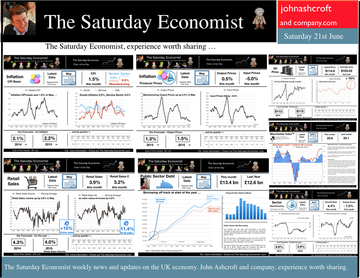

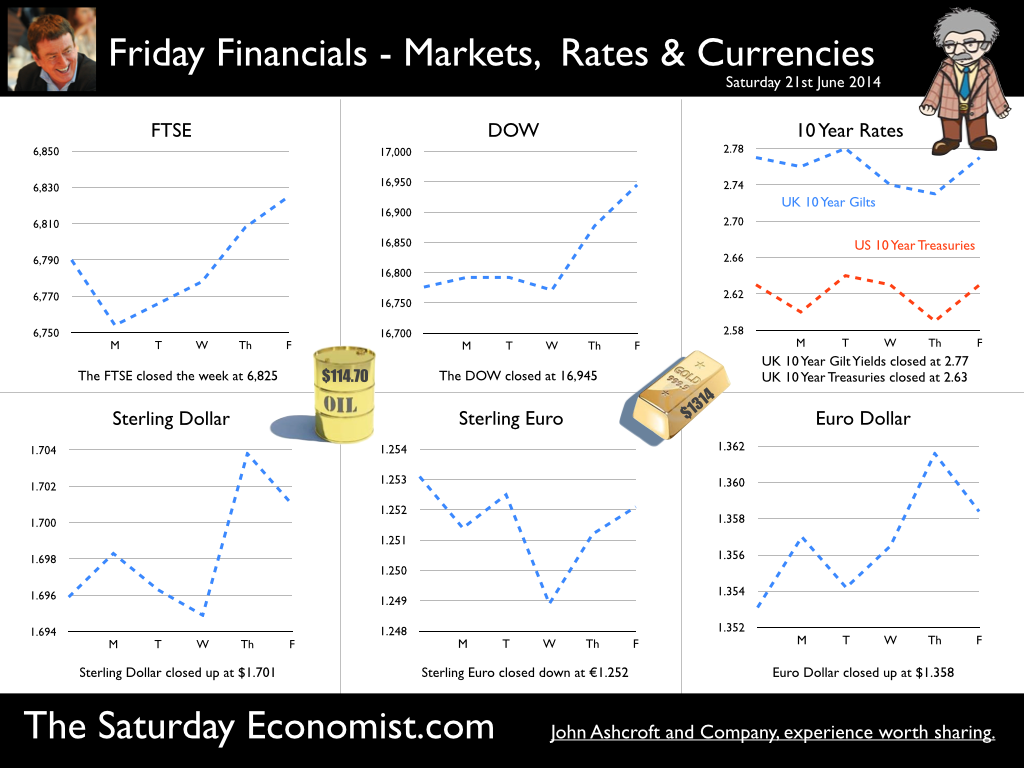

The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.

0 Comments

The week of the budget … “I have never shied away from presenting difficult truths to the British people. And one difficult truth the British people must confront, is that by this time next year, I may well appear to be the most successful Chancellor in UK history.” Well it would have been a great start to the budget speech - and yes it could well be true! Growth up, inflation down. Employment up, borrowing down, just the trade figures will continue to disappoint. Construction will be much higher. Investment and real earnings will be rising by the second half of the year. The Tories could not hope for a better economic platform to pitch at the hustings next year. The Budget 2014 simply enhanced economic prospects for the year ahead. Proclaimed as a budget for makers, doers and savers. The savers did particularly well but above all else, it was a budget for voters. The Chancellor offered a prudent budget with fiscal constraint and an obvious eye on the electorate. “Fixing the roof whilst the sun is shining” the mantra. It is clear the Bullingdon boys are fixing the roof in Downing Street, intent on a prolonged stay beyond May 2015. For a more comprehensive note on the budget itself, check out the full post here. It was a budget which 24 hours later was considered (by the IFS and others) to be more expansionary than at first thought. It was a clever budget. Hard to think it came from the same stable as the "omni shambles" just two years ago. The polls have Labour just 3 to 4 points ahead of the Conservatives. Tory analysts will have an eye on the 1986 rally. A fifteen point swing in just twelve months, to enable the Thatcher administration to stay in power. The Lib Dem vote has collapsed, the UKIP vote will evaporate. The Chancellor has created a winning platform. It will be difficult, but not impossible, for Prime Minister Cameron to slip from the podium. Borrowing … The borrowing figures for February were released on Friday. At first sight the figures appear disappointing. Borrowing in the month was £9.3 billion, slightly up from £9.2 billion in the prior year. Heading in the wrong direction? Not really. The prior year figures were enhanced by the £2.3 billion sale of 4G licences. For the year as a whole the OBR projections assume borrowing of around £108 billion in the year down from £115 billion last year. Over the next four years, assuming the budget forecasts for spending are achieved, borrowing could be eliminated within four years. Entirely plausible. Then the real task of reducing the £1.5 trillion debt can begin. Unemployment … The good news on employment continued with further news this week. The claimant count fell by almost 35,000 in February to a rate of 3.5%. Over the last twelve months the count has fallen by 360,000 to a level of 1.175 million. Over the last three months, the count has fallen by 100,000. On current trends, assuming growth of around 2.7% in the year, the unemployment level could fall below 1 million by the end of the year, hitting the critical 2.5% rate by the middle of next year. Why so critical? This would be the best performance since the beginning of 2008. A 2.5% claimant count rate is consistent with earnings of 4% - 5%. Far more than current achievements of 1.5%. “Spare capacity” could become a scarce resource, sooner than we think. Base rates are set to rise in the first half of next year. The rate rise could be sooner and thereafter faster than we are currently led to believe. Rate rise USA … Janet Yellen as the new head of the Fed gave a clear indication, US tapering will continue with a possible elimination of the whole QE programme by the Fall. Thereafter Yellen made clear, US rate rises are likely to follow within six months. Watch the UK and add six months, our mantra modified to perhaps three months, the guideline last week. On current job trends, we caution, watch the US and don’t blink. The UK rate rise - much sooner than you think. So what happened to sterling? The pound closed at $1.649 from $1.662 and at 1.1956 from 1.196 against the Euro. The dollar closed at 1.379 from 1.390 against the euro and 102.27 from 101.31 against the Yen. Oil Price Brent Crude closed at $107.37 from $108.34. The average price in March last year was $108. Markets, the Dow closed at 16,410 from 16,107 and the FTSE closed at 6,557 from 6,527. UK Ten year gilt yields closed at 2.76 from 2.67 and US Treasury yields closed at 277 from 2.65. Gold loves a crisis, the crisis is over as the metal moved lower to $1,3358 from $1,378. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results - recorded - then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experts in strategy. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  This was a budget for the makers, the doers and the savers but above all it was a budget for the voters, in a country which does not invest enough, export enough or save enough apparently. With just over twelve months to go to the election, the Chancellor could not have hoped for a better economic backdrop with which to revisit the polling stations in May next year. Growth is up, inflation down, employment up, borrowing down, investment up, so all is well. Just the trade figures will continue to disappoint, as the structural deficit trade in goods will continue to provide a drain on net trade. Despite the clear evidence of a strong recovery, the Chancellor will continue with the austerity programme. More departmental cuts planned, along with a cap on welfare spending. The chancellor is determined to “fix the roof” whilst the sun is shining. The deficit will fall over the next four years, the plan to eliminate government borrowing by 2018. Attacks on tax dodgers, will ensure the complex tax avoidance schemes and “Corporate wraps for property” are placed under pressure. Fines for LIBOR abusers will be redirected to good causes including military charities, scouts, guides, cadets and St John’s Ambulance. Exporters will receive a modest boost with and increase to £3 billion in the amount available to finance export growth. Alas £ 3 billion - a small drop in the world’s five oceans, if the £1 trillion export target is to be met. In housing, the help to buy scheme is to be extended to 2020, assisting the purchase of 120,000 new homes, with an additional 15,000 new homes planned for Ebbsfleet. Where is that? In infrastructure, £270 million is planned for the Mersey Gateway Bridge, with a further £200 million available to fill “potholes” around the country. A modest contribution if HS2 is to proceed. Investment also receives a boost, with a doubling of the investment allowance to £500,000. Almost every business in Britain, will pay no upfront tax as they invest to expand capacity in the future. Energy costs will be clipped, with caps on carbon price support and additional measures providing savings to every manufacturer in the country. Bingo tax is set to halve, fuel duty prices will not be implemented in September, the lost revenue, partly financed by increase duties on betting terminals and offshore bookies. Personal allowances will increase to £10,500 producing tax savings for millions of voters. Tax cuts for those on low incomes and those on middle incomes too. But the biggest giveaway was for savers. A new composite ISA for cash and shares, new higher yielding pensioner bond, yielding 4% on a three year investment. An end to the iniquity of the forced purchase annuity. An end to caps and drawdown limits on pensions. People will have the right to access their own savings at a time of their own choosing and best of all, the abolition of the 10 pence tax rate for savers altogether. It is a vote winner for hitherto disillusioned pensioners. The Chancellor claims this is a budget for the makers, the doers and the savers. Above all the savers appear to have done remarkably well, the makers and the doers, less so. Above all it is a clever budget for the electorate. The Labour lead in the polls is narrowing to around five points. Tory analysts will have an eye on the 1986 pre election swing. A swing yielding over 15 points to the Conservatives in the twelve month run up to the election of 1987. The Lib Dem vote has collapsed, the UKIP vote will evaporate. This is a budget which will do little harm to the economy but a great deal for Tory spirits and voters in this critical pre election phase. It is a budget which should be commended to the House but above all to the Tory back benchers, particularly MPs and prospective candidates in marginal seats. © John Ashcroft 2014 Word Count 650 words |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed