|

The Prime Minister was in Davos this week. A keynote speech, "So what can I say" or "what did she say", more to the point?

Not much, according to Janet Daley in the Telegraph. "It was a classic speech of the May genre, it said nothing. Her peroration was so platitudinous as to be utterly meaningless". Ouch. "If you look at the newswires from other countries around the world, they’re all talking about Macron, Modi and Merkel not May". [Trump, still to come, was to be the closing act on Friday] Ah yes, platitudinous peroration, perfectly positioned to avoid the delicate issue of Brexit. Brexit is rapidly becoming "Brexit, the policy that dare not speak its name". Lord Alfred Douglas and Oscar Wilde would be proud. Theresa May has abandoned preparations for a third high profile speech on Brexit next month. Why? For fear of widening cabinet and back bench splits on Britain's future relationship with the EU. No thought to businesses up and down the country, desperately looking for clarity on what we are hoping to achieve. Philip Hammond suggested changes to the UK-EU relations could be very modest post Brexit. The Chancellor received a rap on the wrist from Downing Street for his modesty. David Davis claimed there was no difference between him and the Hammond. Hammond's comments provoked "fury" on the back benches. Jacob Rees-Mogg accused the government of adopting "a timid and cowering" approach to the talks. Rees-Mogg an iconic item of Victorian memorabilia, plays the rôle of Palmerston. "Implementation not transition" the mantra for the post Brexit period. No new regulations or new laws from the ECJ or we "send the gunboats". Ah yes, a big old stick waving an old big stick. Someone should point out we have no landing craft to get the marines on the beach and we will have to wait some time for Boris's Bridge across the channel, if we are going to make the trip. Matthew Parris in The Times today, suggests one well aimed speech could topple the Prime Minister. Nick Boles had a go this week. A speech in which he called the Prime Minister "timid". According to reports, about forty Tory MPs have now written to Graham Brady, Chair of the 1922 committee, to express their lack of confidence in Theresa May. Just eight more and he will be forced to launch a vote of no confidence in the Prime Minister. Brady himself is getting nervous. He is advising MPs to "think carefully" before putting pen to paper. "Just do it" the Nike mantra and probably the best way forward. Anything is better than this condition of "anarchic anomie" ... A conscious recoupling ... The UK can “consciously recouple” with an accelerating global economy this year, according to Bank of England governor Mark Carney. "The UK economy could start to grow in line with the global economy if more clarity about the UK’s relationship with the European Union emerges from Brexit negotiations." he said. It was a (not so) subtle hint to government. Gwyneth Paltrow had coined the phrase. The Governor gave due credit. Paltrow had been talking about her divorce ... her conscious uncoupling. “I wanted to turn my divorce into a positive,” “What if I didn’t blame the other person for anything and held myself 100% accountable? What if reminded myself about the things about my ex-husband that I love. What if I fostered the friendship?” A form of conscious re coupling. "Not Implementation, Not Transition, but "Fostering the Friendship" a "Conscious Re Coupling" under the broad church of the European Court of Justice." Moog Music to business ears! Mogg cacophany on the back benches. So what was the Governor talking about ... World trade grew by an over 5% in the third quarter of 2017. World growth will be almost 4% this year. The EU and the US grew by 2.3% last year. The UK grew by 1.8%. According to the latest data from the ONS. Growth slowed to 1.5% in the final quarter, despite a strong performance from manufacturing and business services. The figures could well be revised up. We expect a similar performance in the overall economy in 2018 despite the continuance of platitudinous perorations about our future with the EU. Did the economy really slow in the final quarter? The jobs market and the borrowing figures suggest not. In the latest data for the quarter, employment and vacancies increased, unemployment fell. Earnings increased by 2.5%. Vacancies increased to 810,000. Unemployment fell to 1.439 million a rate of 4.3%. With recruitment difficulties becoming more acute and the UV ratio at an all time low, something has to give on wage rates. Either the ONS is already under recording the real level of earnings in the economy, or wage rates are set to rise this year as we have long expected. Government Borrowing would put a smile on the Chancellor's face, despite the rap on the knuckles from the Prime Minister over Brexit. Public sector borrowing fell by £6.6 billion to £50.0 billion in the current financial year-to-date compared with the same period in 2016.; this is the lowest year-to-date net borrowing since 2007. In December, borrowing fell by £2.5 billion to £2.6 billion helped in part by a £1.2 billion credit from the European Union. Oh the delicious irony! The Office for Budget Responsibility (OBR) forecasts that public sector net borrowing (excluding public sector banks) will be £49.9 billion during the financial year ending March 2018, an increase of £3.9 billion on the out turn net borrowing in the financial year ending March 2017. The projection appears to be pessimistic. £42 billion seems a reasonable extrapolation, down from £46 billion last year ... More next week ...

0 Comments

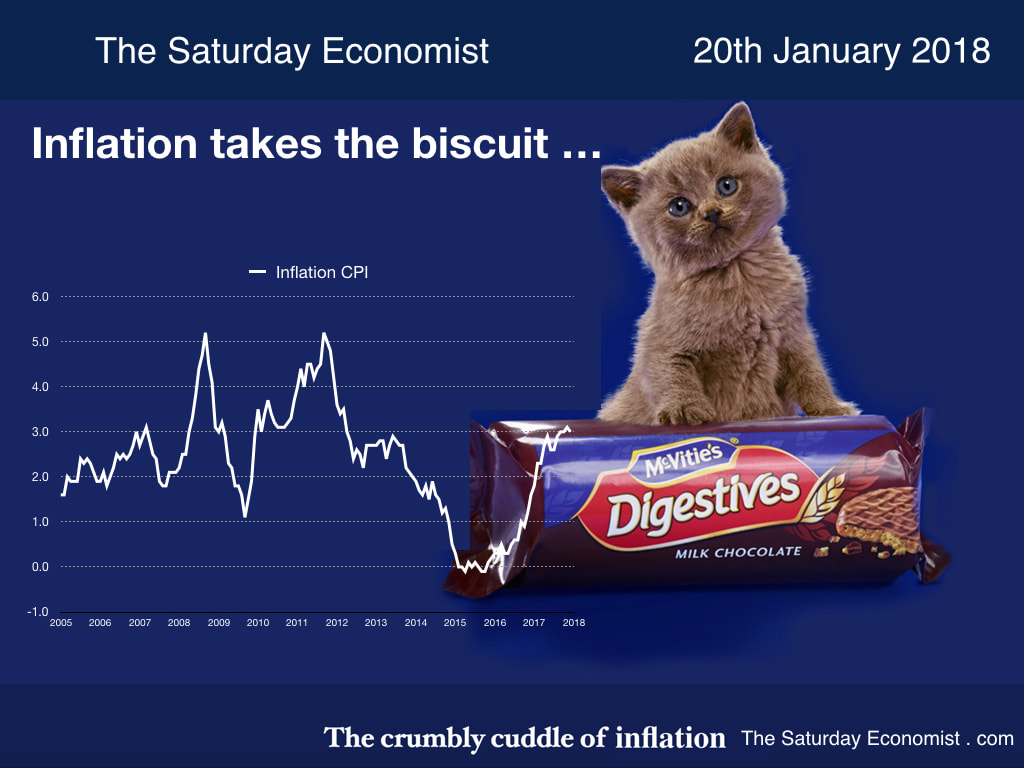

Inflation CPI eased back to 3.0% in December. The worst appears to be over. Or is it? Most analysts expect inflation to ease back to 2.4% by the end of 2018. It's a fair bet, though it may be slightly ambitious.

Goods inflation increased to 3.5% in December. Food inflation hit 4.1% but fish lovers were paying 9% more for the catch. Coffee addicts were shelling out nearly 10% more than the same fix, same time last year. Still smoking... that'll be nine per cent plus. Want to heat the house, you will be paying 6% extra. Using electricity, why that's up by 11% year on year. Planning to leave the house, transport costs are up by over 4%. Stay at home, read a book there's a 5% tariff this year. Time to renew the insurance policies, then allow 6% extra for that. So what does this really mean? It means inflation is endemic in the system. Don't be mislead by the headline number. The apparent fall in CPI inflation was achieved by a perceived fall in service sector inflation to 2.5%. Can that really be right? Producer prices in the UK increased to 3.3% in December from 3.1% prior month. Food prices increased by over 5%. Yes inflation does take the biscuit. McVities cut the pack size of digestives from 500g to just 400g. All to preserve a precious price point for household incomes under pressure. Manufacturing input prices increased by just 4.9% from over 7% prior month. The fall had been expected. Sterling has rallied from the post referendum lows, oil prices have rallied but further gains are unlikely given the advances in US shale output. There is some suggestion the fall may allow the MPC to pass on further rate hikes this year. Do not plan for that. The Fed is expected to hike rates at least three times this year. The US tax bill will flatter growth but increase the fiscal and trade deficits. The dollar is weakening. US ten year bonds are trading at 2.6% plus. The US bond market is well along the path to normalization as UK gilts languish at just 1.3%. Trump may talk tough on trade with China but hints of a Sino inspired bond strike could put further pressure on bond yields and on short rates. The MPC will probably follow with at least two rate increases this year despite the concerns about Brexit. Ironic this week Boris Johnson announced ambitions for a bridge with Europe across the Channel. Oh the irony. Jacob Rees-Mogg explained he is not in favour of a transition period to bridge the EU deal but would be in favour of an implementation period. In and out. Leaving Europe not leaving Europe. Building bridges not trenches. implementing not transitioning. Time to check the small print ... as always ... the riddle of Rashomon rules ... Schrödingers cat is not sitting on a packet of chocolate digestives this week-end ... So what of retail sales ... The riddle of retail appeared to bamboozle the ONS this week. Headlines tell the story retail sales fell by 1.4% in December compared to prior month. Don't get too alarmed. Compared to December 2017, sales volumes were actually up by 1.4%. In value terms retail sales increased by 4.4% prior year. A healthy increase sustained over the full final quarter of the year. The changing pattern of retail is changing the pattern of sales in the run up to Christmas a result. Long gone are the days when retail would hold off price cuts until the January sales. The January sale moved to Boxing Day. Blue Cross days pulled the cuts before Christmas. Then came the internet, Black Monday and Cyber Friday pulled the discounting and the volume into November. On line sale were up by 9% in December, accounting for 18% of retail activity. Clothing sales were up by 21% account accounting for almost one in five transactions. On line food sales were up by 12%, taking one in twenty transactions with a 5.5% share. It's a mixed bag on the high street. Waterstones and Halfords offered strong results. Carpetright announced a profit warning. Next and Kingfisher shares took a hit. Primark bucked the tends with good sales growth.Bonmarché share fell by 20 per cent as it warned of difficult market conditions. Overall sales in the final quarter fell by 6.9% in like for like sales despite a near 30% surge in on line sales. Lies, damn lies and seasonal adjustments are forcing radical readjustments to the ONS data. Don't be too alarmed by the headlines, like for like sales spending increased by 4.5% in the final quarter of the year. That's assuming we have captured all of the significant data ... and made the correct seasonal adjustments ... So what exactly does take place in cabinet? Do we have a policy towards the European Union? We are leaving the EU customs union but may join a customs union with the EU. We will pay for access to the single market but will not pay for access to the single market. This week Phillip Hammond affirmed we will pay for access to the single market to protect the banking sector. By the end of the week Number Ten explained there will be no payments made for access to the single market whatsoever.

In and out, paying not paying, the singularity of a simple solution is best explained by the Schrödinger's cat duality. But what of perception? Theresa May's administration is perhaps best understood by accepting the Riddle of Rashomon. Better known as the Rashomon Effect, the Rashomon effect occurs when the same event is given contradictory interpretations by different individuals involved. The effect is named after Akira Kurosawa's 1950 film Rashomon, in which a murder is described in four mutually contradictory ways by four witnesses. No one gets murdered in the May cabinet. [The Prime Minster struggles to kill someone off in a cabinet reshuffle.] It would appear decisions are made in Cabinet and then everyone walks away with a contradictory interpretation. Brexiteers v Remainers. Eurosceptics versus Europhiles. Hard right versus soft left. Resolutions are constructed to appease all parties. Cabinet members walk away happy in the knowledge their specific "App Group" members will have a great week end. Safe in the understanding no one has been offended. The Riddle of Rashomon Rules OK. Meanwhile in the real world, industry pleads for an explanation of policy and strategy towards the EU negotiations. Nowhere is this more true than in the Automotive sector. As Mike Hawes Chief Executive of the SMMT explained this week. "We face perhaps more challenges – simultaneously – than any other sector. We need the Industrial Strategy and our sector deal to be supported across government, with all departments recognising the importance of a healthy automotive industry to deliver technological, environmental and economic change." A not unreasonable request. At the Consumer Electronics Show in Las Vegas this week, Vauxhall motors revealed their future vehicles will be fitted with accelerated "Level 4" autonomy. Yes in the future, the Prime Minister's car will sit outside Number Ten without plastic, pedals and a driving wheel, talking to 30 million vehicles on the road mapping the way to move forward in the short term ... Is this a vision of the future? Or is it just an apt metaphor for the current state of government in the UK ... Economics prospects in 2018 ... This week NIESR upgraded their forecast for growth in 2017 to 1.8% from 1.6% in the November publication. A reasonable move given the release of the ONS data just before Christmas. It seems reasonable to expect growth just under 2% in 2017 and 2018 as we explained last week. This week, the ONS released the latest information for manufacturing. Growth in November was up by 3.5% year on year, following growth of just under 5% in October. For the year as whole we now expect manufacturing growth of 3.6% slowing to 2.5% in 2018. Is this a manufacturing miracle? Not really. By the end of 2017 growth will be back to the levels last seen in the first quarter of 2008. A ten year recovery following the big shock to output in the recession. The march of the makers appears to be rebuilding the workshops of the world with a six per cent surge in capital goods largely for the export market. Manufacturing export activity is stimulated in part because of sterling depreciation but is largely fueled by the growth rates in Europe, Asia, North America and the rest of the world. The impact is reflected in the latest balance of payments data for the month of November. For the year 2017, we now expect the deficit trade in goods to be £135.6 billion, pretty much unchanged from the same level last year. Exports will have increased by 14% in value terms, as imports increased by 10%. The export surge is partly a reflection of depreciation and translation effect. Values are up by 14%, volumes are up by 8%. Import volumes are up by 4% compared to a 10% increase in values. [A large proportion of exporters price to market in currency]. The overall current account deficit will fall to £28 billion in 2017 compared to £41 billion in 2016. Good news on output and good news on trade. Not quite so good for construction. Despite growth in housing and commercial real estate, the sluggish performance of industrial and central government infrastructure spending limited growth to less than 1% in November. So what of rates? Central bankers are in a slow sack race to hike rates and put an end to more QE. The quest to normalise rates within a three year period is underway. Strong growth in the world economy will provide the rationale despite the apparent subdued levels of inflation around the world ... For the moment we still expect at least three rate hikes in the USA this year with bond yields already at 2.6% set to move higher. In the UK, ten year gilts closed at 1.35% up eleven basis points on the week. At least two rate rises are expected in 2018, with a hike in gilt yields of 50 to 100 basis points in prospect. The implication for gilt prices is evident ... © 2018 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2018 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List or the Dimensions of Strategy List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom. Happy New Year! I hope you had a great break over Christmas and New Year. So what lies ahead in 2018? Conventional thinking is that uncertainty over Brexit will impact on business confidence and investment. Household incomes will be squeezed by high inflation and low pay growth. Government spending will be hampered by targets set for the public sector deficit. Low growth will persist into 2018 as inflation lingers above target through the year.

According to the Treasury summary of forecasts for the UK economy, growth estimates this year range from 0.3% to 2.6%. Forecasts for investment range from -1.0% to 3.1%. Household spending forecasts range from zero to almost 2%. Confused? Well that's hardly surprising. The Office for Budget Responsibility were hung up on UK productivity or lack of it. The Central forecasts from the OBR in November, suggest growth will be around 1.4%. Why so gloomy? Just before the Christmas break, the ONS released the latest update on growth in the economy for the first nine months of the year. The good news, growth was revised up to 1.9% in 2016. GDP(Output) averaged 1.9% over the first nine months of 2017. Manufacturing up 3.3% and construction up 4.8% featured well in the Q3 data. Investment was resilient over the first nine months of the year despite the "locker talk" about an investment strike. The bad news, service sector growth almost halved from the heady levels of 2016 to just 1.4% in the data from July to September. Consumer spending slumped to just 1% growth from over 3% last year. The SMMT are worried about the impact on car sales in 2017 and 2018, this plus the lack of an industrial strategy for the motor industry and support for diesel specifically. For those who worry about productivity (and I recommend you don't), the latest ONS data released this week suggests productivity grew by almost 1% in the third quarter of the year. Growth at last? Perhaps but comparable levels of performance have not been so low since the 1820s. Features were productivity growth in healthcare and the criminal justice system. Who would have thought ... . So why the rally? Steady growth with low job growth the explanation. Productivity is not a driver of growth but a simple fraction solution from and output nominator and labour denominator. Why do economists worry so much about productivity? Well, it stops them worrying about capacity and the output gap ... Bless ... Economics prospects in 2018 ... Overall we expect growth of around 1.8% in 2017 and 1.7% in 2018. Manufacturing output growth will halve from over 3% in 2017 to just 1.5% in the year ahead. Construction output growth will slow from over 5% in 2017 to 2.9%. Service sector output will rally in the year to around 2%. The full forecast set will be released next week. The quarterly economics presentation will take place in the second week in February. Inflation will end the year around 2.5%. Earnings will increase to between 2.5% and 3% by the final quarter of the year. Exports will benefit not so much for currency falls but relative rates of growth in Europe, North America and the rest of the world. With the exception of Venezuela, world growth is expected to be just over 3.5% this year. Growth in Eastern Europe was around 4% in 2017. No wonder the EU immigration stats are falling. World trade growth is expected to be almost 4% boosted by an upswing in defence spending. Will this benefit the balance of payments deficit? To some extent yes but exports have a high degree of import dependency. The latest data in the national accounts for Q3 flatter to deceive. Government borrowing is set to fall in the 2017/18 financial year to just over £40 billion around 2% of GDP. A further fall to around £35 billion is on the cards for 2018/19. In the US growth is expected to be over 2.5% this year boosted by the Trump tax cuts. The boost to consumer spending will be relatively muted. The impact on corporate earnings and dividends will be substantial. No wonder US markets are bouncing. As much as $400 billion could be repatriated into the homeland as a result of the change in tax regime. So what of rates. The Fed is expected to raise rates three or four times this year. The Bank of England is expected to follow at least twice in 2018 assisting the process of returning inflation to target. Base rates will rise to 1% by the end of the year. They should be higher but given doubts over Brexit and growth, the MPC may be reluctant to make the call. We remain relatively confident about the year ahead despite the confusion over Brexit. the Chancellor is suggesting the UK could leave the EU customs union but enter into a new customs union with the EU. Another Schrödinger's feline solution, in and out at the same time! Liam Fox is suggesting we join the TPP, the Trans Pacific Partnership. You don't have to have a shore line on the Pacific Ocean but it will almost certainly help. So much for defying the laws of a gravity trade model. No one in government appears to realise growth in foreign parts will lead to investment in local manufacturing facilities in North America, China and S E Asia. The Secretary of State for International Trade and President of the Board of Trade has traveled 200,000 miles over the past year at a cost of over £100,000. Doing what, we can't be sure. Perhaps he should play more golf, until we have the EU deal in the bag ... © 2018 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. _______________________________________________________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed