Economics news – UK economy on track for growth this year. Another week of excitement for economists. The first estimate of GDP for the second quarter was released on Wednesday. The good news - the UK Economy is on track for growth of 1% this year, GDP statistics confirm the economy is recovering. According to the official ONS figures, the economy grew by 0.6% in the second quarter compared to the first quarter of the year. Confirmation of trends reflected in the Greater Manchester Chamber of Commerce Quarterly Economic Survey last month. The largest contribution to growth came from the service sector but there was also a positive contribution in the quarter from manufacturing and construction. Comparisons with last year are distorted by the extra holiday provided by the Queen’s Jubilee. On an adjusted basis the economy probably grew year on year by around 0.7%. What does this mean for the rest of the year? We believe the recovery will continue albeit at a steady state. For the year as a whole we anticipate growth around 1%. Growth will continue to be driven by the service sector, with still lots of work required in manufacturing and construction to herald a return to growth across the board. George Osborne, the chancellor, said: “Britain is holding its nerve, we are sticking to our plan and the British economy is on the mend” Excellent. Good news for the manufacturing in the North West this week. The announcement of the new Bentley SUV to be built at Crewe with an investment of £800 million. Juergen Maier - MD of Siemens - champion of the manufacturing sector, will be pleased and quite right to. In other news ... Not so great for the North West, this week, Newsnight was in Eccles on Wednesday. There is something very worrying about Newsnight - Paul Mason and economics. Paul Mason’s grasp of economics is tenuous enough. When he dumbs down his limited comprehension to a late night audience, the facile output should not be allowed to cross the Blue Peter watershed. This week Mason visited Eccles, to investigate the economic recovery and how it is affecting job growth in the North West. Eccles, why choose Eccles? Well, we learned, there are 77 outlets selling alcohol within one kilometer along the high street. It is a shocking example of how the North is falling behind in recovery! Is it really? No it’s not, it’s an example of what happens to a high street, when the Trafford Centre, two retail parks, a Costco, B&Q, Asda and Marks and Spencer open up within a ten minute drive time. Newsnight could have gone to the Trafford Centre or to Media City UK, ten minutes by tram, in the other direction. All great examples of progressive infrastructure investment and economic growth in the North. No Paul had to have his fish and chips in Eccles. The BBC claims the journey North, revealed UK’s skewed economic recovery. It doesn’t, it reveals the skewed economics thinking on Newsnight. The problems exposed in the world of Paul Mason’s economics are not “structural” problems, they represent myopic, misleading perceptions of economic reality which do nothing for the reputation and image of Manchester and the North West. They don’t do much for the reputation of Newsnight either. Paul Mason is one of us, born in Leigh, educated in Bolton with a degree in music. Paul trained as a music teacher in Loughborough. Challenged, Paul claimed “it was journalism” not a “dumb neoliberal marketing plug for Manchester.” Well it certainly wasn’t a plug for Manchester, it may have been journalism but it wasn’t economics. Check out the article here and the link to the Newsnight piece. Let us know what you think! What happened to sterling? Sterling rallied further this week closing at $1.5384 from $1.5258 against the dollar but down against the euro to 1.1581 from 1.1608. The Euro dollar closed down at 1.3275 from 1.3411 and against the Yen, the dollar also closed down 98.2 from 100.3. Oil Price Brent Crude closed down slightly at $107.2. The average price in July 2012 was $103 approximately. Markets, were up - The Dow closed up 15,558 from 15,543. The FTSE closed at 6,554 from 6,630. Markets continue to rally. This is the time to average in, albeit slowly into August. Appetite for IPOs and new issues is improving. The backlog from the recession will assist activity over the next eighteen months. UK Ten year gilt yields closed at 2.34 from 2.29, US Treasury yields closed down at 2.56 from 2.48. Yields are set to move higher, albeit against the wishes of the central banks. Gold closed up at $1,325 from $1,292. Bernanke may not understand gold? Bull or bear, that’s what makes a market. We cannot always understand it. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

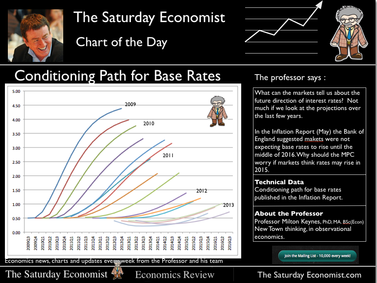

There is something very worrying about Newsnight - Paul Mason and economics. This week Mason visited Eccles, to investigate the economic recovery and how it is affecting job growth in the North West. Eccles, why choose Eccles? Well, we learned, there are 77 outlets selling alcohol within one kilometer along the high street. Do the maths, that’s one every 12 metres. Pawn shops and betting shops can be used to break up the pub crawl and provide additional funding en route. So what can we do to restore the Eccles high street to it’s former glory, asks the man born in Leigh, educated in Bolton and with a degree in music from Sheffield? It will take ten years, real jobs and training in skills to begin to restore the balance says Alec McFadden, from the Salford Unemployed Community Centre. There is no quick fix! Quite right Alec. Alec has been engaged with this problem for some time now. Eccles is what we call in economics “ a structural problem” says the itinerant BBC presenter. No it’s not, it is representation of social deprivation in a specific area of the Greater Manchester. It is also an example of what can happen to a high street, when the Trafford Centre, two retail parks, a Costco, B & Q, Asda and Marks and Spencer open up within a ten minute drive time. Newsnight could have made a visit to Media City, a great example of job creation and infrastructure investment into the new dynamic growth areas of digital and creative media. After all, it’s only ten minutes away by tram, a great example of infrastructure investment in Greater Manchester, part of the Transport for Greater Manchester Plan. Whilst there, he could have visited the Salford University New Media Campus, after all Manchester has one of the largest university student populations in Europe. He could have arrived by plane, reminding viewers we have just bought Stansted. Had he done so, he would have passed the Airport Enterprise Zone en route within sight of the new Medi Park, both on track to create a substantial number of new jobs over the next five years within Greater Manchester. No, Newsnight had to go to Eccles. It had been a long day. Paul had taken breakfast in a pop up breakfast bar in Soho, it doubles as a bar in the evening. “It’s what we call in economics using spare capacity” says the man who once trained to be a music teacher. No it’s not. It’s a pop up shop using space capacity, not quite the same thing as doubling up shifts on a car production line to meet demand in a growing economy. For lunch, Paul was in the Midlands to visit BSA Machine Tools. Now with 35 workers, Paul wanted to understand the constraints to growth. BSA Cycles Ltd and BSA Guns Ltd also in Birmingham, once controlled 67 factories, employed 28,000 people and contained 25,000 machine tools. The now much smaller BSA Machine tools was struggling to expand again because of a lack of skilled labour and and access to finance. Shocking, the problem - labour skills and those banks again. Mason claimed “It was said the recovery would be led by industry and exports to rebalance the economy”. Not really Paul, The march of the makers rebuilding the workshop of the world was always a Whitehall dream. Most economists never really believed that anyway. Will the problems of capacity constraints in Birmingham and Eccles lead to low growth in the UK economy as a whole? He asked. Of course not. Job creation continues at pace in the private sector. The problems exposed in the world of Paul Mason’s economics are not “structural” problems, they represent myopic, misleading perceptions of economic reality which do nothing for the reputation and image of Manchester and the North West. They don’t do much for the reputation of Newsnight either The closing shot featured Paul Mason having “tea” in Eccles, fish and chips on the high street. The people of Eccles looked on. They have no jobs, well let them eat Eccles cakes, the obvious solution. The journey north did not reveal the UK's skewed economic recovery, more the skewed thinking on Newsnight. Miss the show, watch it here and let us have your views  Economics news – news in the droppings - understanding market movements This week it doesn’t get more exciting for economists. The first set of minutes of the MPC under the Mark Carney regime were released on Wednesday. Looking for nuggets of information, amidst the download. A bit like the scene in Jurassic Park when Dr Ellie Sattler is digging with her hands through a pile of dinosaur droppings. Nuggets of information, amidst the download! How did the new Governor vote on QE? How did the other members vote? What was the guidance on forward guidance? Would the ten page minutes be worth the ten thousand minute wait? They were! The death of QE was foretold! “Regarding the Bank Rate and the stock of asset purchases, the Committee voted unanimously in favour of the proposition that base rates and Quantitative Easing (QE) should be kept on hold.” The MPC were united - Carney called time on QE. The epoch of Quantitative Easing draws to a close. David Miles [MPC member] and Paul Tucker [Deputy Governor Responsible for Financial Stability] fell into line with the “new reality”. The pair had been the two QE stalwarts who had “stuck it out” with Mervyn King right to the end of the line. With the economy recovering and inflation rising, it was time to say goodbye to QE. Time for the MPC to wash it’s hands of the monetary experiment, just as Dr Sattler, post examination of the dung, washed her hands before tucking into dinner, we hope. Now we enter the era of forward guidance and intermediate thresholds. The Governor is not ruling out a quantum of additional stimulus. He just needs time to think about the form it may take, plus guidance on the time frame and “triggers” for the new monetary policy framework. Can’t wait for the August deposit. Monetary policy is a bit like genetic experimentation. We have tried M3, shadowing the Deutschmark [An old Germanic monetary medium] and QE. Time for a cautionary word from Jurassic Park’s Dr. Ian Malcolm [Jeff Goldblum], “The kind of control you're attempting simply is... it's not possible. If there is one thing the history of evolution has taught us it's that life will not be contained. Life breaks free, it expands to new territories and crashes through barriers, painfully, maybe even dangerously, but, uh... well, there it is.” And so it is with gilt yields, sooner or later the market will break out, back to equilibrium value, as the period of financial repression and life on Planet ZIRP draws to a close. For the moment, rejoice. QE is dead, it ran out of intellectual currency long ago. In other news ... The good news for the UK economy continued. In jobs data, the claimant count fell by 20,000 in the month to June, an unemployment rate of 4.4%. The wider unemployment rate fell 6,000 to 2.51 million in the three months to May, a rate of 7.8%. Retail sales also presented a positive picture with volumes rising by 2.2% in June after 2.1% in May. On line sales continue to force the pace of change in the high street, with internet sales up by 18% in the month. In the first quarter of the year, retail sales were pretty flat but the second quarter (up 1.7%) offers promise for the rest of the year. Government borrowing figures were also released this week. Good news as the figures for last year were revised down by £2.1 billion to £116.5 billion last year. Not so good news as the borrowing figure for June was slightly higher than June last year. The net figure flattered by the transfer of almost £4 billion from the Bank of England Asset Purchase Facility. The old lady mugged again for gilt coupons under the Treasury - “Money for nothing, gilts for free” campaign. Public sector debt was £1.2 trillion at the end of the month equivalent to 75% of GDP. For the year as a whole, the recovery, if maintained will positively impact on net borrowing. The tax take is rising but spending is resilient to austerity. Nevertheless, the Chancellor may be in a much stronger position by close of year. Inflation, proved to be the real negative in the week. Inflation CPI increased to 2.9% in June from 2.7% in May. The Governor narrowly avoided having to write an explanatory letter to the Chancellor, explaining the missed target. Not to worry, the 2% target is off the agenda for now. We may not see the like in Mark Carney’s term in office. 2.5% by end of year will be challenge enough. Producer prices suggested inflation pressures are rising but not intense. Output prices increased to 2% in June as input costs increased to 4.2%. Home food prices along with energy and oil prices to blame for the latter. What happened to sterling? Sterling recovered further this week closing at $1.5258 from $1.51 against the dollar and up against the euro to 1.1608 from 1.1560. The Euro dollar closed relatively unchanged at 1.3411 and against the Yen, the dollar closed up 100.3 from 99.01. Oil Price Brent Crude closed relatively unchanged at $108.1. The average price in July 2012 was $103 approximately. Markets, were up - The Dow closed up 15,543 from 15,464. The FTSE closed at 6,630 from 6,545. Markets continue to rally. This is the time to average in, albeit slowly into August. UK Ten year gilt yields closed at 2.29 from 2.33, US Treasury yields closed down at 2.48 from 2.59. The feral hogs back in the pen. Yields are set to move higher, the financially repressed will break free from their golden fetters. Gold closed up at $1,292 from $1, 277. Bernanke admitted this week, he didn’t understand gold? I think he was referring to the movements, our theme of the week. That’s all for this week. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  “Regarding the Bank Rate and the stock of asset purchases, the Committee voted unanimously in favour of the proposition that base rates and Quantitative Easing (QE) should be kept on hold. The Governor had "invited the Committee to vote on the propositions that Bank Rate should be maintained at 0.5% and the Bank of England should maintain the stock of asset purchases at £375 billion". The MPC were united as Carney called time on QE. “And so the period of Quantitative Easing draws to a close, as an experiment in monetary policy. David Miles [MPC member] and Paul Tucker [Deputy Governor Responsible for Financial Stability] fell into line with the “new reality”. The pair had been the two QE stalwarts who had “stuck it out” with Mervyn King right to the end of the line. With the economy recovering and inflation rising, it was time to say goodbye to QE. A farewell stimulated by the arrival of the new Governor. “Earlier this week, Paul Fisher, Head of Markets at the Bank of England, gave evidence to the Treasury Select Committee. Fisher suggested any unwinding of monetary stimulus was likely to be years in the future. No need to worry about the unwinding of QE, the gilts will be held to redemption and like old soldiers will fade away, into the ghostly shadows of public sector accounting. “Paul Fisher also confirmed that market expectations of rate rises was much sooner than the Bank might expect. The MPC would like markets to believe base rates will not rise until 2016. We shall await the notes on forward guidance in August for more information on this. For the moment, rejoice, QE is dead, it ran out of funding and intellectual currency a long time ago.” - See more at: http://www.gmchamber.co.uk/stories/committee-united-on-quantitative-easing#sthash.Z3vxUJnC.dpuf  This week Ben Bernanke appeared to reel back the hardline stance on US monetary policy suggesting a “highly accommodative monetary policy” would probably be needed for the “foreseeable future”. Markets rallied and treasury yields fell on the statement mid week. So now we know, forward guidance and “constrained discretion” is linked to Treasury Yields and the Dow Jones index rather than payroll and inflation data. US markets love a dove and Bernanke, wings clipped by Obama remains the Wall Street favourite for now. Yields fell and the Dow closed back towards the 15,500 level. Despite the fears of tighter monetary conditions and the impact on recovery, QE will still be for the policy chop and US base rates may still rise towards the end of 2014. Fundamentals should push the markets higher with or without policy manipulation at the Fed. Speculation on Bernanke’s successor begin, Janet Yellon and Larry Summers both with PhDs, are two on the short list. Back in the UK A further blow for those who still believe in the rebalancing agenda or in the march of the makers rebuilding the workshop of the world. Are there any left in the MySpace group? Manufacturing output fell in May according to the ONS stats, down by 2.9% on the same month last year. Should we be too concerned about this gross set back? Probably not, last weeks PMI Markit survey data was much more upbeat on the manufacturing sector. For the year as a whole, we expect output to be down but not that much! The ONS warns “in 2012, the end of May bank holiday was moved to June resulting in an additional working day in May, which may have been a contributing factor to the growth (or lack of it) between these two periods!” Excellent, so much for - lies, damned lies and seasonal adjustments. The Balance of Payments data for the month, were much more straightforward. The trade figures for May reported a deficit, trade in goods of £8.5 billion, partly offset by an estimated surplus of £6.1 billion on services. The overall deficit trade in goods and services, was £2.4 billion compared to £2.0 billion in April. For the second quarter, the deficit trade in goods is likely to be around £26.5 billion and £106 billion for the year as a whole. Should we be worried about this? Not really. The figures are in line with our forecasts at start of year. "We should see things as they are, not as we would like them to be", Jack Welch said that. As for sterling, a weaker currency does not lead to an improvement in net trade performance but it does have an impact on domestic inflation. Carney take note. Lessons from history - “Great is the power of steady misinterpretation” Charles Darwin said that in "Origin of the Specious" probably. What happened to sterling? Sterling recovered this week closing at $1.51 from 1.4897 but slipped against the euro to 1.1560 from 1.1611. The Euro dollar closed unchanged at 1.31 and against the Yen, the dollar closed at 99.01 from 101.2. What is it about the Euro? Oil Price Brent Crude closed up $108.8 from $107.72. The average price in July 2012 was $103 approximately. Markets, The Dow closed up 15,464 from 15,135. The FTSE closed at 6,545 from 6,376. Markets have rallied from lows, this is the time to average in. UK Ten year gilt yields closed at 2.33 from 2.51, US Treasury yields closed at 2.59 from 2.74. The feral hogs sated for now. Yields are set to move higher, the financially repressed will break free one day. Gold closed down at $1, 277 from $1,232. Shorts covered but worshippers of the old relic still at a loss, as we begin the exodus from Planet ZIRP. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Rates on the move, central bankers behind the curve Ben Bernanke started it. Let’s assume the current round of forward guidance started two weeks earlier. Bernanke signaled the end of QE in the USA with the possibility of tapering assuming the US unemployment rate hit 7%. The end of QE could begin mid 2014 according to market analysts last week. Fed Statement June here. You have to wonder why, with the economy growing at not far below trend rate before the great crash and the DOW soaring to new highs in May, the markets should be dependent on succour from the Fed soup kitchen to support market action for a further twelve months but that’s economics USA. The great Fed - Wall Street Alliance. The end of QE? US Non Farm Payroll data - On Jobs Friday, the non farm payroll figure revealed 195,000 jobs had been created in the USA, above the 165,000 figure expected. Analysts began to speculate the end of QE could materialise as early as September this year. US Ten Year Treasury yields jumped to 2.74 at close this week and the Dow closed above the 15,000 level. Like it or not the great QE experiment is almost over, all over the world. We should make ready for the great exodus from Planet ZIRP. US base rates could begin to rise by the middle of 2014 - the UK will follow within six months. Europe whatever it takes for as long as it takes . In Europe the ECB said it expects key rates to remain at present or below lower levels for an extended period of time. “Whatever it takes for as long as it takes” is now the Draghi guideline. Latvia, Lithuania and Luxembourg may be the growth economies to envy but Croatia with negative growth and jobs falling is meeting the current conversion criteria for EU membership. We don’t expect an increase in Euro rates anytime soon. UK - forward guidance In the UK, we expected forward guidance from the New governor would wait until August. But no. The MPC statement on Thursday, held base rates and QE but added “in the Committee’s view, the implied rise in the expected future path of Bank Rate was not warranted by the recent developments in the domestic economy”. What are they talking about? In the recent Inflation Report, the bank had offered the “market conditioning path for base rates” as some form of base rate outlook. No rate rises expected until 2016, the guideline presented by an elaborate manipulation of [OIS] swaps data. For once the markets were believing “that which the old lady would have them believe”. In recent days, the swaps guideline had begun to suggest base rate would rise in 2015. This followed the recovery in UK Ten year gilts yields towards 2.5% as central banks lose control of the yield curve. Should we really worry about the swaps data anyway? Markets have no idea about the future path of interest rates as our Chart of the Day clearly shows. An analysis of the implicit future path of interest rates over the last four years ranges from 4% to 0.5%. The chart looks more like a porcupine on heat, than a clear market signal to track and follow. Experience tells us that forward rates can tell us little about the future path of rates. UK Economic Data Better the attention is paid to the UK economic data. The economy is growing into the second quarter lead by a strong recovery in service sector growth according to the Markit/CIPS UK Services PMI®. The headline Business Activity Index recorded 56.9 in June, up from May’s 54.9 and the highest reading for 27 months. In the manufacturing sector, the UK Manufacturing PMI hit 52.5 in June, up from a revised reading of 51.5 in May, the index posted above the neutral mark of 50.0 for the third month running. In the construction sector, PMI companies indicated a further moderate rise in business activity during June. This was highlighted by the index 51.0, up fractionally from 50.8 in May and above the 50.0 no-change value for the second month running. In the car market, according to the SMMT, new car demand was up 10% in first half of 2013. New car registrations passed the one million mark in June, growing 10% in the first half of 2013 to 1,163,623 units. The UK new car market saw the 16th successive monthly rise in the month, growing 13.4% to 214,957 units. Even in the housing markets, prices and volumes are beginning to move albeit from a pretty low base. The US economy is recovering as is the UK. The recovery in Europe will have to wait for some time yet. But for the UK, growth in the second quarter will surprise most analysts. We expect the economy to grow by between 1% - 1.5% this year. So what of forward guidance? The Governor will announce further guidelines on forward guidance in August. But great care is needed. Forward Guidance increases market volatility, it just gives the markets more things to fret about. The Governor must avoid becoming hostage to a monthly indicator, as Bernanke is hooked onto Non Farm Payroll data. Monetary policy is in danger of drifting behind the curve. Growth is emerging, the inflation challenge remains. If forward guidance leads to a fall in sterling, the inflationary pressures will increase. Sterling sub $1.50 as oil prices rise - will exacerbate inflation and stifle recovery. Weaker sterling will do little or nothing to stimulate export growth. Alas, the great dollar bull run has begun. What happened to sterling? Sterling fell further on dollar strength at 1.4897 from 1.5220 and slipped against the euro to 1.1611 from 1.1687. The Euro dollar closed at 1.2827 from 1.302 and against the Yen, the dollar closed up 101.2 from 99.12. Yes, the great dollar bull run has begun. Oil Price Brent Crude closed at $107.72 from $102.16. Average price in July 2012 was $103 approximately. Markets, The Dow closed up 15,135 from 14,910. The FTSE closed at 6,376 from 6,215. Markets have rallied from lows, this is the time to average in. The call is FTSE 7000 end of year. UK Ten year gilt yields closed at 2.51 from 2.46, US Treasury yields closed up 2.74 from 2.49. The feral hogs will not be cowed. Yields are set to move higher. Gold closed down at $1,222 from $1232. Inflation will be back on the agenda soon. Watch out for the basing action. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  The decision to hold rates was widely expected. The economy is showing signs of recovery, confirmed by recent data including our own QES survey and the important GM composite indicator. It is too early to begin the programme of base rates rises but it is time to say goodbye to QE as a policy option. Commenting on today's Monetary Policy Committee (MPC) interest rate decision, as Chief Economist at the Greater Manchester Chamber of Commerce. The sooner long term gilt rates return to some semblance of normality the better. The August meeting should be more interesting to rate watchers. Markets are looking for a statement on forward guidance and the future path of interest rates. Mark Carney must be careful not to make the same mistakes as Bernanke. Forward guidance increases market volatility with an unhealthy focus on the US non farm payroll data. The markets can no more ignore a speech delivered by Bernanke, than Chinese banks can ignore a directive from the People’s Bank of China. The new Governor must avoid becoming hostage to a monthly data set. What can the markets tell us about the future direction of interest rates? Not much if we look at the projections over the last few years. In the Inflation Report (May) the Bank of England suggested markets were not expecting base rates to rise until the middle of 2016. Why should the MPC worry if markets think rates may rise in 2015? The analysis of expectations over the last four year has not proven to be much of a guide as the Chart of the Day indicates. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed