|

Boris Johnson made it into Number 10. Tory votes were cast two to one at the expense of Jeremy Hunt. The promise to "love bomb" opponents and detractors was cast aside. A cabinet purge ensued. Macmillan's night of the long knives was made to look like a rearrangement of the cutlery draw. Seventeen cabinet members were removed from office as the transition team moved into action.

Sajid Javid, became Chancellor of the Exchequer, Priti Patel moved into the home office, Liz Truss, became secretary of international trade, Andrea Leadsom is down for business, Dominic Raab moved into the Foreign Office, where big maps on the wall will explain the importance of Calais and Dover. Jacob Rees-Mogg became head boy and leader of the house. The guardian of Victorian values immediately issued a staff guide for internal missives. Matters of state to one side, there must be a double space after a full stop, no comma after "and", and no full stop after Miss or Ms. Banned words include "unacceptable", "disappointment", "lot" and "got". Banned phrases include "no longer fit for purpose". Why would that be? Imperial measures are to be preferred, monetary measures must include the sixpence and for the avoidance of doubt there are three asterisks in "f*** that". Boris Johnson announced the search for the British Mojo will be assisted by an additional 20,000 police officers on the street. Stop and search will be escalated to provide more knives for cabinet sessions, plus there is always the chance someone somewhere may be hiding that missing mojo in a hoodie. More money for the North, a train set for the Leeds Manchester link. Austerity is over. The quest to stay in office begins. Johnson made progress with Brexit, the Irish backstop must be removed before talks can resume. So yes we are off. It promises to be very exciting. The Queen was mystified. "I can't believe anyone would want the job", Boris revealed in a breach of palace protocol. "I can't believe I got the job", the probable reply. Not to worry, it could all be over by Christmas ... U.S. Economy slows ... Latest data from the Bureau of Economic Analysis, suggests growth in the US economy slowed in the second quarter. Growth was just 2.3% in Q2 compared to 2.7% in the first three months of the year. Problems with trade and investment largely to blame ... the White House dream of 3% growth this year is dashed. Most estimates now assume growth will be around 2.5% for the year as a whole. Given the tax cuts and spending plans in process, the achievement is a grave disappointment. Trump believes the Fed is to blame, with over an aggressive monetary policy the problem. "Q2 GDP Up Not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck. Almost no inflation. USA is set to Zoom!" Trump Tweeted. Consumer spending increased by 2.6% in the quarter compared to 2.5% in the first three months. Fixed investment growth slowed to 3.5%, exports increased by just 0.4%, as import growth continued at 3.2%.The US economy is slowing, Trump trade policy partly to blame. The Fed is set to cut rates by 25 basis points as ten year gilt yields move towards the 2% level. Congress and the White House agreed an extension of the debt ceiling this week. The $22 trillion limit has been extended beyond the 2020 election date. An increase in spending and a limit of proposed cuts will ensue. The US budget deficit is set to exceed 4% of GDP over the next two years, the dollar deficit heading for $1 trillion as the trade deficit continues to grow. U.S. ten year bond yields closed at 2.07% this week. The yield of ten year Greek bonds closed at 2.07% The Trump administration decided this week, not to engage in currency manipulation to undermine the strength of the dollar. White House hard line trade adviser Peter Navarro presented President Donald Trump on Tuesday with ideas on how to devalue the United States dollar to gain an upper hand in the trade fight with China. The president, who has regularly accused other countries of unfairly devaluing their own currencies, quickly shut him down and dismissed the proposals, this time ... Hasbro leaving China ... Hasbro announced this week, the company is relocating manufacturing facilities away from China. Vietnam and India are becoming the preferred destinations. Production on the mainland will account for just 50% of total production by the end of 2020. Trade wars are damaging the prospects for world trade the IMF has warned again this week. Growth in China may slow to just 6% for the year as a whole as exports and investment are hit. Nevertheless, no trade deal is expected until after the U.S elections. Trump may be forced to feel the pain before the voting round. The economic cycle is not moving in favor of the President. China is in no rush to make the deal with the U.S.A. Trade for China will pivot further to the Asean group of countries over the medium term. The Regional Economic Comprehensive partnership will include 26 nations across the region including India, Japan, South Korea, Australia and New Zealand. Trade with the Asean group increased by 4% in the first six months of 2019. The largest trading blocks of the future will be Asean, European and North American, in that order ... Trump's trade policy no longer fit for purpose but then it never was ... That's all for this week, have a great weekend. We will be back with more news and updates next week!

0 Comments

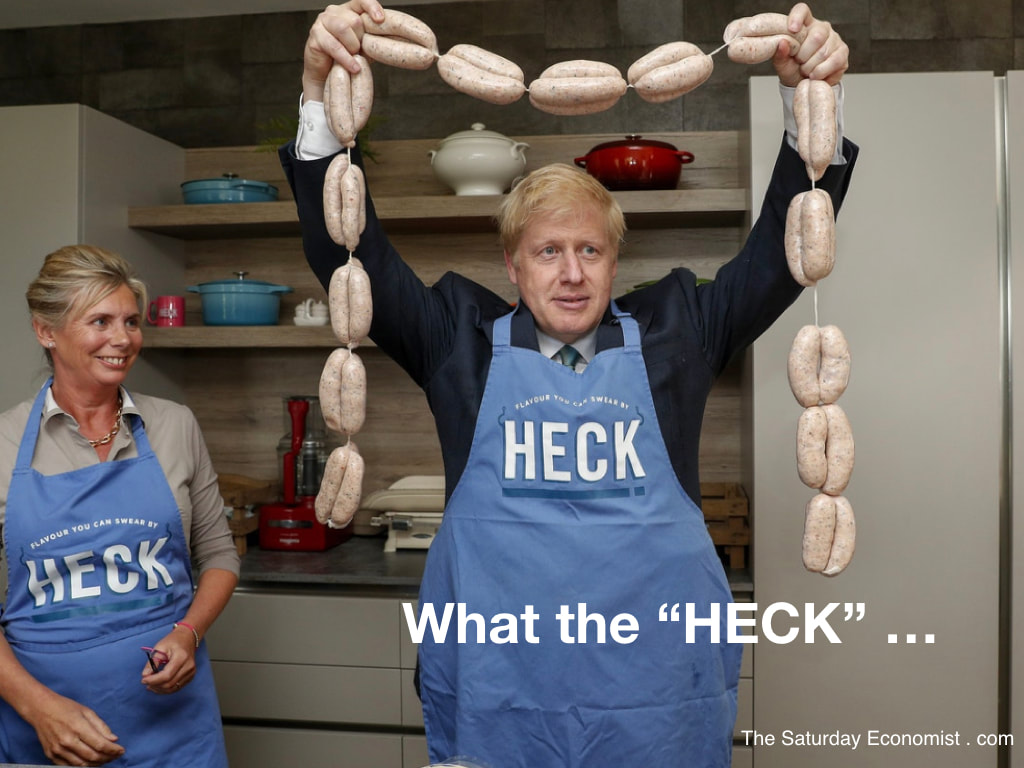

How do you like your PMs cured ...

Not long to wait ... the next Prime Minister of Great Britain will be in office on Wednesday. Boris Johnson is odds on favorite to win the Tory vote. This man will accept the poisoned chalice, to get Britain out of the EU. Such are the twists and fortunes of the Brexit challenge, Boris could be out of office by the end of October, if things go badly. The task is urgent. Another horrific tale of Brussels bureaucracy was revealed this week. Vacuum packed kippers sent through the post, must be accompanied by a plastic ice pillow, Boris revealed. Producers in the Isle of Man, are furious at the extra costs involved, a result of another useless layer of EU red tape. Leaving the EU would allow the UK to end this "damaging regulatory overkill". Putting kippers back onto a fair cost, eco-friendly platform, a key item in the Johnson agenda. "Pointless,expensive, environmentally damaging health and safety. When we come out we will be able to end this damaging regulatory overkill and do things to boost Britain's economy. We will be able to establish an identity as a truly global Britain and get our mojo back." Johnson explained. Are yes our mojo, that "Magic charm, our talisman, the object, an inscribed ring or stone, thought to have magic powers and to bring good luck." Boris as Prime Minister, will be on a quest for the holy grail of challenges, the search for the missing British mojo. A challenge akin to extracting the "Tory sword of Damocles from King Arthur's stone" begins with taking the plastic pillow from beneath the head of a smoked herring. It shouldn't be too difficult. The Isle of Man is not part of the EU and "the case described by Mr Johnson falls outside the scope of EU legislation, it is purely a national competence" explained Anca Paduraru, a European Commission food safety spokesperson. A yes national competence ... never in doubt ... we can send the pillow packing, packing in or out of the EU ... Retail Sales Rally in June ... More good news on the economy this week. Retail sales bounced back in July. Sales volumes increased by 4% in volume and value in the month. The number of people unemployed fell again in the latest data to just under 1.3 million, the unemployment rate held at 3.8%. Earnings are on the rise. Growth in average weekly earnings increased to 3.4% for total pay (including bonuses) and 3.6% for regular pay (excluding bonuses). In real terms (after adjusting for inflation), total pay is estimated to have increased by 1.4% compared with a year earlier. Regular pay is estimated to have increased by 1.7%. The growth in real earnings is expected to be maintained. The latest inflation data CPI based suggested the headline rate of 2% in May was maintained in June. Underlying inflationary pressures are weak. Manufacturing prices (output based) were up by just 1.6% in the month, input costs were negative, assisted by the weakness in oil prices. The blot on the landscape for the UK economy appeared late in the week. The borrowing figures for June revealed an increase in borrowing of £7.2 billion compared to £3.4 billion prior year. For the three months of the new fiscal year, borrowing was up by £4.5 billion to just under £18 billion. An increase in government spending largely to blame, the prospects for the year will not be enhanced by the announcement of public sector pay increases ahead of inflation. The government target of £30 billion borrowing in the current financial year is now at risk. Phillip Hammond has already warned there is little or no money to fund the Johnson tax promises. This week the OBR warned a no deal Brexit would lead to recession and an increase in borrowing of over £30 billion by 20/21. The search for the lost Mojo, may well be hampered by lack of funds. The new administration faces daunting challenges to achieve a Brexit exit by the 31st of October. It is an impossible task. A snap election no way to gamble the Number Ten dream. For the moment the prime task is to become prime minister. Once overnight in Downing Street, time then to reveal the strategy of "one bed, many dreams" ... Market Watch ... Sterling on the rack this week, the Pound closed below $1.25 against the dollar having tested $1.24 in the process. The prospect of a no deal Brexit spooked markets, the threat of a snap election will not help. In the U.S. the Fed is expected to cut rates by 25 basis points next week despite strong jobs growth and consumer spending data. Markets were confused by the speech from New York Fed President John Williams suggesting the Fed raised rates ahead of the curve. Williams suggested "more aggressive and preemptive action is warranted when the economy is weakening". Markets began to price in a higher rate cut. The New York Federal Reserve issued a rare clarification. The speech was not intended as a market signal, more an outline of twenty years academic research. Markets closed lower. "We have not seen anything like this before and we are not sure what they are thinking" said Neil Dutta, head of economics at Renaissance Macro research. It was left to the President to explain the process. "Because of the faulty thought process at the Federal Reserve, we pay much higher rates, our interest costs are much higher than other countries, when they should be lower. We must stop with the crazy quantitative easing. We are winning big, it is no thanks to the Federal Reserve" Jerome Powell, lock him up, or send him back ... drain that swamp, take back control, Taylor rules OK ... That's all for this week, have a great weekend. We will be back with more news and updates next week! Sleep is the answer ...

The government is set to offer official guidance on how many hours citizens of the U.K. should sleep every night. The suggested guide lines will vary according to age and the degree to which voters have confidence in the incoming Johnson administration. In the event of a no deal Brexit, the guidelines will not apply to Brits living abroad or Remain voters. Matt Hancock, the health secretary is thought to be working with the Alexa app, to ensure the strict guidelines are followed in bedrooms around the country. Macbeth described sleep as the "chief nourisher in life's feast" according to the Times today. Famously, Margaret Thatcher survived on just four hours sleep.Trump digests just three hours sleep and a packet of Provigil allegedly. Steve Brine, a former public health minister, explained, working in government, "we are all familiar with the notion of being tired and grouchy", lack of sleep just one of many reasons. Matt Hancock is the man for the challenge. A man of conviction, Hancock was the first to jump his own ship and join the Boris bandwagon. Hancock's planned introduction of a sugar tax on sodas and milk shakes, hit a sour note this week. Boris Johnson, declared he was opposed to the extension of any action to extend the levy. The contradiction in policy may generate sleepless nights in cabinet for the health secretary. A man of conviction, Boris Johnson reaffirmed his commitment to leave the EU on the 31st October. Prerorgation of Parliament, sequestration of the Queen, a front with Farage, all steps will be taken to ensure Johnson secures election in the current Tory voting round. Jeremy Hunt on the other hand, thinks Brexit will all be over by Christmas. Boris, the historian is well aware, difficulties in Europe tend to take much longer ... Back to work in May ... Good news on the economy this week. The car industry went back to work in May. The Brexit shutdown, over for the moment, business went back into action. Let's not get too excited. Manufacturing output in the month was flat compared to prior year. This marked a recovery from the one percent drop prior month. In the second quarter of the year, we expect a modest fall in manufacturing output compared to prior year. Construction output is likely to expand by 2.3% in the quarter compared to a 3% plus rise in Q1. Service sector growth is expected to rise by just under 2% in the current three months. The data suggests growth could be around 1.4% in the second quarter. A slow down perhaps but still consistent with growth for the year overall of 1.4%. The trade deficit continues to be a problem for the UK economy. The trade deficit in goods was around £12 billion in May. £36 billion is the likely deficit for the quarter. This would be a significant reduction from the £47 billion recorded in the first quarter of the year when stock building ahead of the March 31st deadline, accelerated the shortfall. For the year as a whole we expect a deficit of over £150 billion. Leaving the EU without a deal, will compound the problem. Boris and Brexit is becoming the major concern for voters and business. Survey data suggests investment and hiring decisions are being postponed ahead of the hurdle date in the Autumn. Trump and Tariffs, Boris and Brexit, the challenges loom large for business in the UK and around the world ... Trump will get his rate cut ... Jerome Powell, chair of the Federal reserve gave the clearest indication yet, base rates will be cut later this month. Trump will have his way in the development of monetary policy. In a statement before Congress this week, Powell explained ... “Since June, uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook." James Bullard, president of the St. Louis Fed, a dove, said, “Sitting here today I would argue for a 25 basis point cut at the next meeting,” Bullard wanted to see a cut in June but lost that fight. “I put 50 basis points worth of reductions by the end of the year. So that would mean this cut plus another one at some point later in the year.” Powell made clear the independence of the Fed from political interference is of paramount importance. Despite intense criticism from the President, the chair made it clear he had no intention of resigning. Markets reacted with a strong Wall Street rally. The S&P, Dow and NASDAQ pushed to new highs. The Fed remit to nurture markets continues. Powell explained, “Our baseline outlook is for economic growth to remain solid, labor markets to stay strong and inflation to move back up over time to the 2 per cent objective". The Fed is moving ahead of the curve. The twin deficits will emerge as the major problem for the U.S economy in the medium term. At that stage the need for rate hikes will become more urgent. No need to squander ammunition now. The Fed believes downside risks to the economy have “increased significantly”. Latest forecasts suggest growth in the USA will slow to 2.5% this year, from over 3% in the first quarter of the year. Trump and tariffs the major concern. The White House may blame the Fed for the slow down. The Oval Office alone is witness to the major culprit. That's all for this week, have a great weekend. We will be back with more news and updates next week! John It's the Boris sausage machine for sure ...

Hang on to your apron strings ... Boris Johnson is set walk into Number Ten as the next Prime Minister of Great Britain. Johnson is set for a landslide victory according to the latest poll numbers. He is backed by 74% of Tory voters. Jeremy Hunt, is supported by just 26% according to a YouGov/Times poll. Significantly, 90% of believe Boris Johnson will force through a no-deal Brexit. Just 27% think My Hunt would push through the no deal resolution. "Boris and Brexit" is emerging as the second greatest threat to the world economy. We have "Trump and Tariffs" in top spot despite the sound bites and photo ops emerging from the President's visit to the East last week. The race to find a personality for Hunt just ran out of time, despite the substantial resources committed to the project. The candidate declared last week, he was "happy" for people to hunt foxes with horse and hound. The Hunt campaign position on cock fighting, bear baiting and bare knuckle fighting was not revealed. What is it about the Tories and fox hunting? You may recall Theresa May decided to include a review in the Tory manifesto in 2017. Hardly a vote winner, the Hunt campaign team appear to have forgotten completely the irrelevance of this anachronistic pastime, to the majority of voters. Boris Johnson is on a winning rampage. So proud to have a sausage named after him this week, the "Boris sausage" man has put his weight behind plans to erect an enormous sausage overlooking the AI(M). It could dwarf the angel of the North, it is said. It would be a firm, long lasting, commitment to the Northern Powerhouse at least. The New Prime Minister, promises to make Great Britain Great again, unify the country and deliver a no deal Brexit. In office on the 22nd of this month, the one hundred day honeymoon, would continue until the 30th of October. Just one day, then remaining to deliver the deal, well good luck with all that ... Not being taken for suckers ... Trump declared in Osaka last week, the US is not "being taken for suckers anymore", a great transition since he entered the Oval Office as president. Not being taken for suckers? The world is perplexed by the mixed messages from inside the Oval Office. This week, the President enjoyed his military parade. The 4th July celebrations, were high jacked by the White House. The Trump speech included a reference to the great success of the American soldier in the revolutionary wars of 1775 to 1783. A success most heroic augmented by the President's claim "Our army, manned the air, it rammed the ramparts, it took over the airports, it did everything it had to do." Yeah like taking over airports, flying planes, great planes and things ... history never a strong point for the 45th President of the United States. Trump and Tariffs, trade wars are weighing on the world economy. Mark Carney Governor of the Bank of England warned this week, trade tensions triggered by Donald Trump’s tariff policies could “shipwreck” the global economy. "They are having a chilling effect on growth." World leaders are confused. Kim Jong-un received an invitation to the White House last week. This week the North Korean leader warned the U.S. is hell bent on hostile acts. How else to explain the invitation to the White House coinciding with the call to the U.N to implement tougher sanctions on Pyongyang. China made the position clear this week, the U.S. must remove all the tariffs placed on Chinese goods as a condition for reaching a trade deal. “If the two sides are to reach a deal, all imposed tariffs must be removed,” Ministry of Commerce Spokesman Gao Feng said on Thursday. “China’s attitude is clear and consistent.” Korea, China in confusion, Trump turned on Vietnam. The President expressed displeasure when asked about unfair trading practices, calling Vietnam “almost the single worst abuser of everybody.” The U.S. Commerce Department imposed duties of more than 400% on steel imports from the South East Asian country in response. The Trump administration took a shot at Scotch whiskey in the latest trade spat with the E.U. A $4 billion catalogue of European goods is now threatened with tariffs on products including Scotch whisky and Edam cheese. The latest world trade data confirms volume growth has stalled in the first quarter of 2019 compared to a 3.4% growth last year. The slowdown became evident through the year as manufacturing growth slowed around the word. Trump and Tariffs, Boris and Brexit, the two biggest threats to world growth. Lessons from history, so true, self imposed injuries are always the worst ... E.U. open for business ... Job growth in the U.S. this week confirmed the economy will continue to enjoy the ten year plus period of economic expansion. The trade deficit increased in May, despite the imposition of tariffs. The President continued his assault on the Federal Reserve."If we had a Fed that would lower interest rates, we would be like a rocket ship". A rocket ship overheating and heading for a crash. The President's grasp of macro economics is as well grounded as his grasp of aeronautical history. The European Union on the other hand has decided to just "get on with it". While the Trump administration walks away from trade deals and throws up ever more barriers to free trade, the rest of the world is racing headlong to deepen globalization, according to Foreign Policy magazine. U.S. consumers are paying higher prices at home, and U.S. producers are facing greater obstacles for their exports. “We reinforce multilateral agreements whilst others rip them up,” EU Trade Commissioner Cecilia Malmstrom said on Twitter Wednesday. After 20 years, the EU and four Latin American countries making up the Mercosur customs union finally completed a sweeping trade deal covering almost $100 billion worth of bilateral trade a year. Days later, as the Trump administration sanctioned Vietnam, the EU and Vietnam announced a new free trade deal. The Mercosur countries of Argentina, Brazil, Bolivia and Paraguay, together with the EU, are set to become the world's biggest trade bloc by the end of the year, dwarfing the free trade area between, the E.U and Japan. China will look to Europe as a great trading partner. The world is not dependent on the U.S. The period of adjustment may be a little painful in the short term. The E.U. has an ambitious free trade agenda. The U.K would benefit from a Brexit deal which includes membership of the single market and the customs union ... no need then for the Northern Ireland back stop ... The UK needs more than a free trade deal with the Faroe Islands ... That's all for this week, have a great weekend. We will be back with more news and updates next week! John |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed