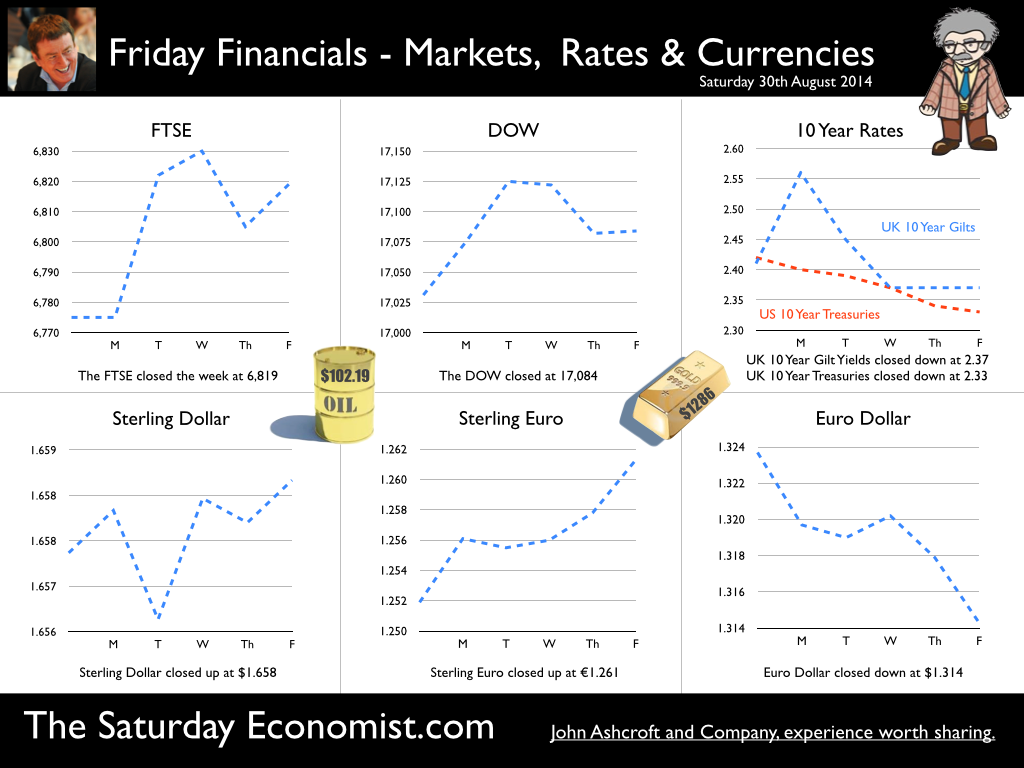

Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed