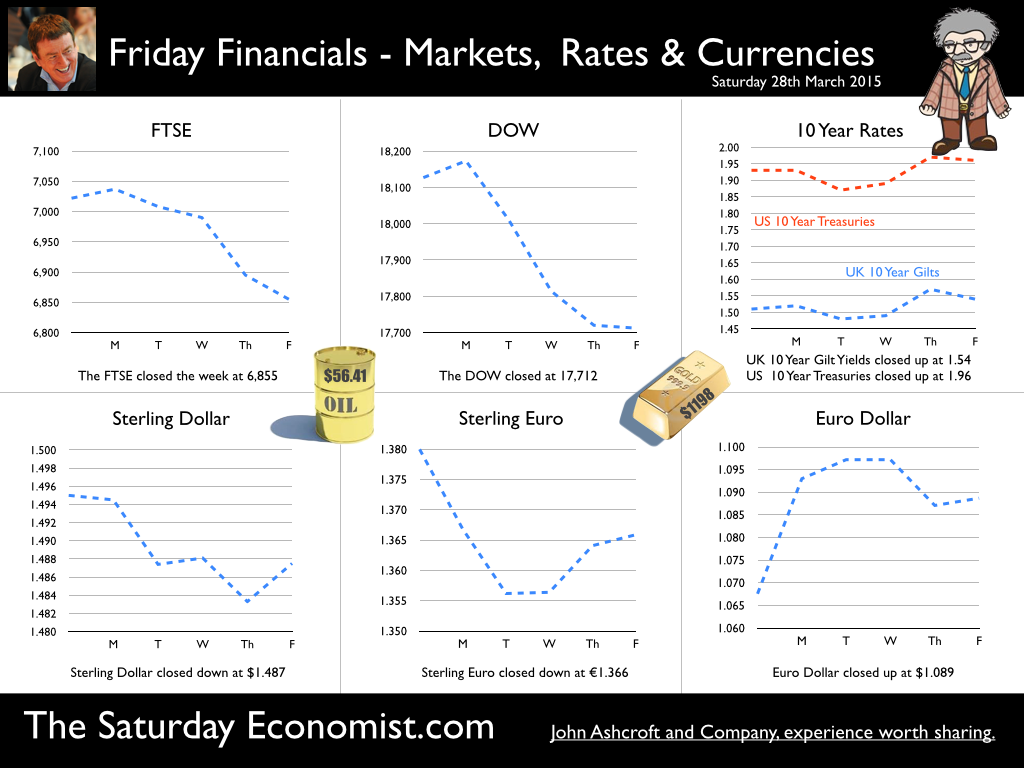

Retail Sales … strong growth continues … Retail sales volumes increased by 5.7% in February, following growth of 5.9% in January. This was the 23rd consecutive month of year-on-year growth and the longest period of sustained growth since May 2008. Online sales increased by 10% compared with February 2014, accounting for 11.6% of all retail sales in the month. Department store and household goods stores experienced strongest growth up 9%. Clothing stores also enjoyed buoyant growth up 6%. Car registrations in February were up by 12% compared to prior year. They are up by 8% over the first two months of the year. House sales continue to enjoy strong growth despite some obvious slow down in price escalation. Consumer confidence figures according to GfK are high in relation to the state of the economy and household finances. The tracker is actually higher than pre recession levels. The “Right time to buy” index is at the highest level since 2007. For the year as a whole we expect retail sales volumes to increase by over 4% compared to growth of 4% in 2014. Values are expected to increase by just over 2.5%. We expect car sales for the year to be up by over 5% at least. Housing transactions will continue at pace. Unemployment is falling, earnings are set to rise, strong retail sales growth and a buoyant consumer outlook, are incompatible with rates on hold at just 50 basis points. The next move in rates will be up. CPI Inflation … It was slightly surprising last week, when Andy Haldane, Chief Economist at the Bank of England suggested the next move in rates could well be down. Markets shuddered and Sterling took a hit. The cerebral banker had been swayed by imminent developments in domestic price inflation. And so it proved with the data released this week. Annual Inflation CPI basis fell to 0.0% in February compared to 0.3% in January according to the latest data from the Office for National Statistics (ONS). UK consumer price inflation hit the lowest point since the early 1960s. The greatest contributors to the inflationary slowdown were falling oil, motor fuels and food prices. Service sector inflation remained above target at 2.4% with the fall in goods inflation to -2.0%, pulling overall inflation below target. Education costs up by 10% were amongst the largest contributors to price rices. Smokers with kids at private school continue to take a hit. Producer Prices … Producer prices, fell by 1.8% in the month compared to a fall of 1.9% last month. Input costs fell by 13.5% compared to a reduction of 14% prior month. Crude oil prices, down over 40%, were the largest contributor to the reduction in costs. For the moment, inflation is always and everywhere an international phenomenon. Oil prices collapsed and world trade prices fell by 10% in the final quarter of the year, driven lower by oil price movements. Most analysts anticipate a brief bout of UK deflation in the coming months with inflation at -0.1% and -0.1% in March and April. For 2015 as a whole we expect inflation to average 0.4% over the first nine months of the year. By the end of the year, the inflation outlook will be radically different. Should we worry about deflation? Not really. We have growth, falling employment, rising earnings, with oil prices and commodity prices on the turn. The inflation outlook will look radically different by the final quarter of the year. Last week, we warned of the evident signs of overheating in the labour market. No more evident than in the claimant count data. By the time of the election, the number of vacancies will be higher than the actual claimant count. This is unprecedented. This week Mark Carney made it clear, the next move in UK base rates will be up. A sentiment subsequently reinforced by Ben Broadbent. The timing of the move, as yet unclear. So when will rates rise? Markets still believe the Fed will begin to increase rates later this year. Q3 now the favourite following the slight downward growth revisions for 2015. In the UK the forward OIS curve suggests markets expect rates to rise in the first or second quarters of 2016. The wait may not be so long … In the UK, we expect growth of 2.5% to 2.9% this year. The labour market is tightening, recruitment difficulties are increasing, wage rates and settlements are set to rise. The inflation outlook will be materially different towards the end of the year. Once the Fed makes a move, the MPC will surely follow within the current year …. It really is time to leave Planet ZIRP. So what happened to Sterling this week? Sterling closed down against the Dollar at $1.487 from $1.495 and moved down against the Euro to €1.366 from €1.3824. The Euro closed up against the Dollar at €1.089 from €1.0815. The push to parity postponed or perhaps aborted. Oil Price Brent Crude closed up at $56.41 from $55.32 US oil stocks are rising putting pressure on prices. The average price in March last year was $107.48. Markets, moved down. The Dow closed at 17,712 from 18,127 and the FTSE closed down at 6,855 from 7,022. UK Ten year gilt yields moved slightly to 1.54 from 1.52. US Treasury yields moved up to 1.96 from 1.93. Gold closed up at $1,198($1,182). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

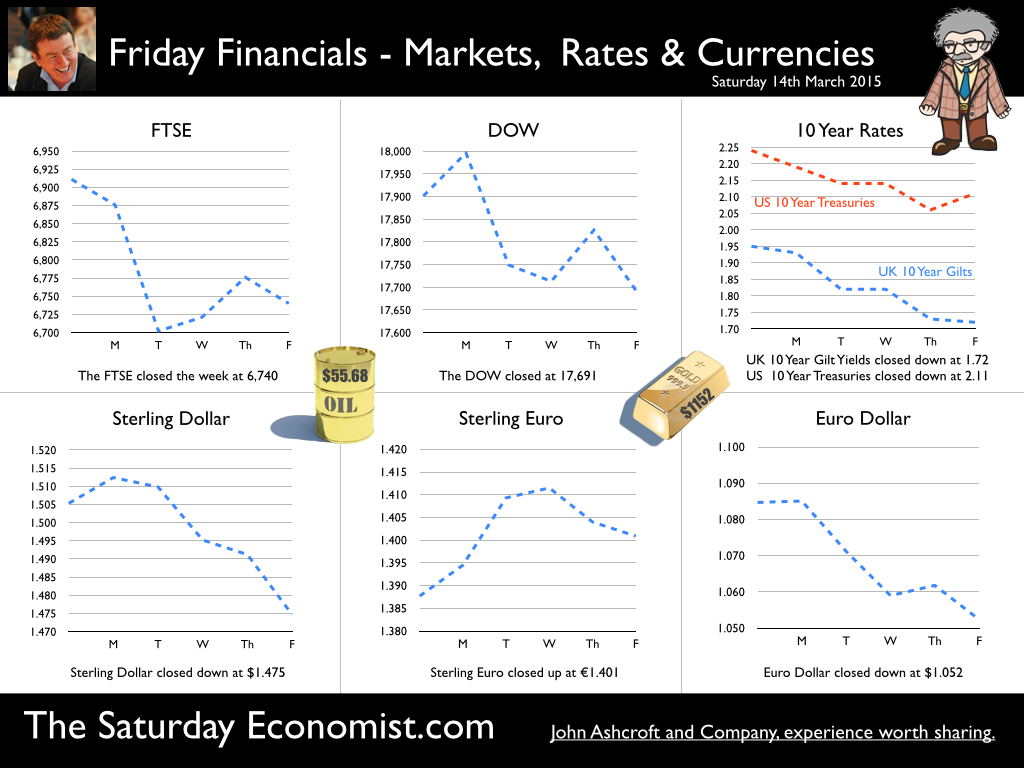

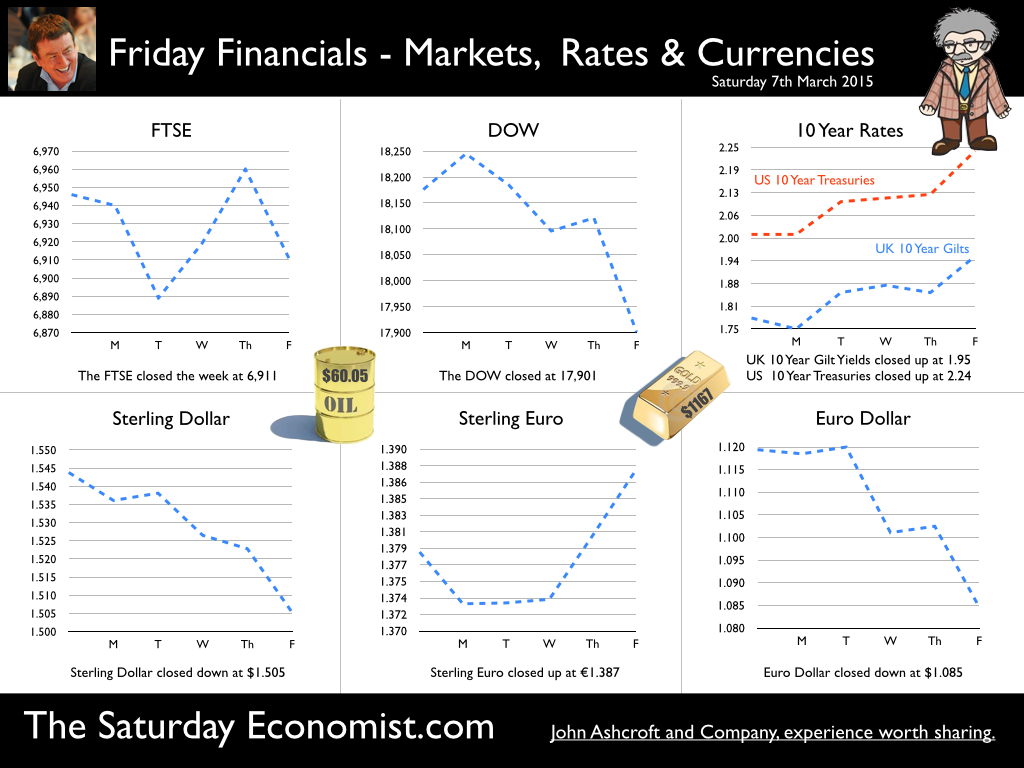

There is something special about Budget Week. It isn't economics. Politics is all. With just weeks to go to the election, the Chancellor delivered his sixth budget. Growth is up, unemployment is down, inflation is lower, borrowing is lower. Even the balance of payments managed a surprisingly positive out turn in the latest figures for January. “He may be a Good Chancellor but is he lucky?” The OBR talked of a “Roller Coaster profile” for public services spending through the next Parliament. A much sharper squeeze on real spending in 2016-17 and 2017-18 than anything seen over the past five years, followed by the biggest increase in real spending for a decade in 2019-20. The Chancellor has been assisted by lower forecasts for inflation and debt service costs. Borrowing is set to fall from £97.5bn in 2013-14 to £90.2bn in 2014-15, £75.3bn in 2015-6, £39.4bn in 2016-7 before reaching a £5.2bn surplus in 2018-9. The Northern Powerhouse is set to re balance the economy. The North is growing faster than the South. Living standards are higher than in May 2010. Tax cuts for all, a rising threshold lifting all votes, a penny of a pint, petrol duty frozen. It is an incredibly strong platform and budget for re-election … but can it really be so good? Public Sector Borrowing Figures on Track … On Friday, the borrowing figures for February were even better than expected. Public Sector Borrowing was just £6.9 billion down by £3.5 billion compared to February last year. In the first eleven months of the year, total borrowing was was £81.8 billion, a decrease of £8.8 billion compared with the same period in 2013/14. Income tax and corporation tax receipts were up significantly. The out turn for the year may be even better than the latest OBR projections suggest. Labour Market Data … strong growth continues … On Tuesday, the ONS released the latest labour market stats. There were nearly 31 million people in work up by 617,000 from a year earlier. There were 1.86 million unemployed down by 500,000 from a year earlier. We have warned of the evident signs of overheating in the labour market. No more evident than in the claimant count data. In February, the claimant count fell to 791,000 down by 380,000 from the same period last year. This is now lower than pre recession levels. We will be closing the job centres in 2017, there will be no one looking for work. The number of vacancies increased to 735,000. By the time of the May election, the number of vacancies will have increased to over 750,000. The claimant count is likely to have fallen to just 727,000. The number of vacancies will be higher than the actual claimant count by the time of the election. This is unprecedented. Businesses are continuing to recruit but are experiencing greater difficulties in doing so. For the moment average earnings remain subdued but for how much longer. We expect the earnings outlook to be significantly different towards the end of the year. The OBR is forecasting GDP growth of just 2.5% this year compared to consensus estimates of 2.7%. Inflation is expected to average 0.2% through the year. Earnings are expected to rise to 2.3% this year and 3.1% next. In the US, the Fed revised down there forecasts for growth in the current year to just 2.5%. So when will rates rise? ... Markets still believe the Fed will begin to increase rates later this year. Q3 now the favourite following the growth revisions for 2015. Forward indications suggest US rates will hit 2.0% by the end of 2016 down from a previous 2.5% expected level. In the UK, we expect growth of 2.5% to 2.9% this year. The labour market is tightening, recruitment difficulties are increasing, wage rates and settlements are set to rise. The inflation outlook will be materially different towards the end of the year. Once the Fed makes a move, the MPC will surely follow within the year …. It really is time to leave Planet ZIRP. So what happened to Sterling this week? Sterling closed up against the Dollar at $1.495 from $1.475 and moved down against the Euro to €1.3824 from €1.401. The Euro closed up against the Dollar at €1.0815 from €1.052. The push to parity postponed for now. Oil Price Brent Crude closed unchanged at $55.32 from $55.68 US oil stocks are rising putting pressure on prices. The average price in March last year was $107.48. Markets, moved higher. The Dow closed at 18,127 from 17,691 and the FTSE closed up at 7,022 from 6,740. UK Ten year gilt yields moved down to 1.52 from 1.72. US Treasury yields moved down to 1.93 from 2.12. Gold closed down at $1,182 ($1,152). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Euro QE - the placebo effect … Last week we suggested Euro QE was an idea whose time had come and gone. No need to worry, it has already been a great success, according to President Draghi. If indeed Dollar Parity is the Prize, Draghi should step up to the podium. The Euro closed at €1.05 against the Greenback, well on the way to parity. Bond yields are falling, stock markets are rallying. Hot money is moving into European equities on a growth - yield ticket with a guaranteed currency kicker over the medium term. The placebo effect is in full sway … in ways we could never have imagined at onset. US and UK monetary policy … In the US, the Fed determined to push forward with a rate rise later this year, despite the strength of the dollar. Mark Carney on the other hand suggested, strength of Sterling may be the reason the rate rise will be delayed into 2016. Confused … you should be. Mark Carney’s new broom is sweeping through the Bank of England, the Labours of Hercules as nothing. As the rivers Alpheus and Peneus washed through the Augean stables. It is as if the Thames is sweeping through Threadneedle Street, with the SFO in a mine sweeper. The MPC - out and about with clear thinking and straight talking. Mark Carney was out of office delivering a speech to the Sheffield Advanced Manufacturing Institute on inflation targeting - “Writing the path to target”. Ian McCafferty, avoided getting his feet wet. He was in Durham explaining the impact of oil prices on monetary policy. The hog cycle and cobweb theorem dragooned into the intellectual debate at Durham University. Excellent … explains all. So what happened in the UK this week? Construction output fell 3% in January … I am beginning to think, the construction data is produced by an algorithm with some kind of Bipolar or SADD (Seasonally Adjusted Deficiency) Disorder. One month up, one month down. In January the depressives ran the model. Output down -3% compared to prior year following an increase of 5% in December. In December, the optimists tweaked the buttons. Don’t worry too much about one months figures. We continue to forecast growth of over 5% in 2015 as the housing market will continue to drive activity. Manufacturing Output up by 1.9% in January… Manufacturing output increased by 1.9% in January compared to prior year. A slow start to 2015. Total production increased by just 1.3%. A large increase in mining and quarrying, offset by falls in utilities this month. Within the manufacturing sector, there was a surprise fall in capital goods, offset by strong growth in consumer durables. Textiles output fell by 10% with strong growth evident in transport equipment and food. ‘Wheels, wings and onion rings” the mantra for manufacturing growth in the years ahead. For the year as a whole we are still forecasting manufacturing growth of 2.5% following growth of 2.9% last year. A slow start in the first month, no need to worry just yet. Trade Deficit … On the face of it, the trade figures for January were heading in the right direction. The UK deficit - trade in goods and services was estimated to have been £0.6 billion compared with £2.1 billion in December 2014. This reflects a deficit of £8.4 billion on goods, partially offset by an estimated surplus of £7.8 billion on services. Good news but … The sharp narrowing of the deficit, reflects a fall of £2.5 billion in imports. Almost half of this fall (£1.2 billion) is attributed to oil imports. We estimate the impact of oil price movements to the trade deficit, will be worth some £4 billion to £5 billion in the full year. [The deficit in oil narrowed to £0.4 billion compared to £0.9 billion in January last year. Oil imports fell by £1.2 billion but exports fell by £0.8 billion.] On a regional basis, exports to the US were up but exports to Europe and China fell. Imports were down reflecting lower oil and commodity prices with a surprising fall in consumer goods and capital goods. Surprising given the strength of the recovery in the UK. So what does this mean for the full year? We forecast a deficit of around £120 billion this year. The gains in oil offsetting domestic demand growth effects. [The deficit in goods in 2014 was £120 billion up from £113 billion in 2013.] The overall deficit (goods and services) will be around £30 billion, down from the £32 billion in 2014. At less than 2% of GDP the deficit is not a challenge to growth. So when will rates rise? We still think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The Euro QE is a placebo. A financial placebo which has already worked according to President Draghi. We will not see the full programme or it’s like again … So what happened to Sterling this week? Sterling closed down against the Dollar at $1.475 from $1.505 and moved up against the Euro to €1.401 from €1.387. The Euro closed down against the Dollar at €1.0520 from €1.1387, a huge move. The push to parity is on. Oil Price Brent Crude closed down at $55.68 from $60.55. US oil stocks are rising putting pressure on prices. The average price in March last year was $107.48. Markets, fell back on interest rate and currency fears. Hot money moves into Europe. The Dow closed at 17,691 from 17,901 and the FTSE closed down at 6,740 from 6,911. UK Ten year gilt yields moved down to 1.72 from 1.95. US Treasury yields moved down to 2.11 from 2.24. Gold closed down at $1,152 ($1,167). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  If there is nothing more powerful than an idea whose time has come - there can be nothing more impotent than an idea, whose time, has come and gone. So it must be with QE in Euroland. On Monday, the ECB begins the monthly purchase programme of €60 billion of Euro denominated public and private sector securities. The spend will continue until September 2016 or until such time as there is a recovery in the “sustained adjustment in the path of inflation”. QE in Europe, is not about growth. Forecasts for real GDP growth in Euroland are now expected to be 1.5% in 2015, 1.9% in 2016 and 2.1% in 2017 according to the ECB latest forecasts. Nor can it really be about liquidity. The annual growth rate of broad money M3 increased to 4.1% in January and narrow money M1 increased at an rate of 9% in the same month. Can it really be about deflation? HICP inflation in February was -0.3% slightly better than the -0.5% in January. Inflation is expected to remain very low or negative in the months ahead. The latest ECB projections forecast annual inflation at 0.0% in 2015, rising to 1.5% in 2016 and 1.8% in 2017. We know that oil, energy and commodity prices are pushing headline inflation rates lower. Oil at $60 per barrel Brent Crude basis remains some 50% lower than March last year. Perhaps then the QE bond buying programme should continue until “Oil prices bounce back to a reasonable level”. Whatever that is! Who will benefit from the bond buying programme? Almost half of the euro bonds are held outside the euro area. The average weighted price of bonds in the 2 to 30-year maturity is well above par. It’s exactly 124% according to Mario Draghi’s statement this week. So Euro bonds offer negative yields, with a negative price to redemption, in a currency vulnerable to the Dollar rally. The ECB will be the buyer of last resort in a desiccated Euro bond market. One of the many facets of life on Planet ZIRP, telling us it really is time to pack up and leave. Long oil and short Euro bonds must be the Golden Spread for 2015! America will lead the way … “Brisk jobs growth in the US puts Fed on notice” is the headline in today’s Wall Street Journal. US payrolls increased by 295,000 in February and the unemployment rate fell to 5.5%. The central bank could be on track to increase rates in June or certainly in Q3, pushing the dollar towards parity against the Euro. The UK will follow … News of growth in the UK economy continued this week. Car sales in February were up by 12% year on year providing three straight years of continuous expansion. The latest UK Markit/CIPS data revealed manufacturing rising to a seven month high, construction output rising at sharpest rate for four months and strong growth in the service sector maintained. New business, employment and order books are increasing across all sectors. Our forecasts for the UK and world economy were updated last month. We expect strong growth to continue around 3% in 2015 and 2016. The labour market is showing signs of overheating. The MPC voted to keep rates on hold this week. Six years of rates on hold - but for how much longer? So when will rates rise? We think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The yield curve is distorted. It really is time to move on and let markets, especially bond markets, clear. The Euro QE is a placebo. A shadow of an idea whose time has come and gone. If indeed it should have had much time at all. So what happened to Sterling this week? Sterling closed down against the Dollar at $1.505 from $1.544 and moved down against the Euro to €1.387 from €1.379. The Dollar closed against the Euro at €1.085 from €1.1379, with some traders calling parity within months. Oil Price Brent Crude closed down at $60.05 from $61.44. The average price in March last year was $107.48. Markets, fell back on rate rise fears. The Dow closed at 17,901 from 18,176 and the FTSE closed down at 6,911 from 6,946. UK Ten year gilt yields moved up to 1.95 from 1.78. US Treasury yields moved down to 2.24 from 2.01. Gold closed down at $1,167 ($1,215). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed