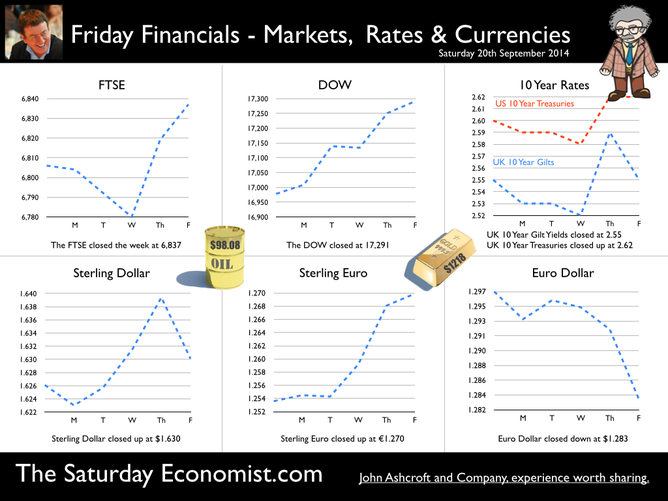

The prospect of a UK base rate rise before the end of the year receded this week with the release of latest data on inflation and earnings … Retail Prices … Retail price inflation CPI basis slowed to 1.5% in August from 1.6% prior month. Falls in the prices of motor fuels and food provided the largest downward contributions to the change in the rate. Markets expect CPI inflation to average 1.7% over the final quarter of the year, significantly below the MPC benchmark 2% target. Don’t worry about deflation too much, service sector inflation actually increased to a rate 2.7%, as goods inflation fell to 0.6%. Manufacturing Prices … Manufacturing output prices actually fell in August, down by -0.3% compared to a fall of -0.1% in July. Input costs, price of materials and fuels bought by UK manufacturers, fell -7.2% in the year to August, compared with a fall of -7.5% in the year to July. Crude oil costs were down by 14% as price of energy and import costs generally benefited from the weakness of world commodity and trade prices. The appreciation of Sterling helped, up by 8% against the dollar in the month. Home food material costs were down by -10%. Evidence that weak food prices at retail level are not really attributable to supermarket food wars after all. For the moment, inflation, or lack of it, is always and everywhere an international phenomenon. World trade prices are weak. Oil price Brent Crude is trading below $100 per barrel compared to $112 last year. Sterling closed at $1.63 this week up by just 3% compared to September last year. A warning perhaps, the currency contribution may be eroding and the dramatic fall in manufacturing costs may soon be reversed. Unemployment data … The number of people unemployed, claimant count basis fell below 1 million in August, the actual figure was 966,500 and a rate of 2.9%. Over the last six months over 200,000 have left the register. At this rate, job centres will be closing by the end of 2017, there will be no one looking for work. Despite the surging jobs market, pay data remains remarkably weak. Average earnings increased by 0.7% in July. Surprising given the rate of jobs growth. Some evidence of compression is more evident in manufacturing pay, up almost 2% and construction, up by 4%. Retail Sales ... Retail sales rallied in August as volumes increased by 3.9% year on year and values increased by 2.7%. Online sales volumes were up by 8.3% accounting for 11% of all retail transactions. Households are spending and will continue to do so. The August ©GfK Consumer Confidence Barometer confirms households are more optimistic, feel better off and believe it is a good time to spend. So what of base rates …? Janet Yellen, head of the Fed, gave additional guidance on the direction of US rates this week. “The Committee currently anticipates that economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run”. “A highly accommodative stance remains appropriate”. There was no real change in the police stance. Markets rallied and the Dow closed above 17,000. Analysts do not expect a rate rise in the USA before June next year. So what does this mean for UK rates? Weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. No escape from Planet ZIRP just yet, we may regret the delayed take off in the years ahead. So what happened to sterling this week? Sterling rallied against the dollar to $1.630 from $1.626 and well up against the Euro at 1.270 from 1.254. The Euro was down against the dollar at 1.270 (1.297). Oil Price Brent Crude closed down at $98.08 from $97.62. The average price in September last year was $111.60. Markets, move up. The Dow closed at 17,291 from 16,978 and the FTSE closed down at 6,837 from 6,806. UK Ten year gilt yields moved 2.55 from 2.49 and US Treasury yields closed at 2.62 from 2.60. Gold drifted lower at $1,218 from $1,227. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed