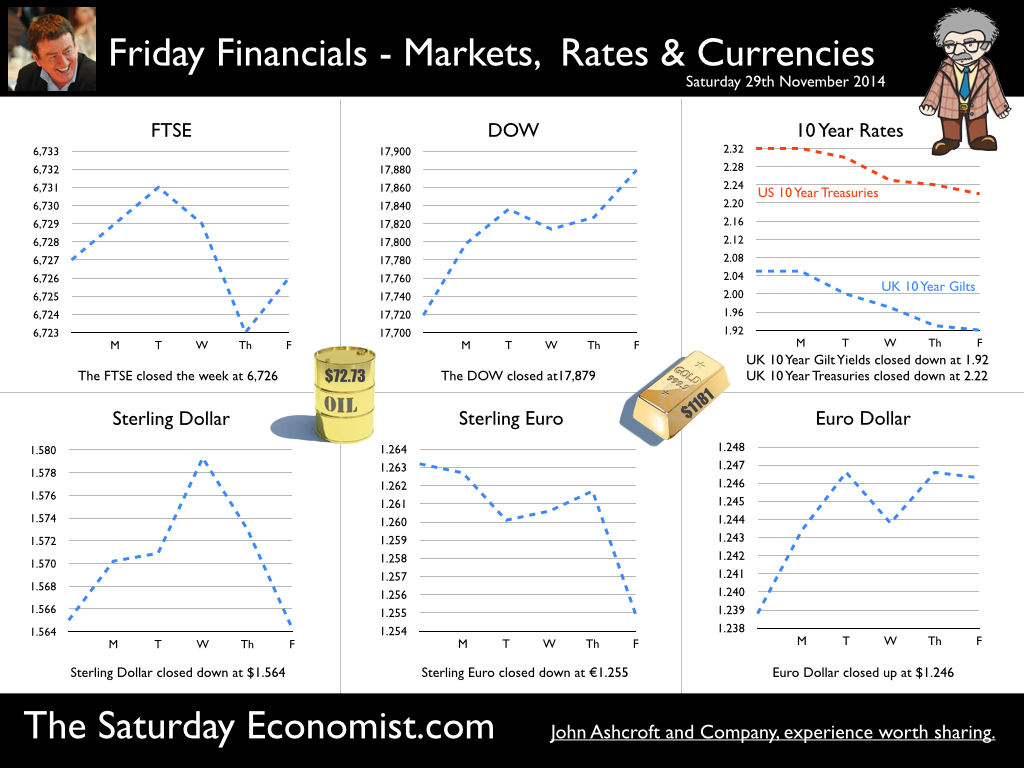

The UK economy grew by 3% in the third quarter ... The US economy grew by 2.4% in the same period. In India, growth slowed to 5.3% and in Europe … well it just doesn’t get any better for the moment. The battle against deflation continues over there. The second estimate of GDP for the third quarter was released by the ONS this week. For ONS watchers, it doesn’t get any more exciting. Domestic demand increased by 2.5% supported by a 2.4% growth in household spending. Government spending increased by 1%. Investment was up, increasing by just over 7%. Is the economy rebalancing? Not really … International Trade … Strange things are happening in the trade data. Exports fall by 1% compared to last year and imports fell by 2.4%. Weak world trade growth, up by just 2% in the quarter, is limiting the potential for UK exports. Problems in Europe are exacerbating the challenge …. but For imports, the pattern is rather strange. Domestic demand up by 2.5%, imports down by 2.4% - it doesn’t make sense. The trade deficit will increase significantly this year, if the UK continues to grow faster than major trading partners. We import to satisfy growth in the economy, despite the vagaries of Sterling. Slowly too, we are realising “we have to import to export”. A high proportion of exports are import dependent. It’s the Morton’s Fork of International Trade Theory. We cannot export without a significant growth in imports. Raw materials, components and semi manufactures. Just look at the car market. There is no simple “trade” solution to the twin deficit dilemma. On a better note … In nominal terms, the economy grew by over 5% which should argue for stronger tax receipts to assist the Treasury borrowing target before the end of the year. In output terms, the economy grew by over 3%! The service sector grew by 3.3%, with 4% growth in leisure, distribution and business services. Construction output was up 3% and manufacturing output increased by 3.4%. We see no reason why the economy should lose momentum into the final quarter and into next year for that matter. Our forecasts are unchanged. We still expect the economy to grow by 3% this year and around 2.8% in 2015. Don’t miss Our Quarterly Economics Update for December. It will be released following the Autumn statement from the Chancellor and the debt update from the OBR. Don’t miss either "The Great Manchester Economics Conference” in October next year. We have a great line up of specialists in Manchester for the day. It won't be dull - imagine Beyonce meets Newsnight! What’s Happening to Oil prices … Oil price Brent Crude traded briefly below $70 dollars per barrel on Friday, a reaction to “The Viennese Slice” - news from OPEC of no output cuts to improve short term oil prices. We mark the close at $72.73 this week. Is OPEC sending a message to US shale? Possibly. But the bears are out of the woods and naked. We think intra day sub $70 last week was a shake out! That’s our long shot of the week. We expect a winter rally anytime soon! So what happened to sterling this week? Sterling closed unchanged against the Dollar at $1.564 ($1.565) but moved down against the Euro to 1.255 from 1.263. The Euro closed up against the Dollar at €1.246 from (€1.239). Oil Price Brent Crude closed down at $72.73 from $79.61. The average price in November last year was $107.79. As we said last week, expect one last squeeze to flush out the timid, then settle in for the bull ride. The intra day sub $70 could well have marked the move. Markets, moved up. The Dow closed at 17,879 from 17,719 and the FTSE closed unchanged at 6,726 from 6,727. Our call is for 7,000 in the Christmas stocking! We shall see! Mining and Commodity majors feature in the UK market profile. UK Ten year gilt yields moved down to 1.92 from 2.05. US Treasury yields were down to 2.22 from 2.32. Gold moved down to $1,181 from $1,202. That’s all for this week. Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Interested in Social Media? Profiled on LinkedIn? You should be. LinkedIn claims one in three of the worlds professionals are on the platform. Check out our PhD in LinkedIn Guide. Now available on Amazon … 20% of the profits go to our nominated charities, Forever Manchester, WWF, Water Aid and Oxfam. Help the cause and Boost Your profile at the same time! Get Your PhD In LinkedIn for just £4.95 Click the Link! The Great Manchester Economics Conference - October 201 Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Interested in speaking, featuring or sponsoring, just drop me a line at [email protected]. Join the mailing list for The Saturday Economist or why not forward to a colleague or friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

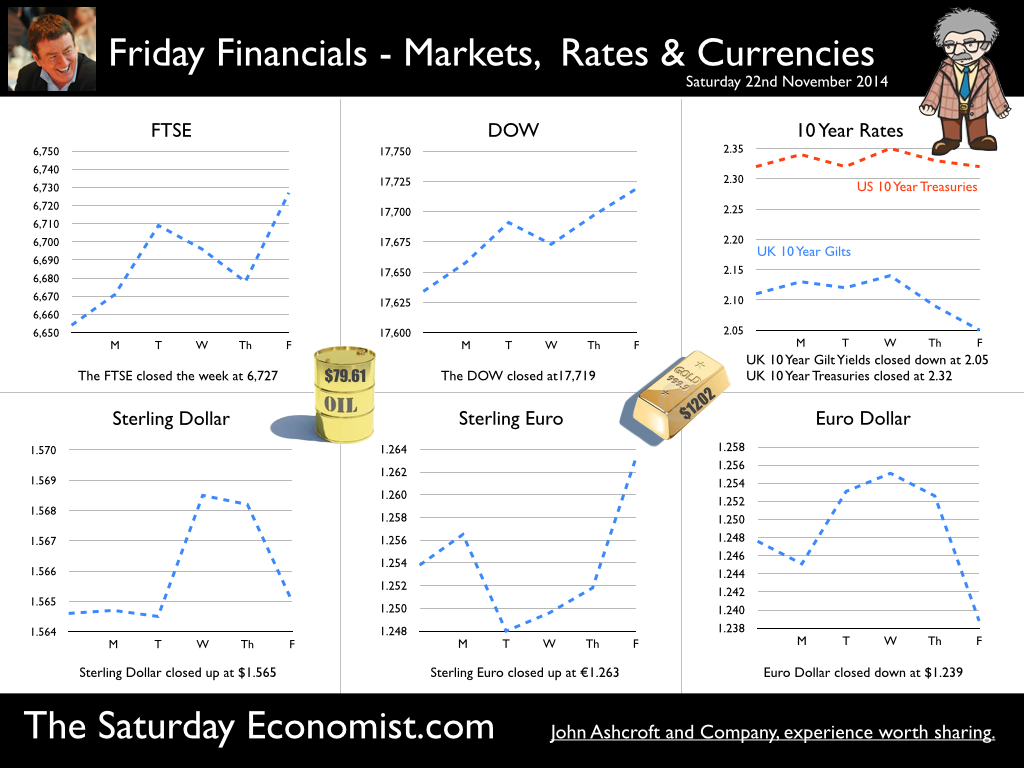

Government borrowing is off track but could yet get better. Borrowing for 2013/14 has been revised down yet again to £97.5 billion. This will be a tough target to beat. Our forecasts for the year are largely unchanged. For the year as a whole we now expect borrowing to be around £98 billion. Full revisions will be prepared following the Autumn Statement and the revised forecasts from the Office for Budget Responsibility due in the next few weeks. In the month of October borrowing was £7.7 billion in October slightly down on the 7.9 billion in the equivalent period. In the financial year to date borrowing was £64.1 billion, an increase of £3.7 billion compared with the same period in 2013/14. Revenues remain a challenge for the Chancellor. VAT receipts, stamp duty and corporation tax revenues are strong. The big weakness is income tax. Despite the strong rise in employment, the tax take remains weak. Low earnings and a big rise in self employment partly to blame. Total debt fell slightly to £1.449 trillion just under 80% of GDP. Borrowing is off Track but could yet get better. Lots of scope for revisions and updates before the end of March 2015. Retail Sales October …. Retail sales volumes increased by 4.3% year on year in October, the fastest growth rate since April this year. Values increased by just 2.8%. The sectors with the strongest growth this month were non-store retailing up 11.5% over the past year and household goods stores up by 10.8% increase. Department stores also continued to post positive results with growth in volumes of 8.2% over the past year. The strength of the housing market and in the increase in housing market transactions is impacting positively on retail activity. The total value of retail sales values increased by 2.8% in the month. On line sales increased by 7.5% in the month accounting for just over 11% of all retail activity. Our forecasts for the year are largely unchanged. For the year as a whole we now expect retail sales to increase by 3.5% in 2014 slowing slightly to 3.3% in the following year. The strong start to the “Golden Quarter” for retail may yet lead to an upward revision for the current year. Consumer Price Inflation : October … Inflation CPI basis increased to 1.3% in October from 1.2% prior month. Service sector inflation edged higher from 2.4% to 2.5% and goods inflation increased from just 0.2% to 0.3%. Heavy smokers and drinkers with kids in private school continue to suffer, as education costs increased by 10%, followed by alcohol and tobacco costs up by 5%. Utility bills continue to rise, up by 3.2% and restaurants and hotel costs increased by 2.5%. Transport costs remain subdued and food prices fell in the twelve month comparison. Producer Prices : October … Producer output prices increased by just 0.5% in October unchanged from the September level. Input costs fell by 8.4% in the month driven by a 22% drop in crude oil costs. Food costs down by 10% and imports of chemicals and materials down 4% assisted the cost reduction process. Where next for prices? The consensus is for inflation to remain below the 2% target for the foreseeable future. Oil prices trading at $80 Brent Crude basis will assist together with the relative weakness of world trade and commodity prices. Inflation is always and everywhere an international phenomenon, at least for the moment, until wages start to rise that is. So what happened to sterling this week? Sterling was largely unchanged against the dollar at $1.565 from $1.567 but moved up against the Euro to 1.263 from 1.251. The Euro closed down against the dollar at 1.239 (1.252). Oil Price Brent Crude closed unchanged at London close at $79.61 from $79.41. The average price in November last year was $107.79. Late news on Chinese rate cuts pushed oil above the $80 dollar mark. Expect one last squeeze to flush out the timid, then settle in for the bull ride. Markets, moved up. The Dow closed at 17,719 from 17,635 and the FTSE closed up at 6,727 from 6,654. Our call is now for 7,000 in the Christmas stocking! UK Ten year gilt yields moved down to 2.05 from 2.11 on dovish minutes from the MPC meeting. US Treasury yields were unchanged at 2.32. Gold moved to $1,202 from $1,187. That’s all for this week. Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Join the mailing list for The Saturday Economist or why not forward to a colleague or friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Great Manchester Economics Conference brought to you by The Saturday Economist, in association with pro-manchester and Greater Manchester Chamber of Commerce. It's a great line up of speakers with more BIG names due. Sign up to The Saturday Economist for news and updates of this great event. Want to join the line up or want to sponsor? Drop me an email ... the prof is really excited ...

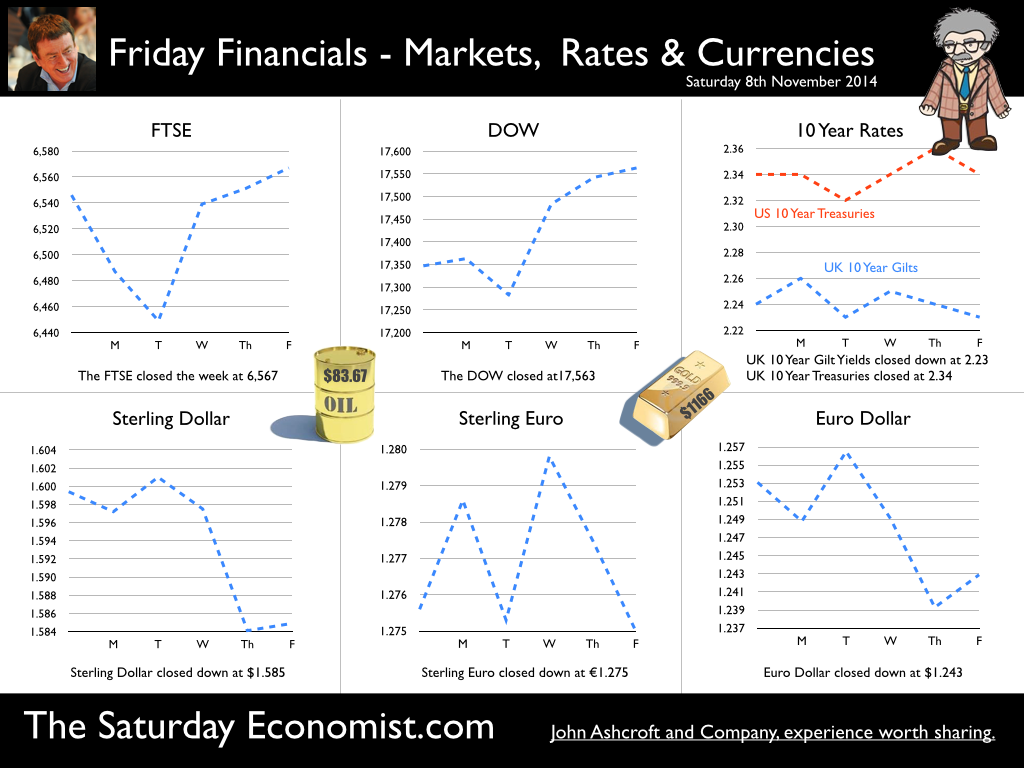

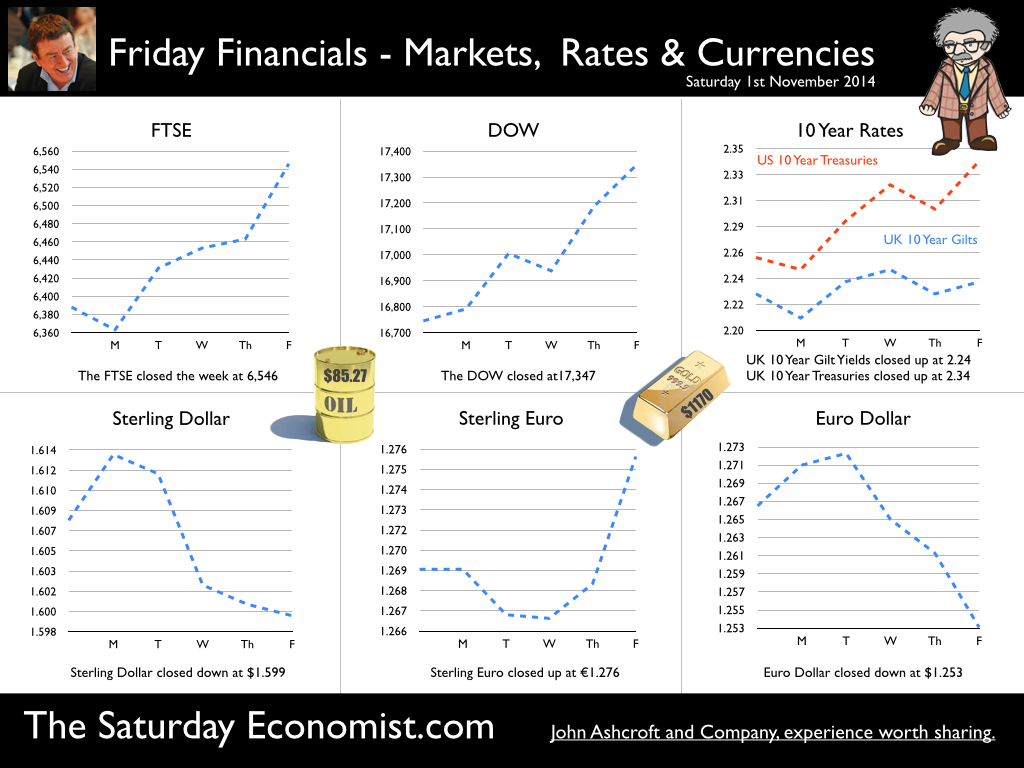

A spectre is haunting Europe …” It is the spectre of economic stagnation” … the opening words of Mark Carney, Governor of the Bank of England at the press conference for the November Inflation Report this week. Official figures from Eurostat … Official Q3 figures from Eurostat, on Friday, suggest the spectre could yet be something of a phantom. Greece breaks out of recession after six years! the headline in The Times, as the Greek economy grew by 1.4%. In the Euro area as a whole, growth increased by 0.8%. Latvia, Lithuania and Luxembourg lead the growth charts (up by over 2%). The German economy grew by 1.2%. France, up by 0.4%, avoided a set back. The Italians not quite so fortunate, the economy experienced a further quarter of negative growth (-0.4%). Forecasts for the year remain subdued. Lessons from history … Trade wars damage export growth! Is QE the solution … “Never confuse movement with action” the best advice. Back to the Inflation Report … Back to the Inflation Report … any prospect of a rate rise in the UK, is off the agenda until the second quarter or even Autumn of next year according to the latest comments from the Bank of England. Don’t mention forward guidance! Well the Governor didn’t as Ed Conway of Sky News pointed out in a testy question and answer exchange. Alas poor Yorick we knew him well … a man of infinite jest. QE was something of a joke said Ed! Ouch! The Governor, having previously been asked if he was a Loon (the Canadian bird) in the MPC aviary, wasn’t laughing. The Prospects for Oil Prices … Oil prices closed below $80 Brent Crude basis this week. The EIA, (US Energy Information Administration) revised their forecasts for oil prices into 2015 as a result. Despite any significant change in the fundamentals, oil prices (according to the EIA) are now expected to average $83 dollars per barrel in 2015 compared to the forecast of $103 dollars per barrel just a few weeks ago. Can we really expect oil prices to remain subdued, if the recovery in world growth continues? Oil is subject to short term trader action. Let's not forget, the strong price move to $150 per barrel in 2008 reflected the “Speculative Bubble Map” rather than a fundamental supply and demand push. The price reaction towards $40 in 2009 was a reflection of position clearance rather than real market value movements. It is too early to make the call for $80 dollar oil into 2015, though prices may yet be tested if the bears continue to squeeze. Oil and the impact on world growth … According to research released by Credit Suisse, the price drop will increase GDP, across the world, by an average 1% over the next three years with a particularly significant impact on growth in the US and Canada of almost 2%. Russia will be most disadvantaged by the price move, with a drop in growth in the first year of over 2%. OPEC Middle East economies will suffer but with a much smaller shock over the first four quarters. The impact on the UK … According to the NIESR model, the impact of the price drop on UK growth will be less than 1% over a period of three years. [Earnings from North Sea Oil will take a hit]. The impact on UK price levels may be more significant. Inflation CPI basis is expected to fall below the 1% level over the next few months. The Governor may have to write a letter to the Chancellor of the Exchequer, explaining why the MPC has failed in a remit to maintain prices at or around the 2% CPI level. $80 oil and the Governor will have to write faster! So what of UK unemployment …? ONS data this week confirmed, Unemployment (claimant count basis) fell by a further 20,000 in October to 931 thousand and a rate of 2.7%. This is the lowest level since August 2008 and lower than the average level achieved in the whole of 2006. Is this significant? Of course. Spare capacity in the labour market is evaporating. Recruitment pressures are increasing. Earnings increased by 1.4% in September, compared to the single figure growth in the prior month. Private sector pay is increasing at a faster rate (2.3%) boosted by growth in manufacturing and construction. 400,000 have left the jobs register over the past year. On current trends, Job centres will be closing in the Summer of 2017, there will be no one looking for work! Despite the strong trends in the labour market, the headline CPI inflation outlook remains subdued, flattered by slow world trade growth, weak world trade prices, low commodity costs and a short term collapse in the oil price. A spectre is now haunting the MPC. It is the spectre of high economic growth and low inflation. Not so bad really! The Governor may have to write a letter to the Chancellor of the Exchequer as inflation slips below 1% in a pre Christmas lull! So what happened to sterling this week? Sterling moved down against the Dollar to $1.567 from $1.585 and also moved down against the Euro at 1.251 from 1.275. The Euro closed up against the dollar at 1.252 (1.243). Oil Price Brent Crude closed down at $79.41 from $83.67. The average price in November last year was $107.79. Markets, moved up. The Dow closed at 17,635 from 17,563 and the FTSE closed up at 6,654 from 6,567. UK Ten year gilt yields moved down to 2.11 on updates from the Inflation Report and US Treasury yields were largely unchanged at 2.32. (2.34) Gold moved to $1,187 from $1,166. That’s all for this week. We are in London for the weekend. Mary and I went with the prof to the Opera last night and we are off to the ATP semis later today. In the meantime, join the mailing list for The Saturday Economist or why not forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  Forward Guidance … après ZIRP le déluge … Speaking in Paris this week at a symposium organised by the Banque de France, Mark Carney, Governor of the Bank of England warned markets to expect a bumpy ride when central banks begin to raise rates. Jumpy markets will not prevent central bankers from undertaking the important task of rate stabilization. Low levels of volatility are not here to stay. Fed Chairman Janet Yellen, also in Paris, echoed the message, saying "rate rises, when they materialize, could lead to heightened financial volatility”. New York Fed President William Dudley went further to say, “the resultant market turbulence could create significant challenges for those emerging market economies that have been the beneficiaries of large capital inflows in recent years”. Yes it’s “Après ZIRP le déluge” the message to markets, with Mark Carney cast in the role of Louis XV and Janet Yellen as Madame Pompadour. The message on low volatility will come as some surprise to oil slicks. Market traders love volatility, investors less so. The tumbrels are oiled and the edges sharpened, rates are set to rise in 2015. US Labour Markets … In the US strength in the labour market continued with 214,000 added to the payroll in October. The unemployment rate fell to 5.8%, closing the “spare capacity" gap still further. Job growth has now been underway since October 2010 as the US expansion continues. The recovery too late to save the Democrat hold on Congress, the Obama lament. UK Manufacturing … In the UK manufacturing output increased by 2.9% in September according to the latest data from the Office for National Statistics. Growth for the quarter was just over 3%, slightly below the first estimate suggest in the preliminary GDP release. Capital goods output increased by 3.7% in the month, and a remarkable 11% growth was recorded in consumer durables output. It is possible the strength of the housing market is boosting output in the household durables sector. Energy and utilities continue to be drag on growth and overall manufacturing output remains some 4.5% below the peak recorded in January 2008. Nevertheless, manufacturing is demonstrating a significant recovery this year, supported by strong growth in motor, marine and aerospace output. Despite fears of a slowing economy, the latest data confirms the recovery is on track as suggested in the Manchester Index™ derived from the influential Greater Manchester Chamber of Commerce QES survey. UK Car Market … New car registrations jumped 14.2% in October to 179,714 units. 2,137,910 cars have been registered in the year-to-date. The October performance exceeded expectations. We expect total sales to be just under 2.5 million in 2014, up by 8% on prior year. Mike Hawes, SMMT Chief Executive, said, “With economic confidence still rising, customers continue to benefit from attractive financial packages on exciting new models”. UK Trade … The strength of the car market is just one reason the trade deficit continues to deteriorate as we have long explained. According to first estimates from the ONS released this week, the UK’s deficit on trade in goods and services was £2.8 billion in September 2014, compared with £1.8 billion prior month. This reflects a deficit of £9.8 billion on goods, partly offset by an estimated surplus of £7.0 billion on services. In the third quarter of the year, the deficit (trade in goods) increased to £29 billion compared to £28 billion in the prior quarter. Germany remains the the UK's largest trading partner but in Q3 the UK recorded its largest ever deficit as exports fell and imports increased. Although we may worry about growth in Europe, the UK surplus with the USA reached the lowest level in almost eight years but there notable improvements to the deficits with China and Hong Kong. Do the latest figures change our outlook? Not really. For the year as a whole we expect the deficit (trade in goods) to increase to around £113 billion compared to £110 billion last year offset by an £82 billion (trade in services) surplus. The residual deficit (goods and services) will be around £31 billion, slightly down on prior year and at less than 2% of GDP, no threat to growth. So what happened to sterling this week? Sterling moved down against the dollar to $1.585 from $1.599 and also moved down slightly against the Euro at 1.275 from 1.276. The Euro closed down against the dollar at 1.243 (1.276). Oil Price Brent Crude closed down at $83.67 from $85.27. The average price in November last year was $107.79. Markets, moved up. The Dow closed at 17,563 from 17,347 and the FTSE closed up (just) at 6,567 from 6,546. UK Ten year gilt yields steadied at 2.23 and US Treasury yields were unchanged at 2.34. Gold moved to $1,166 from $1,170. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Forward Guidance … Remember forward guidance? With forward guidance, The Bank of England would try to guide expectations of the future path of monetary policy. Interest rates would be linked to certain economic indicators including employment, spare capacity or a broader spectrum of “Eighteen Indicators” as in Forward Guidance Mark II. Across the water, in the USA, forward guidance persists but is less “specific”. In the FOMC statement this week, Janet Yellen, declared “The Committee anticipates, based on its current assessment, that it will be appropriate to maintain the 0 to 1/4 percent target range (for the federal funds rate) for a considerable time following the end of its asset purchase program this month.” Yes, tapering is completed, QE is terminated but forward guidance, vague though it may be, continues. North of the Border, Mark Carney’s successor as the Governor of the Bank of Canada, Stephen Poloz, has made no secret that he’s done with providing “forward guidance”. “We’ll let markets do their job, which is to deal with the daily flow of new information and grind out new pricing, without specific interest rate guidance from the bank”. Ian McCafferty - is a Hawk ... In the UK, Forward Guidance seems to have given way to a sort of “Open Market Outcry”. In an article in The Sunday Times last week, McCafferty explained why “I am voting for higher rate rises now”. Essentially, although domestic price inflation and earnings data are subdued, the role of international prices is significant in setting domestic price levels. There is a risk domestic inflationary pressure is masked by international price trends. Slow world growth and low levels of world trade mean that commodity and world trade prices are low. This together with the relative strength of sterling is assisting in maintaining a low inflation outlook in the short term in the domestic economy. In the UK, earnings are also low, but the rapid growth in employment over the last twelve months and the dramatic fall in the claimant count, suggests the labour market may be tightening. There is evidence of skills shortages in the survey data and most economists believe that earnings are set to rise in the near term. Spare capacity is shrinking and the output gap is beginning to close. Above all Ian McCafferty believes, the short term outlook for inflation may remain benign but the full pass through effect of a rise in rates may take between eighteen months to two years to develop. The MPC must be forward looking. A slow rate rise now will avoid a more rapid rise later on. It is time to raise rates now. Minouche Shafik is a Dove … Minouche Shafik one of the newest members of the MPC, is a dove! believing there is “no significant evidence” of inflationary pressure in the economy. “If you look at what we would expect to see at this point in the recovery, the increases in wages that we have seen have not been significant,” Ms Shafik said in an interview with the Financial Times this week. Dismissing surveys pointing to future wage pressures for the moment, these are indicators that “haven’t manifested themselves” in real data. Wages and unit labour costs are important but “there is as yet no significant evidence of upward pressure on those prices” as yet. Ms Shafik believes the labour market could withstand significant further falls in unemployment before the pressure on earnings and wages begins to rise. “I think unemployment has not reached the place where we can say all the slack has gone in the labour market,” she said. So much for forward guidance. The messages are confused … The official guidelines from the Bank of England have turned into a bit of a free for all. The statement from Minouche is linked with formal “Dovish” speeches from other MPC members including Andy Haldane, Sir John Cunliffe and Ben Broadbent. The Medium Term Outlook - so what of rates? For the moment, the doves rule the Threadneedse Street coop. Concerns rates would rise before the end of the year are now completely abated. For most of this year, economists and markets believed rates would rise in February next year, before the UK election. Now, given developments in the UK, USA and particularly Europe, a rate rise pre election seems unlikely. In the USA, the Fed is unlikely to raise rates before June next year. US growth in Q3 was disappointing and some believe that increase may even be postponed until the Autumn of 2015. In Europe, an increase in rates appears to be off the agenda for two years at least. So what will happen to interest rates in the UK? We have always said the Bank of England will be reluctant to move ahead of the Fed and move base rates before an increase in the Fed Funds Rate. This would argue against any pre-election rate rise in February. Some analysts are beginning to think rates may not rise in the UK until the Autumn. For most June 2015 is becoming the month of choice. Don't rule out a pre election rise just yet ... What we do know, is that domestic demand remains strong, the job market is tightening rapidly. Earnings are set to rise as skill shortages are exacerbated. Service sector inflation remains above target despite the low levels of goods inflation and manufacturing prices. The balance of payments is deteriorating and the current account deficit could develop into a real problem for policy makers any time soon. The twin deficit dilemma, government borrowing and current account at 5% of GDP, will not be resolved by base rates at 0.5%. The Doves have control for the moment but the hawks are ready to pounce. For the moment we would sit with the doves. David Cameron may think it would be "lovely" for interest rates to remain at historic lows “forever” - but don't rule out a pre election rise just yet. So what happened to sterling this week? Sterling moved down against the dollar to $1.599 from $1.630 and also moved up against the Euro at 1.276 from 1.270. The Euro closed down against the dollar at 1.276 (1.283). Oil Price Brent Crude closed up at $85.27 from $86.26. The average price in November last year was $107.79. Markets, moved up. The Dow closed at 17,347 from 17,291 and the FTSE closed up at 6,546 from 6,387. What a difference a week makes! 7,000 FTSE for Christmas - back on! UK Ten year gilt yields move down to 2.24 and US Treasury yields closed at 2.34. Gold moved to $1,170 from $1,218. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed