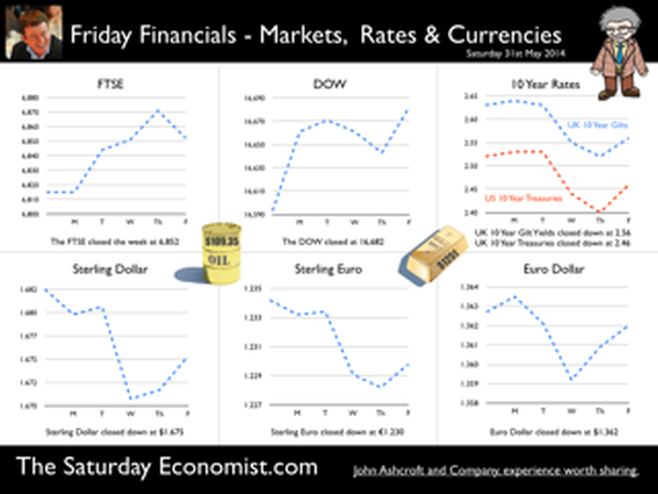

It may have taken some time but households across Britain have finally come to terms the with strength of the recovery. According to GfK, the UK Consumer Confidence Barometer increased to levels last seen in the early part of 2005. Rejoice - we are having a recovery - would have been the Conservative mantra under Prime Minister Thatcher. Confidence in the economic situation of the country, increased to the highest level EVER, since records released in 2004. The propensity to spend is back to levels of 2006, even though the financial situation of households index is still below pre recession numbers. No surprise, perhaps, but with interest rates at such low levels, there is no real uptick in the intentions to save - for the moment at least. Interest Rates set to rise … Maybe households are waiting for the rates to rise. According to Markit®, nearly one in four households expect a rate rise within the next six months … almost half expect rates to rise within the next twelve months. Chris Williamson, Chief Economist at Markit® said, “the recent upbeat news-flow on the economy, strong economic growth in the first quarter, record employment growth and surging house prices, means an increasing number of people think it inevitable that policymakers will be forced into an earlier rate hike than previously envisaged.” Quite right! In fact almost ten per cent, think rates are set to rise within the next three months! So much for forward guidance from the Bank of England. Charlie Bean and Baby Steps … Charlie Bean, the outgoing (as in departing) deputy governor of the Bank of England has suggested “The argument for gradual rises suggests rates should start to go up sooner. The rise could start with “baby steps to avoid making mistakes”. “There’s a case for moving gradually because we won’t be quite certain about the impact of tightening the Bank rate, given everything that has happened to the economy.” The sentiment was also echoed by MPC member Martin Weale, this week. "We can wait a bit longer. How long that 'bit longer' will be I'm not sure.” Ah yes, the merits of forward guidance and a clear steer on monetary policy. Governor Carney will have to whip the MPC troops into line if we are to avoid complete confusion on the direction of rates. The Bank would still have us believe rates will rise in the second quarter of next year. UK rates should rise in the Autumn … In our Greater Manchester Chamber of Commerce Economic Quarterly Outlook, to be released next week, we begin to caution, UK rates should be on the rise in the Autumn, if the present trends in household spending, retail sales and the housing market continue. From an international perspective, the MPC will be reluctant to act ahead of the Fed and the ECB. In the first quarter, US GDP recorded growth of just 2% year on year, postponing, perhaps, the inevitable rate rise. In Europe, fears of deflation may force the ECB to act, to ease, rather than tighten, monetary conditions still further in the June meeting. Japan ends fears of deflation … In Japan, fears of deflation have been assuaged by Abenomics. The solution to fears of falling prices - increase the rate of sales tax and push up prices! Japanese inflation increased by over 3% in April, half of which is explained by the hike in taxes! Fears may later emerge about the slow down in growth, such is the Ground Hog day experience of the lost decade but for the moment, rejoice - the deflationary spiral has been broken in the East! Good News for growth in the UK … Good news for growth in the UK continued this week according to today’s Financial Times. Drugs and prostitution will add £10 billion to the UK economy. Yes, the news that prostitution and drugs will be included in the calculation of the National Accounts from September onwards, adding a new dimension to the “Service Sector” offer. The change will add almost £10 billion to the National Accounts. Hookers will contribute £5.3 billion to “output” (GDP(O)) and drug addicts will add £4.4 billion to the calculation of expenditure (GDP(E). According to ONS research, in 2009, 60,879 prostitutes serviced 25 clients per week at an average spend of £67.19. Don’t you just love economics! If only "tricks" paying 19p could be persuaded to spend more … that would be a recovery! So what happened to sterling this week? The pound closed down against the dollar at $1.675 from $1.682 and down against the Euro at 1.230 (1.234). The dollar closed broadly unchanged at 1.362 from 1.363 against the euro and at 101.80 (101.97) against the Yen. Oil Price Brent Crude closed down at $109.35 from $110.52. The average price in May last year was $102.30. Markets, the Dow closed up at 16,682 from 16,593 and the FTSE moved up to 6,852 from 6,815. The markets are set to move higher. UK Ten year gilt yields closed at 2.56 (2.63) and US Treasury yields closed at 2.46 from 2.52. Gold moved down to $1,251 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

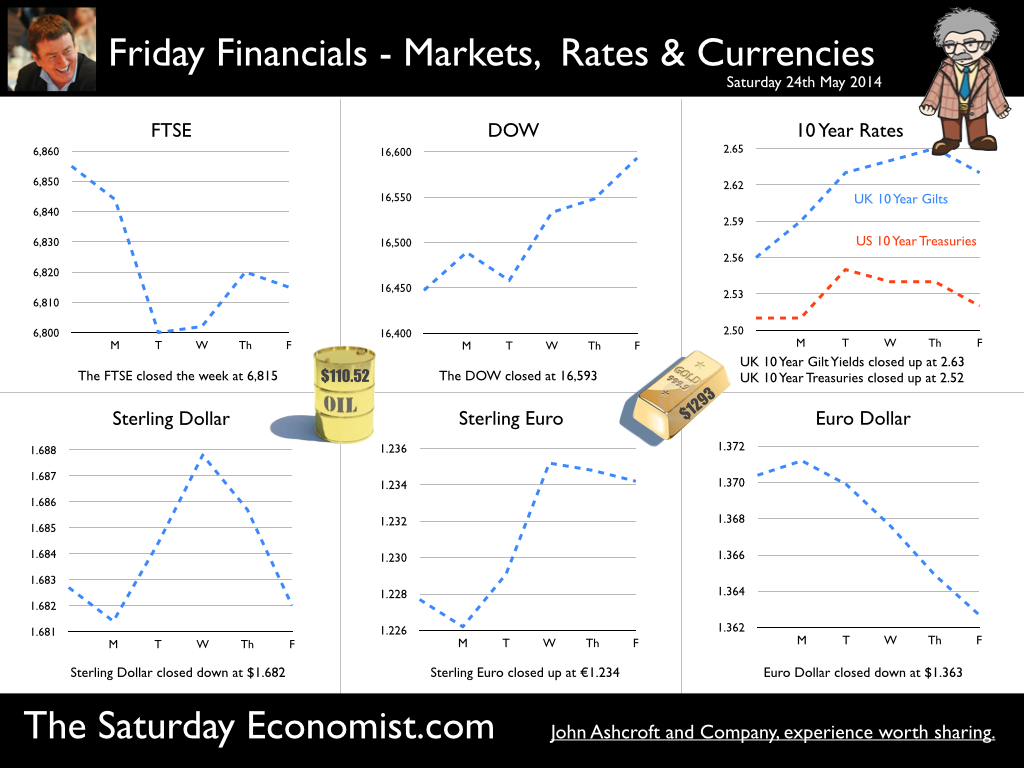

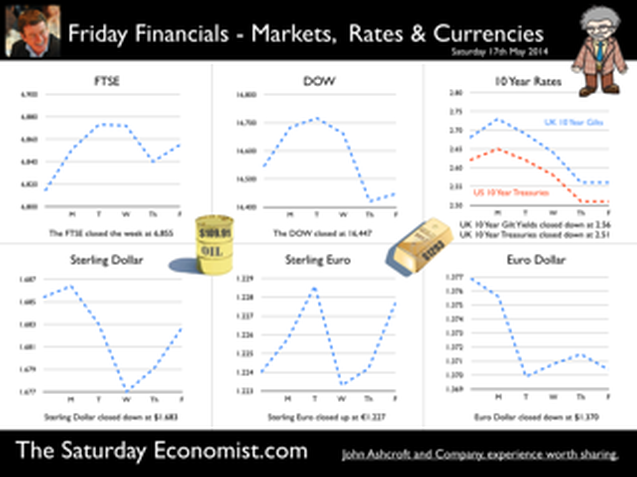

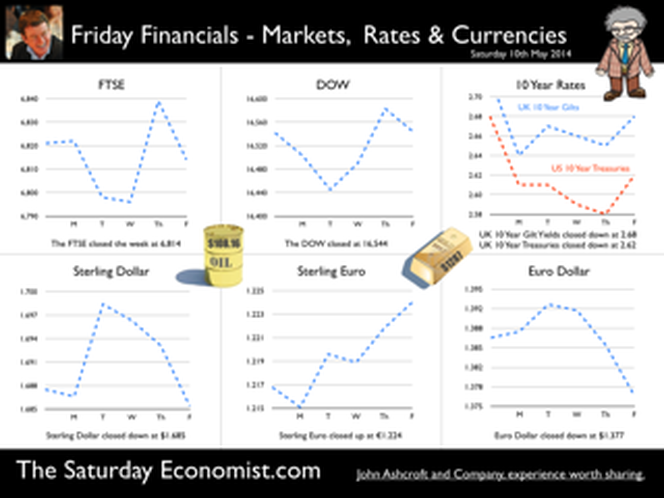

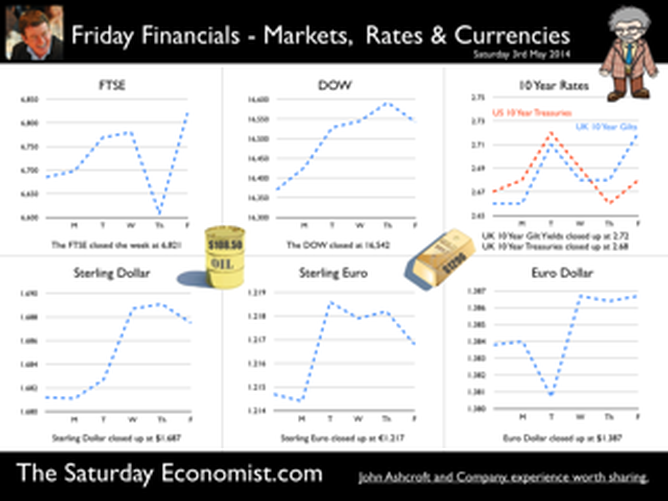

It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England Inflation Report - May - So when will rates rise? Q2 2015 still the best bet. The final whistle not for some time yet! The Bank of England Inflation Report was released this week. It was all so predictable. The Governor’s opening remarks explained, “The overall outlook for GDP growth and inflation in this report is little changed from February. The UK economy continues to perform strongly. Having increased by more than 3% in the past year, output is now close to regaining the pre-crisis level. 700,000 more people are in work than a year ago and inflation is below, but close to, the 2% target. And so it proved. The strong labour market performance continued into April. The claimant count rate fell by 25,000, to a rate of 3.3%. The wider LFS data (to March) also reflected the improvement with a fall in the overall rate to 6.8%. On current trends the job centres really will be closing in 2017! The MPC expectations are for growth to increase by 3.2% in the second quarter and by 3.4% for the year as a whole, with continued expansion in household spending. Spending will be supported by an increase in real wages as inflation remains close to target and earnings increase moderately, with a gradual improvement in productivity. The MPC obsession with spare capacity continues. “While there is a range of views on the Committee, the best collective judgement is the margin of spare capacity is around 1% to 1.5% of GDP.” Charlie Bean is not entirely convinced about the “fuzzy concept” of spare capacity. “There is a real danger of spurious precision and the pretence of knowledge in this area” said the Deputy Governor. Quite so. That and many others perhaps! Does spare capacity impact on inflation prospects? Not so much. International inflationary pressures are key to current price trends and for the moment remain subdued. “The global picture is consistent with muted external inflationary pressures which, coupled with sterling’s appreciation, will moderate CPI inflation in the near term” said the Governor. Inflation has fallen sharply since the Autumn and the outlook for inflation in the medium term remains benign. A benign inflation outlook which will avoid undue pressure, in the short term, to increase rates, despite the strong growth figures and the buoyant housing market. So what of rates? The strength of the recovery has moved the economy “closer to the point at which interest rates will have to rise”, the official statement. So when will rates rise? In February, the MPC were happy to attach some credence to the market view that rates would begin to rise in the second quarter of next year. If anything the view in May is slightly more “dovish” or certainly more obtuse. “Our guidance is giving businesses and households confidence that we won’t take risks with price stability, financial stability, or the incipient expansion. It will promote the recovery in business investment, productivity and real wages, that a sustained expansion demands.” Rates are still unlikely to move until the second quarter of next year, the implication. As we explained last week, the MPC will be reluctant to move ahead of the Fed and the ECB. Forward guidance then lapsed into sporting analogy as the governor explained : “Securing the recovery is like making it through the qualifying rounds of the World Cup. That is an achievement but not the ultimate goal. The real tournament is just beginning and the prize is a strong, sustained and balanced expansion.” Yes the the Governor is laying out his team formation for the tournament ahead . “A flat back four with growth, inflation, unemployment and borrowing all heading in the right direction. Two strikers up front, household spending, with support to come from business investment. Some confusion in mid field from the housing market but no mention of exports and rebalancing. So expect the odd own goal from the trade performance, errant on the wing, as we move into the final stages of the competition. The Governor, for now, is not “taking away the punchbowl as the match gets going”. Far from it, you may continue to consume alcohol on the terraces, well into the final stages. Base rates are not expected to rise anytime soon. Q2 next year still the best bet. The final whistle will not be blown for some time yet.” So what happened to sterling this week? The pound closed broadly unchanged against the dollar at $1.683 from $1.685 and up against the Euro at 1.227 (1.224). The dollar closed at 1.370 from 1.375 against the euro and at 101.54 (101.18) against the Yen. Oil Price Brent Crude closed up at $109.91 from $108.16. The average price in May last year was $102.3. Markets, the Dow closed down at 16,447 from 16,544 but the FTSE closed up at 6,855 from 6,821. The markets are set to move, the push before the summer rush. UK Ten year gilt yields closed at 2.56 (2.68) and US Treasury yields closed at 2.51 from 2.62. Gold moved up slightly $1,293 from $1,287. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK … This week, the Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of QE assets at £375 billion. No real surprise, UK rates are expected to remain on hold until the second quarter of 2015. For the moment, UK policy is relatively clear cut. USA … Over in the USA, matters became a little more diffuse. Tapering is expected to continue, concluding the asset purchase programme in September or October this year. But then what happens next? In March, Janet Yellen head of the Fed, gave a clear indication US rates would begin to rise within six months of the end of tapering. Markets reacted badly and the FOMC was minded to recant. This week, testifying before the Joint Economic Committee of the U.S. Congress, Chairman Kevin Brady pushed pushed Yellen for more clarity on when the FOMC would raise interest rates. The Fed chair would not be drawn on this occasion. “There is no mechanical formula for when that would occur” - the somewhat mechanical and evasive response. Oh yes, a month is a long time in the formulation of monetary policy. Europe … In Europe, Mario Draghi, President of the ECB, faced the opposite dilemma. With modest growth forecast for Euroland this year, inflation below target at less than 1% and a Euro strengthening against the dollar ($1.375), the Italian banker is under pressure to alleviate European monetary conditions still further. Playing for time, Draghi stated policy makers at the bank were comfortable with action in early June. Action awaits the “staff projections” for growth and inflation next month, before considering the next step. Draghi must hope forecasts are revised upwards. Having promised to “do what it takes” to stimulate growth, the President is clearly at a loss, as to what can be done next. A reduction in base rates to the zero floor would have little economic impact. Experimentation with negative rates is a high risk strategy. The move would thrill academic economists but cause trauma in the markets. This is no time for experimentation with central bank novelties. QE is muted as a possibility but with German and French long rates at 1.45% and 1.9%, there seems little cause to push rates lower. Ten year bond rates in Spain and Italy are this week trading within 25 basis points of UK gilts. MPC Dilemma … So here in a way is the dilemma for the MPC. The UK economy is growing at 3% a year, unemployment is falling at such a rate, we may have to close the job centres in 2017. Inflation is below target but as Mario Draghi pointed out this week, it is the weakness in international commodity prices, oil, energy and food, the real determinants of low inflation. Low inflationary pressure exacerbated or assisted by the rise in the Euro (and Sterling) against the Dollar. The UK is caught in the Dollar Euro vortex, with basic economics pushing monetary policy in opposing directions apparently. The MPC cannot move ahead of the Fed or much in advance of Europe for that matter without pushing Sterling still higher. Deflation the illusion - OECD World Forecasts This month the OECD forecast a recovery in world growth this year to 3.4% in 2014 and almost 4% in 2015. The Euro area is set to grow by 1.2% and 1.7% over the period. Euro inflation is set to rise above 1.2% next year. Commodity prices (base metals) are demonstrating a price basing action, Oil Brent Crude basis is trading ahead of last year. The international price profile can change quickly and dramatically. The threat of deflation - an illusion - which may quickly dissipate. A strong ECB president should do nothing. The US must accept rates will rise within six months of the end of tapering. This would leave the MPC free to begin the inevitable rate rise in the second quarter of next year. Want to here more, don’t miss the quarterly economics presentation on Wednesday at DWF next week. The multi media roadshow rolls on! So what happened to sterling this week? The pound closed unchanged against the dollar at $1.685 from $1.687 and up against the Euro at 1.224 (1.217). The dollar closed at 1.375 from 1.377 against the euro and at 101.18 (102.23) against the Yen. Oil Price Brent Crude closed at $108.16 from $108.50. The average price in May last year was $102.3. Markets, the Dow closed unchanged at 16,544 from 16,542 and the FTSE also closed up at 6,821 from 6,814. The markets are set to the move, the push before the rush. UK Ten year gilt yields closed at 2.68 (2.72) and US Treasury yields closed at 2.62 from 2.72. Gold moved down $1,287 from $1,296. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  GDP Figures Q1 … UK growth in the first quarter of 2014 was an impressive 3.1% year on year with significant growth in construction, manufacturing and the service sector. [According to the preliminary estimate from the Office for National Statistics released this week.] Construction growth increased by 5.1% in the quarter and manufacturing output increased by 3.5%. Service sector output was up by 2.9% with continued strong growth in distribution, hotels, and leisure (4.9%). The business and financial services sector increased by 3.6%. The outturn is more or less in line with our estimates in the Quarterly Economics Outlook released in March. Following the latest data, we have lowered our forecasts for growth in the construction sector for the year as a whole and increased our estimate of growth in manufacturing. The overall GDP position remains unchanged. We still forecast GDP growth of 2.9% in 2014 and 2.8% in 2015. Growth continues into Q2 … The good news continued this week, with the latest Markit/CIPS PMI® survey data on manufacturing and construction. In April the UK manufacturing sector maintained a robust start to the year. At 57.3, the seasonally adjusted index rose to a five-month high and registered one of the best readings over the past three years. Construction output continued to increase in April, albeit at the slowest pace for six months. The index recording of 60.2 is down from the peaks at the turn of the year but still ahead of the long run average of 54.3. Residential construction was the best performing area of activity. The rate of expansion in April remained one of the fastest seen over the past ten years … just as well! House Prices - increase into double figures … House prices increased by over 10% according to the latest figures from Nationwide. Robert Gardner, Nationwide's Chief Economist said: “After several months of moderation, the pace of house price growth picked up in April. Annual house price growth reached double digits for the first time in four years, with the price of a typical home 10.9% higher than April 2013. Still much to be done in construction however, “The upturn in construction of new homes continues to lag far behind the upturn in demand, with the number of new homes being built in England still around 40% below pre crisis levels.” Sir Jon Cunliffe, Deputy Governor of the Bank of England, expressed some concerns about the housing market in a speech in London this week. “The question for the Financial Policy Committee, is whether the sustained momentum in the housing market will lead to unsustainable growth in household indebtedness, undermining the resilience of the financial system. The growing momentum in the housing market is now the brightest light on the dashboard of warning lights.” You have been warned! Growth in the USA ... In the USA, growth in the first quarter was up by 2.3% year on year (0.1% quarter on quarter). The relatively disappointing number was attributed to a severe winter and much bad, wet weather. The Federal reserve derived some consolation from the strength of the jobs numbers released this week. In April, the number of non farm payroll jobs increased by almost 290,000, the unemployment rate fell to 6.3% and revisions to the employment numbers over the past three months confirmed the strength of the US recovery. Jobs growth over the last three months has averaged almost 240,000. With evidence of a strong performance in employment and household spending, the Federal reserve announced a further reduction in tapering with a reduction in asset purchases to $45 billion per month. Tapering is on track to completion by the September / October this year. Interest rate rises will then ensue possibly within six months. With inflation below target, wages rising by just 1.9% and almost 10 million Americans unemployed, the FOMC will be in no rush to act. So what happened to sterling this week? The pound closed up against the dollar at $1.687 from $1.681 and up against the Euro slightly at 1.217 (1.215). The dollar closed at 1.387 from 1.382 against the euro and at 102.23 (102.15) against the Yen. Oil Price Brent Crude closed at $108.50 from $109.54. The average price in May last year was $102.3. Markets, the Dow closed up at 16,542 from 16,370 and the FTSE also closed up at 6,821 from 6,685. The markets are making the move, the push before the rush, may see the FTSE hit 7000 before the summer sell off! UK Ten year gilt yields closed at 2.72 (2.66) and US Treasury yields closed at 2.72 from 2.67. Gold moved down $1,296 from $1,301. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed