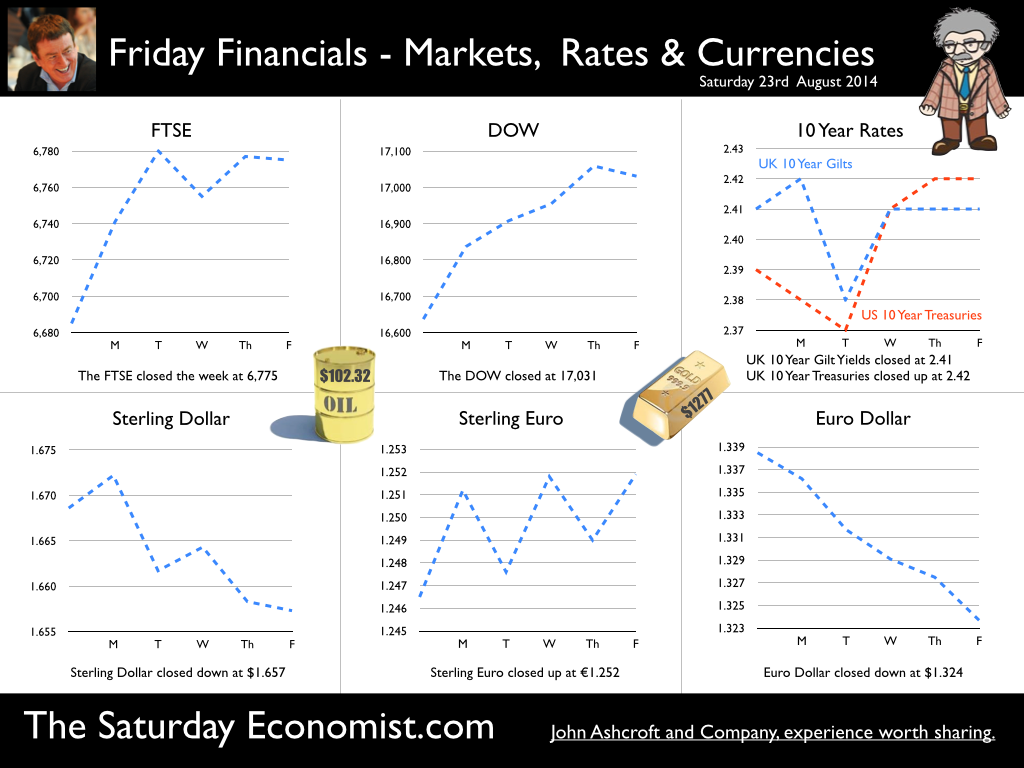

Jackson Hole, Wyoming. Skiing in Winter and Fly Fishing in Summer, there are several perks to the role of central banker. This week the bankers were in Jackson Hole, Wyoming, fishing for answers to the employment - inflation conundrum. The occasion - the Federal Reserve, Kansas City, Economic Symposium, Jackson Hole, Wyoming. Why Wyoming? You may well ask? In 1982 the conference moved to Jackson Hole (Kansas City district) to persuade Paul Volcker, then chairman of the Fed and an avid fly-fisherman, to attend. Flies and fish were the big lure for the head of the Fed - and so it began. The location, based some 2,000 miles from New York and 5,000 miles from London is not ideal. Communication - in the early days - not always ideal either. Want a copy of the New York Times? The local store stocked today’s and yesterday’s but if you wanted today’s copy, you had to come back tomorrow - delivery lagged a day behind. Monetary Policy and the Muddler Minnow* … This year the theme was Labor Market Dynamics and Monetary Policy. Mario Draghi reassured markets there would be no early rise in rates in Europe! Quelle Surprise! Janet Yellen delivered a lecture on structural, cyclical, secular and frictional unemployment before claiming the mantle of Truman’s two handed economist to explain the Fed’s stance on future monetary policy. On the one hand … “If progress in the labor market continues to be more rapid than anticipated or if inflation moves up more rapidly than anticipated, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target could come sooner than the Committee currently expects and could be more rapid thereafter.” On the other hand … “If economic performance turns out to be disappointing and progress toward our goals proceeds more slowly than we expect, then the future path of interest rates likely would be more accommodative than we currently anticipate.” Excellent. Yellen then left the room, thrust on a pair of waders, tied on a muddler minnow before making an excellent double spey cast into the River Snake. [*The muddler minnow is currently one of the most favoured trout flies amongst central bankers.] The MPC Minutes … muddying the waters … Back in the UK, the Bank of England released the minutes of the August MPC meeting. Two members of the committee, Martin Weale and Ian McCafferty voted for an increase in base rates by 25 basis points. The Carney consensus has cracked. Charm school is out for the Summer. Markets fell, Sterling rallied, on the prospect of an early rate rise. Inflation Update ... The day before, the ONS released the inflation figures for July. CPI fell to 1.6% from 1.9% prior month. Markets had rallied, Sterling fell, prospects of an imminent rate rise postponed. No one seemed to notice that service sector inflation was unchanged at 2.5%. The overall drop in the headline rate - attributable to goods inflation down to 0.8% from 1.4% in June. So why the drop in goods inflation? Manufacturing output prices were flat but input costs fell by over 7% in the month. Effects of sluggish world trade, weak commodity and energy prices were exacerbated by the translation impact of a stronger Sterling. Government Borrowing … Thursday and the ONS released figures on government borrowing for the month of July. Four months into the year and borrowing remains off track compared to last year and to plan. In the first four months, total borrowing was £37.0 billion compared to £35.2 billion in 2013. In July borrowing was down to £0.7 billion from £1.6 billion last year. An improvement but with an economy expanding by over 3% in the first half of the year, we would expect a big improvement in borrowing given the strength of the recovery. Government spending is not the problem, nor VAT receipts up by 5%. The problem is revenues from income and capital gains tax are actually down on prior year over the first four months of the fiscal year. In part this is a result of strong receipts in the first quarter last year which may level out in due course. Compared to two years ago, revenues are up 5%. Even so, for the year as a whole the Chancellor will still have some work to do if the OBR target is to be met. Retail Sales … Retail sales in July were up by 2.6% after growth of 4% in the first half of the year. A disappointment, perhaps. Internet sales were up by 11% accounting for 11% of all retail activity. It will take more than a few digital mannequins to reverse fortunes on the high street but it is a tad to soon to make the call about a slow down in overall activity. The house market remains strong in terms of prices and the Council of Mortgage Lenders reported a 15% increase in gross mortgage leading last month. So what of base rates … The MPC minutes suggested the rate rise could come earlier than expected but news on inflation and retail sales suggest the rates will be kept on hold until 2015. No rate rise in prospect in Europe but Janet Yellen has “nowcast” a muddler minnow into the thought stream. A rate rise in the USA on the cards for Q2 next year or even earlier? Possibly. In the UK - February or June would appear to be the call. So what happened to sterling this week? Sterling closed down against the dollar at $1.657 from $1.669 but up against the Euro at 1.252 from 1.246. The Euro was down against the dollar at 1.324 (1.246). Oil Price Brent Crude closed down at $102.32 from 102.96. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,031 from 16,637 and the FTSE closed up at 6,775 from 6,685. UK Ten year gilt yields were unchanged at 2.41 and US Treasury yields closed at 2.342 from 2.39. Gold was largely unchanged at $1,302. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed