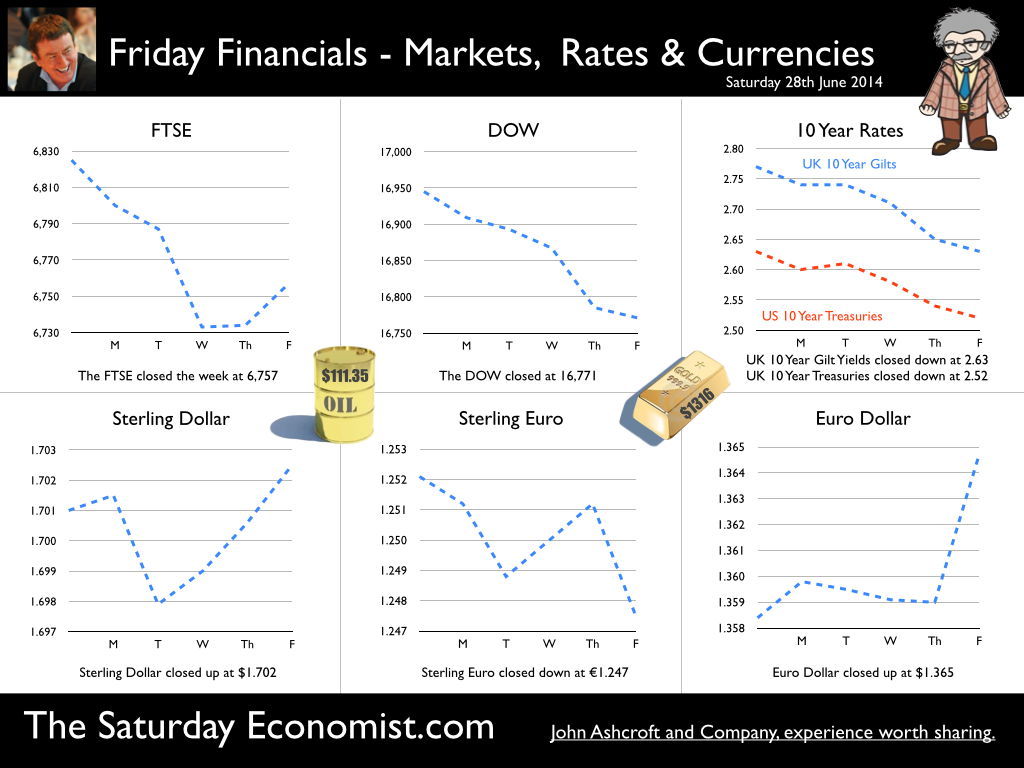

The Governor was in front of the Treasury Select Committee this week. Pat McFadden raised a laugh about forward Guidance - “The bank is behaving like an unreliable boyfriend, one day hot, one day cold, - people on the other side of the message not really knowing where they stand”. But is that really fair? It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the strength of sterling and the low inflation figures for May. The Governor is advising markets, “forward guidance is state contingent”. As the state of the economy changes, the timing of future rate increases will also change. No need to wait for the Quarterly Inflation Report to mark the move. The situation is fluid and dynamic. As the data changes, so will future rate rise probabilities. “Don’t watch my lips - watch the data!” the new guidance. Revisions to GDP data … And so it was, the UK data changed, slightly, this week with the revisions to growth in the first quarter. The ONS revised down growth in Q1 from 3.1% to 3%! This is hardly likely to impact on monetary policy in any way shape or form. The adjustments reflect minor statistical adjustments rather than major structural moves. Our forecast of growth for 3% in 2014 is unaffected by the change. Investment grabbed the headlines, increasing by almost 10% in the quarter. The year on year comparison was against a particularly weak quarter last year. We expect investment growth of over 7% for the year as a whole, using research data derived from the Manchester Index™. [GM Chamber of Commerce research data - capacity and investment intentions]. In the USA, the revisions to GDP growth in the first quarter were much more significant. The headlines confirm growth fell by 2.9% quarter on quarter. Yet, the underlying growth year on year was up by 1.5%. The FOMC expect US growth of 2.2% this year rising to over 3% next. So what of Medium Term Rates … In the UK, the governor would have markets believe rates will rise slowly and thereafter are unlikely to rise above 2.5% in the medium term. In the USA, the Fed present no such illusion. Medium term rates, according to members of the FOMC, are expected to rise to 4% plus and some members expect this to occur by 2016. For now, US Bond traders believe the FOMC is too optimistic about the economy. Interest rates will remain low well into this decade. But if it does happen “over there”, is the UK - US spread manageable? Hardly likely. The medium term path of UK base rates is set to return to the 4.0% plus norm in due course, narrowing the divide. As for the timing - well that is another "guidance" issue altogether! So what happened to sterling ... The pound closed up against the dollar closing above the highly significant $1.70 level. Sterling closed at $1.702 from $1.70, slipping against the Euro to 1.247 (1.252). The Euro moved up against the dollar at 1.365 from 1.358. Oil Price Brent Crude closed down at $111.35 from $114.70 as Middle East concerns cleared slightly. The average price in June last year was $102.92. Markets, closed down. The Dow closed down at 16,771 from 16,945 and the FTSE was also down at 6,757 from 6,825. UK Ten year gilt yields were down at 2.63 from 2.77 and US Treasury yields closed unchanged at 2.63. Gold was steady at $1,316 from $1,314. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

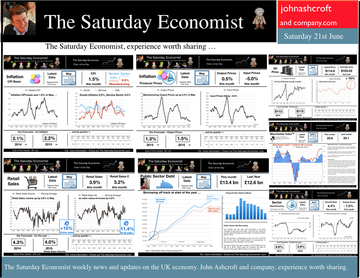

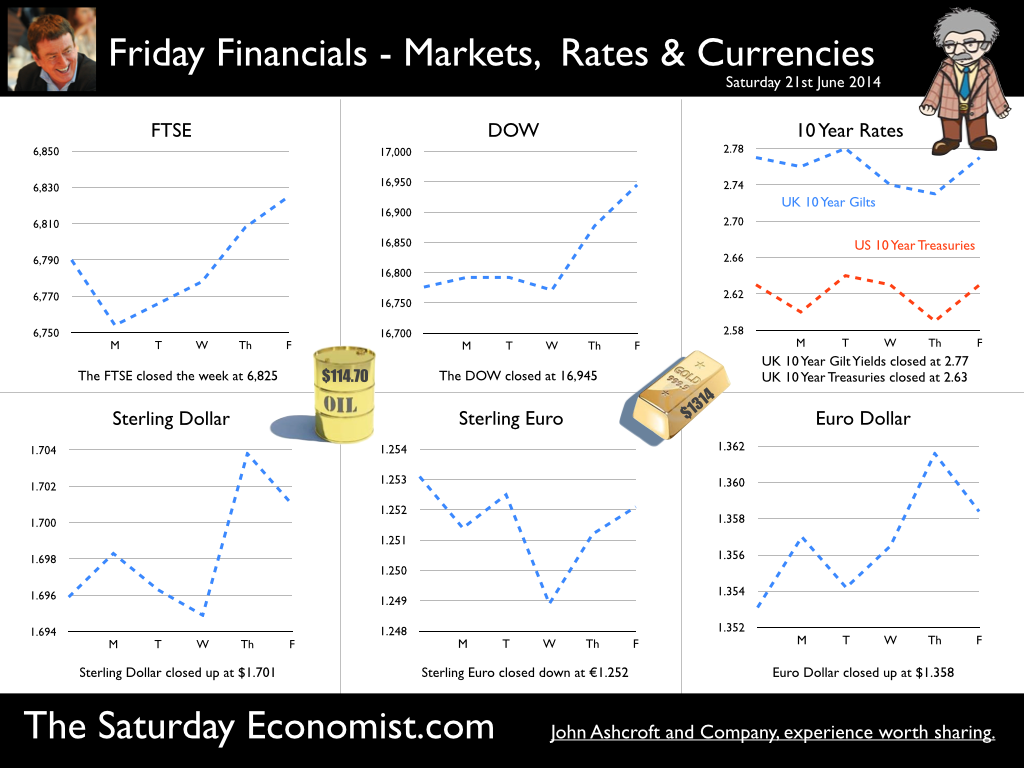

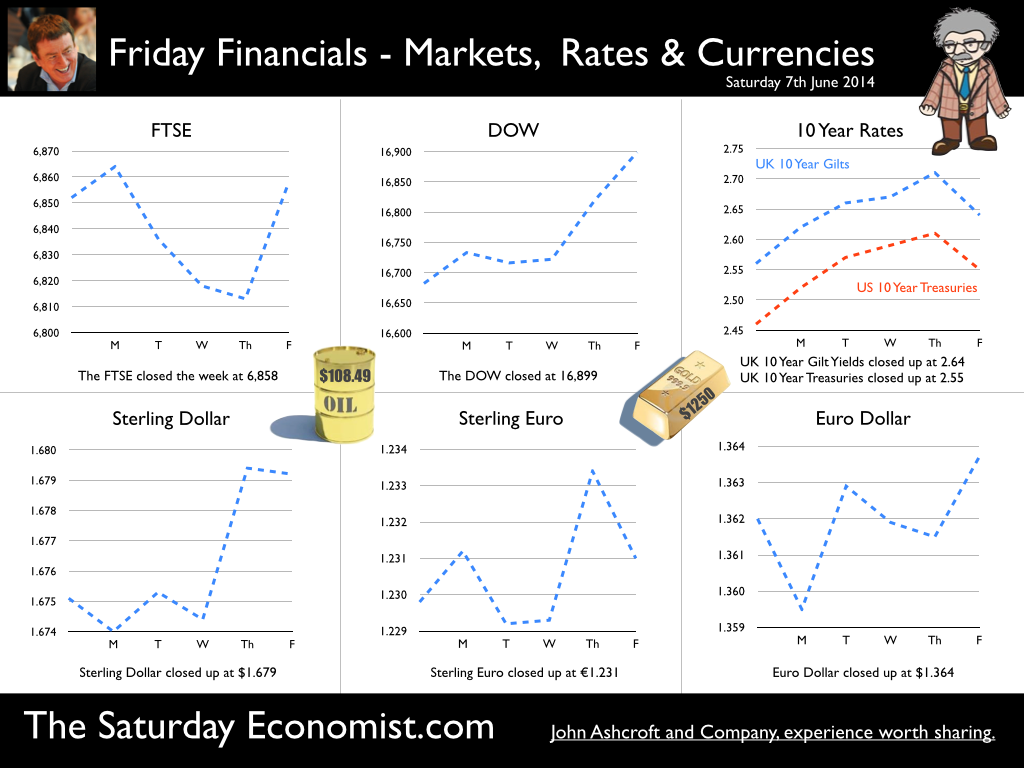

The Governor of the Bank of England, was before the Treasury Select Committee this week. The members of the committee were disturbed. The MPC and the Governor in particular were behaving like an unreliable boyfriend, one day hot, one day cold, leaving "people" not really knowing where they stand! Is that entirely fair? We look to Shakespeare for advice on the "Quality of Guidance following the leader in The Times today. The quality of guidance is not strained, It droppeth as the gentle rain from heaven. Upon the market place beneath. It is thrice blest. It blesseth him that giveth and him that provides an update some months later. Tis mighty and moves markets, Yeah even the lofty dollar trembles at the sound. It becomes the governor of the Bank of England, yeah even better than the crown. His script doth amply demonstrate the force of monetary policy and power. The attribute to awe and majesty, wherein doth sit the mystery of spare capacity and yield. Guidance is a sceptred sway, first this way and that. Dethroned in the hearts of Kings long past, it is an attribute to deity itself. For monetary power doth then show likest best, when reality seasons theory and pragmatic policy rules the nest. Anon.  Earlier this month is his speech at the Mansion House, Mark Carney, Governor of the Bank of England, referenced the Sterling Crisis of 1931 and imbalances within the economy. “We need balance. One has only to look back to 1931 when Britain’s economic prospects were strained by a large budget deficit and a deteriorating balance of payments. In 1931 the UK faced a balance of payments crisis and a run on the pound sterling which in the end led to a negation of the Gold peg and the dollar pricing of $4.86. By modern standards the deficit was no big deal. In 1929, the country had a credit balance (current account) of some £100 million falling to £30 million in 1930. In 1931 there was an estimated debit balance of £90 to £120 millions. It was this anticipated deficit on current account that led to a run on Sterling and a repatriation of assets particularly to France and the USA. The problem for the balance of payments was a deterioration in the net receipts from invisible exports largely as a result of the fall in international trade and collapse of shipping revenues. The government was unwilling to raise interest rates to defend the currency given the overwhelming concern re unemployment. The visible account had long been in substantial deficit, despite a surplus on manufactures and semi manufactures. Imports of raw materials and food, particularly food, meant that exports of manufactures and a surplus in invisible earnings had to finance the food bill of the UK population. In 1931, food exports totalled £39 billion but the import bill was £377 billion producing a deficit of £338 million. The proposition to remedy the balance of payments problem was to eat less, import fewer manufactures and export more. Food, drink and tobacco imports should be reduced by 7%, manufactured goods imports should be reduced by 25% and exports of manufactures increased by 25%. A combination of import tariffs and duties would assist in the process. Certain items were considered to be non-essential including shell fish, game, pickles and pickled vegetables, precious stones, feathers, flowers, plants and bulbs. The category of non essentials, totalled £13 million. The “pickled imports” alone cost the UK £6,000 such was the level of detail in the analysis. In 1930 and 1931, the deficit on merchandise trade was £386m in both years and this was offset by invisible receipts of £400m – £420m in 1931, falling to £285m to £315m in 1931 largely as a result of the fall in income from overseas investments. In 1930, the visible deficit was equal to almost 9% of GDP but thanks to the surplus on invisible account the current account was in balance. It was argued there is no problem of the balance of trade so long as the “£ is free to move” as, if the balance is adverse, sterling will automatically fall to the point necessary to maintain equilibrium. “The real problem is to secure such a balance of payments as is consistent with a reasonable exchange values of the £.” (Committee on the Balance of Trade – report January 19th 1932). In September 1931 the British Government suspended obligations due under the Gold Standard Act of 1925 which required the bank to sell gold at a fixed price. As the statement from the Prime Minister Ramsay MacDonald explained. “In the last few days the international financial markets have been “demoralised” and seem intent on liquidating their foreign assets in a sense of panic. Since the middle of July, funds amounting to more than £200 million have been withdrawn from the London market. The withdrawals have been met partly from gold and foreign currency held by the Bank of England, and short term credits of £130 million from the USA and France.” By September 1931, reserves were exhausted. In a chilling note from the Bank of England to the Prime Minister, the Deputy Governor E M Harvey reported : Gentlemen, I am directed to state that the credits for $125,000,000 (£25.7m) and FFs. 3,100,000,000, (£25m) arranged by the Bank of England in New York and Paris respectively, are exhausted, and that the credit for $200,000,000 arranged in New York by His Majesty's Government, together with credits for a total of FFs. 5 millions negotiated in Paris, are practically exhausted also. The heavy demands for exchange on New York and Paris still continue. Under these circumstances, the Bank consider that, having regard to the above commitments and to contingencies that may arise, it would be impossible for them to meet the demands for gold with which they would be faced on withdrawal of support from the New York and Paris exchanges. The Bank therefore feel it their duty to represent that, in their opinion, it is expedient in the national interest that they should be relieved of their obligation to sell gold under the provisions of Section 1 subjection 2 of the Gold Standard Act, 1925. I am, Gentlemen, Your obedient Servant. And so it was, the UK abandoned the Gold Standard, the Pound was left to float, to a level which will automatically produce equilibrium. The rest “as they say” is history. This article was originally posted in April 2011  Deficits with inky blots and rotten parchment bonds sustained - of Balance of Payments and Public Sector Finances. Earlier this month is his speech at the Mansion House, Mark Carney, Governor of the Bank of England, referenced the Sterling Crisis of 1931 and imbalances within the economy. “We need balance. One has only to look back to 1931 when Britain’s economic prospects were strained by a large budget deficit and a deteriorating balance of payments. In the ensuing crisis, the government of the day resigned, sterling was forced off the gold standard" [and the Governor of the day went back to Canada.] In 2014, despite significant internal and external deficits, neither the resignation of the government, nor the repatriation of the Governor of the Bank of England appears imminent. It is however, worth revisiting 1931 and recalling the worlds of Sir Warren Fisher, permanent secretary to the Treasury. In September of that year, Sir Warren Fisher, warned Cabinet, of the Balance of Payments Crisis and the National Budget problem - "Deficits with inky blots and rotten parchment bonds sustained". He could easily have been talking of the present day, QE and debt monetisation. Trade Deficit ... Fisher 1931: The seriousness of the financial difficulties which are engaging public attention is perhaps not fully realised. The root cause of the "run on Sterling" on the part of the foreign depositor is the fact of our living beyond our means as evidenced by our ordering from abroad more goods than we could pay for and therefore our owing to other countries more in dollars and francs than they owe to us in sterling.” Public Sector Finances … Fisher 1931: Closely associated with this fact in the foreign mind is the question of our national Budget. After the war a certain number of countries continued to have difficulties in balancing their budgets and instead of pulling in their belts, resorted to the expedient of meeting deficits by printing innumerable bank or currency notes. Whenever this was done, the national currency lost much or all of its value i.e. purchasing power, and with the corresponding rise in prices, hardship, even hunger, was widespread. Consequently, when any of these countries subsequently desired financial assistance from other countries before the citizens of the latter could be induced to lend, they insisted on the borrowing country balancing its budget. And no one was more emphatic than ourselves in preaching this doctrine. National Budget … Fisher 1931: A national Budget has thus come to be regarded as a touchstone of a country's financial stability second only in importance to its international balance of trade; and if, as the case at present with us, we are "down" on our balance of trade with other countries, foreigners to whom we owe money automatically turn a microscope on to our Budget. And if the Budget is not really balanced, but is merely dressed up to look as though it were, the distrust abroad of our soundness would be intensified. Any expectation that we might continue on a "rake's progress" would complete the destruction of international confidence and thus result in the final collapse of our greatest asset, i.e. our credit. Living beyond our means … Fisher 1931: The remedy is to reverse the process which has been responsible for the trouble, and this means that instead of living at a level which has entailed ordering abroad more goods than we can pay for, we must relate our orders to our capacity to pay. And unless we can produce and sell abroad more goods (including "services") than we have been doing, we shall be forced to cut down our orders abroad, and our and our standard of living must be reduced accordingly. Consequences ... If not the epitaph of us English of to-day will be written by historians to come in Shakespeare' words (Richard II , Act 2, Scene l ) "England, bound in with the triumphant sea, Whose rocky shore beats back the envious siege of watery Neptune, Is now bound in with shame, with inky blots and rotten parchment bonds. That England, that was won’t to conquer others, hath made a shameful conquest of itself". Lessons from History And so history is revisited. With inky blots and rotten bonds sustained. The latest data on the Public Sector Finances is hardly reassuring and the trade deficit will continue to present a problem for an economy growing faster than major trading partners. Note "By the Secretary, The attached memorandum by Sir Warren Fisher is circulated to the Cabinet by instructions from the Prime Minister. (Signed) M. P. A. HANKEY Secretary, Cabinet, Whitehall Gardens, SW1. September 14th, 1931. Footnote : Up to this time the pound sterling, has for international purposes been valued and accepted as the equivalent of a gold pound or of 4.00 dollars or 124 Francs. The Financial and Economic Position of the United Kingdom 1931. Memo to Cabinet from Sir Warren Fisher, Permanent Secretary to the Treasury September 1931. Deficits with Inky Blots and Rotten Parchment Bonds sustained. This article was originally published John Ashcroft.co.uk in July 2009. References : Fun with the National Archives : Cabinet Papers  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The first rate hike - it could happen sooner than markets expect … speaking at the Mansion House this week, Mark Carney gave a clear indication UK rates could be hiked this year. “It could happen sooner than markets expect”, the exact wording. A bit tough on the markets, they had placed great confidence in forward guidance. So much for the “unemployment trigger” or the “eighteen indicators” - “watch my lips”, the Governor’s new condition precedent. Last week we suggested - UK rates would have to rise sooner than forward guidance implied. We didn’t have long to wait. The Governor made the move. The markets now believe rates may rise in the final quarter of this year. October would be a fair bet. UK data continues to suggest rates should rise in the Autumn … Construction output increased by a revised 6.7% in the first quarter of the year and by 4.7% in April. We are forecasting growth of almost 6% this year and 5% in 2015. Our forecast for GDP growth is upgraded slightly to 3% from 2.9% this year, as a result of the revisions to the construction data. [Our forecast is unchanged for 2015 - 2.8%]. Manufacturing output increased by 4.4% in April following growth of 3.6% in the first quarter. A strong performance in capital goods output was supported by growth in consumer durables. The march of the makers is picking up the pace but output remains just over 7% below the peak level of 2008. We continue to forecast a recovery with growth of 4% this year. Jobs Data - another strong performance revealed this week. The claimant count fell by 27,000 to 1,086 thousand in May. The reduction over the last three months was 86,000. The average claimant count from 2005 to the middle of 2008 was 880,000. If current trends persist, the pre recession levels will be achieved by the end of the year and job centres will be closing by the end of 2017! The number of vacancies increased to 637,000. This is higher than the average pre recession levels of 634,000. The UV ratio fell to 1.7 from a peak of 3.8 in 2009. The average 2005 - 2008 was 1.4. 33 million are in work [DYDC], an increase of over one million over the last twelve months. Our estimate of spare capacity is 0.6%, compared to the estimates of 1% - 1.5% within the Bank of England. The margin is wafer thin. The “gap” will be exhausted by the final quarter of the year. The labour market is tightening. Rates should be set to rise towards the end of the year. So what happened to sterling this week? The pound closed up against the dollar following the comments from the Governor, encountering resistance at the $1.70 level. Sterling closed up at $1.696 from $1.679, up against the Euro at 1.253 (1.231). The Euro softened against the dollar at 1.353 from 1.364. Oil Price Brent Crude closed up at $113.07 from $108.48. The situation in Iraq and the Middle East pushed prices higher. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed down on fears of the rate hike in the UK and in the USA. The Dow closed down at 16,776 from 16,899 and the FTSE was also down 6,790 from 6,858. UK Ten year gilt yields rallied at 2.77 (2.63) and US Treasury yields closed at 2.77 from 2.55 on interest rate trends. Gold moved higher on geo political fears at $1,274 from $1,250. That’s all for this week. Visit the revamped web site. Download our quarterly forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed