|

When higher wages and higher skills ... mean higher taxes and higher bills ... who really benefits from the Chancellor's budget and the Prime Minister's vision for Britain.

Rishi Sunak opened the Tory Red Box and a "rarebit" jumped out. It was a dish of melted austerity seasoned heavily with tax and spending plans. The Chancellor announced £150 billion of spending commitments for hospitals, schools and the justice system. Almost every department received large budget increases. Local authorities would be forced to lean on council tax hikes to balance the books. But money was made available to assist with the leveling up agenda across the U.K. £100 billion of new spending is expected over the next three years, funded in part by previously announced tax increases in corporation tax, personal allowances and national insurance hikes. With tax increases of £40 billion over the same period, the budget is expansionary with a kick of some 2% of GDP. The Chancellor promised a "new age of optimism" slightly downgraded from an earlier promise to make the U.K. the best place on the planet. Footnotes indicated the sections drafted by Number Ten. Sunak almost apologized directly for the tax hikes. He was not "comfortable or happy" about the tax burden he said. It really was his mission to see taxes coming down and within the lifetime of this parliament. His long term ambition was to cut taxes before the next election arguing there was a "moral case" for a smaller state. "Do we want to live in a country where the response to every question is "what is the government going to do about it". Well not every question but it certainly begins with transport, infrastructure, telecommunications, education, skills, training, healthcare, social care, welfare, energy policy, water pollution, global warming, defense, security, police, prisons and more. "The government has limits, the government should have limits" he added. It was a message to Number Ten about spending, a message to the back benches about future tax policy. Rishi Sunak "Trick or Treat". The Tory lead over Labour moved up. The Chancellor's approval rating moved down. The odds of a move along the street edged lower. The change in stance had been made possible following the latest forecasts from the Office For Budget responsibility. In March, the OBR had expected the economy to expand by just 4% in the current year. Borrowing over the five year forecast period was expected to be £855 billion. The outlook for finances was so dire, tax increases were introduced to raise some £40 billion. In October, the OBR revised the outlook for growth following the strong recovery this year. Growth is expected to be 6.5% this year and 6% next. Over the next three years, nominal growth will be over 20%. More people will be in work than previously estimated. Additional tax revenues would mean borrowing would fall by over £200 billion more than previously expected. A perfect opportunity for the Prime Minister to pursue his spending plans and grab the cash rather than reduce the level of borrowing still further. Will the Chancellor be able to cut taxes ahead of the next election? It may be a tight squeeze with the hustings slated for May 2024. The planned corporation tax increase scheduled for 2023 could be short lived or even suspended. The problem for government is the future direction of inflation and interest rates. The OBR expects CPI inflation to hit 4.4% in the second quarter next year. Interest rates are expected to rise to almost 1% by the end of 2022. Strong growth is expected over the three year period. The Chancellor may yet get his wish to cut taxes before the election. Now that would be a real trick and treat ... Stick or Twist ... Time is running out for central bank reaction in the USA. Inflation CPI basis increased to 5.4% in September. The Fed's preferred CPE measure increased to 4.4%. Growth in the third quarter increased by 4.9% year on year. Nominal growth adjusted for inflation increased by 9.6%. Growth for the year as a whole is expected to be nearer 5% than the 6% previously expected. Recruitment difficulties and supply shortages are hampering expansion. The Fed is due to begin tapering before the end of the year. A reduction in the spend on mortgage backed securities a fair bet. The US Treasury may yet need some help with conventional debt in the current year. Stick or Twist? Joe Biden has a tough decision about the future of Jerome Powell at the Fed. Stick or Twist? The FOMC will have a slightly easier decision about a rate rise before the end of the year. As in the UK no central bank action is envisaged before Christmas. Sterling move down against the Dollar. Inflation expectations in the US remain firmly anchored. Ten year rates moved lower in the week ... The markets have decided to stick, no twist, no trick just a continued treat ...

0 Comments

Huw Pill, incoming Chief economist at the Bank of England gave an exclusive interview with the Financial Times this week. "I would not be shocked", he said "If we were to see inflation close to 5% or above in the coming months."

"With an inflation target of 2%, this would be an uncomfortable place for a central bank to be" he added. Governor Andrew Bailey had excited markets earlier this week, suggesting the Bank would "have to act" to curb inflation. Some analysts think the MPC will act to increase rates by perhaps 15 base points in the November meeting. The Bank had previously said, it expected inflation to hit 4% by the end of the year before easing back into the second half of next year. Pill was of the view the MPC was "finely balanced" over whether to raise interest rates or not. The latest inflation data would not be much help. The CPI headline rate slowed to 3.1% in September from 3.2% prior month. Goods inflation increased to 3.4%, service sector inflation fell to 2.6%. Basing effects related to the "Eat Out to Help Out" campaign last year, largely explain the drop in service sector prices. Even so without the campaign effect, the headline rate would have been 3.2% to 3.3% at best, hardly a step towards hyperinflation and stagflation. Producer Prices continued to demonstrate the pressure on manufacturing prices. Output prices increased to 6.7% in September, consistent with a 3.4% increase in consumer goods prices. Input costs increased to 11.4%. Oil, metals and minerals are driving costs higher. This week, Brent Crude closed up at $85.30 dollars a barrel, compared to $41 dollars last year. Earlier in the year, our models had suggested inflation would peak at around 3% in August before easing back towards the end of the year. The "stickiness of oil prices" suggests this scenario is too benign. Last year Brent Crude Prices increased to $50 dollars by December. We still expect oil prices to was back to $80 dollars in the final quarter. The inflationary impact on producer prices will ease either way. We may have seen the worst of the cost price pressure. We would not expect the headline CPI rate to rise over much from here. This week Unilever suggested Marmite prices will have to rise by 4%. Product shrink-flation suggests the Cadburys Double Decker may soon be rebranded as a "Minibus". Pill concluded, "We do not see, given the transitory nature of what we are seeing in our base case, the need to go to a restrictive policy stance." Inflation is always and everywhere a transitory phenomenon. In the US, the Fed is trying to convince the public, inflation may turn out to be a little stronger for a little longer than forecast. "Transitory" didn't feature at all in the September FOMC minutes ... Growth Picks Up In October ... The UK recovery regained momentum in October. The IHS Markit / CIPS flash Composite PMI® data was released this week. Markets just love the headline data. The October index closed up at 56.8 from 54.9 in September. The service sector index closed up at 58.0 a three month high. The data highlighted a "robust and accelerated" increase in private sector business activity. Survey respondents reported buoyant business and consumer spending as pandemic restrictions are rolled back. New business volumes increased at a strong pace in October. It was the fastest rate of expansion since July. The manufacturing sector was hit by supply shortages and rising energy and material prices. The headline index fell to 50.6. a nine month low. Still in positive territory but only just. It was the lowest level for eight months. Producers commented on difficulties meeting demand, a result of capacity constraints from lengthy supply lead times and staff shortages. Producers reported faster rates of new orders with a drop in production linked to capacity restraints. Stocks were depleted. Recovery in the sector hindered. The official output data confirms slowing growth in the sector. We still expect manufacturing growth of around 8% this year, last year's set back was so severe. The tectonic shift in the supply and demand plates nowhere more evident than in manufacturing. We expect GDP growth forecasts for the current year to be revised up to 7.5% to 8% or possible more. Strong Growth Reflected in Borrowing Figures ... Strong growth is reflected in the government borrowing figure released this week. Borrowing in the first six months of the year was £108 billion compared to £209 billion over the same period last year. For the year as a whole borrowing could fall to £150 billion. This compares to the OBR forecast of £234 billion at the start of the year, postulated on the basis of 4% growth in the economy. Interesting to see what lies in the Budget Red Box next week. No real need for tax rises at this stage in recovery. No time to hike corporation tax, no need for a rise in NI employment tax. Strong revenues are flowing into the Treasury coffers. The deficit will fall to pre Covid levels within two years ... no need for strong action at the Despatch Box ... unless the Treasury thinks it has a point to prove ... Tectonic Plates Have Shifted ...

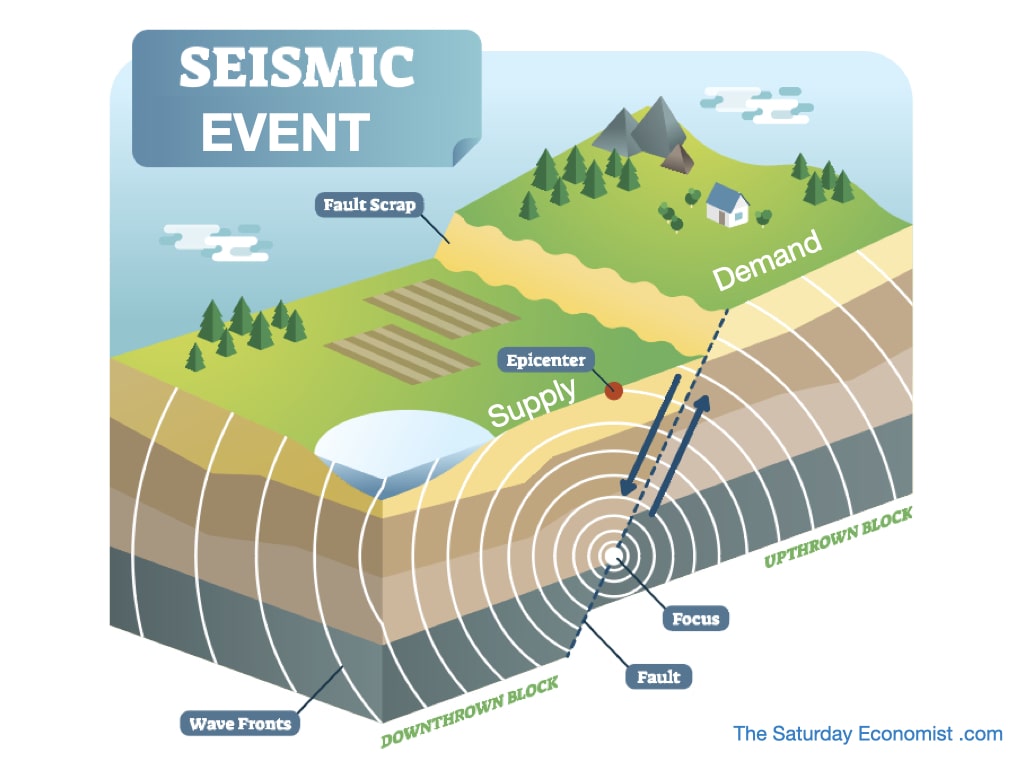

Two early morning sessions this week. It was our Quarterly economics update with Protiviti and Robert Half on Thursday. On Friday, we were presenting at the ICAEW Virtual Economic Summit. The challenge, how best to explain the vagaries of recovery with concerns about supply shortages, recruitment difficulties and energy cost spikes. Questions about possible stagflation were in the "virtual" room. Concerns were expressed about growth and recovery prospects. The situation was complicated by the jobs survey data, this week. Unemployment fell to 1.5 million. Vacancies increased to 1.1 million. The unemployment rate fell to 4.5%. The earnings rate slowed to 7.2%. The furlough scheme closed at the end of September. The expectation is most of the estimated one million on furlough, will be absorbed back into work or into the workforce more generally. The IFS worst case scenario is that approximately 300,000 may form part of a frictional adjustment in unemployment to be absorbed over the next six months. On Thursday, the latest estimates of growth were released for the UK economy. In the second quarter, growth is estimated to have risen by over 24%. It is now clear growth in the third quarter will be 7% year on year. Assuming growth slows to around 5% in the final quarter, the year on year performance will be over 8%. Accommodation and Food expanded over 25% year on year in Q3. Transport and storage is growing at over 10%. Construction output will average over 10% in the period. The trend rate of growth for the UK economy we model at 2%. A fourfold increase in the growth rate, with a tight labour market, supported by the furlough scheme, is leading to labour and supply constraints not just in the UK but around the world. There are four critical phenomenon ... 1 The Covid pandemic was a seismic event creating a shock to output in the UK and world economy in 2020. 2 The strong recovery has revealed a tectonic shift in supply and demand plates in the world in 2021. Supply streams are struggling to get back on line and into line with the dramatic demand surge. 3 Energy costs and commodity costs are spiking as demand returns to a world economy growing at 6% p.a. 4 Lock down and WFH has generated for many a fundamental reassessment of work life balance. Quality of life issues abound. 4.5 million quit their jobs in the USA in August. Recruitment difficulties are endemic as jobs growth pressures increase. So what of inflation? CPI inflation is expected to peak at around 4% before easing back from the second quarter next year. Inflation is always and everywhere a transitory phenomenon. No real expectation of an early rate rise. The shift in tectonic plates will continue to "shake" the world economy. No need to hide under the furniture, a chance to recognise strong growth and the challenges and opportunities that presents ... All At Sea ... Much talk of supply side constraints at the ICAEW event last week. No surprise really. World trade increased by 22% in the second quarter. Growth is expected to be 15% for the year as a whole. Trade fell by 14% in Q2 last year. Container capacity was cut by 10% as a result. Shipping pressures are evident. Supply networks are all at sea. Freight costs have surged. China to the West coast peaked at over $20,000 dollars in September. Prices have eased back to $15,000 dollars since then but still well above the $5,000 average at the start of the year. Lead times are increasing. The gap between order and delivery for "chips with everything" increased to a record 22 weeks in September from 12 weeks in January. Lead times for container shipments have increased from 60 days to 70 days. Congestion at port is increasing. In Los Angeles, 29 ships are in port with 38 waiting to dock. In HK Shenzen, 39 are in port with 67 out at sea. In Shanghai, 86 are in port with 61 at anchor. This week Maersk redirected container ships away for Folkestone to avoid excessive delays ... Once in port, containers are piling up on the docks. A shortage of HGV drivers is creating problems to clear the decks. In the US President Biden is urging the ports to work 24/7 to clear the backlog. In the U.K. the government is increasing visa allocations for elves and sleigh drivers to ensure Christmas is delivered on time. Strange to think I had a couple of weeks off in August. It all seemed so predictable and straightforward. Not a Black Swan in Sight ... A reminder, when all the plates are spinning nicely, it's either the end of the act or an illusion ... But Not For Long ...

The U.S. is pushing OPEC to boost oil production. China is ordering miners to ramp up coal output. Russia is pressing Europe to commission Nord Stream 2. The LNG tankers are turning East. China seeks to boost stocks before the hard winter ahead. Saving the planet will just have to wait but hopefully not for too long. The fuel crisis is pushing prices higher. Brent Crude closed at $82.54 up from $78.77 last week. Gas prices hit $6.50 dollars before moving off peak. Prices closed 12% down from the mid week high. The cost of extraction is no mean variable. Hikes and Spikes the real reason for the price performance. The price pattern is beginning to mirror the problems in the lumber region, earlier this year. Lumber now trades back towards $500 from the $1,500 dollar mark in April this year. We would expect gas prices to ease back, despite stock building in major markets. Prices averaged just $3.00 per unit in May. The markets explain why short term demand exceeds supply but not the full extent of the price ramp. This week, gas dependent producers including paper, steel and gas met with Business Secretary Kwasi Kwarteng pleading for help with cost prices. They failed to find any solutions in the Kwarteng closet. Production cuts or even closures are on the cards unless the government introduces price intervention to alleviate the cost burden. "A problem for the Treasury and not the Business Department" explained the Secretary of State, never one to dodge a difficult issue. The recent success with the boost to CO2 emissions was obviously enough in a busy year. Rishi Sunak at Conference this week explained " The future is here, even if you can't see it yet." No thought of tomorrow? Not really! "We are going to make the UK the most exciting place on the planet." No explanation forthcoming from the Prime Minister's speech, as to how we are to achieve this. The petrol crisis may be easing but dead pigs may soon lie at the doors of Downing Street. The Russians wants to boost gas delivery to Europe with the opening of the Nord Stream 2 pipeline. Gazprom is seeking a fixed term price contract to avoid spot price exposure for buyer and seller. The EU should accept the deal and not succumb to U.S. pressure to accept North American LNG as an alternative. "The raucous squawkus from the Anti Aukus caucus" should be a rallying call for the reassessment of U.S. foreign policy and trade policy. Uncle Sam is enthralled by the Eastern promise not the ways of the West. In the UK, the government should offer a short term price cap for business with a commitment to build gas stock capacity to the European average. "Build back better" should include gas fittings in addition to Johnson's "fibre optic vermicelli" set to assist with the leveling up agenda. If OPEC open the oil valves and Biden gives the nod to US oil rigs, oil prices could move back into line and ensure the talk of $100 dollar oil is removed from the agenda once and for all ... the price crisis could be over by Christmas ... households will have enough gas to defrost the foreign frozen turkeys imported from Poland and France ... Inflation ... Transitory or Tipping Point ... "High inflation is rising faster than expected and will last longer than anticipated". The new Chief Economist Huw Pill was speaking before the Treasury select committee this week. The rise in prices would prove to be temporary but the "magnitude and duration of the transient inflation spike is proving greater than expected". The Bank now believes inflation CPI basis will hit 4% before easing back towards the 2% target by the end of next year. The emphasis remains on "transitory rather than a tipping point". Prices pushed higher by energy, commodity and metal prices should unwind as supply begins to meet the demand surge from a world responding to the covid output shock. This month, shipping costs are falling back as the container capacity moves back into line. We will update our price forecasts once the latest date for September is released on the 20th this month. The resilience of the oil price suggests the Bank expectations could understate the short term peak ... some expect prices to rise over 5% into the New Year but then some expect a rate rise before Christmas. Pull the other one, that's if you can find a Cracker for Christmas ... Here's What It Means ...

Last week we explained how the surge in world trade is causing problems at the docks. This week we explain how the surge in UK growth is much faster than expected and much faster than currently forecast. Growth in the second quarter was up by 24% compared to prior year. For the year as a whole we expect growth of between 7.5% and 8.5%. Growth could well be over 15% over the two year period. No wonder the economy is showing signs of overheating. We map the trend rate of growth over the ten years prior to the shut down at 2% per annum. The rate of change is slowing as the economy returns to the trend rate of output. Fears for the current year are over blown. If there was no growth at all from Q2 levels, the comparisons with prior year would still show growth of 7.2% for the year as a whole. Last year was so bad after all. Manufacturing was up by 28% in the second quarter. Construction was up by 57%. Service sector growth was up by 23%. No wonder, there are over one million vacancies in the economy and wages are rising. Household spending was up by 20% in the second quarter. Business investment was up by 13%. We expect consumer spending to increase by over 8% this year. With a strong surge in leisure, clothing and tourism sales, forcing the pace. The furlough scheme ended in September. Most furloughed are expected to return to work. Some "frictional" unemployment may arise before the u rate returns to current levels over the next six months. Strong domestic demand led to a surge in imports up 20%. No evidence of a strong performance from "Truly Global Britain", exports were up by just 3.5%. Strong growth continues into the third quarter. The so called GDP "slow down" in July meant that output was up 7.5% year on year. The latest IHS / Market CIPS UK Manufacturing PMI headlined "Manufacturing upturn slows further as supply chain and labour shortages stymie growth". Was it really that bad? The headline index was 57.1 in September with an average of 60.0 in the quarter as a whole. That is actually higher than the second quarter!. Sterling was hit this week, closing at $1.3562 against the dollar. The Pound was out of favour as traders fear slowing growth will inhibit the capacity of the Bank to raise rates before the end of the year. As if that was on the cards anyway. The government is acting to deal with the emerging crises. Subsidies to boost CO2 emissions, the army to deliver petrol and pick the daffodils. Visas for EU drivers and chicken pluckers. Imports of turkeys from Poland and France to save Britain's Christmas Dinner. Older drivers to be captured from care homes to return to the cab. Driving tests to eased and fast tracked. No need to test for reversing skills or the ability to hook up the trailer in the new era. Extended hours for existing drivers, five star hotels for those away overnight. What next? Lorry drivers allowed to use the hard shoulder to help push the deliveries through. Growth is much faster than expected. It will continue into next year. Shortages and supply constraints will be measured as demand deferred into the later period. Strong growth is producing signs of overheating .. Inflation pushed higher by rising energy and commodity costs ... Signs of Overheating ... But commodity prices are easing. Oil Brent crude basis closed at $78.77 this week, the move over $80 dollars proved too much. We expect the trade to continue between $75 and $80 dollars in the current quarter. This compares to an average $42 dollars in the final quarter last year. The inflationary impact will fade by Spring next year. Gas prices moved off peak, closing at $5.576 from $6.000. Copper closed at $4.20 from $4.70. Aluminum leading the chase higher, was off the top closing at $2,852 from $2,937 in September. Remember the stress in the lumber region? Prices closed at $620 at the end of the week, compared to $1,670 in July. Freight costs are moving lower, the cost of shipping to the west coast was off 5% from peak in September. The best cure for rising prices is rising prices. CPI inflation is projected to rise temporarily in the near term, to 4% in Q4. Thereafter, inflation is expected ease back towards target by the end of next year. Signs of overheating are evident as the economy returns to trend. Rising cost prices. Delivery shortages. Higher wage levels and a high level of vacancies persist. The surge in world trade is causing problems at the docks. Covid disruption in Vietnam still plays havoc with the global supply chain. Growth in the UK is much faster than expected and currently forecast. Signs of overheating are evident. The underlying trend is that of strong growth, set to continue. It is important to distill the signals from the noise. At The Saturday Economist we always keep you in the picture ... Our September forecast available to Premium Subscribers, members of The Saturday Economist Club ... That's all for this week. Have a great weekend and a great week ahead, John |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed