Shocking news emerged this week of the state of patriarchic top down regulation in the EU. Boris Johnson was in front of the Treasury Select Committee to be interrogated by Andrew Tyrie. During the session The Mayor of London revealed that no one over the age of eight was allowed to blow up a balloon in the Johnson household. The truth emerged during a question from the Chairman of the committee. Boris Johnson had claimed there were EU rules restricting the recycling of tea bags and banning children under the age of eight from blowing up balloons. Of course, there are no such restrictions. The EU has recommended that children under eight should be supervised when blowing up balloons to prevent swallowing and choking. Advisory guidance should be included on all relevant packaging the suggestion. There is no ban on blowing up balloons or tea bags for that matter! Boris had made the claim at a speech in Deptford last week, adding why should the EU determine the size of road traffic containers we build in the UK? Fair point. It’s so the containers can be driven around Europe without getting stuck in tunnels and avoiding crashing into bridges. A single market with a level playing field and roads free from road traffic disasters, all part of the European grand plan. Headlines and soundbites to not make for a sound “Leave” of “Remain” campaign for that matter. The Public look to senior politicians for information and advice on this important issue. The information must have a high degree of authority and intellectual honesty. This will not be delivered by blonde buffoonery. There should be an EU regulation about that … Brexit ... This week, we concluded our extensive research on the referendum question. It had arisen at the request of Marketing Stockport. Gold members of the Stockport group were confused about the issues and wanted an objective presentation about the key facts and figures. Some eighty slides were included in the presentation. [The vote was 85% in favour of “Remain” before the presentation was made.] A few undecided were later convinced to stay. We do not formally campaign for either camp. However from the research it is best to segment the arguments into four issues. The Business Case, The Economics Case, The Political Case and the Social Case. The latter is largely about immigration, the political case largely about sovereignty. The economics case is always finally balanced with well argued analysis from either camp. On the one hand … On the other hand, it is difficult to argue the business case to “Leave” the EU. Uncertainty is a drain on investment on the short term and in the medium term. We have no idea of the new world order which accounts for almost half of UK trade, 12% of GDP and 3.5 million jobs. The impact on aerospace and transport manufacturing could be significant. The “Leave” camp suggest it will be possible to secure a free trade agreement for goods, services and capital, without payment into the club, avoiding labour and product regulation in the process. Good luck with that. It is an impossible ask. Quad Erat Demonstrandum as some might say … We are hosting a series of events in the run up to the vote. The presentation to Marketing Stockport, discussions with our private equity group in Manchester, Sir Richard Leese arguing the “Remain” case and John Longworth ex Director General of the BCC will be with us at an additional event arguing the “Leave” case. More events are planned in the pro-manchester calendar over the next few months. Back in the UK … Inflation remained at 0.3% in February. Service sector inflation was 2.4% (that’s above target). Retail sales were up 3.8% year on year and government borrowing looks set to overshoot in the year to date by around £5 billion. £77 billion would appear to be the forecast outcome compared to the OBR forecast of £72 billion in the latest update and £92 billion last year … So what of rates … In the US the latest GDP revisions suggest growth was stronger across the board but with no revision to the 2.4% out turn for 2014. We expect growth in the US of 2.4% this year with a further two rises in interest rates before the end of the year. Sterling rallied against the Dollar rising to $1.48 by the end of the week from the February over sold position. We expect UK rates to rise in the third quarter this year as inflation accelerates and commodity prices rally. The MPC will be obliged to follow the Fed at some stage … So what happened to Sterling? Sterling closed up against the Dollar at $1.480 from $1.449 and down against the Euro at €1.265 from €1.285. The Euro moved down against the Dollar to €1.116 from €1.127. Oil Price Brent Crude closed at $40.45 from $41.12 The average price in March last year was $59.58. The deflationary impact continues but will begin to unwind later this year. Markets, held - The Dow closed at 17,515 from 17,554. The FTSE closed at 6,106 from 6,189. Gilts - yields moved up and down. UK Ten year gilt yields were up at 1.48 from 1.449. US Treasury yields moved up to 1.90 from 1.87. Gold closed at $1,265 ($1,251). The old relic glitters briefly. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out soon! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

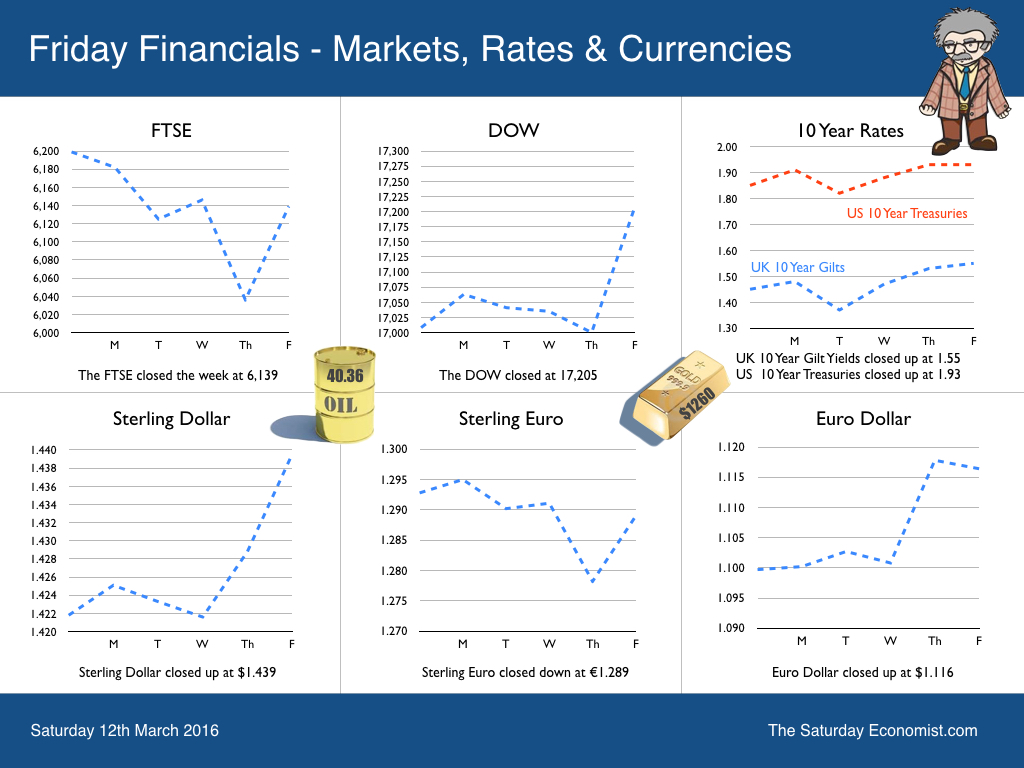

Budget week and the Chancellor outlined a budget for the next generation of Prime Ministers. Matthew Parris writing in the Times today is not so sure George Osborne will be one of them. Osborne may struggle to be the next Prime Minister, particularly from the job next door, he writes today. Time for a change in number eleven perhaps? I doubt that. The budget had a mixed reaction especially with the cuts to disability payments. The PR photo shots of the Chancellor in school the following day didn't look so good. The Treasury Boss looked as out of place and nervous as a new boy in the wrong school uniform on his first day in class. Beware the IDS of March … Iain Duncan Smith resigned on Friday. The latest attack on welfare benefits a step too far. All in this together? Not really, the Brexit boys are moving in to position before the referendum. The Prime Minister was puzzled and disappointed. The proposed changes to personal Independent payments and other disability cuts were to be kicked into the long grass. After all, who needs a back bench revolt on welfare and an EU schism at the same time. The ideas had emerged from Works and Pensions in any case. Treasury were just doing the adding up! No reason to cut and run. Man up ad take the hit for the team! We are all in it together after all. Of Budgets, Magic and Mystery … Another budget and another forecast from the Office for Budget Responsibility. Always exciting. It’s like a new chapter in a Harry Potter novel. We never know what mystery and magic will emerge from the text. So it proved. The OBR had been so optimistic in November forecasting growth of 2.4% this year and an average growth of 2.4% over the next five years. Nominal GDP was set to increase by 4.4% in each year. By 2021, the economy would be worth almost £2.4 trillion. Economists are subject to mood swings. The OBR is no exception. In March, the growth forecasts have been revised down to 2.1% real growth and four percent nominal growth. Growth in the current year has been revised down to 2%. By the end of the forecast period, the economy will be worth just £2.3 trillion. Over the period, the Chancellor will have lost some £100 billion of revenues. Why is the OBR so gloomy? Employment is increasing, wages are rising, interest rates are on hold. Business confidence remains high despite some short term concerns about Brexit. It’s a mystery why the OBR have become so pessimistic about growth in just a few months. It’s a miracle that despite the lower growth forecasts, the Chancellor will still produce a budget surplus of £10 billion by 2020 despite the revenue loss. The real surprise, the OBR expect borrowing in the current year to be just £72 billion, when the January number suggest £80 billion would be the likely out turn. Soon all will be revealed but not necessarily by the year end the warning ... strange that. Worries about productivity abound? The OBR is worried about productivity in the UK economy. Things were improving in the first three quarters of 2015. Q4 was a setback. The Q4 level is now taken as the new norm(al) over the next five years. Why so pessimistic? The OBR think that “productivity is a driver of growth in the economy”. It isn’t. Productivity is the measure of growth in the economy. It is just an output statistic. Output divided by labour equals productivity. The is no Harry Potter magic productivity dust. Factor inputs, like labour, business Investment, infrastructure investment, education, training, apprenticeships, they are the real drivers of growth in productivity. In the UK, there is no constraint to labour or capital inputs. The labour pool is growing as the immigration stats confirm. Productivity may slow as the service sector dominates growth. Charlie Bean’s review of the national statistics, suggest significant parts of the economy are excluded from the ONS GDP stats in any case. The high added value, high productivity creative digital sector may is significantly under recorded. Later adjustments may suggest productivity is not as bad as is currently outlined. So what of he future? We shall await the next chapter in the OBR series with interest. What magic and mystery will emerge in the next release. What spells will be cast. What mood of the cast. So what of rates … The Fed made a dovish statement about rates this week. Two rather than four rate rises are now envisaged this year. The blue dots have been pushed lower in the forward projections. The Dollar softened against the Euro and Sterling as a result. In the UK, at its meeting ending on 16 March 2016, the MPC voted unanimously to maintain Bank Rate at 0.5%. The Committee also voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion. All MPC members agreed that when Bank Rate does begin to rise, it is expected to do so more gradually and to a lower level than in recent cycles. This guidance is an expectation, not a promise. The actual path Bank Rate will follow over the next few years will depend on the economic circumstances. We still expect UK rates to rise in the third quarter this year as inflation accelerates in the third quarter 2016 and commodity prices rally. The MPC will be obliged to follow the Fed … So what happened to Sterling? Sterling closed up against the Dollar at $1.449 from $1.439 and down against the Euro at €1.285 from €1.289. The Euro moved up against the Dollar to €1.127 from €1.116. Oil Price Brent Crude closed at $41.206 from $40.36 The average price in March last year was $59.58. The deflationary impact continues but will begin to unwind later this year. Markets, rallied - The Dow closed at 17,554 from 17,205. The FTSE closed at 6,189 from 6,139. Gilts - yields moved up and down. UK Ten year gilt yields were up at 1.449 from 1.439. US Treasury yields moved down to 1.87 from 1.95. Gold closed at $1,251 ($1,260). The old relic slips further. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out soon! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here.  Chancellor faces tough budget week … It was a tough week for the Chancellor in the run up to the budget. This is the week of ONS updates on manufacturing,trade and construction. Manufacturing was flat in the first month of the year, construction was hit by the lack of public sector projects and the trade deficit with the EU hit record levels. The Chancellor will miss his borrowing target in the current financial year as the OBR will reveal next week. A great start! Should we worry about our 2.6% growth projection this year? A bit. We don’t expect much from manufacturing or construction, dependent on service sector and leisure sector output as we are. Household spending and investment will support domestic demand. The consensus is for lower growth of 2.2% this year. We expect sluggish growth in the first quarter but don’t write off the higher target just yet. Brexit … Boris Johnson appeared in Dartford this week, warning of “Brexit” fear mongers and the Gloomadon [Popper] Doppers. Reassuring the people of Britain, we have nothing to fear but fear itself. Boris takes his lines from Franking D Roosevelt in his 1933 inauguration speech. Churlish to point out US unemployment then averaged 20% over the next six years. Further reassurance was offered. No need to worry about tariffs. The people of France love the dense, glutinous chocolate cake we export from Walthamstow apparently. No need to worry about The Free Trade Area. The UK will have a deal like Canada. OK it may take seven to ten years to get the deal but what fun (and uncertainty) we will have along the way. Especially if Boris is leading the negotiations. What hope for simultaneous translation ... add another two years to the timetable for that! No need to worry about onerous regulation from Brussels. The people of Britain will “cast off their chains and be free”. Free to let our children “blow up balloons” and build “tall lorries” which won’t be allowed to drive in Europe but will be able to crash into bridges around the UK. Excellent! Gunboats down the Rhine, tall ships along the Seine, we will let them eat Essex cake and Welsh lamb, tax free. Civis Britannicus Sum. The Brexit is a vital issue for the UK economy. The voting public deserve an intelligent debate. Not a series of sound bites and photo ops in a cold depot in Dartford with a strange blend of Franglais to spell out the message. Don't miss The Saturday Economist on Brexit - Out Soon. Draghi Magic Fails to Convince … In Europe the ECB voted to reduce rates to zero and extend the QE programme. The interest rate on the main refinancing operations of the Euro system was reduced by 5 basis points to 0.00% and the rate on the marginal lending facility was reduced by 5 basis points to 0.25%. The rate on the deposit facility was lowered by 10 basis points to -0.40%. Monthly purchases under the asset purchase programme were expanded from €60 billion to €80 billion, intended to run until the end of March 2017. The ECB expects the key ECB interest rates to remain at present or lower levels for an extended period of time and "well past the horizon of our net asset purchases". The key objective remains the 2% inflation target.. Draghi is peddling old medicines for the wrong ailment. Inflation is always an everywhere an international phenomenon at present. Monetary policy will have little impact with energy and commodity prices on the floor. The good news? The IEA have suggested the oil price has bottomed out. Commodity prices are on the move. The ECB may get back to the inflation target sooner than is believed. A good thing too. The ECB is in danger of dragging Europe deeper into the NIRP crevasse on Planet ZIRP. So what of growth in Europe … According to the ECB economists, growth for the current year is expected to be 1.4% rising to 1.7% next year. The EU28 grew at a rate of 1.8% in 2015. In Spain, the economy grew by 3.5% in the final quarter. In Ireland the Celtic tiger grew by 7.8% last year. A strange time to experiment with lax monetary policy. We know the problems of a one size fits all monetary policy all too well. Oil prices and markets … Markets are bullish. Oil prices Brent Crude closed at over $40 Brent Crude basis, Sterling bounced back to $1.439 and the FTSE closed above 6,000. In the US the Dow closed once again above the sensitive 17,000 level. US Treasury yields rallied, copper, iron ore are on the rise. So what of rates … Our view remains. US rate rises will continue into 2016. Negative rates will be reversed in Europe and Japan. The Bank of England will be forced to act this year, as growth continues, the labour market tightens, earnings increase and inflation trends return. We expect UK rates to rise in the second or third quarter this year as inflation accelerates in the third quarter 2016 … I had a long exchange on Twitter last week with Danny Blanchflower. Mary and I were returning from London and a visit to the ENO. Danny fundamentally disagrees with our outlook and thinks the next move for UK rates will be down. A fair debate! I only wish I had a “Magic Flute” and all would dance to my tune … So what happened to Sterling? Sterling closed up against the Dollar at $1.439 from $1.422 and down against the Euro at €1.289 from €1.293. The Euro moved up against the Dollar to €1.116 from €1.100. Oil Price Brent Crude closed at $40.36 from $38.55 The average price in March last year was $59.58. The deflationary impact continues but will begin to unwind in the third quarter this year. Markets, rallied - The Dow closed at 17,205 from 17,008. The FTSE closed at 6,139 from 6,199. Gilts - yields moved up and down. UK Ten year gilt yields were down at 1.439 from 1.450. US Treasury yields moved up to 1.95 from 1.85. Gold closed at $1,260 ($1,268). A little flutter from the old relic settles back. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out soon! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Sterling bounces back, markets rally ... This is the week of the Markit / CIPS updates on UK manufacturing, construction and service sector. At first sight, they made for dismal reading … according to the headlines ... Manufacturing … UK manufacturing hit a 34 month low in February, as the index dropped to 50.8 down from 52.9 in January. Construction … Construction growth hit a twelve month low in February, led by the weakest rise in housing activity since June 2013. The headline index registered 54.2 in February down from 55.0 in January. “The latest reading pointed to one of the weakest rises in construction output seen over the last two and a half years” according to the release. Services … Service sector growth was the weakest in nearly three years. The seasonally adjusted Business Activity Index fell to 52.7 in February, from 55.6 in January. This signaled the slowest rise in service sector activity since March 2013. ONS data … There were no releases from the ONS. The Markit / CIPS data grabbed the headlines. It is said that nature ignores a vacuum. Economics should ignore the vacuous. The Markit/CIPS offers a great data set with established pedigree and lengthy history. The headlines are often written with red top leaders betraying the integrity of the data within. There was lots of good news in the releases. All indices were in positive territory above the neutral 50.0 level. That implies all sectors are growing albeit at various rates. Service sector output has risen continuously for 38 months, the second-longest sequence of expansion in the survey history. The UK economy continues to expand at a fair rate despite the slow down in manufacturing and the year on year comparison on construction. The Saturday Economist UK Economic Outlook March 2016 … This week we released the UK Economic Outlook for March 2016. We expect growth of 2.6% in the UK this year supported by strong growth in the leisure sector and the service sector generally. We expect manufacturing growth of just 0.9% and construction growth of 0.5%. Household spending will increase by 3% with a 4% growth in investment. Employment will rise, borrowing will fall, inflation will increase and the trade deficit will deteriorate. There will be no rebalancing … and certainly no “march of the makers”. The UK is in danger of drinking it’s way to deficit with strong growth in hotels and restaurant spending. Transport growth will accelerate as “Deliveroo” “Just Eat” “Hungry House” and others make progress. You can download the update here. It offers over twenty pages of reviews and analysis. It is our benchmark for the year ahead based on the latest ONS data. Should be be so optimistic for UK growth? … Car sales … This week the SMMT reported car sales were up by over 8% in February compared to the same month last year. Registrations were up by 5% year to date. Private car sales were up by 22% in the month. Not a bad start to the year … House Prices … The Halifax House Price Index reported prices were up by 9.7% in February. The more moderate Nationwide series suggested prices were up by 4.8% but that’s up from 4.4% in January. Strong car sales and a strong housing market would support our positive outlook for the year ahead. The employment data in February suggests the UK jobs market is over heating as does the situation in the USA … USA jobs data … In the US, we expect growth of 2.4% this year. The broad consensus forecast is 2.2%. Why so optimistic? In February, total non farm payroll employment increased by 242,000. The data for December was revised up from plus 262,000 to 271,000. The January data was revised from plus 151,000 to 172,000. The American labor force increased by 555,000 people in February. Over the last three months, that number totals 1.52 million, the highest it has been in 16 years. The unemployment rate was unchanged at 4.9 percent. The jobs data suggests strong growth continued into 2016 following growth of 2.2% last year. China sets Growth Range … China has set the growth target for 2016 at 6.5% to 7% indicating the government will continue to support the growth plan. In opening the National People’s Congress on Saturday, Premier Li Keqiang laid out policies and goals for the year that aim to stimulate growth and encourage restructuring of industries afflicted with overcapacity. Oil prices and markets … Markets are bullish. Oil prices Brent Crude closed at over $38 Brent Crude basis, Sterling bounced back to $1.42 and the FTSE closed up at 6,199. In the US the Dow closed above the sensitive 17,000 level. Gilt yields rallied, copper, iron ore prices are on the rise. Remember two weeks ago when we talked of the GOBI desert on Planet ZIRP. As markets tumbled we talked of the Great Opportunity to Buy In on market weakness. Since then the FTSE has rallied by 600 points! So what of rates … Our view remains. US rate rises will continue into 2016. Negative rates will be reversed in Europe and Japan. The Bank of England will be forced to act this year, as growth continues, the labor market tightens, earnings increase and inflation trends return. We expect UK rates to rise in the second or third quarter this year as inflation accelerates in the third quarter 2016 … So what happened to Sterling? Sterling closed up against the Dollar at $1.422 from $1.387 and up against the Euro at €1.293 from €1.270. The Euro moved up against the Dollar to €1.100 from €1.091. Oil Price Brent Crude closed at $38.55 from $35.68 The average price in March last year was $59.58. The deflationary impact continues but will begin to unwind in the third quarter this year. Markets, rallied - The Dow closed at 17,008 from 16,711. The FTSE closed at 6,199 from 6,096. Gilts - yields moved up but not much. UK Ten year gilt yields were at 1.45 from 1.40. US Treasury yields moved to 1.85 from 1.77. Gold closed at $1,268 ($1,220). A little flutter from the old relic. John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed