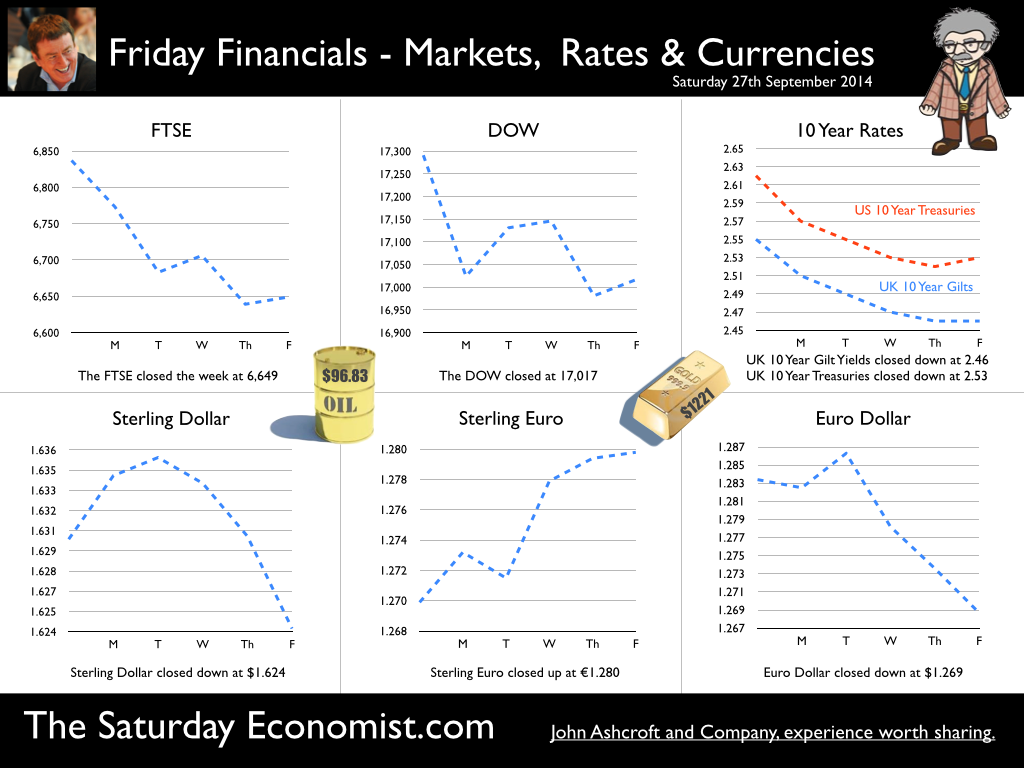

Brigitte Bardot, the "impossible dream of married men", will be 80 years of age tomorrow. Now a great grandmother, in a birthday interview for Paris Match, Ms Bardot claimed “I have loved a lot, passionately madly and not at all. Yet, I only keep one man in mind : the next one”. I feel much the same way about economic forecasts. I love a lot, passionately and madly, some not at all. I only keep one forecast in mind - the next one. Especially the next forecasts resulting from the GDP revisions out next Tuesday. The inclusion of drug dealing and prostitution for the first time, will no doubt, boost output and productivity in the UK economy. UK growth forecasts for the year will be revised as a result. The productivity dilemma resolved, understanding economic agents, burn a spliff, lie back and think of England as they contribute to economic growth. Forecast Revisions … Good news from Spain this week, as forecasts of growth have been revised up. The Finance Minister, Luis de Guindos has suggested growth this year will be 1.3% and 2% next. Still some way to go to full employment, the government now expects the unemployment rate to be 22.9% in 2015, down from prior forecasts of 23.3%. In the USA, growth in the second quarter has also been revised up! The annualised rate of growth revised higher to 4.6% from the previous 4.2%. The underlying growth rate (year on year) revised to 2.6% in the quarter. We now expect US growth of 2.5% for the year as a whole, following the slow start in the first quarter. The Manchester Index™, In the UK, the economy is on track for growth of 3.1% this year slowing to 2.8% next according to the latest data from GM Chamber of Commerce Quarterly Economic Survey and the influential Manchester Index™. The Manchester Index™ index moderated from 33.6 in Q2 to 32.0 in the third quarter largely as a result of the change in outlook for exports. The index remains above the pre recession average for the period 2005 - 2007. The outlook for home orders and deliveries improved slightly in both the service sector and the manufacturing sector. Exports, on the other demonstrated a significant fall in deliveries in both manufacturing and services. Service sector orders fell but the drop in export manufacturing orders was particularly marked. Overall confidence in turnover and profits was maintained and the prospects for employment and investment was particularly marked. Borrowing figures … Government borrowing figures were released this week. Public sector net borrowing was £11.6 billion in August, an increase of £0.7 billion compared with August 2013. For the year to date, total borrowing was £45.4 billion, an increase of £2.6 billion compared with the same period in 2013/14. Receipts in the month were boosted by Stamp duty up 24% and VAT receipts with a recovery in income tax payments, up by 2.4%. The cautionary note, expenditure £54 billion increased by 3.3%. The government is off track to meet the deficit targets this year. The good news, borrowing was revised down for 2013/14 to £99.3 billion. The reduction to £95 billion this year, less of a challenge as a result but there is still much to do with seven months to go before the end of the financial year if the targets are to be hit. So what of base rates … The Governor delivered a speech in Wales this week. “With many of the conditions for the economy to normalise now met, the point at which interest rates also begin to normalise is getting closer. In recent months the judgement about precisely when to raise Bank Rate has become more balanced. While there is always uncertainty about the future, you can expect interest rates to begin to increase. We have no pre-set course, however; the timing will depend on the data.” So what does this mean for UK rates? As we said last week, weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. The timing will depend on the data. The inflation and pay data says “don’t move yet but February is the best bet”. So what happened to sterling this week? Sterling slipped against the dollar to $1.624 from $1.630 but up against the Euro at 1.280 from 1.270. The Euro closed against the dollar at 1.269 (1.270). Oil Price Brent Crude closed down at $96.83 from $98.08. The average price in September last year was $111.60. Markets, moved down. The Dow closed at 17,017 from 17,291 and the FTSE closed down at 6,649 from 6,837. UK Ten year gilt yields move up to 2.46 from 2.55 and US Treasury yields closed at 2.53 from 2.62. Gold moved sideways at $1,221 from $1,218. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

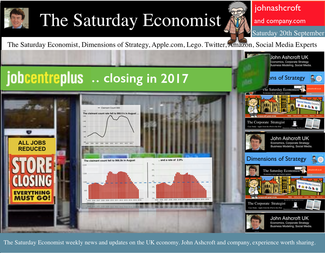

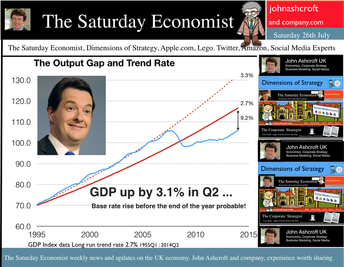

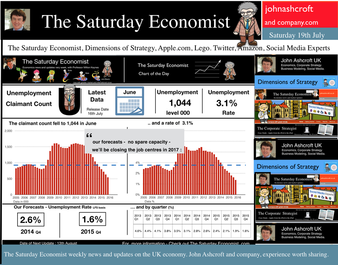

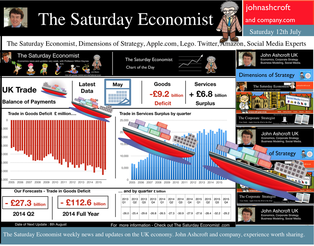

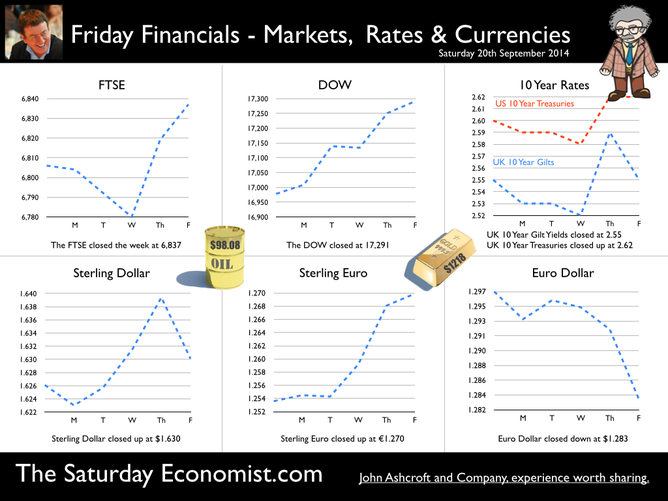

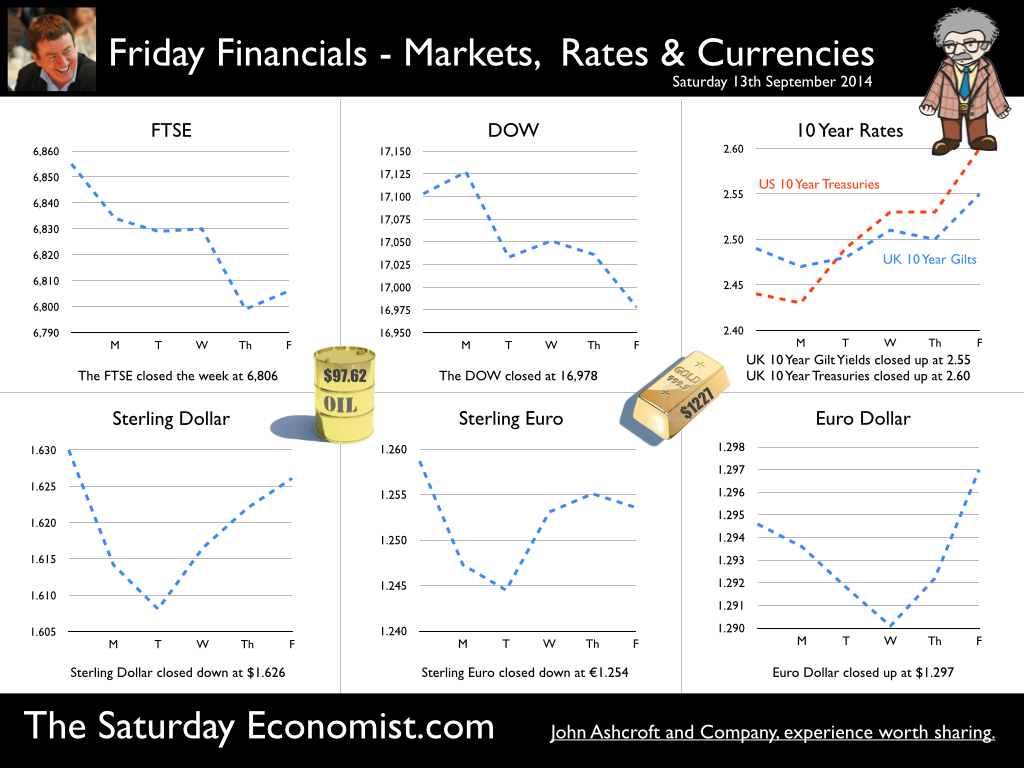

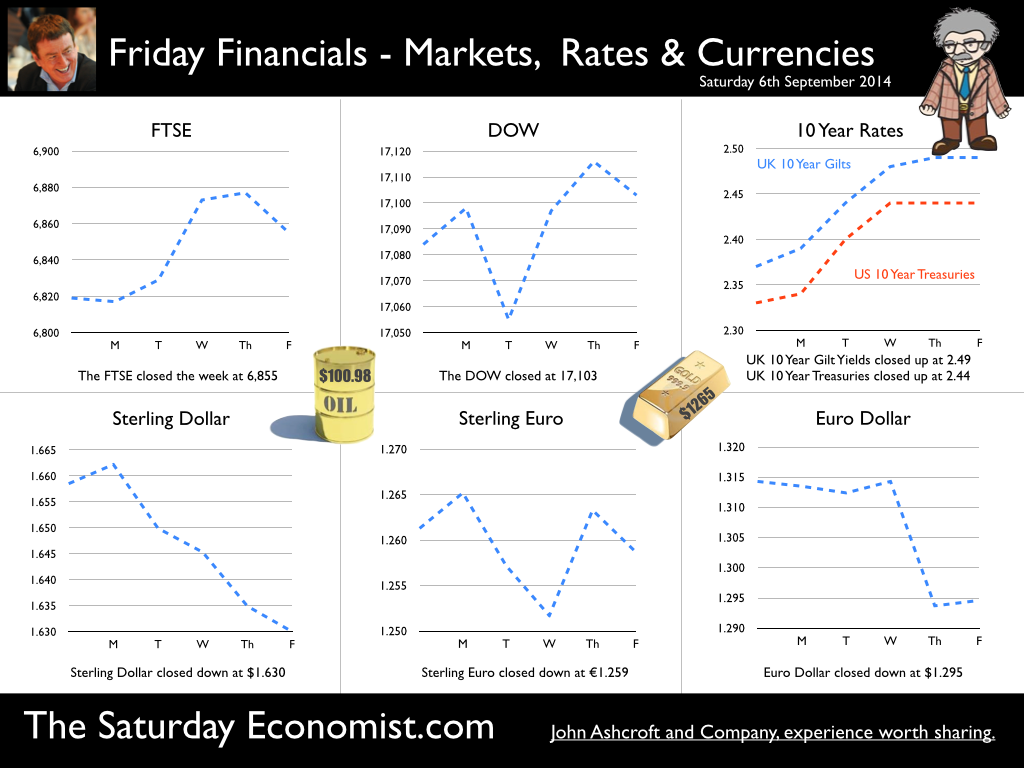

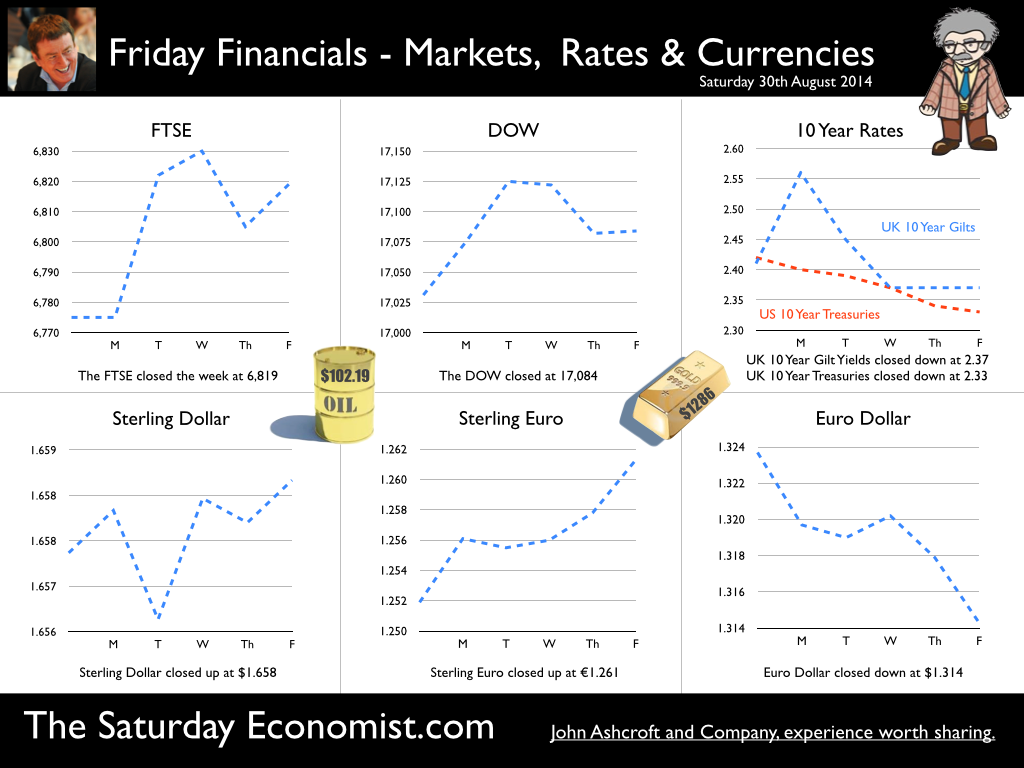

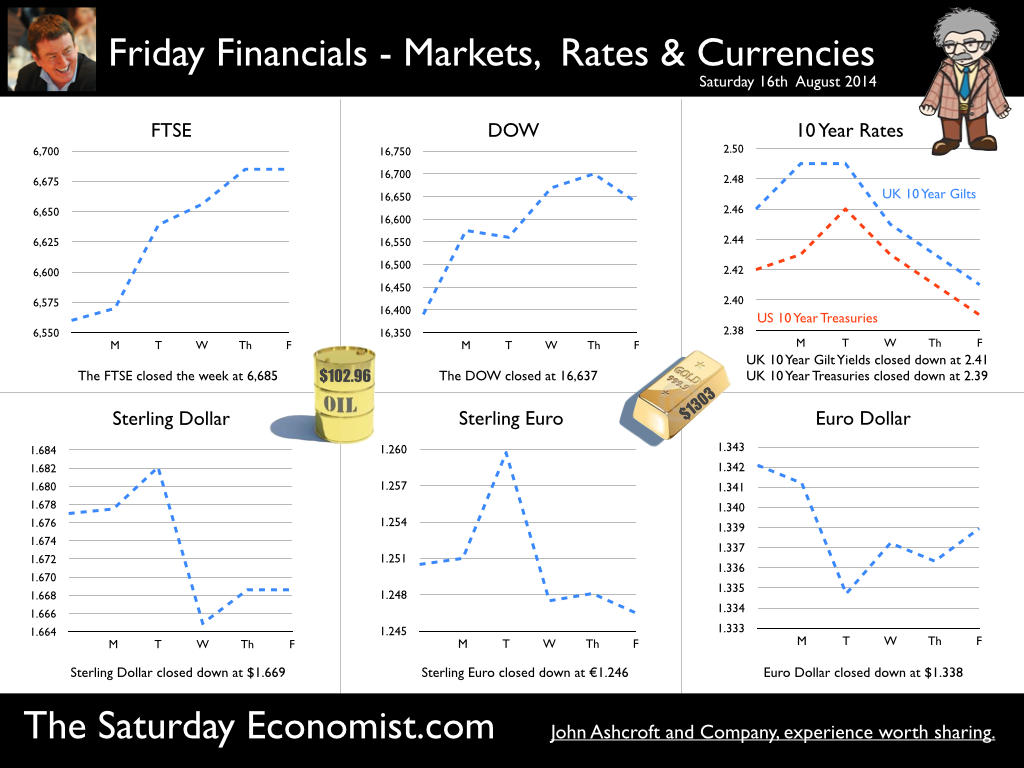

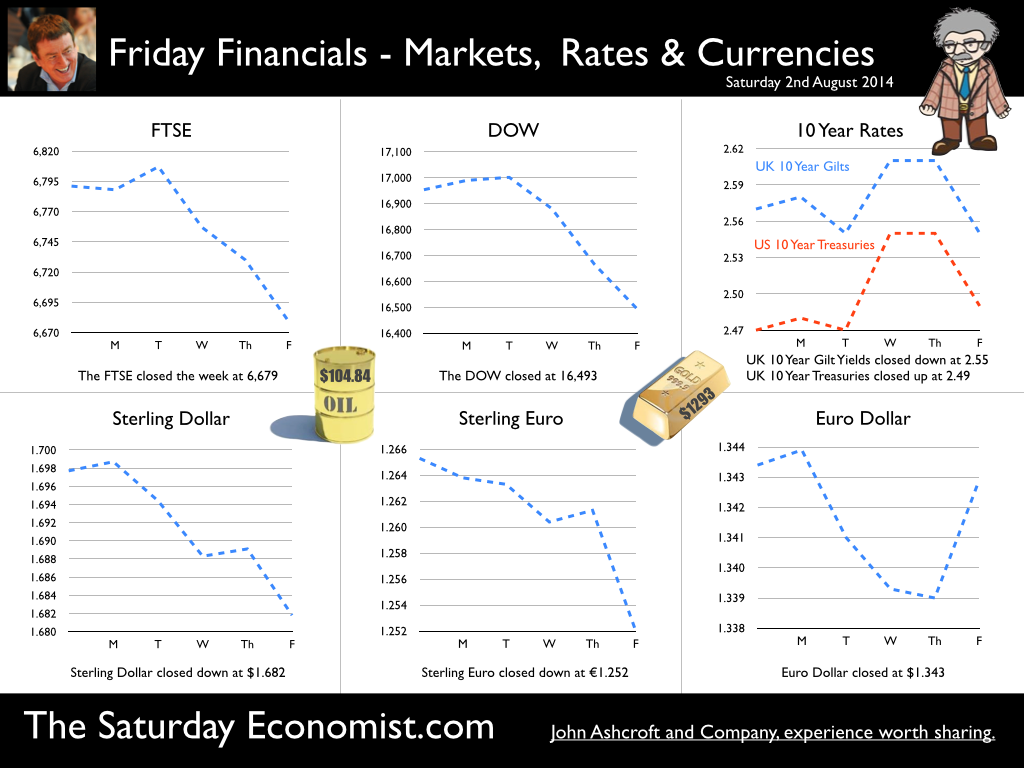

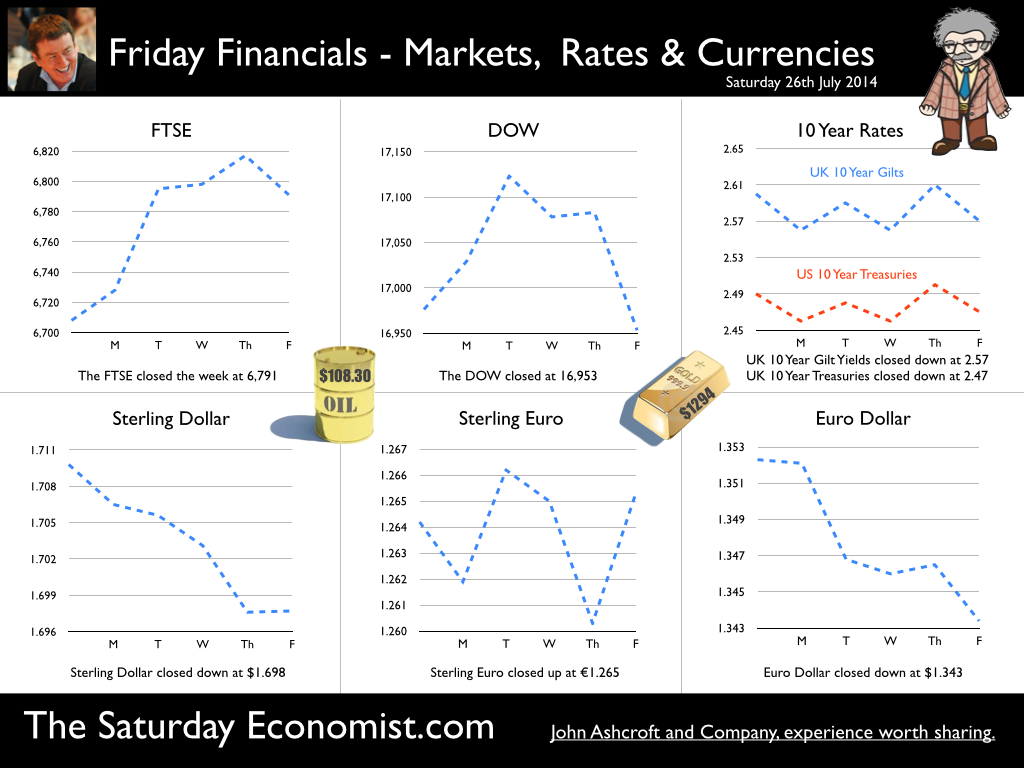

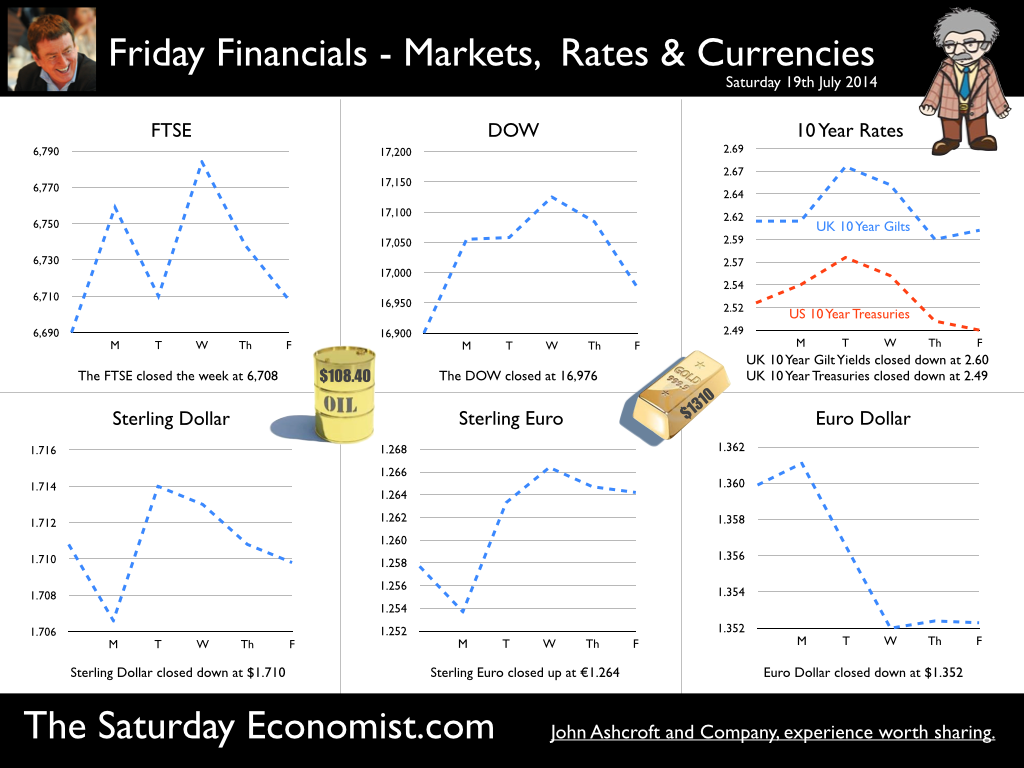

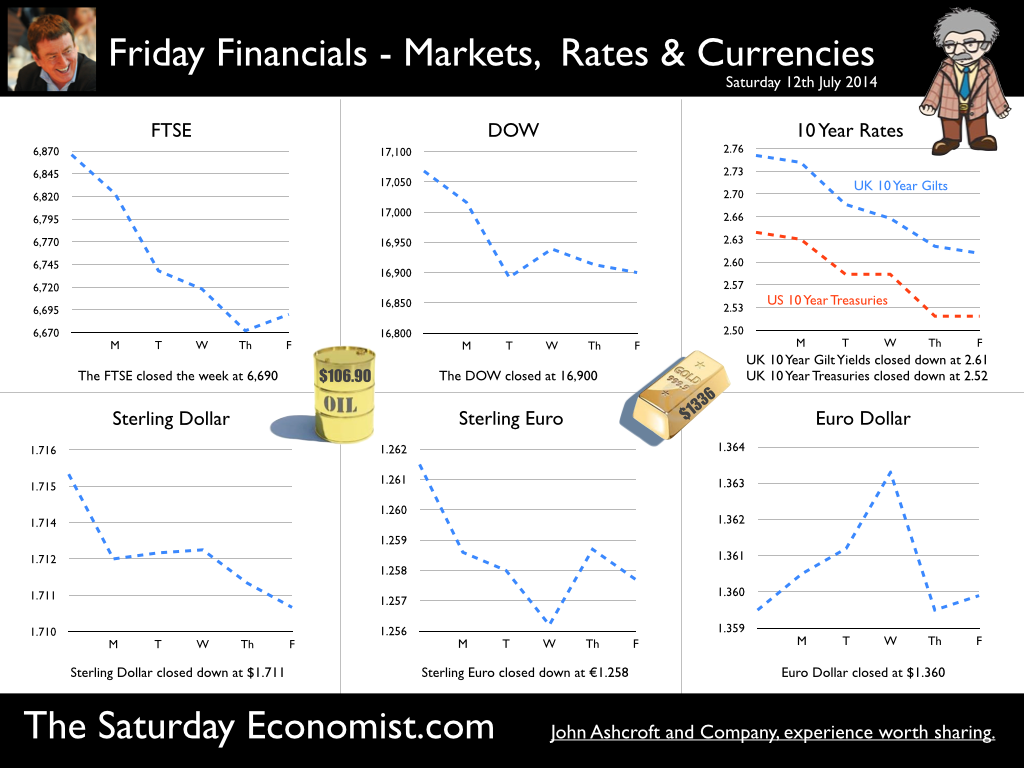

The prospect of a UK base rate rise before the end of the year receded this week with the release of latest data on inflation and earnings … Retail Prices … Retail price inflation CPI basis slowed to 1.5% in August from 1.6% prior month. Falls in the prices of motor fuels and food provided the largest downward contributions to the change in the rate. Markets expect CPI inflation to average 1.7% over the final quarter of the year, significantly below the MPC benchmark 2% target. Don’t worry about deflation too much, service sector inflation actually increased to a rate 2.7%, as goods inflation fell to 0.6%. Manufacturing Prices … Manufacturing output prices actually fell in August, down by -0.3% compared to a fall of -0.1% in July. Input costs, price of materials and fuels bought by UK manufacturers, fell -7.2% in the year to August, compared with a fall of -7.5% in the year to July. Crude oil costs were down by 14% as price of energy and import costs generally benefited from the weakness of world commodity and trade prices. The appreciation of Sterling helped, up by 8% against the dollar in the month. Home food material costs were down by -10%. Evidence that weak food prices at retail level are not really attributable to supermarket food wars after all. For the moment, inflation, or lack of it, is always and everywhere an international phenomenon. World trade prices are weak. Oil price Brent Crude is trading below $100 per barrel compared to $112 last year. Sterling closed at $1.63 this week up by just 3% compared to September last year. A warning perhaps, the currency contribution may be eroding and the dramatic fall in manufacturing costs may soon be reversed. Unemployment data … The number of people unemployed, claimant count basis fell below 1 million in August, the actual figure was 966,500 and a rate of 2.9%. Over the last six months over 200,000 have left the register. At this rate, job centres will be closing by the end of 2017, there will be no one looking for work. Despite the surging jobs market, pay data remains remarkably weak. Average earnings increased by 0.7% in July. Surprising given the rate of jobs growth. Some evidence of compression is more evident in manufacturing pay, up almost 2% and construction, up by 4%. Retail Sales ... Retail sales rallied in August as volumes increased by 3.9% year on year and values increased by 2.7%. Online sales volumes were up by 8.3% accounting for 11% of all retail transactions. Households are spending and will continue to do so. The August ©GfK Consumer Confidence Barometer confirms households are more optimistic, feel better off and believe it is a good time to spend. So what of base rates …? Janet Yellen, head of the Fed, gave additional guidance on the direction of US rates this week. “The Committee currently anticipates that economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run”. “A highly accommodative stance remains appropriate”. There was no real change in the police stance. Markets rallied and the Dow closed above 17,000. Analysts do not expect a rate rise in the USA before June next year. So what does this mean for UK rates? Weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. No escape from Planet ZIRP just yet, we may regret the delayed take off in the years ahead. So what happened to sterling this week? Sterling rallied against the dollar to $1.630 from $1.626 and well up against the Euro at 1.270 from 1.254. The Euro was down against the dollar at 1.270 (1.297). Oil Price Brent Crude closed down at $98.08 from $97.62. The average price in September last year was $111.60. Markets, move up. The Dow closed at 17,291 from 16,978 and the FTSE closed down at 6,837 from 6,806. UK Ten year gilt yields moved 2.55 from 2.49 and US Treasury yields closed at 2.62 from 2.60. Gold drifted lower at $1,218 from $1,227. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  USA ... When will US rates rise? According to the latest survey in the Wall Street Journal, most economists expect the Fed to raise rates in June next year. 40% expect rates to rise in the second quarter and almost half expect the rise to be delayed until the second half of the year. Positive about the prospects for growth in the US, economists believe concerns about Europe and challenges in the Ukraine suggest the Fed will be anxious to hold the rate rise for as long as possible and well into the year ahead. Mark Carney in Liverpool … The Governor was in Liverpool this week speaking to the TUC Annual Congress. Reassuring union members he and 3,600 staff in the Bank of England were paid a living wage, the governor went on to explain the “judgement about precisely when to raise Bank Rate has become more balanced”. “With no pre set course, the timing would depend on the data.” This week, the data suggests there will be no pressure to increase rates anytime soon and probably not before the end of the year. Oil Price … Fears of inflation abate, as the oil price fell below the $100 dollar mark. Despite turmoil in Iraq and Syria, Oil Price Brent Crude closed at $97.62. The average price in September last year was $112. UK manufacturing prices and headline inflation rates will soften as a result. For the moment, the Saudi swing producers are relaxed. The seasonal low will impact and prices will take the hit. Restoration to the $100 - $110 band will follow in the Autumn, demand and supply will adjust to ensure this is the case. Manufacturing … UK Manufacturing output increased by just 2.2% in July after growth of 3.5% in the first half of the year. Output of capital goods and consumer goods was surprisingly week in the month. We have downgraded our forecasts for the third quarter and the year as a whole (3.4%) as a result. Construction output ... UK Construction output growth slowed to 2.6% in July after growth of 6% in the first half of the year. Strong growth in new housing (both public and private) up by 27% and in private industrial (up by 20%) was offset by weakness in infrastructure and related public sector projects. For the year as a whole we expect growth of 4.6% slightly down on the June forecast of 5.1%. UK Trade Figures … The trade deficit (goods) increased to £10.2 billion in July offset by a £6.8 surplus in services. Our forecasts for the year as whole - unchanged as a result. We expect the deficit (trade in goods) to be £30.8 billion in the quarter and £112.5 billion for the year as a whole. Is this a threat to recovery? Not really. The trade in services surplus will reduce the combined deficit in the year, to around £30 billion. Less than 2% of GDP, the deficit is easily funded. No pressure on policy makers to increase rates, assuming overseas dividends recover to finance the shortfall. Growth in the UK … Despite the soft figures in manufacturing and construction in July, our forecast for growth in the UK in the Q3 and for the year as a whole remains unchanged around 3.1% So what of base rates … Last week, base rates were held at 50 basis points. The chances of a rate rise before the end of the year are receding. Next week’s inflation and retail figures will be soft but the labour stats will suggest further tightening in the claimant count and vacancy rates. There will be nothing in next week’s data to precipitate a rate rise this year. So what happened to sterling this week? Sterling fell against the dollar to $1.626 from $1.630 and down against the Euro at 1.254 from 1.259. The Euro was up against the dollar at 1.297 (1.295). Oil Price Brent Crude closed down at $97.62 from 100.98. The average price in September last year was $111.60. Markets, move down slightly. The Dow closed down at 16,978 from 17,103 and the FTSE closed down at 6,806 from 6,855. UK Ten year gilt yields move up to 2.55 from 2.49 and US Treasury yields closed at 2.60 from 2.44. Gold was further tarnished at $1,227 from $1,265. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  No surprise this week as MPC votes to hold rates … It’s that time of month again …The Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The minutes of the meeting will be published on the 17 September. Can’t wait! The hawks views may have been subdued by the latest data on retail sales and earnings data but the economics news this week remains bullish about growth this year. Car Sales … Car sales in August were up by 9% in the month and just over 10% in the year to date. The UK is on track to sell 2.45 million cars this year. That’s higher than the pre crash levels recorded in 2007. Commercial vehicle sales were up almost 12% in August, increasing by 13% for the year to date. The car market remains a powerful indicator of consumer confidence and spending trends. August, with registrations of just 72,000, is no longer a big month for sales. September is the one to watch with over 400,000 new car sales recorded last year, 425,000 a hurdle number! UK Survey Data … The Markit/CIPS UK PMI® surveys for August were released this week. Chris Williamson, Chief Economist at Markit, claimed “An acceleration of growth in the services sector and an on-going construction boom offset a weakened performance in manufacturing in August. The three PMI surveys indicate that the economy grew at the fastest rate since last November, providing further ammunition for policymakers arguing for higher interest rates.” In the service sector, activity growth was the strongest for ten months. The headline Business Activity Index recorded 60.5 up from 59.1 in July, representing the sharpest monthly improvement in activity since October 2013. In the construction sector, output appears to have risen at the fastest pace for seven months. The key index recorded a level of 64.0 in the month, up from 62.4 in July. Residential construction posted the fastest growth in activity. News from the manufacturing sector disappointed slightly. The Manufacturing PMI index posted 52.5 in August, down from 54.8 in July. Albeit a 14 month low, the index is still in growth (above 50) territory. Domestic sales dominate, export demand is strong in North America, the Middle East and China but obvious problems in European order books persist. So what of the rest of the world? US jobs disappoint but Fed still on track to tighten … The US labour market added 142,000 new jobs in August, significantly below consensus expectations and well below the 225,000 average over the prior six months. The unemployment rate fell to 6.1%. Positive news on car sales and manufacturing output also hit the headlines … “The data doesn’t say the economy is slowing down but it does not suggest it is accelerating much either” according to Steven Blitz chief economist at ITG Investment Research. Nor we would add, is there much in the data to suggest the Fed will stray from the path of gently monetary tightening in the first half of 2015. In Europe … The ECB adopted further measures in an attempt to stimulate the slow recovery and low inflation in the Eurozone. Growth in Q2 increased by 0.7% compared with Q2 last year with some evidence of a slow down in Germany. Inflation fell to 0.3% and unemployment remained stubbornly high at 11.5%. The ECB lowered policy rates by 10 basis points, the refinancing rate moved down to 0.05%, the marginal lending facility fell to 0.3% and the deposit rate was pushed further into negative territory, dropping to -0.2%. No escape from Planet ZIRP in prospect! Despite the concerns about deflation, GDP is forecast to increase by 0.9% in 2014 and 1.6% in 2015. Low prices are an international phenomenon, not confined to Europe. Negative rates and QE are unlikely to provide the solution to low commodity prices. A slow for recovery for Europe is in prospect. Marooned on Planet ZIRP, digging up the runway will not improve the timetable for takeoff and escape. There is an old Iberian imprecation, “May the builders be in your home”. Far worse - the curse “May the academics be in your central bank”. So what of base rates … In the UK base rates were held at 50 basis points with no additions to the asset purchase programme. The chances of a rate rise before the end of the year are receding. Hot money is moving to February for the first rate hike but if the bad news from Europe continues, the hike may be post hustings after all. Is this at odds with the latest data? Of course. Demand conditions are strong, the labour market is tightening, recruitment challenges are increasing and skill shortages are ubiquitous. Pay and earnings remain subdued and international energy and commodity prices remain low. For the moment the inflation target remains within reach, easing the grip of the hawks on monetary policy. So what happened to sterling this week? Sterling fell against the dollar to $1.630 from $1.658 and down against the Euro at 1.259 from 1.261. The Euro was down against the dollar at 1.295 (1.314). Oil Price Brent Crude closed down at $100.98 from 102.19. The average price in September last year was $111.60. Markets, move up slightly. The Dow closed up at 17,103 from 17,084 and the FTSE closed up at 6,855 from 6,819. UK Ten year gilt yields move up to 2.49 from 2.37 and US Treasury yields closed at 2.44 from 2.33. Gold was slightly tarnished at $1,265 from $1,286. That’s all for this week but we would like to introduce the Bracken Bower Prize to our readers! John Introducing the Bracken Bower Prize The Financial Times and McKinsey & Company, organisers of the Business Book of the Year Award, want to encourage young authors to tackle emerging business themes. They hope to unearth new talent and encourage writers to research ideas that could fill future business books of the year. A prize of £15,000 will be given for the best book proposal. The Bracken Bower Prize is named after Brendan Bracken who was chairman of the FT from 1945 to 1958 and Marvin Bower, managing director of McKinsey from 1950 to 1967, who were instrumental in laying the foundations for the present day success of the two institutions. This prize honours their legacy but also opens a new chapter by encouraging young writers and researchers to identify and analyse the business trends of the future. The inaugural prize will be awarded to the best proposal for a book about the challenges and opportunities of growth. The main theme of the proposed work should be forward-looking. In the spirit of the Business Book of the Year, the proposed book should aim to provide a compelling and enjoyable insight into future trends in business, economics, finance or management. The judges will favour authors who write with knowledge, creativity, originality and style and whose proposed books promise to break new ground, or examine pressing business challenges in original ways. Only writers who are under 35 on November 11 2014 (the day the prize will be awarded) are eligible. They can be a published author, but the proposal itself must be original and must not have been previously submitted to a publisher. The proposal should be no longer than 5,000 words – an essay or an article that conveys the argument, scope and style of the proposed book – and must include a description of how the finished work would be structured, for example, a list of chapter headings and a short bullet-point description of each chapter. In addition entrants should submit a biography, emphasising why they are qualified to write a book on this topic. The best proposals will be published on FT.com. Full rules for The Bracken Bower prize are available here or here http://membership.ft.com/PR/brackenbower/ © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*  The Inflation Report Press Conference … Reassurance from the Inflation Report Press Conference this week. The Bank of England may be uncertain about what is happening in the economy but it is certainly not clueless. Excellent. £3.5 million spent on the economics model and 200 PhDs in the pot to stir up the data, not all is for nought. James Macintosh of the FT put the difficult question “It would appear you've been moving over the past five years from a fair degree of certainty towards a fair degree of cluelessness and currently - you are at the more clueless end of the spectrum.” Is this a fair point? Well perhaps. Larry Elliott of the Guardian had begun the challenge suggesting there's a wide range of views on the Committee about the likely degree of slack in the economy. There is uncertainty about the housing market, wages may go up, they may not go up. Guidance on the pace and extent of interest rate rises is an expectation not a promise … “I mean once you cut through all this doesn't it lead you to three conclusions - one, that the Bank hasn't really got a clue what's going on out there; two, that the MPC is divided about what's going on out there; and thirdly, any person thinking about taking out a mortgage on the basis of the Bank's forward guidance would be ill-advised to do so, because anything you say, has to be taken with a very large pinch of salt?” Oh dear ... The Carney honeymoon is over … Well one thing we can be certain about, this is not the questioning we would have expected under Governor King. For Governor Carney the honeymoon is over. So much for the open routine. The Emperor’s economics models are proving to be as insubstantial as the clothing. Perhaps it is time to return to the enigmatic, grumpy old professor emeritus routine, dismissive of those of a lower intellectual order including undergraduates and the press core particularly. Ed Conway now with Sky News, would occasionally rattle Governor King teasing about the accuracy of the inflation forecasts, (not actually forecasts of course) but Governor Carney,cast in the role as the unreliable boyfriend, is taking more and more hits. All a bit of a muddle … Clearly Asa Bennett From the Huffington Post rattled the Governor, sensitive to criticism of forward guidance, “I just wanted to ask Governor about the evolution of your forward guidance plan, particularly when it started with the sort of clear to understand unemployment threshold, and then the sort of output gap, and then this bolt on about pay growth. Do you wish you started with this at the beginning? Hasn’t it all been a bit of a muddle or is it a learning process? “Well you’re muddled I'm afraid”. The playground retort from the Governor of the Bank of England. So is that the best we can get? The Old Lady of Threadneedle Street - the Aunt Sally of Fleet Street … The Old Lady of Threadneedle Street is becoming the Aunt Sally of Fleet Street. It would help if Jenny Scott, Executive Director of Communications, chairing the press conference, appeared to know some of the names of the press corp, instead of jabbing a pencil in this or that direction, when it came to question time. Perhaps Jenny was trying to ward off evil spirits, waving the magic wand of oblivion, which Governor King carried so successfully in his cloak. For debutante MPC member Minouche Shafik, it was all too much. Shifting uneasily, apparently bored, struggling under the weight, not of office but of a voluminous hair style, the governor allowed Minouche one question response on Europe … Minouche : “It would be good for us if Europe grew faster since it’s our key trading market, but for the near term that doesn’t look very likely”. “That’s all we have time for”, said the Director of Communications and that was that. Well, we must hope there is much more to come. So what happened this week? GDP Estimate … The ONS second estimate of GDP was released this week. Growth in the UK Q2 increased by 3.2% compared to the prior estimate of 3.1%. Actually the numbers hadn’t changed, the statisticians were using a more accurate calculator this time round for the rounding. Our estimates of growth for the year are unchanged at 3% which makes the Bank of England estimates of growth (3.5%) all the more difficult to understand. Either the economy will grow at an eye watering 4% in the second half of the year or the Bank expects big revisions to the data in September as a result of the inclusion of drugs and prostitution in the national accounts. Who would have thought hookers had that much clout. We shall have to wait until the end of September for the update. Labour Market Stats … The jobs outlook just gets better. The claimant count rate fell to 3% in July at just over 1 million unemployed. 400,000 have found work in the past year. At the current rate of growth we will be closing the job centres at the end of 2016, there will be no on left on the register looking for work. The wider LFS data confirmed the trend with the unemployment rate falling to 6.4%. More people in work, unemployment rates falling, recruitment increasing, skills shortages heightening, which makes the pay data even more inexplicable. Earnings increased by less than one per cent in June. We would expect increases in line with inflation or more at 3% plus at this stage in the recovery. For this we have much sympathy with the models at the Bank of England, something strange is happening on Planet ZIRP. Maybe low rates are the problem and no the solution? So what of base rates … Growth and jobs data would push the argument for a rates rise before the end of the year. Inflation and pay data would suggest the rates could be kept on hold until 2015. The latest data from Europe confirms a rate rise is off the agenda for months if not years to come. The MPC will be loathe to act ahead of the Fed and not too eager to move in advance of the ECB. Markets assumed rates will be kept on hold as a result of the Inflation Report… So what happened to sterling this week? Sterling closed down against the dollar at $1.669 from $1.6774 and down against the Euro at 1.246 from 1.252. The Euro was down against the dollar at 1.246 (1.341). Oil Price Brent Crude closed down at $102.96 from 105.02. The average price in August last year was $111.28. Markets, rallied on the rates news. The Dow closed up at 16,637 from 16,554 and the FTSE closed up at 6,685 from 6,567. UK Ten year gilt yields were down at 2.41 from 2.55 and US Treasury yields closed at 2.39 from 2.49. Gold was largely unchanged at $1,303 from $1,305. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  A letter from America … This week the Professor is in America, reviewing the prospects for the US economy. Despite the pressure on the Bank of England to increase rates before the end of the year, the MPC will be reluctant to move ahead of the Fed and be the first to leave Planet ZIRP. So what are the prospects of a US rate rise any time soon? Two Fed policy hawks, Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed, made comments this week, suggesting they have seen enough evidence to support an interest rate rise earlier than expected. Currently, tapering is expected to continue, extinguishing the asset purchase programme in October. US rates are not expected to rise until Q1 or even Q2 next year. The Prof thinks the latest crop of economics data will take the pressure off the doves to move earlier. Growth in the USA … In the USA, real gross domestic product increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. 4% sounds quite exhilarating but …. According to our year on year comparison, US GDP Q2 increased by 2.4% in the second quarter compared to Q2 2013. This followed growth of 1.9% in the first quarter - both below trend rate. Our forecast of growth at 2.4% in 2014 is unchanged based on the latest data. The latest GDP estimates ensure there is no pressure on the Fed to accelerate the change in monetary policy. We expect tapering to continue into the Autumn, with a rate rise postponed into 2015. Jobs in the USA … Friday's employment and income reports pointed to steady U.S. job growth with the number of non farm payroll jobs increasing by 209,000. The unemployment rate ticked higher to 6.2% but this a refection of a widening labour pool rather than a slow down in the economy. Moderate expansion in payroll numbers, slightly below expectations, will ensure there is no short term pressure to increase rates anytime soon. Inflation in the USA … The US Consumer Price Index increased by 2.1 percent in the twelve months to June. The PCE (personal consumption expenditure) price index, the Fed's favoured measure of inflation, was up 1.6%. Average hourly earnings of private-sector workers were up 2.0% from a year earlier, unchanged from the range of the past few years. Growth, jobs, earnings and inflation are all demonstrating trends that are likely to keep the Federal Reserve on course to conclude the bond-purchase program in October but remain cautious about raising short-term interest rates before the end of the year. We would expect US rates to rise in the Spring of 2015. Despite any further increase in The Saturday Economist™ Overheating Index™, the MPC will be reluctant to increase rates this year and open the “Spread with the Fed”. So what of the UK? The latest manufacturing data from Markit/CIPS UK PMI® confirmed the strong output growth continued into July. Production and new orders both continued to rise at robust, above long-run average rates in the month. At 55.4, down from 57.2 in June, the headline index posted the lowest reading in one year but remained well above the survey average of 51.5. No need to worry about manufacturing output! Something to worry about … Ben Broadbent, Deputy Governor for monetary policy, Bank of England, made a speech in London this week. His theme - “The UK Current Account Deficit”. Last year the UK current account deficit was 4.5% of GDP. That’s the second-highest annual figure since the Second World War. So is the near record deficit a threat to growth? The Deputy Governor concludes the “significance [of the deficit] depends on the health of a country’s net foreign asset position and more fundamentally, on the trust in its institutions”. “…having a balanced net asset position seems to reduce the threat from a large current account deficit, as does a floating currency.” Now that is concerning. In the 80’s Chancellor Lawson argued the Balance of Payments “doesn’t matter”. It does and in the end it did! Interest rates had to rise dramatically to curtail domestic demand. In the current cycle, the deficit, trade in goods, is offset in part by the service sector surplus. At around 2% to 2.5% of GDP, the deficit is not a threat to growth. The collapse in overseas earnings on the other hand is a more serious concern. A current account deficit of 4.5% is unsustainable. A dismissive speech at Chatham House will not disguise the extent of the problem, rule or no rule. So what happened to sterling this week? Sterling closed down against the dollar at $1.682 from $1.698 and down against the Euro to 1.252 from (1.2653). The Euro was unchanged against the dollar at 1.343. Oil Price Brent Crude closed down at $104.84 from 108.30. The average price in August last year was $111.28. Markets, closed down. The Dow closed down 460 points at 16,493 from 16,953 and the FTSE was down 12 points at 6,679 from 6,791. UK Ten year gilt yields were down at 2.55 from 2.57 and US Treasury yields closed at 2.49 from 2.47. Gold was unchanged at $1,293 from $1,294. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  GDP up by 3.1% in Q2 ... a rate rise before the end of the year seems probable! The UK economy grew by 3.1% in the second quarter of the year according to the latest figures from the ONS. The economy is on track for growth of just over 3.0% this year and 2.8% next. The output gap closed to 9.2% based on our estimated long term trend growth rate of 2.7%. Service sector continued to support the expansion (up by 3.3%) with particularly good performances in the leisure sector (4.9%) and business services sector (4.2%). Manufacturing and construction also made strong contributions with growth of 3.2% and 4.2% respectively. This is the first estimate of growth based on partial information. The next update is due on the 16th August. The initial estimate may well be revised up (3.2%) based on revisions to the manufacturing data. This week the IMF revised their forecasts of the UK economy to 3.2% for 2014 and 2.7% next. The UK will be the fastest growing economy in the western world with deleterious implications for the trade balance. If the IMF forecasts are correct, UK growth will accelerate in the second half of the year to 3.4%. It‘s simple arithmetic not complex economics! If that is the case, The Saturday Economist™ Overheating Index™ will move higher, bringing the prospect of a rate rise before the end of the year into clear focus. Retail Sales … Retail sales volumes increased by 3.6% in June 2014 compared with June last year. This is lower than the average over the first six months of the year, a period within which the volume of sales averaged 4.1%. (March and April were particularly strong months for retail activity.) Retail sales growth averaged 3.9% in our benchmark period [200Q1 - 2008Q1]. The performance in June of 3.6% suggests MPC members will rest easy on the news, with no pressure on a rate rise evident in the data. The amount spent online increased by 13.4% year on year, accounting for 11.3% of all retail spending. The pressure on conventional retail is continuing to increase significantly. UK Government Borrowing : No fiscal fizzle, the deficit is increasing! Writing in the New York Times this week, Paul Krugman talked of the imaginary US budget and debt crisis. Despite all the fears of deficit doomsters, the US federal deficit will be just 2.8% of GDP this year, down from 9.8% in 2009. The economy is growing and the deficit is falling. It's a fiscal fizzle. “We don’t have a debt crisis, and we never did”, says Krugman. Excellent news for them over there! But is it so good over here? According to the figures released by the ONS this week, in the first three months of the year, total borrowing was higher than first quarter last year by some £3 billion. Total borrowing was £36.1 billion compared to £33.6 billion last year. Despite economic growth in the quarter of over 3%, the deficit is increasing rather than falling. The government is off track to hit the deficit target of £95.5 billion in 2014/15. The deficit to GDP ratio was 6.5% in 2013/14 set to fall to around 5.5% this year. On current trends this is not about to happen. Total debt of £1.3 trillion has risen to over 77% of GDP. Analysts are beginning to call for more cuts in spending to resolve the problem. Yet spending over the first three months of the year was up by less than 1% [ANLP basis] assisted by a fall in interest costs of almost 3%. The problem for the Chancellor - Exchequer revenues actually fell. Despite an increase in the VAT take of just over 4%, Income and CG taxes were down by 3.5%, which is bizarre in an economy growing by 3% in real terms and over 5% in nominal values. The US economy invariably demonstrates an ability to rebound, evaporating the internal deficit in the process in quite dramatic fashion. Fiscal drag, generates a fiscal fizzle, vaporising the deficit and improving the outlook for the Fed. In the UK, the process is more protracted. The current trend is troubling. No need to panic just yet. We still expect a significant rebound in the tax take through the year as the economy continues to grow at over 5% in nominal terms. The deficit was revised down last year to £105.8 billion. The target of £95.5 billion appears to be a stretch for the moment. No fiscal fizzle for the Chancellor more like a slow burn - the OBR targets could still be hit! So what of interest rates … At the last meeting of the MPC, the Committee agreed that no increase in base rates was warranted. For some members the decision had become “more balanced in the past few months compared to earlier in the year”. The latest figures on retail spending and GDP would suggest the decision remains finely balanced but the hawks will be flapping their wings. The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the GDP data. The chances of a rate rise before the end of the year edged higher in line with the index. So what happened to sterling this week? Sterling closed down against the Dollar at $1.698 from $1.709 but up against the Euro to 1.265 from (1.263). The Euro moved down against the dollar at 1.343 from 1.352. Oil Price Brent Crude closed down at $108.30 from 108.40 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed below the 17,000 level at 16,953 from 17,100 and the FTSE was up at 6,791 from 6,749. UK Ten year gilt yields were down at 2.57 from 2.60 and US Treasury yields closed at 2.47 from 2.49. Gold was down at $1,294 from $1,310. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Of inflation and unemployment? Job centers will be closing in 2017 … This week the ONS released latest data on inflation and unemployment. The rate of employment growth is such, job centers will be closing in 2017, if current trends hold. Unemployment falls … Unemployment fell to 3.1% in June, (claimant count basis) and to 6.5% in the three months to May (LFS basis). The number of unemployed in June was 1.04 million. The rate of job creation has surprised not just our models but those of the Bank of England. Spare capacity will be eliminated within the next three months. Claimant count levels will be back at pre recession levels within six months and job centres will be closing by 2017 - no-one will be looking for work. Is this realistic? Probably not! Earnings remain at unrealistic levels if we accept the official data (sub 1%). The level of recorded earnings does not correlate with job levels. Neither does it sit well with evidence of household spending on car sales, retail sales and trends in the housing market. Our evidence on recruitment and skills shortages also infers that earnings should be on the increase. It is a strange world on Planet ZIRP! As for the so-called Productivity Paradox, do we really believe our businesses are taking on more and more people to do less and less work - of course not. The economy is in danger of overheating based on job trends. Productivity absorption will improve as output increases but this will not really ameliorate the inflation impact! So what of inflation in June? Inflation rises … Inflation CPI basis increased to 1.9% in June from 1.5% in May. Service sector inflation increased to 2.5% and goods inflation also increased to 0.9%. The largest contributions to rising prices came from clothing, food, drinks and transport. We expect inflation to hover above the 2% level for the rest of the year assuming sterling tracks $1.75. Manufacturing prices, increased by just 0.2% in the twelve months to June, slightly down from the prior month. Low world prices and higher sterling dollar values are easing the pressure on input costs. Metals, materials, parts and chemicals are all down in price, import cost basis. Housing Market … So what of the housing market this week? The Council of Mortgage Lenders released the latest gross lending figures for June. “The pace of lending slowed” according to the headlines. Commenting on market conditions in this month’s Market Commentary, CML chief economist Bob Pannell observes: "The macro-prudential interventions announced by the Financial Policy Committee in late June are finely calibrated and precautionary, but could nevertheless reinforce April’s Mortgage Market Review in tipping the UK towards a more conservative lending environment.” Yeah, thanks Bob. Lending was up by 20% in the first quarter, that’s an increase of almost 30% for the first six months of the year. Despite the interventions of the FPC we expect the volume of activity to increase by 25% this year and by a further 15% in 2015. Even then, activity will still be some 20% below pre recession levels. A great recovery but no real threat to the economic outlook over the medium term either. So what of interest rates … The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the inflation and jobs update. Our overall growth outlook is unchanged but the chances of a rate rise before the end of the year ticked higher in line with the index. So what happened to sterling this week? Sterling closed down against the dollar at $1.709 from $1.711 but up against the Euro to 1.263 from (1.258). The Euro moved down against the dollar at 1.352 from 1.360. Oil Price Brent Crude closed up at $108.40 from 106.90 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed above the 17,000 level at 17,100 from 16,900 and the FTSE was up at 6,749 from 6,690. UK Ten year gilt yields were down at 2.60 from 2.61 and US Treasury yields closed at 2.49 from 2.52. Gold was down at $1,310 from $1,336. That’s all for this week. Join the mailing list for The Saturday Economist™ or forward to a friend. John © 2014 The Saturday Economist™ by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Is the recovery weakening ? A raft of economics news had the sub editors reaching for the panic button this week. “UK recovery hopes hit by new blow as trade deficit widens” The Evening Standard, yesterday. “Construction setback casts doubt on recovery”, The Times Business News, today. “Shock fall in output hits the pound”, the headline in The Times mid week. Should we be worried about the recovery? Not really! Recent Markit PMI™ survey data confirmed the strength of activity in services, manufacturing and construction into June. The NIESR GDP tracker suggests the UK economy grew at a rate of over 3% in the second quarter. Our own Manchester Index™, suggests growth may have weakened but only slightly, still around the 3% level. The preliminary estimate of GDP for Q2 is due out on the 25th July. Not long to wait for the next edition of the National Accounts. It’s like waiting for the next chapter in a Harry Potter novel. Can’t wait! Trade Deficit increased slightly … The trade deficit deteriorated slightly in May. The increasing trade deficit is a measure of the strength of the recovery not the weakness. For those who were expecting a recovery led by exports, re balancing trade, the data may come as something of a disappointment. For readers of The Saturday Economist it will come as no surprise. The trade in goods deficit increased to -£9.2 billion in May compared to -£8.8 billion in April. Our forecast for the quarter is a deficit of £27.3 billion and a full year deficit of £112.5 billion. The service sector surplus in the month was £6.8 billion unchanged from April. We expect a quarter surplus of £21 billion and a full year contribution of £81 billion. Overall the monthly deficit, goods and services was -£2.4 billion. We expect a full year deficit of - £31.6 billion. That’s approximately 2% of GDP. Disappointing, perhaps but no real surprise to readers of the Saturday Economist. The trade deficit is increasing, that’s a measure of the strength of the recovery as we have long pointed out. The service sector weakness, reflects the translation effect of a stronger pound rather than any price elasticity response. A strong recovery and a strong pound, the deficit will only deteriorate … Manufacturing output … Manufacturing output increased by 3.7% in May. The strong growth in investment (capital) goods continued (4.5%) as consumer durable output slowed to 2.7%. Our forecasts for the year remain unchanged, we anticipate growth of 4.2% for manufacturing output in 2014 and 3.9% in 2015. No change to our GDP forecasts for the year. Construction Figures … The construction figures for May were a little disappointing. After strong growth in the first quarter (6.8%), growth slowed to 3.4% in May. Our estimate of growth in the second quarter is lowered to 4% as a result. For the moment we make no change to our revisions for the full year. The monthly data is “dynamic” and subject to revision. Time to wait and see, if the revisions and seasonal adjustments yet to come, will change the outlook for the full year. Housing Market The latest data from Halifax HPI confirmed strong growth in the housing market continued. House prices were 8.8% higher in the three months to June compared to the same three months last year. Commenting, Stephen Noakes, Mortgages Director, said: "Housing demand continues to be supported by an economic recovery that is gathering pace, with employment levels growing and consumer confidence rising” The LSL Acadata price index for June was also released this week. The annual price rise was 9.6% with some evidence the volume of transactions is slowing. Opinion remains divided as to whether the new MMR are making an impact, or there is a shift in purchasers’ attitudes to market. Despite the new lending rules, we expect a significant increase in the volume of transactions this year, with the level of mortgage activity up 30% to date. Don’t miss our Housing Market update - due out next week. So what happened to sterling this week? Sterling closed down against the dollar at $1.711 from $1.715 and down against the Euro to 1.258 from (1.261). The Euro was unchanged against the dollar at 1.360. Oil Price Brent Crude closed down at $106.90 from $110.66. The average price in July last year was $102.92. Markets, closed down. The Dow closed below the 17,000 level at 16,900 from 17,068 and the FTSE was down at 6,690 from 6,866. The move to 7,000 too much for the moment. UK Ten year gilt yields were down at2.61 from 2.75and US Treasury yields closed at 2.52 from 2.64. Gold was up at $1,336 from $1,320. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed