutral monetary policy over the medium term” than is generally assumed. They must have been listening to the speech by David Miles last month. Asked about the current rate of inflation, the median answer was 3.5% down from 4.4% in November. Excellent. So much for the madness and the wisdom of crowds. US Payroll data up … In the USA, better than expected payroll data guarantees the Federal Reserve will continue to taper, with a further reduction this month to $55 billion. Employers added 175,000 more jobs in February. Movement in US futures suggest the markets attach a "higher probability to a US rate rise in the middle of 2015". Fed officials have said they are “comfortable with market expectations of future rate rises”. We think US rate rises could be on the agenda by the end of 2014 or early 2015. The implications for UK rate rises should be evident. Our mantra - watch the USA and add six months - may be a little more compressed in this cycle. UK survey data … This week the February Markit/CIPS UK PMI® surveys were released. The strong upswing in the UK manufacturing sector continued in February. Output and new business continued to rise at above-trend rates. The leading index at 56.9 was up from a revised reading of 56.6 in January. In construction, the pace of expansion continued to rise sharply. The leading index scored 62.6 in February, down from a 77-month high of 64.6 in January. Still a very strong performance. In the service sector, output continues to expand strongly in the month. The headline Business Activity Index recorded 58.2 during February, little changed on January’s 58.3 and indicative of a sharp rise in activity on a monthly basis. Overall, output in construction, manufacturing and services suggest the economy continues to recover across the board at a very strong rate. The latest NIESR GDP tracker suggest growth increased by 3.5% in January. The Bank of England expects growth of over 3.5% in the first quarter. For the year as a whole, the consensus forecast is for growth of 2.7% this year. We await the details of the latest GM Chamber of Commerce survey before raising our estimates of growth this year. The GDP(O) model is signalling growth of 3% for the year as a whole. The survey data is a little more tempered, I suspect. In the UK and the USA, growth is accelerating and the job market is “tightening”. The pay round will become more difficult by the end of the year. Earnings are set to increase significantly as critical unemployment levels are breached by early 2015. Household incomes are set to improve and the recovery in spending will continue. There will be no “rebalancing”, whatever that really means. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint. If growth hits 3% this year, disappointment could turn to shock and alarm. Then all forward rate bets will be off. So what happened to sterling? The pound closed at $1.672 from $1.675 and at 1.205 from 1.213 against the Euro. The dollar closed at 1.387 from 1.381 against the euro and 103.3 from 101.7 against the Yen. Oil Price Brent Crude closed at $108.86 from $109.02. The average price in February last year was almost $116 falling to $108 in March. Markets, moved slightly - The Dow closed at 16,458 from 16,367 and the FTSE slipped closing at 6,712 from 6,809. UK Ten year gilt yields closed at 2.81 from 2.72 and US Treasury yields closed at 2.80 from 2.67. Gold lovers worship alone with a close at $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Revisions to GDP … The second estimates of growth in the UK and the USA were released this week. In the US growth of 3.2% in the final quarter of the year, was revised down to a more modest 2.5%. Janet Yellen, head of the Fed is prepared to dismiss recent soft economic data as possible result of the bad cold snap. For the year as a whole, US growth in 2013 was a respectable 1.9%. Most forecasters still expect US growth of 2.8% to 2.9% in 2014. In the UK, the second estimate of GDP was also released this week. Growth in 2013 was revised down to 1.8%. Oh dear, the UK is no longer the fastest growing economy in the developed world. Just as well, the balance of payments strain would have been too much. The outlook for the current year hasn’t changed overall. We still expect growth of 2.5% in the year, with the consensus forecast slightly higher around 2.7%. The right kind of growth? … But is it the right kind of growth? For the purists, probably not. For the pragmatic, what’s not to like? The service sector continued to drive expansion in the economy, with significant growth in the leisure sector along with business and financial services. Distribution, hotels and restaurant trades grew by almost 4% in the year, up by almost 5% in the final quarter. Business and financial services were up by 3% in the last quarter, up by 2.6% for the year as a whole. The service sector accounts for 80% of total output in the economy. The real driver of recovery. Good news in construction … The good news in construction continued with growth up by 4.4% in the last three months of the year. Developments in the housing sector providing foundations for recovery. Assuming we can make the bricks, growth should continue into 2014 with our forecast growth over 6% in the current year. The march of the makers … So what of the march of the makers? Growth in manufacturing output was revised down to less than 2% in the final quarter. This is particularly disappointing, since the prior year figure was a “nothing to beat number”. For the year, manufacturing output actually fell by 0.6%. Output is still almost 10% below the pre recession peak. We have to be realistic when formulating a policy for industry. We expect growth for the manufacturing sector broadly in line with total GDP this year but not much more. So what of rebalancing … Household spending last year was up by 2.5% accounting for over 60% of GDP. There is little evidence of rebalancing in the economy, either in terms of net trade or investment. Investment, accounting for 14% of total spending, actually fell slightly, despite growth of over 8% in the final three months. Was this a trend reversal, end of year? Possibly. We expect investment growth to continue into 2014 as the forward outlook clears and confidence returns to the board room. M & A activity, will assist the figures. Plus, 60% of investment is related to dwellings and commercial property. Investment in plant and machinery, the real capital stock within the economy, accounts for just 20% of total investment. With property resurgent, we expect investment growth of 8% in 2014. And what of base rates? … In the US, Janet Yellen affirmed the Fed commitment to continued tapering. QE could be eliminated by the Fall with a steady reduction of $10 billion per month. That could mean, a US rate rise could be on the agenda by the end of the year. The mantra for the UK remains watch the USA and add six months. The MPC cannot move ahead of the Fed without significant appreciation of sterling. When will UK rates rise? Martin Weale has suggested UK rates will rise in the Spring next year and could rise earlier if productivity fails to improve and inflation ticks up. Ian McCafferty a fellow MPC member suggests the rate rise may be held back because of the strength of sterling and the resultant mitigating impact on inflation. Either way, rates are set to rise, probably in 2015 but possibly after the May election. The banks are beginning to model affordability and pay back with a 5% base rate test. This may prove too severe for some years yet. The MPC would have us believe rates will be held below 2% until late 2017. David Miles in a speech to the Mile End group this week, suggests the “new normal” could include an equilibrium base rate of 2.5% to 3% over the long term. Imagine, we may never see the 4.5% base rate again! So much for 320 years of history, in which we have endured an average base rate of 4.5% to 5%. If only! New normals usually end up as the same old same olds. So what happened to sterling? The pound closed up at $1.675 from $1.664 and at 1.213 from 1.210 against the Euro. The dollar closed at 1.381 from 1.374 against the euro and 101.7 from 102.5 against the Yen. Oil Price Brent Crude closed at $109.02 from $109.67. The average price in February last year was almost $116 falling to $108 in March. Markets, moved slightly - The Dow closed at 16,367 from 16,143 and the FTSE closed at 6,809 from 6,838. UK Ten year gilt yields closed at 2.72 from 2.79 and US Treasury yields closed at 2.67 from 2.75. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed