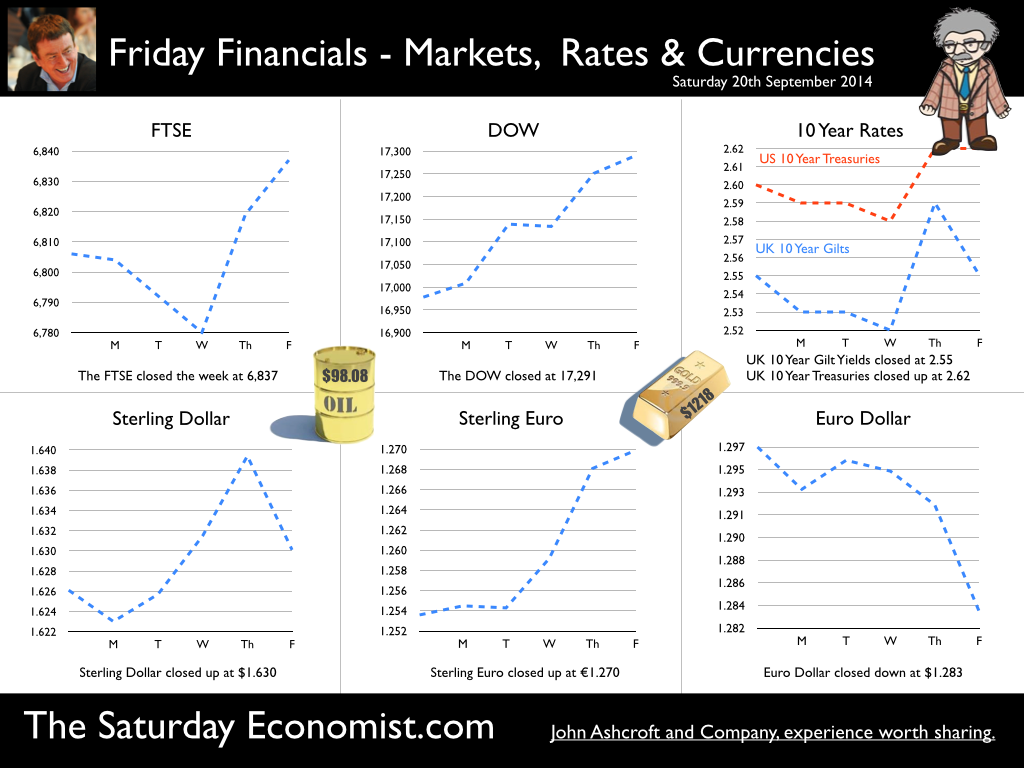

The UK economy grew by 3% in the third quarter as the strong growth experienced in the first half of the year continued. The results are in line with our latest forecasts and estimates produced by the Manchester Index™, the now-casting model from the GM Chamber of Commerce Quarterly Economic Survey. Service sector growth underpins the recovery in the economy with overall growth up by 3.3%. Business Services increased by 4.3% and leisure activity was also strong up by (3.8%). Distribution activity came in ahead of our latest forecasts with strong growth of 3.7%. So what of manufacturing and construction? Manufacturing growth was 3.4% and construction activity increased by a more modest 3%. An all round strong performance for the economy held back by the secular down trends in agriculture and extractives. Our forecasts for the year are unchanged. We expect growth of 3.1% for the year slowing to 2.8% in 2015. You can check out the full Quarterly Economics Outlook for the complete forecasts. Public Sector Borrowing Off Track … We think the UK economy grew by just over 5% (nominal) in the first half of the financial year. Revenues should track nominal growth. Hence, we would expect an improvement in borrowing given the strength of the recovery and some semblance of austerity. Six months into the year and borrowing remains off track compared to last year and to plan. In the first six months, total borrowing was £46.2 billion compared to £42.3 billion in 2013. In September, the latest month available, borrowing was £11.8 billion compared to £10.3 billion in the prior year. Last year’s figure has been revised down to £98 billion for the year as a whole. Good news but revenues will have to improve if this year’s OBR expectations are to be met. Spending is not really the problem. The squeeze on local government continues as departmental spending increased by a modest 1.6%. The paradox of thrift in recovery, continues as debt payments were up by 2.6% and social security payments increased by 3%. The real problem for the Chancellor is revenue … Central government receipts were down compared to last year, despite a strong rise in VAT (up 3.9%) and stamp duty (up 25%). Corporation tax revenues were healthy, up by over 5% but income tax revenues increased by just 0.1%. This is a real problem in an economy growing at over 5% in nominal terms, expanding jobs in the process. The low growth in earnings largely to blame perhaps but the paradox is at odds with basic economics. Compounding the embarrassment for Treasury, is the fall in interest and dividend receipts from the QE “Money for nothing, gilts for free” programme. Interest and dividends fell by £7.3 billion to just £9.1 billion as payments from the Bank to Treasury fell in the current financial year. Public sector net debt excluding financial interventions (PSND ex) was £1.45 trillion in September 2014, £100.7 billion or 7.5% higher than at the end of September 2013. That’s approximately 80% of GDP, still heading in the wrong direction. So what can we make of it all? The government is set to miss the OBR target for the current year, with borrowing overshooting the £100 billion mark in the year unless some dexterous accounting takes place. A serious embarrassment in the immediate run up to the election in either case. No Retail Boom … as the online squeeze continues … Retail sales volumes increased by just 2.7% in September as values increased by just 1.3%. Online sales were up by over 10% accounting for 11% of all activity continuing the squeeze on the conventional retail model. You can’t run a retail business without commenting on the weather. Warm weather in September appeared to hit clothing and footwear sales according to the ONS. “Too hot, too cold, too wet, too dry”, the retail mantra continues, perhaps the met office and not the ONS should handle the retail data. Average store prices in the month fell by 1.4% but with a large assist from petrol prices down by over 5%. Online food sales increased by over 13% year on year, compounding the footprint challenge for Tesco and other large store formats. Now accounting for 4% of all food sales, the problems set by online and multi channel will only increase in the food sector. After a strong start to the year with sales up 4% in the first six months, the third quarter retail has been disappointing. We have downgraded our forecasts for the rest of the year and into 2015 to just over 3%. Check out the Chart of the Day series … So what happened to sterling this week? Sterling moved up against the dollar at $1.630 from $1.609 and also moved up against the Euro at 1.270 from 1.260. The Euro closed up against the dollar at 1.283 (1.278). Oil Price Brent Crude closed up at $98.08 from $86.26. The average price in October last year was $109.08. The EIA forecast for Q4 average is $103 as we pointed out last week. Markets, moved up. The Dow closed at 17,291 from 16,352 and the FTSE closed up at 6,837 from 6,292. What a difference a week makes! 7000 FTSE for Christmas - back on! UK Ten year gilt yields move up to 2.55 from 2.15 and US Treasury yields closed at 2.62 from 2.18. Gold moved to $1,218 from $1,232. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

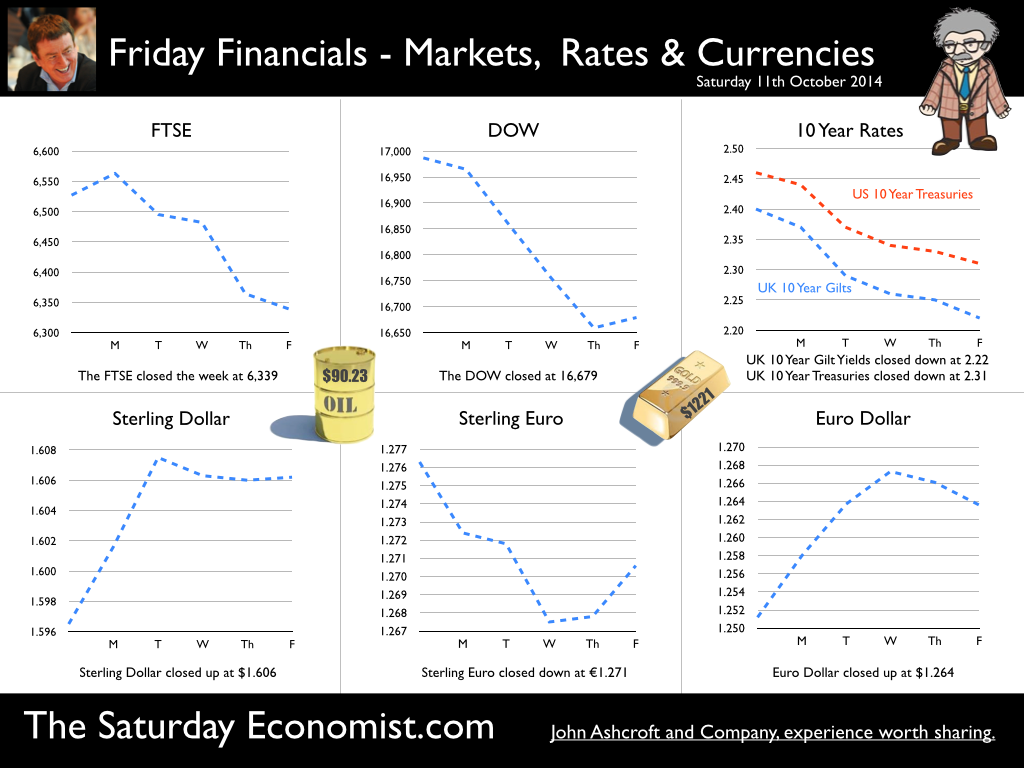

0 Comments

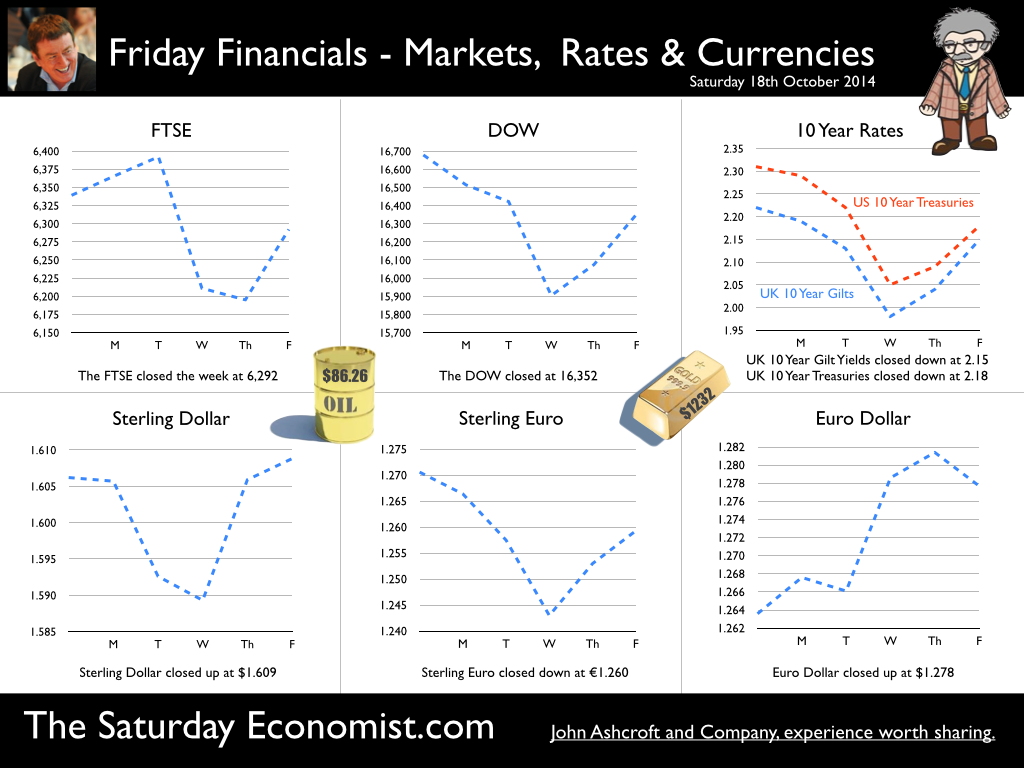

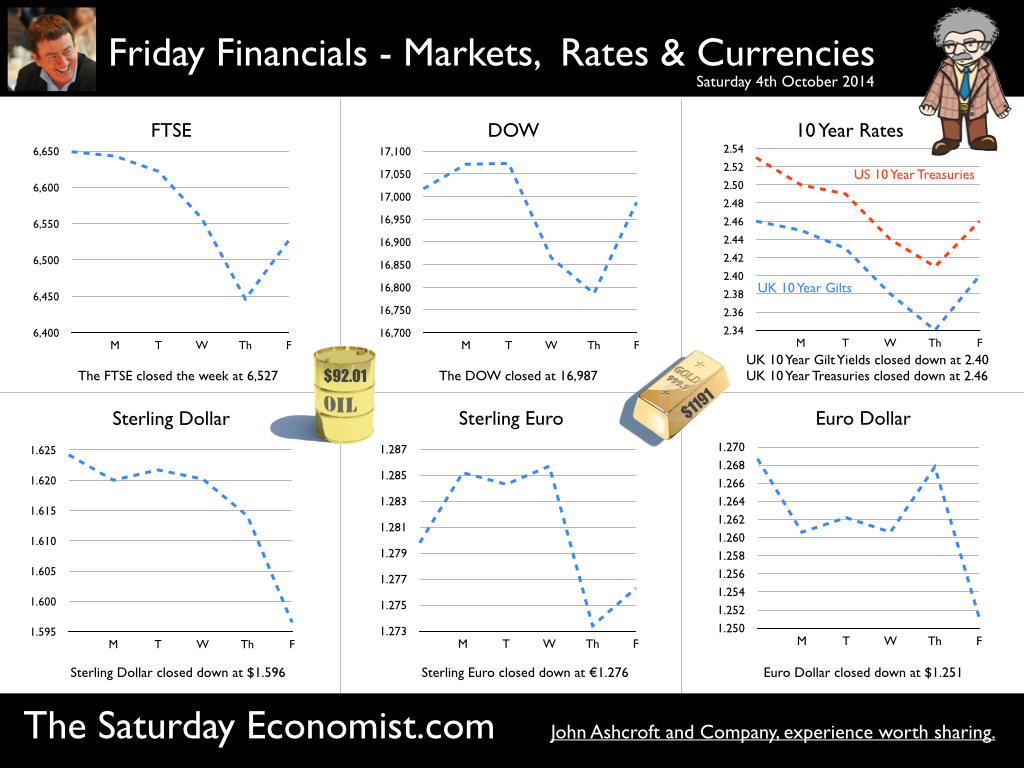

Planet ZIRP … It is a strange world on Planet ZIRP. Inflation is falling, employment is increasing, earnings remain low and the UK is set to grow by just over 3% this year. Interest rates are fixed at 50 basis points but Andrew Haldane, Chief Economist at the Bank of England, is “gloomier”. Interest rates could remain lower for longer, certainly longer than expected a few months ago. There is now real speculation, base rates will not rise until after the UK election and possible as late as Q4 2015. According to a speech in Kenilworth this week, worries include “the mark-down in global growth, heightened geo-political and financial risks and weak pipeline inflationary pressures from wages and commodity prices (including oil). In some ways the comments follow on from Fed statements in the US. A rate rise in the US is not expected until June 2015, with some speculation this could be postponed until the end of the year. We have always said, the MPC will be reluctant to move ahead the Fed. In some ways a dove was expected sing in Threadneedle Street any time soon. As it was the Chief Economist was nominated and Kenilworth was located. Why not! Oil Prices … Oil prices played the part this week testing $83 per barrel Brent Crude basis, before closing at $86.26. What is really going on? The EIA had not made any significant change to the short term demand outlook for oil in the October monthly review. If anything price conditions hardened slightly with Q4 prices expected to revert to $103 for the quarter and into 2015. Traders over reacted as the Saudis held nerve. The demand and supply fundamentals are unchanged. Markets felt the squeeze with the Dow relinquishing nine months gains in just a few weeks, before closing at 16,352. The FTSE closed at 6,292. Yes I know, we all thought 7,000 was a done deal all through the year but more patience is required! UK Inflation … The week had started well enough in the UK. Inflation CPI basis slowed to just 1.2% in September from 1.5% prior month. Goods inflation slowed to just 0.2% but service sector inflation was much higher at 2.0%. No real fears of deflation for the UK just yet. Manufacturing prices explain the inflation story in part, reflecting weak world prices. Manufacturing output prices were just 0.4% in September and the more volatile input costs were negative -7.4%. Crude oil and fuel were the big downward drivers. Food prices both manufactured and home produced were down by an average 10%. Don’t get too carried away with the retail price wars headlines. Inflation (or lack of it) is always and everywhere an international phenomenon at present. Food is no exception. UK Employment … The UK employment data confirmed we will be closing jobs centres by the end of 2017. The claimant count fell in September to 952,000, a rate of 2.8%. 400,000 have left the register over the past twelve months and the pace shows no signs of slowing. Within two years there will be no one looking to work! We may need more immigration not less! The wider LFS count fell below 2 million in August and a rate of just 6%. Vacancies increased and our U:V ratio fell to 1.41. That’s actually lower than the first quarter of 2007. The labour market is tightening, which makes the earnings data even more confusing. Earnings in August were up by just 0.8% in the month but manufacturing and construction earnings increased by almost 2% (3 month average). Earnings are compressed on Planet ZIRP but the pressure int he job market will force a return to norm at some stage. Problems in Germany .. Fears for Euroland and the German economy were prevalent this week. Euro inflation slowed to 0.3% in September and surprisingly weak output data in Germany in August caused great concern. Forecasts for growth in the largest Euro economy were officially downgraded. Berlin now expects growth of just 1.2% this year and the same in 2015, Slowing export growth the problem. Who would have thought that trade wars would hinder business! Quarterly Economics Review Q3 Our quarterly economic review for Q3 was released last week. We expect UK growth of 3.1% this year slowing to 2.8% next. The outlook for employment remains strong with the continuation of a subdued inflation outlook. We are more optimistic about investment. The trade figures will continue to disappoint and the current account deficit is cause for concern. So what happened to sterling this week? Sterling held against the dollar at $1.609 from $1.606 and down slightly against the Euro at 1.260 from 1.264. The Euro closed up against the dollar at 1.278 (1.264). Oil Price Brent Crude closed down at $86.26 from $90.23. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,352 from 16,679 and the FTSE closed down at 6,292 from 6,339. UK Ten year gilt yields move down to 2.15 from 2.31 and US Treasury yields closed at 2.18 from 2.31. Gold moved to $1,232 from $1,221. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Christine Lagarde head of the IMF set the mood for the markets this week. Global growth disappoints, the pace of recovery is uneven and we are all beginning to worry about the Germans, the IMF included. Lacklustre domestic demand, increasing tensions to the East and fears for the French are beginning to undermine the European and world recovery. The IMF expects world growth to be just 3.3% this year rising to 3.8% next. In our own quarterly economics outlook released this week, we are even more pessimistic. We expect the world economy to grow by 2.7% in 2014 and 3.2% in 2015. We expect the volume of world trade to increase by just 3.1% in 2014 and 3.5% in 2015. In some part this explains the slump in world trade and commodity prices. Inflation (or lack of it) is always and everywhere an international phenomenon. World trade prices fell by 1.0% in 2013 after falls of 2% in 2012. We expect world trade prices to increase by 0.5% in 2014 rising to 1.5% and 2.5% over the subsequent two years. It is a slow recovery. The Fed holds its nerve … In the West the Fed cheered markets with minutes of the FOMC meeting in September. Somewhere in the 26 pages of minutes, analysts found comfort in a belief the Fed would not be increasing rates anytime soon, despite the strong job creation in September. Fed forecasts for growth this year remain modest at just over 2% with the unemployment rate expected to fall below 6%. Markets still expect rates to rise in June but the spread on the Fed “blue dot” forecasts vary dramatically. The MPC votes to hold rates … No surprise on Thursday as the MPC decided to keep rates on hold. A rate rise this year is ruled out with odds increasing against a pre-election hike given the trauma in Europe and the Fed delay to the West. In the UK …Manufacturing In the UK, the data was mixed this week. Manufacturing output increased by almost 4% in August following growth of 3% in the first half of the year. The pattern of recovery is mixed. Automotive, Transport, Aerospace, Marine, Engineering and Capital Investment Goods continue to drive growth in the sector. Food drink and utilities offer stability but too many sectors including chemicals, pharmaceuticals and building products remain shocked and await recovery. For others, including textiles and tobacco evidence of long term decline persists. Check out our Ten Slides to Understand Recovery in the UK Manufacturing Sector for more detail. Construction ... Construction output slumped in August according to the news headlines. Actually, growth year on year was down by just 0.3%. Don’t fire the “brickies” just yet. We still expect growth of over 5% this year. The ONS monthly data is remarkably volatile, subject to revision and at odds with wider survey data. Trade Figures August ... The trade figures improved in August. There was a deficit of £9.1 billion on goods partly offset by a surplus of £7.2 billion on services. The trade in goods deficit narrowed by £1.3 billion compared with July 2014. The main factor was not an increase in exports but a large fall in imports from non-EU countries. We suspect someone failed to take delivery of a luxury yacht in the month, maintaining for some, hopes of re-balancing. Our overall forecasts for the year unchanged. We continue to warn of the twin deficit dilemma and the 5% deficit on current account. Quarterly Economics Review Q3 Our quarterly economic review for Q3 was released this week. We still expect growth of 3.1% this year slowing to 2.8% next. The outlook for employment remains strong in contrast to a subdued inflation outlook. Worth a read you can download the full review here. So what happened to sterling this week? Sterling slipped against the dollar to $1.606 from $1.696 and down against the Euro at 1.264 from 1.276. The Euro closed up against the dollar at 1.264 (1.251). Oil Price Brent Crude closed down at $90.23 from $92.01. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,679 from 16,987 and the FTSE closed down at 6,339 from 6,527. UK Ten year gilt yields moved down to 2.31 from 2.40 and US Treasury yields closed at 2.31 from 2.46. Gold moved sideways back to $1,221 from $1,191. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*  In the US this week, more evidence of the strong recovery emerged with the news of 248,000 jobs created in September. The unemployment rate fell to 5.9%, moving closer to the Fed long run target range 5.2% - 5.5%. 2014 will be the strongest year for US job growth since the late 1990s, raising the spectre of an early Fed funds rate rise in the first quarter of 2015. The Dow and Dollar soared on the news, the Dow testing the 17,000 level and the Dollar moving to €1.25 against the Euro. In Europe the dismal news continued. France is finished according to Andy Street the Managing Director of John Lewis. “Sclerotic, hopeless and downbeat, anyone with investments in France should get out now”. “La France c’est foutu” the reassuring comment from Manuel Valls the incoming French prime minister. According to the ECB “Survey data available to September confirm the weakening in the euro area’s growth momentum”. Growth forecasts in the French economy have been revised down for the year to just 0.5% compared to 0.9% for Euroland as a whole. Fears of deflation persist with the latest HICP data for September recorded at just 0.3%. [According to the Eurostat flash estimate, euro area annual HICP inflation was 0.3% in September 2014, after 0.4% in August.] In the UK … The much awaited revision to the GDP data for Q2 generated few surprises. Growth in the second quarter was 3.2% following growth of 2.9% in Q1. Our forecasts for the year are unchanged. The economy remains on track for growth of just over 3% this year slowing to 2.8% next. Particularly marked was the surge in investment spending. Following revisions to the methodology, investment spending increased by 10% in the first half of the year. The new data set included drug dealing and prostitution for the first time. The UK is spending more on drugs and prostitution than on fresh fish and tools for the garden shed! Just a few of the many facts revealed in out Chart of the Day release. The latest PMI Markit survey data provided evidence of growth moderation in Q3. The manufacturing index hit a 17 month low as the index fell to 51.6 from 52.2 in September. Still in growth but at a lower rate. In construction, the index moved higher to 64.2 in September, the sharpest expansion in output for eight months. In the services sector, strong growth continues, despite a drop in the index from 60.5 to 58.7. Overall we expect growth in the third quarter to slow to around 3.0% based on our short run forecasting model and the latest reading from the Manchester Index.™ Warning Flags … the twin deficit dilemma ... We now post two warning flags about the UK economy. In the first half of 2014, the current account deficit averaged 5% of GDP. We have long forecast a trade in goods deficit offset in part by a trade in services surplus. The overall “trade” deficit at around 2% of GDP reflects a structural problem for the UK, exacerbated by a higher rate of growth in domestic demand relative to world trade growth. Of itself the dimensions of deficit do not pose a threat to recovery. The external deficit … The larger current account deficit is quite another matter. Since 2013, the UK has experienced a significant collapse in overseas investment income. The reasons for which are not entirely clear as yet. The situation may reverse in due course, if European growth rallies and or sterling depreciates for example but we cannot be sure. The overall deficit on current account at 5% of GDP has been hit on previous occasions in the UK. In 1974 and in 1989. Interest rates were closer to 15% than 0.5% as rates were hiked to curb domestic demand and inflation and to offer some support to capital flows. The internal deficit … Latest government borrowing figures reveal the government is borrowing more this financial year than last. Concerning, given growth of 3% plus. The basic problem is receipts rather than spending. VAT and stamp duty revenues are up but income tax and corporation tax receipts are lagging. Last year’s receipts in the first six months of the year were flattered by the “money for nothing, gilts for free” benefits of QE. APF dividend revenues were £12 billion in the first five months of the year falling to £4 billion in the current year. The Chancellor is not reaping a “growth dividend” as the economy expands. The twin deficit dilemma … As a result, government borrowing in the current financial year will be around £95 billion. The internal deficit (PSNBR) is over 5% of GDP, the external deficit (Current Account) is of a similar dimension. The imbalance is manifest. We have been here before, but the MPC has not. Weaker sterling and higher UK base rates have always been the result … So what happened to sterling this week? Sterling slipped against the dollar to $1.696 from $1.624 and down against the Euro at 1.276 from 1.280. The Euro closed against the dollar at 1.251 (1.269). Oil Price Brent Crude closed down at $92.01 from $96.83. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,987 from 17,017 and the FTSE closed down at 6,527 from 6,649. UK Ten year gilt yields move up to 2.40 from 2.46 and US Treasury yields closed at 2.46 from 2.53. Gold moved sideways at $1,191 from $1,221. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed