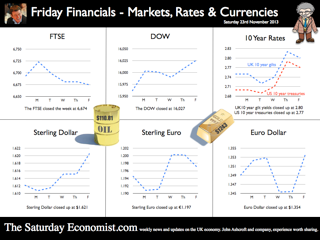

The release of the second estimate of GDP in the 3rd quarter brought few surprises. Growth was confirmed at 1.7% year on year following growth of 1.4% in the second quarter. Service sector output continues to drive the recovery with particularly strong growth in the leisure sector. Construction output increased by 4% with manufacturing growth relatively flat in the latest three month period. In current value spending terms the economy grew by 3.8% as incomes of employees and businesses continued to show strong growth. Expenditure within the economy was driven by household spending up by 2.4% in real terms plus a build up in inventories. Government spending was up by just 1.1%, investment fell slightly and the trade figures continue to disappoint. Exports fell and imports increased as UK domestic demand exceeded the rate of growth in Europe and the USA. So what does this all mean? We expect strong growth to continue into the final quarter with overall growth around 2.4% bringing the year on year growth rate to 1.3%. We still think the economy is on track for growth of around 2.4% in 2014. Check out our latest publication “Modeling GDP(O)”. We release the forecasts of the ten key sectors and sub sectors in the UK economy over the next two years. Should we too worried by the lack of investment? Not really. At this stage in the cycle we would expect investment to be weak. Plant and machinery accounts for just 20%, of total investment. Spending on commercial real estate will continue to be subdued for some time yet as the overhang continues. We expect strong growth in productive capacity in the final quarter of the year and into next year. The four year capital stock model is down by just 15% from the peaks of 2008. No need to worry about “lost output” for the years ahead, trend rate of growth can be recovered and maintained. Investment will receive a significant boost in the final three months of the year and into next. Our UK investment model will be released next week. Prospects for the UK look good, but without a strong recovery in Europe and sustained growth in the USA, the trade figures will continue to be a net drain on overall performance. This should be no surprise to regular readers! The trade deficit in goods will increase largely (but not entirely) offset by a strong performance in service sector exports. Is this the wrong kind of growth? The UK economy has been dependent on domestic consumption since our records began. Growth based on investment and exports a policy dreamboat. There will be no rebalancing of the economy just more of the same to come. Bank moves on mortage lending Which is perhaps why the Bank of England modified the terms of FLS away from mortgage lending towards business loans. The old lady is no fan of the help to buy votes scheme. The Governor has made it clear the Bank of England will move to prevent another housing boom. The policy response includes several options this time around including post code selective spread and capital provisions to curb excessive movements in house prices if necessary. What happened to sterling? The pound closed up at £1.6360 from £1.6215. Against the Euro, Sterling closed at €1.2045 from €1.1966. The dollar moved down up the yen closing at ¥102.4 from ¥101.3 and closing at 1.3582 from 1.3555 against the Euro. Sterling is on a rally which has led to a break out above £1.60, pushing through resistance at €1.20 euro basis. Oil Price Brent Crude closed at $109.65 from $111.05. The average price in November last year was almost $110. The average price just $106 this year. Markets, US pushed higher - The Dow closed at 16,086 up from 16,065. The FTSE closed at 6,650 from 6,674. 7,000 FTSE still the call before Christmas. UK Ten year gilt yields closed at 2.78 from 2.79 US Treasury yields closed at 2.75 from 2.74. Yields will test the 3% level over the coming months but this may await the New Year. Gold closed at $1,252 from $1,244. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist, #TheSaturdayEconomist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

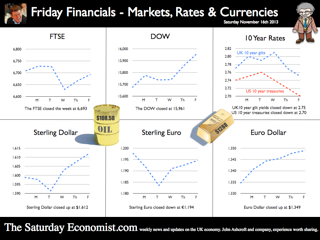

Economics news – no Flowers by arrangement ... Treasury Enquiry ... The Treasury has ordered an independent investigation into events at the Co-op Bank including the circumstances surrounding the appointment and governance of Paul Flowers. The former Chairman of the Bank was arrested on Thursday night, days after he was filmed handing over money for cocaine and exotic substance. Mr Flowers issued a statement apologising for doing some “stupid things” claiming, it had been a difficult year. Unfortunately, for lots of loyal workers and stakeholders at the Co-op bank the difficult years will roll on for some time yet. The Treasury enquiry will be led by an independent person appointed by the PRA and the FCA which of course replaced the FSA (which allowed the Flowers appointment in the first place). How the process of “Regulatory Scrabble” moves forward. The enquiry should ask what system considered Bob Diamond so unacceptable as a career banker, yet allowed Flowers to flourish when clearly out of his depth both managerially and professionally. Answers on a PRA, FCA postcard please. Borrowing Back to the economics, more good news for the Chancellor this week as the borrowing figures fell to £8.0 billion from £8.5 billion in October. The underlying data is much stronger than top line figures suggest. Expenditure year to date is up by just 2% but revenues have increased by almost 8%. Income tax and VAT revenues are increasing by over 5% as the recovery gathers momentum. Total borrowing at £115 billion last year will fall towards £100 billion in the current year. CBI and the March of the Makers The CBI survey reported a strong rise in output in the manufacturing sector in the latest survey data released this week. Growth in the manufacturing sector was the strongest for 18 years. Both the size of order books and the pace of output were the highest recorded since 1995. In other news, the SMMT reported a 17% increase in car manufacturing for the month of October. Output for domestic sales increased by over 50%. Don’t get too excited, year to date output growth is up by just over 5%. So what does this all mean? We expect a strong rally in manufacturing output in the final quarter of the year around 2.5% continuing into 2014. Borrowing figures for the year will be much better than expected. The median forecast of the HM Treasury panel is now just £100 billion for the current financial year, falling below £90 billion next year. Growth up, unemployment down, inflation down, borrowing down, only the trade figures will continue to disappoint the coalition platform as the election looms. What happened to sterling? The pound closed up at £1.6215 from £1.6113. Against the Euro, Sterling closed at €1.1966 from €1.1940. The dollar moved up against the yen closing at ¥101.3 from ¥100.1 and closing at 1.3555 from 1.3494 against the Euro. Oil Price Brent Crude closed at $111.05 from $108.50. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, US pushed higher - The Dow closed at 16,065 up from 15,962. The FTSE closed at 6,674 from 6,693. 7,000 FTSE still the call before Christmas. UK Ten year gilt yields closed at 2.79 from 2.75 US Treasury yields closed at 2.74 from 2.70. Yields will test the 3% level over the coming months. Gold closed at $1,244 from $1,288. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – you don’t have to be an optimist to see the glass is half full .. Yes it's the Inflation Report “You don’t have to be an optimist to see the glass is half full”, the opening remarks from Governor Carney’s Inflation Report presentation this week. The Governor went on to say, “the glass is half full and it will be filled”. A clear reference the recovery will be allowed to gain momentum before the Bank of England and the MPC will intervene “to take away the punch bowl” and begin the rise in base rates. The MPC are sticking with forward guidance. Rate rises will not even be considered until the level of unemployment hits 7% or even lower. [Subject to caveats on inflation expectations and market stability]. When will this be? In August the Bank assumed this would be in 2016 at the earliest. On Wednesday, the Governor admitted there was a 40% chance this could be by the end of 2014 with a 60% chance it would be by the end of 2015. Such has been the strength of the economics data over the last three months. Our own models assume the knock out unemployment rate will be hit by the third quarter of 2015. Thereafter rates may rise by around 50 basis points in short time. For the moment, the MPC are on a learning journey. The path of productivity, earnings, job creation and unemployment so unclear, we are all embarking on a “learning journey” suggested the governor. The £5m recently spent on the Bank of England model, of little value in the new world it would appear. Charlie Bean appeared most discomfited by the trip. Economics from Cambridge, a PhD from MIT and teaching at Stanford and LSE in the knowledge pack. One could be forgiven the reluctance to take the Mark Carney refresher course. But then why not? Having seriously failed to understand the impact of low rates on investment and depreciation on the trade balance, it is time to denounce the omniscient stance of the Oxbridge collective. Yes send them back to school. Martin Weale was indeed sent back to school this week. The MPC member was delivering a speech on the role of monetary policy and forward guidance to A-level students in London. “To cut a long story short, our job is to ensure that people buy coats when they need them”. Excellent. I am sure that cleared things up. Martin once worked in a shop apparently. Yes the black cloud gang disbanded, it’s back to school for all. Fill up your glasses, the punch bowl is on the table, the Carney Credit card is behind the bar. Inflation Good news for the Governor, inflation fell in October CPI to 2.2% from 2.7% in the prior month. Education hikes last year fell out of the index as we expected but the fall in transport costs pushed the index even lower. 2.4% CPI inflation was our call and still seems to be a reasonable target by the end of the year. Manufacturing prices suggest there is little cost pressure in the economy but retail energy prices are moving significantly higher. Retail Sales Retail sales figures in October were slightly disappointing, an increase of 1.8% in volume and 2.5% in value, slightly down on the averages in Q3. The demise of Barratts Shoes and Blockbuster a reminder, conditions remain tough on the high street as household real incomes remain under pressure. Internationally Janet Yellen, the new head at the Fed is still worried about the strength of the US recovery. Tapering may be postponed still later into the New Year. Growth in France and Japan in the third quarter a further warning the world recovery still requires accommodation. QE tapering US style is not the answer. Buying treasuries and Mortgage Backed Securities to support asset prices makes no sense. Blend a NASDAQ tracker fund into the purchase mix would follow the logic and demonstrate the folly. What happened to sterling? Sterling closed at £1.6113 from £1.6018. Against the Euro, Sterling closed at €1.1940 from €1.1982. The dollar moved up against the yen closing at ¥100.1 from ¥99.1 and closing at 1.3494 from 1.3368 against the Euro. Oil Price Brent Crude closed at $108.50 from $105.12. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,962 up from 15,762. The FTSE closed at 6,693 from 6,708. UK Ten year gilt yields closed at 2.75 from 2.77 US Treasury yields closed at 2.70 from 2.75. Yields will test the 3% level over the coming months. Gold closed at $1,288 from $1,284. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – import drive and the march of the makers ... Import Drive ... “Sales of European cars drive trade gap wider” is the headline in the Times today as Britons “flocked” to buy cars built on the continent. The trade figures released this week, reveal the September deficit (trade in goods) increased to £9.8 billion from £9.6 billion last month. The trade deficit with the EU reached a record £6.0 billion as imports increased by £0.4 billion to £18.6 billion. “Half of the increase is attributed to cars”, according to the ONS, hence the slightly unbalanced headline from the Times. In reality, Britons have been flocking to the showrooms since the start of the year. Car sales are up by 10% this year. The deficit was offset as usual by a trade in services surplus of £6.5 billion. This is a familiar pattern which should come as no surprise to readers of The Saturday Economist. The trade deficit will deteriorate further especially if the UK continues to grow at a faster rate than major trading partners in the EU and USA. We are forecasting an overall trade deficit this year of £110 billion offset by a service sector surplus of almost £80 billion. The residual overall deficit easily financed. The September figures are confirmation of the trends within our well established trade model. Depreciation damages UK trade in goods performance. Imports do not react significantly to price changes. There will be no rebalancing of the economy. March of the makers picks up pace ... Did the march of the makers pick up the pace in September? Not really. According to the latest figures from the ONS. Manufacturing output increased in the month by just 0.8%. Output for the quarter was flat as signaled in the Markit/CIPS PMI® survey data last week. Nevertheless we still expect manufacturing growth of almost 2.5% in the final quarter of the year. Last year was such a dismal quarter, even the stumbling marchers will make progress. Watch out for the headlines heralding the rebalancing over the next few months and tie me to a chair. Other survey news ... The service sector continues to drive growth in the economy according to the Markit/CIPS UK Services PMI® for October. The headline Business Activity Index reached a level of 62.5 in October. “The UK service sector maintained its recent run of strong growth during October, with activity expanding at the fastest pace since May 1997 as levels of incoming new business rose at a survey record rate”. The construction rally also continues according to the Markit/CIPS UK Construction PMI® index. The sharp rebound in UK construction output continued in October. The lead index posted 59.4, up from 58.9 in September, above the 50.0 no-change threshold for the sixth consecutive month. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. The pick up in manufacturing output will add to the growth in services and construction. Higher growth, more jobs, lower borrowing, inflation falling, investment will pick up in the second half of next year, it’s all looking pretty good for the Chancellor. Just the trade figures will continue to disappoint. We now think base rates are now more likely to rise by around 50 basis points in 2015. Higher growth will result in unemployment hitting the 7% hurdle rate in the third quarter of 2015, several months after the election. What happened to sterling? The Euro rate cut weakened the hybrid and Sterling strengthened as a result. The pound closed at £1.6018 from £1.5912. Against the Euro, Sterling closed at €1.1982 from €1.1814. The dollar moved up against the yen closing at ¥99.1from ¥98.7 and closing at 1.3368 from 1.3484 against the Euro. Oil Price Brent Crude closed at $105.12 from $105.91. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,762 up from 15,616. The FTSE closed at 6,708 from 6,721. The rally continues with a stronger Santa rally in prospect over the next five weeks. UK Ten year gilt yields closed at 2.77 from 2.66 US Treasury yields closed at 2.75 from 2.62. Yields will test the 3% level over the coming months. Gold closed at $1,284 from $1,312. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Housing Market and Leisure Sector continue to lead recovery ... Nationwide House Prices House prices increased at a rate of almost 6% in October according to the Nationwide House Price Index. Access to finance, a result of FLS and H2B have improved the willingness of buyers to step into the market. The housing market is up, up and away as our October review of the UK Housing market confirms. Is there a boom in prospect? Robert Gardner, Nationwide's Chief Economist, points out that “while house price growth has picked up - prices remain 7% below their 2007 peak.” Houses are generally affordable - ‘typical mortgage servicing costs remain modest by historic standards thanks to the ultra-low level of interest rates. A typical mortgage payment for a first time buyer is currently equal to around 29% of take home pay, in line with the long term average.” Well it won’t take long for the price lag to be wiped out, even on the Nationwide index. The “real cost of borrowing” is negative - borrowing rates are lower than asset price rises. The essential conditions for market expansion. We expect transactions to increase above one million this year, still well below the peak of 2007. No boom in prospect but a healthy recovery is in train, the house market is up, up and away on a sustainable growth path. Service Sector Growth The service sector continues to provide the back bone of growth in the economy, with growth accelerating to over 2% for the year as a whole. The leisure sector is now the fastest growing sector of the UK economy. Distribution, hotels and leisure have expanded at a rate of 4% in the year. Check out our Service Sector Update for November. Six slides to explain just what is happening in the UK economy. Manufacturing Not the march of the makers, that’s for sure. The latest Markit/CIPS UK Manufacturing PMI® survey was released on Friday. The index slipped to 56.0 in October, down from a revised reading of 56.3 in September. “The UK manufacturing sector continued a strong third quarter performance into the final quarter of the year according to the summary”. Yet manufacturing growth in the third quarter was pretty flat. Nevertheless we still expect growth of over 2% in the final quarter of the year (in manufacturing). Last year was such a dismal quarter, even the stumbling marchers can make progress. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. We still think base rates are now more likely to rise by around 50 basis points in 2015 rather than 2016. We still say this, despite the decision by the Fed this week to hold rates and continue with QE. Growth in the US is weak, inflation is below target and the housing market is confusing analysts. We expect tapering will be back on the agenda in the New Year as we migrate to Planet Janet. What happened to sterling? It was all about the dollar this week. Sterling slipped against the dollar but moved up against the Euro. The pound closed at £1.5912 from £1.6166. Against the Euro, Sterling closed at €1.1814 from €1.1713. The dollar moved up against the yen closing at ¥98.7 from ¥97.4, closing at 1.3484 from 1.3803 against the Euro. Oil Price Brent Crude closed at $105.91 from $106.93. The average price in November last year was almost $110. We expect Brent Crude to average $110 - $115 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,616 up from 15,570. The FTSE closed at 6,7351 from 6,721. The rally continues. UK Ten year gilt yields closed at 2.66 from 2.63 US Treasury yields closed at 2.62 from 2.51. Gold closed at $1,312 from $1,352. The bulls may have it but are pegged and penned for the moment. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist, #TheSaturdayEconomist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed