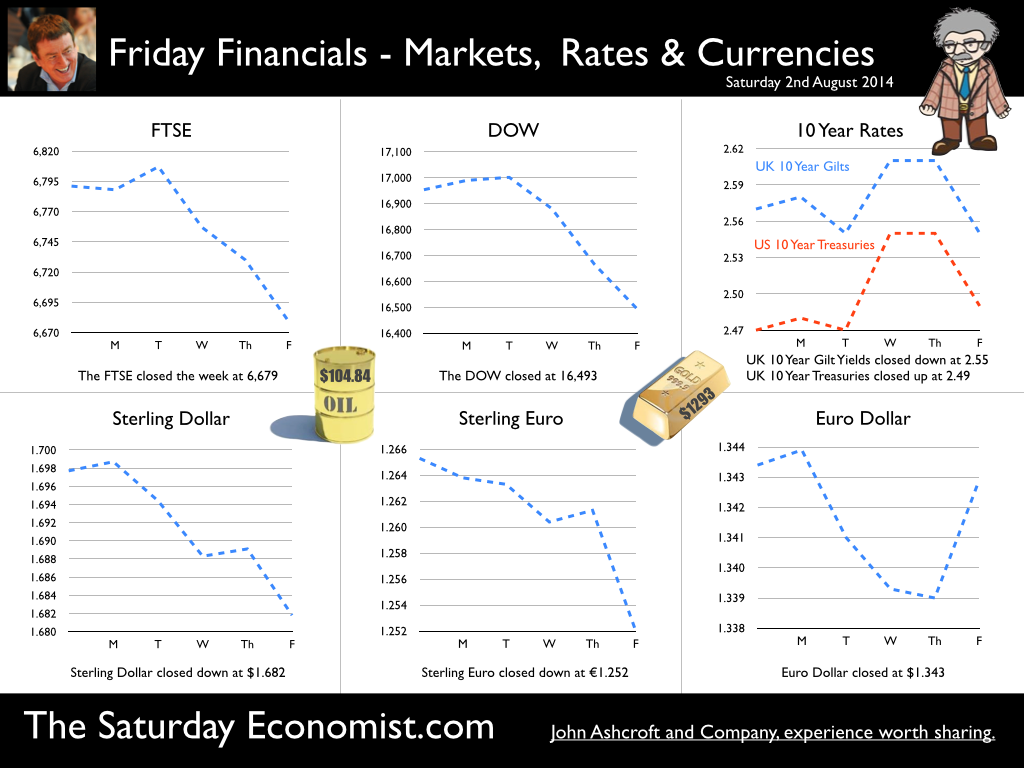

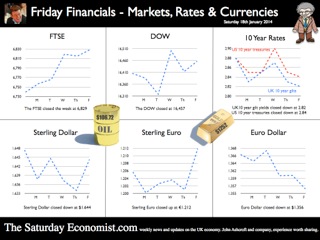

A letter from America … This week the Professor is in America, reviewing the prospects for the US economy. Despite the pressure on the Bank of England to increase rates before the end of the year, the MPC will be reluctant to move ahead of the Fed and be the first to leave Planet ZIRP. So what are the prospects of a US rate rise any time soon? Two Fed policy hawks, Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed, made comments this week, suggesting they have seen enough evidence to support an interest rate rise earlier than expected. Currently, tapering is expected to continue, extinguishing the asset purchase programme in October. US rates are not expected to rise until Q1 or even Q2 next year. The Prof thinks the latest crop of economics data will take the pressure off the doves to move earlier. Growth in the USA … In the USA, real gross domestic product increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. 4% sounds quite exhilarating but …. According to our year on year comparison, US GDP Q2 increased by 2.4% in the second quarter compared to Q2 2013. This followed growth of 1.9% in the first quarter - both below trend rate. Our forecast of growth at 2.4% in 2014 is unchanged based on the latest data. The latest GDP estimates ensure there is no pressure on the Fed to accelerate the change in monetary policy. We expect tapering to continue into the Autumn, with a rate rise postponed into 2015. Jobs in the USA … Friday's employment and income reports pointed to steady U.S. job growth with the number of non farm payroll jobs increasing by 209,000. The unemployment rate ticked higher to 6.2% but this a refection of a widening labour pool rather than a slow down in the economy. Moderate expansion in payroll numbers, slightly below expectations, will ensure there is no short term pressure to increase rates anytime soon. Inflation in the USA … The US Consumer Price Index increased by 2.1 percent in the twelve months to June. The PCE (personal consumption expenditure) price index, the Fed's favoured measure of inflation, was up 1.6%. Average hourly earnings of private-sector workers were up 2.0% from a year earlier, unchanged from the range of the past few years. Growth, jobs, earnings and inflation are all demonstrating trends that are likely to keep the Federal Reserve on course to conclude the bond-purchase program in October but remain cautious about raising short-term interest rates before the end of the year. We would expect US rates to rise in the Spring of 2015. Despite any further increase in The Saturday Economist™ Overheating Index™, the MPC will be reluctant to increase rates this year and open the “Spread with the Fed”. So what of the UK? The latest manufacturing data from Markit/CIPS UK PMI® confirmed the strong output growth continued into July. Production and new orders both continued to rise at robust, above long-run average rates in the month. At 55.4, down from 57.2 in June, the headline index posted the lowest reading in one year but remained well above the survey average of 51.5. No need to worry about manufacturing output! Something to worry about … Ben Broadbent, Deputy Governor for monetary policy, Bank of England, made a speech in London this week. His theme - “The UK Current Account Deficit”. Last year the UK current account deficit was 4.5% of GDP. That’s the second-highest annual figure since the Second World War. So is the near record deficit a threat to growth? The Deputy Governor concludes the “significance [of the deficit] depends on the health of a country’s net foreign asset position and more fundamentally, on the trust in its institutions”. “…having a balanced net asset position seems to reduce the threat from a large current account deficit, as does a floating currency.” Now that is concerning. In the 80’s Chancellor Lawson argued the Balance of Payments “doesn’t matter”. It does and in the end it did! Interest rates had to rise dramatically to curtail domestic demand. In the current cycle, the deficit, trade in goods, is offset in part by the service sector surplus. At around 2% to 2.5% of GDP, the deficit is not a threat to growth. The collapse in overseas earnings on the other hand is a more serious concern. A current account deficit of 4.5% is unsustainable. A dismissive speech at Chatham House will not disguise the extent of the problem, rule or no rule. So what happened to sterling this week? Sterling closed down against the dollar at $1.682 from $1.698 and down against the Euro to 1.252 from (1.2653). The Euro was unchanged against the dollar at 1.343. Oil Price Brent Crude closed down at $104.84 from 108.30. The average price in August last year was $111.28. Markets, closed down. The Dow closed down 460 points at 16,493 from 16,953 and the FTSE was down 12 points at 6,679 from 6,791. UK Ten year gilt yields were down at 2.55 from 2.57 and US Treasury yields closed at 2.49 from 2.47. Gold was unchanged at $1,293 from $1,294. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

1 Comment

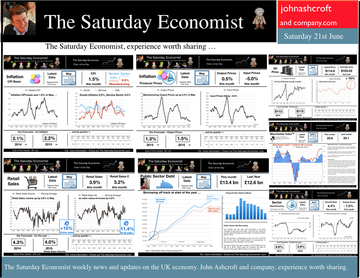

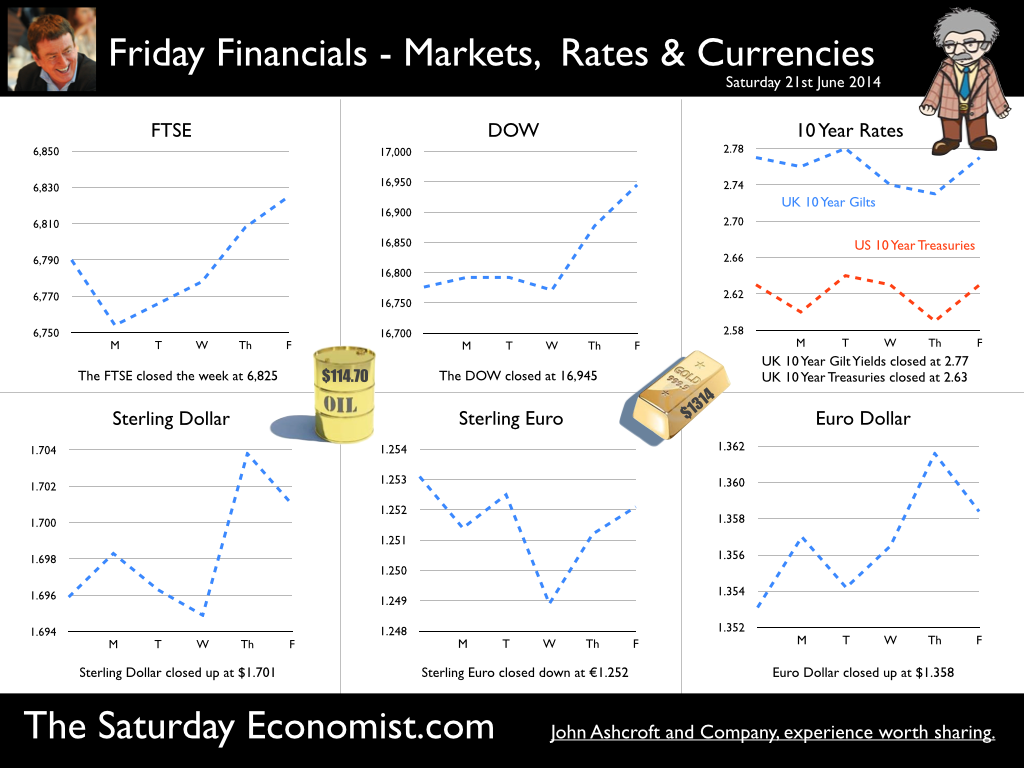

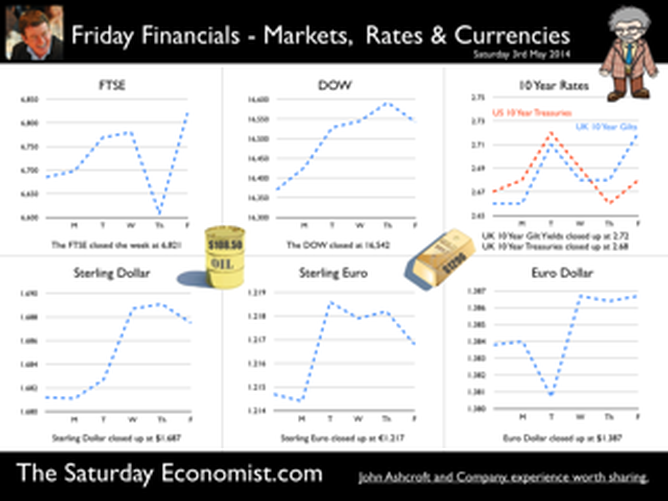

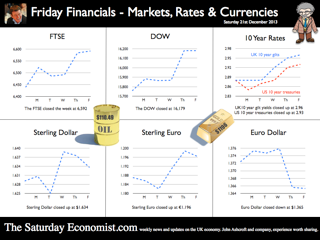

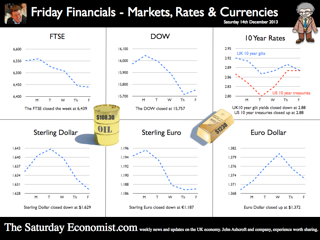

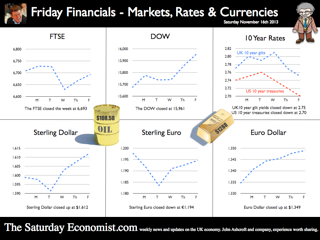

The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  GDP Figures Q1 … UK growth in the first quarter of 2014 was an impressive 3.1% year on year with significant growth in construction, manufacturing and the service sector. [According to the preliminary estimate from the Office for National Statistics released this week.] Construction growth increased by 5.1% in the quarter and manufacturing output increased by 3.5%. Service sector output was up by 2.9% with continued strong growth in distribution, hotels, and leisure (4.9%). The business and financial services sector increased by 3.6%. The outturn is more or less in line with our estimates in the Quarterly Economics Outlook released in March. Following the latest data, we have lowered our forecasts for growth in the construction sector for the year as a whole and increased our estimate of growth in manufacturing. The overall GDP position remains unchanged. We still forecast GDP growth of 2.9% in 2014 and 2.8% in 2015. Growth continues into Q2 … The good news continued this week, with the latest Markit/CIPS PMI® survey data on manufacturing and construction. In April the UK manufacturing sector maintained a robust start to the year. At 57.3, the seasonally adjusted index rose to a five-month high and registered one of the best readings over the past three years. Construction output continued to increase in April, albeit at the slowest pace for six months. The index recording of 60.2 is down from the peaks at the turn of the year but still ahead of the long run average of 54.3. Residential construction was the best performing area of activity. The rate of expansion in April remained one of the fastest seen over the past ten years … just as well! House Prices - increase into double figures … House prices increased by over 10% according to the latest figures from Nationwide. Robert Gardner, Nationwide's Chief Economist said: “After several months of moderation, the pace of house price growth picked up in April. Annual house price growth reached double digits for the first time in four years, with the price of a typical home 10.9% higher than April 2013. Still much to be done in construction however, “The upturn in construction of new homes continues to lag far behind the upturn in demand, with the number of new homes being built in England still around 40% below pre crisis levels.” Sir Jon Cunliffe, Deputy Governor of the Bank of England, expressed some concerns about the housing market in a speech in London this week. “The question for the Financial Policy Committee, is whether the sustained momentum in the housing market will lead to unsustainable growth in household indebtedness, undermining the resilience of the financial system. The growing momentum in the housing market is now the brightest light on the dashboard of warning lights.” You have been warned! Growth in the USA ... In the USA, growth in the first quarter was up by 2.3% year on year (0.1% quarter on quarter). The relatively disappointing number was attributed to a severe winter and much bad, wet weather. The Federal reserve derived some consolation from the strength of the jobs numbers released this week. In April, the number of non farm payroll jobs increased by almost 290,000, the unemployment rate fell to 6.3% and revisions to the employment numbers over the past three months confirmed the strength of the US recovery. Jobs growth over the last three months has averaged almost 240,000. With evidence of a strong performance in employment and household spending, the Federal reserve announced a further reduction in tapering with a reduction in asset purchases to $45 billion per month. Tapering is on track to completion by the September / October this year. Interest rate rises will then ensue possibly within six months. With inflation below target, wages rising by just 1.9% and almost 10 million Americans unemployed, the FOMC will be in no rush to act. So what happened to sterling this week? The pound closed up against the dollar at $1.687 from $1.681 and up against the Euro slightly at 1.217 (1.215). The dollar closed at 1.387 from 1.382 against the euro and at 102.23 (102.15) against the Yen. Oil Price Brent Crude closed at $108.50 from $109.54. The average price in May last year was $102.3. Markets, the Dow closed up at 16,542 from 16,370 and the FTSE also closed up at 6,821 from 6,685. The markets are making the move, the push before the rush, may see the FTSE hit 7000 before the summer sell off! UK Ten year gilt yields closed at 2.72 (2.66) and US Treasury yields closed at 2.72 from 2.67. Gold moved down $1,296 from $1,301. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  We will not take risks with this recovery … The Bank of England will not take risks with this recovery, according to the latest statements from Mark Carney, Governor of the Bank of England. Base rates will remain on hold for some time yet. When they begin to rise, the increase will be slow and gradual. It will be many years before fair value base rates of 4.5% will be on the agenda, according to the guidelines issued this week. Markets anticipate the first rate rise may appear in the second quarter of 2015. Thereafter a rise to 2% may be possible but not until the end of 2016 or the beginning of the following year 2017. “The level of interest rates necessary to sustain low unemployment and price stability will be materially lower than before the crisis,” the more cryptic quote. The recovery has gained momentum. Output is growing at the fastest rate since 2007, jobs are being created at the quickest pace since records began and the inflation rate is back at 2%. “The recovery has been underpinned by a revival in confidence, a reduction in uncertainty, and an easing in credit conditions”. Yes, Forward Guidance has been a success! The Bank of England expect the economy to grow by 3.8% this year and 3.3% next year assuming interest rates are held at 0.5% through 2014 and into 2015. Assuming rates follow the path outlined in current market profiles, growth will be a more modest 3.4% this year falling to 2.7% next. A recovery neither balanced or sustainable … No wonder the Bank consider the recovery is neither balanced nor sustainable. The recovery is dependent upon household spending, with a sluggish investment performance to date and a structural trade deficit, exacerbated by weak growth in Europe. Growth of 3.4% is significantly above trend rate and above most forecasts for the year. Consensus forecasts predict growth of just 2.7% in 2014 falling to around 2.5% next. The bank is very bullish on a recovery in earnings, consumer spending and investment. We shall see who is right in due course. For the moment, the Bank looks hot! So what of Forward Guidance … Forward guidance may have been a success but the single point reference to the unemployment rate has been beset with problems. The 7% guideline for unemployment will be breached in the first quarter this year. Hence the single point guideline is on the way out. It was too easy to understand. The Governor will not be allowed to make the same mistake again. The Bank collective has had its way. “To allow others to monitor how the economy is evolving relative to our projections, today we are publishing forecasts of 18 more economic indicators.” Excellent. Yes, now we will have eighteen guidelines to better understand policy. The output gap is back, as is the meandering NAIRU. Eighteen reasons why it will prove more difficult to pin the Governor in difficult interviews on Newsnight in the future. It was never clear why 7% was the correct number to choose anyway. The Americans bagged the 6.5% level first but the Governor admitted the long term NAIRU was more like 5% anyway. It was just a number but at least we could “see it” so to speak. Not so the “Output Gap”. What is the size of the output gap? What colour are the eyes of a Yeti? an equally productive debate. In a service sector economy with limited supply constraints, does it really matter anyway? Forward Guidance is a great step forward. Simplicity, part of the success, made the process just too transparent for some. Forward Guidance USA … Over in the USA, Janet Yellen, as the new Chair of the Fed provided assurances there would be policy continuance following the Bernanke regime. Accommodative monetary policy, with progressive tapering remains on the agenda. The US is expected to grow by almost 3% this year with inflation below 2%. Unemployment will fall below 6.5% through the year. So what of forward guidance, - markets believe a rise in base rates may be possible towards the end of this year or early next. So what happened to sterling? The pound closed up at $1.6730 from $1.6407 and 1.2220 from 1.2030 against the Euro. The dollar closed at 1.3690 from 1.3635 against the euro and 101.82 from 102.31 against the Yen. Oil Price Brent Crude closed at $108.56 from $109.57 The average price in February last year was almost $116. Markets, moved up - The Dow closed at 16,105 from 15,794 and the FTSE closed at 6,663 from 6,571. UK Ten year gilt yields closed at 2.80 from 2.71 and US Treasury yields closed at 2.74 from 2.69. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  “If inflation is the genie, deflation is the ogre that must be fought decisively...” Christine Lagarde head of the IMF was speaking to the National Press Club in Washington this week. With inflation below central bank targets in Japan, USA and Europe, the IMF believe the rising risks of deflation could prove disastrous for the world recovery. Western leaders, haunted by fears of the American Great Depression and Japan’s Lost Decade, are fearful of premature monetary tightening which could threaten the nascent recovery. In folklore, a genie is a supernatural creature who does the bidding once summoned. This may not have been the intentioned meaning by the boss of the IMF but Mark Carney Governor of the Bank of England, could be forgiven the interpretation. This week, the inflation figures for December were released by the ONS. CPI inflation increased by just 2%. For the first time in over four years, the genie returned to target, as would an obedient creature, undertaking the bidding of the new Governor of the Bank of England. The genie is working hard to obey. It has taken some time to get the message into the bottle and the genie back on message! Mission accomplished? With such success, it would be churlish to point out that in the same month, RPI increased from 2.6% to 2.7%, goods inflation actually went up and service sector inflation closed the year at 2.4%. For the moment the wild ride of the last four years has come to a close. As Christine Lagarde stated, “Optimism is in the air, the deep freeze is behind us and the horizon is much brighter.” In further good news, UK manufacturing prices increased by just 1% in December and input costs actually fell by just over 1%. Import prices of metals, parts and equipment fell, reflecting higher sterling values and lower world prices. For the moment, the inflation outlook for 2014 appears benign. Deflation is the ogre ... So what of ogres and deflation. Ogres are monsters in legends and fairy tales that eat humans and are particularly cruel, brutish or hideous. In the UK fears of deflation are not evident. We still expect inflation to hover slightly above target through the year. The ogre of deflation will be banished within the Kingdom. Particularly with earnings on the rise and a Chancellor of the Exchequer, as the handsome prince, up for re election, pledging an increase in the minimum wage to £7 an hour over the next couple of years. Inflation has fallen to target much faster than we had envisaged. The good news - as earnings rise, the boost to real incomes will lead to a sustained level of growth in consumer expenditure and retail sales. Higher but not quite as high as the latest UK data might suggest perhaps! Retail Sales the nymph spirit ... This week, the ONS released the retail sales figures for December. Sales volumes increased by 5.3% and values increased by 6.1% compared to December last year. Despite the fears of the major retailers, the consumer hit the high street with great gusto in the run up to Christmas allegedly. Internet sales, increased by 11.8% and small stores, experienced higher growth with sales increasing by just over 8%. Can retail sales have been so strong in December? Contractions in volume sales amongst food stores and petrols stations adds to the confused picture in the month. According to the ONS, in the three months prior to December, retail sales volumes averaged just 2%. So much for saving for Christmas. The surge in activity in December appears rather high and slightly at odds to the anecdotal evidence from retailers themselves. The BRC, British Retail Consortium suggests sales increased by just 1.8% in December as footfall actually fell. The BDO high street tracker reported sales down in the pre Christmas week with a recovery to 3.5% growth in the final week of the year. Debenhams, M & S, Morrisons and Sainsburys struggled in the Christmas period. Argos, Dixons, Halfords, Primark, Lidl and Ocado amongst the winners in the multi channel race. The 5% growth in volumes reported by the ONS appears to be a high call. So much for lies, damned lies and seasonal adjustment. Shrek shacking up with the Sleeping Beauty ... Ogres returned to the High Street this week as Sports Direct revealed a near 5% stake in Debenhams. Imagine Shrek shacking up with Sleeping Beauty, shudders must have swept around the Debenhams board room. The subsequent put and call option by Sports Direct, just added more confusion to the retail horizon. So what happened to sterling? The pound closed at £1.6422 against the dollar and 1.2127 against the Euro. The dollar closing at 1.3538 against the euro and 104.23 against the Yen. Oil Price Brent Crude closed at $106.48. The average price in January last year was almost $113, so no real threat to inflation from crude oil prices Markets, moved higher. The Dow closed at 16,458 and the FTSE closed at 6,829. 7,000 on the FTSE a soft call for the near term. UK Ten year gilt yields closed at 2.84 and US Treasury yields closed at 2.82. Yields will test the 3% level as tapering accelerates into 2014. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research and our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The good news for policy makers continued this week as inflation and unemployment continued to head in the right direction. The latest revisions to the National Accounts suggest the economy will grow by 2% this year. Inflation CPI ... falling Inflation CPI basis fell to 2.1% in November down from 2.2% in October. Manufacturing output prices increased by less than 1% in the month, unchanged from the prior period. Input costs for manufacturers actually fell by 1% as world commodity prices including metals and oil remained subdued. Overall the inflation outlook is benign with inflationary pressures diminishing. It will take some time for world demand to impact on price levels as long as the recovery in Europe remains protracted. We expect the international inflation outlook to look pretty soft over the next twelve months. Labour Costs ... set to rise On the other hand we expect a reversal in the trend in domestic labour costs by the end of next year. The claimant count fell by 37,000 in November to a level of 1.269 million, a rate of 3.8%. The overall number of claimants, over the past year, has fallen by 300,000 down from a rate of 4.6% in November 2012. 120,000 have found work over the past three months. At the current rate of jobs growth, the claimant count rate will fall to around 2.5%, within twelve to fifteen months. This is a pre recession rate, consistent with significant growth in rates of pay and remuneration. As it is, the rate of private sector earnings increased by almost 1.5% in October. The widely reported “whole economy rate” increased by just under 1% but the warning signs are there for policy makers - domestic inflationary pressures and labour costs will be back on the MPC agenda by the end of 2014. As unemployment falls ... The wider Labour Force Survey Data confirmed the unemployment level fell to 2.388 million in October and a rate of 7.4%. This is a fall of 120,000 over the past year as the overall number of people in employment increased by almost 500,000. The 7% hurdle rate outlined in Forward Guidance could be within reach within twelve months as the rate of economic growth accelerates into the final quarter of 2013 and into next. Interest rates are set to rise, probably after the 2015 election. Bank of England MPC Minutes ... The minutes of the Bank of England Monetary Policy Committee were released this week, explaining why base rates were not increased in the December meeting. The domestic recovery was robust with inflationary pressure diminishing it was said. The GDP figures had confirmed the rapid pick up in consumption growth. Strong contribution from stock building had been offset by a large drag from net trade. The overall divergence between domestic demand and net trade had been larger than expected. Any significant narrowing of the current account deficit in the near term seemed unlikely! Rebalancing ? Does this mean the MPC had got the message about the rebalancing agenda? Sadly not. The minutes went on to claim that a sustained recovery would require some rebalancing from domestic to external demand! Some hope, the UK is set for a classic consumption rally with domestic demand growth of significant proportions. Fears about the appreciation of sterling are misguided. Higher sterling will alleviate inflationary pressures and de facto improve margins and competitiveness of exports. For exporters, demand (not price) conditions are dominant. The sluggish recovery in Europe will be the real obstacle to export growth over the next twelve months. And what of Investment ... Better news for investment however. The minutes claimed that beyond the near term, it seemed likely that a pick up in business investment spending would be necessary, Business and Dwellings investment had been weaker than expected to date. Weaker than expected in the Bank of England model, perhaps. The good news is that, we expect a strong rally in investment spending in 2014 as capital expenditure projects are brought back to the board room on the back of stronger domestic demand. Just 20% of total investment is determined by plant and machinery and our models suggest the four year capital stock has fallen to £163 billion down from an average £183 billion in the three years prior to recession. That represents a fall of 12%. Our less aggressive ten year Capital Stock Model suggests the overall level of productive investment has fallen by just 2%. No threat to the output capacity of UK PLC. The shortfall will be addressed by additional investment over the next three years to restore capacity equilibrium. Investment in transport equipment is set to rally on the back of a a 10% increase in commercial vehicle sales this year. Intangibles “investment” is set to rise on the back of a healthier M & A and corporate finance market in 2014. Together transport equipment and intangible investments account for a further 20% of total investment. Why has investment been subdued ... ? Why has investment been subdued post recession? Well in general businesses will invest in response to rising demand not a fall in the cost of capital. More specifically, 60% of investment identified in the national accounts is linked to property, either dwellings or commercial real estate. No policy maker should be surprised by the lag in investment intentions in this sector. Significant price collapse has left almost half the banked commercial real estate under water on a conventional 65% LTV (loan to value) test. A significant recovery in prices is required to restore equilibrium in the commercial real estate sector. The recovery in property and real estate may be a little more protracted, than “other investment classes”. Nevertheless we expect strong investment growth in 2014 and 2015 with investment in “dwellings” staging a marked recovery. So what of the revisions to the National Accounts? The latest revisions to the National Accounts confirm the economy grew by 2% year on year in Q3. We now expect the economy to grow by 2% for the year as a whole and by 2.5% in 2014 rising to 2.7% in the following year. And what of tapering? The Fed announced the beginning of tapering with a reduction in the rate of asset purchases by $10 billion from January 2014. What is that all about? The Fed said, “The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.” Oh dear? The link between longer term rates and growth has never been fully explained as neither has the linkage between domestic asset price inflation and international deflationary pressures. Nevertheless, it is time to buckle up, we are leaving Planet ZIRP - This week, the US growth rate was revised up to 2% year on year in Q3, Fed rates will also be on the rise in 2015. What happened to sterling? The pound closed at £1.6351 from £1.6294. Against the Euro, Sterling closed at €1.1950 from €1.1856. The dollar moved up against the yen closing at ¥104. from ¥103.6 and closing at 1.3678 from 1.3740 against the Euro. Sterling is on a rally which has led to a break out above £1.60, but €1.20 still presents significant overhead resistance. Oil Price Brent Crude closed at $111.58 from $108.53. The average price in December last year was almost $110, so no real threat to inflation. Markets, US moved higher - The Dow closed at 16,275 from 15,755. The FTSE closed at 6,606 from 6,434. 7,000. UK Ten year gilt yields closed at 2.94 from 2.90 US Treasury yields closed at 2.89 from 2.87. Yields will test the 3% level as tapering accelerates. Gold closed at $1,207 from $1,239. That’s all for this week, and for this year. No Sunday Times and Croissants tomorrow or for the next few weeks. The professor and his team are away for a short break. Have a great Christmas of Holiday Break and have a Happy New Year. Join the mailing list for The Saturday Economist or forward to a friend John © 2013 The Saturday Economist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – the spirit of Christmas present is a cheerful spirit ... The spirit of Christmas Past - should not be forgotten. The spirit of Christmas Present - is a cheerful spirit. The spirit of Christmas Yet to Come suggests that it is unlikely that equilibrium interest rates will return to historically normal levels any time soon”. Excellent. Don’t you just love a central banker with a Christmas message. Governor Carney was speaking in New York this week at the Economic Club of New York. The Governor is anxious to secure the message, interest rates will not rise any time soon. The recovery will not be put at risk. The UK will achieve escape velocity from a liquidity trap, avoiding secular stagnation in the process. Forward guidance is the new policy mantra, secular stagnation the new spectre on the blog. The UK is set for recovery, despite the prophets of gloom on either side of the Atlantic. Forward guidance is integral to the central bankers response to the recession and setback. FG reduces uncertainty, providing reassurance that monetary policy will not be tightened before the recovery is sufficiently established. Businesses will have the confidence to invest. Households will have the confidence to spend. A liquidity trap is avoided. A liquidity trap occurs when the short-term nominal interest rate hits the zero lower bound. Typically in a liquidity trap, inflation is low, the equilibrium real interest rate is negative, creating a persistent inability to match aggregate demand and supply. Businesses won’t invest and consumers are reluctant to spend, aggregate demand continues to fall and a deflationary spiral develops. Fiscal constraints ensure Government spending cannot bridge the output gap. In the UK, the financial crisis pushed the equilibrium real interest rate to the lower bound. With nominal interest rates stuck at zero, and inflation low, monetary policy was unable to push actual real rates to a level low enough to generate growth allegedly. “Pushing on a string, is no way to wag the dog”. I think Keynes said that. Hence the emergence of QE on Planet ZIRP. Allegedly, a way to stimulate liquidity AND activity. In reality, a great way to undermine the gilt curve and returns to savers and investors in the process. So what of secular stagnation? Larry Summers had recently raised the spectre of secular stagnation at the IMF meeting in November in honour of Stanley Fischer, guru of monetary theory at MIT. Secular stagnation, a concept first developed by Alvin Hansen in the 1920s suggested the “new normal” in the USA (post depression) was of lower growth, primarily a result of lower population growth and technological exhaustion. No new things to boost productivity, that sort of thing. Larry Summers, resurrected the term, suggesting the short term real interest rate consistent with full employment may have fallen to -2% -3% in the middle of the last decade. “The natural and equilibrium interest rates may have fallen significantly below zero”. “We may have to think about how we manage an economy in which the zero nominal interest rate is a chronic and systemic inhibitor of economic activity holding our economies back below their long run potential.” he said. In theory, the Fed funds rate can be kept at ZIRP forever but it is much harder to do “extraordinary additional stuff” forever” either in the form of QE, or government deficit funding perhaps. This said Summers, is “my” lesson from this crisis which the world has “under internalised”. Actually Summers went on to say “Now this may all be madness and I may not have this right at all”. Mmm. Stuck on Planet ZIRP, QE was introduced, the effect of which, was to ensure we were marooned on the planet for longer. ZIRP creates of itself a problem which is compounded by QE. In the UK, QE has lost intellectual credibility and momentum but in the USA the persistent purchase of Treasuries and Mortgages (CMBS) continues, achieving no more for Uncle Sam, than a monthly dispensation into a NASDAQ tracker fund. It really is time to begin tapering in the US, end QE and return the equilibrium rate of interest to a natural rate. A natural rate for gilts and treasuries, which reflects an inflation hedge and a real rate of return to risk. In his speech, Summers said, “we have learned one thing, finance cannot be left to the financiers”. Perhaps but then I have always felt much the same about monetary economics. We should begin to think how we can manage an economy in which the academics are confined to campus and not allowed near policy levers. The concept of a negative equilibrium interest rate, which may have fallen to -3% pre recession is as incomprehensible, as life on Planet ZIRP without oxygen. The escape from ZIRP and the beginning of recovery can only be accelerated by an end to QE. Let the free markets free and end QE - the cry. It is time to suggest “Schools out for Summers” and the MIT class of 14462. The US is set to grow by over 2.5% next year or has no one noticed. Back in the UK Back in the UK, as expected the march of the makers picked up the pace in October. Manufacturing growth year on year increased to 2.7% in the month. Construction output grew at over 5% in the latest data for October. The trade figures on the other hand continued to disappoint. The UK's deficit on trade in goods and services was estimated to have been £2.6 billion in October 2013, unchanged from September. The deficit of £9.7 billion on goods, partly offset by an estimated surplus of £7.1 billion on services. Yes, the march of the makers is picking up pace, momentum is “building”, investment plans will be brought back to the board room, just the trade figures alone will continue to disappoint, as the UK recovery gains pace. What happened to sterling? The pound closed at £1.6294 from £1.6346. Against the Euro, Sterling closed at €1.1856 from €1.1922. The dollar moved down up the yen closing at ¥103.2 from ¥102.8 and closing at 1.3740 from 1.3700 against the Euro. Sterling is on a rally which has led to a break out above £1.60, but €1.20 still presents significant overhead resistance. Oil Price Brent Crude closed at $108.83 from $111.61. The average price in December last year was almost $110, so no threat to inflation. Markets, US moved lower - The Dow closed at 15,755 from 16,020. The FTSE closed at 6,434 from 6,552. 7,000 FTSE now a tough call before Christmas. The markets still nervous until tapering finally begins. UK Ten year gilt yields closed at 2.90 from 2.91 US Treasury yields closed at 2.87 from 2.86. Yields will test the 3% level over the coming months but this will await the New Year. Gold closed at $1,239 from $1,231. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – you don’t have to be an optimist to see the glass is half full .. Yes it's the Inflation Report “You don’t have to be an optimist to see the glass is half full”, the opening remarks from Governor Carney’s Inflation Report presentation this week. The Governor went on to say, “the glass is half full and it will be filled”. A clear reference the recovery will be allowed to gain momentum before the Bank of England and the MPC will intervene “to take away the punch bowl” and begin the rise in base rates. The MPC are sticking with forward guidance. Rate rises will not even be considered until the level of unemployment hits 7% or even lower. [Subject to caveats on inflation expectations and market stability]. When will this be? In August the Bank assumed this would be in 2016 at the earliest. On Wednesday, the Governor admitted there was a 40% chance this could be by the end of 2014 with a 60% chance it would be by the end of 2015. Such has been the strength of the economics data over the last three months. Our own models assume the knock out unemployment rate will be hit by the third quarter of 2015. Thereafter rates may rise by around 50 basis points in short time. For the moment, the MPC are on a learning journey. The path of productivity, earnings, job creation and unemployment so unclear, we are all embarking on a “learning journey” suggested the governor. The £5m recently spent on the Bank of England model, of little value in the new world it would appear. Charlie Bean appeared most discomfited by the trip. Economics from Cambridge, a PhD from MIT and teaching at Stanford and LSE in the knowledge pack. One could be forgiven the reluctance to take the Mark Carney refresher course. But then why not? Having seriously failed to understand the impact of low rates on investment and depreciation on the trade balance, it is time to denounce the omniscient stance of the Oxbridge collective. Yes send them back to school. Martin Weale was indeed sent back to school this week. The MPC member was delivering a speech on the role of monetary policy and forward guidance to A-level students in London. “To cut a long story short, our job is to ensure that people buy coats when they need them”. Excellent. I am sure that cleared things up. Martin once worked in a shop apparently. Yes the black cloud gang disbanded, it’s back to school for all. Fill up your glasses, the punch bowl is on the table, the Carney Credit card is behind the bar. Inflation Good news for the Governor, inflation fell in October CPI to 2.2% from 2.7% in the prior month. Education hikes last year fell out of the index as we expected but the fall in transport costs pushed the index even lower. 2.4% CPI inflation was our call and still seems to be a reasonable target by the end of the year. Manufacturing prices suggest there is little cost pressure in the economy but retail energy prices are moving significantly higher. Retail Sales Retail sales figures in October were slightly disappointing, an increase of 1.8% in volume and 2.5% in value, slightly down on the averages in Q3. The demise of Barratts Shoes and Blockbuster a reminder, conditions remain tough on the high street as household real incomes remain under pressure. Internationally Janet Yellen, the new head at the Fed is still worried about the strength of the US recovery. Tapering may be postponed still later into the New Year. Growth in France and Japan in the third quarter a further warning the world recovery still requires accommodation. QE tapering US style is not the answer. Buying treasuries and Mortgage Backed Securities to support asset prices makes no sense. Blend a NASDAQ tracker fund into the purchase mix would follow the logic and demonstrate the folly. What happened to sterling? Sterling closed at £1.6113 from £1.6018. Against the Euro, Sterling closed at €1.1940 from €1.1982. The dollar moved up against the yen closing at ¥100.1 from ¥99.1 and closing at 1.3494 from 1.3368 against the Euro. Oil Price Brent Crude closed at $108.50 from $105.12. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,962 up from 15,762. The FTSE closed at 6,693 from 6,708. UK Ten year gilt yields closed at 2.75 from 2.77 US Treasury yields closed at 2.70 from 2.75. Yields will test the 3% level over the coming months. Gold closed at $1,288 from $1,284. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – Building recovery one brick at time .. Construction data Good news this week from the construction sector. Output in August was up by 4% compared to August last year. New work increased by almost 6% driven by developments in the housing market. FLS and Help to Buy are stimulating new mortgage activity on a really significant scale. The Council of Mortgage Lenders announced home-owner house purchase lending was up by 15% on August last year. First-time buyers took out 27,100 loans in August, an increase of 33% compared to August 2012. The house market is on the move. We expect the surge in housing activity to continue into the final quarter of the year and into 2014. Do we really need “Help to Buy Phase 2” probably not. No need to pay for a landslide, the economic recovery secured. We have increased our forecasts for GDP growth this year to 1.5% increasing to 2.5% next year. NIESR monthly GDP data Our estimates are in line with the NIESR monthly GDP tracker for September, released this week. The (NIESR) GDP rate of growth in the third quarter was 1.6% year on year. We expect the rate of growth to accelerate further into the final quarter towards trend rate of 2.4%, driven by a steady recovery in the service sector and a big push in construction output. Monetary Policy No surprise this week the MPC voted to keep interest rates and QE on hold. Forward Guidance is the new mantra. UK base rates will not rise until the U rate falls to 7%, assuming no shocks to the monetary system and the inflation outlook. In the USA, the Fed continued with the monthly asset purchases of $85 billion. What is it about the USA? The Fed might as well commit dollars to a NASDAQ tracker fund to sustain confidence in the markets. “Tapering will not begin until the DOW hits 17,000 could be the new forward guidance. Janet Yellen is to replace an exhausted Bernanke. Such a dove, they should “paint her white and give her wings”, the markets will love Planet Janet orbiting, as it will, around Planet ZIRP. So what of the UK recovery? The trade figures and manufacturing data were also released this week. Remember, "the march of the makers, rebuilding the workshop of the world, rebalancing the UK economy away from domestic consumption with an improvement in net trade"? Well forget that. The professor (Milton Keynes) invested in a sandwich board and spent his summer holidays in Cornwall this year. Stationed at Land’s End, facing Western traffic, the sign read “sail on - the earth is not flat”. “We get the message” shouted a wise cracking grockle. The professor turned to reveal the message on the other side, “Exports will not lead a UK recovery”, “yeah but how long did it take”, replied the perspicacious prof. Trade Data And so it proved with the trade data this month. The trade in goods deficit was £9.6 billion in August. We expect a deficit of £29 billion in the quarter compared to £26 billion last year. Our forecast for the year, is now at the top end for the year as a whole around £110 billion. The UK recovery will exacerbate the deficit. Monthly data can be erratic but fifty year trends provide a certain guide. The UK cannot grow faster than Europe and the USA without a significant deterioration in net trade in goods. Is this such a problem? Not really. The surplus on services will mitigate the deficit to around £30 billion. At 2% of GDP this is neither a threat to sterling nor a constraint to growth. Manufacturing The march of the makers skipped a drum beat in August as output fell by -0.2% compared to August last year. Consumer goods output fell by just over 2% as capital goods growth slowed to a similar level. We expect a better performance in September and in the final quarter of the year. Housing new build and a higher level of transactions will stimulate direct related construction output, (bricks & mortar). Housing related spending on products including furniture and carpets will also stimulate growth. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. Will US debt intransigence derail recovery? We assume not. If you lived through the Cuban missile crisis and the era of an international nuclear strategy underwritten by the concept of Mutually Assured Destruction, (They call it MAD), You assume sooner or later, the Republican ships will turn around and avoid the disaster that could unfold. Failing that, the President can always mint a few Trillion Dollar Platinum coins, develop section four of the fourteenth amendment or invoke the 1861 Feed and Forage Act. Union soldiers were allowed to “eat your crops, kill your chickens and water their horses”. The Act ensured, sooner or later, Congress would enact the necessary appropriation. The troops had to eat even though the deficit had not been approved. And so it is with debt markets, “let them eat noodles” is no message to send to international creditors. What happened to sterling? Sterling moved down against the dollar and against the Euro. The pound closed at £1.5954 from $1.6012. Against the Euro, Sterling closed at €1.1772 from €1.1816. The dollar moved up against the yen closing at ¥98.5 from ¥97.4.The dollar euro cross rate at 1.3542 was largely unchanged from 1.3556 Oil Price Brent Crude closed at $111.28 from $109.46. The average price in October last year was almost $112. We expect oil to average $112 in the month, with no real inflationary impact. Markets, rallied - The Dow closed at 15,237 from 15,073. The FTSE closed at 6,487 from 6,454. The markets sense a deal on the deficit is in sight. UK Ten year gilt yields closed at 2.74 from 2.75, US Treasury yields closed at 2.69 from 2.64. Gold closed at $1,270 from $1,310. The bulls have it or do they? Gold will trade sideways for some time yet. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist. By John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – inflation falls, no boom in the housing market, good news on borrowing, Chancellor Osborne is ticking the right boxes this week ... Inflation - Retail Prices The rate of inflation slowed to 2.7% in August compared to 2.8% in July. We expect a further significant fall next month and by the end of the year the inflation rate should be around 2.4%. Thereafter prices could be a little sticky. Service sector inflation was 3% in August and goods inflation was 2.4% in the latest monthly data. Inflation - Manufacturing Prices The good news on inflation was also manifest in the manufacturing sector. Output prices increased by just 1.6% compared to 2.1% in July. Input costs for manufacturers also fell back from 5% in July to 2.8%. Part of the reason for the slow down was oil and energy costs. The average price of oil in August was $111 dollars per barrel, slightly down on the same period last year. The rate of wages and earnings growth remains subdued, presenting a benign outlook for inflation over the short term. At close this week Brent Crude was trading at $109 dollars per barrel. The outlook for manufacturing inflation is pretty benign. House Prices - ONS data For those wary of a housing boom, the ONS also released the House Price Index in July. In the 12 months to July 2013 UK house prices increased by 3.3%, up from a 3.1% increase in the 12 months to June 2013. Signs of a national boom? Not really but certainly signs of a good recovery! Annual house price increases in England were driven by London (9.7%) and the South East (2.6%). Excluding London and the South East, UK house prices increased by just 0.8%. In the North West, prices actually fell by almost 1%. The RICS has made the call for a peg on prices around 5%. This to reflect a normalised earnings growth rate of 3% plus a supply side restraint adjustment to stimulate additional investment presumably. Would this work nationally? Obviously not. But some consideration to mortgage rationing on a regional basis especially in the South East may gain political if not market traction. Retail Sales August - A further indication, the recovery is on track with no signs of a runaway boom in prospect... Retail Sales in August were up by 2.1% in volume and 3.6% by value compared to August last year. Internet sales were up by 22% in the month accounting for 10% of all retail sales. Trading is better but not that much. With online trends and large store consolidation, life for most retailers is tough. Government Borrowing Further good news for the Chancellor, the level of borrowing fell in August. We expect further significant falls before the end of the financial year. In August 2013, public sector net borrowing excluding temporary effects of financial interventions (PSNB ex) was £13.2 billion. This was £1.3 billion lower than in August 2012 when it was £14.4 billion. The Chancellor is on track for a significant fall in borrowing this year. We expect the level of borrowing excluding interventions and transfers to fall to around £105 billion compared to a revised £115 billion last year. Car Manufacturing Car output increased by 16% in August bring the year to date output growth to 3%. More good news but the August headline should be kept in perspective. The year to date total is the better trend guide and let’s not forget commercial vehicle output is down in the year by 17%. Tapering USA Despite clear indications “Tapering” may begin in the Fall, the Fed decided to continue the process of QE, purchasing mortgage backed securities at a pace of $40 billion per month and longer term Treasury securities at the rate of $45 billion per month, this week. What does this mean for US and UK interest rates? Not much in the short term. Check out the Saturday Economist Special Post "No tapering, more tampering, leads to more questions than answers at the Fed". Assessing market reaction over the week, Bernanke fires a blank would have a more appropriate headline. What happened to sterling? Sterling responded to the news on tapering, moving up against the dollar but down against the Euro. The pound closed at $1.5994 from $1.5871 having tested the 1.60 level intra week. Against the Euro, Sterling closed down at €1.1824 from €1.1940. The dollar moved little against the yen closing at ¥99.3 from ¥99.4 Oil Price Brent Crude closed at $109 from $111. The average price in September last year was almost $113. We expect oil to average $110 in the current quarter, with no real inflationary impact. Markets, rallied - The Dow closed up at 15,451 from 15,376 . The FTSE closed up at 6,596 from 6,584. The Fed statement this month was a mis fire non event. We still think the FTSE will clear 7000 within ten weeks and the DOW will press 16,000. UK Ten year gilt yields closed at 2.92 from 2.94, US Treasury yields closed at 2.79 from 2.89. The fed statement this week pulled long rates down by just 12 basis points. Long rates are decoupling from shorts, returning to fair value. They are just a bit reluctant to leave, with pleas from the FOMC to “stick around”! Gold closed at $1,331 from $1,312. The bulls have it or do they? The news on tapering bought some upside gain but not much, we think gold will trade sideways for some time. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy . The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed