|

Central Bankers In A Hole ... That's Jackson Hole of Course ...Jackson Hole Economic Symposium is the three-day annual international conference hosted by the Federal Reserve Bank of Kansas City at Jackson Hole, Wyoming, USA.

The event is attended by central bankers from around the world. Discussions and speeches are closely followed to divine clues for the likely direction of interest rates in the U.S. and globally. It has been described by The New York Times as "the world's most exclusive economic get-together". Why Jackson Hole? The Kansas City Federal Reserve originated an annual conference in 1978. In the early years, the discussions focused on agriculture. Organizers had aspirations for a more high-profile event. With a proposed focus on economics and monetary policy, the ambition was to lure Paul Volcker, then Chairman of the Federal Reserve to attend. Volcker was fond of fly fishing. "We need a place for our next symposium where people can fish for trout," said Tom Davis, head of economic research at the Kansas City Federal Reserve. In 1982, Jackson Hole was chosen. Volcker took the bait. The venue became part of the annual calendar, the Fed event of the year. Volcker did reportedly raise questions about the distance. "He said, "How in the hell did we ever get to Jackson, Wyoming?" In the early days, communication was also a challenge. To get a copy of the Wall Street Journal, allegedly, yesterday's edition was always the most up to date available. "If you want a copy of today's edition, you would have to come back tomorrow", the riposte. The most hotly anticipated event is the speech by the Fed chair. Scheduled for a Friday morning, the speech is often used as a chance for the central bank to send a signal about policy. "We are navigating by the stars under cloudy skies. This year's conference 2023 was focused on the presentation from Jerome Powell. Markets waited with bated breath and a finger on the buy sell button as the hour of the Fed Chair speech drew close. Fed Chairman Jerome Powell Kept His Jackson Hole Speech Vague. It was mostly a reiteration of what we already knew: The Fed would be proceeding cautiously. The economy might not be cooling as much as we previously thought. Powell didn’t commit to any particular way forward, leaving the door open to additional interest rate increases while declining to say what would be coming or when. His closing line, that the central bank would “keep at it until the job is done,” was included almost verbatim from the speech he delivered in the same setting a year ago. "We are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical. At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We will keep at it until the job is done. So there you have it. Let's hope the fishing was more conclusive ...

0 Comments

China Leads the U.S. in Advanced Technology ...

More significantly research from the Australian Strategic Policy Institute suggests China leads the U.S. in technology, despite the restrictions on Huawei and the chip squeeze. ASPI claims China leads in 37 out of 44 key advanced technologies. Research reveals China has built the foundations to position itself as the world’s leading science and technology superpower, by establishing a stunning lead in high-impact research across the majority of critical and emerging technology domains. Western democracies it is argued, are losing the global technological competition, including the race for scientific and research breakthroughs and the ability to retain global talent. These are crucial ingredients that underpin the development and control of the world’s most important technologies, including those that don’t yet exist. China’s global lead extends to 37 out of 44 technologies that ASPI is tracking, covering a range of sectors spanning defence, space, robotics, energy, the environment, biotechnology, artificial intelligence (AI), advanced materials and key quantum technology areas. The Critical Technology Tracker shows that, for some technologies, all of the world’s top 10 leading research institutions are based in China and are collectively generating nine times more high-impact research papers than the second-ranked country, most often the U.S. The Chinese Academy of Sciences ranks highly (often first or second) across many of the 44 technologies included in the Critical Technology Tracker. ASPI sees China’s efforts being bolstered through talent and knowledge import. One-fifth of its high-impact papers are being authored by researchers with postgraduate training in a Five-Eyes country. Five Eyes Countries are Australia, Canada, New Zealand, the United Kingdom and the United States A key area in which China excels is defence and space-related technologies. China’s lead is the product of deliberate design and long-term policy planning, as repeatedly outlined by Xi Jinping and his predecessors. The ASPI dataset reveals there’s a large gap between China and the US, as the leading two countries, and everyone else. The US comes second in the majority of the 44 technologies examined in the Critical Technology Tracker. The US lead is confined to areas such as high performance computing, quantum computing and vaccines. Hope for the UK? The race to be the next most important technological powerhouse is a close one between the UK and India, both of which claim a place in the top five countries in 29 of the 44 technologies. South Korea and Germany follow closely behind. Could a bigger Brics bloc be a global match for the G7? The new members of the China-led group will add to its economic clout but that is unlikely to translate into political weight any time soon. Brazil has no intention of being drawn into an East West paradox. India still has significant territorial disputes with China. Russia will remain a pariah on the international stage following the invasion of Ukraine and South Africa would be loathe to accept engagement in the second partition of Africa by colonialist powers. Our hypothesis remains. China will overtake the U.S. as the largest economy in the world. It may just take a bit longer than we first thought. It may have to do it, with its own chips. Clearly it has the technology to achieve that, with or without the Taiwan Semiconductor Manufacturing Company. China’s headline consumer price index fell 0.3% year-on-year in July to register deflation for the first time in two years. This presents the opposite problem to that faced by major central banks in the West including the Bank of England.

“Persistent deflation in China would likely spill over to developed markets, as a weaker yuan and an high inventory levels lower the cost of Chinese goods abroad,” said Pimco economists in CNBC this week. A deflation spillover into the West? Well not just yet. In the U.K. Inflation CPI basis slowed to 6.8% in July from 7.9% prior month. CPI(g) goods inflation slowed to 6.1% from 8.5%. CPI(s) Service Sector inflation moved slightly higher to 7.4% from 7.2%. Core inflation eased to 6.8% from 6.9%. An element of deflation in manufacturing prices exist. Manufacturing output prices PPOs fell to -0.8% from 0.3%. Manufacturing input costs also fell to -3.3% from -2.9%. The fall in prices was largely fueled by the drop in oil prices. Oil prices Brent crude averaged $112 dollars in July last year, compared to $80 dollars this year. This is a -33% inflationary impact £ Sterling adjusted. We expect the oil price comparisons to ease through to the end of the year. We forecast oil prices to average $ 82 dollars in the third quarter and $84 in the final quarter Q4. Manufacturing input costs are volatile. The pass through rates are roughly 50% from PPIs (input prices) to PPOs (output prices). The pass through rates are roughly 70% from PPOs to CPI goods. CPI(g) accounts for roughly 50% of the total CPI index. This is why we expect inflation levels to ease this year, despite the strength of service sector inflation. Major concerns persist about the high levels of service sector inflation and the strength of earnings and wage settlements. This may mean the inflation target of 2% will remain elusive in 2024. We expect inflation to average 6.0% in Q3, easing to just under 5% perhaps by the end of the year. Our assumption is for one more 25 basis point rate rise in September. Higher rates for longer the guideline for scenario planning. Our Inflation Chart Book with full models and forecasts and the Labour Market Chart available to The Saturday Economist Club members with benefits ... U.S. President Joe Biden called China a "ticking time bomb" this month because of economic challenges and weak economic growth.

David Roche, president and global strategist at Independent Strategy, said “China’s economic model is washed up on the beach” and “it's not going to take off again.” “A ticking time bomb, washed up on the beach?” It’s not looking too good for the second largest economy in the world, or is it? Speaking at a political fundraiser in Utah, Biden said, “China has got some problems. That’s not good, because when bad folks have bad problems, they do bad things.” Biden said he did not want to hurt China and wanted a rational relationship with the country. Then he signed an executive order to prohibit new U.S. exports and investment in sensitive technologies including semiconductors, microelectronics, quantum computing, and artificial intelligence capabilities. China, said it was "gravely concerned" about the order and reserved the right to take measures, complaining of blatant economic coercion. “China is strongly dissatisfied with, and resolutely opposed, to the restrictions on investment in China,” the Foreign Affairs Ministry said in a statement. “This is blatant economic coercion and technological bullying.” The Chinese Embassy in Washington called the move by the Biden administration another attempt to “politicize and weaponize trade” between the world’s two largest economies. Eswar Prasad, economics professor, Cornell University added to the gloom … “Confidence is falling, growth is stalling, China seems to be sliding into a downward spiral with deflation, low growth and lack of confidence all feeding on each other.” Peter S. Goodman, an economics reporter, points to a “slew of developments” supporting the new narrative. These include declining Chinese exports and imports, falling prices on a range of goods, from food to apartments, a housing slump, and a real-estate default that has produced losses of US$ 7.6 billion. (A sizeable event, but nothing close to the average US bank bailout). China Suspends Data on Youth Unemployment ... This week, China suspended releases of data on youth unemployment, lately recorded at over 20%. July economic data showed a broad slowdown exacerbated by the country’s property market slump. Market worries about spillover from China’s massive real estate sector to the rest of the economy have reemerged this month as once healthy developer Country Garden hovers on the brink of default and Evergrande filed for bankruptcy protection in the U.S. Biden had a dire prediction about the country's future. "China is a ticking time bomb ... China is in trouble. China was growing at 8% a year to maintain growth. It’s now close to 2% a year," he said. Never too great on detail, data from China's National Bureau of Statistics showed the economy grew 4.5% in the first quarter and 6.3% in the second. The ruling Chinese Communist Party has set a growth target of 5% for 2023. China’s central bank has moved to alleviate concerns about the country’s slow growth as global investors pare back their exposure to the world’s second largest economy. The bank has already reduced holdings of U.S. dollars down to under $900 billion from $1.3 trillion at peak. The central bank has stepped up exchange rate intervention after yuan hit a 16-year low against the Dollar. In a move to stabilize markets, authorities have asked investment funds, to “avoid being net sellers of equities”. In a press conference Wednesday, Chinese Foreign Ministry Wang Wenbin insisted the country’s recovery is “generally on a sound track”. China “remains an important engine for world economic growth,” after growing by 5.5% year-on-year in the first half of 2023. He highlighted a higher share of domestic demand as a portion of economic growth. He talked of continued upgrades to industrial infrastructure, investment in high-tech industries and rising exports of electric cars, lithium batteries and solar panels. “The results of our response are already showing. Substantive measures aimed at promoting consumption, boosting the private sector, and attracting foreign investment are already in place,” Wang said. “The Chinese economy enjoys strong resilience, ample potential and robust dynamism and the fundamentals sustaining China’s sound economic growth in the long run remain unchanged.” “Action will be taken to adjust policy to ward off instability”. U.S. Narratives Are Geared Towards The 2024 election ... J K Galbraith writing for the South China Morning Posts affirms China’s economy is slowing. It will be hard to scale anything to match the cities and transport networks that are already in place, or the campaign to eliminate extreme poverty. China’s main tasks now lie elsewhere, in education and healthcare, in matching skills to jobs, in mitigating youth unemployment, in providing for the elderly and in curbing carbon dioxide emissions. They will be pursued in Chinese fashion: step by step, over time. So, what is the new narrative really about? It is not so much about China as it is about the U.S. It is about a lead in technologies, a free-market system, and an attempt to wield power and to keep all challengers at bay. It is about reinforcing what Westerners like to believe, the inevitable triumph of capitalism and democracy. Above all, it is about American leaders, posing for the electorate, winning out against “bad folks” who may do “bad things”. It’s a narrative that’s made-to-measure for the 2024 election campaign. It is as myopic and counter productive as it is short-lived. China will still overtake the U.S. as the largest economy in the world. It may just take a bit longer than we first thought. It may just have to do it, with its own chips. Growth ...

The economy appears to have expanded by 0.4% year on year in the second quarter, with growth in construction (2.6%), manufacturing (0.8%) and services (0.4%). This suggests a positive performance overall, slightly lower than the first quarter growth of 0.5%. Car registrations increased by 20% in the first seven months of the year, providing a boost to output. The earlier setbacks in manufacturing, reflect a return to trend rate rather than a setback to output. In the first half of the year, growth was just over 0.4%. Unexciting maybe, but still suggests much of the gloom and doom is overdone. So what of the year as a whole? In our presentations, we forecast growth of 0.4% this year. At present there appears to be no reason to adjust the forecast. The latest NIESR forecasts in the August update, now also project growth of 0.4%. According to NIESR, growth in 2024 is expected to be 0.3%, not really sure why. We model in growth of 1.0% in 2024 and 1.5% in 2025. We expose our optimism bias perhaps. Inflation In the second quarter of the year, inflation CPI basis averaged 8.4%. Producer output prices averaged 2.6%. Producer input prices averaged 1.7%. Manufacturing cost trends have fallen rapidly. We expect CPI inflation to average 6.0% in Q3 and 5.0% in the final quarter. Energy prices have fallen. Gas prices have collapsed. The continuing war in Ukraine and uncertainty in the Black sea maintain an overhang on price trends. Oil prices Brent Crude averaged $78 in the second quarter compared to $114 dollars in the same period in 2022. Oil marked at $86.81 this morning. The impact of Saudi cuts to output are assessed. We model average prices at $84 dollars in the final quarter. The overall rate of inflation (CPI basis) is expected to fall to around 5% by the end of the year. The 2% target for headline inflation may remain elusive into 2025. Employment and Earnings Unemployment was 1.37 million in the second quarter. The unemployment rate was 3.8%. The number of vacancies averaged 1.0 million, the challenge of recruitment persists. We expect unemployment to drift slightly higher to 1.45 million by the end of the year. The u-rate rising to 4.1%. Earnings in the second quarter averaged over 6.5%. We expect this to peak in the quarter, drifting slightly lower to around 5.2% by the end of Q4. The underlying rate of wage inflation will underpin the forward outlook for prices despite the hopes of the Bank of England. Total employment in the first quarter increased to just over 33 million. The number of people self employed was steady at 4.4 million. Interest Rates We maintain our base rate peak this year at 5.5% on the basis of a further 25 basis point hike in September. We model 4.50% as the long run rate for base rates and ten year gilts in life after Planet ZIRP and yes you can have economic growth with 4.5% rates. The gilt curve softening reflects our mid term projections. Short rates up to one year remain too high. Long term rates are falling into place. Mortgage rates are easing back reflecting the more moderate outlook for base rates. We still expect US ten year bond yields to average over 4.00% in the final quarter of 2023. U.K. rates will also average over 4.00%. Ten year gilt yields marked at 4.52% this morning. In the UK, prior to the Great Financial Crash [2000 - 2008] the average inflation rate was 2.0%, the average UK base rate was 4.50%. Ten year bond yields averaged 4.50%. The average growth rate was 2.5%. The hard yards now gained in life after Planet ZIRP. There will be no return to the forbidden planet. Under pricing capital never a great idea. What's Wrong With Economic Forecasts at The Bank of England

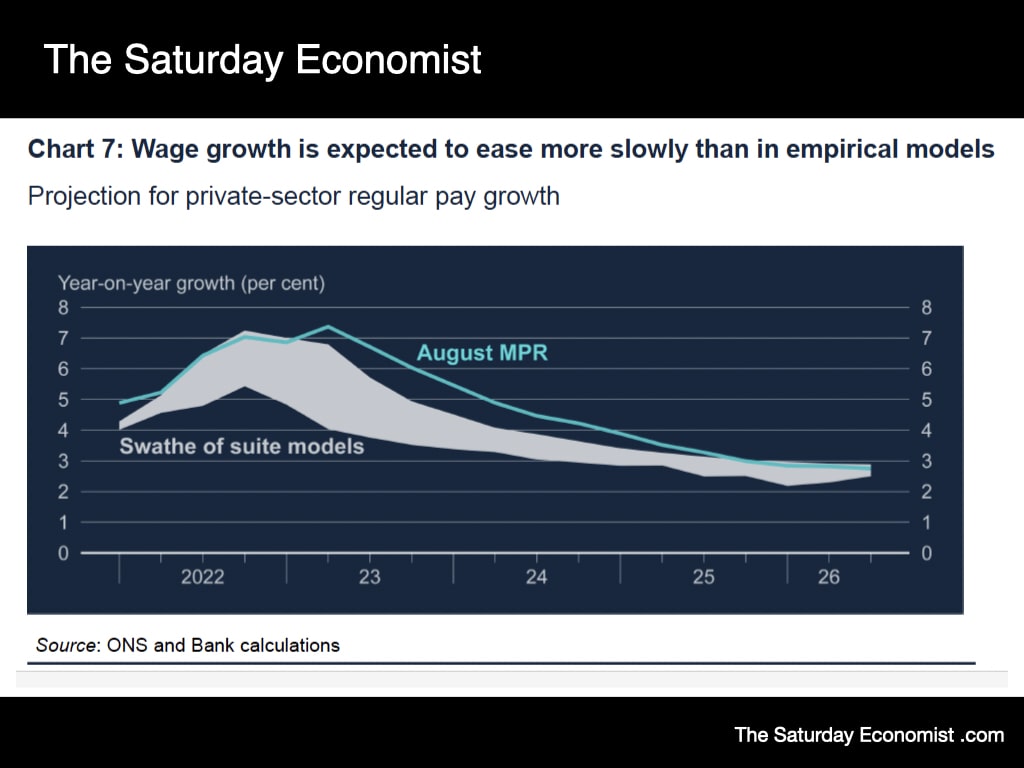

The governor revealed this week, the MPC has a "Swathe of models" just to forecast wages. The economics team delivers the model forecasts, then the committee decides on a completely different "best view" guess. So how good are the guesses? The Bank of England has called in Ben Bernanke, former chairman of the US Federal Reserve and a joint winner last year of the Nobel prize for economics, to review the way in which the Bank goes about forecasting (and the guesswork). The appointment comes as the Bank faces criticism for its efforts to control soaring inflation and failure to predict the surge in prices. Governor Andrew Bailey said "Bernanke will lead a review into the Bank’s forecasting and related processes, assisted by the Bank’s own independent evaluation office. The process should be completed next spring." Dr Bernanke is a renowned and award-winning economist whose distinguished career makes him the ideal person to lead this review." Many will remember Bernanke was head of the Fed, when the world economy crash landed onto Planet ZIRP. As we wrote at the time "Welcome to life on Planet ZIRP. Unfortunately we do not have a guide book. We do not full understand the terrain. Helicoptering more could be just like dropping water in the desert, such are the fissures in the financial system. Rates at the zero bound, could leave us trapped on Planet ZIRP for some time." In Bernanke's policy response, short term rates of interest came very close to zero in the aftermath of the global financial crisis. This drove the Fed and other central banks towards a range of “unconventional” policies, including large-scale asset purchases, generally known as “quantitative easing” and “forward guidance” on future monetary policy. So what hope for the model evaluation? Jagjit Chadha, director of the National Institute of Economic and Social Research, argues that the problem is not so much with the Bank’s model, as the way it was used. The model can give a central case and the balance of risks ... “The Bank’s failing was not to articulate the risks and failing to act promptly in response. It is less a models’ problem and more one about how to use information and communicate narratives.” The problem would appear to be much more complicated than this. There is not just one model. The governor yesterday revealed this week, the MPC has a "Swathe of models" just to forecast wages. The economics team delivers the model forecasts, the committee then delivers a completely different "best view" guess. As the Governor explains, Chart 7 shows a swathe illustrating the range of forecasts from a swathe of such wage models maintained by Bank staff, along with the MPC’s projection for private-sector regular wage growth. In the MPC projection, which reflects the MPC’s best collective judgment, wage growth is expected to ease more slowly than these models would predict." "Earnings" just one of the hundreds of parameters in the model set. Over ten years ago, the Bank's core macro econometric model consisted of about 20 key equations determining endogenous variables. With a further 90 or so identities defining relationships between variables and about 30 exogenous variables for which paths have to be developed. The models have become much more complicated since then. At least 150 variables with an average of six model options, would create almost 1000 model equations to be assessed. David Smith writing in the Times suggests "Anybody thinking that Bernanke will be able to advise on tweaks to the Bank’s economic model to make bad forecasts a thing of the past is fooling themselves." Not too worry. It's going to be the Spring next year before we get the results ... by then inflation will have fallen to around 3%. The forecasting crisis will be over. That's if the Bank of England model is correct ... |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed