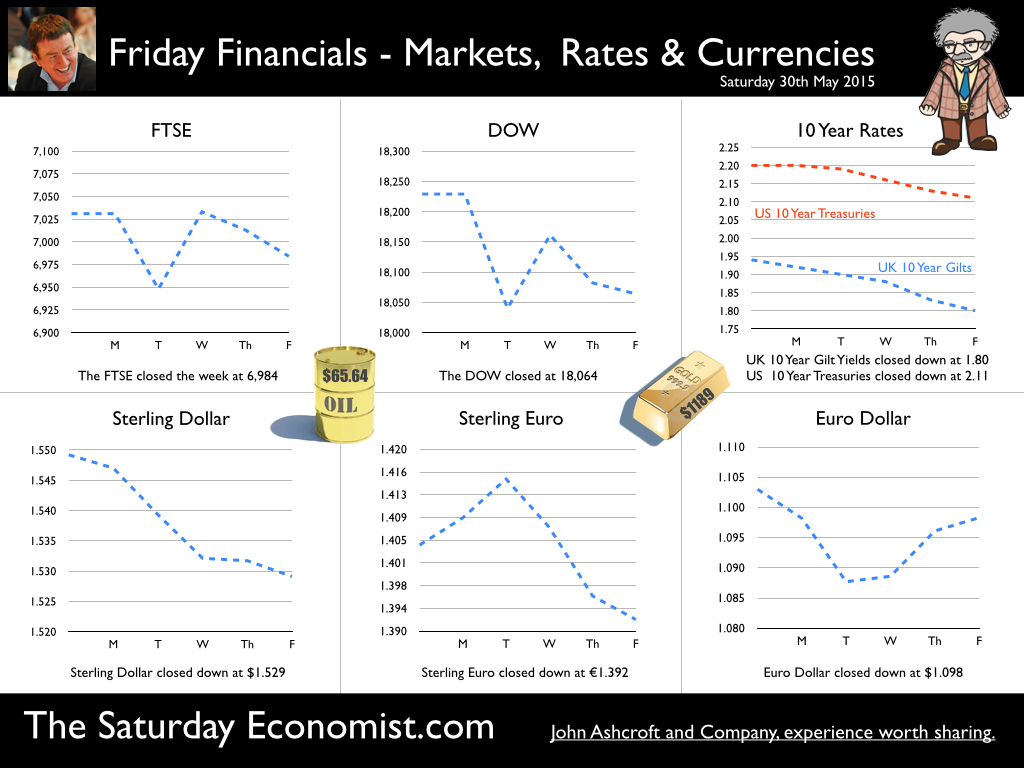

The second estimate of GDP was released this week. To the disappointment of many, growth of 2.4% was confirmed in the first quarter. Many analysts had expected an upgrade as a result of recent survey data but it was not to be. Service Sector … The service sector continues to drive recovery, with growth in private sector services increasing by almost 4%. Leisure, distribution, hotels, restaurants, transport, storage and comms are creating jobs at great pace, as sector growth impacts at over 4.5%. As we explained in our sectoral analysis of productivity, much of the job growth offers low productivity gains. Until robots deliver food to the table, or we all dine sushi mobile style, productivity gains to the economy will not be achieved. So why should we worry! It is time to realise, in a service sector economy, productivity is an output of growth divided by employment. It is not a driver of growth per se. The days of the Spinning Jenny yields are long passed. The sectoral adjusted trend rate of productivity is around 1.5% much lower than the long term average rate just over 2%. Time to stop worrying about productivity and man up to the reality of growth in a service sector economy! Business services increased at a slower rate of 3.3%. Public sector i.e. education and health increased by just 0.8%. Overall the service sector grew at a rate of 3.0%. Manufacturing, construction and investment … So what of the re balancing agenda? Manufacturing output increased by just 1.3% in the quarter. We analyse over sixty sub sectors in our manufacturing model. We had expected growth of 2.5% this year and next. The Q1 data has to be a blip! Even furniture output is enjoying a recovery. There may be some impact on capital goods output as a result of the investment slowdown. In turn that may be due to some election uncertainty and cutbacks in the North Sea. But overall we are obliged to reduce our forecast this year to manufacturing growth of just 2.1% this year rising to 2.5% next year. And what of construction … Construction output fell in the first quarter apparently! The ONS construction data is becoming as credible as Sepp Blatter statements on ethics within FIFA. There is something adrift in the seasonal adjusted data. We had expected growth of over 5% this year and next. We are obliged to revise down our estimate of construction growth this year to just 3.6%, rising to 5.1% next. We made the same mistake last year. In the end, construction growth in 2014 was 7.5%. And what of investment … Investment increased by 3.4% in the quarter, we had expected growth around 5%. Business investment increased by 3.7% and investment in plant and machinery increased by just 2%. So what of the rest of the year? We expect growth of 5% this year rising to 5.8% in 2016. We model investment as a function of growth and survey data. (Capacity and investment intentions). There is still widespread misunderstanding about investment. Two thirds of investment in the UK is property related. Commercial real estate and housing dominate the overall spend. Less than 30% is related to “productive capacity” including machinery and transport. Our four year “capital stock model” confirms there was no real fall in output capacity as a result of the apparent investment slow down. No need to “fret” about lost capacity. And what of trade … The trade deficit had a negative impact on the overall growth figures as the deficit, trade in goods, was offset by the surplus in services. No surprise to readers of The Saturday Economist! We forecast the deficit trade in goods to rise to £124.2 billion in 2015 and £130 billion in 2016. The trade in services surplus increased to £85.9 billion in 2014. We forecast a service sector trade surplus of £88.0 billion in 2015 and £91.7 billion in 2016. The central forecast is for the overall deficit (trade in goods and services) to increase to £36.2 billion in 2015 rising to £38.8 billion in 2016. No real surprises in the first quarter data. So what of growth this year … Overall we expect growth 2.8% this year rising to 2.9% in 2016. Our Quarterly Economic Outlook will be finalised this week-end with detailed forecasts and analysis available on line early next week. Don’t miss that! So what of rates? There is something strange in the way data is presented in the USA! The Bureau of Economic Analysis headline suggested US GDP decreased at an annual rate of 0.7 percent in the first quarter of 2015. The actual year on year growth was 2.7%, revised down from a first estimate of 3%. Hardly a huge setback. Janet Yellen made it clear last week, the Fed will look through the soft data in the first quarter. The revisions to US data for Q1 should not change this view. US rates will rise before the end of the year. Once the Fed makes a move, the MPC will surely follow within the six months framework. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.529 from $1.549 and moved down against the Euro to €1.392 from €1.404. The Euro moved down against the Dollar to €1.098 from 1.103. Oil Price Brent Crude closed at $65.64 from $64.67. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved down on latest growth data. The Dow closed down at 18,064 from 18,229 and the FTSE closed down at 6,984 from 7,031. Gilts moved down. UK Ten year gilt yields moved to 1.80 from 1.94 US Treasury yields moved to 2.11 from 2.20. Gold moved down to $1,189 ($1,206). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

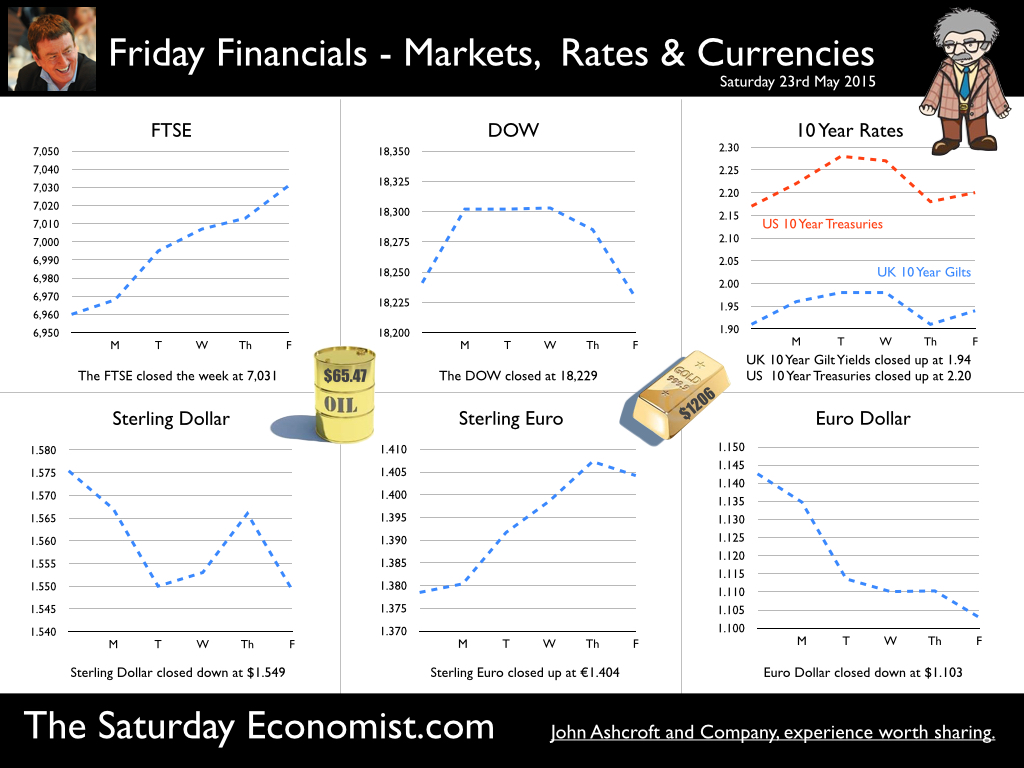

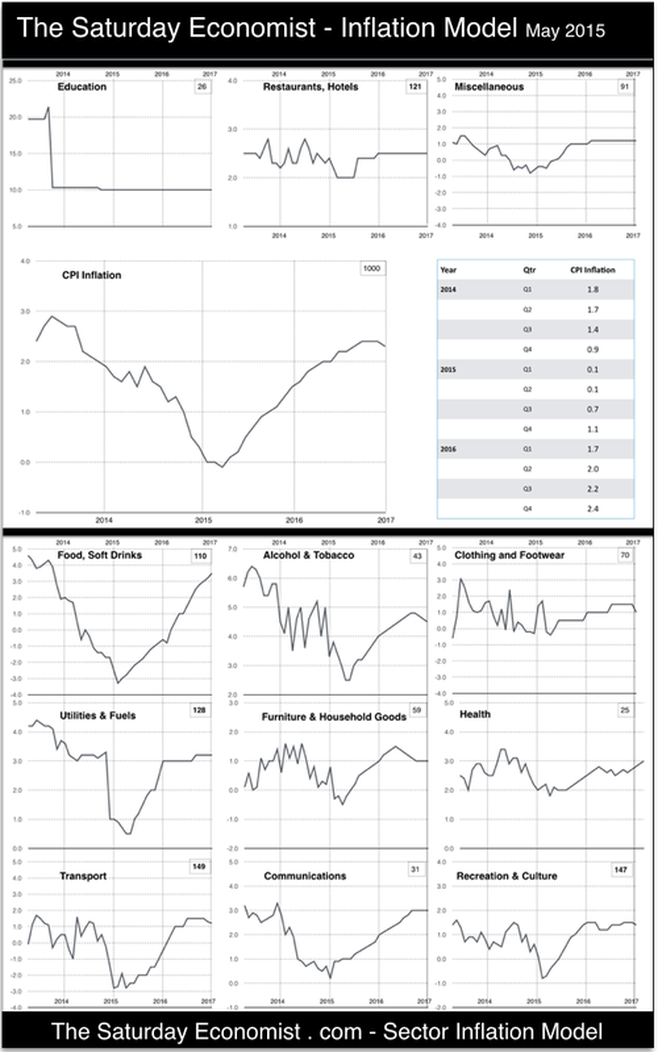

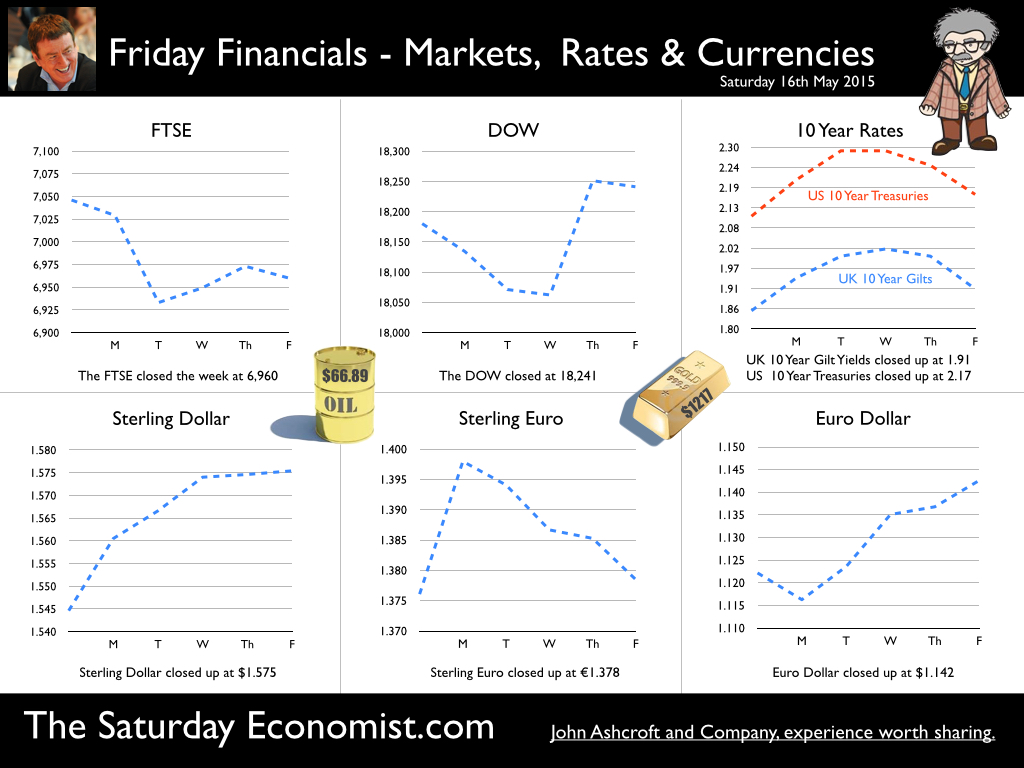

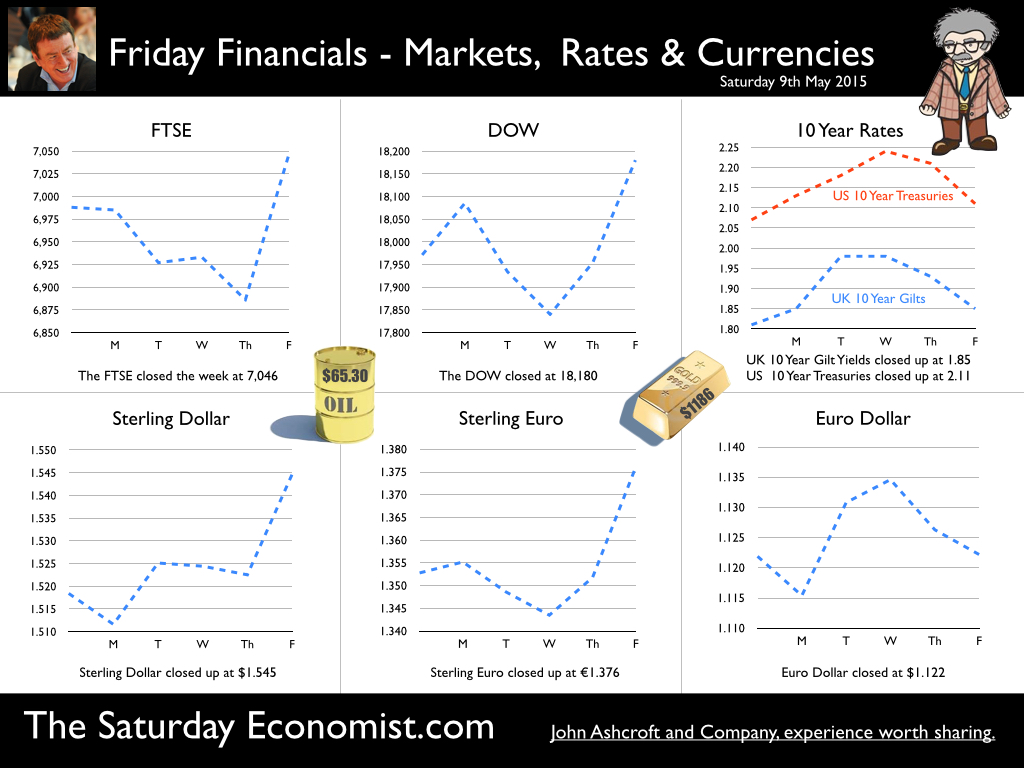

Of Retail Sales, Inflation and Borrowing … Public Sector Borrowing is off to a fine start for the year … the Chancellor is on track to meet the OBR borrowing target of £75.3 billion in the current year! According to the latest data from the ONS, April Public Sector Net Borrowing was £6.8 billion, a decrease of £2.5 billion compared to April 2014. Income and corporation tax payments were up by 3.7% and 11.3% respectively. Expenditure was lower, as were debt interest payments. In the financial year ending March 2015, public sector net borrowing was £87.7 billion, 4.8% of Gross Domestic Product. Year on year, the deficit was reduced by £10.8 billion. Public sector net debt was £1,487.7 billion (80.4% of GDP), up by £83.6 billion compared to prior year. So what does this mean for the rest of the year? The Chancellor is on track to meet the OBR projection of a reduction in borrowing to £75.3 billion this year. There is still much to be done if the targets are to be met. The cost reduction targets will be difficult as public sector earnings rise and gilt yields rally, putting pressure on borrowing costs. Increases in growth, jobs and inflation will assist the revenue task. Strong retail sales will assist the process … Retail Sales Boom Continues in April … Retail sales volumes increased by 4.7% in April following growth of 5.1% in the first quarter of the year, according to the latest data from the ONS [Office for National Statistics]. Sales values increased by 1.8% in the month following growth of 1.7% in Q1. The strong level of retail sales continues, as consumer confidence continues to improve. Household goods stores enjoyed strong sales growth up by almost 12%. Textile, clothing and footwear stores increased by almost 9%. Food sales were flat as food values fell by 1.4%. Omni channel is now the key word in retail. Online sales increased by 13.1% compared with April last year, accounting for 12.2% of all retail sales in the month. So what does this mean for the rest of the year? We expect the strong retail sales growth to continue into 2015 slowing into the second half as prices increase. We anticipate sales volume growth of 4.2% for the year as a whole, compared to 4% last year. So what of inflation … Inflation CPI basis fell to -0.1% in April, down from 0.0% in March according to ONS data. Reductions in transport costs and food provided the largest contribution. In the year to April, food prices fell by 3.0% and prices of motor fuels fell by 12.3%. There were smaller downward price movements for housing and household services, clothing and footwear, furniture and household equipment. Overall goods inflation fell by 2% offset by a 2% rise in service sector inflation. Restaurant costs increased by 2% and education costs increased by 10%. Producer Prices … Output prices for UK manufacturers fell by 1.7% in the year to April 2015, unchanged since February 2015. Total input prices, the overall price of materials and fuels bought by UK manufacturers fell by 11.7% in the year to April 2015, a modest recovery from a fall of 12.8% in the year to March 2015. Output prices were largely affected by petroleum prices, down by just over 16% and food prices down by 3%. Input costs were dominated by a near 40% fall in oil prices. Home food prices fell by 12% and imported materials (metals and chemicals) fell by 5% approximately. So what does this mean for the rest of the year? Oil prices, food prices and earnings will hold the key to the out turn by the end of the year. The Bank of England Inflation Report released last week, suggests inflation will return to target 2% over a two year period. Most analysts expect inflation to average just under 1% during the last quarter of the year and just under 2% by the end of 2016. Our disaggregated model (below) suggest inflation will average just over 1% by the end of the year and return to target by the second quarter of 2016. Oil prices are recovering and earnings are beginning to rise rapidly. In farming, it is said the best remedies for low prices are low prices. The best remedies for high prices - high prices. The Californian drought should serve as a warning, the food price outlook could change rapidly. Oil prices are 40% below a market norm. World commodity prices, excluding oil, are 30% below linear trend rate. So what of rates? Janet Yellen made it clear this week, the Fed will look through the soft US data in the first quarter. US rates will rise before the end of the year. Once the Fed makes a move, the MPC will follow. Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … but there may be time for a ski trip (in Europe, it will be cheaper) first. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.549 from $1.575 and moved up against the Euro to €1.404 from €1.378. The Euro moved down against the Dollar to €1.103 from 1.142. Oil Price Brent Crude closed at $65.47 from $66.89. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved in different directions. The Dow closed slightly down at 18,229 from 18,241 and the FTSE closed up at 7,031 from 6,960. UK Ten year gilt yields moved up to 1.94 from 1.91 US Treasury yields moved up, to 2.20 from 2.17. Gold moved down to $1,206 ($1,217). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England was pretty sanguine about growth in the latest Inflation Report this week. The projection is for solid demand growth, the boost to household spending from lower energy and food prices sustained by a pickup in wage growth and higher levels of employment. Business investment will remain robust, reflecting the recovery in the economy generally. The Bank GDP growth forecast has been downgraded to around 2.5% this year and over the next few years. Inflation is expected to return to the 2% target over the next two years. The path implied by forward market rates suggests interest rates are expected to rise to just 1.4% by Q2 2018. So what can we make of it all? In one sense the Bank is right to downgrade forecasts for the year. Growth in the first quarter is estimated to be just 2.4%. The latest data on manufacturing and construction continue to disappoint … March of the makers slows to a standstill in March … According to the latest data from the Office for National Statistics, manufacturing output increased by just 1.1% in March and by just 1.3% in the first quarter of the year. After strong growth in the final quarter of 2014 (3.3%) manufacturing output, the march of the makers, has slowed to a standstill. Consumer durables output increased by 2.8% in the month, buoyed by the strength of the consumer confidence and a strong housing market. The strong pattern of investment and capital goods growth experienced in 2014 slowed to just 0.5% in the first quarter. So what is going on? The slowdown in the oil and gas market may be impacting on overall production output in the short term. Output in the energy sector fell by 5% on the quarter. This in turn is having an impact on the manufacturing related sectors and investment goods in particular, according to feedback from The Saturday Economist Readers. So what are the prospects for the rest of the year? We analyse over sixty manufacturing sectors in the preparation of our forecasts. We had forecast growth of 2.5% in 2015 which we would expect to fall to 2.2% based on the short run data. However in the main quarterly forecast due later this month, we expect strong growth in transport, engineering and consumer goods to continue, so too with food and drink. Even furniture is experiencing a change in fortunes following the strength of the housing market. A rally in investment and capital goods into the second half of the year may well mean our forecast for the year is unchanged. So what of construction … Construction output falls despite strong housing growth … Construction output was flat in the first quarter of the year compared to the first quarter last year. Despite strong growth in private housing (up 8%) and industrial building (up 11%), weak growth in commercial and repair and maintenance damaged the overall output figures. For the year as a whole we had expected construction growth of over 5% in our February forecast following the growth of over 7% last year. Based on Q1 data, that no longer makes sense. The construction data is incredibly volatile. The fall in commercial output and repair and maintenance may be reversed in the months ahead. Our model suggests zero growth this year but common sense says otherwise. 5% growth could still be a possibility. So what of jobs and pay…? Employment continues to rise … Employment continued to rise and unemployment continued to fall in the latest data from the Office for National Statistics for the first quarter of the year. There were 31.1 million people in work, 564,000 more than for a year earlier. Most of the jobs created are now full time employment, predominantly in the service sector. (With a zero productivity yield). There were 1.83 million unemployed, a rate of 5.5%, down by almost 400,000 on a year earlier according to the Labour Force Survey Data. The claimant count fell to 763,000, a rate of 2.3% in April. This is now lower than pre recession levels in 2008. Vacancies fell slightly to 733,000 but the U:V ratio fell to just 1.04 well below the average levels for 2005 to 2008. The labour market is tightening. Wages start the big move … Comparing January to March 2015 with a year earlier, pay for employees in Great Britain increased by 2.2% excluding bonuses. Doesn’t sound too bad! In March, average earnings increased by 3.3% with a 4.3% surge in private sector earnings. Construction workers enjoyed a 6% plus pay rise and leisure sector workers enjoyed a 7% increase in earnings. Earnings have reached the tipping point … as recruitment difficulties increase. So what do we expect for the rest of the year? … We think the Inflation Report is too conservative with an outlook, beset with an outdated fixation on productivity constraint. We expect the economy to grow by 2.9% this year with a strong continuation of employment growth and continued falls in unemployment. Recruitment difficulties will persist in manufacturing, construction and the service sector. The pressure on earnings will increase. The inflation outlook will look radically different by the end the year. World recovery will continue, the pressure on commodity prices will increase. The oil price will rise by Q4 this year offset in part by the strength of Sterling. So what of rates … So what of rates? Markets still believe the Fed will begin to increase rates in Q3 this year. We expect US growth of almost 3% in 2015. The recovery in Europe continues. The Fed will make a move this year. June no longer the favourite. September the hot month. Once the Fed makes a move, the MPC will surely follow. Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … You know it makes sense … Buckle Up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.575 from $1.545 and moved up against the Euro to €1.378 from €1.376. The Euro moved up against the Dollar at €1.142 from 1.122. Oil Price Brent Crude closed at $66.89 from $65.30. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remain as the base case. Markets, moved in different directions. The Dow closed up at 18,241 from 18,180 and the FTSE closed down at 6,960 from 7,046. UK Ten year gilt yields moved up to 1.91 from 1.85. US Treasury yields moved up, to 2.17 from 2.11. Gold moved up to $1,217 ($1,186). That’s all for this week. Don’t miss The Big Social Media Conference in July and The Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Markets bounce on Cameron win … News of the Tory majority boosted business sentiment this week. The FTSE closed above the critical 7,000 mark and Sterling moved higher against the Dollar and the Euro on news of the Tory win. The dream team continues with the Cameron Osborne alliance. There will be no change in Downing Street occupancy. Osborne will remain as Chancellor. Policy will no longer hampered by the Lib Dem coalition. Constituency casualties will bring an end to the mayhem in BIS created by the interventionist Cable. OK it’s a small majority! But anything is better than another coalition run. Dissident Tory backbenchers will never be forgiven if they upset the front bench with too much angst about Europe. The Tories can lay the platform for ten years in office, if they play their cards right. As for Europe, it is time to bring on the referendum. Sooner rather than later. The dream duo will secure the best deal on the Euro table and put it to the resounding yes vote. We don’t want years of uncertainty overhanging the great opportunity for growth in the years ahead. And we don’t want Brexit! So what about Scotland? The Scots have all but driven Labour out. It is difficult to see a return. The Conservatives have little political ambition across the border. Accommodation with Nicola Sturgeon will secure much of the SNP agenda, no need for break up. In London the Tory prize would secure SNP abstention or a removal from the vote on domestic issues. RealPolitik rules in the shadows of formal alliance. So what of the economy this week? Car Sales continue to flourish … April car sales increased by just over 5% in April with the strongest performance in the month for over ten years. Sales of 185,778 units increased sales in the first four months of the year to over 920,000 units, up by 6.4% on the same period last year. Mike Hawes, SMMT Chief Executive, said, "The figures highlight the current strength of consumer confidence, even at a time of such political uncertainty. We are confident that the UK’s new car market – so symbolic of economic mood – will continue to thrive.” And so it will. The latest GfK figures for April highlight the strength of consumer confidence in the national economic situation and of household finances in general. The worrying factor is the weak growth in car manufacturing at a time of strong growth in the markets both in the UK and in Europe. Trade Data … Trends in the car market will impact on the trade deficit. So it proved with the March data. Seasonally adjusted, the UK’s deficit on trade in goods and services was estimated to have been £2.8 billion in March 2015, compared with £3.3 billion in February 2015. This reflects a deficit of £10.1 billion on goods, partially offset by an estimated surplus of £7.3 billion on services. Doesn’t sound so bad but … In the first quarter, the UK's deficit on trade in goods and services was estimated to have been £7.5 billion, widening by £1.5 billion from the previous quarter. The deficit trade in goods was almost £30 billion. For the year as a whole, we expect the trade in goods deficit to be £124 billion offset by a surplus in services of almost £90 billion. The residual trade deficit of £35 billion is less than 2% of GDP and is not a threat nor constraint to growth. Service Sector Growth continues … For those who still believe in the “March of the Makers” rebuilding the workshop of the world, to rebalance the UK economy … Or for those who still believe in “onshoring” the repatriation of manufacturing from the Far East and “Homespun from India” it is time to wake up and smell the imported coffee. It ain’t going to happen. There will be no manufacturing resurgence and no trade in goods rebalancing no matter what happens to Sterling. The latest Markit/CIPS UK Services PMI® Index hit an eight-month high in the April data released this week. The Business Activity Index rose for the second month running in April to 59.5, from 58.9, signalling the fastest rate of service sector expansion since August 2014. Activity in the sector has now risen for 28 successive months, the longest sequence of growth in seven years. The Index remained comfortably above its long-run average of 55. The (private) service sector is the driver of growth. We expect growth of over 4% this year in this dominant sector within the economy. So what of rates? Markets still believe the Fed will begin to increase rates in Q3 this year. In April the US economy created 223,000 jobs in the month. We expect US growth of almost 3% in 2015. The Fed will make a move soon. June no longer the favourite. Once the Fed makes a move, the MPC will surely follow. The inflation outlook will look completely different by the end of the year as oil and commodity prices rally. Brent Crude tested the $70 level this week. The recovery in the US and Europe will continue! Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … You know it makes sense … Buckle Up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.545 from $1.518 and moved up against the Euro to €1.376 from €1.353. The Euro held against the Dollar at €1.122 unchanged. Oil Price Brent Crude closed at $65.30 from $66.07. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 no longer so far fetched. Brent Crude tested $70 intra week. Markets, bounced on UK election result and US jobs news. The Dow closed at 18,180 from 17,971 and the FTSE closed down at 7,046 from 6,988. UK Ten year gilt yields moved up to 1.85 from 1.81. US Treasury yields moved up, to 2.11 from 2.07. Gold slipped to $1,186 ($1,173). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! Later this month we release our Quarterly Economic update. Don't miss that! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  According to the ONS preliminary estimate of GDP, the UK economy grew by 2.4% in the first three months of the year. The growth rate in the prior quarter was 2.9%. A slow down in manufacturing output growth to just 1.3% was largely to blame, along with a slump in construction output, down by almost 1%. Service sector growth maintained the momentum, up 3.0% with strong growth in leisure and business services. Private service sector growth increased at a rate of 3.9%. The tale of two economies continues. Strong growth in output, jobs and inflation in the (private) service sector is at odds with slow growth in manufacturing and an inexplicable fall in construction output. Has this changed our outlook for the year? Not yet. We still expect the UK economy to grow by 2.9% this year, despite the apparent disappointing performance in the first three months. Some revision is possible in the construction data in the later estimates of GDP growth to follow this month. For the moment we do not expect to make any major revisions in the full forecast review out in May. We still expect growth of almost 3% for the year as a whole. Can we be so confident about the manufacturing forecasts? Well we were expecting growth of just 2.5% for the year as a whole, so not much is at risk. Markit/CIPS Purchasing Manager’s Index® (PMI ®) The latest Markit/CIPS survey data for April didn’t help over much. April saw a marked slowdown in the rate of UK manufacturing expansion. Output rose at the weakest pace since November last year. The seasonally adjusted Markit/CIPS Purchasing Manager’s Index ® posted 51.9 in April, below the March reading of 54.0 (originally 54.4). So what’s happening in manufacturing? Last week, we touched on car production. In the first three months of the year, UK car output fell by 0.6% compared to last year. Strange when you think European car sales were up by 8.6% in the first three months of the year and UK car sales were up by 6.8%. Car production is an international syndication process. The data suggests a model shift out of the UK into Europe perhaps. Fears of Brexit or Currency trends? We can’t be sure but something strange is going on. It’s not the march of the makers, that’s for sure! [Data from ACEA European Automobile Manufacturers Association and SMMT UK Society of Motor Manufacturers and Traders.] So what’s happening in the US? The first estimate of GDP in Q1 USA suggested a slow down in the economy. The US economy "all but stagnated" in the first three months of the year according to the BBC, growing at an annual rate of just 0.2%, official figures show. It was said. The Fed FOMC minutes released this week didn’t help. “Information received since the Federal Open Market Committee met in March suggests that economic growth slowed during the winter months and in the first quarter”. You have to wonder if anyone stops to check the data. The US process of taking the quarterly growth rate then annualising is totally misleading. Year on year, the US economy grew by 3% in the first quarter of the year compared to the first quarter of 2014. In 2014, the growth rate in Q4 and for the year as a whole was 2.4%. Far from “slowing down” growth is accelerating. Earnings and inflation are showing signs of a rally. Job growth is increasing, we expect growth of 3% this year. So what of rates? Markets still believe the Fed will begin to increase rates in Q3 this year. June no longer the favourite. Once the Fed makes a move, the MPC will surely follow. The inflation outlook will look completely different by the end of the year as oil and commodity prices rally. The recovery in the US and Europe will continue! Gilt yields are moving up. We could be leaving Planet ZIRP before Christmas …. Buckle up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.518 from $1.514 but moved down against the Euro to €1.353 from €1.397. The Euro rallied against the Dollar at €1.122 from €1.083. Oil Price Brent Crude closed at $66.07 from $64.94. The average price in April last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 no longer so far fetched. Markets, slipped below the magic marks. The Dow closed at 17,971 from 18,055 and the FTSE closed down at 6,988 from 7,071. UK Ten year gilt yields moved up to 1.81 from 1.69. US Treasury yields moved up, to 2.07 from 1.96. Gold slipped to $1,173 ($1,180). That’s all for this week. Don’t miss The Big Social Media Conference in July and The Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed