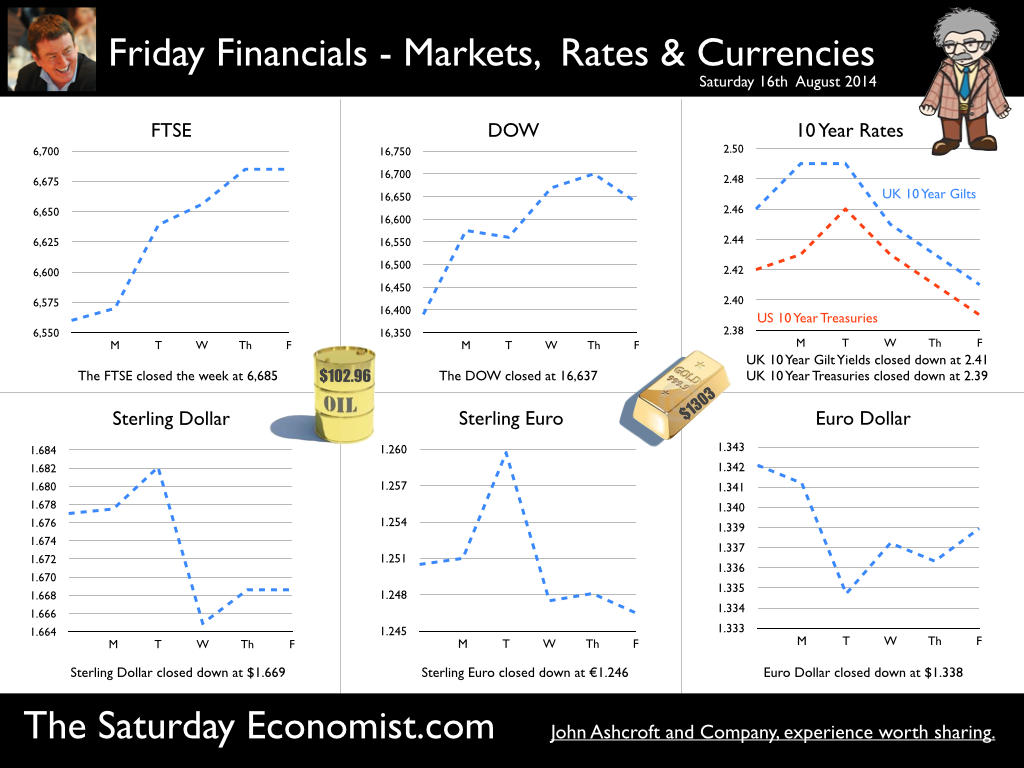

The Inflation Report Press Conference … Reassurance from the Inflation Report Press Conference this week. The Bank of England may be uncertain about what is happening in the economy but it is certainly not clueless. Excellent. £3.5 million spent on the economics model and 200 PhDs in the pot to stir up the data, not all is for nought. James Macintosh of the FT put the difficult question “It would appear you've been moving over the past five years from a fair degree of certainty towards a fair degree of cluelessness and currently - you are at the more clueless end of the spectrum.” Is this a fair point? Well perhaps. Larry Elliott of the Guardian had begun the challenge suggesting there's a wide range of views on the Committee about the likely degree of slack in the economy. There is uncertainty about the housing market, wages may go up, they may not go up. Guidance on the pace and extent of interest rate rises is an expectation not a promise … “I mean once you cut through all this doesn't it lead you to three conclusions - one, that the Bank hasn't really got a clue what's going on out there; two, that the MPC is divided about what's going on out there; and thirdly, any person thinking about taking out a mortgage on the basis of the Bank's forward guidance would be ill-advised to do so, because anything you say, has to be taken with a very large pinch of salt?” Oh dear ... The Carney honeymoon is over … Well one thing we can be certain about, this is not the questioning we would have expected under Governor King. For Governor Carney the honeymoon is over. So much for the open routine. The Emperor’s economics models are proving to be as insubstantial as the clothing. Perhaps it is time to return to the enigmatic, grumpy old professor emeritus routine, dismissive of those of a lower intellectual order including undergraduates and the press core particularly. Ed Conway now with Sky News, would occasionally rattle Governor King teasing about the accuracy of the inflation forecasts, (not actually forecasts of course) but Governor Carney,cast in the role as the unreliable boyfriend, is taking more and more hits. All a bit of a muddle … Clearly Asa Bennett From the Huffington Post rattled the Governor, sensitive to criticism of forward guidance, “I just wanted to ask Governor about the evolution of your forward guidance plan, particularly when it started with the sort of clear to understand unemployment threshold, and then the sort of output gap, and then this bolt on about pay growth. Do you wish you started with this at the beginning? Hasn’t it all been a bit of a muddle or is it a learning process? “Well you’re muddled I'm afraid”. The playground retort from the Governor of the Bank of England. So is that the best we can get? The Old Lady of Threadneedle Street - the Aunt Sally of Fleet Street … The Old Lady of Threadneedle Street is becoming the Aunt Sally of Fleet Street. It would help if Jenny Scott, Executive Director of Communications, chairing the press conference, appeared to know some of the names of the press corp, instead of jabbing a pencil in this or that direction, when it came to question time. Perhaps Jenny was trying to ward off evil spirits, waving the magic wand of oblivion, which Governor King carried so successfully in his cloak. For debutante MPC member Minouche Shafik, it was all too much. Shifting uneasily, apparently bored, struggling under the weight, not of office but of a voluminous hair style, the governor allowed Minouche one question response on Europe … Minouche : “It would be good for us if Europe grew faster since it’s our key trading market, but for the near term that doesn’t look very likely”. “That’s all we have time for”, said the Director of Communications and that was that. Well, we must hope there is much more to come. So what happened this week? GDP Estimate … The ONS second estimate of GDP was released this week. Growth in the UK Q2 increased by 3.2% compared to the prior estimate of 3.1%. Actually the numbers hadn’t changed, the statisticians were using a more accurate calculator this time round for the rounding. Our estimates of growth for the year are unchanged at 3% which makes the Bank of England estimates of growth (3.5%) all the more difficult to understand. Either the economy will grow at an eye watering 4% in the second half of the year or the Bank expects big revisions to the data in September as a result of the inclusion of drugs and prostitution in the national accounts. Who would have thought hookers had that much clout. We shall have to wait until the end of September for the update. Labour Market Stats … The jobs outlook just gets better. The claimant count rate fell to 3% in July at just over 1 million unemployed. 400,000 have found work in the past year. At the current rate of growth we will be closing the job centres at the end of 2016, there will be no on left on the register looking for work. The wider LFS data confirmed the trend with the unemployment rate falling to 6.4%. More people in work, unemployment rates falling, recruitment increasing, skills shortages heightening, which makes the pay data even more inexplicable. Earnings increased by less than one per cent in June. We would expect increases in line with inflation or more at 3% plus at this stage in the recovery. For this we have much sympathy with the models at the Bank of England, something strange is happening on Planet ZIRP. Maybe low rates are the problem and no the solution? So what of base rates … Growth and jobs data would push the argument for a rates rise before the end of the year. Inflation and pay data would suggest the rates could be kept on hold until 2015. The latest data from Europe confirms a rate rise is off the agenda for months if not years to come. The MPC will be loathe to act ahead of the Fed and not too eager to move in advance of the ECB. Markets assumed rates will be kept on hold as a result of the Inflation Report… So what happened to sterling this week? Sterling closed down against the dollar at $1.669 from $1.6774 and down against the Euro at 1.246 from 1.252. The Euro was down against the dollar at 1.246 (1.341). Oil Price Brent Crude closed down at $102.96 from 105.02. The average price in August last year was $111.28. Markets, rallied on the rates news. The Dow closed up at 16,637 from 16,554 and the FTSE closed up at 6,685 from 6,567. UK Ten year gilt yields were down at 2.41 from 2.55 and US Treasury yields closed at 2.39 from 2.49. Gold was largely unchanged at $1,303 from $1,305. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed