|

China and US make progress ...

Great new from Osaka this week, the trade talks between China and the USA are back on track. "Good Trump" was on display in Osaka. The President, following "excellent talks" with President Xi, promised no further tariffs for the moment, eased the pressure on Huawei and agreed to meet Kim Jong-un in the Korean DMZ on the way home. Earlier in the week it hadn't looked so good. Days ahead of the crucial G20 meeting, China’s state media ramped up the rhetoric. US Secretary of State Mike Pompeo was described as the “source of all chaos” in international affairs by the Global Times. “It is extremely rare for a world power to have such a crazy person as their top diplomat" claimed the tabloid, "Pompeo has become a person who threatens world peace and adds fuel to flash points between countries with conflicts.” Pompeo may well be flattered, talking an obvious hit for the President. He may also feel badly done to, the "bad boy" role is usually assigned to National Security Advisor John (the mustache) Bolton. North Korea had previously made clear the regime views on Bolton. “Crooked sound will always come out the mouth of a man who is structurally flawed. It is best this defective human product goes away as soon as possible.” It is not clear if Bolton will accompany President Trump to the Demilitarized Zone. Donald Trump has declared US trade negotiations with China to be “right back on track” after the highly anticipated meeting with Xi Jinping on the sidelines of the G20 summit in Osaka. Trump said the US would not impose further tariffs in a trade war that threaten the global economy. The world’s two biggest economies will restart negotiations on a trade deal. The tariff policy is facing increasing pressure at home. More than 300 companies were in discussions with government officials in Washington this month. The trade war between the U.S. and China has been detrimental to business. As Best Buy's merchandising director explained ... “American manufacturers may lose share almost immediately to foreign competitors whose products are not made in China and, therefore, not subject to price increases in the form of tariffs.” Apple, having warned of the potential threat to competitiveness last week, announced this week, the decision to move the Mac Pro assembly out of the U.S. and into China. It is a clear blow to the President's policy on trade and tariffs. The President is obliged to ease back on the aggressive trade stance. The new deal includes a promise to farmers they would win back lost markets as a result of the revived talks with China ... Vauxhall issues warning ... In the U.K, Boris Johnson may be committed to leaving the EU on the 31st October with or without a deal but Vauxhall issued a clear warning this week. French carmaker PSA Group has made it clear, it will only build the new Vauxhall Astra at Ellesmere Port, if the UK avoids a no-deal Brexit. PSA said, “The decision on the allocation to the Ellesmere Port plant will be conditional on the final terms of the UK’s exit from the European Union.” No deal means no new Astra. The new line will be headed for Poland instead. The Society of Motor Manufacturers and Traders also warned this week, a no deal Brexit could deliver a “knockout blow” for UK car manufacturing. Frictionless trade with the EU is essential to maintain markets and supply lines. Border delays could cost the industry up to £50,000 a minute if the country were to leave the European Union without an agreement. Projections released by the society suggest that British automotive producers and suppliers would face costs of up to £70 million a day. Disruptions at the border would fracture just-in-time manufacturing lines. The industry generates a turnover of £82 billion. It made about 1.3 million vehicles for export last year, the majority of which are destined for Europe. The outlook for the UK and world economy is threatened by Trump and Tariffs on the one hand and Boris and Brexit on the other. We cannot be sure if the President is really going to be capable of a long term detente on trade. Neither can we be sure, the next Prime Minister of the UK will be able to deliver an exit from the EU on the 31st October with or without a deal. For the moment, the prospects for progress, appear to be more promising from the President but then ... G20 looks on ... In a G20 declaration issued at the end of the two-day summit, the world leaders committed themselves to realizing “free, fair and non-discriminatory” trade and to “keep markets open”. The declaration avoided criticism of Trump style protectionism. On climate change, all G20 nations except the US reiterated their determination to implement the Paris agreement. A separate note stated Washington intended to withdraw from the agreement “because it disadvantages American workers and taxpayers”. Fears that disagreement over the climate crisis could sink the G20 declaration were overcome with a compromise that again left the US isolated in international efforts to reduce greenhouse gas emissions. The lack of progress on the climate emergency, despite it being flagged as a priority by the summit’s Japanese hosts, drew an angry reaction from campaigners. Kimiko Hirata, international director of the Kiko Network, said Japan’s prime minister, Shinzo Abe, had “raised expectations that he would use this G20 moment to take bold action for the planet. Instead, the Japanese Prime Minister falied to build a clear majority of support for climate action. “Prime Minister Abe and other G20 leaders need to get serious about their climate commitments and make sure they don’t show up empty-handed for the climate action summit in September.” The Kiko network is a non-governmental organization (NGO) supported by individuals, organizations and regional networks from all over Japan. The primary goal is the practical implementation of the Kyoto Protocol and the prevention of dangerous climate change. So some progress on trade in Osaka, little progress on climate change. The Japanese government seized the moment to re launch the whaling fleet. Japan has withdrawn from the International Whaling Commission which banned hunting. Japan will send out its first official whaling fleet next month, in local waters of course. That's all for this week, have a great weekend. We will be back with more news and updates next week! John

0 Comments

Central Bankers Hold Fire For Now ...

Drama in the air ... Donald Trump held back on a missile attack on Iran this week. "We were cocked and loaded, ready to retaliate" tweeted the President, "When I asked how many will die, 150 was the answer. Ten minutes before the strike, I stopped it." The Iranians had shot down a US unmanned drone earlier in the week. The President considered 150 deaths would be disproportionate to the loss of a $250 dollar flying machine. Capable of many things, the Iranians claimed the drone was flying in Iranian air space. Not so, according to Trump, the drone was flying in "international waters". A "submersible" flying drone, versatile indeed. "We had the evidence" said Trump "it was scientific evidence, not just words". The Iranians had the evidence, bits of the RQ-4 Global Hawk drone were on parade. There was some suggestion the shooting was executed by a rogue command rather than a regime call. Hence the Trump reprieve. US protocols have been amended to ensure the death toll is assessed before launch buttons are pushed next time. In similar news, central bankers were "Cocked and Loaded" but decided to hold fire for now. Mario Draghi received a standing ovation. He told the European Union that additional monetary stimulus and a much more expansionary fiscal policy may be needed to overcome persistent economic weakness. The President of the EU Central Bank promised once again, to do whatever it takes to support the growth objective. In the UK, the MPC voted to keep rate changes on hold. Noise from the hawks, including Ben Broadbent and Andy Haldane, was offset by the UK inflation slow down, announced earlier in the week. Headline inflation CPI basis slowed to 2%. Andy Haldane's call, to nip inflation in the bud, appeared premature for now. In the US, the Fed also held rates but signaled the possibility of a rate cut later in the year. The first cut could appear as early as July. The Fed appeared to forego the pledge to be "patient" in formulating interest-rate policy. The Fed Chair Jerome Powell appears to be promising to cut rates if need be, to extend the recovery into 2020. Markets rallied, bond yields fell. Stocks rose to records, bonds surged, oil prices jumped and gold rose above $1,400 dollars an ounce. The fundamentals in the US economy remain strong. The risk of the Trump trade policy remains the chief threat to growth this year ... in the US and around the world. Retail Sales ... Blowing in the wind ... In the UK, retail sales growth slowed to 2.3% in May. Cold wet weather kept shoppers from the high street. Clothing and footwear sales fell by 4.5% the biggest drop since July 2015. Online sales growth slowed to just over 8% accounting for almost 20% of total sales in the month. The pressure on the high street continues. Some slow down was to be expected. Total sales volumes had averaged 5% in the first four months of the year. Consumer confidence remains firm. Real income growth continues as the inflation data demonstrated this month. We still expect overall growth of around 3.5% this year. The level of inflation CPI basis eased back to 2% in May from 2.1% prior month. Service sector inflation fell back to 2.6%. Goods inflation increased slightly to 1.5%. Inflationary pressures remain subdued. Oil prices remain weak, despite the slight rally to $65 dollars Brent crude basis this week. Manufacturing prices fell in the month. Input costs pressures fell significantly. Cost price rises slowed to 1.3% from 4.5% in April. Output prices slowed to 1.8%. No pressure on the Bank of England to increase rates for the moment. The MPC will await developments in the Brexit debacle before making any significant move. Borrowing figures for the first two months of the fiscal year were released this week. Public sector borrowing was £5.1 billion in May, £1 billion higher than during the same month last year. In the first two month, borrowing was £1.8 billion up on prior year. Markets expect an increase in the current financial year to around £30 billion from £24 billion last year. The result is broadly in line with expectations. Tax receipts rose by £1.9 billion, or 3.5 per cent, to £56.7 billion on the back of higher income tax revenue and national insurance contributions. VAT receipts rose by £500 million over the same period. Corporation tax revenue fell by 0.8 per cent. Expenditure, in the month increased by £2.5 billion, or 4.2 per cent, to £61 billion. The task of the Chancellor made more difficult as austerity eases slightly. Global Economic Growth is Slowing ... Around the world further evidence appears of a slow down in global growth. Trump’s trade war is damaging business investment, confidence and trade flows across the world. The slow down in Europe and elsewhere, coincides with Trump’s intensified trade fight with China and other partners. A further escalation of tariffs on Chinese goods or levies on EU autos, could slow global growth to a crawl. French wine came under attack as the President railed against protective tariffs in the EU. Weakness in China, driven in part by fallout from the trade war, has damaged the economies of Germany, Australia and the Asian block. Exports from Singapore fell by 16% in May as sales to China and Hong Kong fell by 25%. Japan, South Korea and Taiwan are “highly exposed” to the Chinese economy, supplying goods for the mainland market and re-export. Trump may think "tariffs are a beautiful thing" but others including US business are not so sure. Retaliation is inevitable. India imposed higher customs duties on a raft of U.S. goods this week, in response to similar measures taken by Washington. Apple has warned the tariff war with China could harm the company’s international standing and reduce its contribution to the American economy. Imposing an import tax on the iPhone and other products assembled in China, will “weigh on Apple’s global competitiveness”. Toy makers, telecom officials, port workers and shoemakers kicked off a seven-day hearing in Washington this week. The warning is simple. Trump’s plan to impose tariffs on nearly all Chinese imports would raise costs for consumers, disrupt supply chains and potentially force them to lay off employees or go out of business. Trump may think the Mexicans will pay for the wall and China will pay for the tariffs. Tariffs are in effect a domestic consumption tax, impacting on US growth. Tariffs and trade wars are a real threat to world growth. Just as Brexit is a clear and present danger to UK and European business. In the UK frustration at politicians has morphed into outright anger in the three years since the referendum. Companies continue to lose customers and delay investments, it is said. “It’s not that the Brexit uncertainty and fear of no deal is going to have an impact in the future, it’s having it right now,” said Carolyn Fairbairn, director general of the Confederation of British Industry. Trump launched his election campaign this week. It was much of the same. "Build that wall, drain that swamp, lock her up". Make America Great Again has been updated to "Keep America Great". It may not be so easy. Good news for the White House. The President may soon have friends in Downing Street to help the cause. Johnson is set to walk in to Number Ten. A snap election, followed by a deal with the Brexit Party could then see Farage next door as Chancellor ... That's all for this week, have a great weekend. We will be back with more (Shock) news and updates next week ... John Causes Shock to Output ...

Manufacturing output fell in April. Latest data suggests activity fell by almost 1% year on year. The car industry shutdown grabbed the headlines. A 7% drop in investment and capital goods the major reason. It is a continuing story of lost exports of investment goods, as world activity slows. The trade in goods deficit was £12 billion in the month. A reversion to the mean, following the stock build augmented £47 billion deficit in the first quarter. It remains a huge deficit and a significant drain on growth. Service sector growth in the month was 1.7%. Construction activity was up by 2.4%. The job market continues to reflect growth in the economy. The unemployment rate in April was unchanged at 3.8%. There were 1.3 million unemployed and almost 840,000 vacancies. Excluding bonuses, average weekly earnings for employees in Great Britain were estimated to have increased by 3.4, a 1.5% increase in real earnings. The ONS fast figure estimate for growth in the economy was 1.3% in the month, compared to 1.8% in the first quarter. Most analysts expect growth of 1.4% for the year as a whole, in line with the prior year figure. The Bank of England Monetary Policy Committee meets next week. Hawks are beginning to ruffle a few feathers. Deputy governor, Ben Broadbent, suggested the Bank’s latest health check on the UK economy warranted higher interest rates than financial markets currently expect. Chief Economist Andy Haldane said the time was nearing for a rate rise to nip inflation pressure in the bud. The MPC is unlikely to raise rates this month, or this year for that matter. Brexit remains a huge concern for policy makers in the UK. Fears of a global slowdown are haunting policy makers around the world. The Governor is unlikely introduce a rate hike during his tenure. His term in office comes to an end in January. We expect rates to remain on hold when the MPC meets on Thursday next week. Fed Set to Cut Rates ...? Last week, markets were pretty convinced the Fed was set to cut rates this year. As many as three cuts of around 75 basis points were expected. Stock markets rallied, ten year bond yields fell. The latest jobs figures didn't help. Just 75,000 new jobs in April supported fears of a significant slow down, pushing the Fed into action. The IMF reduced forecast growth this year to 2.6%, the World Bank to 2.5%. The Fed has suggested growth may fall below 2% this year. A significant slowdown following growth of over 3% in the first quarter. The White House team are more confident of growth. Larry Kudlow, director of the National Economic Council, said Tuesday that the U.S. economy will continue to grow at a strong pace through the rest of 2019 with or without a trade deal with China. Kudlow also shrugged off the release of weaker-than-expected economic data from last week. “The U.S. economy is very strong,” he told CNBC’s “Power Lunch. “I think we’re in very good shape and I think we’ll maintain a 3% growth pace this year.” “What has changed is lower tax rates, massive deregulation, opening up the energy sector and various trade reforms.” Good news from the Department of Commerce. Retail sales, increased by a seasonally adjusted 0.5% in May from a month earlier. April sales were revised to a 0.3% increase from a 0.2% decline. Indications continue to suggest a strong performance in terms of unemployment, retail sales and consumer confidence. For the moment inflation remains subdued. There is no pressure to hike rates, nor much pressure to reduce rates either. “Fade the futures.” That’s market jargon for going against the financial futures market is gaining traction. The market is betting on multiple reductions in the Federal Reserve’s main interest-rate target later this year. The trouble is, the futures market was just as certain late last year that multiple rate increases were ahead. Ten year bond yields closed up two basis points this week. Technically, a stronger rally may be in play as the Fed is likely to hold off any move this year. China tariffs remain a concern. Trump may consider "tariffs to be a beautiful thing", most economists are not sure. In effect they are tax on consumption supressing consumer demand and inhibiting investment as uncertainty continues. Hopes for a positive development on trade talks soon will be disappointed. At the moment we cannot be sure, the Presidents will meet for talks at the G20 meeting at the end of the month. China inflation on the rise ... In China, inflation increased to 2.7% in May. Food prices increased by almost 8%. Fresh food prices increased by 27%. Pork prices increased by 18%. The swine flu epidemic continued to impact on supply and price. Output is slowing.The latest industrial output figures from China fell short of expectations, with growth dropping to 5 per cent in the year to last month, down from 5.4 per cent in April. Analysts had forecast a modest recovery for May, with a growth estimate of about 5.5 per cent. Forecasts for growth this year have been reduced but not by much. GDP growth is expected to increase by 6.3% this year compared to 6.6% last year. The trade war is a significant inconvenience, not the major disaster Peter Navarro, Assistant to the President, and Director of Trade and Manufacturing Policy would have Trump believe. Author of "Death By China, Confronting the Dragon" Navarro is a super hawk in the implementation of tariffs. Agreement is unlikely to be reached anytime soon. Unless President Xi meets for Dinner with Trump at the G20 meeting, further tariffs will be applied. A rare step in diplomacy and the art of the deal. It all depends on the mood of the President and how much Provigil Trump has imbibed. Reading this week, "The Siege Trump Under Fire" by Michael Wolff, the sequel to "Fire and Fury" Wolff revealed (p 54) “Admiral Jackson was the go-to doctor for the president. Jackson was a popular get-along figure, not least because he was casual about prescribing medication. He kept the president stocked with Provigil, an upper, which Trump’s New York doctor has longed prescribed him.” Interesting. Provigil is a medication that promotes wakefulness. It is thought to work by altering the natural chemicals in the brain. The medicine may impair thinking and or reactions. The warning ... "Be careful if you do anything that requires you to be alert." Stop using Provigil and call your doctor at once if you have, anxiety, hallucinations, unusual thoughts, unusual behaviour, aggression, being more active or talkative than usual. Evidence of overdose ... confusion, rapidly changing moods, agitation or excitement. So much explained and now revealed. Presidents Xi and Putin will have compared notes ... That's all for this week, have a great weekend. We will be back with more news and updates next week! John Our next Brabners Quarterly Economics Briefing will take place on the 25th and 27th June. We are in Manchester at the Lowry Hotel and in Liverpool at the Radisson Blu. Places are limited but you can still register here for the FREE Breakfast session. It would be great to see you there ... J The Meeting Was Incredible ...

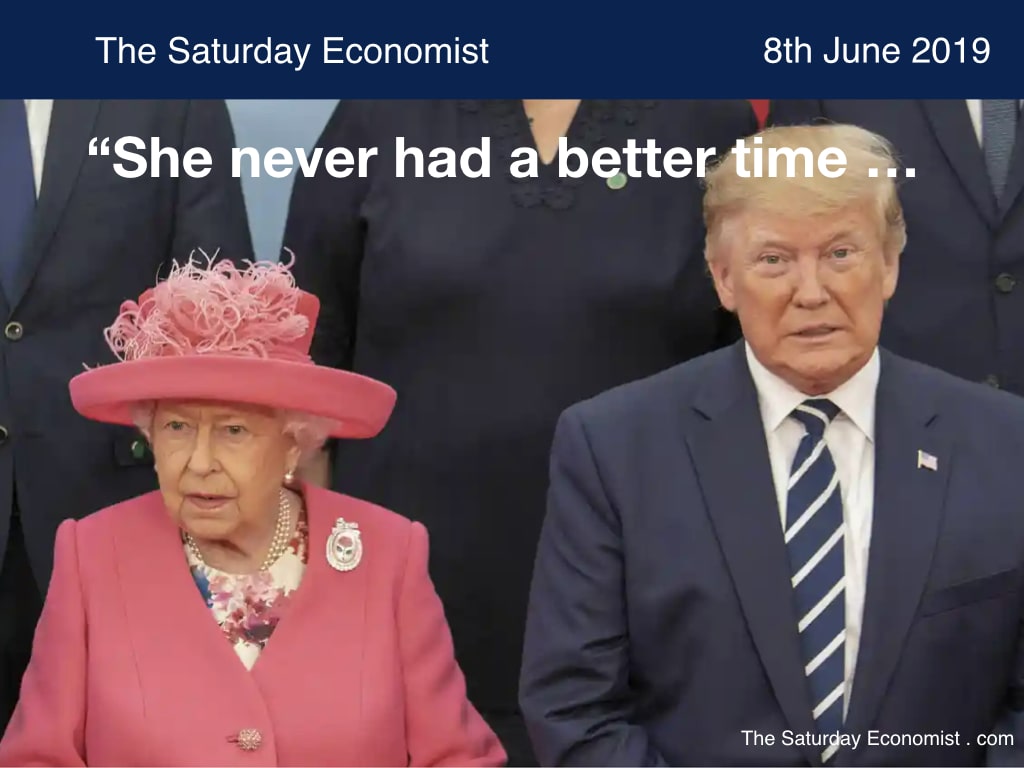

President Trump was in London this week. The visit went well. Major diplomatic gaffes avoided. Trump was keen to reassure Fox News he had not fist bumped the Queen on arrival. The President stayed on message, constrained within a tight script and an even tighter suit and waistcoat for the state banquet. "The meeting with the Queen was incredible" Trump said. "I think I can say I really got to know her because I sat with her many times. We had automatic chemistry. She's a spectacular woman. We had a really great time." "There are those who say they have never seen the Queen have a better time, a more animated time." We just had a great time together". "We had a period when we were talking solid straight. I didn't even know who the other people at the table were." Just the two of them in the room for a state banquet. "I intend to keep the conversation going" Trump promised the nation. Excellent. Trump spent time with Prince Charles. The meeting scheduled for afternoon tea over ran by fifteen minutes. Prince Charles has strong views on climate change. The President considers global warming to be a "Chinese Hoax". Trump has withdrawn the US from the 2015 Paris convention on climate mitigation. Fears of a disruptive meeting were dispelled. The pair discussed a wide range of issues over an extended meeting. No fall out. In an interview with Piers Morgan, Trump said of Prince Charles, 'I'll tell you what moved me is his passion for future generations. He's really not doing this for him. He's doing this for future generations. He wants to have a world that's good for future generations." Not for Trump the thought of future generations, the current timeline is confined to just "four more years". Later Prince Charles revealed he fears it may be too late to save the planet, or the "natural world" at least. Just one meeting with Trump appears to have been enough to accelerate the demise of the planet. Yeah we know the feeling ... Fed Set to Cut Rates ...? Good news from the White House this week-end. The threat of further tariffs on Mexico has been abandoned indefinitely. In a joint declaration both countries said Mexico agreed to immediately expand a program that sends migrants seeking asylum in the United States to Mexico, while they await adjudication of their cases. The country also agreed to increase enforcement to contain the flow of migrants headed to the US, including the deployment of national guard troops to its southern border and a crack down on human smuggling organizations. The threat of further tariffs had risked a back lash in the Senate and Congress with Republicans and Democrats against the move. The White House team had been divided with Kushner, Mnuchin and Lighthizer pleading with the President to avoid further putative action on trade. The US economy is already struggling to shake off the implications of a trade war with China. The imposition of tariffs will lead to higher domestic prices, job losses and a slow down in the economy. The latest jobs data released on Friday confirmed the economy added just 75,000 jobs last month compared to the 180,000 expected. The report also revised previous month's numbers down by an additional 75,000. The US economy is not as robust as first thought. Stock markets rallied and bond yields fell. US ten year rates slipped to 2.06% on close, down 11 basis points. The Fed is now expected to cut rates this year. The conundrum clarified by a bad set of job results. Wall Street couldn’t contain its excitement after Fed Chair Jerome Powell said he’d be open to interest rate cuts. Stocks enjoyed their second best day of the entire year. Last November, the Fed signaled it might raise interest rates three times this year. The flight from Planet ZIRP may have hit a bird strike. It would be a mistake to cut rates at this stage in the cycle. The real challenge is to take the tariff toys away from the President. The world is facing a slowdown in world trade which can be easily avoided. The Bundesbank slashed growth forecasts for the German economy this week to just 0.6%. The World Bank reduced world growth expectations to just 2.6%. The IMF is concerned trade wars could cut 50 basis points from growth unless the trade disputes are ended ... Ford workers devastated ... This week, Ford announced the closure of the engine factory in Bridgend. The loss of some 1,700 jobs will come into effect in the Autumn of 2020. The company blamed changing customer demand and cost structures. Brexit was not attributed to the closure. Bridgend Labour MP Madeleine Moon is not so sure. "The decision is clearly about Brexit. The knock-on effect to the South Wales economy is huge, there are about 12,000 jobs associated with the Ford installation." The uncertainty over Brexit will have been a factor in consideration. A hard Brexit is now the more likely outcome. This week Theresa May resigned as leader of the Conservative Party. The runners and riders to be announced on Monday, will parade their Brexit credentials. The result from Peterborough will not ease the mood. The party was driven into third place in the bye-election with big losses to the Farage Brexit party. The Tories will swing "right" towards the ERG diehards. The Tories will be charged to deliver the "Will of the people". Business will take note and position accordingly. October 31st is not such a long way away. So what of the prospects of a deal with the US? Trump avoided a gaffe on the NHS this week. The NHS will not take part in any "New Deal" on trade with Uncle Sam. Don't expect any favours from the USA ... America’s trade deficit with the European Union has expanded to its widest on record, suggesting that President Trump’s protectionist policy is failing. US imports and exports tumbled in April, a report by the Census Bureau showed this week. The trade deficit is widening, the threat of tariffs against the UK and Europe has been postponed for the moment. The Mexican manoeuvre serves as a warning to all ... That's all for this week, have a great weekend. We will be back with more news and updates next week! John Our next Brabners Quarterly Economics Briefing will take place on the 25th and 27th June. We are in Manchester at the Lowry Hotel and in Liverpool at the Radisson Blu. Places are limited but you can still register here for the FREE Breakfast session. It would be great to see you there ... J Always gets the best view ...

President Trump has backed Johnson to be Britain's next prime minister. "Mr Johnson would be excellent in the position", the President said. "I have always liked him, he is very talented". More importantly, "he has been very positive about me and our country". Boris Johnson remains the front runner in a race which hasn't started yet. Will the Trump support help? The President believes his personal backing offers a great endorsement to candidates. "I am loved in the UK, my mother came from Scotland, I have three golf courses there". Yep, what's not to like! The Met will deploy snipers, firearms officers, sniffer dogs and 15,000 officers trained in riot control to deal with a potential 250,000 demonstrators traveling to the capital next week. Asked about the leadership election, Trump said, "I have studied it very hard. I know the different players, I think Boris would do an excellent job". Trump also praised Jeremy Hunt, "Yup like him!" Michael Gove ...not so much. Last week, the environment secretary accused the president of sabre rattling over his policy on Iran. Meanwhile the list of runners and riders in the election race continues to grow. Boris Johnson is the odds on favorite. Michael Gove, is next up 7/2 [Betfred]. Dominic Raab and Andrea Leadsom are both on 8/1. Rory Stewart is moving up the table. Confessions of an Afghan opium exploit boosted his odds to 16/1 alongside Jeremy Hunt. Sajid Javid is the outsider in the short pack at 25/1. The candidates are caught on the Brexit tripwire. The EU elections pushed forward the agenda of the Brexit party. The Lib Dems gained support as a plausible "remain" option. The Brexit debate is polarising politics. A recent YouGov poll put the Lib Dems and Brexit party ahead of Labour and the Conservatives. If the Tories were traumatized by UKIP, they will be terrified about the new Farage Brexit Party. Candidates for the Downing Street race flaunt hard line Brexit policies to garner support among the right wing back benches. The CBI warned again this week of the dangers of a no deal exit. In the mayhem of the hustings, the complaints from business groups will be overshadowed by naked political ambition. It doesn't bode well ... Don't say we didn't warn you ... The trade war with China is hotting up. This week the ominous warning "Don't say we didn't warn you" emerged from within the Beijing ranks. The People's Daily, the Communist Party's official mouthpiece, carried a stark warning for the United States. The People's Daily, which often signals official positions with subtle language, uses the phrase sparingly: It famously appeared before China launched border attacks against India in 1962 and Vietnam in 1979. Additional tariffs on $60 billion of US imports were implemented this month. China is considering restrictions on the export or rare earth metals. On Friday, China announced it would establish a blacklist of "unreliable" foreign companies and organizations, effectively forcing companies around the world to choose whether they would side with Beijing or Washington. No sign of a settlement any time soon, The developing tit-for-tat is reinforcing a sense in Washington and Beijing the world's two largest economies are destined to unwind a system of economic dependency built over the past three decades. The Times they are a changing. The Trump administration appears oblivious to the dangers to the US economy of arbitrary trade actions. On Friday night, the Trump administration announced, it would strip India of a special status that exempts billions of dollars of its products from American tariffs. The decision is set to raise trade tensions with the world’s second-most populous country. The move was taken as retaliation for what Mr. Trump said was India’s failure to provide “equitable and reasonable access to its markets.” Earlier on Friday, Trump announced tariffs on Mexico, "On June 5th the US will impose a 5% Tariff on all goods coming into the country from Mexico, until such times as illegal immigrants coming through Mexico STOP. The tariff will gradually increase (to 25%) until the illegal immigration problem is remedied." "Mexico has taken advantage of the United States". "Mexico makes a fortune from the United States". "Mexico has taken 30% of our Auto Industry". "We have a $100 billion dollar deficit with Mexico". The Trump temper tantrum continued on twitter. No thought of the New NAFTA deal, or the wishes of business across the US. Trump had taken the unusual step of linking trade tariffs to an immigration policy objective. The US Chamber of Commerce denounced the move with a consideration of legal action. House Democrats began considering legislative remedies aimed at halting the arbitrary powers of the President to implement tariffs. Border state Republicans expressed concerns. The President of Mexico was confused. "Social problems cannot be resolved with tariffs" his claim. The administration was split on the issue. President Trump's top trade adviser Robert Lightizer had opposed the plan. Jared Kushner had expressed concern ... the chances of implementation look slim ... so what was the real reason for the Trump actions this week ... "The Peach in impeachment ..." Bob Mueller made a statement this week, effectively putting the Democrats on notice to begin impeachment proceedings. Nancy Pelosi is facing pressure from the hard line ranks to take action. The Mueller statement had made it clear this week, there was adequate just cause. "As set forth in the report, after the investigation, if we had confidence that the president did not clearly commit a crime, we would have said so," Mueller told reporters at the Justice Department on Wednesday. "Justice Department policy prohibits the indictment of a sitting president, charging the president with a crime was therefore not an option we could consider," Mueller said, adding that the Constitution requires a "process other than the criminal justice system" to address wrongdoing by a president. He was talking about impeachment of course. There appears to be clear evidence of obstruction of justice by the President of the United States. Trump was infuriated. "The Greatest Presidential Harassment in history. After spending $40 million dollars over two dark years, Robert Mueller would have brought charges if he had anything, but there were no charges to bring." Trump claims Mueller was conflicted and biased against him. "He had wanted to be Director of the FBI," claimed Trump, "I said no." The next day he was appointed special counsel!" The Mueller Story threatened to grab the headlines over the week-end. The White House has a back stop "Wag the Dog" strategy. Wag the Dog is a black comedy film starring Dustin Hoffman and Robert De Niro. The screenplay concerns a spin doctor and Hollywood producer who fabricate a US war to distract voters from a presidential scandal. It's a great movie and a cute strategy. The announcement of "immigration tariffs" against Mexico is diversionary strategy, without logic, merit or substance. What is the value of any trade deal or international agreement made with the USA with Trump in the White House? Markets, the much loved barometer of the President, reacted pushing the DOW, NASDAQ and others across the world lower in response. Trump revealed on Twitter last night, he will be announcing his Second Term Presidential run on the 18th June in Orlando, Florida. Melania and Mike Pence will be there. Mickey and Minnie will not. The venue will be the Amway centre Florida. Disneyland didn't make the cut. The President's best mate Kim Jong-un has expressed support. Last week the Korean regime called Joe Biden "a fool of low IQ" and mocked Biden for thinking he would be a popular candidate. "This is enough to make a cat laugh" the report said. Trump could only agree and did on Twitter of course. West Wing WTF ... it's enough to make a cat laugh ... and it is getting worse ... That's all for this week, have a great weekend. We will be back with more news and updates next week! John |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed