|

"Proof The Plan Is Working" ...

Mixed news for policy makers in the inflation data this week. Inflation CPI basis eased to 2.3% in April, down from 3.2% in March and well below the peak for this cycle of 11.1% in October 2022. Rishi Sunak said: "Today marks a major moment for the economy, with inflation back to normal. This is proof that the plan is working. The difficult decisions we have taken are paying off." He could have added ... "From here it could get worse, one of the main reasons I made the election call, I'm off". Markets were disappointed. Analysts had expected a drop to 2.1%, closer to the Bank of England target of 2.0%. Disappointed but not unduly troubled. Ten year bond yields increased by 12 basis points, closing at 4.25. Sterling ended the week unchanged at $1.27. Further analysis of inflation data, would only cause "further" disappointment. Goods inflation, fell to -0.8%. The goods figure was flattered by a further fall in energy costs. Ofgem lowered the cap on average annual household energy bills by 12 per cent in the month, leading to a fall in energy costs of minus 27%. Service sector inflation eased to just 5.9% from 6.0% prior month. Insurance, health care, restaurants and hotels prices were particularly high. Treasure that no claims bonus, transport insurance costs were up by 24%. Underlying inflation excluding energy, food and booze, eased to 3.9%. The arithmetic mean CPI number for the month was 2.5%, significantly above the Bank's 2.0% target. Grant Fitzner, chief economist at the ONS, said: "There was another large fall in annual inflation led by lower electricity and gas prices." Read "Prices are falling gangbusters." "Tobacco prices also pull down the rate, with no duty changes announced in the budget. Food price inflation saw further falls over the year." [The rate of food inflation eased to 2.8%.] Manufacturing output prices increased by 1.1% in April, up from an average 0.3% in the first quarter. Manufacturing input costs were lower by -1.6% in April, compared to -2.7% in the first three months of the year. Still no retail price pressure but evidence of a turning point perhaps. Oil prices Brent Crude averaged $89.90 dollars in April this year, compared to $84.60 dollars last year. A plus 6% inflation impact Sterling adjusted. Money Supply M4, for some a leading indicator of inflation, bottomed out in September and October last year, with the latest data in March completing a reverse head and shoulders formation. The pattern suggests prices are set to rise towards the end of this year, in line with the Bank's own expectations. CPI inflation is expected to end the year at around 2.5%. So What of Rates ? The Bank of England will be concerned by the stubborn performance in service sector inflation, sticky earnings data and the moderate drop in underlying inflation. According to The Times, Tomasz Wieladek, chief European economist at T Rowe Price, said: "Although there is some evidence that services inflation is falling gradually, the data today will likely prevent a cut in June." Paul Dales, chief UK economist at Capital Economics, said: "It feels as though a cut in June now seems very unlikely. Even a cut in August is looking a bit more doubtful." The IMF this week suggested three rate cuts are possible in the UK this year. As we said last week, June [22nd] may just be a bit too soon. No meeting in July, the next MPC meeting after that, is the 3rd August.

0 Comments

Why Call An Election Now ... Many Have Asked ...

The Prime Minister made his announcement outside Number Ten in the rain, as the Labour promise of "Things Can Only Get Better" played in background. "Things can only get wetter" the pun but for Rishi Sunak, from here it could only get worse. Inflation figures will rise before the end of the year, along with the unemployment rate and the numbers out of work. If the April borrowing figures are anything to go by, the OBR forecasts for the current financial year will be widely exceeded. Growth in the first quarter suggested the economy was up by just 0.2% year on year. For the year as a whole the IMF growth upgrade to 0.7% may be something of a challenge. The IMF has warned there is no money for a further cuts in taxes and National Insurance rates. A series of big spending commitments already announced, including an uplift in defence spending, a large compensation package for victims of infected blood and the Post Office scandal, imply there's nothing left for tax cuts in an autumn budget anyway. Despite the IMF suggestion, there could be three interest rate cuts this year, the markets are beginning to think there may be just one. The immigration figures could get better, especially if student numbers for higher education are radically cut. The small boats keep coming. The Rwanda flights are still up in the air but not literally. The latest YouGov polling for The Times shows the Tories over twenty points behind in the polls, with no evidence the position is improving. Labour is on track for a 200 plus majority in the House. Tory MPs have decided in record numbers, enough is enough. The number of Tory MPs standing down at the general election (76) has now surpassed the prior Conservative Party record of 75. A record set in 1997 when Tony Blair won the Labour landslide. There is a question over Sunak's appetite for hanging on. Few can believe he is attempting to pull off a turnaround that would be truly unique in modern political history. July isn't a great month to poll. The last July election in the UK was in 1945. The result then was a significant Labour victory. So what is he up to? Sunak's decision to call a summer election is seen as a bold and risky move, reminiscent of past political gambles. Or is it? Earlier this year he was said to cut an increasingly dejected figure, frustrated that voters were not responding to his carefully orchestrated announcements and plans for the smoking ban and maths for all. While he has been more "chipper' in recent weeks, those close to him have suggested that holding out for longer would become an exercise in endurance and survival. The Post Master General for the Back Bench Committee is thinking of making daily deliveries of letters of no confidence. The Prime Minister has had enough. One look at the Rich List must have pushed him into the decision. The Out of Office option looms. It ain't that bad. Former Chancellor Nadhim Zahawi has just been named as the new chair of The Very Group this month. Dominic Raab has taken on a new role as Senior Strategic Adviser, at private equity firm Appian Capital. For someone else the challenge of NHS waiting lists, stopping the boats and flying to Africa. Sue Gray, Keir Starmer's chief of staff, has drawn up a list of potential crises that could trip up a Labour government. The collapse of Thames Water, overcrowding in prisons, universities going under, failing local councils and an NHS funding shortfall included. Not to mention a difficult public sector pay round. They all feature on a Labour Government risk list. But come to think of it, that's probably on the Tory risk list too ... fourteen more years? No thanks ... The Labour Market is Cooling ... "No Gangbusters Growth" ...

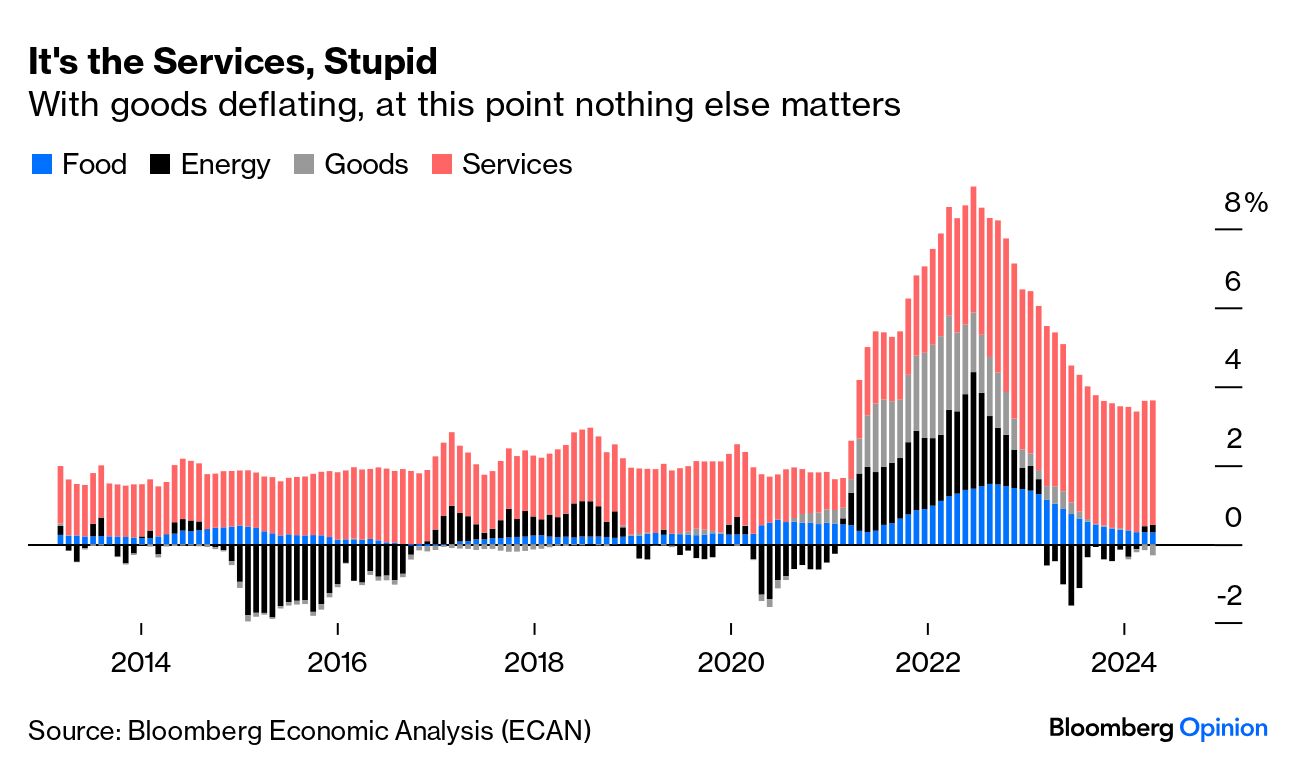

Mixed news for policy makers in the labour market data this week. The economy is slowing down, not "going gangbusters" after all. Unemployment is increasing, the number of vacancies is falling. Unemployment increased to 1,486 million at the end of March compared to 1,320 million at the end of December. The jump of 166,000 over the period was matched by an increase in the unemployment rate from 3.8% in December to 4.3% by the end of March. The number of vacancies in the economy fell to 898,000 in the three months to April compared to 929,000 in December. Not a huge drop, a reversion to trend perhaps, marked by significant recruitment difficulties in health, social care, accommodation, food, retail, distribution and professional services. Our standard models suggest, for an unemployment count of 1.5 million, the level of vacancies should be around 820,000. The variance (near 80,000) a measure of recruitment difficulties in the economy, adding pressure to wage rates and earnings. Average earnings (total pay including bonuses) averaged 5.7% in the three months to March. This down from a peak of 9.3% single month in July last year. Markets are braced for the April data which will include the near 10% hike in the minimum wage. Of itself not a huge kicker but watch out for the "compression effect" as lower paid workers seek to maintain differentials in the coming wage rounds. Huw Pill Strikes Dovish Tone ... The Bank of England's top economist has boosted hopes of lower borrowing costs after saying it is "not unreasonable" to expect the Bank to consider cutting interest rates over the summer. Huw Pill, the Bank's chief economist, told an online event organised by ICAEW, the Bank could consider cutting rates if inflation continues to ease off. Pill has been actively discussing the potential for interest rate cuts during the summer in various media outlets this week. His comments have sparked considerable interest among investors, markets and commentators. He acknowledged the recent indicators showing a slight increase in unemployment and a deceleration in wage growth, which could suggest a slowdown in regular pay growth in the months to come. Despite these signs of easing, he emphasised the British labour market remains tight by historical standards. This context is crucial. It influences the BoE's decisions on monetary policy, particularly interest rates. During his presentation to the Institute of Chartered Accountants in England and Wales (ICAEW), Pill mentioned that it was a reasonable assumption for the BoE to consider rate reductions during the summer months. However, Pill also cautioned against cutting rates too soon, warning that inflation could become "embedded" if the Bank tolerates high wage growth and service sector prices rises. "The direction of inflation is moving correctly, the BoE must remain vigilant to ensure that inflationary pressures do not become entrenched." "The Labour Market Is Rebalancing", says Greene The labour market is rebalancing and inflation is on a "benign"" path, Megan Greene has said this week, boosting hopes that interest rates could come down next month. Megan Greene, an external member of the Bank's rate setting monetary policy committee, said the supply of and demand for workers was better aligned, having been out of balance for the past two years. She said that this would constrain pay growth and would suppress inflation. Markets now expect a first rate cut in June with two further rate cuts possible before the end of the year. Strong growth figures in the U.S. in the first quarter, imply there will be no Fed rate cut in the Summer months. The Governor has explained, "There is no law which says the Fed must move first and everyone else moves afterwards". It's just usually like that!. And so it may be after all ... In the U.K., June may just be a bit too soon ... U.S Rate Cuts Could Come In September ... Traders appear increasingly confident, the U.S. Federal Reserve could start cutting interest rates as early as September, as inflation data cooled more than expected in April. Jerome Schneider, head of short-term portfolio management at PIMCO, said on Thursday, the latest U.S. inflation data confirmed to investors the potential for a near-term rate hike was now off the table. The next move will be down. John Authers, Points of Return, Bloomberg this week explained the market dilemma. "There was white smoke over the Bureau of Labor Statistics on Wednesday morning. The key measures of consumer price inflation for April confirmed expectations for a slight decline, and alleviated growing anxiety over a possible re acceleration. [Inflation CPI basis eased to 3.4% in April from 3.5% prior month.] The numbers could easily have been worse, and after a month in which prices had discounted growing risks of inflation, the direction of travel on markets made total sense. Bond yields should come down a little in these circumstances, while equities are reinforced. It is, however, reasonable to question whether these numbers were any kind of a turning point in the battle against inflation. To start, this "beautiful" chart generated by Bloomberg Economic Analysis breaks CPI into four major components; food, fuel, other goods, and other services. Two years ago there were major shocks to the prices of goods, food and energy, all of which have now dissipated. That's why inflation is much lower now. The problem is that services inflation remains stubbornly high, and accounts for substantially all of headline inflation at this point." "The Atlanta Fed's sticky price index, concentrates on goods and services whose prices take a while to change and seldom fall. This is inflation that's particularly difficult to reverse, and so any rise will make the central bank uncomfortable. It is coming down, but very slowly, and it remains above 4% level. Taken together these confirm that disinflation is still happening while there is no sign of an outright acceleration. So rate hikes look very unlikely. But cuts in the near term can also be ruled out as several key measures are sticky and remain too high." Markets expect the first U.S. rate cut in September, with two possible rate cuts before the end of the year. It remains to be seen if the Bank of England will move ahead of the Fed ... Britain's economy is going "Gangbusters" the UK's statistics office has said. Britain has escaped recession. The Office for National Statistics (ONS) hailed the performance of the economy. Gross domestic product (GDP) expanded by 0.6pc in the first quarter of 2024. (Quarter on Quarter).

ONS chief economist Grant Fitzner said: "To paraphrase the former Australian Prime Minister Paul Keating, you could say the economy is going gangbusters." Chancellor Jeremy Hunt said: "Today's growth figures are proof that the economy is returning to full health for the first time since the pandemic." Really? There is a strange statement in the Bank of England's Agent survey of business conditions which should serve as a warning. "Subdued consumer demand is widespread across the retail and service sectors. While some of the weakness in spending in 2024 Q1 was owed to poor weather, there is also a sense that underlying demand has weakened, although contacts are unsure as to the reason." Demand has weakened, subdued demand is widespread and businesses are not quite sure why! Hardly an economy that is "going gangbusters". More like an economy subject to political "Gaslighting" as Rachel Reeves suggests. Dig into the detail of the GDP figures for the first quarter, growth year on year was up by just 0.2%. Service sector growth was up by 0.3% boosted by public sector growth of over 2% in defence, social security, education, health and social work. In private sector services, output fell by -0.4% with significant drops in accommodation, food, transport, storage, finance and insurance. The leisure sector continues to suffer for the fourth quarter in succession. Retail trade sectors have been in negative territory for seven quarters with a slight uptick in Q1. The construction sector contracted for the second consecutive quarter by -0.6%. (Manufacturing the hero sector up 2.1% in the first quarter). Jeremy Hunt, the chancellor, told Times Radio that the figures were “more positive than many people have perhaps been thinking”. Rishi Sunak said the economy had “turned a corner”. Demand has weakened, subdued demand is widespread and businesses are not quite sure why! Hardly an economy that is "going gangbusters". More like an economy subject to political "Gaslighting as Rachel Reeves suggests. "Gangbusters by Gaslight" our theme for the week. The Doves Take Flight ...

At the MPC meeting this month, the committee voted to maintain bank rate at 5.25%. Two members of the MPC, Dave Ramsden and Swati Dhandri voted against the proposition. Two doves take flight, preferring to reduce Bank Rate by 25 basis points to 5%. The Bank of England's decision to hold the base rate for a sixth consecutive meeting came as little surprise. Inflation is due to fall below the target rate of 2.0% when data for April comes out later this month, largely impacted by the Ofgem rate cap. The Bank expects inflation to rise back above target in the coming months ending the year at around 2.5%. Service sector inflation remains and high rates of wage growth will impede the path to lower inflation, it is said. Nevertheless the Governor Andrew Bailey was remarkably dovish. "It is likely we will need to cut rates in coming quarters, more than implied in the current market forecasts." he said. The possibility of a rate cut in June returns. "June rate changes are neither ruled out nor a fait accompli", teased the Governor. Don't you just love it when central bankers talk French. Strong growth figures in the U.S. in the first quarter, imply there will be no Fed rate cut in the Summer months. But the Governor explained, "There is no law which says the Fed must move first and everyone else moves afterwards". [It's just usually like that!]. GDP growth is expected to pick up, slack is likely to increase, excess supply is likely to appear, second round effects on wages and prices are expected to ease as real incomes grow to offset wage round pressures. All this suggests a path to lower rates but the Governor cautions ... "Inflation must come back to target on a sustainable basis". Then the usual boiler plate. ... "The MPC remains prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably. It will therefore continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including a range of measures of the underlying tightness of labour market conditions, wage growth and services price inflation." "The Committee will consider forthcoming data releases and how these inform the assessment that the risks from inflation persistence are receding. On that basis, the Committee will keep under review for how long Bank Rate should be maintained at its current level." Economists at Swiss bank UBS were among those who shifted their view on when the BOE may lower interest rates, saying they were now expecting the first rate cut to take place in June rather than August. "The broader message and the tone of the MPC were more dovish than we had anticipated," economists said, in a note published after the BOE's latest interest rate decision. UBS cited changes to the BOE's forward guidance, inflation expectations and comments from Bailey regarding the impact of increased national living wages on overall wage growth as reasons for its changed expectations. The Swiss bank now expects rates to be cut in June, August and November, by 25 basis points each. Our Friday Forward guidance remains. We expect the first cut could be as early as June, with two further rate cuts possible by the end of the year. This is the dovish scenario but watch the data! |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed