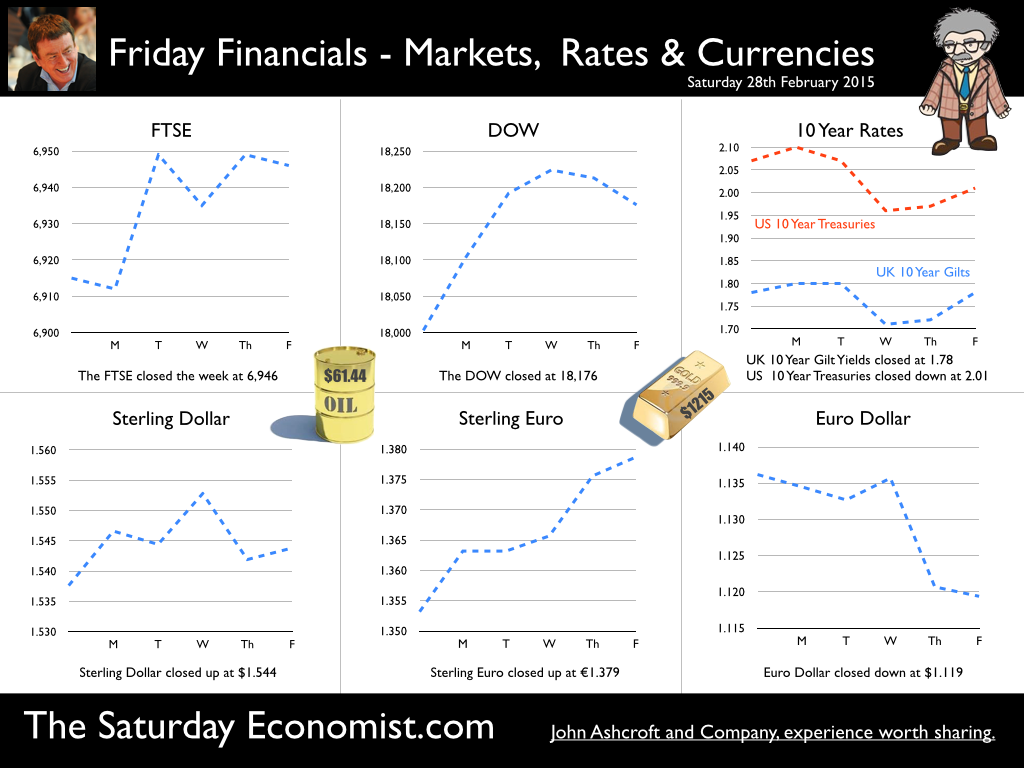

Latest UK GDP Data … The latest revisions to GDP released this week, were unchanged from prior estimates. Household spending increased by 2.1% in the year, government expenditure increased by 1.5%. Investment in the form of Gross Fixed Capital Formation increased by almost 7%. Export growth was modest at 0.4% as imports increased by 1.8%. The trade deficit continues to deteriorate as leisure and construction drive recovery. In output terms, the service sector contributed growth of 3%, private service sector growth increased by almost 4%, with strong growth in leisure, transport and business services. Manufacturing increased by 2.7%, construction increased by 7.3%. So what does this mean? The recovery continues. Our forecasts for this year are broadly unchanged. Updated Forecasts for 2015 … This week we update our forecasts for 2015 and 2016 reflected in the UK Economic Outlook March edition. The UK recovery continues. We expect growth of 2.9% in 2015 … slowing to 2.8% in 2016. The collapse in oil prices has significantly changed the world outlook for growth and inflation over 2015. Growth estimates for oil importers have been revised upwards and the fortunes of oil exporters have been revised down as a result. The inflation outlook is much more benign with fears of deflation continuing to overhang the recovery in Europe. In the US the recovery continues with growth of 3.1% expected in the year ahead. In the March update we forecast world growth of 2.9% in 2015, increasing to 3.1% in 2016. UK Inflation will average just 0.8% over the balance of the year. Unemployment will continue to fall, government borrowing will also fall. The service sector will lead the recovery as manufacturing and construction output also rise. We are forecasting a modest increase in manufacturing of around 2.5% with a 5.5% increase in construction activity as the strong housing market recovery continues. The trade figures will continue to disappoint, offset by a potential £4 billion oil dividend, as a result of the oil price collapse. The challenge to the current account following the drop in overseas investment income continues and will present a significant problem to the outlook for sterling over the medium term. For the moment, the Dollar and the Swiss Franc remain the traders favourites with the Euro under pressure as the QE placebo unwinds slowly across Euro land. Check out our UK Economic Outlook for 2015 and 2016. These are the benchmark forecasts against which we update the Chart of the Day and Quarterly Data Forecast Series. It’s a free download! Check out our Oil Market outlook which reflects the outlook for oil prices. As Mark Carney and more recently Janet Yellen have confirmed, the pricing issue is not a function of demand. It is the adjustment to new output particularly in the US. The Baker Hughes US Oil Rig Count dropped by almost 30% over the past six months. An indication of why we think prices will harden significantly by the end of the year. So when will rates rise? Markets expect UK rates to stay on hold into 2016. We think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The yield curve is distorted. It really is time to move on and let markets, especially bond markets, clear. So what happened to Sterling this week? Sterling closed up against the Dollar at $1.544 from $1.538 and moved up against the Euro to €1.379 from €1.3553. The Dollar closed down against the Euro at €1.1379. €1.1360. Oil Price Brent Crude closed up at $61.44 from $60.48. The average price in February last year was $108.90. Markets, rallied. The Dow closed at 18,176 from 18,003 and the FTSE closed up at 6,946 from 6,915. UK Ten year gilt yields held at 1.78 unchanged. US Treasury yields moved down to 2.01 from 2.07. Gold closed up at $1,215 ($1,206). That’s all for this week. Don’t miss the Great Manchester Business Conference in next week, the Big Social Media Conference in July and The Saturday Economist Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

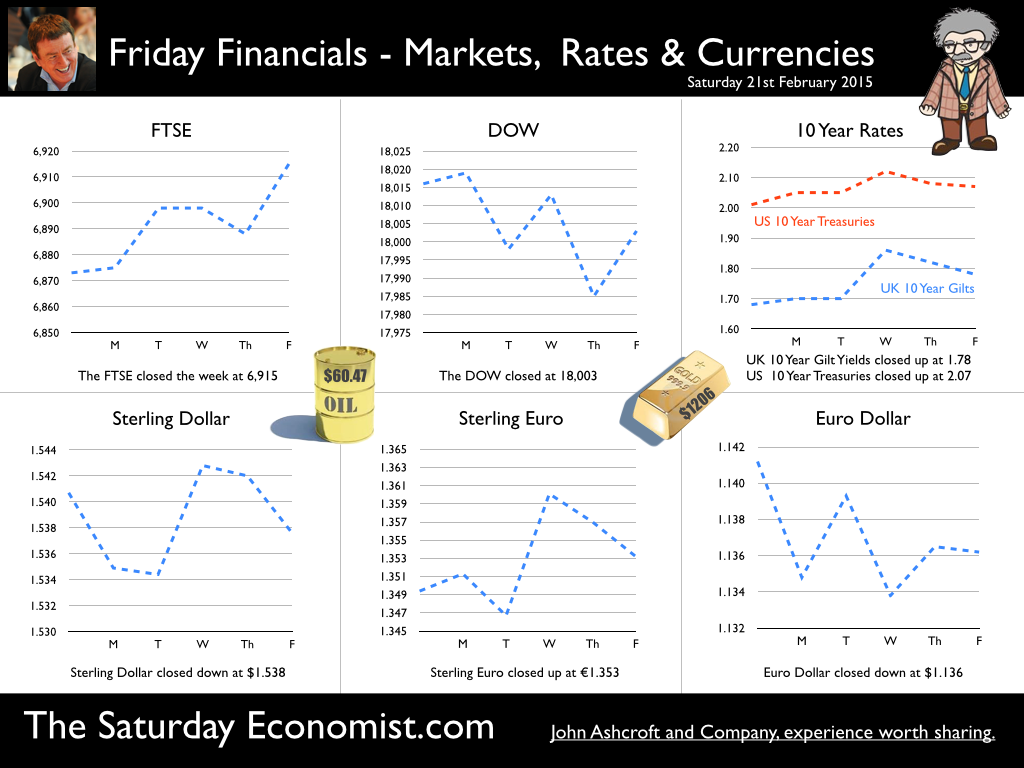

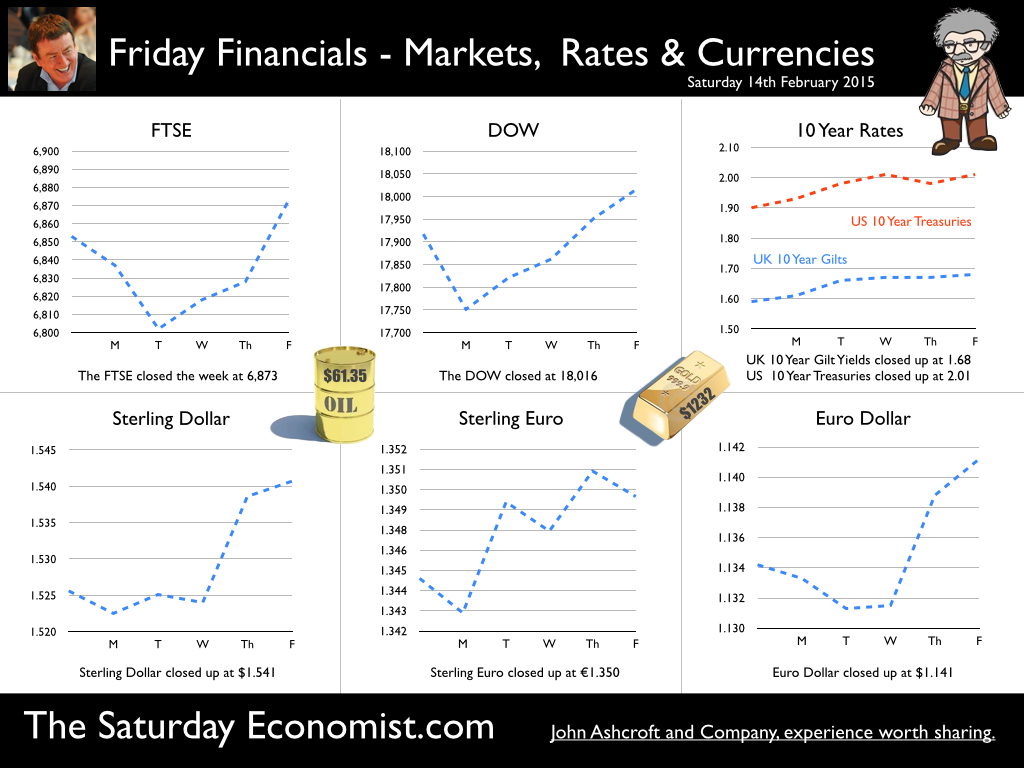

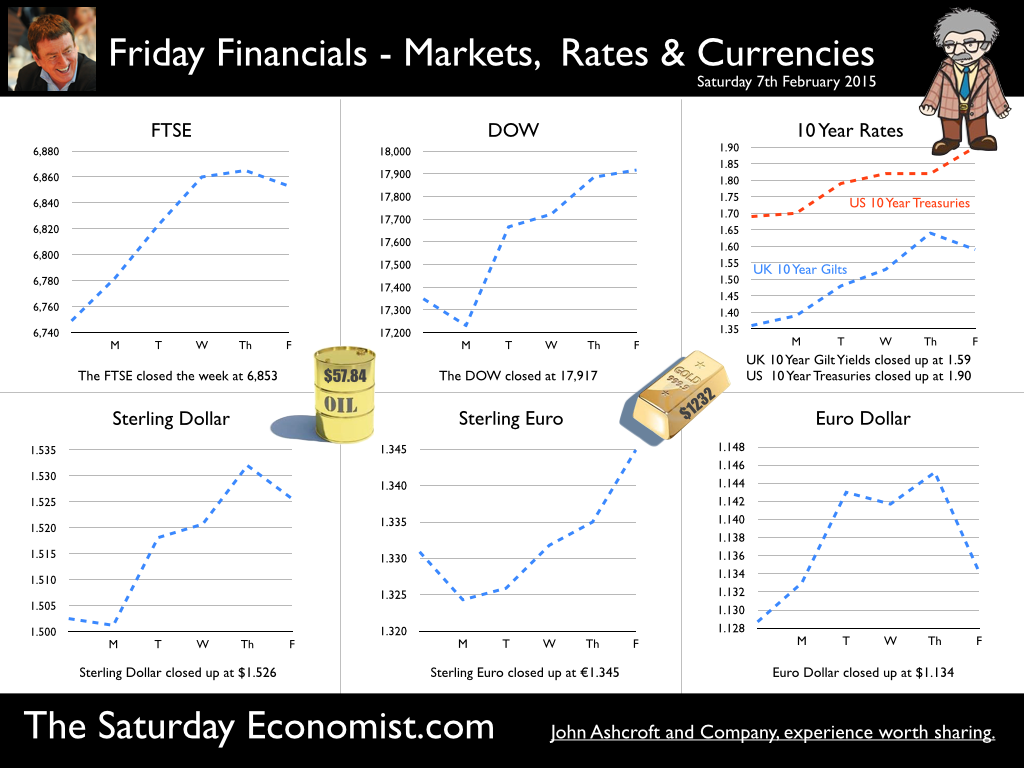

A great week for the Chancellor with good news on borrowing, retail sales, employment, earnings and inflation. With months to go to the election, the economy will be in great shape come polling day … Borrowing on track, Chancellor will meet OBR targets this year … In January 2015, Public Sector Borrowing was -£8.8 billion, an increased surplus of £2.3 billion compared with January 2014. In the financial year to date borrowing was £74.0 billion, a decrease of £6.0 billion compared with the same period in 2013/14. The Chancellor is back on track to hit the OBR target of £91.3 billion in the current financial year. It will make for a great pre election story, very convenient! Retail boom continues - volumes up 5.4% … Retail sales in January 2015 increased by 5.4% compared with January 2014. This is the 22nd consecutive month of year-on-year growth. The longest period of sustained growth since May 2008. Retail sales values increased by 2.3% compared with prior year. Internet sales increased by 12% year on year accounting for 11.6% of all retail activity in the month. All main store types, except petrol stations, showed increases in the amount spent year-on-year. Our forecasts for retail sales volumes have increased into 2015 as a result of the anticipated trends in inflation, employment and earnings. We now expect retail sales volumes to increase by at least 3.7% in the year with values increasing by 2.5%. Employment Trends - sign of overheating … Claimant Count Rate .. lower than 2007 The headline claimant count fell to 823,000 in January. This is good news for the economy but alarming for the overheating index. The average claimant count in the first quarter of 2008, immediately pre recession was 797,000. The average claimant count in 2007 was 863,000. The unemployment rate dropped to 2.5% in the month. The rate is lower than 2007 and marginally above the 2.4% recorded in the first quarter of 2008. The jobs market is tightening … the claimant count the measure. Vacancies … higher than pre recession The number of vacancies increased to 718,000 in January. The UV rate, the ratio of claimant count to vacancies dropped to just 1.15. Vacancy rates are higher than the pre recession average and indicate the growing pressures on recruitment and placement. Earnings … recovering quickly Earnings increased in the latest data to December. The single month earnings count jumped to 2.4% with strong growth of 2.7% in private sector earnings and 3.6% growth in business and financial services. Manufacturing earnings up 2.3% and construction pay up 3.5% also demonstrated strong growth. Employment Rate … highest since 2005 The employment rate was 73.2%. A level last seen in February 2005. It has never been higher, since comparable records began in 1971, LFS Unemployment … There were 1.86 million unemployed people. This was 486,000 fewer than for a year earlier. The unemployment rate was 5.7%, significantly lower than a year earlier (7.2%). Compared to pre recession peaks in the first quarter of 2008, the averages then were 1.6 million unemployed and a rate of 5.2%. We will reach those levels by the second quarter this year! So what can we make of it all … The labour market is simmering to the boil gently with early signs of over heating reflected in claimant count levels and the number of vacancies. Earnings are rising and real incomes will be boosted by the low headline inflation rate. Four hundred thousand left the unemployment register in the last twelve months. If current growth rates are maintained, job centres will be closing at the end of 2017, there will be no one left looking for work. Inflation falls - it’s all about oil and food. The consumer price index CPI basis was just 0.3% in January, according to data released by the Office for National Statistics (ONS). This is down from 0.5% in December. Food and soft drink prices were 2.5% lower. Transport prices were 2.8% lower. Should we worry about deflation? Not really. Service sector inflation increased in the month to 2.4% from 2.3% in December. Goods inflation on the other hand was negative -1.5%, driven lower by oil and food prices. Manufacturing Prices … The output price index for goods produced by UK manufacturers fell by 1.8% in the year to January 2015. Falling prices for crude oil, petroleum and food products were the main contributors to the reduction in prices. The overall price of materials and fuels bought by UK manufacturers fell 14.2% compared with a fall of 11.6% in the year to December. Crude oil prices fell by 50%, the largest annual fall seen for the crude oil index (data from 1997). Prospects for the year … Inflation is at its lowest level since the introduction of “Targeting” two decades ago. It will fall further, potentially turn negative in the Spring, before rising towards the end of the year. Inflation is then expected to return to the 2% target within eighteen months. The key barometer to watch in the short term is oil prices. Prices have rallied from a $46 dollar low in January, Brent Crude basis, to over $60 dollars spot last week! We expect prices to return to “normality” $80 plus by the end of the year. So what of base rates ... ? Service sector inflation is above target, earnings are increasing, oil, energy and commodity prices are set to increase. Inflation will return to the 2% target within eighteen months and possibly in the early part of 2016. Strong growth in the economy and a labour market showing early signs of overheating suggest base rates will have to rise before the end of the year, especially if oil prices rally as we now expect. The markets may expect a rate rise to be delayed into 2016. The MPC was unanimous in voting to keep rates on hold this month … but not for much longer. If the Fed moves in June, a UK move must follow soon … So what happened to Sterling this week? Sterling closed down against the Dollar at $1.538 from $1.541 and moved up against the Euro to €1.353 from €1.3505. The Dollar closed down against the Euro at €1.136. Oil Price Brent Crude closed down at $60.47 from $61.35. The average price in February last year was $108.90. Markets, rallied. The Dow closed at 18,003 from 18,016 and the FTSE closed up at 6,915 from 6,873. UK Ten year gilt yields moved up to 1.78 from 1.68. US Treasury yields moved up to 2.07 from 2.01. Gold closed down at $1,206 ($1,232). That’s all for this week. Don’t miss the Great Manchester Business Conference 6th March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Inflation Report headlines were “relatively straightforward" this week according to the Governor. Inflation is at its lowest level since the introduction of “Targeting” two decades ago. It will fall further, potentially turn negative in the Spring, before rising towards the end of the year. Inflation is then expected to return to the 2% target over a two year horizon. GDP growth is expected to be around 2.9% for this year and into next. Unemployment will continue to fall, the capacity gap will shrink and base rates are likely to remain on hold until the second quarter of 2016. World growth reflects a continuing recovery boosted by low oil, energy, food and commodity prices. Monetary policy around the world remains accommodating. [Euroland recently joined the QE club pushing rates to the floor in the process. The latest Eurostat data released this week confirms recovery in Germany and elsewhere. ] In the UK, unemployment continues to fall, earnings are rising and real earnings are enhanced by the fall in headline inflation. Households will benefit. Consumer spending will boost domestic demand along with an expected increase in investment. Should we worry about deflation … In his letter to the Chancellor, the Governor explained the drop in inflation was largely as a result of the falls in energy and food prices. Core inflation is around 1.3%. Inflation is muted as a result of a prolonged period of high unemployment, low earnings growth and remaining “slack” in the economy. However, the large, one-off falls in prices (oil) are likely to dissipate in around a year. Service sector inflation remains above target. Earnings are set to rise faster as the labour market tightens. Commodity prices are set to rally and [we] continue to believe the oil price will rally faster than markets expect. The implications for headline inflation will impact in the final quarter of 2015. So what of interest rates … The Governor reiterated the brief. The inflation target is symmetric. “We care as much about inflation below target as above”. The Bank believe monetary policy takes between eighteen months to two years to have peak impact. So with the effects of the large, one-off falls in prices likely to dissipate in around a year, “We will look through them”. In other words, base rates and QE will remain on hold, with no tendency to push rates lower or to extend QE as a result of the low headline inflation rate. The inflation forecast in the report shows inflation coming back to the target within two years and then rising a little further. The forecast assumes Bank Rate follows the path implied by market yields - gradual and limited increases over the forecast horizon beginning some time in Q2 2016. So are we heading for a NICE decade …? Is the period of non inflationary constant expansion returning? Growth in the UK over the next two years should continue, with inflation returning to target perhaps a little sooner than markets expect. The labour market is tightening, earnings are rising, private service sector growth is way ahead of trend rate. Oil prices will rebound, the recovery in US and Europe will continue and gather pace. The Fed is still expected to move in June this year. The MPC is unlikely to delay a UK rate response beyond the end of the year, if Yellen blinks first. A NICE decade - that’s a big call. We expect growth of around 3% this year and into next, with continued falls in unemployment and government borrowing. The trade figures will continue to disappoint. The current account deficit at 6% of GDP may become a real threat to growth. So what of base rates? We expect rates to rise towards the end of 2015, extension into 2016 too much of a stretch. Sterling markets appear to heed the call … So what happened to Sterling this week? Sterling closed up against the Dollar at $1.541 from $1.526 and moved up against the Euro to €1.350 from €1.345. The Euro closed up against the Dollar at €1.141 from 1.134. Oil Price Brent Crude closed up at $61.35 from $57.84. The average price in February last year was $108.90. Low oil prices are for Christmas not for life! Markets, rallied. The Dow closed at 18,016 from 17,917 and the FTSE closed up at 6,873 from 6,853. UK Ten year gilt yields moved up to 1.68 from 1.59. US Treasury yields moved up to 2.01 from 1.90. Gold closed unmoved at $1,232 ($1,232). That’s all for this week. Check out the Oil Market Update. Don’t miss the Great Manchester Business Conference in March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here  The Bank of England’s MPC voted to maintain Bank Rate at 0.5% this week. The Committee also voted to maintain the stock of purchased assets at £375 billion. No real surprise, low oil prices and the prospect of negative inflation were hardly likely to produce tough debates, about a rise in rates. Don’t be too complacent, oil prices jumped by 17% last week. The number of US oil rigs fell by 10% in January. The U.S. rig count dropped by 200 in the month according to the Baker Hughes data. The oil price collapse is not a function of demand. The world recovery continues, as does the demand for energy. For a few barrels more, around 2% of consumption, prices have fallen by 60%. Hence we cautioned, “Low oil prices are for Christmas, not for life”. The rebound to $100 dollar oil will come sooner than anyone expects. Then, the impact on inflation and interest rate policy will be significant! The hawks will squawk once again in the MPC aviary ... So what news of the economy this week … The PMI Markit data on manufacturing, construction and services for January produced a raft of strong headlines. “Construction output growth rebounds at the start of 2015”. “Manufacturing PMI edges higher at start of year”. Service sector sharp growth sustained”. In fact in every major sphere of activity within the economy, the strong growth continues into the new year according to the Markit/CIPS survey data. Private service sector growth increased by over 4% in the final quarter of 2014. Construction growth will continue to benefit from strong housing market growth. Even the march of the makers will pick up the pace. Consumer confidence is high, mortgage rates remain low, the economy is simmering gently. Watch out for “double, double, oil price trouble, Fire burn, and caldron bubble”. Fears may soon turn to overheating in the UK economy, despite the current qualms about growth in Europe … Car Sales … Car sales in January were up by 7% compared to last year, the strongest January since 2007. It was the 35th consecutive month of rises, reflecting the strength of the recovery in the UK. Remember there were almost 2.5 million new cars registered in the UK last year, the most in a calendar year since 2004. We expect a 5% increase in registrations this year, a reflection of the strength of the recovery increasing the deficit trade in goods in the process. Halifax House Prices … Halifax house price increased by 8.5% in January compared to prior year. The data slightly at odds with the 6.8% rise reported by Nationwide last month. Mortgage approvals increased in December and low rates continue to attract buyers into the market. For the year as a whole we expect house prices to increase by 5%. The real cost of borrowing will remain negative providing a boost to transaction activity over the period. Trade Data … The UK deficit on trade in goods and services was estimated to have been £2.9 billion in December 2014. A deficit of £10.2 billion on goods, was partly offset by an estimated surplus of £7.3 billion on services. For the year as a whole the trade in goods deficit was £120 billion compared to £113 billion in the prior year. The deficit is set to rise to £125 billion this year despite the mitigating impact of lower oil prices. The overall deficit, trade in goods and services was £35 billion in the year compared to £34 billion in 2013. What happened in the US? In the USA, the strong recovery continues. January payroll numbers increased by 257,000 jobs in the month as wages increased by 2.2% year-on-year. The US economy is expected to grow by 3% this year. The Fed is still expected to make the move on rates in June or early Q3. So what happened to Sterling this week? Sterling rose against the Dollar to $1.526 from $1.503 and against the Euro at €1.345 from €1.331. The Euro rallied slightly against the Dollar at €1.134. Oil Price Brent Crude closed up 17% at $57.85 from $49.60. The average price in February last year was $108.90. Markets, closed up. The Dow closed down at 17,917 from 17,349 and the FTSE closed up - to 6,853 from 6,749. 7,000 just a hop ahead of the Easter bunny! UK Ten year gilt yields moved up to 1.59 from 1.36. US Treasury yields rallied to 1.90 from 1.69. Gold closed at $1,232 ($1,272). That’s all for this week. It is looking good for the election run in. Just the borrowing figures to sort out! Check out our Oil Market Update. Don’t miss the Great Manchester Business Conference in March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all our events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed