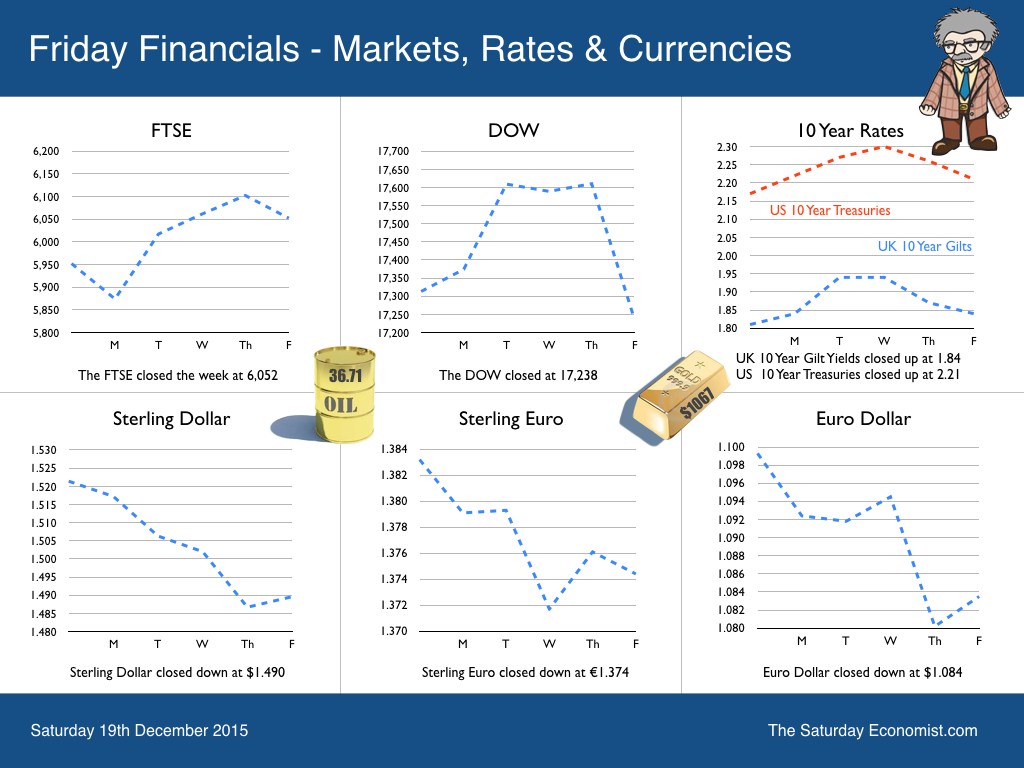

The Fed raised rates by 25 basis points this week. Markets now expect a further rate rise of similar dimension in March. The Fed blue dot chart suggest rates may rise to 1.25% by the end of 2016 with 2.25% in prospect for 2017. It is time to fasten seat belts, we are leaving Planet ZIRP. Well it’s an attempted take off at least. There can be no turning back, nor should there be. The US unemployment rate fell to 5% in November, with strong consumer spending, retail sales and automobile sales evident. US Inflation remains subdued as energy and commodity prices collapse. It all sounds very familiar from a UK perspective, so why should the MPC hold back? Janet Yellen stressed the importance of moving ahead of the curve. Better to raise rates slowly now, rather react with more dramatic increases later, as the recovery continues and inflation becomes endemic. What will happen to UK rates? What will happen to UK rates? Mark Carney hinted this week he may stay for an eight year term pushing tenure to 2020. Forward guidance of sorts? Some think it may take that long, for the Old Lady to effect a rate rise! We doubt that. This week data from the ONS suggests markets may not have long to wait. The retail sales boom continues - sales volumes increased by 5% in November - online sales increased by almost 11%. Car registrations increased by almost 4% in the month, with an increase of over 6% in prospect for the year as whole. Eight charts to explain why UK rates will rise and soon ... The unemployment fell to 5.2% in the three months to October as the claimant count rate fell to 2.3%. Vacancies increased, exceeding levels pre recession. In fact on a variety of indicators jobs data are ahead of levels at the beginning of 2008. Earnings data appeared to slow in October despite a 6% rise in construction pay. It is important to look through the one month data and accept the labour market is heating up with vacancies rising, recruitment difficulties increasing and pay levels moving higher. Inflation data remains subdued with the headline CPI level rising to 0.1%. Goods inflation fell by -1.9% as service sector inflation increased by 2.4%. Falls in transport and food costs are weighing on the rate of headline inflation. Manufacturing prices are held back by the weakness of oil and commodity prices. It’s all about oil … It really is all about oil at the moment. Oil, food and commodity prices. Inflation is always an everywhere an international phenomenon. Brent Crude fell to $36 per barrel this week, as OPEC indecision continues. Oil stocks are rising. The US is voting to allow exports of US black gold into world markets. The spread between Brent and WTI will narrow as a result. The battle for the markets of China and Asia becoming more critical to the OPEC cartel. To date the collapse in US production anticipated, has not yet materialised, despite a big fall in the oil rig count. It wouldn't take a big cut in OPEC production to change the price outlook. World demand for oil continues to grow as the recovery in the West continues and strong growth is maintained in China and India. If the world can agree on a strategy for Syria, it shouldn’t take much for OPEC to adapt to a new world order and reverse current output and price strategy for oil. Should that happen, prices would bounce back. Headline inflation would increase significantly. So what do we expect of UK rates … The MPC will follow the FED within six months with a change in ECB policy possible before the end of 2016. Conditions in the UK mirror those of the US. The Fed has made the bold move, it really is time for the Old Lady to pack her bags and prepare to leave Planet ZIRP. So what happened to Sterling over the last two weeks? Sterling moved down against the Dollar to $1.490 from $1.521 and moved down against the Euro to €1.374 from €1.383. The Euro moved down against the Dollar to €1.087 from €1.099. It's all about the Dollar this week Oil Price Brent Crude closed at $36.71 from $37.95. The average price in December last year was $62.24. The Goldman Sachs call to $20 no longer so ridiculous perhaps. Markets, closed above critical levels - The Dow closed at 17,238 from 17,313. The FTSE closed at 6,052 from 5,952 despite the weakness of mining stocks. Gilts - yields moved up. UK Ten year gilt yields were at 1.841 from 1.817. US Treasury yields moved to 2.21 from 2.17. The great rotation will continue into 2016. Gold moved down to $1,084 ($1,076), going nowhere slowly. That's all for this week. This will be the last Saturday Economist of 2016. We will be taking a break for a few weeks. Our What the Papers Say, Twitter morning review will continue during the break! Follow @jkaonline We wish you all a Merry Christmas and a Happy New Year. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

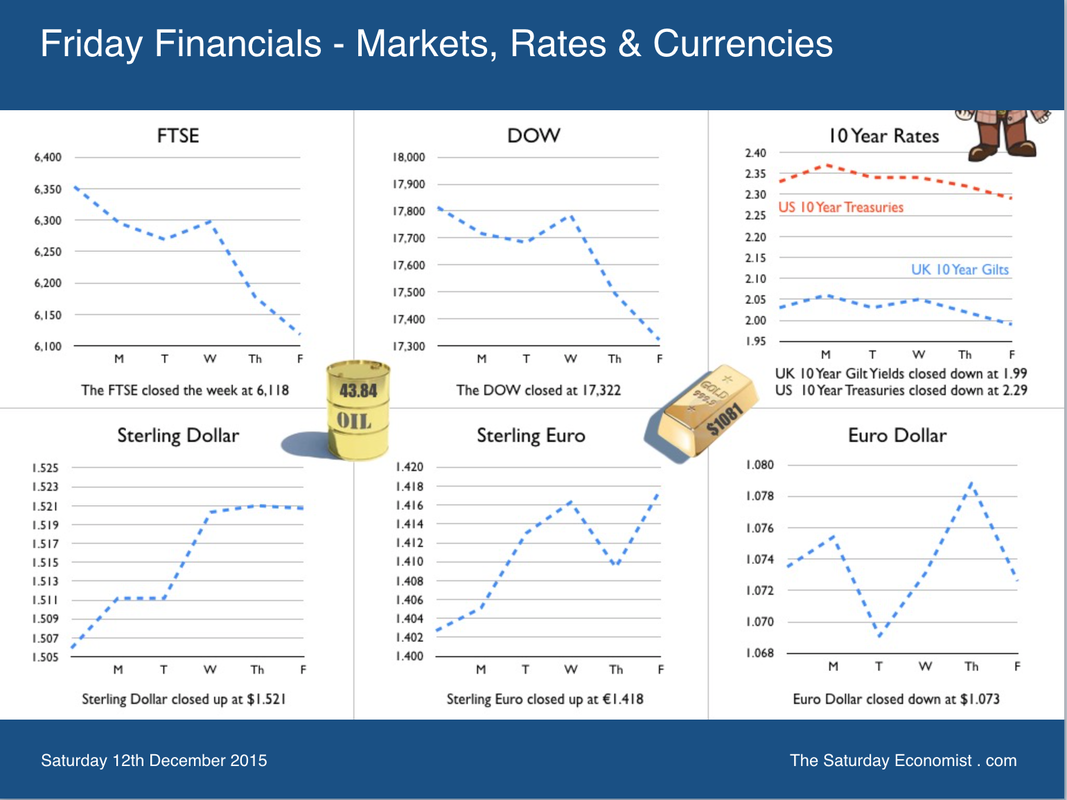

News of US retail sales in November will provide the platform for the Fed to increase rates next week. A strong performance in cars, home products and leisure activities offset weakness in food and gasoline spending. Retail sales increased by just 1.4% year on year, not a big move but enough for Janet Yellen to lead the flight from Planet ZIRP. The UK will be wise to follow within six months. This week the MPC voted to keep rates on hold and tp maintain the stock of asset purchases at £375 billion. The committee voted 8 : 1, Ian McCafferty the hawk, calling for a 25 basis points increase. Planet ZIRP was supposed to be an emergency stopover not a permanent settlement. Last week Super Mario pushed rates further into negative territory placing greater pressure on the Swiss, Swedes and Danes to follow into the NIRP dug out. In Canada, Governor Stephen Poloz suggested negative rates were a policy option for Canada, as the country grapples with low inflation and sluggish growth rates. How easy do untried, untested, policy options fall into central bank parlance? Digging up the runway on Planet ZIRP … Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts, bonds and property prices. Low cost of capital can lead to over investment in oil and commodity prices, with resultant lower prices exacerbating the deflationary environment. Negative rates will impair not improve the banking system. With negative rates, deposits are withdrawn to avoid punitive charges and the bank asset base and lending capacity shrinks as a result. Time to make the move ... Chinese whispers … In China fears about growth are over blown. Retail sales increased by 11.2% in November, the fastest pace this year. Industrial output increased by 6.2% in the month, boosted by production of cars and non ferrous metals specifically. Consumption accounted for 60% of GDP in the first half of the year as the rebalancing agenda develops on plan. Exports fell by 6.8% in November as imports also declined in value terms. Fears about growth are exaggerated, as volume imports of oil and metals, especially copper, continue to increase. China is stock piling at low prices, whilst producers allow prices to enter free fall. The apparent fall in trade values, a result of the weakness of world prices not underlying volumes. Back in the UK … Chancellor Osborne received a pat on the back from the IMF this week. Christina Lagarde confirmed the UK has “repaired the damage” from the financial crisis, like “few other countries have been able to achieve”. “Fixing the roof whilst the sun shines” stated the confident chancellor, excellent. OK, we still have a few problems on the snagging list. The 4% borrowing deficit, surging house prices, the trade deficit and international capital flows heading in the wrong direction. Markets may fret about the fall in China’s international reserves to $3.4 trillion dollars. In November, UK reserves fell to around $36 billion that’s down from $70 billion last year. UK reserves are now lower than than Poland, Peru and the Philippines. Worrying. And it isn’t getting any better. This week, the ONS revealed the deficit trade in goods increased to £11.8 billion in October offset by a £4.1 billion services surplus. We expect the trade in goods deficit to increase to £125 billion this year and £130 billion next. The service sector surplus will increase but at a slower rate as the tourism deficit increases. Weak data on manufacturing and construction in October reveal the inability of the Chancellor to fulfil the rebalancing agenda. The trade and capital account deficit at more than 5% of GDP will be a real challenge to the maintenance of reserves and sterling credibility. The Chancellor may have to spend more time with the IMF in the months to come, discussing more than roof repairs. If Sterling credibility comes under pressure, the MPC may not have the luxury of a vote. Markets will decide on the direction and pace of the next rate moves. So what happened to Sterling over the last two weeks? Sterling moved up against the Dollar to $1.521 from $1.511 and moved down against the Euro to €1.383 from €1.387. The Euro moved up against the Dollar at €1.099 from€1.088. Oil Price Brent Crude closed at $37.95 from $43.00. The average price in December last year was $62.24. Markets, fell! The Dow closed at 17,313 from 17,847. The FTSE closed down at 5,952 from 6,238. Gilts - yields moved down. UK Ten year gilt yields were at 1.81 from 1.87. US Treasury yields moved to 2.17 from 2.27. Gold moved up to $1,076 ($1,059), going nowhere slowly. That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. Digging up the runway on Planet ZIRP … why negative rates are not the solution ...

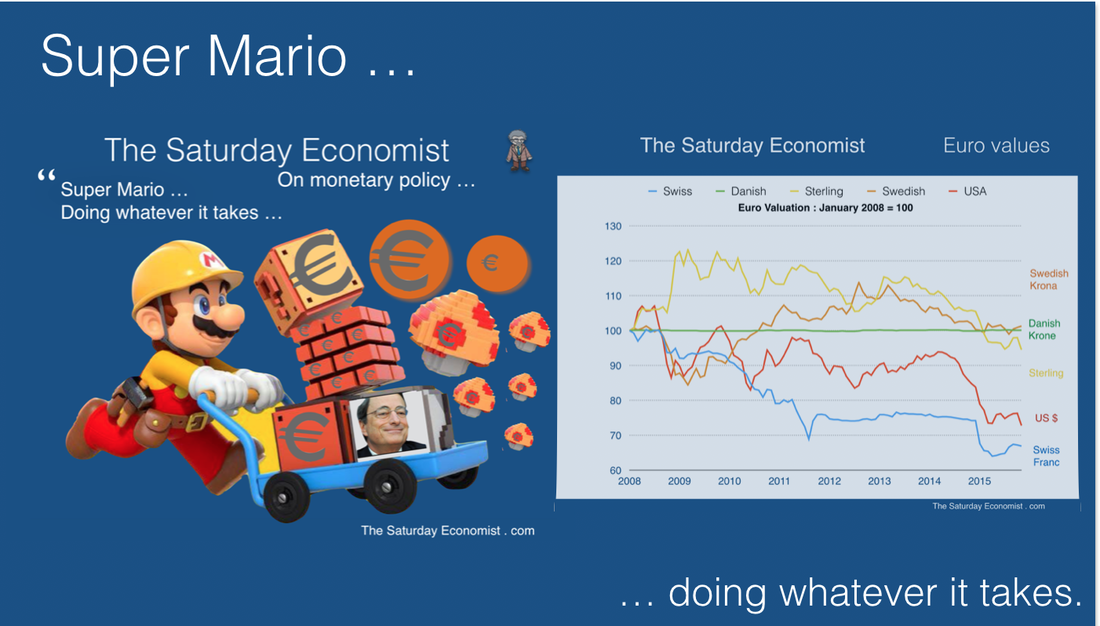

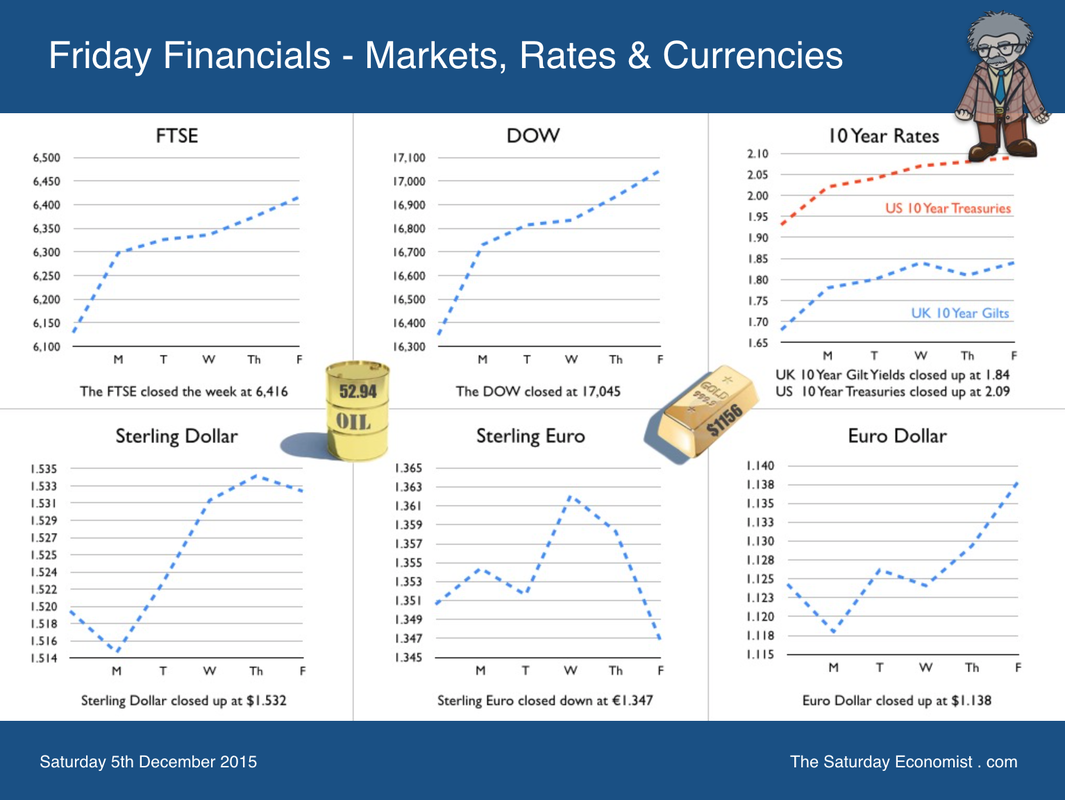

Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts bonds and property prices. Super Mario Draghi is doing whatever it takes to save Euroland. Last week the European Central Bank lowered the deposit rate to minus 0.3% from minus 0.2%. Three eurozone neighbours, Denmark, Sweden and Switzerland have pushed their interest rates deeper into negative territory in response to ECB rate cuts. The Swiss National Bank has a deposit rate of minus 0.75%, Denmark’s National Bank interest rate on certificates of deposit is -0.75 per cent and in Sweden the deposit rate is -1.1%. Europe is digging in on Planet ZIRP, going beyond the zero bound and exploring the catacombs of NIRP with a negative interest policy. It is a dangerous and misguided development. So what is the objective … There are two principal objectives relating relating to growth and inflation. The ECB believes lower rates will stimulate household spending, encourage business investment and engineer a weakness in the Euro currency to increase export competitiveness. A weaker Euro will stimulate inflation as the cost of imports of raw materials, food, energy, manufactures and semi manufactures increase. Mario Draghi believes Euroland will have a better chance of meeting the near 2% inflation target with negative interest rates. Well that’s the theory anyway. It is a theory and an experiment. A dangerous experiment in which central banks impose a levy on financial institutions to hold their money and banks will charge customers for money in deposit accounts and checking accounts. Homeowners with floating rate agreements may end up with negative-interest mortgages. Instead of paying the bank principal plus interest each month, households will pay principal, minus interest. If negative interest rates become entrenched, individuals would withdraw money from the bank and hoard cash. Banks would have a lower lending capacity. To avoid households hoarding cash, central bankers could consider a bank note cancellation policy. State lotteries will randomly select on a weekly basis, a series of bank note numbers which would be withdrawn from use with immediate effect. Imagine trying to pay in Euros for your weekly shop or a trip to the Bierkeller, only to discover the notes you want to pay with were out of date. Retailers would be required to check for counterfeit currency and currency currency! Consumers would be reluctant to accept any notes whatsoever, without confirmation the notes offered were within date. So what’s the problem … it’s madness of course … Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts bonds and property prices. Subzero rates in Denmark and Sweden have helped fuel a surge in house prices. The average price of a Danish apartment climbed 8% in the first half of 2015. The cost of Swedish apartments is 16% higher than a year ago according to the Wall Street Journal article this week. Andy Haldane Chief Economist at the Bank of England, suggested in 2013, the combination of interest rates at the lower bound and QE had created the biggest bond price bubble in history. As for currency depreciation … the ECB’s negative deposit rate has helped bring down the value of the euro but will that really help the trade balance? Exports increase as a function or world trade and relative prices. The demand conditions are dominant with a much weaker price effect. As the weakness in world trade volumes persist, there will be little or no growth in the volume of exports from Euroland, no matter what happens to the value of the currency in the short term. Euroland already enjoys a trade surplus with the rest of the world. Further currency wars would have a negative effect of international capital flows. Beggar thy neighbour depreciation is bad enough but experimenting with negative rates to effect the change could well be disastrous. As for inflation, inflation is always and every where an international phenomenon at the present time. Energy prices have collapsed as a result of over investment, oversupply and OPEC intransigence to cut output. Low cost of capital has led to an over investment in oil exploration and mining. The resultant over capacity has lead to a collapse in prices. Tinkering with exchange rates will be of limited value if oil prices collapse to $20 per barrel in 2016 as some pessimistic pundits predict. As for household spending and business investment, in theory, negative rates impact on consumers or businesses by encouraging borrowing and spending. For businesses and investment, the cost of capital is merely one of the factors in a payback calculation. The anticipated returns to capital over the life time of the investment are dominant. If forward conditions are correct businesses will invest. Negative rates will just add to fears about sustainability over the medium term. As for consumers, they are already benefiting from the year of the Lilies with a recovery in employment, earnings, low inflation and strong growth in real earnings. Lower rates will merely impact further to the detriment of savers. Time to co-ordinate international monetary policy … The US is set to increase base rates later this month. The UK is likely to follow within six months. This is not the time for Euroland to be moving in the opposite direction. In the seventies we talked of a coordinated response to recession in the West. The US would lead recovery with an expansive fiscal policy to which the rest of the west could hook up. We called it the "locomotive theory" of recovery. Now is the time for a co-ordinated monetary policy response. Planet ZIRP was supposed to be an emergency stop over, never a long term settlement. This is not the time to dig up the runway, experimenting with negative rates. It really is time to leave Planet ZIRP together in full flight formation. Mario Draghi should do whatever it takes … and rethink negative rates action.  Super Mario … doing whatever to takes ... Strong jobs data suggests the Fed will hike rates at the December meeting later this month. Non Farm payroll employment increased by 211,000 in November and the US employment rate was steady at 5.0%. It seems clear Janet Yellen has staked a fair degree of credibility, on a gradual process of rate rises, beginning on the 16th December. In Europe, The ECB is heading in the other direction. “Super” Mario Draghi on Thursday, announced a commitment to extend the asset purchase programme into March 2017 and to drop the discount rate to -0.3%. The move is at odds with Uncle Sam’s monetary policy and contra to the advice of the Berlin Council of Wise Men. Last month, Berlin’s Council of Economic Experts - known as the country's five "wise men" said the ECB must consider tapering its bond-buying measures early “to avoid dangerous imbalances from building up in the bloc.” The warning was unheeded. Markets were disappointed by the paucity of the move in rates. The shorts had bet on a stronger discount and were forced to move quickly to close bear positions. The Euro closed up against the Dollar and Sterling, despite the ECB attempt to push the currency lower. Whatever it takes … In New York on Friday, Draghi reaffirmed the commitment to do whatever it takes to achieve the inflation target. “There cannot be any limit to how far we are willing to deploy our instruments to achieve our mandate” the quote. The central bank’s mandate is for inflation just below 2 per cent. A goal that has been missed substantially over the last two years, so what's the rush!. It’s a goal which will be pretty elusive with commodity prices on the floor and oil prices hovering around $40 per barrel. The move to weaken the Euro clearly backfired … the Euro rallied against both the Dollar and Sterling. Markets are coming to realise the Euro won’t go much lower on a technical and fundamental basis. The process of QE, as a policy option to boost growth and inflation has largely been discredited. Reliance on the spurious accuracy of dubious econometrics does not make for good monetary policy. Soon European policy makers will realise that NIRP on Planet ZIRP will just extend the misery of entrapment in this strange land. So what of locomotive theory … To pull the world out of recession in the mid seventies, the US led the way with fiscal expansion and the rest of the West was urged to hook up to the engine of growth. The oil price shock of the seventies had transferred wealth to the OPEC cartel, at the price of real effective demand in the oil importing countries. A co-ordinated policy response would prove more effective than policy heading in different directions. The oil price shock of the 2015 is reversing the process of wealth transfer. Oil importers gaining as oil exporters miss out. For the world economy, it is a zero sum game. The deflationary action of an oil price collapse is leading to a misalignment of monetary policy in a move to stimulate inflation. Domestic demand is not the problem in the West. “Inflation is always and everywhere an international phenomenon” brought about by the collapse in energy and commodity prices. Low rates and mis priced capital, leads to problems along the yield curve and over investment in asset classes including commodity extraction. Low rates are compounding, not resolving, the price problem. Flight formation, not locomotion theory, the solution. The US will lead the flight, the UK should be set for departure within months. The ECB should abandon NIRP before too much damage is done. It is time to leave Planet ZIRP, doing whatever it takes. So what of the UK … This week, PMI Markit data was released for November. Construction growth slowed in the month amid the slowest rise in housing activity for two years. Manufacturing expansion continued but at slower rates. Service sector growth continued to grow with new business increasing to a four month high. This month we update our UK Economic Outlook, our final update of 2015. We expect growth of 2.5% this year and 2.6% next. Manufacturing will disappoint. We expect construction growth of around 2.8% this year and 2.9% next. Private service sector growth will continue to lead the recovery with a strong performance in leisure, distribution and business services. Household spending in this the year of the LILIES will be 3.1% this year, slowing to 2.8% next. Business investment will increase by 3.9% this year rising to 5.6% next. The trade figures will continue to disappoint. The trade deficit will average 2.7% of GDP and will become a constraint to growth within our extended five year forecast framework [February 2016]. Employment and earnings will continue to rise, the government deficit will fall despite a significant rise in borrowing costs. This year and next may be as good as it gets. The LILIES will droop and fade as we enter 2017. You can download a copy of the Economic Outlook from the Saturday Economist web site here. So what happened to Sterling over the last two weeks? Sterling moved up against the Dollar at $1.511 from $1.503 and moved down against the Euro to €1.387 from €1.419 The Euro moved up against the Dollar at €1.088 from €1.059. Oil Price Brent Crude closed at $43.00 from $46.25. The average price in December last year was $62.24. Markets, steadied! The Dow closed at 17,847 from 17,806. The FTSE closed up at 6,238 from 6,393. Gilts - yields moved up. UK Ten year gilt yields were at 1.93 from 1.87, US Treasury yields moved to 2.27 from 2.23. Gold moved to $1,086 ($1,059). That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed