Economics news – "The recovery is not yet secure" says the Chancellor ... The recovery is not yet secure and our economy is still too unbalanced. The Chancellor made use of a visit to Hong Kong this week to warn on the perils of the recovery. Just as well the Governor Mark Carney has stated the MPC will not take any risks with the rally. The Chancellor is concerned about the strength of the recovery. It is not yet secure, we are not making enough and we are not exporting enough, the continued claim. Hence in four weeks time George Osborne will deliver a budget that supports investment, manufacturing and exports. “A budget that ensures around the world, you can't help but see “Made in Britain”. A budget that lays the foundations for long term economic security". Excellent. Investment incentives and export support are both welcome. But we must ensure policy is founded on economic reality. We don’t need subsidies for the Spinning Jenny and a ban on homespun cotton from ancient empire. A strategy for investment and manufacturing, has to be grounded on firm foundations, fit for the 21st century. Christine Lagarde - the age of multilateralism As Christine Lagarde, pointed out in the Dimbleby lecture earlier this month, we live in the age of multilateralism. A world of integrated supply chains, where more than half of total manufactured imports and more than 70 percent of total service imports, are intermediate goods or services. “A typical manufacturing company today uses inputs from more than 35 different contractors across the world” according to the leader of the IMF. It is not so much as “Made in Britain” as assembled in Britain. It is not so much a question of exporting but “re-exporting”. Manufacturing exports are dependent on imports for raw materials, energy, processed goods, semi manufactures and finished components. The good news a strong currency will improve cost inputs, mitigating any re sale price effect. The bad news, any improvement in net trade in goods will be elusive. The Chancellor claimed “We cannot rely on consumers alone for our economic growth and we cannot put all our chips on the success of the City of London.” The fact is the recovery is driven by growth in the service sector, accounting for 80% of total output. Leisure, retail and financial services are leading the recovery, meeting the needs of an ambitious household sector accounting for two thirds of demand in the economy. We need a successful city of London, to generate the service sector surplus to offset the trade in goods deficit. As the Chancellor announced in Hong Kong, the UK is the first country in the G7 to agree an Renminbi swap line with the People’s Bank of China. London investors will have the confidence to expand their RMB activities. We may have in due course a RMB clearing bank in London. Chinese banks will be able to set up wholesale branches in the UK. This is all good news for the Banking, Financial and Professional services sector - essential for growth in the age of multilateralism. A policy dependent on the “March of the Makers” rebuilding the workshop of the world is neither balanced nor sustainable in the 21st Century. We shall see, just what the budget delivers next month. So what happened in the economy this week … A raft of economic data, confirming the recovery is on track for growth this year. Inflation, CPI basis, fell to 1.9% in January, pushed lower by a fall in goods inflation (1.4%) as service sector inflation remained steady at 2.4%. Unemployment fell, with a strong fall in the claimant count to 1.2 million, a rate of 3.6%. The wider LFS unemployment count, also fell in the month, albeit with a rate slightly up in the month to 7.2%. Earnings increased towards the end of the year. Retail sales were up in January by 4.3% in volume terms and 4.5% in value. The government borrowing figures for January at first sight, were a little disappointing with repayment in the month at £4.7 billion down from £6.3 billion last year. Tax receipts were significantly lower in the month, which is surprising given another 400,000 are in work with earnings are increasing. The figures will look better by the end of the financial year. We still think borrowing will be around £105 billion for the year as a whole. Heading in the right direction to eliminate the deficit in due course. So what does this all mean? The recovery may be unbalanced but probably is secure. Growth up, inflation down, employment up, borrowing down, just the trade figures will continue to disappoint, as we have long pointed out. So what happened to sterling? The pound closed down at $1.6640 from $1.6730 and at 1.210 from 1.222 against the Euro. The dollar closed at 1.3740 against the euro and 102.499 against the Yen. Oil Price Brent Crude closed at $109.67 from $108.56. The average price in February last year was almost $116. Markets, moved up - The Dow closed at 16,143 from 16,105 and the FTSE closed at 6,838 from 6,663. UK Ten year gilt yields closed at 2.79 from 2.80 and US Treasury yields closed at 2.75 from 2.74. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? The list is growing as is our research and research team. Over ten thousand receive The Saturday Economist each and every week! © 2014 The Saturday Economist. John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

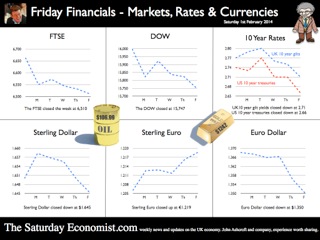

We will not take risks with this recovery … The Bank of England will not take risks with this recovery, according to the latest statements from Mark Carney, Governor of the Bank of England. Base rates will remain on hold for some time yet. When they begin to rise, the increase will be slow and gradual. It will be many years before fair value base rates of 4.5% will be on the agenda, according to the guidelines issued this week. Markets anticipate the first rate rise may appear in the second quarter of 2015. Thereafter a rise to 2% may be possible but not until the end of 2016 or the beginning of the following year 2017. “The level of interest rates necessary to sustain low unemployment and price stability will be materially lower than before the crisis,” the more cryptic quote. The recovery has gained momentum. Output is growing at the fastest rate since 2007, jobs are being created at the quickest pace since records began and the inflation rate is back at 2%. “The recovery has been underpinned by a revival in confidence, a reduction in uncertainty, and an easing in credit conditions”. Yes, Forward Guidance has been a success! The Bank of England expect the economy to grow by 3.8% this year and 3.3% next year assuming interest rates are held at 0.5% through 2014 and into 2015. Assuming rates follow the path outlined in current market profiles, growth will be a more modest 3.4% this year falling to 2.7% next. A recovery neither balanced or sustainable … No wonder the Bank consider the recovery is neither balanced nor sustainable. The recovery is dependent upon household spending, with a sluggish investment performance to date and a structural trade deficit, exacerbated by weak growth in Europe. Growth of 3.4% is significantly above trend rate and above most forecasts for the year. Consensus forecasts predict growth of just 2.7% in 2014 falling to around 2.5% next. The bank is very bullish on a recovery in earnings, consumer spending and investment. We shall see who is right in due course. For the moment, the Bank looks hot! So what of Forward Guidance … Forward guidance may have been a success but the single point reference to the unemployment rate has been beset with problems. The 7% guideline for unemployment will be breached in the first quarter this year. Hence the single point guideline is on the way out. It was too easy to understand. The Governor will not be allowed to make the same mistake again. The Bank collective has had its way. “To allow others to monitor how the economy is evolving relative to our projections, today we are publishing forecasts of 18 more economic indicators.” Excellent. Yes, now we will have eighteen guidelines to better understand policy. The output gap is back, as is the meandering NAIRU. Eighteen reasons why it will prove more difficult to pin the Governor in difficult interviews on Newsnight in the future. It was never clear why 7% was the correct number to choose anyway. The Americans bagged the 6.5% level first but the Governor admitted the long term NAIRU was more like 5% anyway. It was just a number but at least we could “see it” so to speak. Not so the “Output Gap”. What is the size of the output gap? What colour are the eyes of a Yeti? an equally productive debate. In a service sector economy with limited supply constraints, does it really matter anyway? Forward Guidance is a great step forward. Simplicity, part of the success, made the process just too transparent for some. Forward Guidance USA … Over in the USA, Janet Yellen, as the new Chair of the Fed provided assurances there would be policy continuance following the Bernanke regime. Accommodative monetary policy, with progressive tapering remains on the agenda. The US is expected to grow by almost 3% this year with inflation below 2%. Unemployment will fall below 6.5% through the year. So what of forward guidance, - markets believe a rise in base rates may be possible towards the end of this year or early next. So what happened to sterling? The pound closed up at $1.6730 from $1.6407 and 1.2220 from 1.2030 against the Euro. The dollar closed at 1.3690 from 1.3635 against the euro and 101.82 from 102.31 against the Yen. Oil Price Brent Crude closed at $108.56 from $109.57 The average price in February last year was almost $116. Markets, moved up - The Dow closed at 16,105 from 15,794 and the FTSE closed at 6,663 from 6,571. UK Ten year gilt yields closed at 2.80 from 2.71 and US Treasury yields closed at 2.74 from 2.69. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – UK recovery continues at pace in January ... According to survey data this week, [Markit/CIPS UK PMI® January], the recovery in the UK economy continues at pace into the New Year. Manufacturing, construction and services all continued to demonstrate strong levels of activity. In the manufacturing sector, the strong rebound continued with improved domestic demand and rising export orders suggesting robust growth in the month. Construction survey data suggests the sector is experiencing the sharpest rise in construction output since August 2007. Housing activity is increasing at the sharpest rate for over ten years. Service activity remains elevated with a headline index rate at 58.3 during January, down slightly from 58.8 in December. Service sector output is still at a very high level, anything above 50 suggests growth. The latest monthly NIESR GDP tracker suggests the economy grew by over 3% in January. This week, NIESR also upgraded UK forecasts for growth this year to 2.5% with projections of unemployment falling, inflation tracking the 2% target level and government borrowing continuing to reduce. In fact on current plans, according to the leading think tank, the public sector finances will be in surplus in 2018-19. So much for fears of prolonged austerity to come. So growth up, inflation down, employment up and borrowing down. Just the trade performance is expected to deteriorate with the external current balance increasing from a deficit of £54 billion in 2013 to £78 billion by 2015. ONS Data on Trade ... ONS data this week for trade was a little surprising. The trade deficit in December improved significantly compared to our forecasts. Seasonally adjusted, the UK's deficit on trade in goods and services was estimated to have been £1.0 billion in December 2013, compared with a deficit of £3.6 billion in November 2013. There was a deficit of £7.7 billion on goods, partly offset by an estimated surplus of £6.7 billion on services. Some £2 billion of imports appear to have been lost in the analysis. If domestic demand was as strong as the data suggests, the fall in imports for the month is illogical. In any case, don’t get to excited about the rebalancing agenda - for the year as a whole, the deficit trade in goods was £108 billion. US Payroll data ... Over in the US, payroll data upset the markets as jobs growth proved disappointing for the second month running. US payrolls rose a seasonally adjusted 113,000 in January after gains of just 75,000 in December. The unemployment rate continued to move down, to 6.6% the lowest level since December 2008 and perilously close to the Fed forward guidance hurdle rate. It is thought the latest data is unlikely to change the Fed stance on progressive tapering through 2014. Janet Yellen, the new chair of the Federal Reserve Board, makes her first appearance before Congress next week. Emerging markets will shudder as the adjustment in the stance of QE and tapering continues. Rate rises could be on the US agenda by the end of the year. So what happened to sterling? Sterling closed at $1.6407 from $1.6433 and 1.2030 from 1.2184 against the euro. The dollar closing at 1.3635 from 1.3487 against the euro and 102.31 against the Yen. Oil Price Brent Crude closed at $109.57 from $106.40 The average price in February last year was almost $116. Markets, steadied - The Dow closed at 15,794 from 15,698 and the FTSE closed at 6,571 from 6,5210. UK Ten year gilt yields closed at 2.71 from 2.72 and US Treasury yields closed at 2.69 from 2.65. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? The list is growing as is our research and research team. Over ten thousand receive The Saturday Economist each and every week! © 2014 The Saturday Economist. John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  GDP growth up in the UK .. The ONS delivered the preliminary estimate of growth in the final quarter of the year this week. The UK economy grew by 2.8% year on year and 1.9% for the year as a whole. Who would believe this time last year markets were still fretting about a triple dip recession. The service sector, accounting for almost 80% of activity increased by 2.6%, construction increased by 4.5% and even the beleaguered manufacturing sector managed to push output up by 2.6%. Within the service sector, the leisure pound was once again to the fore, with strong growth in distribution, hotels and restaurants up by 4.5%. Business services increased by over 3%. We expect growth to be revised up to 2% for 2013 at some stage. For the moment we stick with our forecast of growth in 2014 and 2015 of 2.5% and 2.7% respectively. Our GDP(O) model is still performing well. The dataset has been updated and is available on the Publications page, along with our latest review of world trade. For economists, it doesn’t get more exciting. The release of the preliminary estimate is comparable to the release of a first draft of a Harry Potter chapter. What happened to the Weasleys, Gilderoy and Malfoy? Has Hagrid shaved off his beard as an end of year bet? Has Dumbledore lost weight. Has Voldemort renounced the devil and all his works? So what happened to Hermione and Harry? Can water supply and sewage really have grown by 8% in the final three months of the year? All is revealed to muggles and analysts alike by Joe Grice Chief Economist of the Office for National Statistics. In a high profile press conference, analagous to the lottery or some talent show, Joe reveals all... and the number is 1.9%. Excellent, thanks Joe. Data revisions are always interesting. But imagine if the next chapter of Rowling release revealed, the philosopher’s stone has been lost, the Chamber of Secrets has been opened to the public, the prisoner of Azkaban has been recaptured and the goblet of fire turns out to be a flaming glass of sambuca. It really can be so dramatic. After all the double dip disappeared. One day we may discover there was no recession in 2008 after all. Can’t wait for the next chapter in the GDP chronicles on the 26th February. So what happened to consumer spending and what of investment? Still stuck in the deathly hallows no doubt. US GDP also increased by 2.7% in the final quarter ... Over in the US, the Bureau of Economic Analysis announced growth of 2.7% in the final quarter and 1.9% for the year as a whole. The UK and the USA are neck an neck in the race to be the fastest growing economies in the Western World. Makes you wonder why the Fed were spending $85 million each month on treasuries and mortgage debt. No wonder the decision was made to taper further and reduce the spend to $65 billion with immediate effect. It is said that if a butterfly flaps its wings in Nicaragua, it can cause a hurricane in New York. I always found that difficult to be believe. But then who would have thought gay marriage could cause such flooding in Somerset according to UKIP. Even so, Bernanke flapping his tapering wings in Washington caused chaos in capital markets across the world. The tapering announcement led to falls in international stock markets, capital flight from developing economies and exchange rates rattling in India, Turkey and Argentina. Turkey hiked rates to over 10% to persuade the dollars to stick around. In Buenos Aires, they have long since departed. So what happened to sterling? Markets were disturbed by the decision on tapering, once again undermining stock market strength in the USA and destabilizing international capital flows across developing economies. Nevertheless, the CBOE Vix volatility index closed relatively unchanged over the week at 18.4. The pound closed at $1.6433 from $1.6481 against the dollar and 1.2184 from 1.2041 against the Euro. The dollar closing at 1.3487 from 1.3681 against the euro and 101.96 from 102.34 against the Yen. Oil Price Brent Crude closed at $106.40 from $107.88. The average price in January last year was almost $113, no real threat to inflation from crude oil prices Markets, moved down - The Dow closed at 15,698 from 15,879 and the FTSE closed at 6,5210 from 6,663. 7,000 on the FTSE no longer such a soft call for the near term. UK Ten year gilt yields closed at 2.72 from 2.78 and US Treasury yields closed at 2.65 from 2.72. Yields will test the 3% level as tapering accelerates into 2014 but for this week, once again, the flight to quality led the market. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed