|

There is something about working in the Brexit department which doesn't bode well. Joyce Anelay, Minister in the House of Lords resigned from the project this week. Cold feet? Perhaps, Joyce hurt her foot jumping out of a helicopter two years ago, the pain lingers on.

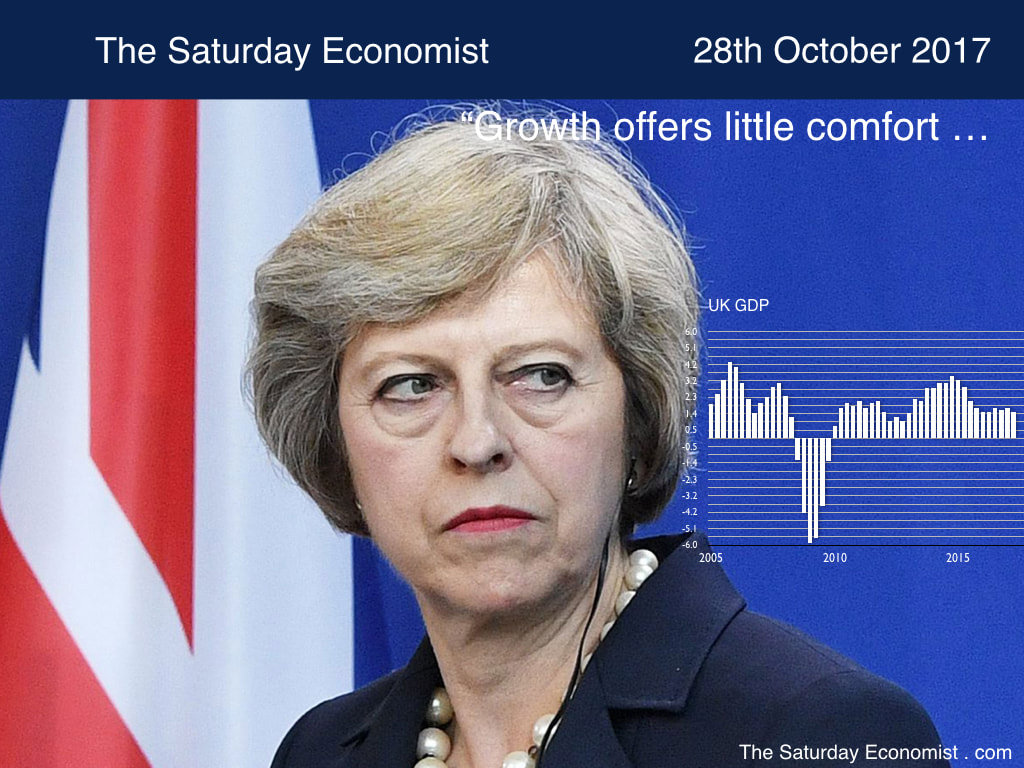

Or perhaps one leap into the unknown is enough, for Baroness Anelay. The EU department casualty list now includes George Bridges, David Jones and Olly Robbins permanent secretary. David Davis' skills as a negotiator do not extend to talks with his own team apparently. Davis has a reputation for being something of a lone wolf in the execution of duties. Baroness Anelay remains confident about the future "I leave the department certain the negotiations surrounding our exit and our future relationship with the EU will be successful", she said. Well that's good to know. "We have a very strong team of ministers and officials in the department". The Prime Minister replied. Mmmm ... meanwhile ... The negotiations may go down to the wire, Davis explained this week. So much so, the parliamentary vote to leave the EU, may take place once we have left. Shocking! Davis was swiftly denounced at PMQs. Parliament will have the final say on the negotiations once completed, the PM affirmed. The Tory back benches were not convinced. According to the Evening Standard, senior Conservative MPs plan to go over the Prime Minister's head and seek their own talks with the European Union. They want to be sure May is offering the best terms available! The best terms available do not include a refund from the European Investment Bank apparently. The UK may have to wait until 2054 to reap the dividend and return of any investment cash. Alexander Stubb Vice President of the EIB explained this week, we may even have to cough up more, if any investments back fire. The impossible task of reconciling the ambitions of a divided Tory party continue ... Economics news this week ... The preliminary estimate of growth in the third quarter was released this week. Growth of 1.5% in the quarter will offer little comfort to the beleagured Prime Minister. The growth rate was unchanged from the second quarter and down on the first quarter of the year (1.8%). Good news in manufacturing and construction. Manufacturing growth was up by 2.7% and construction growth increased by 2.8%. Service sector growth slowed to 1.5%, with a pronounced weakness in transport and business services. Based on the latest data, we now expect growth of around 1.6% this year, compared to 1.8% in 2016. Will this be enough to push rates higher next month? It will be a close call, the Governor may decide to wait and see once again. The latest data from the SMMT on car production are of concern. Output fell by 4% in September and by 2.2% in the year to date. Manufacturing output for the home market was down by 14% in the month. Worries about toxic fumes from Brexit and diesel, are fueling concerns for domestic buyers and producers. Over in the U.S.A. the latest figures led to headline talk of 3% growth in the third quarter. It is misleading. The quarterly growth rate annualised is the process. The year on year comparison is the more realistic and less volatile guide. Year on year the growth rate in the third quarter is 2.3%. Up from 2.2% in the second quarter and 1.8% last year. The economy offers steady growth, which will lead to a slow rate rise process. The possible injection of a huge tax cut planned by Trump may lead to higher short term growth but will weaken the dollar, accelerate inflation and lead to a higher trade deficit, in due course, assuming it gets over The Hill ... © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List or the Dimensions of Strategy List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom.

0 Comments

"I'm very clear: I have no idea what Theresa May is talking about" claimed Michael Deacon in the Daily Telegraph this week. Patrick Kidd, Political Sketch writer in The Times was equally flustered. "One thing is clear, we are confused. Does anyone have the foggiest idea how it is going?" he asks. It's a good question.

The Prime Minster outlined her thoughts on leaving the EU without a deal. "As I have said and others have said, it would be irresponsible for the British Government not to look across at the changes that would be necessary, regardless of the eventuality, and indeed some of the changes that would be necessary in the event of a no deal would be the same as changes that would be made in relation to us achieving a deal". Excellent. In the Commons two weeks ago, when asked if new EU laws would apply in Britain during the transition period, the Prime Minister was equally clear " Given the way things operate, it is highly unlikely that anything brought forward during that period that has not already started discussions through the European Union to which we are being party of until we leave and on which we would have been able to say whether they would be a rule that we would sign up to or a rule that we would not wish to sign up to". Mmmm. [Verbatim quotes from Michael Deacon]. Confused? You should be. Should we worry? Well Yes. Mrs May has emphasised we will all still be friends after the divorce in 2019. The PM wants a "strong and successful EU working alongside a confident outward looking Britain". A truly global Britain in which Liam Fox will resurrect the 16th Century Board of Trade and Chris Grayling will have us grow more food in his "Back to the Allotment Dig for Victory" appeal. We will join NAFTA, The TPP and the Melbourne Chamber of Commerce. It's going to be great, making Great Britain Great Again! According to a poll by BMG research this week, 76% think the negotiations are going badly. 12% think they are going well. Slightly down on the 15% who thought may delivered a great speech at conference this month. Ah the resilience of the British people and the Tory hard right. Theresa May was left talking to the plants this week, the real talks were underway in the "Big room" next door. The EU offered a concession. They may be prepared to move to the next phase of talks as early as December, as long as Boris Johnson doesn't make the trip to Brussels. Meanwhile Lloyd Blankfein head of Goldman Sachs tweeted this week "He looks forward to spending more time in Frankfurt". May should take a leaf from Prince Charles' greenhouse, he didn't just talk to the plants, he would instruct them! Maybe then we might see real progress! Economics news this week ... Latest inflation figures were released on Tuesday, the headline rate CPI hit 3.0% in September, goods inflation increased to 3.2%, core service sector inflation remained steady at 2.7%. Fish and book price increases were in double figures, the price of Butter is mounting. It is healthy to eat butter again, with fish, reading a good novel presumably. Manufacturing prices were up by 3.3%, input costs were up by 8.4%. The latter driven higher by the prices of oil, imported metals and home food costs. The Governor had warned of an imminent rate rise last week. The inflation data pushed Sterling higher, the rate rise loomed large. Then came the jobs data on Wednesday, unemployment fell, vacancies increased. The low pay mystery continued. Overall pay in the UK increased by just 2.2%. Private sector pay increased by 2.4%, driven higher by a surge in business and financial service sector pay. The prospects of an imminent rate rise abated slightly. The pressure on real earning would hit household spending. Or would it? Retail sales increased by just 1.2% in volume terms in September. The value of sales increased by 4.4%. Online sales increased by 14% accounting for 17% of all retail sales. 2,000 job losses were announced at Sainsbury, bringing the total job losses in the sector to over 20,000 so far this year. Huge structural changes are taking place as a result of the changes in retail dynamics. So should we worry about household spending? Not just yet. Retail spending will be around 4.5% in Q3. The strong jobs market continues. Don't worry about productivity or low pay, the market will self correct at it's own pace. Revenues will continue to flow into the state coffers. So it proved with the release of government borrowing figures for the first half of the year. Public sector borrowing decreased by £0.7 billion to £5.9 in September ... the lowest September for ten years. Year to date spending was £32.5 billion, down by £2.5 billion prior year. The OBR is forecasting a deficit of £58 billion in the current year. Simple extrapolation would suggest £42 billion would be nearer the mark. Just as well. Net debt is £1.8 trillion up by £140 billion on last year. The OBR will revise figures ahead of the budget next month. No matter the quantum, the funding challenge for Treasury and the Debt Management Office will continue ... a rate rise can only assist the process ... Spreadsheet Phil was in trouble this week. "Hammond must go" claimed the Brexiteers. If Johnson is sacked, the lozenge provider must be axed. The Chancellor must have raised his head in disbelief, an innocent in the playground, "So what have I done?"

"Nothing, absolutely nothing" the retort. The Treasury has failed to deliver any money or provision for the hard line, no deal option as part of the EU settlement. Negotiators are needed for the "Truly Global Britain" trade team. Additional facilities are required at Dover, Folkestone and all ports North, East, South and West. More Customs and Excise Officers required, along with upgraded computer facilities, more sniffer dogs and storage facilities for the volumes of paperwork, once outside of the customs union and free trade area. Others are making the effort. An approach to join NAFTA and the Trans Pacific Partnership combines truly global vision with geographic and economic myopia. Liam Fox is recreating the Board of Trade. First established in the early 17th Century with a focus on the colonies and plantations. OK so far Fox is the only member of an organisation which never really recovered from the American War of Independence. The Lords of Trade and Plantations may be smiling from the grave. James 1st initiated the process to investigate various problems of economic performance, the decline in trade and balance of payment difficulties. The King's coffers were under pressure. It all sounds so familiar. Hammond had cautioned any money spent on the "no deal" option would be at the expense of the Health Service, Education and other priorities in the short term. No need to jingle more cash at the jingoists. Funds have been earmarked for the Home Office, Transport and Customs and Excise when needed. For the moment Hammond thinks it is better to plan for a transition deal. A deal which would ensure flights between the UK and Europe could still take place, along with the fundamentals of trade continuance. In an effort to prove his credentials as "one of the boys", Hammond was in Washington. "The enemy, the opponents are out there, they're on the other side of the negotiating table." He said. Ah yes the enemy. We have fought them before on the beaches, on the seas and oceans, in the fields and streets, in the alleyways of Whitehall ..." Shortly following, Hammond apologised. "I regret I used a poor choice of words. We will work with our friends and partners in the EU on a mutually beneficial Brexit deal" he even included a hashtag #noenemieshere. adding " In an interview today, I was making the point that we are united at home". Yes of course we are ... no enemies at home among the Tory back benches ... Trade Deficit Deteriorates ... Meanwhile back in the real world, the ONS released the trade figures for August. The deficit trade in goods increased to £14.2 billion, up from £12.8 billion prior month. It hasn't been so bad since, well since, September last year! We expect the deficit trade in goods to be around £140 billion this year. Almost 7% of GDP. It will take more than a resurrected Board of Trade to solve the structural problem underpinning the trade shortfall. The service sector surplus was £8.6 billion. The surplus for the year as a whole will be around £100 billion. The trends continue despite the vagaries of Sterling. The ONS also released the latest data on manufacturing. Output in August was up by 2.8% in the month, following growth of just 1% in the second quarter. The bounce is partly a statistical blip working from a low comparison with the prior year. Even so, we now expect growth of 2.1% for the year as a whole. Is this a recovery? Not really! Output still remains before the pre-recession peak. The impact of leaving the EU will have a systemic shock to manufacturing with motor, aerospace and big pharma bearing the brunt of the set back. Overall output has been flat lining over the past twenty years. The progressive shocks of 1974 (-11%), 1979 (-18%), 1990 (-7%) and 2008 (-10%) continue to take their toll. EU departure will deliver a further setback of around 10% to output. Expect more relocation of manufacturing into Europe and deep sea markets. The threat of job losses at Vauxhall this week, is merely an indication of things to come. Mark Carney was also in Washington this week. In a live interview with CNBC he said there likely will be an interest rate hike in the UK soon, as the bank seeks to control inflation. The Governor is bearish on the impact of Brexit "It is going to be a big adjustment". Without a trade deal in place there will be a period when the economy is "reorienting". Rates are set to rise! We are reorienting! There lies another enemy within ... The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com Copyright © 2017 The Saturday Economist, All rights reserved.  The Prime Minister was in Manchester this week. The Tory party conference theme - building a country that works for everyone. The keynote speech was important, championing the cause of capitalism and free markets... renewing the British dream of home ownership, fulfilling the hopes of greater wealth creation for successive generations. To be fair, it wasn't a bad speech. "That's what I am in this for", the Prime Minister explained, a strong commitment to justice, equality and fair values. OK a few contradictions, a champion of free markets with price caps on energy and subsidies for housing. A champion of business, with salary caps in the board room and an end to "rip off energy prices" by the big six. There are a few anomalies in Theresa May's thought process, the hard right in the party eye with suspicion. Above all the delivery created the problem. Stage management and security were lapse. The persistent cough, the P45 incident and the letters falling from the stage, were all many will remember from the speech. According to a YouGuv poll, 15% of voters thought the speech went well! So much for the Tory diehards. The mood in the conference hall during the week was flat. A "barely live" Conservative party conference the caption on the BBC broadcast should have read. It was as if, on the eve of St Crispin's day, rumours were circulating, the long bow arrows were stuck in traffic, Henry V had lost his voice and the cavalry had caught an early ferry back to Folkestone. Conference needed a rousing speech! "We few, we happy few, we band of brothers.Tories in England now abed, shall think themselves accursed they were not here". Not so accursed as them that were. This was not Agincourt and Henry V, this was more like the Peterloo massacre with Theresa May in the crowd scene. What next for the leadership? Boris Johnson, Hildegaard from the North and Jacob Rees-Mogg are in the line up to take over from the Prime Minister. It is not a great choice, with the Mogg brought in to capture the youth vote presumably. "Leave my despicability to one side for the moment" I might be electable as leader of the party, would be his campaign theme perhaps. So what of Brexit negotiations. In the EU it is said, to start a fight in the Tory party shout "Europe", then offer the European Court of Justice to arbitrate. If that's not enough, propose the unification of Ireland to avoid the hard border problem in Ulster and begin backdoor talks with Corbyn to smooth the process. It is now over one year since the referendum decision. The Barons and captains of industry look on in confusion as to what is set to happen. David Davies is announcing his withdrawal from the battle. The Prime Minister is set to struggle on, offering "calm" leadership. The latter a tribute to medication perhaps after a very difficult week struggling to deliver the dream, building houses and a country that works for everyone ... So what of productivity ...? If I were Prime Minister, I would ban the ONS from issuing data on UK productivity, especially the international comparisons with France, Germany and Italy. It is an affront to every business and worker in the UK. It is nonsense to suggest the Europeans can achieve as much by Thursday as we achieve in the complete working week. Just look at the achievements in Nissan North East or BMW in Oxford. Travel to East Lancashire and robots working twenty four seven toil without sunshine to achieve output targets. When someone suggests the French or Italians are more productive, then ask which exchange rate did they use? Productivity is a function of output divided by labour input. The size of the cake divided by the number of bakers. To measure the size of the cake or GDP output, the key parameter for international comparison is the exchange rate multiplier. The ONS are using the OECD Purchasing Power Parity values from 2014. The cross rate against the Euro is just over parity. Use the cross rates before the referendum and the productivity disparity disappears. Complaints about UK productivity are long in the history. In the 1930s, work at NIESR found that productivity gaps as large as 60% between British and German firms could result from a skills shortage. "The aversion to all things technical were revealed as a source of weakness, threatening the very existence of the nation." "In all key industries, there was a shortage of skilled workers. The inadequacy of scientific and technical education in Britain, compounded by the withering away of apprenticeships in trades hit worst by the great depression had created the paradox of skills shortage amidst mass unemployment." Here we are talking about the great depression of the 1930s not the comparatively modest slow down in 2008. Over eighty years later, economists are still fascinated by "productivity". It's just a residual after all. Output divided by labour with something in between. Low growth begats lower productivity, higher growth generates higher productivity. No magic moon dust. In the UK and in the US for that matter, we should celebrate the growth in output and in jobs. The fashion for self flagellation about the lack of productivity growth will get us nowhere. If there is a productivity problem, it lies not with within family business and UK ownership. It begins with government investment in transport, infrastructure and telecommunications supported by spending on health, education, skills, training and apprenticeships. Saddling our newly qualified with hefty student loans is not part of that solution. That's all for this week ... Have a great week-end ... © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List or the Dimensions of Strategy List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed