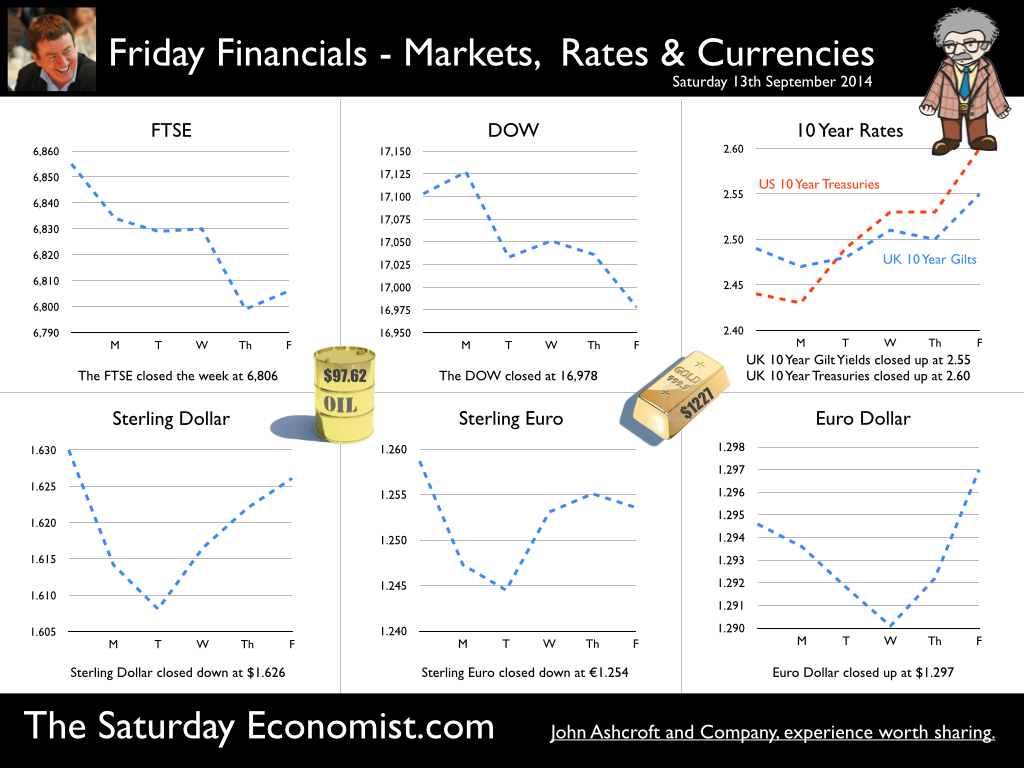

USA ... When will US rates rise? According to the latest survey in the Wall Street Journal, most economists expect the Fed to raise rates in June next year. 40% expect rates to rise in the second quarter and almost half expect the rise to be delayed until the second half of the year. Positive about the prospects for growth in the US, economists believe concerns about Europe and challenges in the Ukraine suggest the Fed will be anxious to hold the rate rise for as long as possible and well into the year ahead. Mark Carney in Liverpool … The Governor was in Liverpool this week speaking to the TUC Annual Congress. Reassuring union members he and 3,600 staff in the Bank of England were paid a living wage, the governor went on to explain the “judgement about precisely when to raise Bank Rate has become more balanced”. “With no pre set course, the timing would depend on the data.” This week, the data suggests there will be no pressure to increase rates anytime soon and probably not before the end of the year. Oil Price … Fears of inflation abate, as the oil price fell below the $100 dollar mark. Despite turmoil in Iraq and Syria, Oil Price Brent Crude closed at $97.62. The average price in September last year was $112. UK manufacturing prices and headline inflation rates will soften as a result. For the moment, the Saudi swing producers are relaxed. The seasonal low will impact and prices will take the hit. Restoration to the $100 - $110 band will follow in the Autumn, demand and supply will adjust to ensure this is the case. Manufacturing … UK Manufacturing output increased by just 2.2% in July after growth of 3.5% in the first half of the year. Output of capital goods and consumer goods was surprisingly week in the month. We have downgraded our forecasts for the third quarter and the year as a whole (3.4%) as a result. Construction output ... UK Construction output growth slowed to 2.6% in July after growth of 6% in the first half of the year. Strong growth in new housing (both public and private) up by 27% and in private industrial (up by 20%) was offset by weakness in infrastructure and related public sector projects. For the year as a whole we expect growth of 4.6% slightly down on the June forecast of 5.1%. UK Trade Figures … The trade deficit (goods) increased to £10.2 billion in July offset by a £6.8 surplus in services. Our forecasts for the year as whole - unchanged as a result. We expect the deficit (trade in goods) to be £30.8 billion in the quarter and £112.5 billion for the year as a whole. Is this a threat to recovery? Not really. The trade in services surplus will reduce the combined deficit in the year, to around £30 billion. Less than 2% of GDP, the deficit is easily funded. No pressure on policy makers to increase rates, assuming overseas dividends recover to finance the shortfall. Growth in the UK … Despite the soft figures in manufacturing and construction in July, our forecast for growth in the UK in the Q3 and for the year as a whole remains unchanged around 3.1% So what of base rates … Last week, base rates were held at 50 basis points. The chances of a rate rise before the end of the year are receding. Next week’s inflation and retail figures will be soft but the labour stats will suggest further tightening in the claimant count and vacancy rates. There will be nothing in next week’s data to precipitate a rate rise this year. So what happened to sterling this week? Sterling fell against the dollar to $1.626 from $1.630 and down against the Euro at 1.254 from 1.259. The Euro was up against the dollar at 1.297 (1.295). Oil Price Brent Crude closed down at $97.62 from 100.98. The average price in September last year was $111.60. Markets, move down slightly. The Dow closed down at 16,978 from 17,103 and the FTSE closed down at 6,806 from 6,855. UK Ten year gilt yields move up to 2.55 from 2.49 and US Treasury yields closed at 2.60 from 2.44. Gold was further tarnished at $1,227 from $1,265. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed