Welcome to the Saturday Economist. Here we explore the fascinating world of economics and financial markets. Our expert analysis is dedicated to bringing you the latest news, insights, and analysis on all things economics.

Discover how to navigate the complex world of economics and gain valuable insights to help you make informed decisions. With The Saturday Economist , you'll have a deeper understanding of the fascinating world of money and markets.

Check out Our Latest Weekly Updates, Our Friday Forward Guidance plus our Monday Morning Markets Weekly Review of Financial Markets. Join The Mailing List ... Don't Miss Out ... Join The club! For those deeper insights ...

To understand the markets, you have to understand the economics and we do ...

John Ashcroft

Discover how to navigate the complex world of economics and gain valuable insights to help you make informed decisions. With The Saturday Economist , you'll have a deeper understanding of the fascinating world of money and markets.

Check out Our Latest Weekly Updates, Our Friday Forward Guidance plus our Monday Morning Markets Weekly Review of Financial Markets. Join The Mailing List ... Don't Miss Out ... Join The club! For those deeper insights ...

To understand the markets, you have to understand the economics and we do ...

John Ashcroft

UK inflation "may have" peaked according to the latest data. We are not so sure. In the U.S. on the other hand, both headline CPI and producer prices suggest inflation may well have been transitory after all.

|

|

Jeremy Hunt, the new UK chancellor, today scrapped the bulk of Kwasi Kwarteng’s tax cuts 17th October 2022 ....

Jeremy Hunt, the new UK chancellor, today scrapped the bulk of Kwasi Kwarteng’s tax cutsin a desperate effort to calm markets. In an emergency move to rebuild the government’s fiscal credibility, Hunt ripped up the government’s tax and spending plans, putting a wrecking ball through the economic policy of prime minister Liz Truss. Markets responded positively to signs the UK government was finally getting a grip on Britain’s public finances. Gilts and sterling extending the rally after the chancellor ’s morning statement. The 30 year gilt yield trades at 4.39%. Ten year gilts trade at 3.962, it looks like an over reaction. We expect ten year gilts to trade between 4.0% and 4.5% in the final quarter of the year. Sterling trades higher testing the $1.13 level … |

|

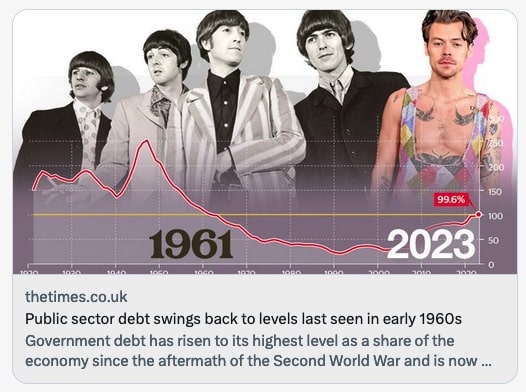

Not so much the kindness of strangers, just the generosity of old friends ...

The Treasury will have to sell £234 billion of gilts this year. The Bank will have to step in as the buyer of last resort. Nothing Cute about QT. The Old Lady will have to abandon plans to sell off £80 billion of government debt. The Bank held 33% of the £2.4 trillion of gilts in issue at the start of the year, according to the Debt Management Office. Government debt is set to rise by almost £500 billion over the next three years. Government spending plans by "inky blots and rotten bonds sustained. Johnny Foreigner's holdings have slipped below 30%. The Old Lady of Threadneedle street will have to step up. This is no time for The Bank of England to shirk the task and shrink the balance sheet. |

To understand the markets, you have to understand the economics

To understand the economics, you have to understand the history